Deck 6: Deductions and Losses: in General

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/144

Play

Full screen (f)

Deck 6: Deductions and Losses: in General

1

Under the "one-year rule" for the current period deduction of prepaid expenses of cash basis taxpayers,the asset must expire or be consumed by the end of the tax year following the year of payment.

True

2

The concept of reasonableness applies not only to salaries but also to other business expenses.

True

3

Some expenses that are necessary are not ordinary and,therefore,are not deductible.

True

4

Bonnie sells her personal use SUV for $22,000 (adjusted basis of $38,000).Her realized loss of $16,000 ($22,000 - $38,000)can be recognized for income tax purposes.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

5

The period in which an accrual basis taxpayer can deduct an expense is determined by applying the economic performance test.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

6

A taxpayer in the 25% tax bracket may receive a different tax benefit for a $100 expenditure that is classified as a deduction from AGI than he or she will receive for a $100 expenditure that is classified as a deduction for AGI.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

7

None of the prepaid rent paid on October 1 by a calendar year cash basis taxpayer for the next 18 months is deductible in the current period.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

8

A taxpayer who claims the standard deduction can also deduct expenses that are classified as deductions for AGI.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

9

Generally,a closely-held family corporation is not permitted to take a deduction for a salary paid to a family member in calculating corporate taxable income.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

10

A moving expense that is reimbursed by the employer is a deduction for AGI,whereas an unreimbursed moving expense is classified as an itemized deduction.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

11

Only certain employment related expenses are classified as deductions for AGI.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

12

For an expense to be deducted as ordinary,it must be recurring in nature.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

13

Rob,a shareholder-employee of Falcon,Inc. ,receives a $300,000 salary.The IRS classifies $100,000 of this amount as unreasonable compensation.The effect of this reclassification is to decrease Rob's gross income by $100,000 and increase Falcon's gross income by $100,000.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

14

Investment-related expenses such as those related to investments in stocks and bonds are deductions for AGI.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

15

The income of a sole proprietorship are reported on Schedule C (Profit or Loss from Business).

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

16

Expenses incurred in a trade or business are deductible from AGI.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

17

Payment of expenses by a cash basis taxpayer does not necessarily ensure a deduction in the current year.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

18

Using his bank credit card,Seneca,a cash method taxpayer,charged a business expense on December 5,2010.He paid the credit card bill,which included the charge,on January 23,2011.Seneca can deduct the expense in 2010.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

19

For an expense to be deducted,the amount must be paid by the taxpayer.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

20

All expenses associated with the production of income are classified as deductions from AGI.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

21

Legal fees incurred in connection with a criminal defense are deductible if the crime is associated with a trade or business.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

22

Legal expenses incurred in connection with rental property are deductions from AGI.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

23

A hobby activity can result in all of the hobby income being included in AGI and no deductions being allowed.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

24

If a taxpayer cannot satisfy the three-out-of-five year presumption test associated with hobby losses,then expenses from the activity cannot be deducted in excess of the gross income from the activity.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

25

Two-thirds of treble damage payments under the antitrust law are deductible.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

26

Clark operates a gambling operation,which is an illegal business under the laws of Texas.Therefore,none of the expenses of the business are deductible.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

27

Fines paid in the course of carrying on a trade or business generally are deductible if there is a related business purpose.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

28

The amount of the addition to the reserve for bad debts for an accrual method taxpayer is allowed as a deduction for tax purposes.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

29

A baseball team that pays a star player an annual salary of $25 million can deduct the entire $25 million as salary expense.If the same amount is paid to the CEO of IBM,only $1 million is deductible.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

30

A bribe paid to a domestic (U.S. )official is not deductible,but it may be possible to deduct a bribe paid to a foreign official.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

31

The legal cost of having a will prepared is deductible.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

32

A political contribution to the Democratic Party or the Republican Party is not deductible,but a contribution to the Presidential Election Campaign Fund is deductible.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

33

Investigation of a business unrelated to one's present business never results in a current period deduction of the entire amount.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

34

Ordinary and necessary business expenses,other than cost of goods sold,of an illegal drug trafficking business do not reduce taxable income.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

35

If an activity involves horses,a profit in at least two of seven consecutive years meets the presumptive rule of § 183.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

36

If a taxpayer makes a profit in three of the five consecutive years ending with the taxable year,the burden of proof is on the IRS to prove the activity is a hobby rather than a trade or business.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

37

Hollis operates a lawn care service in southeastern Missouri.He incurs $63,000 of expenses determining the feasibility of expanding the business to southwestern Missouri.If he expands the business,the $63,000 is deductible in the current year.If he does not do so,then he must amortize the $63,000 over a 180-month period.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

38

If an item such as property taxes exceeds the income from a hobby,the excess amount of this item over the hobby income can be deducted if the taxpayer itemizes deductions.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

39

Susan is a sales representative for a U.S.weapons manufacturer.She makes a $100,000 "grease" payment to a U.S.government official associated with a weapons purchase by the U.S.Army.She makes a similar payment to a Saudi Arabian government official associated with a similar sale.Neither of these payments is deductible by Susan's employer.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

40

The cost of legal advice associated with the preparation of an individual's Federal income tax return is not deductible because it is a personal expense.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following expenses is classified as a deduction for AGI?

A)Alimony.

B)Reimbursed employee business expense.

C)Safe deposit box rental fee in which investment securities are stored.

D)Only a.and b.

E)a. ,b. ,and c.

A)Alimony.

B)Reimbursed employee business expense.

C)Safe deposit box rental fee in which investment securities are stored.

D)Only a.and b.

E)a. ,b. ,and c.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

42

If a vacation home is classified as primarily personal use (i.e. ,rented for fewer than 15 days),none of the related expenses can be deducted.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

43

If a vacation home is classified as primarily personal use,part of the maintenance and utility expenses can be allocated and deducted as a rental expense.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

44

Trade and business expenses should be treated as:

A)A deduction from AGI subject to the 2%-of-AGI floor.

B)A deduction from AGI not subject to the 2%-of-AGI floor.

C)Deductible for AGI.

D)An itemized deduction if not reimbursed.

E)None of the above.

A)A deduction from AGI subject to the 2%-of-AGI floor.

B)A deduction from AGI not subject to the 2%-of-AGI floor.

C)Deductible for AGI.

D)An itemized deduction if not reimbursed.

E)None of the above.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

45

For purposes of the § 267 loss disallowance provision,a taxpayer's nephew is a related party.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

46

Hobby activity expenses are deductible from AGI to the extent of hobby income.Such expenses not in excess of hobby income are not subject to the 2% of AGI floor.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

47

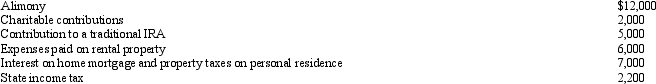

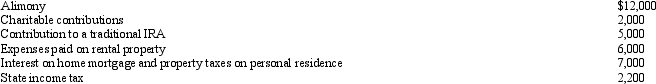

Saul is single,under age 65,and has gross income of $50,000.His deductible expenses are as follows:  What is Saul's AGI?

What is Saul's AGI?

A)$15,800.

B)$27,000.

C)$32,000.

D)$33,000.

E)None of the above.

What is Saul's AGI?

What is Saul's AGI?A)$15,800.

B)$27,000.

C)$32,000.

D)$33,000.

E)None of the above.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

48

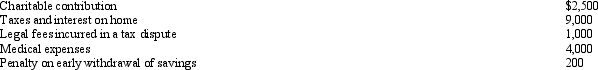

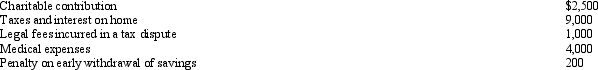

Janice is single,had gross income of $38,000,and incurred the following expenses:  Her AGI is:

Her AGI is:

A)$21,300.

B)$28,800.

C)$32,800.

D)$35,500.

E)$37,800.

Her AGI is:

Her AGI is:A)$21,300.

B)$28,800.

C)$32,800.

D)$35,500.

E)$37,800.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

49

Beulah's personal residence has an adjusted basis of $250,000 and a fair market value of $230,000.Beulah converts the property to rental use on December 1,2010.The vacation home rules that limit the amount of the deduction to the rental income will apply and the adjusted basis for depreciation is $230,000.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

50

In preparing his 2010 Federal income tax return,Sam,who is not married,incorrectly claimed alimony payments of $12,000 as an itemized deduction (rather than as a deduction for AGI).Sam's AGI is $60,000 and itemized deductions (which consist of the alimony,property taxes,and mortgage interest)are $20,000.Which of the following statements is correct?

A)The error will result in taxable income being overstated.

B)The error will result in taxable income being understated.

C)The error could result in either taxable income being overstated or understated.

D)The error will have no effect on taxable income.

E)None of the above.

A)The error will result in taxable income being overstated.

B)The error will result in taxable income being understated.

C)The error could result in either taxable income being overstated or understated.

D)The error will have no effect on taxable income.

E)None of the above.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

51

A taxpayer pays his son's real estate taxes.The taxpayer may deduct the real estate taxes,but the son cannot.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

52

Theo owns a vacation home that is classified in the personal use/rental use category.Rent income is $9,000,while property taxes and mortgage interest allocated to the rental use part are $12,000.Only $9,000 of the $12,000 expenses can be deducted.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

53

Marge sells land to her adult son,Jason,for its $20,000 appraised value.Her adjusted basis for the land is $25,000.Marge's recognized loss is $0 and Jason's adjusted basis for the land is $25,000 ($20,000 cost + $5,000 disallowed loss of Marge).

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

54

If a vacation home is classified as primarily rental use,a deduction for all of the rental expenses is allowed.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

55

If a vacation home is a personal/rental residence,no maintenance and utility expenses can be claimed as a deduction.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

56

A vacation home rented for 200 days and used personally for 18 days is classified in the personal/rental use category.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

57

If a vacation home is used for personal use less than 15 days and is rented for more than 14 days during a year,the property is treated as primarily rental property.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

58

Landscaping expenditures on new rental property are deductible in the year they are paid or incurred.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

59

Susan rents part of her personal residence in the summer for 10 days for $1,000.Anne rents all of her personal residence for 3 weeks in December for $2,500.Anne must include the $2,500 in her gross income whereas Susan is not required to include the $1,000 in her gross income.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

60

LD Partnership,a cash basis taxpayer,purchases land and a building for $200,000 with $150,000 of the cost being allocated to the building.The gross receipts of the partnership are less than $100,000.LD must capitalize the $50,000 paid for the land,but can deduct the $150,000 paid for the building in the current tax year.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following are deductions for AGI?

A)Mortgage interest on a personal residence.

B)Property taxes on a personal residence.

C)Mortgage interest on a building used in a business.

D)Fines and penalties incurred in a trade or business.

E)None of the above.

A)Mortgage interest on a personal residence.

B)Property taxes on a personal residence.

C)Mortgage interest on a building used in a business.

D)Fines and penalties incurred in a trade or business.

E)None of the above.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

62

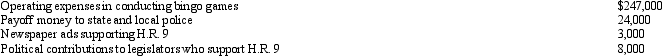

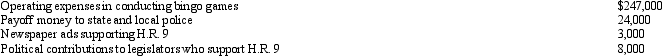

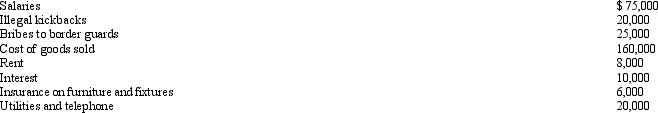

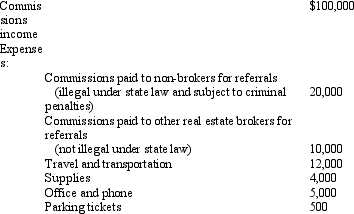

Rex,a cash basis calendar year taxpayer,runs a bingo operation which is illegal under state law.During 2010,a bill designated H.R.9 is introduced into the state legislature which,if enacted,would legitimize bingo games.In 2010,Rex had the following expenses:  Of these expenditures,Rex may deduct:

Of these expenditures,Rex may deduct:

A)$247,000.

B)$250,000.

C)$258,000.

D)$282,000.

E)None of the above.

Of these expenditures,Rex may deduct:

Of these expenditures,Rex may deduct:A)$247,000.

B)$250,000.

C)$258,000.

D)$282,000.

E)None of the above.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following is incorrect?

A)Alimony is a deduction for AGI.

B)The expenses associated with royalty property are a deduction for AGI.

C)Contributions to a traditional IRA are a deduction from AGI.

D)Medical expenses are a deduction from AGI

E)All of the above are correct.

A)Alimony is a deduction for AGI.

B)The expenses associated with royalty property are a deduction for AGI.

C)Contributions to a traditional IRA are a deduction from AGI.

D)Medical expenses are a deduction from AGI

E)All of the above are correct.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

64

Benita incurred a business expense on December 10,2010,which she charged on her bank credit card.She paid the credit card statement which included the charge on January 5,2011.Which of the following is correct?

A)If Benita is a cash method taxpayer,she cannot deduct the expense until 2011.

B)If Benita is an accrual method taxpayer,she can deduct the expense in 2010.

C)If Benita uses the accrual method,she can choose to deduct the expense in either 2010 or 2011.

D)Only b.and c.are correct.

E)a. ,b. ,and c.are correct.

A)If Benita is a cash method taxpayer,she cannot deduct the expense until 2011.

B)If Benita is an accrual method taxpayer,she can deduct the expense in 2010.

C)If Benita uses the accrual method,she can choose to deduct the expense in either 2010 or 2011.

D)Only b.and c.are correct.

E)a. ,b. ,and c.are correct.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

65

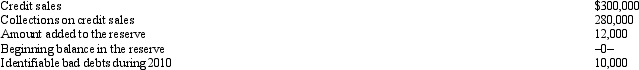

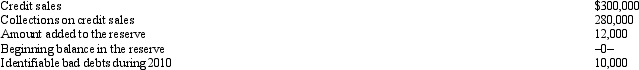

Swan,Inc.is an accrual basis taxpayer.Swan uses the aging approach to calculate the reserve for bad debts.During 2010,the following occur associated with bad debts.  The amount of the deduction for bad debt expense for Swan for 2010 is:

The amount of the deduction for bad debt expense for Swan for 2010 is:

A)$10,000.

B)$12,000.

C)$20,000.

D)$22,000.

E)None of the above.

The amount of the deduction for bad debt expense for Swan for 2010 is:

The amount of the deduction for bad debt expense for Swan for 2010 is:A)$10,000.

B)$12,000.

C)$20,000.

D)$22,000.

E)None of the above.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

66

Which of the following is a deduction from AGI (itemized deduction)?

A)Contribution to a traditional IRA.

B)Roof repairs to a rental home.

C)Safe deposit box rental fee in which stock certificates are stored.

D)Alimony payment.

E)None of the above.

A)Contribution to a traditional IRA.

B)Roof repairs to a rental home.

C)Safe deposit box rental fee in which stock certificates are stored.

D)Alimony payment.

E)None of the above.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

67

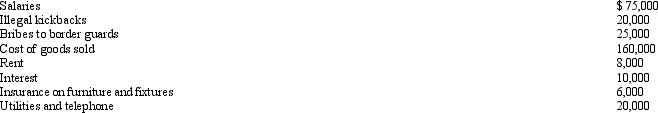

Tom operates an illegal drug-running operation and incurred the following expenses:  Which of the above amounts reduces his taxable income?

Which of the above amounts reduces his taxable income?

A)$0.

B)$160,000.

C)$279,000.

D)$324,000.

E)None of the above.

Which of the above amounts reduces his taxable income?

Which of the above amounts reduces his taxable income?A)$0.

B)$160,000.

C)$279,000.

D)$324,000.

E)None of the above.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following statements is correct in connection with the investigation of a business?

A)If the taxpayer is not already engaged in the trade or business,the expenses incurred are deductible if the project is abandoned.

B)If the business is acquired,the expenses may be deducted immediately by a taxpayer engaged in a similar trade or business.

C)That business must be related to the taxpayer's present business for any expense ever to be deductible.

D)Regardless of whether the taxpayer is already engaged in the trade or business,the expenses must be capitalized and amortized.

E)None of the above.

A)If the taxpayer is not already engaged in the trade or business,the expenses incurred are deductible if the project is abandoned.

B)If the business is acquired,the expenses may be deducted immediately by a taxpayer engaged in a similar trade or business.

C)That business must be related to the taxpayer's present business for any expense ever to be deductible.

D)Regardless of whether the taxpayer is already engaged in the trade or business,the expenses must be capitalized and amortized.

E)None of the above.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following is correct?

A)A personal casualty loss is classified as a deduction from AGI.

B)Real estate taxes on a taxpayer's personal residence are classified as deductions from AGI.

C)An expense associated with rental property is classified as a deduction from AGI.

D)Only a.and b.are correct.

E)a. ,b. ,and c. ,are correct.

A)A personal casualty loss is classified as a deduction from AGI.

B)Real estate taxes on a taxpayer's personal residence are classified as deductions from AGI.

C)An expense associated with rental property is classified as a deduction from AGI.

D)Only a.and b.are correct.

E)a. ,b. ,and c. ,are correct.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

70

Melvin is engaged in an illegal drug-running operation.Which of the following expenses will reduce Melvin's taxable income?

A)Rent.

B)Bribes paid to border guards.

C)Cost of goods sold.

D)Interest on business indebtedness.

E)None of the expenses are deductible.

A)Rent.

B)Bribes paid to border guards.

C)Cost of goods sold.

D)Interest on business indebtedness.

E)None of the expenses are deductible.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

71

Agnes is the sole shareholder of Violet,Inc.For 2010,she receives from Violet a salary of $200,000 and dividends of $100,000.Violet's taxable income for 2010 is $500,000.On audit,the IRS treats $50,000 of Agnes's salary as unreasonable.Which of the following statements is correct?

A)Agnes's gross income will increase by $50,000 as a result of the IRS adjustment.

B)Violet's taxable income will not be affected by the IRS adjustment.

C)Agnes's gross income will decrease by $50,000 as a result of the IRS adjustment.

D)Violet's taxable income will increase by $50,000 as a result of the IRS adjustment.

E)None of the above is correct.

A)Agnes's gross income will increase by $50,000 as a result of the IRS adjustment.

B)Violet's taxable income will not be affected by the IRS adjustment.

C)Agnes's gross income will decrease by $50,000 as a result of the IRS adjustment.

D)Violet's taxable income will increase by $50,000 as a result of the IRS adjustment.

E)None of the above is correct.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

72

Which of the following is not a "trade or business" expense?

A)Interest on business indebtedness.

B)Property taxes on business property.

C)Parking ticket paid on business auto.

D)Depreciation on business property.

E)All of the above are "trade or business" expenses.

A)Interest on business indebtedness.

B)Property taxes on business property.

C)Parking ticket paid on business auto.

D)Depreciation on business property.

E)All of the above are "trade or business" expenses.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

73

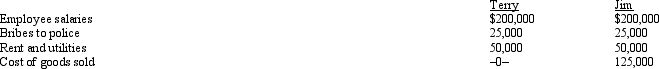

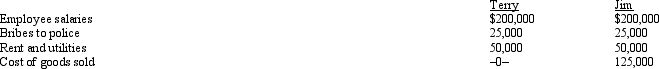

Terry and Jim are both involved in operating illegal businesses.Terry operates a gambling business and Jim operates a drug running business.Both businesses have gross revenues of $500,000.The businesses incur the following expenses.  Which of the following statements is correct?

Which of the following statements is correct?

A)Neither Terry nor Jim can deduct any of the above items in calculating the business profit.

B)Terry should report profit from his business of $250,000.

C)Jim should report profit from his business of $500,000.

D)Jim should report profit from his business of $250,000.

E)None of the above.

Which of the following statements is correct?

Which of the following statements is correct?A)Neither Terry nor Jim can deduct any of the above items in calculating the business profit.

B)Terry should report profit from his business of $250,000.

C)Jim should report profit from his business of $500,000.

D)Jim should report profit from his business of $250,000.

E)None of the above.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

74

Payments by a cash basis taxpayer of capital expenditures:

A)Must be expensed at the time of payment.

B)Must be expensed by the end of the first year after the asset is acquired.

C)Must be deducted over the actual or statutory life of the asset.

D)Can be deducted in the year the taxpayer chooses.

E)None of the above.

A)Must be expensed at the time of payment.

B)Must be expensed by the end of the first year after the asset is acquired.

C)Must be deducted over the actual or statutory life of the asset.

D)Can be deducted in the year the taxpayer chooses.

E)None of the above.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

75

Which of the following is deductible as a trade or business expense?

A)A city coroner contributes to the mayor's reelection campaign fund.

B)Illegal bribes and kickbacks.

C)Two-thirds of treble damage payments.

D)Fines and penalties.

E)None of the above.

A)A city coroner contributes to the mayor's reelection campaign fund.

B)Illegal bribes and kickbacks.

C)Two-thirds of treble damage payments.

D)Fines and penalties.

E)None of the above.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

76

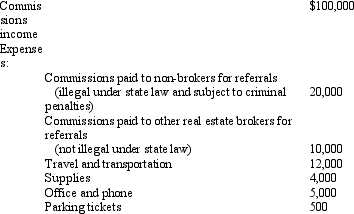

Angela,a real estate broker,had the following income and expenses in her business:  How much net income must Angela report from this business?

How much net income must Angela report from this business?

A)$48,500.

B)$49,000.

C)$60,000.

D)$68,500.

E)$69,000.

How much net income must Angela report from this business?

How much net income must Angela report from this business?A)$48,500.

B)$49,000.

C)$60,000.

D)$68,500.

E)$69,000.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

77

Vera is the CEO of Brunettes,a publicly held corporation.For the year,she receives a salary of $950,000,a bonus of $600,000,and contributions to her retirement plan of $35,000.The bonus was awarded at the December board meeting based on Vera's threat to accept a better paying job with a competitor.What amount may Brunettes deduct?

A)$950,000.

B)$985,000.

C)$1,550,000.

D)$1,585,000.

E)None of the above.

A)$950,000.

B)$985,000.

C)$1,550,000.

D)$1,585,000.

E)None of the above.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

78

Iris,a calendar year cash basis taxpayer,owns and operates several TV rental outlets in Florida,and wants to expand to other states.During 2010,she spends $14,000 to investigate TV rental stores in South Carolina and $9,000 to investigate TV rental stores in Georgia.She acquires the South Carolina operations,but not the outlets in Georgia.As to these expenses,Iris should:

A)Capitalize $14,000 and not deduct $9,000.

B)Expense $23,000 for 2010.

C)Expense $9,000 for 2010 and capitalize $14,000.

D)Capitalize $23,000.

E)None of the above.

A)Capitalize $14,000 and not deduct $9,000.

B)Expense $23,000 for 2010.

C)Expense $9,000 for 2010 and capitalize $14,000.

D)Capitalize $23,000.

E)None of the above.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

79

Tommy,an automobile mechanic employed by an auto dealership,is considering opening a fast food franchise.If Tommy decides not to acquire the fast food franchise,any investigation expenses are:

A)A deduction for AGI.

B)A deduction from AGI,subject to the 2 percent floor.

C)A deduction from AGI,not subject to the 2 percent floor.

D)Deductible up to $5,000 in the current year with the balance being amortized over a 180-month period.

E)Not deductible.

A)A deduction for AGI.

B)A deduction from AGI,subject to the 2 percent floor.

C)A deduction from AGI,not subject to the 2 percent floor.

D)Deductible up to $5,000 in the current year with the balance being amortized over a 180-month period.

E)Not deductible.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

80

Which of the following cannot be deducted as a § 162 business expense?

A)Expenses of investing in stocks and bonds.

B)Charitable contributions made by a sole proprietorship.

C)Fines and penalties.

D)Only a.and c.cannot.

E)a. ,b. ,and c.cannot.

A)Expenses of investing in stocks and bonds.

B)Charitable contributions made by a sole proprietorship.

C)Fines and penalties.

D)Only a.and c.cannot.

E)a. ,b. ,and c.cannot.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck