Deck 10: Capital Budgeting Decision Methods

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/30

Play

Full screen (f)

Deck 10: Capital Budgeting Decision Methods

1

What is the profitability index for an acceptable capital budgeting project?

A)greater than 1.0

B)less than 1.0

C)greater than 0.0

D)less than 0.0

A)greater than 1.0

B)less than 1.0

C)greater than 0.0

D)less than 0.0

A

2

The net present value is the ratio of a project's benefits to its costs and the profitability index is the difference between a project's benefits and its costs.

False

3

If a project is normal, which of the following is true for a project with an internal rate of return exceeding the required rate of return?

A)The net present value is negative

B)The net present value is zero

C)The net present value is positive

D)There is not enough information to determine anything about the project's net present value.

A)The net present value is negative

B)The net present value is zero

C)The net present value is positive

D)There is not enough information to determine anything about the project's net present value.

C

4

The payback period is a useful measure of a project's

A)profitability.

B)economic life.

C)rate of return.

D)liquidity risk.

A)profitability.

B)economic life.

C)rate of return.

D)liquidity risk.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following is not true of the payback period method?

A)It fails to take into account the time value of money.

B)It fails to take into account a project's net cash flows.

C)It fails to take into account a project's net cash flows after the payback period.

D)There is no objective criterion for what is an acceptable payback period.

A)It fails to take into account the time value of money.

B)It fails to take into account a project's net cash flows.

C)It fails to take into account a project's net cash flows after the payback period.

D)There is no objective criterion for what is an acceptable payback period.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following methods properly ranks projects' contribution to firm value when the projects have scale differences?

A)internal rate of return

B)modified internal rate of return

C)net present value

D)profitability index

A)internal rate of return

B)modified internal rate of return

C)net present value

D)profitability index

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following is true about the net present value method?

A)It is the best single measure of a project's profitability.

B)It is the best single measure of a project's overall risk.

C)It is the best single measure of a project's liquidity risk.

D)It is not a good measure of a project's profitability.

A)It is the best single measure of a project's profitability.

B)It is the best single measure of a project's overall risk.

C)It is the best single measure of a project's liquidity risk.

D)It is not a good measure of a project's profitability.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

8

A capital budgeting project's internal rate of return is the rate of return causing a project's net present value to equal the net investment.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

9

A project's net present value is the sum of the future values of the net cash flows compounded at the required rate of return minus the net investment.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following is true for 5-year project with a 3-year payback period?

A)The net present value is negative.

B)The net present value is zero.

C)The net present value is positive.

D)Not enough information to determine anything about the project's net present value.

A)The net present value is negative.

B)The net present value is zero.

C)The net present value is positive.

D)Not enough information to determine anything about the project's net present value.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

11

If a project's internal rate of return is greater less)than the required rate of return, the project is generally acceptable unacceptable).

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

12

The discounted payback period does not take into account the time value of money.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

13

Which one of the following capital budgeting decision methods measures how long it takes for a project's benefits to recover the project's cost?

A)profitability index

B)payback period

C)modified internal rate of return

D)net present value

A)profitability index

B)payback period

C)modified internal rate of return

D)net present value

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

14

The net present value, profitability index, internal rate of return, and modified internal rate of return methods will provide consistent investment decisions for independent projects with normal cash flows.

MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question.

MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

15

If a project's net present value is positive negative), the project is generally acceptable unacceptable).

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

16

Which one of the following capital budgeting decision methods determines a project's annual percentage rate of return?

A)modified internal rate of return

B)profitability index

C)discounted payback period

D)net present value

A)modified internal rate of return

B)profitability index

C)discounted payback period

D)net present value

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

17

If a capital budgeting project's cash flows are not normal, the internal rate of return method should be used to make the investment decision.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following is true for a project with an expected net present value of $200,000?

A)The project is clearly unacceptable.

B)The project's cash flows exceed the project's net investment by $200,000 annually.

C)The project is expected to increase firm value by $200,000 in future value terms.

D)The project is expected to increase firm value by $200,000 in present value terms.

A)The project is clearly unacceptable.

B)The project's cash flows exceed the project's net investment by $200,000 annually.

C)The project is expected to increase firm value by $200,000 in future value terms.

D)The project is expected to increase firm value by $200,000 in present value terms.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

19

A project's net present value is a measure of a project's contribution to firm value.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

20

A project's payback period is the amount of time required for the project's net cash flows to recover or pay back the net investment.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

21

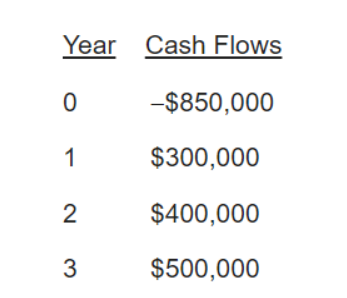

A capital budgeting project is expected to have the following cash flows:

What is the project's net present value at an 18% required rate of return?

A)-$4,173.50

B)$10,800.96

C)-$18,725.33

D)$350,000.00

What is the project's net present value at an 18% required rate of return?

A)-$4,173.50

B)$10,800.96

C)-$18,725.33

D)$350,000.00

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

22

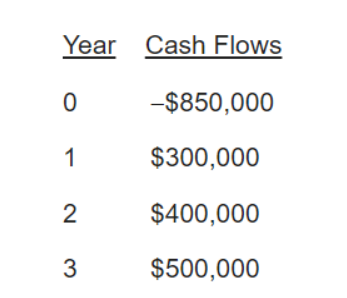

A capital budgeting project is expected to have the following cash flows: Year Cash Flows

0 $850,000

1 $300,000

2 $400,000

3 $500,000

What is the project's payback period?

A)1.50 years

B)3.30 years

C)2.50 years

D)2.30 years

0 $850,000

1 $300,000

2 $400,000

3 $500,000

What is the project's payback period?

A)1.50 years

B)3.30 years

C)2.50 years

D)2.30 years

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

23

A capital budgeting project is expected to have the following cash flows: Year Cash Flows

0 -$1,000,000

1 $400,000

2 $500,000

3 $700,000

What is the project's internal rate of return?

A)21.65%

B)30.88%

C)24.90%

D)27.95%

0 -$1,000,000

1 $400,000

2 $500,000

3 $700,000

What is the project's internal rate of return?

A)21.65%

B)30.88%

C)24.90%

D)27.95%

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

24

A capital budgeting project has a net investment of $550,000 and is expected to generate net cash flows of $200,000 annually for 7 years. What is the payback period?

A)5.5 years

B)2.25 years

C)2.55 years

D)2.75 years

A)5.5 years

B)2.25 years

C)2.55 years

D)2.75 years

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

25

A capital budgeting project has a net investment of $1,000,000 and is expected to generate net cash flows of $350,000 annually for 4 years. What is the internal rate of return?

A)22.11%

B)14.96%

C)2.48%

D)26.43%

A)22.11%

B)14.96%

C)2.48%

D)26.43%

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

26

A capital budgeting project is expected to have the following cash flows: Year Cash Flows

0 $1,000,000

1 $400,000

2 $400,000

3 $200,000

4 $400,000

What is the project's internal rate of return?

A)16.00%

B)8.99%

C)21.86%

D)15.54%

0 $1,000,000

1 $400,000

2 $400,000

3 $200,000

4 $400,000

What is the project's internal rate of return?

A)16.00%

B)8.99%

C)21.86%

D)15.54%

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

27

A capital budgeting project has a net investment of $250,000 and is expected to generate net cash flows of $90,000 annually for 5 years. What is the profitability index at a 13% required rate of return?

A)1.27

B)1.80

C)1.24

D)1.30

A)1.27

B)1.80

C)1.24

D)1.30

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

28

A capital budgeting project has a net investment of $450,000 and is expected to generate net cash flows of $150,000 annually for 5 years. What is the net present value at a 15% required rate of return?

A)$64,962

B)$52,823

C)$41,144

D)$300,000

A)$64,962

B)$52,823

C)$41,144

D)$300,000

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

29

A capital budgeting project is expected to have the following cash flows: Year Cash Flows

0 $250,000

1 $50,000

2 $100,000

3 $200,000

4 $200,000

What is the project's payback period?

A)2.75 years

B)2.25 years

C)2.50 years

D)1.25 years

0 $250,000

1 $50,000

2 $100,000

3 $200,000

4 $200,000

What is the project's payback period?

A)2.75 years

B)2.25 years

C)2.50 years

D)1.25 years

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

30

A capital budgeting project is expected to have the following cash flows: Year Cash Flows

0 $500,000

1 $300,000

2 $300,000

3 $200,000

4 $100,000

What is the project's net present value at a 12% required rate of return?

A)$212,923

B)$200,373

C)$225,868

D)$276,475

0 $500,000

1 $300,000

2 $300,000

3 $200,000

4 $100,000

What is the project's net present value at a 12% required rate of return?

A)$212,923

B)$200,373

C)$225,868

D)$276,475

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck