Deck 10: Fiscal Policy and Debt

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/362

Play

Full screen (f)

Deck 10: Fiscal Policy and Debt

1

__________ government spending,_____ transfer payments,and ____ taxes are all examples of contractionary fiscal policy.

A) Reducing;increasing;raising

B) Reducing;reducing;raising

C) Reducing;reducing;reducing

D) Raising;increasing;raising

A) Reducing;increasing;raising

B) Reducing;reducing;raising

C) Reducing;reducing;reducing

D) Raising;increasing;raising

Reducing;reducing;raising

2

The $787 billion stimulus package passed in the United States in 2009 focused more on spending than on taxes partly because:

A) increased spending leads to a larger increase in GDP than the same reduction in taxes.

B) increased spending leads to a smaller increase in GDP than the same reduction in taxes.

C) the government tax multiplier is more than the government spending multiplier.

D) the government revenue multiplier is about the same as the government tax multiplier.

A) increased spending leads to a larger increase in GDP than the same reduction in taxes.

B) increased spending leads to a smaller increase in GDP than the same reduction in taxes.

C) the government tax multiplier is more than the government spending multiplier.

D) the government revenue multiplier is about the same as the government tax multiplier.

increased spending leads to a larger increase in GDP than the same reduction in taxes.

3

The largest source of federal government revenues is:

A) corporate income taxes.

B) Social Security taxes.

C) individual income taxes.

D) excise and estate taxes.

A) corporate income taxes.

B) Social Security taxes.

C) individual income taxes.

D) excise and estate taxes.

individual income taxes.

4

Which measure is NOT a channel through which the government can influence aggregate demand?

A) direct spending on goods and services

B) transfer payments to households and firms

C) taxes on households and firms

D) regulation on businesses

A) direct spending on goods and services

B) transfer payments to households and firms

C) taxes on households and firms

D) regulation on businesses

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

5

Most studies estimate the overall multiplier of the 2009 stimulus to be between:

A) 0 and 1.

B) 1.5 and 2.

C) 3 and 3.5.

D) 5 and 6.

A) 0 and 1.

B) 1.5 and 2.

C) 3 and 3.5.

D) 5 and 6.

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

6

__________ government spending,_____ transfer payments,and ____ taxes are all examples of expansionary fiscal policy.

A) Increasing;increasing;lowering

B) Increasing;reducing;raising

C) Reducing;increasing;lowering

D) Reducing;increasing;raising

A) Increasing;increasing;lowering

B) Increasing;reducing;raising

C) Reducing;increasing;lowering

D) Reducing;increasing;raising

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

7

Federal spending that is authorized by permanent laws and does not go through the annual appropriation process is called ________ spending.

A) discretionary

B) mandatory

C) long-term

D) infrastructure

A) discretionary

B) mandatory

C) long-term

D) infrastructure

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

8

___________ are all examples of discretionary spending.

A) Social Security,interest on the national debt,and Medicare

B) National defense,income security,and veterans benefits

C) National defense,Social Security,and veterans benefits

D) Social Security,veterans benefits,and Medicare

A) Social Security,interest on the national debt,and Medicare

B) National defense,income security,and veterans benefits

C) National defense,Social Security,and veterans benefits

D) Social Security,veterans benefits,and Medicare

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

9

_____ is the part of the budget that works its way through Congress each year;it includes such programs as national defense,transportation,Medicaid,and education.

A) Discretionary spending

B) Mandatory spending

C) Consumer spending

D) Contractionary spending

A) Discretionary spending

B) Mandatory spending

C) Consumer spending

D) Contractionary spending

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

10

If the economy is at full employment,increases in government spending:

A) have a multiplier effect on equilibrium output.

B) have no effect on the aggregate price level.

C) are primarily absorbed by price increases.

D) reduce aggregate output.

A) have a multiplier effect on equilibrium output.

B) have no effect on the aggregate price level.

C) are primarily absorbed by price increases.

D) reduce aggregate output.

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following statements regarding discretionary and mandatory spending is CORRECT?

A) Discretionary spending is authorized by permanent laws.

B) Mandatory spending may act as an automatic stabilizing force in the macroeconomy.

C) Discretionary spending has steadily grown as a percentage of the federal budget since the 1960s.

D) Mandatory spending programs include national defense,income security,and education.

A) Discretionary spending is authorized by permanent laws.

B) Mandatory spending may act as an automatic stabilizing force in the macroeconomy.

C) Discretionary spending has steadily grown as a percentage of the federal budget since the 1960s.

D) Mandatory spending programs include national defense,income security,and education.

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following is NOT an explicit short-run goal of discretionary fiscal policy?

A) full employment

B) economic growth

C) control of inflation

D) zero unemployment

A) full employment

B) economic growth

C) control of inflation

D) zero unemployment

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

13

Increased government _________ leads to a larger increase in GDP when compared to the same reduction in ________.

A) spending;taxes

B) taxes;spending

C) revenue;government expenditures

D) expenditures;prices

A) spending;taxes

B) taxes;spending

C) revenue;government expenditures

D) expenditures;prices

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

14

__________ are all examples of mandatory spending.

A) Social Security,interest on the national debt,and Medicare

B) National defense,income security,and veterans benefits

C) National defense,Social Security,and veterans benefits

D) Social Security,veterans benefits,and Medicare

A) Social Security,interest on the national debt,and Medicare

B) National defense,income security,and veterans benefits

C) National defense,Social Security,and veterans benefits

D) Social Security,veterans benefits,and Medicare

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

15

The largest category of federal government spending in 2012 was:

A) defense.

B) Social Security.

C) education.

D) net interest.

A) defense.

B) Social Security.

C) education.

D) net interest.

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following categories is an example of discretionary spending?

A) Social Security

B) Medicare

C) food stamps

D) hurricane relief funds

A) Social Security

B) Medicare

C) food stamps

D) hurricane relief funds

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

17

________ policy involves adjusting government spending and tax policies to move the economy toward full employment,economic growth,and low inflation.

A) Goal-oriented fiscal

B) Classical economic

C) Monetary

D) Discretionary fiscal

A) Goal-oriented fiscal

B) Classical economic

C) Monetary

D) Discretionary fiscal

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

18

Mandatory spending comprises nearly ________ of the federal budget.

A) one-fourth

B) one-third

C) one-half

D) two-thirds

A) one-fourth

B) one-third

C) one-half

D) two-thirds

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

19

If the marginal propensity to consume is 0.9,by how much will $100 of government spending increase GDP?

A) $90

B) $100

C) $1,000

D) $900

A) $90

B) $100

C) $1,000

D) $900

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

20

Which three U.S.presidents implemented well-known tax cuts designed to stimulate aggregate demand?

A) Bill Clinton,Ronald Reagan,and George H.W.Bush

B) John F.Kennedy,Ronald Reagan,and George W.Bush

C) John F.Kennedy,Ronald Reagan,and Bill Clinton

D) Bill Clinton,Ronald Reagan,and George W.Bush

A) Bill Clinton,Ronald Reagan,and George H.W.Bush

B) John F.Kennedy,Ronald Reagan,and George W.Bush

C) John F.Kennedy,Ronald Reagan,and Bill Clinton

D) Bill Clinton,Ronald Reagan,and George W.Bush

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

21

When government spending increases,the aggregate demand curve shifts to the ________ and the multiplier effect is dampened by a ______ in the aggregate price level.

A) right;fall

B) right;rise

C) left;fall

D) left;rise

A) right;fall

B) right;rise

C) left;fall

D) left;rise

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

22

An increase in taxes:

A) removes money from the economy's spending stream.

B) stimulates aggregate demand.

C) is the right policy prescription for fighting a recession.

D) always helps balance the budget.

A) removes money from the economy's spending stream.

B) stimulates aggregate demand.

C) is the right policy prescription for fighting a recession.

D) always helps balance the budget.

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

23

If the economy is producing at an output level below full employment,the government should _____________ spending and ________ taxes.

A) decrease;increase

B) decrease;decrease

C) increase;decrease

D) increase;increase

A) decrease;increase

B) decrease;decrease

C) increase;decrease

D) increase;increase

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

24

Suppose the government increases aggregate demand to a level that increases GDP above its long-run equilibrium level.What sequence of events would follow?

A) Prices rise;GDP increases;workers demand higher wages;short-run aggregate supply shifts to the left;GDP drops

B) Prices fall;workers receive lower wages;short-run aggregate supply shifts to the right;GDP rises

C) Prices rise;GDP increases;workers demand higher wages;long-run aggregate supply shifts to the left;GDP falls

D) Prices fall;workers receive lower wages;aggregate supply shifts to the right;GDP rises

A) Prices rise;GDP increases;workers demand higher wages;short-run aggregate supply shifts to the left;GDP drops

B) Prices fall;workers receive lower wages;short-run aggregate supply shifts to the right;GDP rises

C) Prices rise;GDP increases;workers demand higher wages;long-run aggregate supply shifts to the left;GDP falls

D) Prices fall;workers receive lower wages;aggregate supply shifts to the right;GDP rises

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

25

Without government spending,which of the following equations is TRUE?

A) Y = C + S

B) S - I = 1

C) I - S = 1

D) I + S = 1

A) Y = C + S

B) S - I = 1

C) I - S = 1

D) I + S = 1

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

26

An economy is operating at long-run equilibrium.What is the most likely result of an aggressive expansionary fiscal policy?

A) no change in long-run GDP and employment

B) a drop in the unemployment rate

C) a drop in prices

D) a rise in long-run employment

A) no change in long-run GDP and employment

B) a drop in the unemployment rate

C) a drop in prices

D) a rise in long-run employment

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

27

An expansionary fiscal policy can result in:

A) higher unemployment rates.

B) inflation and higher GDP.

C) lower prices.

D) a recession.

A) higher unemployment rates.

B) inflation and higher GDP.

C) lower prices.

D) a recession.

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

28

Transfer payments are:

A) monies paid directly to individuals by the government.

B) not part of the government budget.

C) a vital part of discretionary fiscal policy.

D) payments made to government officials who transfer them back to private companies.

A) monies paid directly to individuals by the government.

B) not part of the government budget.

C) a vital part of discretionary fiscal policy.

D) payments made to government officials who transfer them back to private companies.

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

29

Suppose the economy is in a recession.To increase demand using discretionary fiscal policy,the government can:

A) raise interest rates.

B) raise taxes or shrink government spending.

C) increase government spending or cut taxes.

D) cut interest rates.

A) raise interest rates.

B) raise taxes or shrink government spending.

C) increase government spending or cut taxes.

D) cut interest rates.

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

30

Disposable income is equal to:

A) Y - T.

B) Y + T.

C) T - Y.

D) X - M.

A) Y - T.

B) Y + T.

C) T - Y.

D) X - M.

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following measures is NOT an example of discretionary fiscal policy?

A) The unemployment compensation program pays out more money as unemployment rates rise.

B) Tax rates are increased in the hope of slowing down the rate of inflation.

C) Tax increases are enacted to reduce the government deficit.

D) Government spending is increased to reduce the problems caused by the recession.

A) The unemployment compensation program pays out more money as unemployment rates rise.

B) Tax rates are increased in the hope of slowing down the rate of inflation.

C) Tax increases are enacted to reduce the government deficit.

D) Government spending is increased to reduce the problems caused by the recession.

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

32

Using demand-side fiscal policy to stimulate aggregate demand when the economy is at full employment will primarily result in:

A) unemployment.

B) underemployment.

C) inflation.

D) a large economic expansion.

A) unemployment.

B) underemployment.

C) inflation.

D) a large economic expansion.

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

33

When the economy is at equilibrium:

A) GDP = C + I.

B) GDP = C + I + G + (X - M).

C) Y + C = I.

D) Y = C / I.

A) GDP = C + I.

B) GDP = C + I + G + (X - M).

C) Y + C = I.

D) Y = C / I.

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

34

Anne and Charlie are discussing the best fiscal policy to bring the country out of a recession.Charlie wants to see government cut taxes by $100 billion.Anne prefers to see government spending increase by $100 billion.Whose prescription would have the larger total impact on aggregate demand?

A) Anne's,because the government has more information available to it than do households and firms

B) Anne's,because all of the additional government spending will enter the spending stream,while part of a tax cut would be saved (and not spent)

C) Charlie's,because households and firms have a higher marginal propensity to consume than the government

D) Charlie's,because firms and households are better spenders than the government,whose spending decisions are bogged down in political debating

A) Anne's,because the government has more information available to it than do households and firms

B) Anne's,because all of the additional government spending will enter the spending stream,while part of a tax cut would be saved (and not spent)

C) Charlie's,because households and firms have a higher marginal propensity to consume than the government

D) Charlie's,because firms and households are better spenders than the government,whose spending decisions are bogged down in political debating

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

35

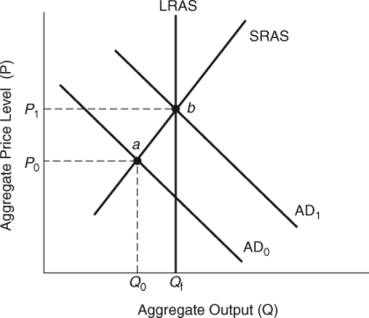

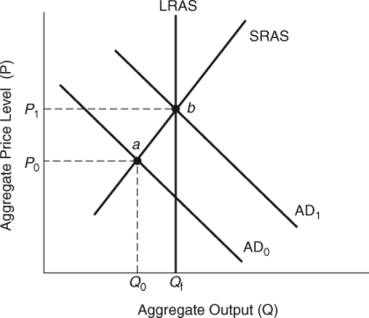

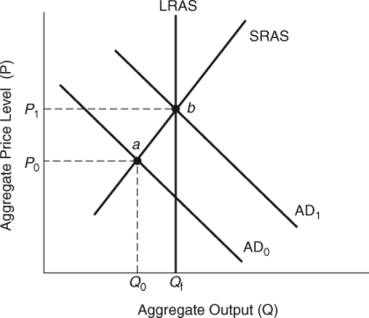

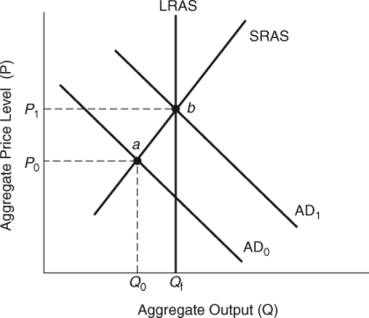

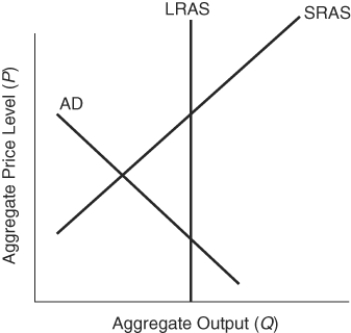

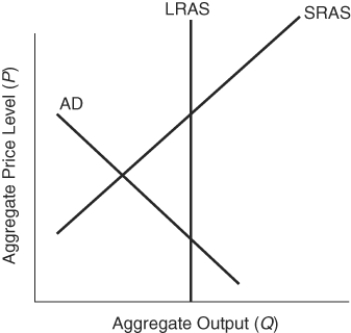

Use the following to answer questions

Figure: Effects of Policy Shifts

(Figure: Effects of Policy Shifts)If government spending increases,shifting aggregate demand from _____ to _____,aggregate output will increase from _____ to _____.

A) AD1;AD0;Qf;Q0

B) AD1;AD0;Q0;Qf

C) AD0;AD1;Q0;Qf

D) AD0;AD1;Qf;Q0

Figure: Effects of Policy Shifts

(Figure: Effects of Policy Shifts)If government spending increases,shifting aggregate demand from _____ to _____,aggregate output will increase from _____ to _____.

A) AD1;AD0;Qf;Q0

B) AD1;AD0;Q0;Qf

C) AD0;AD1;Q0;Qf

D) AD0;AD1;Qf;Q0

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

36

Changes in taxes first cause changes in __________________,and thus the government tax multiplier is ______________ than the government spending multiplier.

A) aggregate spending;larger

B) aggregate spending;smaller

C) disposable income;larger

D) disposable income;smaller

A) aggregate spending;larger

B) aggregate spending;smaller

C) disposable income;larger

D) disposable income;smaller

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following is NOT a leakage that reduces the size of the spending multiplier?

A) purchases of imports

B) personal income tax

C) savings

D) personal investment in human capital

A) purchases of imports

B) personal income tax

C) savings

D) personal investment in human capital

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

38

Suppose policymakers wish to use fiscal policy to fight inflation.Which statement is MOST accurate?

A) Using fiscal policy,the government can have the best of both worlds in the form of low inflation and economic growth.

B) Essentially,the way to lower the inflation rate is to decrease aggregate demand and cause a recession.

C) They should not use fiscal policy because in the long run the economy will always go back to its equilibrium.

D) Policymakers should use an expansionary policy because jobs are more important than inflation.

A) Using fiscal policy,the government can have the best of both worlds in the form of low inflation and economic growth.

B) Essentially,the way to lower the inflation rate is to decrease aggregate demand and cause a recession.

C) They should not use fiscal policy because in the long run the economy will always go back to its equilibrium.

D) Policymakers should use an expansionary policy because jobs are more important than inflation.

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following is NOT an element of expansionary fiscal policy?

A) expanding immigration

B) increasing government spending

C) cutting taxes

D) increasing transfer payments

A) expanding immigration

B) increasing government spending

C) cutting taxes

D) increasing transfer payments

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

40

The fiscal policy that involves reducing government spending,reducing transfer payments,or raising taxes to decrease aggregate demand is called ___________.

A) expansionary

B) contractionary

C) diminishment

D) reductionist

A) expansionary

B) contractionary

C) diminishment

D) reductionist

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

41

When the economy is underperforming and policymakers pursue expansionary fiscal policy,they express willingness to trade off _________ output for a ________ price level.

A) higher;higher

B) higher;lower

C) lower;higher

D) lower;lower

A) higher;higher

B) higher;lower

C) lower;higher

D) lower;lower

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

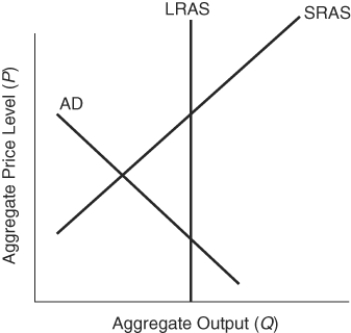

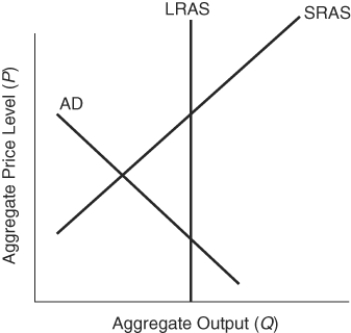

42

Figure: Effects of Contractionary Fiscal Policies  (Figure: Effects of Contractionary Fiscal Policies)Contractionary fiscal policies should:

(Figure: Effects of Contractionary Fiscal Policies)Contractionary fiscal policies should:

A) move the economy to full employment.

B) move the economy away from full employment.

C) lead to a higher price level.

D) lead to a higher price level and lower employment.

(Figure: Effects of Contractionary Fiscal Policies)Contractionary fiscal policies should:

(Figure: Effects of Contractionary Fiscal Policies)Contractionary fiscal policies should:A) move the economy to full employment.

B) move the economy away from full employment.

C) lead to a higher price level.

D) lead to a higher price level and lower employment.

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

43

If an expansionary policy pushes output beyond the full employment level of GDP:

A) the economy will undergo deflation.

B) the natural rate of unemployment will fall.

C) costs of production will drop.

D) the short-run aggregate supply will eventually shift to the left.

A) the economy will undergo deflation.

B) the natural rate of unemployment will fall.

C) costs of production will drop.

D) the short-run aggregate supply will eventually shift to the left.

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following is an example of contractionary fiscal policy?

A) increasing federal spending on renovating college campuses

B) cutting spending on the military

C) building a new interstate highway

D) sending taxpayers a $600 rebate

A) increasing federal spending on renovating college campuses

B) cutting spending on the military

C) building a new interstate highway

D) sending taxpayers a $600 rebate

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

45

___________ government spending,___________ transfer payments,and ________ taxes all increase aggregate demand.

A) Increasing;,increasing;transfer payments;increasing taxes

B) Increasing;decreasing;decreasing

C) Increasing;increasing;decreasing

D) Decreasing;decreasing;increasing

A) Increasing;,increasing;transfer payments;increasing taxes

B) Increasing;decreasing;decreasing

C) Increasing;increasing;decreasing

D) Decreasing;decreasing;increasing

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

46

When an economy is at full employment,an expansionary fiscal policy:

A) has the same multiplier effect as if the economy were in a recession.

B) does not affect the aggregate price level.

C) yields no temporary increase in output.

D) produces no long-run improvement in real output.

A) has the same multiplier effect as if the economy were in a recession.

B) does not affect the aggregate price level.

C) yields no temporary increase in output.

D) produces no long-run improvement in real output.

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

47

Expansionary fiscal policy is typically used to __________ aggregate demand in order to ____________.

A) increase;escape a recession

B) decrease;escape a recession

C) increase;slow down an overheated economy

D) decrease;slow down an overheated economy

A) increase;escape a recession

B) decrease;escape a recession

C) increase;slow down an overheated economy

D) decrease;slow down an overheated economy

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

48

If an economy is producing at a level beyond full employment,using contractionary fiscal policy to reduce aggregate demand means a tradeoff between ________ price levels and ________ output.

A) higher;higher

B) higher;lower

C) lower;lower

D) lower;higher

A) higher;higher

B) higher;lower

C) lower;lower

D) lower;higher

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

49

Use the following to answer questions

Figure: Effects of Policy Shifts

(Figure: Effects of Policy Shifts)If the economy starts below full employment,an expansionary fiscal policy will move the aggregate demand curve from _____ to _____,and the equilibrium will move from _____ to _____.

A) AD1;AD0;a;b

B) AD1;AD0;b;a

C) AD0;AD1;b;a

D) AD0;AD1;a;b

Figure: Effects of Policy Shifts

(Figure: Effects of Policy Shifts)If the economy starts below full employment,an expansionary fiscal policy will move the aggregate demand curve from _____ to _____,and the equilibrium will move from _____ to _____.

A) AD1;AD0;a;b

B) AD1;AD0;b;a

C) AD0;AD1;b;a

D) AD0;AD1;a;b

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

50

Use the following to answer questions

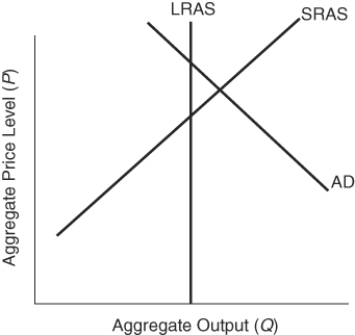

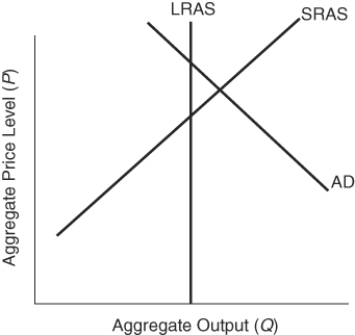

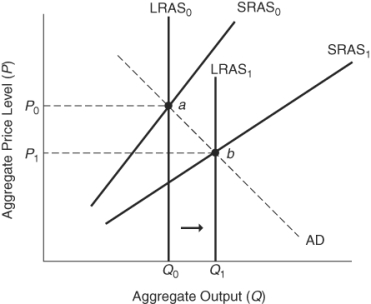

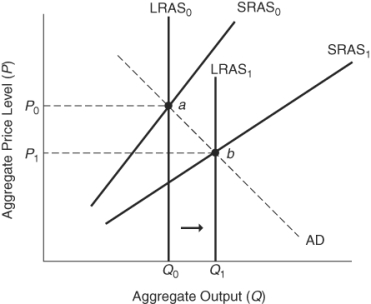

Figure: Determining Fiscal Policy

(Figure: Determining Fiscal Policy)The best discretionary fiscal policy option is:

A) expansionary fiscal policy that leads to full employment.

B) contractionary fiscal policy that leads to full employment.

C) a combination of expansionary and contractionary fiscal policies to achieve full employment and stable prices.

D) only fiscal policies that lead to a lower price level.

Figure: Determining Fiscal Policy

(Figure: Determining Fiscal Policy)The best discretionary fiscal policy option is:

A) expansionary fiscal policy that leads to full employment.

B) contractionary fiscal policy that leads to full employment.

C) a combination of expansionary and contractionary fiscal policies to achieve full employment and stable prices.

D) only fiscal policies that lead to a lower price level.

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

51

Use the following to answer questions

Figure: Determining Fiscal Policy

(Figure: Determining Fiscal Policy)Expansionary fiscal policies could:

A) move the economy to full employment.

B) move the economy away from full employment.

C) lead to a lower price level.

D) lead to a lower price level and lower unemployment.

Figure: Determining Fiscal Policy

(Figure: Determining Fiscal Policy)Expansionary fiscal policies could:

A) move the economy to full employment.

B) move the economy away from full employment.

C) lead to a lower price level.

D) lead to a lower price level and lower unemployment.

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

52

Increasing taxes to fight inflation is an example of:

A) conservative fiscal policy.

B) contractionary fiscal policy.

C) expansionary fiscal policy.

D) demand-braking policy.

A) conservative fiscal policy.

B) contractionary fiscal policy.

C) expansionary fiscal policy.

D) demand-braking policy.

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

53

If the economy is below full employment and the government uses an expansionary fiscal policy in an attempt to reduce unemployment:

A) output and the price level will rise.

B) it will have no effect,as fiscal policy does not work during times of unemployment.

C) output and the price level will fall.

D) output will rise,but the price level will fall.

A) output and the price level will rise.

B) it will have no effect,as fiscal policy does not work during times of unemployment.

C) output and the price level will fall.

D) output will rise,but the price level will fall.

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

54

If the economy expands beyond the level of full employment,what is the outcome?

A) inflation

B) lower interest rates

C) unemployment

D) recession

A) inflation

B) lower interest rates

C) unemployment

D) recession

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following measures is an example of an expansionary fiscal policy?

A) decreasing government spending

B) reducing welfare payments

C) increasing unemployment compensation

D) raising taxes

A) decreasing government spending

B) reducing welfare payments

C) increasing unemployment compensation

D) raising taxes

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

56

When the economy is below full employment,expansionary fiscal policy:

A) shifts the aggregate demand curve to the left.

B) shifts the short-run aggregate supply curve to the right.

C) causes a movement down along the aggregate demand curve.

D) shifts the aggregate demand curve to the right.

A) shifts the aggregate demand curve to the left.

B) shifts the short-run aggregate supply curve to the right.

C) causes a movement down along the aggregate demand curve.

D) shifts the aggregate demand curve to the right.

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

57

Contractionary fiscal policy:

A) increases aggregate demand.

B) decreases aggregate demand.

C) increases aggregate supply.

D) leaves aggregate demand unchanged.

A) increases aggregate demand.

B) decreases aggregate demand.

C) increases aggregate supply.

D) leaves aggregate demand unchanged.

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

58

The solution to simultaneous deflation and unemployment is to shift the:

A) aggregate demand curve to the right.

B) aggregate demand curve to the left.

C) short run aggregate supply curve to the right.

D) short run aggregate supply curve to the left.

A) aggregate demand curve to the right.

B) aggregate demand curve to the left.

C) short run aggregate supply curve to the right.

D) short run aggregate supply curve to the left.

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

59

When the economy is at full employment,an expansionary fiscal policy results in a new long-run equilibrium at an output level _______ full employment and a _________ price level.

A) at;higher

B) above;higher

C) below;higher

D) at;lower

A) at;higher

B) above;higher

C) below;higher

D) at;lower

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

60

When the economy is overheating and policymakers pursue contractionary fiscal policy,they express willingness to trade off _________ output for a ________ price level.

A) higher;higher

B) higher;lower

C) lower;higher

D) lower;lower

A) higher;higher

B) higher;lower

C) lower;higher

D) lower;lower

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following statements about fiscal policy and aggregate supply is CORRECT?

A) The focus of fiscal policy and aggregate supply is to minimize unemployment.

B) Fiscal policies that influence aggregate supply don't always require tradeoffs between price levels and output.

C) Fiscal policies that influence aggregate supply take less time to work than do demand-side fiscal policies.

D) Fiscal policies that influence aggregate supply increase inflationary pressures as output expands.

A) The focus of fiscal policy and aggregate supply is to minimize unemployment.

B) Fiscal policies that influence aggregate supply don't always require tradeoffs between price levels and output.

C) Fiscal policies that influence aggregate supply take less time to work than do demand-side fiscal policies.

D) Fiscal policies that influence aggregate supply increase inflationary pressures as output expands.

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

62

A problem with supply-side fiscal policies is that they:

A) don't work.

B) take longer to work than demand-side fiscal policies.

C) only increase inflation.

D) only decrease inflation.

A) don't work.

B) take longer to work than demand-side fiscal policies.

C) only increase inflation.

D) only decrease inflation.

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

63

_____ has(have)an impact on both aggregate demand and aggregate supply.

A) Encouragement of new technologies

B) Tax rate reductions

C) Investment in human capital

D) Increasing transfer payments

A) Encouragement of new technologies

B) Tax rate reductions

C) Investment in human capital

D) Increasing transfer payments

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

64

Figure: Understanding SRAS and LRAS Shifts  (Figure: Understanding SRAS and LRAS Shifts)This graph shows:

(Figure: Understanding SRAS and LRAS Shifts)This graph shows:

A) demand-side fiscal policies.

B) supply-side fiscal policies.

C) a combination of supply-side and demand-side fiscal policies.

D) None of the answers is correct.

(Figure: Understanding SRAS and LRAS Shifts)This graph shows:

(Figure: Understanding SRAS and LRAS Shifts)This graph shows:A) demand-side fiscal policies.

B) supply-side fiscal policies.

C) a combination of supply-side and demand-side fiscal policies.

D) None of the answers is correct.

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

65

The solution to the simultaneous presence of inflation and unemployment is to implement policies that shift the:

A) aggregate demand curve to the right.

B) aggregate demand curve to the left.

C) short run aggregate supply curve to the right.

D) short run aggregate supply curve to the left.

A) aggregate demand curve to the right.

B) aggregate demand curve to the left.

C) short run aggregate supply curve to the right.

D) short run aggregate supply curve to the left.

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

66

If an advance in technology shifts the long-run aggregate supply curve out:

A) prices drop and output increases.

B) prices increase and output decreases.

C) prices remain stable and output decreases.

D) None of the answers is correct.

A) prices drop and output increases.

B) prices increase and output decreases.

C) prices remain stable and output decreases.

D) None of the answers is correct.

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

67

Graphically,expansionary fiscal policy is displayed by a shift to the _____ in aggregate ______.

A) right;supply

B) right;demand

C) left;supply

D) left;demand

A) right;supply

B) right;demand

C) left;supply

D) left;demand

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

68

Fiscal policy that focuses on shifting the long-run aggregate supply curve to the right is:

A) aggregate shifts policy.

B) contractionary policy.

C) supply-side fiscal policy.

D) consumption policy.

A) aggregate shifts policy.

B) contractionary policy.

C) supply-side fiscal policy.

D) consumption policy.

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

69

Supply-side fiscal policies include all of the following EXCEPT:

A) investment in human capital.

B) projects that include the encouragement of new technologies.

C) increasing transfer payments.

D) policies that encourage investment in research and development.

A) investment in human capital.

B) projects that include the encouragement of new technologies.

C) increasing transfer payments.

D) policies that encourage investment in research and development.

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

70

Contractionary fiscal policy is typically used to:

A) fight inflation stemming from an overheated economy.

B) fight recession due to deficient demand.

C) restore the balance of payments.

D) balance the federal budget.

A) fight inflation stemming from an overheated economy.

B) fight recession due to deficient demand.

C) restore the balance of payments.

D) balance the federal budget.

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

71

__________ marginal tax rates and _______________ are commonly used to increase aggregate supply.

A) Lowering;increasing government transfer payments

B) Lowering;offering investment tax credits

C) Raising;increasing government transfer payments

D) Raising;reducing government spending

A) Lowering;increasing government transfer payments

B) Lowering;offering investment tax credits

C) Raising;increasing government transfer payments

D) Raising;reducing government spending

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

72

All of the following are considered expansionary fiscal policies EXCEPT:

A) a reduction in unemployment compensation.

B) a decrease in personal taxes.

C) an increase in government spending.

D) an increase in transfer payments.

A) a reduction in unemployment compensation.

B) a decrease in personal taxes.

C) an increase in government spending.

D) an increase in transfer payments.

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

73

The Laffer curve has which variables on its axes?

A) price and quantity

B) CPI and GDP

C) tax rates and tax revenue

D) aggregate expenditure and income

A) price and quantity

B) CPI and GDP

C) tax rates and tax revenue

D) aggregate expenditure and income

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

74

Which measure is an example of a supply-side fiscal policy?

A) raising income taxes

B) giving tax breaks to firms that undertake research and development

C) increasing the money supply

D) increasing government spending on Medicare

A) raising income taxes

B) giving tax breaks to firms that undertake research and development

C) increasing the money supply

D) increasing government spending on Medicare

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

75

Which of the following regarding supply-side fiscal policy is INCORRECT?

A) It tends to have a longer impact on the economy than demand-side policies.

B) It is geared toward short-term increases in employment.

C) It attempts to increase the long-run equilibrium level of GDP.

D) It tends to lower prices in the economy.

A) It tends to have a longer impact on the economy than demand-side policies.

B) It is geared toward short-term increases in employment.

C) It attempts to increase the long-run equilibrium level of GDP.

D) It tends to lower prices in the economy.

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

76

Which U.S.presidents reduced marginal tax rates to promote work and business risk taking?

A) Obama and Reagan

B) Kennedy and Clinton

C) Reagan and Kennedy

D) Clinton and Obama

A) Obama and Reagan

B) Kennedy and Clinton

C) Reagan and Kennedy

D) Clinton and Obama

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following is specifically designed to increase the long-run aggregate supply curve?

A) raising marginal tax rates on income

B) developing new technologies

C) increasing government spending on welfare

D) increasing taxes on entrepreneurs

A) raising marginal tax rates on income

B) developing new technologies

C) increasing government spending on welfare

D) increasing taxes on entrepreneurs

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

78

Which economist promoted the idea that reducing tax rates can increase tax revenue?

A) Robert Solow

B) Adam Smith

C) James Buchanan

D) Arthur Laffer

A) Robert Solow

B) Adam Smith

C) James Buchanan

D) Arthur Laffer

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

79

_____ involves increasing government spending,increasing transfer payments,and/or decreasing taxes.

A) Expansionary monetary policy

B) Expansionary fiscal policy

C) Contractionary fiscal policy

D) Contractionary monetary policy

A) Expansionary monetary policy

B) Expansionary fiscal policy

C) Contractionary fiscal policy

D) Contractionary monetary policy

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck

80

Rising productivity will drive increased economic growth and raise the average standard of living,shifting _____ curve to the _____.

A) long-run aggregate supply;right

B) long-run aggregate supply;left

C) aggregate demand;left

D) short run aggregate supply;left

A) long-run aggregate supply;right

B) long-run aggregate supply;left

C) aggregate demand;left

D) short run aggregate supply;left

Unlock Deck

Unlock for access to all 362 flashcards in this deck.

Unlock Deck

k this deck