Deck 15: Alternative Minimum Tax

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/119

Play

Full screen (f)

Deck 15: Alternative Minimum Tax

1

The AMT can be calculated using either the direct or the indirect approaches.The tax law uses the indirect approach while the tax forms use the direct approach.

False

2

The required adjustment for AMT purposes for pollution control facilities placed in service in 2010 is equal to the difference between the amortization deduction allowed for regular income tax purposes and the depreciation deduction computed under ADS.

False

3

AMT adjustments can be both positive and negative in calculating AMTI,whereas AMT tax preferences can be only positive.

True

4

If circulation expenditures are amortized over a ten-year period for regular income tax purposes,there will be no AMT adjustment.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

5

Joel placed real property in service in 2010 that cost $500,000 and used MACRS for regular income tax purposes.He is required to make a positive adjustment for AMT purposes in 2010.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

6

Keosha acquires 10-year personal property to use in her business in 2010 and takes the maximum cost recovery deduction for regular income tax purposes.As a result of this,Keosha will have a positive AMT adjustment in 2010.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

7

If the AMT base is not greater than $175,000,the AMT rate for an individual taxpayer is the same as the AMT rate for a C corporation.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

8

The net capital gain included in an individual taxpayer's AMT base is eligible for the alternative tax rate on net capital gain.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

9

The phaseout of the AMT exemption amount for a taxpayer filing as a head of household both begins and ends at a lower income level than it does for a married taxpayer who files a joint return.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

10

Peter incurred circulation expenditures of $210,000 in 2010 and deducted that amount for regular income tax purposes.Peter has a $70,000 negative AMT adjustment for 2011,for 2012,and for 2013.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

11

If the tentative AMT is less than the regular income tax,the AMT will be zero.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

12

After personal property is fully depreciated for both regular income tax purposes and AMT purposes,the positive and negative adjustments that have been made for AMT purposes will net to zero.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

13

Altrice incurs circulation expenditures of $90,000 in 2010.No additional circulation expenditures are incurred in 2011 or 2012.The cumulative adjustment for circulation expenditures for 2010,2011,and 2012 is $0.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

14

Nonrefundable personal credits are permitted to offset the AMT.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

15

Jan's tentative AMT is $32,500.Her regular income tax liability is $29,000.Jan's AMT is $3,500.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

16

Prior to the effect of tax credits,Brent's regular income tax liability is $145,000 and his tentative AMT is $120,000.Brent has nonrefundable business tax credits of $32,000.Brent's tax liability is $113,000.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

17

Negative AMT adjustments for the current year caused by timing differences are offset by the positive AMT adjustments for prior tax years also caused by timing differences.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

18

Assuming no phaseout,the AMT exemption amount for married taxpayers filing jointly for 2010 is the same as the AMT exemption amount for C corporations.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

19

The purpose of the AMT is to replace the regular income tax.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

20

Since most tax preferences are merely timing differences,they eventually will reverse and net to zero.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

21

If a gambling loss itemized deduction is permitted for regular income tax purposes,the amount of the gambling loss itemized deduction for AMT purposes is the same.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

22

If the regular income tax deduction for medical expenses is $0,under certain circumstances the AMT deduction for medical expenses can be greater than $0.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

23

The AMT adjustment for mining exploration and development costs can be avoided if the taxpayer elects to write off the expenditures over a 10-year period,rather than being expensed in the year incurred for regular income tax purposes.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

24

The deduction for charitable contributions in calculating the regular income tax is not the same as that in calculating the AMT.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

25

If Faye's standard deduction exceeds her itemized deductions,there will be no AMT adjustment.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

26

The deduction for charitable contributions in calculating the regular income tax can differ from that in calculating the AMT because the percentage limitations (20%,30%,and 50%)may be applied to a different base amount.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

27

Land that originally cost $100,000 is sold for $80,000.There is a negative AMT adjustment of $20,000 associated with the sale of the land.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

28

Tammy expensed mining exploration and development costs of $100,000 incurred in 2010.She will be required to make negative AMT adjustments for each of the next nine years and a positive AMT adjustment in the current tax year.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

29

If all long-term contracts are accounted for under the percentage of completion method for regular income tax purposes,no adjustment is required for AMT purposes.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

30

For a building placed in service before 1999,the adjusted basis can be different for regular income tax purposes and for AMT purposes.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

31

In 2010,Daniel exercised an incentive stock option (ISO),acquiring stock with a fair market value of $210,000 for $165,000.His AMT basis for the stock is $210,000,his regular income tax basis for the stock is $165,000,and his AMT adjustment is $45,000 ($210,000 - $165,000).

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

32

For AMT purposes,taxpayers must capitalize and amortize research and experimental expenditures over a 10-year period.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

33

The deduction for personal and dependency exemptions usually is allowed for regular income tax purposes,but is disallowed for AMT purposes.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

34

Income from some long-term contracts can be reported using the completed contract method for regular income tax purposes,but the percentage of completion method is required for AMT purposes for all long-term contracts.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

35

Interest on a home equity loan may be deductible for AMT purposes.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

36

Losses associated with a passive activity owned by an individual are not deductible against active income or portfolio income in computing either the regular income tax or the AMT.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

37

The recognized gain for regular income tax purposes and the recognized gain for AMT purposes on the sale of stock acquired under an incentive stock option (ISO)program are always the same because the adjusted basis is the same.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

38

Medical expenses are reduced by 10% of AGI to compute the amount deductible for AMT purposes and 7.5% of AGI for regular income tax purposes.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

39

Frances,who had AGI of $100,000,itemized her deductions in the current year.She incurred unreimbursed employee business expenses of $6,200.Frances must make a positive AMT adjustment of $2,000 in computing AMT.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

40

The exercise of an incentive stock option (ISO)increases both the AMTI and regular taxable income in the year of exercise.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

41

In 2010 and under § 1202,Jordan excludes from gross income 75% of the realized gain of $80,000 on the sale of qualifying small business stock.As a result of this exclusion,Jordan will have an AMT preference in calculating AMTI of $40,000.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

42

The AMT exemption for C corporations is $40,000 reduced by 25% of the amount by which AMTI exceeds $150,000.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

43

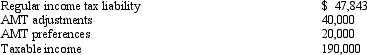

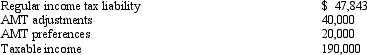

Meg,who is single and age 36,provides you with the following information from her financial records.  Calculate her AMT exemption for 2010.

Calculate her AMT exemption for 2010.

A)$1,143.

B)$27,325.

C)$46,700.

D)$47,843.

E)None of the above.

Calculate her AMT exemption for 2010.

Calculate her AMT exemption for 2010.A)$1,143.

B)$27,325.

C)$46,700.

D)$47,843.

E)None of the above.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

44

The AMT does not apply to qualifying "small corporations."

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

45

As to the AMT,a C corporation has no adjustments or preferences for itemized deductions.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

46

For regular income tax purposes,Yolanda,who is single,is in the 35% tax bracket.Her AMT base is $220,000.Her tentative AMT is:

A)$57,200.

B)$58,100.

C)$61,600.

D)$77,000.

E)None of the above.

A)$57,200.

B)$58,100.

C)$61,600.

D)$77,000.

E)None of the above.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

47

For individual taxpayers,the AMT credit is applicable for the AMT that results from timing differences,but it is not available for the AMT that results from the adjustment for itemized deductions or exclusion preferences.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

48

Corporations are subject to a positive AMT adjustment equal to 75% of the excess of ACE over AMTI before the ACE adjustment.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

49

During its first year of operations,Sherry's business incurred circulation expenditures of $90,000.Since the income of the business is small,Sherry decides to capitalize the expenditures and to amortize them over 3 years for regular income tax purposes.The AMT adjustment for circulation expenditures for the first year of operations is:

A)$0.

B)Negative adjustment of $30,000.

C)Positive adjustment of $30,000.

D)Positive adjustment of $60,000.

E)None of the above.

A)$0.

B)Negative adjustment of $30,000.

C)Positive adjustment of $30,000.

D)Positive adjustment of $60,000.

E)None of the above.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

50

All of a corporation's AMT is available for carryover as a minimum tax credit regardless of whether the adjustments and preferences originate from timing differences or AMT exclusions.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

51

Agnes is able to reduce her regular income tax liability from $40,000 to $36,000 as the result of the alternative tax on net capital gain.Agnes' tentative AMT is $50,000.

A)Agnes' tax liability is reduced by $4,000 as the result of the alternative tax calculation on net capital gain.

B)Agnes' AMT is increased by $4,000 as the result of the alternative tax calculation on net capital gain.

C)Agnes' tax liability is $46,000.

D)Agnes' tax liability is $54,000.

E)None of the above.

A)Agnes' tax liability is reduced by $4,000 as the result of the alternative tax calculation on net capital gain.

B)Agnes' AMT is increased by $4,000 as the result of the alternative tax calculation on net capital gain.

C)Agnes' tax liability is $46,000.

D)Agnes' tax liability is $54,000.

E)None of the above.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

52

If a single taxpayer has regular income tax liability of $19,500 and AMTI of $130,000,calculate the AMT for 2010.

A)$3,296.

B)$3,426.

C)$22,796.

D)$42,325.

E)None of the above.

A)$3,296.

B)$3,426.

C)$22,796.

D)$42,325.

E)None of the above.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

53

The C corporation AMT rate is higher than the individual AMT rates.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

54

Prior to the effect of the tax credits,Justin's regular income tax liability is $200,000 and his tentative AMT is $195,000.Justin has the following credits:  Calculate Justin's tax liability after credits.

Calculate Justin's tax liability after credits.

A)$190,000.

B)$194,000.

C)$195,000.

D)$200,000.

E)None of the above.

Calculate Justin's tax liability after credits.

Calculate Justin's tax liability after credits.A)$190,000.

B)$194,000.

C)$195,000.

D)$200,000.

E)None of the above.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

55

Miriam,who is single and age 36,provides you with the following information from her financial records for 2010.  Calculate her AMTI for 2010.

Calculate her AMTI for 2010.

A)$93,501.

B)$178,800.

C)$206,925.

D)$225,000.

E)None of the above.

Calculate her AMTI for 2010.

Calculate her AMTI for 2010.A)$93,501.

B)$178,800.

C)$206,925.

D)$225,000.

E)None of the above.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following statements is correct?

A)The purpose of the AMT is to replace the regular income tax.

B)Adjustments can either increase AMTI or decrease AMTI.

C)Tax preferences can either increase AMTI or decrease AMTI.

D)Tax preferences can only decrease AMTI.

E)None of the above is correct.

A)The purpose of the AMT is to replace the regular income tax.

B)Adjustments can either increase AMTI or decrease AMTI.

C)Tax preferences can either increase AMTI or decrease AMTI.

D)Tax preferences can only decrease AMTI.

E)None of the above is correct.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

57

If a taxpayer has tentative AMT of $60,000 and AMT of $15,000,what is the regular income tax liability?

A)$0.

B)$15,000.

C)$45,000.

D)$75,000.

E)None of the above.

A)$0.

B)$15,000.

C)$45,000.

D)$75,000.

E)None of the above.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

58

Interest income on private activity bonds issued before 2009,reduced by expenses incurred in carrying the bonds,is a tax preference item that is included in computing AMTI.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

59

Kay had percentage depletion of $82,000 for the current year for regular income tax purposes.Cost depletion was $55,000.Her basis in the property was $70,000 at the beginning of the current year.Kay must treat the percentage depletion deducted in excess of cost depletion,or $27,000,as a tax preference in computing AMTI.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

60

If the taxpayer elects to capitalize intangible drilling costs and to amortize them over a 10-year period for regular income tax purposes,there is no adjustment or preference for AMT purposes.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

61

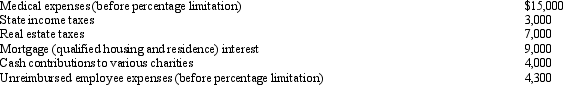

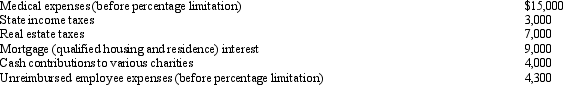

Mitch,who is single and has no dependents,had AGI of $100,000 in 2010.His potential itemized deductions were as follows:  What is the amount of Mitch's AMT adjustment for itemized deductions for 2010?

What is the amount of Mitch's AMT adjustment for itemized deductions for 2010?

A)$14,800.

B)$16,800.

C)$19,300.

D)$25,800.

E)None of the above.

What is the amount of Mitch's AMT adjustment for itemized deductions for 2010?

What is the amount of Mitch's AMT adjustment for itemized deductions for 2010?A)$14,800.

B)$16,800.

C)$19,300.

D)$25,800.

E)None of the above.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

62

On January 3,1997,White Corporation acquired an office building for $100,000 and claimed MACRS depreciation of 2.461%.The Alternative Depreciation System rate for the first recovery year is 2.396%.What was White's AMT adjustment (or preference)for depreciation with respect to the office building in 1997?

A)$65 positive adjustment.

B)$65 negative adjustment.

C)$0 adjustment or preference.

D)$2,461 positive adjustment.

E)None of the above.

A)$65 positive adjustment.

B)$65 negative adjustment.

C)$0 adjustment or preference.

D)$2,461 positive adjustment.

E)None of the above.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following normally produces positive AMT adjustments?

A)Real property taxes deduction.

B)Standard deduction.

C)Personal exemption deduction.

D)Only b.and c.are correct.

E)a. ,b. ,and c.are correct.

A)Real property taxes deduction.

B)Standard deduction.

C)Personal exemption deduction.

D)Only b.and c.are correct.

E)a. ,b. ,and c.are correct.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

64

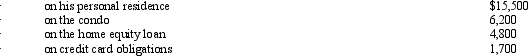

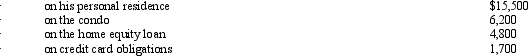

Ted,who is single,owns a personal residence in the city.He also owns a condo near the ocean.He uses the condo as a vacation home.In March 2010,he borrowed $50,000 on a home equity loan and used the proceeds to acquire a luxury automobile.During 2010,he paid the following amounts of interest:  What amount,if any,must Ted recognize as an AMT adjustment in 2010?

What amount,if any,must Ted recognize as an AMT adjustment in 2010?

A)$0.

B)$4,800.

C)$6,200.

D)$11,000.

E)None of the above.

What amount,if any,must Ted recognize as an AMT adjustment in 2010?

What amount,if any,must Ted recognize as an AMT adjustment in 2010?A)$0.

B)$4,800.

C)$6,200.

D)$11,000.

E)None of the above.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

65

Omar acquires used 7-year personal property for $100,000 to use in his business in February 2010.Omar does not elect § 179 expensing,but does take the maximum regular cost recovery deduction.As a result,Omar will have a positive AMT adjustment in 2010 of what amount?

A)$0.

B)$3,580.

C)$10,710.

D)$14,290.

E)None of the above.

A)$0.

B)$3,580.

C)$10,710.

D)$14,290.

E)None of the above.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

66

Marvin,the vice president of Lavender,Inc. ,exercises stock options for 100 shares of stock in March 2010.The stock options are incentive stock options (ISOs).Their exercise price is $20 and the fair market value on the date of exercise is $28.The options were granted in March 2007 and all restrictions on the free transferability had lapsed by the exercise date.

A)If Marvin sells the stock in December 2010 for $3,000,his AMT adjustment in 2010 is a positive adjustment of $800.

B)If Marvin sells the stock in December 2011 for $3,000,his AMT adjustment in 2011 is $0.

C)If Marvin sells the stock in December 2010 for $3,000,his AMT adjustment in 2010 is a negative adjustment of $800.

D)If Marvin sells the stock in December 2011 for $3,000,his AMT adjustment in 2011 is a negative adjustment of $1,000.

E)None of the above.

A)If Marvin sells the stock in December 2010 for $3,000,his AMT adjustment in 2010 is a positive adjustment of $800.

B)If Marvin sells the stock in December 2011 for $3,000,his AMT adjustment in 2011 is $0.

C)If Marvin sells the stock in December 2010 for $3,000,his AMT adjustment in 2010 is a negative adjustment of $800.

D)If Marvin sells the stock in December 2011 for $3,000,his AMT adjustment in 2011 is a negative adjustment of $1,000.

E)None of the above.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

67

In 2010,Ray incurs $60,000 of mining exploration expenditures,and deducts the entire amount for regular income tax purposes.Which of the following statements is incorrect?

A)For AMT purposes,Ray will have a positive adjustment of $54,000 in 2010.

B)Ray will have a negative AMT adjustment of $6,000 in 2015.

C)Over a 10-year period,positive and negative adjustments will net to zero.

D)The AMT adjustment for mining exploration expenditures cannot be avoided if the taxpayer elects to write the expenditures off over a 10-year period.

E)All of the above are correct.

A)For AMT purposes,Ray will have a positive adjustment of $54,000 in 2010.

B)Ray will have a negative AMT adjustment of $6,000 in 2015.

C)Over a 10-year period,positive and negative adjustments will net to zero.

D)The AMT adjustment for mining exploration expenditures cannot be avoided if the taxpayer elects to write the expenditures off over a 10-year period.

E)All of the above are correct.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following itemized deductions will be the same amount for the regular income tax and the AMT?

A)Real property taxes.

B)Medical expenses.

C)Charitable contributions.

D)State income taxes.

E)None of the above.

A)Real property taxes.

B)Medical expenses.

C)Charitable contributions.

D)State income taxes.

E)None of the above.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

69

Prior to the effect of tax credits,Eunice's regular income tax liability is $200,000 and her tentative AMT is $190,000.Eunice has general business credits available of $12,500.Calculate Eunice's tax liability after tax credits.

A)$200,000.

B)$190,000.

C)$187,500.

D)$177,500.

E)None of the above.

A)$200,000.

B)$190,000.

C)$187,500.

D)$177,500.

E)None of the above.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

70

Wallace owns a construction company that builds both commercial and residential buildings.He contracts to build a residential building for $800,000 for which he is eligible to use the completed contract method of accounting.In the current year for regular income tax purposes,Wallace does not recognize any income on the contract.Under the percentage of complete method,the income recognized under the contract would have been $60,000.Wallace's AMT adjustment is:

A)$0.

B)$60,000 negative adjustment.

C)$60,000 positive adjustment.

D)$800,000 positive adjustment.

E)None of the above.

A)$0.

B)$60,000 negative adjustment.

C)$60,000 positive adjustment.

D)$800,000 positive adjustment.

E)None of the above.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

71

Erin owns a mineral property that had a basis of $10,000 at the beginning of the year.The property qualifies for a 15% depletion rate.Gross income from the property was $120,000 and net income before the percentage depletion deduction was $50,000.What is Erin's tax preference for excess depletion?

A)$8,000

B)$10,000.

C)$18,000.

D)$0.

E)None of the above.

A)$8,000

B)$10,000.

C)$18,000.

D)$0.

E)None of the above.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

72

In 2010,Glenda had a $97,000 loss on a passive activity.None of the loss is attributable to AMT adjustments or preferences.She has no other passive activities.Which of the following statements is correct?

A)In 2010,Glenda can deduct $97,000 for regular income tax purposes and for AMT purposes.

B)Glenda will have a $97,000 tax preference in 2010 as a result of the passive activity.

C)For regular income tax purposes,none of the loss is allowed in 2010.

D)In 2010,Glenda will have a positive adjustment of $25,000 as a result of the passive loss.

E)None of the above.

A)In 2010,Glenda can deduct $97,000 for regular income tax purposes and for AMT purposes.

B)Glenda will have a $97,000 tax preference in 2010 as a result of the passive activity.

C)For regular income tax purposes,none of the loss is allowed in 2010.

D)In 2010,Glenda will have a positive adjustment of $25,000 as a result of the passive loss.

E)None of the above.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

73

Factors that can cause the adjusted basis for AMT purposes to be different from the adjusted basis for regular income tax purposes include the following:

A)A different amount of depreciation (cost recovery)has been deducted for AMT purposes and regular income tax purposes.

B)The spread on an incentive stock option (ISO)is recognized for AMT purposes,but is not recognized for regular income tax purposes.

C)Two-percent miscellaneous itemized deductions are not deductible in calculating the AMT.

D)Only a.and b.

E)a. ,b. ,and c.

A)A different amount of depreciation (cost recovery)has been deducted for AMT purposes and regular income tax purposes.

B)The spread on an incentive stock option (ISO)is recognized for AMT purposes,but is not recognized for regular income tax purposes.

C)Two-percent miscellaneous itemized deductions are not deductible in calculating the AMT.

D)Only a.and b.

E)a. ,b. ,and c.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

74

Robin,who is a head of household and age 42,provides you with the following information from his financial records for 2010.  Calculate his AMT for 2010.

Calculate his AMT for 2010.

A)$13,922.

B)$14,810.

C)$191,871.

D)$219,425.

E)None of the above.

Calculate his AMT for 2010.

Calculate his AMT for 2010.A)$13,922.

B)$14,810.

C)$191,871.

D)$219,425.

E)None of the above.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

75

Akeem,who does not itemize,incurred a net operating loss (NOL)of $50,000 in 2010.His deductions in 2010 included AMT tax preference items of $20,000,and he had no AMT adjustments.Assuming the NOL is not carried back,what is Akeem's ATNOLD carryover to 2011?

A)$50,000.

B)$30,000.

C)$20,000.

D)$40,000.

E)None of the above.

A)$50,000.

B)$30,000.

C)$20,000.

D)$40,000.

E)None of the above.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

76

Which of the following statements is correct?

A)The deduction for personal and dependency exemptions is not permitted in calculating the AMT.Therefore,in converting regular taxable income to AMTI,a positive adjustment is required.

B)To the extent that part of the deduction for personal and dependency exemptions is phased out because the taxpayer's AGI exceeds the threshold amount,the amount of the AMT adjustment is smaller than it otherwise would have been.

C)To the extent that itemized deductions exceed the standard deduction for regular income tax purposes,a positive AMT adjustment is required in converting regular taxable income to AMTI.

D)Only a.and b.are correct.

E)a. ,b. ,and c.are correct.

A)The deduction for personal and dependency exemptions is not permitted in calculating the AMT.Therefore,in converting regular taxable income to AMTI,a positive adjustment is required.

B)To the extent that part of the deduction for personal and dependency exemptions is phased out because the taxpayer's AGI exceeds the threshold amount,the amount of the AMT adjustment is smaller than it otherwise would have been.

C)To the extent that itemized deductions exceed the standard deduction for regular income tax purposes,a positive AMT adjustment is required in converting regular taxable income to AMTI.

D)Only a.and b.are correct.

E)a. ,b. ,and c.are correct.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following can produce an AMT preference rather than an AMT adjustment?

A)Circulation expenditures.

B)Research and experimental expenditures.

C)Percentage depletion.

D)Incentive stock options (ISOs).

E)None of the above.

A)Circulation expenditures.

B)Research and experimental expenditures.

C)Percentage depletion.

D)Incentive stock options (ISOs).

E)None of the above.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

78

Celia and Amos,who are married filing jointly,have one dependent and do not itemize deductions.They have taxable income of $82,000 and tax preferences of $53,000 in 2010.What is their AMT base for 2010?

A)$0.

B)$86,400.

C)$88,238.

D)$157,350.

E)None of the above.

A)$0.

B)$86,400.

C)$88,238.

D)$157,350.

E)None of the above.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

79

Kevin's AGI is $285,000.He contributed $150,000 in cash to a public charity.What is Kevin's charitable contribution deduction for AMT purposes?

A)$30,000.

B)$85,500.

C)$142,500.

D)$150,000.

E)None of the above.

A)$30,000.

B)$85,500.

C)$142,500.

D)$150,000.

E)None of the above.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

80

Tad is a vice-president of Ruby Corporation.In 2010,he acquired 1,000 shares of Ruby Corporation stock under the corporation's incentive stock option (ISO)plan for an option price of $43 per share.At the date of exercise in 2010,the fair market value of the stock was $65 per share.The stock became freely transferable in 2011.Tad sold the 1,000 shares for $69 per share in 2012.Which of the following statements is incorrect?

A)Acquisition of the stock in 2010 had no effect on Tad's taxable income,but increased AMTI by $22,000 in 2010.

B)Tad's regular income tax basis for the stock is $43,000 and his AMT basis is $65,000 in 2011.

C)Tad must report a positive AMT adjustment of $22,000 in 2011.

D)Tad will have a negative AMT adjustment of $22,000 in 2012.

E)All of the above are correct.

A)Acquisition of the stock in 2010 had no effect on Tad's taxable income,but increased AMTI by $22,000 in 2010.

B)Tad's regular income tax basis for the stock is $43,000 and his AMT basis is $65,000 in 2011.

C)Tad must report a positive AMT adjustment of $22,000 in 2011.

D)Tad will have a negative AMT adjustment of $22,000 in 2012.

E)All of the above are correct.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck