Deck 17: Monetary Policy

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/180

Play

Full screen (f)

Deck 17: Monetary Policy

1

A deliberate policy change in taxes and government spending to influence the level of aggregate demand is called

A) an automatic stabiliser.

B) discretionary fiscal policy.

C) a fiscal deficit.

D) a fiscal surplus.

A) an automatic stabiliser.

B) discretionary fiscal policy.

C) a fiscal deficit.

D) a fiscal surplus.

discretionary fiscal policy.

2

Discretionary fiscal policy is when

A) existing taxation policy automatically smooths out business cycle fluctuations in the economy.

B) the government changes the level of expenditure or taxation to achieve a macroeconomic aim.

C) policy is left to the discretion of the Reserve Bank of Australia.

D) politicians are discrete about policy changes, and do not advise consumers or producers of new policies.

A) existing taxation policy automatically smooths out business cycle fluctuations in the economy.

B) the government changes the level of expenditure or taxation to achieve a macroeconomic aim.

C) policy is left to the discretion of the Reserve Bank of Australia.

D) politicians are discrete about policy changes, and do not advise consumers or producers of new policies.

the government changes the level of expenditure or taxation to achieve a macroeconomic aim.

3

Government purchases and transfer payments are included in the measure of government expenditure.

True

4

Which of the following would be considered a fiscal policy action?

A) A city changes its rates of land tax.

B) A federal government subsidy for hybrid cars to encourage the purchase of fuel-efficient cars.

C) Foreign aid given to Indonesia.

D) A tax cut designed to stimulate spending during an economic contraction.

A) A city changes its rates of land tax.

B) A federal government subsidy for hybrid cars to encourage the purchase of fuel-efficient cars.

C) Foreign aid given to Indonesia.

D) A tax cut designed to stimulate spending during an economic contraction.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

5

Active changes in tax and spending by government intended to smooth out the business cycle are called ________,and changes in taxes and spending that occur passively over the business cycle are called ________.

A) automatic stabilisers; discretionary fiscal policy

B) discretionary fiscal policy; automatic stabilisers

C) automatic stabilisers; monetary policy

D) discretionary fiscal policy; conscious fiscal policy

A) automatic stabilisers; discretionary fiscal policy

B) discretionary fiscal policy; automatic stabilisers

C) automatic stabilisers; monetary policy

D) discretionary fiscal policy; conscious fiscal policy

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

6

The increase in revenue taxation received by the government during an economic boom is due to discretionary fiscal policy.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

7

Government expenditure in Australia as a percentage of GDP has consistently trended upward since the 1960s.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following is an example of discretionary fiscal policy?

A) An increase in the number of unemployment benefit payments during a recession due to rising unemployment.

B) An increase in income tax receipts during an expansion because incomes are rising.

C) Tax increases to combat rising inflation.

D) A decrease in income tax receipts during a recession because incomes are falling.

A) An increase in the number of unemployment benefit payments during a recession due to rising unemployment.

B) An increase in income tax receipts during an expansion because incomes are rising.

C) Tax increases to combat rising inflation.

D) A decrease in income tax receipts during a recession because incomes are falling.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following is the largest category of Australian federal government expenditures?

A) Defence spending

B) Social security and welfare payments

C) Interest on debt

D) Health care

A) Defence spending

B) Social security and welfare payments

C) Interest on debt

D) Health care

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

10

Fiscal policy refers to the

A) government's ability to regulate the functioning of financial markets.

B) policy applied by the Reserve Bank of Australia to affect the cash rate.

C) techniques used by firms to reduce their tax liabilities.

D) spending and taxing policies used by the government to influence the level of economy activity.

A) government's ability to regulate the functioning of financial markets.

B) policy applied by the Reserve Bank of Australia to affect the cash rate.

C) techniques used by firms to reduce their tax liabilities.

D) spending and taxing policies used by the government to influence the level of economy activity.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following is a government expenditure and not a government purchase?

A) The federal government buys a new ship for the defence force.

B) The federal government pays the salary of police.

C) The federal government pays unemployment benefits.

D) The federal government pays to support medical research on AIDS.

A) The federal government buys a new ship for the defence force.

B) The federal government pays the salary of police.

C) The federal government pays unemployment benefits.

D) The federal government pays to support medical research on AIDS.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

12

What is fiscal policy,and who is responsible for fiscal policy?

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

13

Fiscal policy is defined as changes in federal ________ and ________ to achieve macroeconomic objectives such as price stability,healthy rates of economic growth,and high employment.

A) taxes; interest rates

B) taxes; financial liquidity in the economy

C) interest rates; financial liquidity in the economy

D) taxes; purchases

A) taxes; interest rates

B) taxes; financial liquidity in the economy

C) interest rates; financial liquidity in the economy

D) taxes; purchases

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

14

An 'automatic stabiliser' is

A) a policy for growth of an economy where the current account of the balance of payments is kept in balance.

B) a monetary or fiscal policy that aims to smooth out the business cycle.

C) the tendency for inflation to fall as unemployment rises.

D) a tax or form of government expenditure that has the effect of reducing the size of business cycle fluctuations.

A) a policy for growth of an economy where the current account of the balance of payments is kept in balance.

B) a monetary or fiscal policy that aims to smooth out the business cycle.

C) the tendency for inflation to fall as unemployment rises.

D) a tax or form of government expenditure that has the effect of reducing the size of business cycle fluctuations.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

15

Federal government expenditure as a proportion of GDP in Australia between 1980 and 2010 has varied between

A) 8 per cent and 12 per cent.

B) 15 per cent and 20 per cent.

C) 22 per cent and 28 per cent.

D) 40 per cent and 45 per cent.

A) 8 per cent and 12 per cent.

B) 15 per cent and 20 per cent.

C) 22 per cent and 28 per cent.

D) 40 per cent and 45 per cent.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

16

The largest source of revenue for the Australian federal government is

A) personal income tax.

B) company and petroleum resource tax.

C) petrol excise.

D) superannuation tax.

A) personal income tax.

B) company and petroleum resource tax.

C) petrol excise.

D) superannuation tax.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following is an automatic stabiliser?

A) Interest rate changes.

B) Increases in government spending on schools

C) Reductions in nominal wages as inflation rates rise

D) Unemployment benefit payments to the unemployed

A) Interest rate changes.

B) Increases in government spending on schools

C) Reductions in nominal wages as inflation rates rise

D) Unemployment benefit payments to the unemployed

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following does not function as an automatic stabiliser?

A) Unemployment benefit payments

B) Government expenditure on road building programs

C) The Goods and Services Tax (GST)

D) The personal income tax system

A) Unemployment benefit payments

B) Government expenditure on road building programs

C) The Goods and Services Tax (GST)

D) The personal income tax system

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

19

The largest share of Australian federal government welfare payments in 2013/14 went to

A) unemployment benefits.

B) age pensions and services to the aged.

C) disability pensions and expenditures.

D) payments to families with children.

A) unemployment benefits.

B) age pensions and services to the aged.

C) disability pensions and expenditures.

D) payments to families with children.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

20

During which decade was government expenditure in Australia the highest as a proportion of GDP?

A) 1970s

B) 1980s

C) 1990s

D) 2000s

A) 1970s

B) 1980s

C) 1990s

D) 2000s

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

21

Expansionary fiscal policy ________ the price level and ________ equilibrium real GDP.

A) decreases; increases

B) increases; decreases

C) increases; increases

D) decreases; decreases

A) decreases; increases

B) increases; decreases

C) increases; increases

D) decreases; decreases

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

22

What is the difference between discretionary fiscal policy and automatic stabilisers?

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

23

If the government wants to try to reduce unemployment,it could ________ spending and/or taxes should be ________.

A) increase; decreased

B) decrease; decreased

C) decrease; increased

D) increase; increased

A) increase; decreased

B) decrease; decreased

C) decrease; increased

D) increase; increased

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

24

What is the difference between federal purchases and federal expenditures?

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

25

If the economy were in a recession,we would expect government expenditure to be

A) high and tax revenues to be high, probably leading to a budget deficit.

B) high and tax revenues to be low, probably leading to a budget deficit.

C) low and tax revenues to be low, probably leading to a budget surplus.

D) high and tax revenues to be low, probably leading to a budget surplus.

A) high and tax revenues to be high, probably leading to a budget deficit.

B) high and tax revenues to be low, probably leading to a budget deficit.

C) low and tax revenues to be low, probably leading to a budget surplus.

D) high and tax revenues to be low, probably leading to a budget surplus.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

26

How could the existence of unemployment benefits or other transfer programs reduce the severity of an economic contraction?

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

27

Which is the largest source of federal government revenue and which is the largest single area of government expenditure in Australia?

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

28

Give examples of automatic stabilisers.Explain how automatic stabilisers work when there is an economic boom.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

29

If the government wanted to try to counteract the effects of a recession,it could

A) increase tax rates.

B) increase taxes by a fixed amount.

C) increase government purchases.

D) decrease defence spending.

A) increase tax rates.

B) increase taxes by a fixed amount.

C) increase government purchases.

D) decrease defence spending.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

30

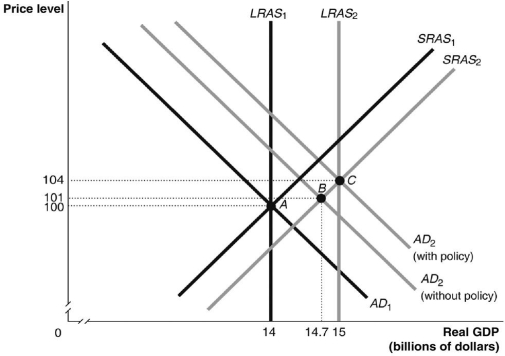

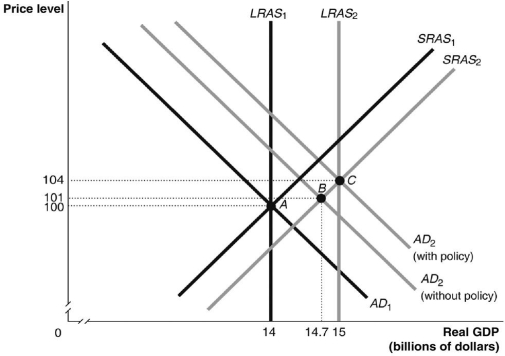

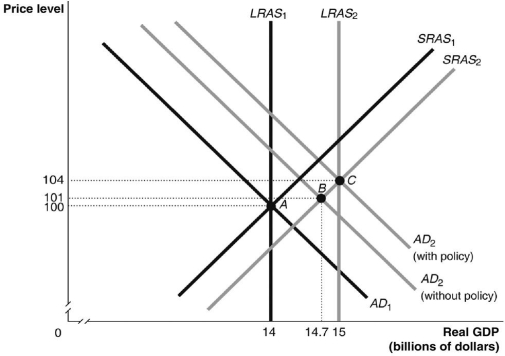

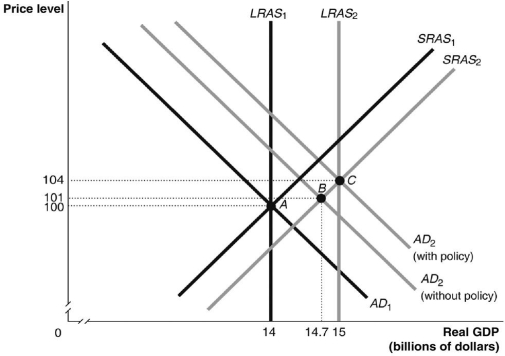

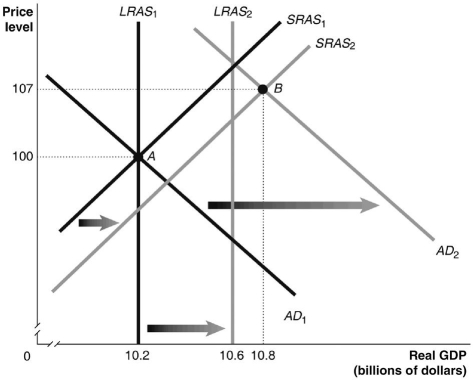

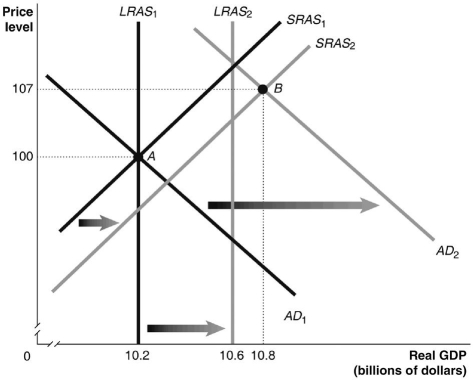

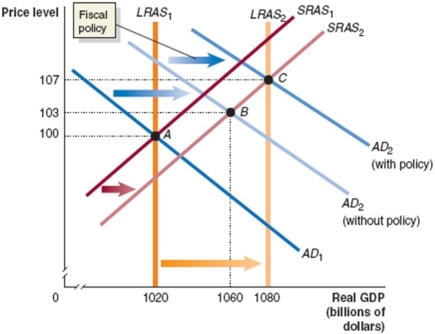

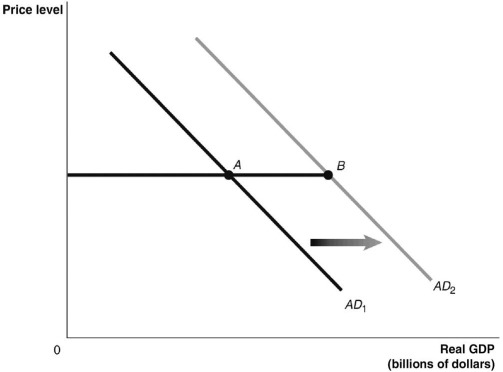

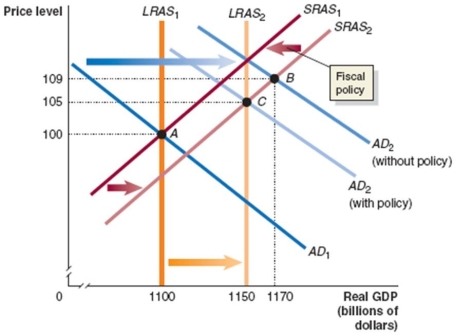

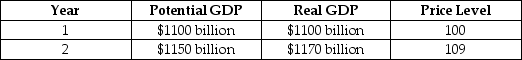

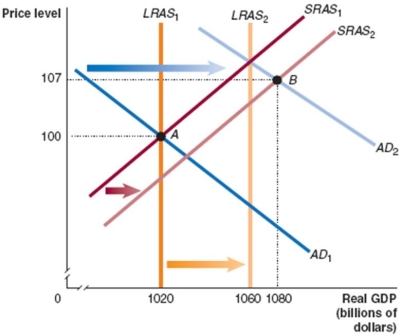

Figure 17.2

In Figure 17.2,suppose the economy in Year 1 is at point A and expected in Year 2 to be at point B.Which of the following policies could the government use to move the economy to point C?

A) Increase government purchases

B) Decrease government purchases

C) Increase income taxes

D) Sell commonwealth government bonds and securities

In Figure 17.2,suppose the economy in Year 1 is at point A and expected in Year 2 to be at point B.Which of the following policies could the government use to move the economy to point C?

A) Increase government purchases

B) Decrease government purchases

C) Increase income taxes

D) Sell commonwealth government bonds and securities

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following may be an appropriate policy if real equilibrium GDP falls below the long-run aggregate supply curve?

A) An increase in government purchases.

B) Contractionary fiscal policy to increase the budget surplus.

C) An increase in individual income taxes to balance the budget.

D) An increase in business income taxes to increase tax fairness.

A) An increase in government purchases.

B) Contractionary fiscal policy to increase the budget surplus.

C) An increase in individual income taxes to balance the budget.

D) An increase in business income taxes to increase tax fairness.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

32

Expansionary fiscal policy should shift the

A) aggregate demand curve to the left.

B) aggregate demand curve to the right.

C) short-run aggregate supply curve to the left.

D) short-run aggregate supply curve to the right.

A) aggregate demand curve to the left.

B) aggregate demand curve to the right.

C) short-run aggregate supply curve to the left.

D) short-run aggregate supply curve to the right.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

33

A decrease in individual income taxes ________ disposable income,which ________ consumption spending.

A) increases; increases

B) increases; decreases

C) decreases; increases

D) decreases; decreases

A) increases; increases

B) increases; decreases

C) decreases; increases

D) decreases; decreases

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following is considered expansionary fiscal policy?

A) The government decreases the income tax rate.

B) The government increases defence spending due to a change in priorities.

C) Legislation that increases education expense deductions from federal income taxes.

D) A state (not federal) government cuts highway spending to balance its budget.

A) The government decreases the income tax rate.

B) The government increases defence spending due to a change in priorities.

C) Legislation that increases education expense deductions from federal income taxes.

D) A state (not federal) government cuts highway spending to balance its budget.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

35

To help fight a recession,the government could

A) decrease government spending to balance the budget.

B) decrease taxes to increase aggregate demand.

C) lower interest rates by decreasing the cash rate.

D) conduct contractionary fiscal policy by raising taxes.

A) decrease government spending to balance the budget.

B) decrease taxes to increase aggregate demand.

C) lower interest rates by decreasing the cash rate.

D) conduct contractionary fiscal policy by raising taxes.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

36

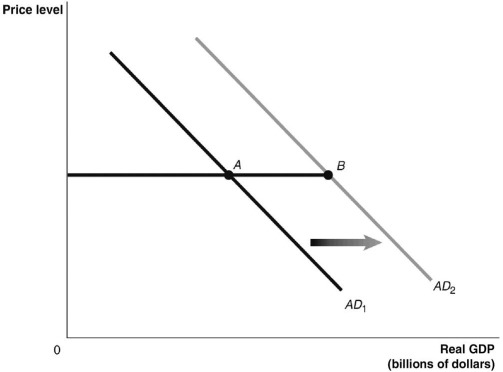

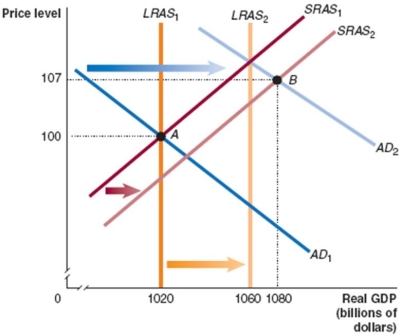

Figure 17.1

If the economy moves from A to B in Figure 17.1,which of the following would be the appropriate fiscal policy to achieve potential GDP?

A) Increase taxes

B) Increase government spending

C) Contractionary fiscal policy

D) Decrease interest rates

If the economy moves from A to B in Figure 17.1,which of the following would be the appropriate fiscal policy to achieve potential GDP?

A) Increase taxes

B) Increase government spending

C) Contractionary fiscal policy

D) Decrease interest rates

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

37

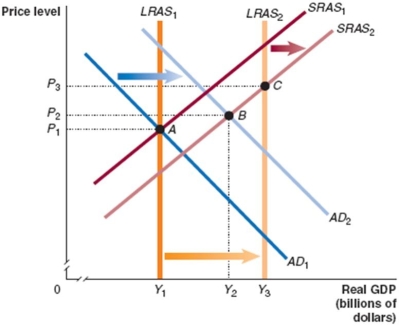

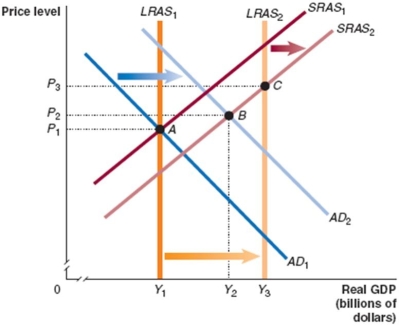

Figure 17.2

If policy makers are concerned that the economy is in danger of rising inflation because aggregate demand is increasing faster than aggregate supply,the appropriate fiscal policy response is to

A) increase taxes.

B) increase government spending.

C) use expansionary fiscal policy.

D) increase interest rates.

If policy makers are concerned that the economy is in danger of rising inflation because aggregate demand is increasing faster than aggregate supply,the appropriate fiscal policy response is to

A) increase taxes.

B) increase government spending.

C) use expansionary fiscal policy.

D) increase interest rates.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

38

Figure 17.1

In Figure 17.1,if fiscal policy successfully moves the economy from point B to equilibrium at potential GDP,this will

A) increase the price level from P2 to P3.

B) increase the price level from P1 to P2.

C) decrease the price level from P3 to P2.

D) decrease the price level from P2 to P1.

In Figure 17.1,if fiscal policy successfully moves the economy from point B to equilibrium at potential GDP,this will

A) increase the price level from P2 to P3.

B) increase the price level from P1 to P2.

C) decrease the price level from P3 to P2.

D) decrease the price level from P2 to P1.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

39

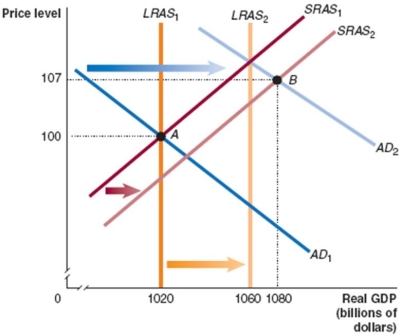

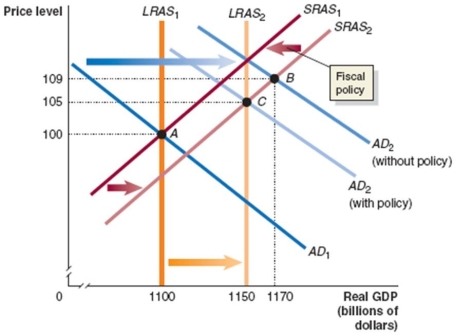

Figure 17.3

Refer to Figure 17.3.Given that the economy has moved from A to B in the graph above,which of the following would be the appropriate fiscal policy to achieve potential GDP?

A) Increase interest rates

B) Increase government spending

C) Decrease interest rates

D) Increase taxes

Refer to Figure 17.3.Given that the economy has moved from A to B in the graph above,which of the following would be the appropriate fiscal policy to achieve potential GDP?

A) Increase interest rates

B) Increase government spending

C) Decrease interest rates

D) Increase taxes

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

40

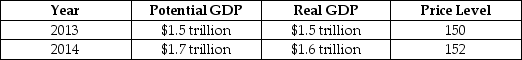

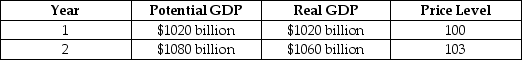

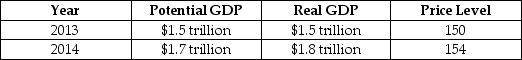

Consider the hypothetical information in the following table for potential GDP,real GDP and the price level in 2013 and in 2014 if the government does not use fiscal policy.  If the government wants to keep real GDP at its potential level in 2014,it should

If the government wants to keep real GDP at its potential level in 2014,it should

A) decrease income taxes.

B) decrease government purchases.

C) decrease interest rates.

D) increase interest rates.

If the government wants to keep real GDP at its potential level in 2014,it should

If the government wants to keep real GDP at its potential level in 2014,it shouldA) decrease income taxes.

B) decrease government purchases.

C) decrease interest rates.

D) increase interest rates.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

41

What is contractionary fiscal policy and under what circumstances would it be used?

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

42

Use the dynamic aggregate demand and aggregate supply model and start with Year 1 in a long-run macroeconomic equilibrium.For Year 2,graph aggregate demand,long-run aggregate supply,and short-run aggregate supply such that the condition of the economy will induce the government to conduct contractionary fiscal policy.Briefly explain the condition of the economy and what the government is attempting to do.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

43

Contractionary fiscal policy to prevent real GDP from rising above potential GDP would cause the inflation rate to be ________ and real GDP to be ________.

A) higher; higher

B) higher; lower

C) lower; higher

D) lower; lower

A) higher; higher

B) higher; lower

C) lower; higher

D) lower; lower

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

44

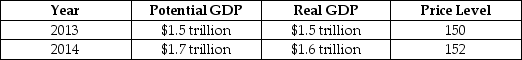

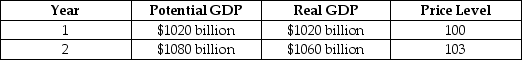

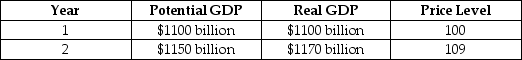

Assume that the economy is in the state described by the following table.

Draw a dynamic aggregate demand and aggregate supply diagram to illustrate the state of the economy in year 1 and year 2,assuming that no policy is pursued.Then illustrate the appropriate fiscal policy to use in this situation.Assume that the policy results in the economy producing at potential GDP.Provide an explanation.

Draw a dynamic aggregate demand and aggregate supply diagram to illustrate the state of the economy in year 1 and year 2,assuming that no policy is pursued.Then illustrate the appropriate fiscal policy to use in this situation.Assume that the policy results in the economy producing at potential GDP.Provide an explanation.

Draw a dynamic aggregate demand and aggregate supply diagram to illustrate the state of the economy in year 1 and year 2,assuming that no policy is pursued.Then illustrate the appropriate fiscal policy to use in this situation.Assume that the policy results in the economy producing at potential GDP.Provide an explanation.

Draw a dynamic aggregate demand and aggregate supply diagram to illustrate the state of the economy in year 1 and year 2,assuming that no policy is pursued.Then illustrate the appropriate fiscal policy to use in this situation.Assume that the policy results in the economy producing at potential GDP.Provide an explanation.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

45

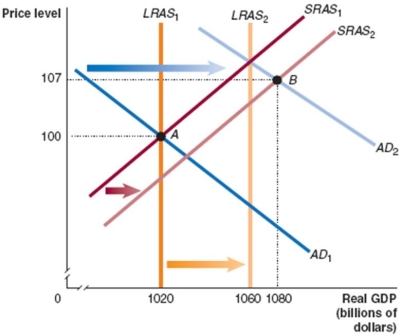

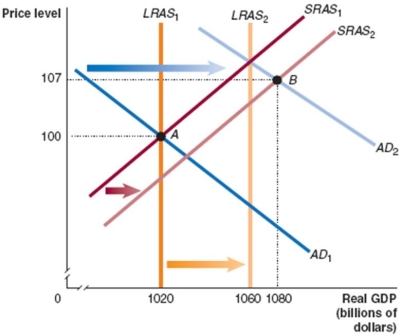

Figure 17.5

Refer to Figure 17.5.If government purchases increase by $100 billion and lead to an ultimate increase in aggregate demand as shown in the graph,the difference in real GDP between point A and point B will be

A) $100 billion.

B) less than $100 billion.

C) more than $100 billion.

D) There is insufficient information given here to make a conclusion.

Refer to Figure 17.5.If government purchases increase by $100 billion and lead to an ultimate increase in aggregate demand as shown in the graph,the difference in real GDP between point A and point B will be

A) $100 billion.

B) less than $100 billion.

C) more than $100 billion.

D) There is insufficient information given here to make a conclusion.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

46

Identify each of the following as (i)part of an expansionary fiscal policy,(ii)part of a contractionary fiscal policy,or (iii)not part of fiscal policy.

a. The personal income tax rate is lowered.

b. The government increases spending on defence due to a change in spending priorities.

c. The company income tax rate is lowered.

d. The State of New South Wales builds a new tollway in an attempt to expand employment and ease traffic congestion.

a. The personal income tax rate is lowered.

b. The government increases spending on defence due to a change in spending priorities.

c. The company income tax rate is lowered.

d. The State of New South Wales builds a new tollway in an attempt to expand employment and ease traffic congestion.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

47

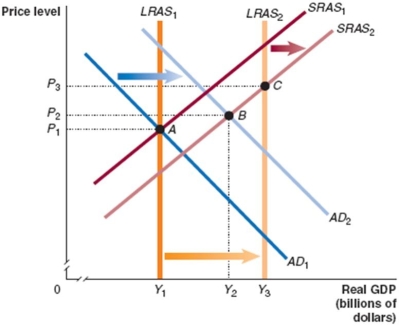

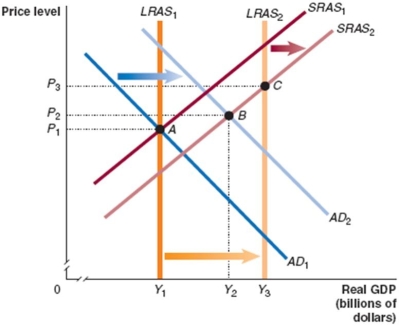

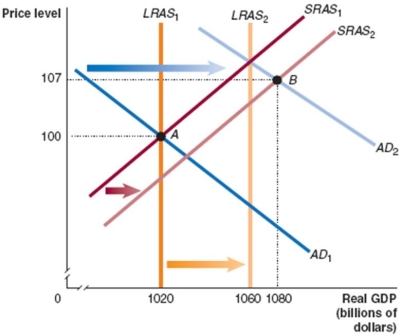

Figure 17.4

In Figure 17.4,if fiscal policy is successful at moving the economy from point B to equilibrium at potential GDP,which of the following will occur?

A) The price level will rise.

B) Deflation will occur.

C) Unemployment will fall.

D) Unemployment will rise.

In Figure 17.4,if fiscal policy is successful at moving the economy from point B to equilibrium at potential GDP,which of the following will occur?

A) The price level will rise.

B) Deflation will occur.

C) Unemployment will fall.

D) Unemployment will rise.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

48

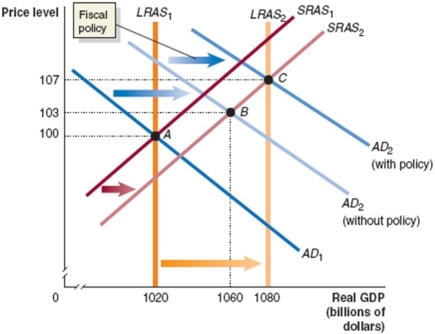

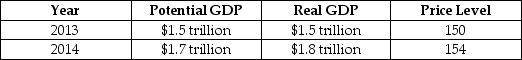

Consider the hypothetical information in the following table for potential GDP,real GDP and the price level in 2013 and in 2014 if the government does not use fiscal policy.  If the government wants to keep real GDP at its potential level in 2014,it should

If the government wants to keep real GDP at its potential level in 2014,it should

A) increase income taxes.

B) increase government purchases.

C) decrease interest rates.

D) increase interest rates.

If the government wants to keep real GDP at its potential level in 2014,it should

If the government wants to keep real GDP at its potential level in 2014,it shouldA) increase income taxes.

B) increase government purchases.

C) decrease interest rates.

D) increase interest rates.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

49

Expansionary fiscal policy is used by the government in an attempt to fight rising inflation.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

50

An increase in government purchases of $200 billion will shift the aggregate demand curve to the right by

A) $200 billion.

B) less than $200 billion.

C) more than $200 billion.

D) None of these options is correct. This policy shifts the long-run aggregate supply curve.

A) $200 billion.

B) less than $200 billion.

C) more than $200 billion.

D) None of these options is correct. This policy shifts the long-run aggregate supply curve.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

51

An appropriate fiscal policy response when aggregate demand is growing at a faster rate than aggregate supply is to increase interest rates.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

52

Tax increases on business income slow down the rate of increase in aggregate demand by decreasing

A) business investment spending.

B) consumption spending.

C) government spending.

D) wage rates.

A) business investment spending.

B) consumption spending.

C) government spending.

D) wage rates.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

53

Suppose the economy is in the state described by the following table.

What problem will occur in the economy if no policy is pursued? What fiscal policy tools could be used to combat the problem? Draw a dynamic aggregate demand and supply graph to illustrate the appropriate fiscal policy to use in this situation.

What problem will occur in the economy if no policy is pursued? What fiscal policy tools could be used to combat the problem? Draw a dynamic aggregate demand and supply graph to illustrate the appropriate fiscal policy to use in this situation.

What problem will occur in the economy if no policy is pursued? What fiscal policy tools could be used to combat the problem? Draw a dynamic aggregate demand and supply graph to illustrate the appropriate fiscal policy to use in this situation.

What problem will occur in the economy if no policy is pursued? What fiscal policy tools could be used to combat the problem? Draw a dynamic aggregate demand and supply graph to illustrate the appropriate fiscal policy to use in this situation.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

54

What is expansionary fiscal policy and under what circumstances would it be used?

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

55

If the economy is growing beyond potential GDP,which of the following would be an appropriate fiscal policy to bring the economy back to long-run aggregate supply? An increase in

A) liquidity and a decrease in interest rates.

B) government purchases.

C) oil prices.

D) taxes.

A) liquidity and a decrease in interest rates.

B) government purchases.

C) oil prices.

D) taxes.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

56

Figure 17.4

To try to combat inflation,the government could

A) decrease government spending.

B) decrease taxes.

C) lower interest rates.

D) conduct expansionary fiscal policy.

To try to combat inflation,the government could

A) decrease government spending.

B) decrease taxes.

C) lower interest rates.

D) conduct expansionary fiscal policy.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

57

Decreasing government spending ________ the price level and ________ equilibrium real GDP,ceteris paribus.

A) decreases; increases

B) increases; decreases

C) increases; increases

D) decreases; decreases

A) decreases; increases

B) increases; decreases

C) increases; increases

D) decreases; decreases

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

58

The multiplier effect is the series of ________ increases in ________ expenditures that result from an initial increase in ________ expenditures.

A) induced; investment; autonomous

B) induced; consumption; autonomous

C) autonomous; consumption; induced

D) autonomous; investment; induced

A) induced; investment; autonomous

B) induced; consumption; autonomous

C) autonomous; consumption; induced

D) autonomous; investment; induced

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

59

Figure 17.4

Given that the economy has moved from A to B in Figure 17.4,which of the following would be the appropriate fiscal policy to achieve potential GDP?

A) Decrease taxes

B) Decrease government spending

C) Expansionary fiscal policy

D) Increase interest rates

Given that the economy has moved from A to B in Figure 17.4,which of the following would be the appropriate fiscal policy to achieve potential GDP?

A) Decrease taxes

B) Decrease government spending

C) Expansionary fiscal policy

D) Increase interest rates

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

60

Contractionary fiscal policy aims to reduce the rate of increase in aggregate demand.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

61

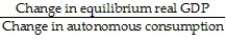

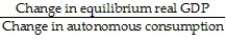

A general formula for the multiplier is

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

62

Suppose real GDP is $13 trillion,potential GDP is $13.5 trillion,and the government plans to use fiscal policy to restore the economy to potential GDP.Assuming a constant price level,the government would need to increase government purchases by

A) $500 billion.

B) less than $500 billion.

C) more than $500 billion.

D) None of these options is correct. The government must act to decrease government purchases in this case.

A) $500 billion.

B) less than $500 billion.

C) more than $500 billion.

D) None of these options is correct. The government must act to decrease government purchases in this case.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following is a true statement about the multiplier?

A) The formula for the multiplier overstates the real-world multiplier when we take into account the impact of changes in GDP on imports, inflation and the interest rate.

B) The larger the MPC, the smaller the multiplier.

C) The multiplier is the ratio of the change in spending to the change in GDP.

D) The multiplier makes the economy less sensitive to changes in autonomous expenditure.

A) The formula for the multiplier overstates the real-world multiplier when we take into account the impact of changes in GDP on imports, inflation and the interest rate.

B) The larger the MPC, the smaller the multiplier.

C) The multiplier is the ratio of the change in spending to the change in GDP.

D) The multiplier makes the economy less sensitive to changes in autonomous expenditure.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

64

A cut in tax rates affects equilibrium real GDP through two channels: ________ disposable income and consumer spending,and ________ the size of the multiplier effect.

A) decreasing; increasing

B) decreasing; decreasing

C) increasing; increasing

D) increasing; decreasing

A) decreasing; increasing

B) decreasing; decreasing

C) increasing; increasing

D) increasing; decreasing

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

65

If the absolute value of the tax multiplier equals 1.6,real GDP is $13 trillion,and potential GDP is $13.4 trillion,then taxes would need to be cut by ________ to restore the economy to potential GDP.

A) $250 billion

B) $400 billion

C) $640 billion

D) None of these options is correct. Taxes should be increased in this case.

A) $250 billion

B) $400 billion

C) $640 billion

D) None of these options is correct. Taxes should be increased in this case.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

66

The multiplier is calculated as the change in

A) real GDP/change in autonomous expenditure.

B) autonomous expenditure/change in real GDP.

C) nominal GDP/change in autonomous expenditure.

D) real GDP/change in induced spending.

A) real GDP/change in autonomous expenditure.

B) autonomous expenditure/change in real GDP.

C) nominal GDP/change in autonomous expenditure.

D) real GDP/change in induced spending.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

67

A change in tax rates

A) has a less complicated effect on GDP than a tax cut of a fixed amount.

B) has a larger multiplier effect the smaller the tax rate.

C) will not affect disposable income.

D) will not affect the size of the multiplier.

A) has a less complicated effect on GDP than a tax cut of a fixed amount.

B) has a larger multiplier effect the smaller the tax rate.

C) will not affect disposable income.

D) will not affect the size of the multiplier.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

68

If the government purchases multiplier equals 2,and real GDP is $14 trillion with potential GDP $14.5 trillion,then government purchases would need to increase by ________ to restore the economy to potential GDP.

A) $7.25 trillion

B) $1 trillion

C) $500 billion

D) $250 billion

A) $7.25 trillion

B) $1 trillion

C) $500 billion

D) $250 billion

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

69

The ratio of the increase in ________ to the increase in ________ is called the 'multiplier.'

A) equilibrium nominal GDP; autonomous expenditure

B) equilibrium real GDP; autonomous expenditure

C) autonomous expenditure; equilibrium real GDP

D) induced expenditure; equilibrium real GDP

A) equilibrium nominal GDP; autonomous expenditure

B) equilibrium real GDP; autonomous expenditure

C) autonomous expenditure; equilibrium real GDP

D) induced expenditure; equilibrium real GDP

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

70

Which of the following is a true statement about the multiplier?

A) The multiplier solely depends on the MPC.

B) The smaller the MPC, the smaller the multiplier.

C) The multiplier is a value between zero and one.

D) The multiplier effect does not occur when autonomous expenditures decrease.

A) The multiplier solely depends on the MPC.

B) The smaller the MPC, the smaller the multiplier.

C) The multiplier is a value between zero and one.

D) The multiplier effect does not occur when autonomous expenditures decrease.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

71

Reducing taxes by a specific fixed amount will usually

A) lower income and lower spending.

B) raise income and lower spending.

C) lower income and raise spending.

D) raise income and raise spending.

A) lower income and lower spending.

B) raise income and lower spending.

C) lower income and raise spending.

D) raise income and raise spending.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

72

Autonomous expenditure is a type of expenditure that does not depend on

A) wealth.

B) expectations.

C) interest rates.

D) income.

A) wealth.

B) expectations.

C) interest rates.

D) income.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

73

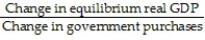

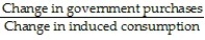

The government purchases multiplier is defined as:

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

74

Cutting taxes will

A) lower disposable income and lower spending.

B) raise disposable income and lower spending.

C) lower disposable income and raise spending.

D) raise disposable income and raise spending.

A) lower disposable income and lower spending.

B) raise disposable income and lower spending.

C) lower disposable income and raise spending.

D) raise disposable income and raise spending.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

75

If an increase in autonomous consumption spending of $10 million results in a $50 million increase in equilibrium real GDP,then the MPC is

A) 0.5.

B) 0.9.

C) 0.8.

D) 0.75.

A) 0.5.

B) 0.9.

C) 0.8.

D) 0.75.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

76

Assume in a closed economy that taxes are fixed and the marginal propensity to consume is equal to 0.8.What is the government purchases multiplier?

A) 10

B) 5

C) 4

D) 3

A) 10

B) 5

C) 4

D) 3

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

77

An equal increase in government purchases and taxes will cause

A) an increase in real GDP.

B) no change in real GDP.

C) an increase in the budget surplus.

D) a reduction in the cyclically adjusted budget surplus.

A) an increase in real GDP.

B) no change in real GDP.

C) an increase in the budget surplus.

D) a reduction in the cyclically adjusted budget surplus.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

78

Which of the following is not an explanation for the decline in autonomous expenditure that occurred in Australia during the Great Depression of the 1930s?

A) A decline in consumption due to a decline in wealth.

B) A decline in investment expenditures due to a lack of money and credit caused by a banking crisis.

C) A rise in export prices which made exports less attractive.

D) A decline in government spending.

A) A decline in consumption due to a decline in wealth.

B) A decline in investment expenditures due to a lack of money and credit caused by a banking crisis.

C) A rise in export prices which made exports less attractive.

D) A decline in government spending.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

79

The tax multiplier

A) is negative.

B) is larger in absolute value compared to the government purchases multiplier.

C) only works when taxes are cut.

D) is less than one.

A) is negative.

B) is larger in absolute value compared to the government purchases multiplier.

C) only works when taxes are cut.

D) is less than one.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

80

If an increase in investment spending of $20 million results in a $200 million increase in equilibrium real GDP,then the multiplier is

A) 1.0.

B) 100.

C) 10.

D) 0.1.

A) 1.0.

B) 100.

C) 10.

D) 0.1.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck