Deck 17: Activity Resource Usage Model and Tactical Decision Making

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

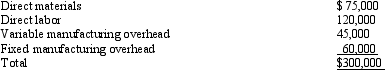

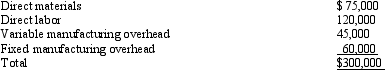

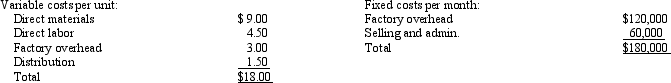

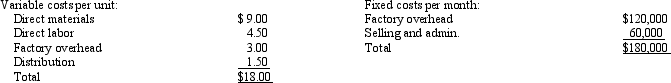

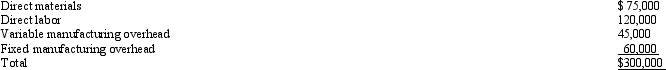

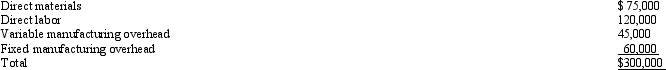

Question

Question

Question

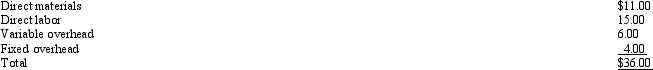

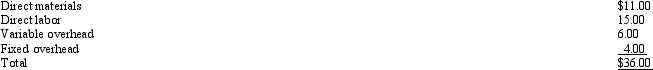

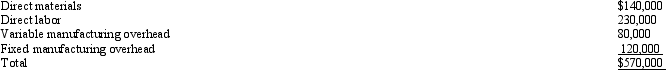

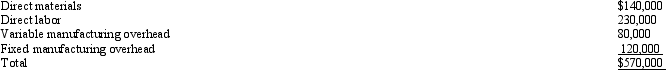

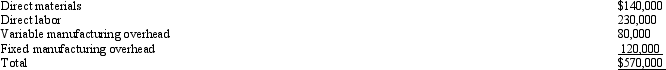

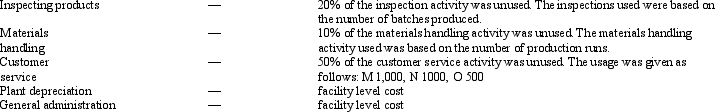

Question

Question

Question

Question

Question

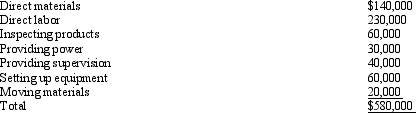

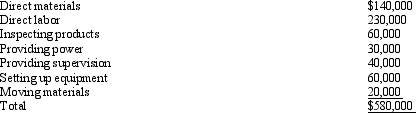

Question

Question

Question

Question

Question

Question

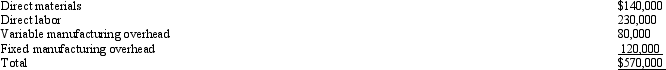

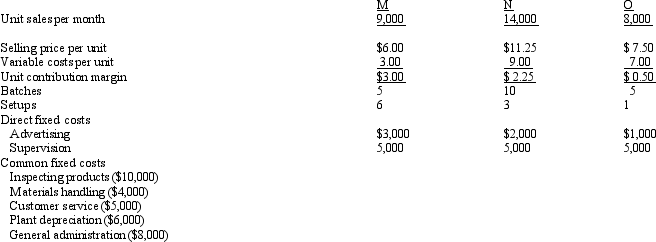

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/128

Play

Full screen (f)

Deck 17: Activity Resource Usage Model and Tactical Decision Making

1

Committed resources are acquired in advance of usage, through implicit contracting.

True

2

Foreign trade zones are set up by the U.S. government to facilitate warehousing and/or manufacturing for companies.

True

3

A sunk cost is irrelevant because it has no influence over future decisions, so it is depreciated.

True

4

For flexible resources, if the demand for an activity changes across alternatives, then resource spending will remain the same and costs are relevant.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

5

Relevant costs and revenues are present costs and revenues that differ across alternatives.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

6

The last of the six steps of the tactical decision model is to choose the quickest way to solve the problem.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

7

A keep-or-drop decision uses irrelevant cost analysis to determine whether to continue or discontinue a segment or line of business.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

8

The activity resource usage model focuses on sorting out the behavior of various activity costs and assess their relevancy.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

9

Tactical decision making consists of choosing among alternatives with an immediate or limited end in view.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

10

Sound tactical decision making is limited to achieve small objectives.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

11

A special-order decision focuses on whether a specially priced order should be accepted or rejected.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

12

Flexible resources are acquired way ahead of time.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

13

Tactical cost analysis uses cost data to identify the choice that will bring the organization the most benefit.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

14

An irrelevant cost is one that is the same for more than one alternative and has no bearing on future decisions.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

15

A tariff is a tax on exports levied by the federal government.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

16

Choosing to make or buy may reduce the cost of producing the main product and increase the quality.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

17

Outsourcing refers to the move of a business function to another company, either in or out of the U.S.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

18

Tactical decision making includes decisions to make or buy a component.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

19

Changes in cost of an activity can occur if the demand for the resource exceeds the supply or if the demand for the resource drops.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

20

The first of the six steps of the tactical decision model is to recognize and define the problem.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

21

Sound tactical decision making

A) only concerns the short run.

B) consists of large scale actions that serve a broad purpose.

C) consists of supporting the strategic objectives of the firm.

D) only concerns the long run.

A) only concerns the short run.

B) consists of large scale actions that serve a broad purpose.

C) consists of supporting the strategic objectives of the firm.

D) only concerns the long run.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

22

The choosing among alternatives with an immediate or limited end in view consists of:

A) Tactical decision making

B) Long-run decision making

C) Universal decision making

D) all of the above

A) Tactical decision making

B) Long-run decision making

C) Universal decision making

D) all of the above

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

23

A __________ model is a set of procedures that, if followed, will lead to a decision.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

24

Decisions consisting of selecting among alternatives with immediate ends in views are

called __________ decisions.

called __________ decisions.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

25

An important qualitative factor to consider regarding a special order is the

A) variable costs associated with the special order.

B) avoidable fixed costs associated with the special order.

C) effect the sale of special-order units will have on existing customers.

D) incremental revenue from the special order.

A) variable costs associated with the special order.

B) avoidable fixed costs associated with the special order.

C) effect the sale of special-order units will have on existing customers.

D) incremental revenue from the special order.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

26

Leasing or buying a building are examples of resources.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

27

Areas that are physically on U.S. soil but considered to be outside U.S. commerce are

called __________ zones.

called __________ zones.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

28

In a keep-or-drop decision, the __________ income or loss determines whether a segment is kept or dropped.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

29

A decision to accept or reject a specially priced order is an example of

a __________ decision.

or

a __________ decision.

or

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following is NOT a step in the tactical decision-making process?

A) Compare full costs and benefits for alternatives.

B) Identify feasible alternatives.

C) Select the best alternative.

D) Recognize and define the problem.

A) Compare full costs and benefits for alternatives.

B) Identify feasible alternatives.

C) Select the best alternative.

D) Recognize and define the problem.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

31

The cost of acquiring activity capacity is called __________ spending.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following statement is true concerning the nature of tactical decisions?

A) Tactical decisions are often small-scale actions.

B) Tactical decisions often have an immediate or limited end in view.

C) Tactical decisions should support alternatives that result in long-term competitive advantage.

D) all of the above statements are true.

A) Tactical decisions are often small-scale actions.

B) Tactical decisions often have an immediate or limited end in view.

C) Tactical decisions should support alternatives that result in long-term competitive advantage.

D) all of the above statements are true.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

33

A doctor choosing between buying laboratory tests externally or performing the tests in house is an example of a __________ decision.

or

or

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

34

Past cost __________ represents an allocation of a cost already incurred.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

35

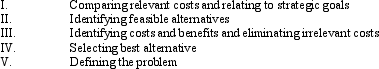

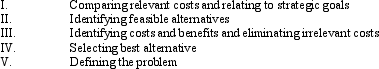

The steps in the tactical decision making process are:  What is the proper sequence of steps?

What is the proper sequence of steps?

A) I, II, V, III, IV

B) II, I, V, III, IV

C) V, II, III, I, IV

D) V, III, II, IV, I

What is the proper sequence of steps?

What is the proper sequence of steps?A) I, II, V, III, IV

B) II, I, V, III, IV

C) V, II, III, I, IV

D) V, III, II, IV, I

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

36

The use of relevant cost data to identify the alternative that provides the greatest benefit to the organization describes

A) target cost analysis.

B) functional cost analysis.

C) activity cost analysis.

D) tactical cost analysis.

A) target cost analysis.

B) functional cost analysis.

C) activity cost analysis.

D) tactical cost analysis.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

37

Future costs which differ across alternatives are called __________ costs.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

38

Tactical decision making relies

A) only on relevant cost information.

B) only on qualitative factors.

C) on relevant costs as well as other qualitative factors.

D) on neither relevant costs nor qualitative decisions.

A) only on relevant cost information.

B) only on qualitative factors.

C) on relevant costs as well as other qualitative factors.

D) on neither relevant costs nor qualitative decisions.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

39

Future costs that differ across alternatives describe

A) relevant costs.

B) target cost.

C) full costs.

D) activity-based costs.

A) relevant costs.

B) target cost.

C) full costs.

D) activity-based costs.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

40

Qualitative factors that should be considered when evaluating a make-or-buy decision are

A) the quality of the outside supplier's product.

B) whether the outside supplier can provide the needed quantities.

C) whether the outside supplier can provide the product when it is needed.

D) all of the above.

A) the quality of the outside supplier's product.

B) whether the outside supplier can provide the needed quantities.

C) whether the outside supplier can provide the product when it is needed.

D) all of the above.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

41

The future costs that differ across alternatives are called

A) Sunk costs

B) Irrelevant costs

C) Relevant costs

D) Past costs

A) Sunk costs

B) Irrelevant costs

C) Relevant costs

D) Past costs

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

42

The cost of acquiring activity capacity is(are)

A) Joint costs

B) Variable costing

C) Absorption costing

D) Resource spending

A) Joint costs

B) Variable costing

C) Absorption costing

D) Resource spending

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

43

Relevant costs are

A) past costs.

B) future costs.

C) full costs.

D) cost drivers.

A) past costs.

B) future costs.

C) full costs.

D) cost drivers.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

44

One of Maersk cargo ships hit an iceberg and sank. In deciding whether or not to salvage the ship, its book value is a(n)

A) relevant cost.

B) discretionary cost.

C) opportunity cost.

D) sunk cost.

A) relevant cost.

B) discretionary cost.

C) opportunity cost.

D) sunk cost.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following costs is NOT relevant to a make-or-buy decision?

A) $20,000 of direct labor used to manufacture the parts

B) $25,000 in rent from leasing the production space to another company if the part is purchased from an outside supplier

C) the supervisor's salary of $35,000 that will be avoided if the part is purchased from an outside supplier

D) $40,000 of depreciation on the plant used to manufacture the parts

A) $20,000 of direct labor used to manufacture the parts

B) $25,000 in rent from leasing the production space to another company if the part is purchased from an outside supplier

C) the supervisor's salary of $35,000 that will be avoided if the part is purchased from an outside supplier

D) $40,000 of depreciation on the plant used to manufacture the parts

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following costs is NOT relevant to a decision to sell a product at split-off or process the product further and then sell the product?

A) joint costs allocated to the product

B) the selling price of the product at split-off

C) the additional processing costs after split-off

D) the selling price of the product after further processing

A) joint costs allocated to the product

B) the selling price of the product at split-off

C) the additional processing costs after split-off

D) the selling price of the product after further processing

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following statements is TRUE when making a decision between two alternatives?

A) Variable costs may not be relevant when the decision alternatives have the same activity levels.

B) Variable costs are not relevant when the decision alternatives have different activity levels.

C) Sunk costs are always relevant.

D) Fixed costs are never relevant.

A) Variable costs may not be relevant when the decision alternatives have the same activity levels.

B) Variable costs are not relevant when the decision alternatives have different activity levels.

C) Sunk costs are always relevant.

D) Fixed costs are never relevant.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following costs is relevant to a make-or-buy decision?

A) original cost of the production equipment

B) annual depreciation of the equipment

C) the amount that would be received if the production equipment were sold

D) the cost of direct materials purchased last month and used to manufacture the component

A) original cost of the production equipment

B) annual depreciation of the equipment

C) the amount that would be received if the production equipment were sold

D) the cost of direct materials purchased last month and used to manufacture the component

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

49

In order for costs or benefits to be relevant, what must be true?

A) All decisions must relate to future.

B) Identifying relevant costs and benefits is an easy process.

C) Relevancy will relate both to the future and the past.

D) all of the above are true statements.

A) All decisions must relate to future.

B) Identifying relevant costs and benefits is an easy process.

C) Relevancy will relate both to the future and the past.

D) all of the above are true statements.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

50

For flexible resources, which of the following statements is true?

A) A change in resource spending will only occur if the demand for a resource drops permanently and exceeds demand enough so the activity capacity will be reduced.

B) Often, resources are acquired in advance for multiple periods and are therefore irrelevant.

C) Decisions often affect multi-period capabilities.

D) If the demand for an activity changes across alternatives, then resource spending will change and the cost of the activity will be relevant to the decision.

A) A change in resource spending will only occur if the demand for a resource drops permanently and exceeds demand enough so the activity capacity will be reduced.

B) Often, resources are acquired in advance for multiple periods and are therefore irrelevant.

C) Decisions often affect multi-period capabilities.

D) If the demand for an activity changes across alternatives, then resource spending will change and the cost of the activity will be relevant to the decision.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following is NOT a way that companies might reduce tariffs?

A) Alter materials to increase the domestic content.

B) Restrict the amount of imported materials.

C) Increase the amount of imported materials.

D) Utilize foreign trade zones.

A) Alter materials to increase the domestic content.

B) Restrict the amount of imported materials.

C) Increase the amount of imported materials.

D) Utilize foreign trade zones.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

52

Sunk costs are

A) future costs that have no benefit.

B) relevant costs that have only short-run benefits.

C) target costs.

D) always irrelevant.

A) future costs that have no benefit.

B) relevant costs that have only short-run benefits.

C) target costs.

D) always irrelevant.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following costs is NOT relevant for special decisions?

A) incremental costs

B) sunk costs

C) avoidable costs

D) all of the above costs are relevant for special decisions

A) incremental costs

B) sunk costs

C) avoidable costs

D) all of the above costs are relevant for special decisions

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

54

A purchasing agent has two potential firms from which to buy materials for production. If both firms charge the same price, the material cost is a(n)

A) irrelevant cost.

B) relevant cost.

C) sunk cost.

D) opportunity cost.

A) irrelevant cost.

B) relevant cost.

C) sunk cost.

D) opportunity cost.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following would be TRUE?

A) Flexible Demand changes Irrelevant

B) Flexible Demand constant Irrelevant

C) Committed Demand increase > Unused capacity Not relevant

D) Committed Demand increase < Unused capacity Relevant

A) Flexible Demand changes Irrelevant

B) Flexible Demand constant Irrelevant

C) Committed Demand increase > Unused capacity Not relevant

D) Committed Demand increase < Unused capacity Relevant

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

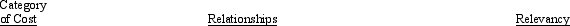

56

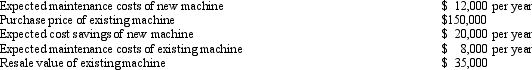

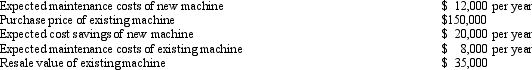

Maldovar Company is considering purchasing a new machine to replace a machine purchased one year ago that is not achieving the expected results. The following information is available:  Which of these items is IRRELEVANT?

Which of these items is IRRELEVANT?

A) Expected maintenance costs of new machine

B) Expected maintenance costs of existing machine

C) Purchase cost of existing machine

D) Expected resale value of existing machine

Which of these items is IRRELEVANT?

Which of these items is IRRELEVANT?A) Expected maintenance costs of new machine

B) Expected maintenance costs of existing machine

C) Purchase cost of existing machine

D) Expected resale value of existing machine

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

57

Santa Lucia Industries employs 500 workers in the factory. These workers produced 85,000 units in 2014. Due to a special order, the units produced in 2015 increased to 95,000 units. However, Santa Lucia produced these units without adding workers. How is that possible?

A) The labor cost associated with the additional units sold will be a relevant cost.

B) The employees were a flexible resource in this situation.

C) The plant had some unused activity capacity.

D) none of the above

A) The labor cost associated with the additional units sold will be a relevant cost.

B) The employees were a flexible resource in this situation.

C) The plant had some unused activity capacity.

D) none of the above

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

58

The U.S. government has set up foreign trade zones (FTZ) that

A) are located on U.S. soil but are considered to be outside of U.S. commerce for tariff purposes.

B) are located in foreign countries and designed to export to the United States.

C) are located in foreign countries and are designed to import from the United States.

D) are located in the United States and are considered part of the United States for tariff purposes.

A) are located on U.S. soil but are considered to be outside of U.S. commerce for tariff purposes.

B) are located in foreign countries and designed to export to the United States.

C) are located in foreign countries and are designed to import from the United States.

D) are located in the United States and are considered part of the United States for tariff purposes.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

59

Which item is NOT an example of a sunk cost?

A) materials needed for production

B) purchase cost of machinery

C) depreciation

D) all are sunk costs

A) materials needed for production

B) purchase cost of machinery

C) depreciation

D) all are sunk costs

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following costs is NOT relevant to a special-order decision?

A) the direct labor costs to manufacture the special-order units

B) the variable manufacturing overhead incurred to manufacture the special-order units

C) the portion of the cost of leasing the factory that is allocated to the special order

D) all of the above costs are relevant

A) the direct labor costs to manufacture the special-order units

B) the variable manufacturing overhead incurred to manufacture the special-order units

C) the portion of the cost of leasing the factory that is allocated to the special order

D) all of the above costs are relevant

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

61

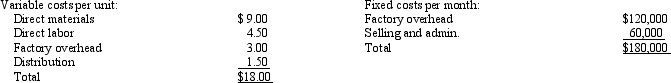

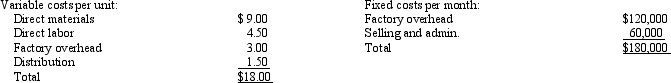

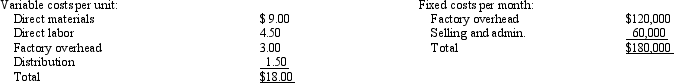

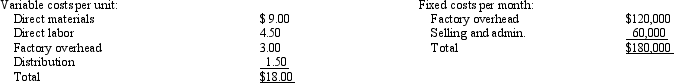

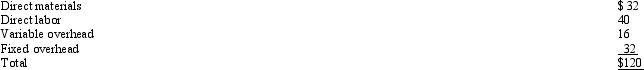

Hobart Company produces speakers for home stereo units. The speakers are sold to retail music stores for $30. Manufacturing and other costs are as follows:  The variable distribution costs are for transportation to the retail music stores. The current production and sales volume is 20,000 per year. Capacity is 25,000 units per year.

The variable distribution costs are for transportation to the retail music stores. The current production and sales volume is 20,000 per year. Capacity is 25,000 units per year.

A Memphis manufacturing firm has offered a one-year contract to supply speaker parts at a cost of $17.00 per unit. If Hobart Company accepts the offer, it will be able to rent unused space to an outside firm for $18,000 per year. All other information remains the same as the original data. What is the effect on profits if Hobart Company buys from the Memphis firm?

A) decrease of $19,000

B) increase of $38,000

C) increase of $19,000

D) decrease of $6,000

The variable distribution costs are for transportation to the retail music stores. The current production and sales volume is 20,000 per year. Capacity is 25,000 units per year.

The variable distribution costs are for transportation to the retail music stores. The current production and sales volume is 20,000 per year. Capacity is 25,000 units per year.A Memphis manufacturing firm has offered a one-year contract to supply speaker parts at a cost of $17.00 per unit. If Hobart Company accepts the offer, it will be able to rent unused space to an outside firm for $18,000 per year. All other information remains the same as the original data. What is the effect on profits if Hobart Company buys from the Memphis firm?

A) decrease of $19,000

B) increase of $38,000

C) increase of $19,000

D) decrease of $6,000

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

62

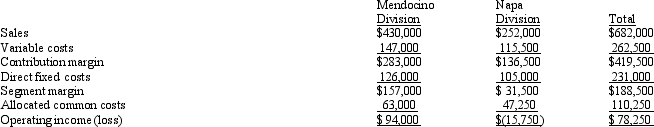

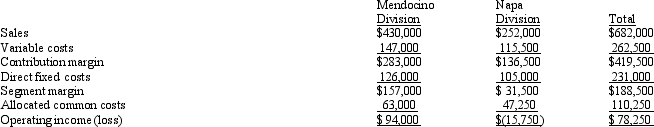

The operations of California Corporation are divided into the Mendocino Division and the Napa Division. Projections for the next year are as follows:  Operating income for California Corporation as a whole if the Napa Division were dropped would be

Operating income for California Corporation as a whole if the Napa Division were dropped would be

A) $46,750.

B) $94,000.

C) $78,250.

D) $109,750.

Operating income for California Corporation as a whole if the Napa Division were dropped would be

Operating income for California Corporation as a whole if the Napa Division were dropped would beA) $46,750.

B) $94,000.

C) $78,250.

D) $109,750.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

63

Hobart Company produces speakers for PA systems. The speakers are sold to retail music stores for $30. Manufacturing and other costs are as follows:  The variable distribution costs are for transportation to the retail music stores. The current production and sales volume is 20,000 per year. Capacity is 25,000 units per year.

The variable distribution costs are for transportation to the retail music stores. The current production and sales volume is 20,000 per year. Capacity is 25,000 units per year.

The speakers are currently unpackaged. Packaging them individually would increase costs by $1.20 per unit. However, the units could then be sold for $33.00. All other information remains the same as the original data. What is the effect on profits if Hobart Company packages the speakers?

A) no change

B) decrease of $24,000

C) decrease of $36,000

D) increase of $36,000

The variable distribution costs are for transportation to the retail music stores. The current production and sales volume is 20,000 per year. Capacity is 25,000 units per year.

The variable distribution costs are for transportation to the retail music stores. The current production and sales volume is 20,000 per year. Capacity is 25,000 units per year.The speakers are currently unpackaged. Packaging them individually would increase costs by $1.20 per unit. However, the units could then be sold for $33.00. All other information remains the same as the original data. What is the effect on profits if Hobart Company packages the speakers?

A) no change

B) decrease of $24,000

C) decrease of $36,000

D) increase of $36,000

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

64

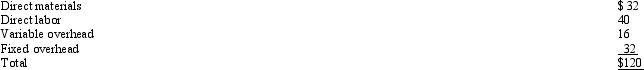

Concierge Industries manufactures 40,000 components per year. The manufacturing cost of the components was determined as follows:  An outside supplier has offered to sell the component for $12.75.

An outside supplier has offered to sell the component for $12.75.

What is the effect on income if Concierge Industries purchases the component from the outside supplier?

A) $30,000 increase

B) $30,000 decrease

C) $270,000 increase

D) $270,000 decrease

An outside supplier has offered to sell the component for $12.75.

An outside supplier has offered to sell the component for $12.75.What is the effect on income if Concierge Industries purchases the component from the outside supplier?

A) $30,000 increase

B) $30,000 decrease

C) $270,000 increase

D) $270,000 decrease

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

65

Composite Company uses 5,000 units of part AA1 each year. The cost of manufacturing one unit of part AA1 at this volume is as follows:  An outside supplier has offered to sell Composite Company unlimited quantities of part AA1 at a unit cost of $32.00. If Composite Company accepts this offer, it can eliminate 50 percent of the fixed costs assigned to part AA1. Furthermore, the space devoted to the manufacture of part AA1 would be rented to another company for $24,000 per year. If Composite Company accepts the offer of the outside supplier, annual profits will

An outside supplier has offered to sell Composite Company unlimited quantities of part AA1 at a unit cost of $32.00. If Composite Company accepts this offer, it can eliminate 50 percent of the fixed costs assigned to part AA1. Furthermore, the space devoted to the manufacture of part AA1 would be rented to another company for $24,000 per year. If Composite Company accepts the offer of the outside supplier, annual profits will

A) increase by $17,000.

B) increase by $24,000.

C) increase by $34,000.

D) increase by $3,500.

An outside supplier has offered to sell Composite Company unlimited quantities of part AA1 at a unit cost of $32.00. If Composite Company accepts this offer, it can eliminate 50 percent of the fixed costs assigned to part AA1. Furthermore, the space devoted to the manufacture of part AA1 would be rented to another company for $24,000 per year. If Composite Company accepts the offer of the outside supplier, annual profits will

An outside supplier has offered to sell Composite Company unlimited quantities of part AA1 at a unit cost of $32.00. If Composite Company accepts this offer, it can eliminate 50 percent of the fixed costs assigned to part AA1. Furthermore, the space devoted to the manufacture of part AA1 would be rented to another company for $24,000 per year. If Composite Company accepts the offer of the outside supplier, annual profits willA) increase by $17,000.

B) increase by $24,000.

C) increase by $34,000.

D) increase by $3,500.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

66

In the activity resource model, flexible resources are

A) resources acquired in advance of usage.

B) resources acquired as used and needed.

C) usually acquired in lumpy amounts.

D) are normally fixed or mixed costs.

A) resources acquired in advance of usage.

B) resources acquired as used and needed.

C) usually acquired in lumpy amounts.

D) are normally fixed or mixed costs.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

67

Hobart Company produces speakers for PA systems. The speakers are sold to retail music stores for $30. Manufacturing and other costs are as follows:  The variable distribution costs are for transportation to the retail music stores. The current production and sales volume is 20,000 per year. Capacity is 25,000 units per year.

The variable distribution costs are for transportation to the retail music stores. The current production and sales volume is 20,000 per year. Capacity is 25,000 units per year.

A Memphis manufacturing firm has offered a one-year contract to supply speaker parts at a cost of $6.00 per unit. If Hobart Company accepts the offer, it will be able to reduce variable costs by 30 percent and rent unused space to an outside firm for $18,000 per year. All other information remains the same as the original data. What is the effect on profits if Hobart Company buys from the Memphis firm?

A) decrease of $19,000

B) increase of $19,000

C) increase of $6,000

D) increase of $13,000

The variable distribution costs are for transportation to the retail music stores. The current production and sales volume is 20,000 per year. Capacity is 25,000 units per year.

The variable distribution costs are for transportation to the retail music stores. The current production and sales volume is 20,000 per year. Capacity is 25,000 units per year.A Memphis manufacturing firm has offered a one-year contract to supply speaker parts at a cost of $6.00 per unit. If Hobart Company accepts the offer, it will be able to reduce variable costs by 30 percent and rent unused space to an outside firm for $18,000 per year. All other information remains the same as the original data. What is the effect on profits if Hobart Company buys from the Memphis firm?

A) decrease of $19,000

B) increase of $19,000

C) increase of $6,000

D) increase of $13,000

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following items would be classified as committed resources (short-term)?

A) salaried employees

B) depreciation on building

C) fuel to generate electricity internally

D) lease on machinery

A) salaried employees

B) depreciation on building

C) fuel to generate electricity internally

D) lease on machinery

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

69

Yankton Industries manufactures 20,000 components per year. The manufacturing cost of the components was determined as follows:  If the component is not produced by Yankton, inspection of products and provision of power costs will only be 10 percent of the production costs; moving materials costs and setting up equipment costs will only be 50 percent of the production costs; and supervision costs will amount to only 40 percent of the production amount. An outside supplier has offered to sell the component for $23.50.

If the component is not produced by Yankton, inspection of products and provision of power costs will only be 10 percent of the production costs; moving materials costs and setting up equipment costs will only be 50 percent of the production costs; and supervision costs will amount to only 40 percent of the production amount. An outside supplier has offered to sell the component for $23.50.

What is the effect on income if Yankton Industries purchases the component from the outside supplier?

A) $25,000 increase

B) $45,000 increase

C) $80,000 decrease

D) $80,000 increase

If the component is not produced by Yankton, inspection of products and provision of power costs will only be 10 percent of the production costs; moving materials costs and setting up equipment costs will only be 50 percent of the production costs; and supervision costs will amount to only 40 percent of the production amount. An outside supplier has offered to sell the component for $23.50.

If the component is not produced by Yankton, inspection of products and provision of power costs will only be 10 percent of the production costs; moving materials costs and setting up equipment costs will only be 50 percent of the production costs; and supervision costs will amount to only 40 percent of the production amount. An outside supplier has offered to sell the component for $23.50.What is the effect on income if Yankton Industries purchases the component from the outside supplier?

A) $25,000 increase

B) $45,000 increase

C) $80,000 decrease

D) $80,000 increase

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

70

Concierge Industries manufactures 40,000 components per year. The manufacturing cost of the components was determined as follows:  An outside supplier has offered to sell the component for $12.75.

An outside supplier has offered to sell the component for $12.75.

Concierge Industries can rent its unused manufacturing facilities for $45,000 if it purchases the component from the outside supplier.

What is the effect on income if Concierge purchases the component from the outside supplier?

A) $195,000 increase

B) $165,000 decrease

C) $225,000 decrease

D) $135,000 increase

An outside supplier has offered to sell the component for $12.75.

An outside supplier has offered to sell the component for $12.75.Concierge Industries can rent its unused manufacturing facilities for $45,000 if it purchases the component from the outside supplier.

What is the effect on income if Concierge purchases the component from the outside supplier?

A) $195,000 increase

B) $165,000 decrease

C) $225,000 decrease

D) $135,000 increase

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

71

A decision to make a component internally versus purchasing from a supplier is a

A) special-order decision.

B) keep-or-drop a product-line decision.

C) make-or-buy decision.

D) both a and c.

A) special-order decision.

B) keep-or-drop a product-line decision.

C) make-or-buy decision.

D) both a and c.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

72

Which of the following items would be classified as flexible resources?

A) salaried employees

B) depreciation on building

C) fuel to generate electricity internally

D) lease on machinery

A) salaried employees

B) depreciation on building

C) fuel to generate electricity internally

D) lease on machinery

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

73

Yankton Industries manufactures 20,000 components per year. The manufacturing cost of the components was determined as follows:  An outside supplier has offered to sell the component for $23.50.

An outside supplier has offered to sell the component for $23.50.

Yankton Industries can rent its unused manufacturing facilities for $45,000 if it purchases the component from the outside supplier.

What is the effect on income if Yankton purchases the component from the outside supplier?

A) $25,000 increase

B) $45,000 increase

C) $75,000 decrease

D) $105,000 increase

An outside supplier has offered to sell the component for $23.50.

An outside supplier has offered to sell the component for $23.50.Yankton Industries can rent its unused manufacturing facilities for $45,000 if it purchases the component from the outside supplier.

What is the effect on income if Yankton purchases the component from the outside supplier?

A) $25,000 increase

B) $45,000 increase

C) $75,000 decrease

D) $105,000 increase

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

74

Yankton Industries manufactures 20,000 components per year. The manufacturing cost of the components was determined as follows:  An outside supplier has offered to sell the component for $23.50.

An outside supplier has offered to sell the component for $23.50.

What is the effect on income if Yankton Industries purchases the component from the outside supplier?

A) $20,000 increase

B) $20,000 decrease

C) $80,000 decrease

D) $80,000 increase

An outside supplier has offered to sell the component for $23.50.

An outside supplier has offered to sell the component for $23.50.What is the effect on income if Yankton Industries purchases the component from the outside supplier?

A) $20,000 increase

B) $20,000 decrease

C) $80,000 decrease

D) $80,000 increase

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

75

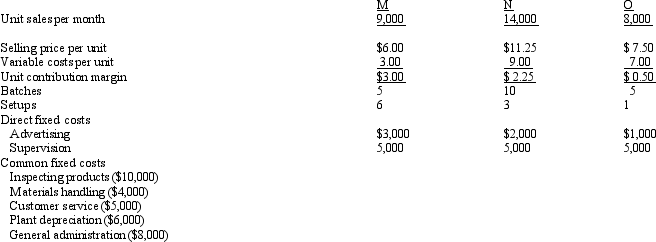

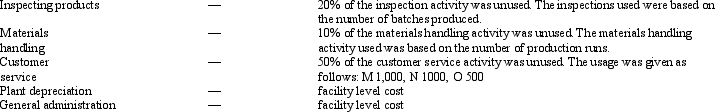

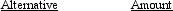

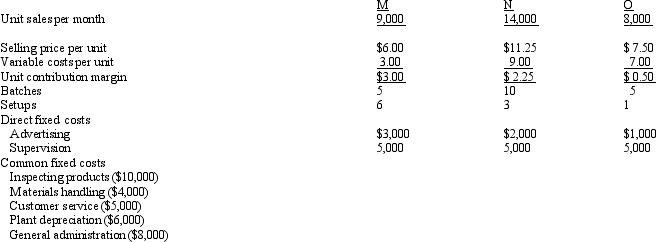

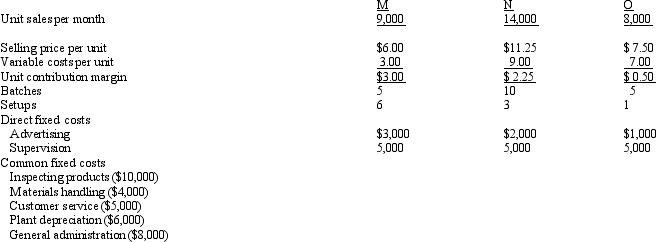

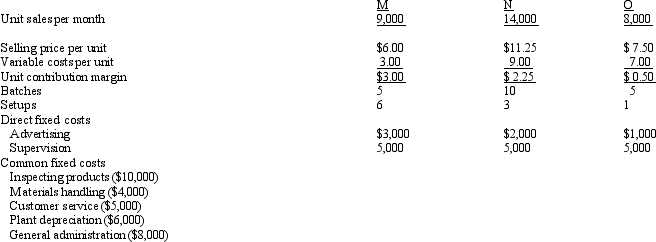

Figure 17-1 The following data pertains to the Montrose Company's three products:

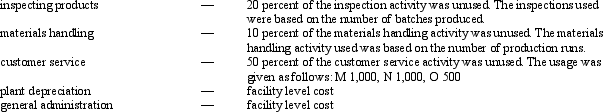

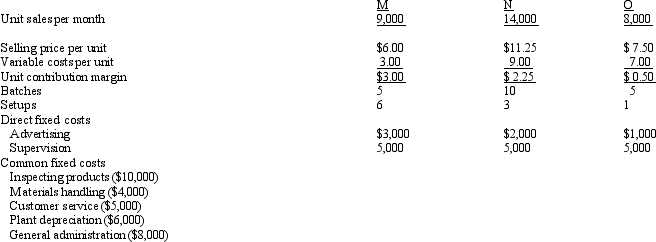

Refer to Figure 17-1. When Montrose converted over to ABC it discovered the following:

Refer to Figure 17-1. When Montrose converted over to ABC it discovered the following:

The product margin for product M using ABC would be

The product margin for product M using ABC would be

A) $9,000.

B) $19,000.

C) $13,840.

D) $27,000.

Refer to Figure 17-1. When Montrose converted over to ABC it discovered the following:

Refer to Figure 17-1. When Montrose converted over to ABC it discovered the following: The product margin for product M using ABC would be

The product margin for product M using ABC would beA) $9,000.

B) $19,000.

C) $13,840.

D) $27,000.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

76

Which of the following items would be classified as committed resources (long-term)?

A) salaried employees

B) depreciation on building

C) lease on machinery

D) both b and c

A) salaried employees

B) depreciation on building

C) lease on machinery

D) both b and c

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

77

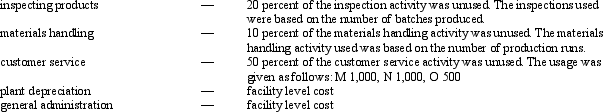

San Antonio Corporation manufacturers a part for its production cycle. The costs per unit for 5,000 units of this part are as follows:  Amarillo Company has offered to sell San Antonio Corporation 5,000 units of the part for $112 per unit. If San Antonio Corporation accepts Amarillo Company's offer, total fixed costs will be reduced to $60,000. What alternative is more desirable and by what amount is it more desirable?

Amarillo Company has offered to sell San Antonio Corporation 5,000 units of the part for $112 per unit. If San Antonio Corporation accepts Amarillo Company's offer, total fixed costs will be reduced to $60,000. What alternative is more desirable and by what amount is it more desirable?

A) Buy $100,000

B) Buy $40,000

C) Make $20,000

D) Make $120,000

Amarillo Company has offered to sell San Antonio Corporation 5,000 units of the part for $112 per unit. If San Antonio Corporation accepts Amarillo Company's offer, total fixed costs will be reduced to $60,000. What alternative is more desirable and by what amount is it more desirable?

Amarillo Company has offered to sell San Antonio Corporation 5,000 units of the part for $112 per unit. If San Antonio Corporation accepts Amarillo Company's offer, total fixed costs will be reduced to $60,000. What alternative is more desirable and by what amount is it more desirable?

A) Buy $100,000

B) Buy $40,000

C) Make $20,000

D) Make $120,000

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

78

Figure 17-1 The following data pertains to the Montrose Company's three products:

Refer to Figure 17-1. When Montrose converted over to ABC it discovered the following:

Refer to Figure 17-1. When Montrose converted over to ABC it discovered the following:

The operating income for Montrose would be

The operating income for Montrose would be

A) $8,500.

B) $9,000.

C) $19,000.

D) $27,000.

Refer to Figure 17-1. When Montrose converted over to ABC it discovered the following:

Refer to Figure 17-1. When Montrose converted over to ABC it discovered the following: The operating income for Montrose would be

The operating income for Montrose would beA) $8,500.

B) $9,000.

C) $19,000.

D) $27,000.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

79

Figure 17-1 The following data pertains to the Montrose Company's three products:

Refer to Figure 17-1. The product margin for product M using functional-based costing would be

Refer to Figure 17-1. The product margin for product M using functional-based costing would be

A) $41,500.

B) $19,000.

C) $13,840.

D) $9,000.

Refer to Figure 17-1. The product margin for product M using functional-based costing would be

Refer to Figure 17-1. The product margin for product M using functional-based costing would beA) $41,500.

B) $19,000.

C) $13,840.

D) $9,000.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

80

Upfront resource spending

A) is always relevant because it relates to the future.

B) is always relevant because it could reduce future costs.

C) is a sunk cost and therefore never relevant.

D) is always relevant because upfront resource spending will generate future revenues or benefits.

A) is always relevant because it relates to the future.

B) is always relevant because it could reduce future costs.

C) is a sunk cost and therefore never relevant.

D) is always relevant because upfront resource spending will generate future revenues or benefits.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck