Deck 10: Capital Investment Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/180

Play

Full screen (f)

Deck 10: Capital Investment Analysis

1

The computations involved in the net present value method of analyzing capital investment proposals are less involved than those for the average rate of return method.

False

2

The method of analyzing capital investment proposals in which the estimated average annual income is divided by the average investment is the average rate of return method.

True

3

The methods of evaluating capital investment proposals can be grouped into two general categories that can be referred to as (1) methods that ignore present value and (2) present values methods.

True

4

Care must be taken involving capital investment decisions, since normally a long-term commitment of funds is involved and operations could be affected for many years.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

5

The excess of the cash flowing in from revenues over the cash flowing out for expenses is termed net cash flow.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

6

The process by which management plans, evaluates, and controls long-term investment decisions involving fixed assets is called cost-volume-profit analysis.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

7

Methods that ignore present value in capital investment analysis include the cash payback method.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

8

Methods that ignore present value in capital investment analysis include the average rate of return method.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

9

The anticipated purchase of a fixed asset for $400,000, with a useful life of 5 years and no residual value, is expected to yield total net income of $300,000 for the 5 years. The expected average rate of return is 30%.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

10

Average rate of return equals estimated average annual income divided by average investment.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

11

Methods that ignore present value in capital investment analysis include the net present value method.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

12

The excess of the cash flowing in from revenues over the cash flowing out for expenses is termed net discounted cash flow.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

13

The cash payback method of capital investment analysis is one of the methods referred to as a present value method.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

14

The process by which management plans, evaluates, and controls long-term investment decisions involving fixed assets is called capital investment analysis.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

15

Average rate of return equals average investment divided by estimated average annual income.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

16

The methods of evaluating capital investment proposals can be grouped into two general categories that can be referred to as (1) average rate of return and (2) cash payback methods.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

17

The computations involved in the net present value method of analyzing capital investment proposals are more involved than those for the average rate of return method.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

18

Methods that ignore present value in capital investment analysis include the internal rate of return method.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

19

Only managers are encouraged to submit capital investment proposals because they know the processes and are able to match investments with long-term goals.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

20

The average rate of return method of capital investment analysis gives consideration to the present value of future cash flows.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

21

The anticipated purchase of a fixed asset for $400,000, with a useful life of 5 years and no residual value, is expected to yield total net income of $200,000 for the 5 years. The expected average rate of return on investment is 25.0%.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

22

If in evaluating a proposal by use of the net present value method there is an excess of the present value of future cash inflows over the amount to be invested, the rate of return on the proposal is less than the rate used in the analysis.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

23

If in evaluating a proposal by use of the net present value method there is an excess of the present value of future cash inflows over the amount to be invested, the rate of return on the proposal exceeds the rate used in the analysis.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

24

If in evaluating a proposal by use of the net present value method there is a deficiency of the present value of future cash inflows over the amount to be invested, the proposal should be accepted.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

25

For years one through five, a proposed expenditure of $250,000 for a fixed asset with a 5-year life has expected net income of $40,000, $35,000, $25,000, $25,000, and $25,000, respectively, and net cash flows of $90,000, $85,000, $75,000, $75,000, and $75,000, respectively. The cash payback period is 3 years.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

26

A qualitative characteristic that may impact upon capital investment analysis is the impact of investment proposals on product quality.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

27

If a proposed expenditure of $70,000 for a fixed asset with a 4-year life has an annual expected net cash flow and net income of $32,000 and $12,000, respectively, the cash payback period is 2.5 years.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

28

The anticipated purchase of a fixed asset for $400,000, with a useful life of 5 years and no residual value, is expected to yield total net income of $300,000 for the 5 years. The expected average rate of return is 37.5%.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

29

A qualitative characteristic that may impact upon capital investment analysis is manufacturing flexibility.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

30

In net present value analysis for a proposed capital investment, the expected future net cash flows are averaged and then reduced to their present values.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

31

A series of equal cash flows at fixed intervals is termed an annuity.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

32

In net present value analysis for a proposed capital investment, the expected future net cash flows are reduced to their present values.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

33

For years one through five, a proposed expenditure of $500,000 for a fixed asset with a 5-year life has expected net income of $40,000, $35,000, $25,000, $25,000, and $25,000, respectively, and net cash flows of $90,000, $85,000, $75,000, $75,000, and $75,000, respectively. The cash payback period is 5 years.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

34

The expected period of time that will elapse between the date of a capital investment and the complete recovery in cash of the amount invested is called the discount period.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

35

The expected period of time that will elapse between the date of a capital investment and the complete recovery in cash of the amount invested is called the cash payback period.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

36

If in evaluating a proposal by use of the net present value method there is a deficiency of the present value of future cash inflows over the amount to be invested, the proposal should be rejected.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

37

A present value index can be used to rank competing capital investment proposals when the net present value method is used.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

38

The internal rate of return method of analyzing capital investment proposals uses the present value concept to compute an internal rate of return expected from the proposals.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

39

If a proposed expenditure of $80,000 for a fixed asset with a 4-year life has an annual expected net cash flow and net income of $32,000 and $12,000, respectively, the cash payback period is 4 years.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

40

The anticipated purchase of a fixed asset for $400,000, with a useful life of 5 years and no residual value, is expected to yield total net income of $200,000 for the 5 years. The expected average rate of return on investment is 50%.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

41

The process by which management allocates available investment funds among competing capital investment proposals is termed capital rationing.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

42

A company is considering the purchase of a new machine for $48,000. Management expects that the machine can produce sales of $16,000 each year for the next 10 years. Expenses are expected to include direct materials, direct labor, and factory overhead totaling $8,000 per year plus depreciation of $4,000 per year. All revenues and expenses except depreciation are on a cash basis. The payback period for the machine is 6 years.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

43

A company is considering purchasing a machine for $21,000. The machine will generate income from operations of $2,000; annual cash flows from the machine will be $3,500. The payback period for the new machine is 6 years.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

44

A qualitative characteristic that may impact upon capital investment analysis is manufacturing control.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

45

In calculating the net present value of an investment in equipment, the required investment and its terminal residual value should be subtracted from the present value of all future cash inflows.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

46

In calculating the present value of an investment in equipment, the present value of the terminal residual value should be added to the cash inflows.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

47

A qualitative characteristic that may impact upon capital investment analysis is employee morale.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

48

A company is planning to purchase a machine that will cost $24,000, have a six-year life, and have no salvage value. The company expects to sell the machine's output of 3,000 units evenly throughout each year. Total income over the life of the machine is estimated to be $12,000. The machine will generate cash flows per year of $6,000. The payback period for the machine is 12 years.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

49

The accounting rate of return is a measure of profitability computed by dividing the average annual cash flows from an asset by the average amount invested in the asset.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

50

A company is considering the purchase of a new machine for $48,000. Management expects that the machine can produce sales of $16,000 each year for the next 10 years. Expenses are expected to include direct materials, direct labor, and factory overhead totaling $8,000 per year plus depreciation of $4,000 per year. All revenues and expenses except depreciation are on a cash basis. The payback period for the machine is 12 years.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

51

A qualitative characteristic that may impact upon capital investment analysis is manufacturing productivity.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

52

The accounting rate of return method of analyzing capital budgeting decisions measures the average rate of return from using the asset over its entire life.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

53

The time expected to pass before the net cash flows from an investment would return its initial cost is called the amortization period.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

54

A company is planning to purchase a machine that will cost $24,000, have a six-year life, and have no salvage value. The company expects to sell the machine's output of 3,000 units evenly throughout each year. Total income over the life of the machine is estimated to be $12,000. The machine will generate cash flows per year of $6,000. The payback period for the machine is 4 years.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

55

A company is planning to purchase a machine that will cost $24,000, have a six-year life, and have no salvage value. The company expects to sell the machine's output of 3,000 units evenly throughout each year. Total income over the life of the machine is estimated to be $12,000. The machine will generate cash flows per year of $6,000. The accounting rate of return for the machine is 16.7%.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

56

A company is considering purchasing a machine for $21,000. The machine will generate income from operations of $2,000; annual cash flows from the machine will be $3,500. The payback period for the new machine is 10.5 years.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

57

The process by which management allocates available investment funds among competing capital investment proposals is termed present value analysis.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

58

A company is considering the purchase of a new piece of equipment for $90,000. Predicted annual cash inflows from the investment are $36,000 (year 1), $30,000 (year 2), $18,000 (year 3), $12,000 (year 4), and $6,000 (year 5). The average income from operations over the 5-year life is $20,400. The payback period is 3.5 years.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

59

Net present value and the payback period are examples of discounted cash flow methods used in capital budgeting decisions.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

60

The payback method can be used only when net cash inflows are the same for each period.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

61

The primary advantages of the average rate of return method are its ease of computation and the fact that:

A) it is especially useful to managers whose primary concern is liquidity

B) there is less possibility of loss from changes in economic conditions and obsolescence when the commitment is short-term

C) it emphasizes the amount of income earned over the life of the proposal

D) rankings of proposals are necessary

A) it is especially useful to managers whose primary concern is liquidity

B) there is less possibility of loss from changes in economic conditions and obsolescence when the commitment is short-term

C) it emphasizes the amount of income earned over the life of the proposal

D) rankings of proposals are necessary

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following is a method of analyzing capital investment proposals that ignores present value?

A) Internal rate of return

B) Net present value

C) Discounted cash flow

D) Average rate of return

A) Internal rate of return

B) Net present value

C) Discounted cash flow

D) Average rate of return

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

63

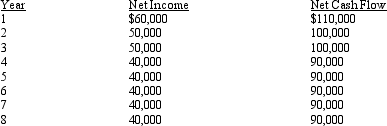

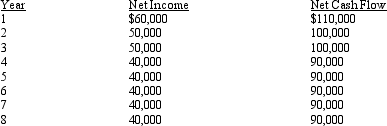

An anticipated purchase of equipment for $580,000, with a useful life of 8 years and no residual value, is expected to yield the following annual net incomes and net cash flows:  What is the cash payback period?

What is the cash payback period?

A) 5 years

B) 4 years

C) 6 years

D) 3 years

What is the cash payback period?

What is the cash payback period?A) 5 years

B) 4 years

C) 6 years

D) 3 years

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following can be used to place capital investment proposals involving different amounts of investment on a comparable basis for purposes of net present value analysis?

A) Price-level index

B) Future value index

C) Rate of investment index

D) Present value index

A) Price-level index

B) Future value index

C) Rate of investment index

D) Present value index

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following are two methods of analyzing capital investment proposals that both ignore present value?

A) Internal rate of return and average rate of return

B) Net present value and average rate of return

C) Internal rate of return and net present value

D) Average rate of return and cash payback method

A) Internal rate of return and average rate of return

B) Net present value and average rate of return

C) Internal rate of return and net present value

D) Average rate of return and cash payback method

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

66

A company is planning to purchase a machine that will cost $24,000, have a six-year life, and have no salvage value. The company expects to sell the machine's output of 3,000 units evenly throughout each year. Total income over the life of the machine is estimated to be $12,000. The machine will generate cash flows per year of $6,000. The accounting rate of return for the machine is 50%.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

67

The method of analyzing capital investment proposals that divides the estimated average annual income by the average investment is:

A) cash payback method

B) net present value method

C) internal rate of return method

D) average rate of return method

A) cash payback method

B) net present value method

C) internal rate of return method

D) average rate of return method

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following are present value methods of analyzing capital investment proposals?

A) Internal rate of return and average rate of return

B) Average rate of return and net present value

C) Net present value and internal rate of return

D) Net present value and payback

A) Internal rate of return and average rate of return

B) Average rate of return and net present value

C) Net present value and internal rate of return

D) Net present value and payback

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

69

The methods of evaluating capital investment proposals can be separated into two general groups--present value methods and:

A) past value methods

B) straight-line methods

C) reducing value methods

D) methods that ignore present value

A) past value methods

B) straight-line methods

C) reducing value methods

D) methods that ignore present value

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

70

The amount of the average investment for a proposed investment of $90,000 in a fixed asset, with a useful life of four years, straight-line depreciation, no residual value, and an expected total net income of $21,600 for the 4 years, is:

A) $10,800

B) $21,600

C) $ 5,400

D) $45,000

A) $10,800

B) $21,600

C) $ 5,400

D) $45,000

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

71

By converting dollars to be received in the future into current dollars, the present value methods take into consideration that money:

A) has an international rate of exchange

B) is the language of business

C) is the measure of assets, liabilities, and stockholders' equity on financial statements

D) has a time value

A) has an international rate of exchange

B) is the language of business

C) is the measure of assets, liabilities, and stockholders' equity on financial statements

D) has a time value

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

72

Which of the following is a present value method of analyzing capital investment proposals?

A) Average rate of return

B) Cash payback method

C) Accounting rate of return

D) Net present value

A) Average rate of return

B) Cash payback method

C) Accounting rate of return

D) Net present value

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

73

The amount of the estimated average income for a proposed investment of $90,000 in a fixed asset, giving effect to depreciation (straight-line method), with a useful life of four years, no residual value, and an expected total income yield of $21,600, is:

A) $10,800

B) $21,600

C) $ 5,400

D) $45,000

A) $10,800

B) $21,600

C) $ 5,400

D) $45,000

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

74

Which method of evaluating capital investment proposals uses the concept of present value to compute a rate of return?

A) Average rate of return

B) Accounting rate of return

C) Cash payback period

D) Internal rate of return

A) Average rate of return

B) Accounting rate of return

C) Cash payback period

D) Internal rate of return

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

75

Which of the following is important when evaluating long-term investments?

A) Investments must earn a reasonable rate of return

B) The useful life of the asset

C) Proposals should match long term goals.

D) All of the above.

A) Investments must earn a reasonable rate of return

B) The useful life of the asset

C) Proposals should match long term goals.

D) All of the above.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

76

Decisions to install new equipment, replace old equipment, and purchase or construct a new building are examples of

A) sales mix analysis.

B) variable cost analysis.

C) capital investment analysis.

D) variable cost analysis.

A) sales mix analysis.

B) variable cost analysis.

C) capital investment analysis.

D) variable cost analysis.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

77

An analysis of a proposal by the net present value method indicated that the present value of future cash inflows exceeded the amount to be invested. Which of the following statements best describes the results of this analysis?

A) The proposal is desirable and the rate of return expected from the proposal exceeds the minimum rate used for the analysis.

B) The proposal is desirable and the rate of return expected from the proposal is less than the minimum rate used for the analysis.

C) The proposal is undesirable and the rate of return expected from the proposal is less than the minimum rate used for the analysis.

D) The proposal is undesirable and the rate of return expected from the proposal exceeds the minimum rate used for the analysis.

A) The proposal is desirable and the rate of return expected from the proposal exceeds the minimum rate used for the analysis.

B) The proposal is desirable and the rate of return expected from the proposal is less than the minimum rate used for the analysis.

C) The proposal is undesirable and the rate of return expected from the proposal is less than the minimum rate used for the analysis.

D) The proposal is undesirable and the rate of return expected from the proposal exceeds the minimum rate used for the analysis.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

78

The expected average rate of return for a proposed investment of $600,000 in a fixed asset, with a useful life of four years, straight-line depreciation, no residual value, and an expected total net income of $240,000 for the 4 years, is:

A) 40%

B) 20%

C) 60%

D) 24%

A) 40%

B) 20%

C) 60%

D) 24%

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

79

Which method for evaluating capital investment proposals reduces the expected future net cash flows originating from the proposals to their present values and computes a net present value?

A) Net present value

B) Average rate of return

C) Internal rate of return

D) Cash payback

A) Net present value

B) Average rate of return

C) Internal rate of return

D) Cash payback

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

80

The process by which management plans, evaluates, and controls long-term investment decisions involving fixed assets is called:

A) absorption cost analysis

B) variable cost analysis

C) capital investment analysis

D) cost-volume-profit analysis

A) absorption cost analysis

B) variable cost analysis

C) capital investment analysis

D) cost-volume-profit analysis

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck