Deck 7: Inventories: Cost Measurement and Flow Assumptions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

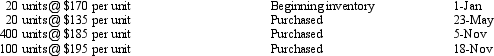

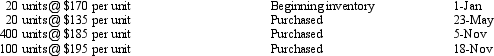

Question

Question

Question

Question

Question

Question

Question

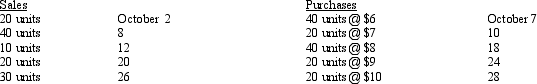

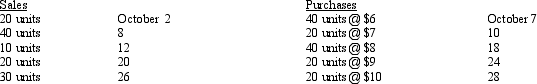

Question

Question

Question

Question

Question

Question

Question

Question

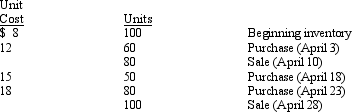

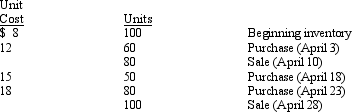

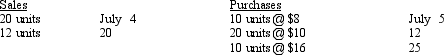

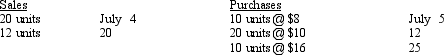

Question

Question

Question

Question

Question

Question

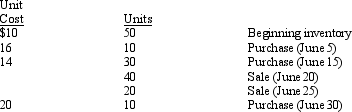

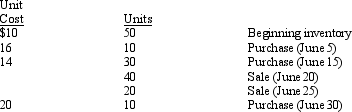

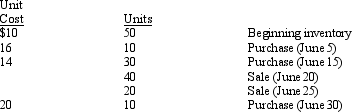

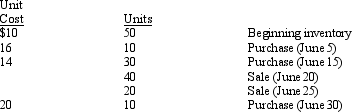

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/123

Play

Full screen (f)

Deck 7: Inventories: Cost Measurement and Flow Assumptions

1

A perpetual inventory system provides management with valuable tools in which to plan and control inventory levels because the amount of inventory is known at any point in time.

True

2

A manufacturing firm would not normally have an account titled

A) goods in process inventory

B) raw materials inventory

C) merchandise inventory

D) finished goods inventory

A) goods in process inventory

B) raw materials inventory

C) merchandise inventory

D) finished goods inventory

C

3

The SEC requires a company that uses LIFO to disclose the amount of the differentiation between LIFO and FIFO.

True

4

If a company uses LIFO for annual reporting purposes, it must also use it for interim reporting. This enables external users to accurately compare financial statements.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

5

In a period of rising prices LIFO produces the highest cost of goods sold and the lowest gross profit.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

6

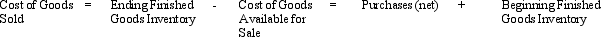

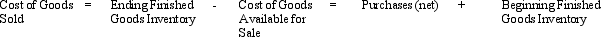

The cost of goods sold model for a manufacturer is:

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

7

A company's liquidation of inventory under LIFO results in higher income during periods of rising costs. Management can manipulate earnings by delaying purchases until after the end of the fiscal year.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

8

For only a merchandiser, the sum of beginning inventory and net purchases, or production costs, of inventory represents the cost of goods available for sale.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

9

Inventory costs include all costs directly or indirectly associated with bringing an item to its existing condition or location for sale.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

10

The use of inventory pools with dollar-value LIFO overcomes the issues associated with keeping numerous detailed records of individual quantities of each item.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

11

When shipping FOB shipping point the seller still retains economic control until the goods are received by the buyer, therefore they should not be recorded into inventory by the buyer until receipt.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

12

A manufacturing company typically has how many inventory accounts?

A) 1

B) 2

C) 3

D) 4

A) 1

B) 2

C) 3

D) 4

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following is included in the work in process account?

A) manufacturing overhead

B) direct labor

C) raw materials

D) all of these

A) manufacturing overhead

B) direct labor

C) raw materials

D) all of these

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

14

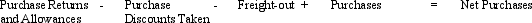

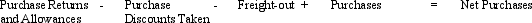

Net purchases is computed as follows:

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

15

A retail firm would normally use an inventory account titled

A) finished goods inventory

B) merchandise inventory

C) goods in process inventory

D) raw materials inventory

A) finished goods inventory

B) merchandise inventory

C) goods in process inventory

D) raw materials inventory

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

16

The LIFO conformity rule allows a company to use FIFO for financial reporting and LIFO for income taxes.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

17

When shipping FOB shipping point the buyer has economic control of the inventory and must record the goods in its inventory accounts.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

18

The use of dollar-value LIFO follows the same methodology as the LIFO method but reduces the record keeping.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

19

In a period of falling prices, FIFO produces the lowest cost of goods sold and the highest gross profit.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

20

The costs of operating a purchasing department are necessary to the purchasing of inventory therefore those costs incurred should be allocated to inventory.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

21

Exhibit 7-1 Edwards Co. purchased raw materials with a cost of $95,000 on March 2, 2014. Credit terms of 3/20, n/60 applied. If Edwards pays for the purchase on March 18, 2014, calculate the amount recorded for inventory on March 2, 2014, using the method given.

-Refer to Exhibit 7-1. Edwards uses a perpetual inventory system and the net price method.

A) $42,000

B) $76,000

C) $92,150

D) $95,000

-Refer to Exhibit 7-1. Edwards uses a perpetual inventory system and the net price method.

A) $42,000

B) $76,000

C) $92,150

D) $95,000

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

22

Which one of the following types of costs is excluded from the cost of inventory that is routinely manufactured?

A) interest

B) raw materials

C) normal spoilage

D) insurance

A) interest

B) raw materials

C) normal spoilage

D) insurance

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

23

The basic criterion for including items in inventory is

A) physical control

B) legal ownership

C) physical possession

D) economic control

A) physical control

B) legal ownership

C) physical possession

D) economic control

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

24

Which one of the following types of costs should be included in the cost of a manufactured inventory?

A) abnormal spoilage

B) production supervisory salaries

C) interest costs

D) selling costs

A) abnormal spoilage

B) production supervisory salaries

C) interest costs

D) selling costs

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

25

Use the following letters to represent items:

P = Purchases (net)

C = Cost of goods sold

B = Beginning inventory

E = Ending inventory

Which equation is correct?

A) B - C + P = E

B) B - E = C + P

C) P - E = B + C

D) B = C - E + P

P = Purchases (net)

C = Cost of goods sold

B = Beginning inventory

E = Ending inventory

Which equation is correct?

A) B - C + P = E

B) B - E = C + P

C) P - E = B + C

D) B = C - E + P

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

26

The cost of goods sold can be determined only after a physical count of inventory on hand under the

A) perpetual inventory system

B) variable costing system

C) moving average system

D) periodic system

A) perpetual inventory system

B) variable costing system

C) moving average system

D) periodic system

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following is not an advantage of a perpetual inventory system?

A) assists in the prevention of stock outs

B) requires less data processing effort than periodic systems

C) maintains up to date inventory and cost of goods sold balances

D) provides evidence of inventory shrinkage

A) assists in the prevention of stock outs

B) requires less data processing effort than periodic systems

C) maintains up to date inventory and cost of goods sold balances

D) provides evidence of inventory shrinkage

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

28

Exhibit 7-1 Edwards Co. purchased raw materials with a cost of $95,000 on March 2, 2014. Credit terms of 3/20, n/60 applied. If Edwards pays for the purchase on March 18, 2014, calculate the amount recorded for inventory on March 2, 2014, using the method given.

-Refer to Exhibit 7-1. Edwards uses a perpetual inventory system and the gross price method.

A) $42,000

B) $76,000

C) $92,150

D) $95,000

-Refer to Exhibit 7-1. Edwards uses a perpetual inventory system and the gross price method.

A) $42,000

B) $76,000

C) $92,150

D) $95,000

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

29

Which one of the following statements is false?

A) A company using the periodic system does not maintain a continuous record of the physical quantities (or costs) of inventory on hand.

B) In the periodic system, the costs of acquisition of inventory are debited directly to an inventory account.

C) In the perpetual inventory system, recording in detailed subsidiary records can be in units only, not in dollar costs.

D) When the perpetual system is used, a physical count still needs to be made periodically.

A) A company using the periodic system does not maintain a continuous record of the physical quantities (or costs) of inventory on hand.

B) In the periodic system, the costs of acquisition of inventory are debited directly to an inventory account.

C) In the perpetual inventory system, recording in detailed subsidiary records can be in units only, not in dollar costs.

D) When the perpetual system is used, a physical count still needs to be made periodically.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

30

The Purchases Discounts Taken account may appear in the accounting records if which one of the following methods is used to account for purchase discounts?

A) net price method

B) gross price method

C) allowance method

D) sales price method

A) net price method

B) gross price method

C) allowance method

D) sales price method

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

31

Stansbury Company determined its December 31, 2014 inventory to be $1,000,000 based on a physical count priced at cost. It then determined the following additional information:

Merchandise costing $90,000 was shipped FOB shipping point from a vendor on December 30, 2014. This merchandise was received and recorded on January 5, 2015.

Goods costing $120,000 were staged on the shipping dock and excluded from inventory although shipment was not made until January 4, 2015. The goods were billed to the customer FOB shipping point on December 30, 2014.

What is Stansbury's ending inventory for its December 31, 2014 balance sheet?

A) $1,000,000

B) $1,090,000

C) $1,120,000

D) $1,210,000

Merchandise costing $90,000 was shipped FOB shipping point from a vendor on December 30, 2014. This merchandise was received and recorded on January 5, 2015.

Goods costing $120,000 were staged on the shipping dock and excluded from inventory although shipment was not made until January 4, 2015. The goods were billed to the customer FOB shipping point on December 30, 2014.

What is Stansbury's ending inventory for its December 31, 2014 balance sheet?

A) $1,000,000

B) $1,090,000

C) $1,120,000

D) $1,210,000

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following are characteristics of a periodic inventory system?

A) The system does not maintain a continuous record.

B) Management knows how much inventory is on hand at all times.

C) The computer tracks inventory upon a sale and the cost of goods and inventory are immediately updated.

D) Purchases of inventory are recorded to the inventory account.

A) The system does not maintain a continuous record.

B) Management knows how much inventory is on hand at all times.

C) The computer tracks inventory upon a sale and the cost of goods and inventory are immediately updated.

D) Purchases of inventory are recorded to the inventory account.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

33

For goods sold FOB shipping point, ownership of the inventory is passed when the

A) inventory arrives at the destination

B) purchase order for the inventory is complete

C) inventory is shipped to the buyer

D) inventory sold is segregated from the seller's other inventory

A) inventory arrives at the destination

B) purchase order for the inventory is complete

C) inventory is shipped to the buyer

D) inventory sold is segregated from the seller's other inventory

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

34

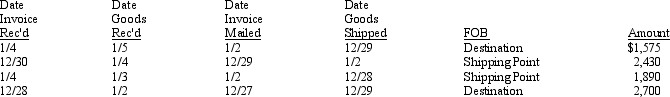

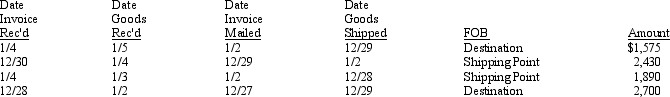

Near the end of 2015, Spruce Co. made the following purchases. The months involved in all cases are December 2015 and January 2016.

What amount of the above purchases should be included in Spruce's inventory at December 31, 2015?

A) $1,575

B) $1,890

C) $4,320

D) $4,575

What amount of the above purchases should be included in Spruce's inventory at December 31, 2015?

A) $1,575

B) $1,890

C) $4,320

D) $4,575

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

35

When a company uses a perpetual inventory system,

A) there is no purchases account

B) the cost of goods sold account is used

C) two entries are required when inventory is sold

D) all of these

A) there is no purchases account

B) the cost of goods sold account is used

C) two entries are required when inventory is sold

D) all of these

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

36

A perpetual inventory system

A) only knows the inventory on hand at the end of the year physical count

B) keeps a continuous record of the physical quantities in its inventory

C) does not maintain a continuous record of the physical quantities of inventory on hand

D) does not maintain a continuous record of the cost of inventory on hand

A) only knows the inventory on hand at the end of the year physical count

B) keeps a continuous record of the physical quantities in its inventory

C) does not maintain a continuous record of the physical quantities of inventory on hand

D) does not maintain a continuous record of the cost of inventory on hand

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

37

Goods in transit shipped FOB shipping point should be included in the inventory of the

A) buyer

B) seller

C) shipping company

D) none of these

A) buyer

B) seller

C) shipping company

D) none of these

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following are characteristics of a perpetual inventory system?

A) Management knows how much inventory is on hand at all times.

B) Purchases of inventory are recorded to the inventory account.

C) The computer tracks inventory upon a sale and the cost of goods and inventory are immediately updated.

D) All of these.

A) Management knows how much inventory is on hand at all times.

B) Purchases of inventory are recorded to the inventory account.

C) The computer tracks inventory upon a sale and the cost of goods and inventory are immediately updated.

D) All of these.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

39

Which one of the following statements is false?

A) FOB shipping point means the buyer has legal title to the goods while they are in transit.

B) FOB shipping point means the buyer has legal title to the goods when they are shipped.

C) FOB destination means the seller has legal title to the goods until they reach the buyer's place of business.

D) FOB shipping point means the buyer acquires legal title to the goods when they reach the buyer's place of business.

A) FOB shipping point means the buyer has legal title to the goods while they are in transit.

B) FOB shipping point means the buyer has legal title to the goods when they are shipped.

C) FOB destination means the seller has legal title to the goods until they reach the buyer's place of business.

D) FOB shipping point means the buyer acquires legal title to the goods when they reach the buyer's place of business.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

40

Which one of the following statements is true?

A) FOB destination means the buyer has legal title to the goods while they are in transit.

B) FOB shipping point means the seller has legal title to the goods while they are in transit.

C) FOB destination means the seller has legal title to the goods until they reach the buyer's place of business.

D) FOB shipping point means the buyer acquires legal title to the goods when they reach the buyer's place of business.

A) FOB destination means the buyer has legal title to the goods while they are in transit.

B) FOB shipping point means the seller has legal title to the goods while they are in transit.

C) FOB destination means the seller has legal title to the goods until they reach the buyer's place of business.

D) FOB shipping point means the buyer acquires legal title to the goods when they reach the buyer's place of business.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

41

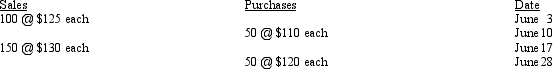

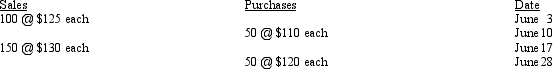

On June 1, Dollar Hardware, Inc. had an inventory of 300 gas grills costing $100 each. Purchases and sales during June are as follows:

What is the cost of Dollar's inventory on June 30 using the FIFO method?

A) $15,000

B) $16,000

C) $16,500

D) $18,000

What is the cost of Dollar's inventory on June 30 using the FIFO method?

A) $15,000

B) $16,000

C) $16,500

D) $18,000

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

42

Which one of the following types of costs is most likely to be included in determining the cost of inventory?

A) freight-in costs

B) freight-out costs

C) interest cost for amounts borrowed to finance the purchase of inventory

D) marketing costs

A) freight-in costs

B) freight-out costs

C) interest cost for amounts borrowed to finance the purchase of inventory

D) marketing costs

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

43

Which one of the following statements is false?

A) Under conditions of rising prices, the LIFO method results in lower income than the FIFO method.

B) In most cases, the FIFO method approximates the physical flow of items in inventory.

C) The LIFO method produces a higher ending inventory value than the FIFO method.

D) The FIFO method includes holding gains in income.

A) Under conditions of rising prices, the LIFO method results in lower income than the FIFO method.

B) In most cases, the FIFO method approximates the physical flow of items in inventory.

C) The LIFO method produces a higher ending inventory value than the FIFO method.

D) The FIFO method includes holding gains in income.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

44

Exhibit 7-2 Edwards Co. purchased raw materials with a cost of $95,000 on March 2, 2014. Credit terms of 3/20, n/60 applied.

-Refer to Exhibit 7-2. If Edwards uses the net method and pays for the purchase on March 31, 2014, what amount is recorded in the Purchase Discounts Lost account?

A) $0

B) $2,850

C) $4,000

D) $8,000

-Refer to Exhibit 7-2. If Edwards uses the net method and pays for the purchase on March 31, 2014, what amount is recorded in the Purchase Discounts Lost account?

A) $0

B) $2,850

C) $4,000

D) $8,000

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

45

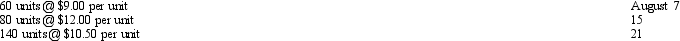

On August 1, Micro Encoders, Inc. had 120 units of a certain software package that cost $6 per unit. During May, the following purchases were made:

During August, 300 units were sold. If Micro Encoders uses the weighted average method, the cost of ending inventory would be

A) $922.50

B) $2,767.50

C) $937.50

D) $2,182.50

During August, 300 units were sold. If Micro Encoders uses the weighted average method, the cost of ending inventory would be

A) $922.50

B) $2,767.50

C) $937.50

D) $2,182.50

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

46

Morton uses the moving average flow assumption. On January 1, there were 180 units on hand and the total inventory cost was $900. On January 10, 40 more units were purchased at a cost of $6 per unit. Sales included 20 units on January 3 and 60 units on January 17. What was the total cost of goods sold recorded for the units sold on January 17?

A) $728

B) $330

C) $100

D) $312

A) $728

B) $330

C) $100

D) $312

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

47

Concerning purchase discounts, which one of the following statements is true?

A) Purchase discounts taken should be deducted from the acquisition cost of the inventory.

B) The net price method results in recording accounts payable at the maximum value of the liability that the company may be required to pay out.

C) Purchase discounts lost should be included in the cost of inventory.

D) An advantage of the gross price method is that it isolates purchase discounts lost and thus highlights inefficiencies.

A) Purchase discounts taken should be deducted from the acquisition cost of the inventory.

B) The net price method results in recording accounts payable at the maximum value of the liability that the company may be required to pay out.

C) Purchase discounts lost should be included in the cost of inventory.

D) An advantage of the gross price method is that it isolates purchase discounts lost and thus highlights inefficiencies.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following inventory cost flow assumptions produces the same ending inventory values under both the periodic and perpetual systems?

A) FIFO

B) LIFO

C) average

D) dollar-value LIFO

A) FIFO

B) LIFO

C) average

D) dollar-value LIFO

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

49

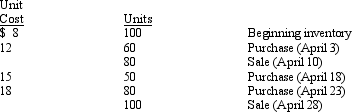

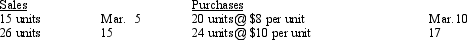

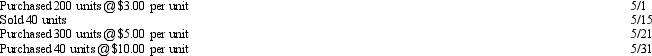

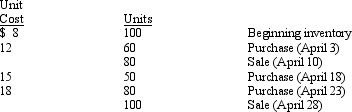

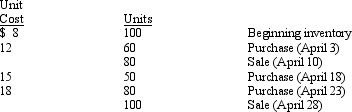

Exhibit 7-3 Davis Co. had the following inventory activity during April:

-Refer to Exhibit 7-3. Assuming Davis uses a periodic FIFO cost flow assumption, ending inventory at April 30 would be

A) $880

B) $920

C) $1,090

D) $1,890

-Refer to Exhibit 7-3. Assuming Davis uses a periodic FIFO cost flow assumption, ending inventory at April 30 would be

A) $880

B) $920

C) $1,090

D) $1,890

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

50

McClure Corp. purchased raw materials with a cost of $86,000. Credit terms of 3/10, n/60 apply. If McClure uses the net price method, the purchase should be recorded as

A) $77,400

B) $86,000

C) $83,420

D) $88,580

A) $77,400

B) $86,000

C) $83,420

D) $88,580

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

51

Left Images Printing uses perpetual LIFO in valuing its inventory. The March 1 inventory was 36 units at $6 each. Purchases and sales during March were as follows:

The cost of the ending inventory was

A) $424

B) $312

C) $330

D) $286

The cost of the ending inventory was

A) $424

B) $312

C) $330

D) $286

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

52

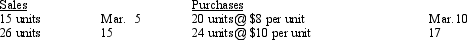

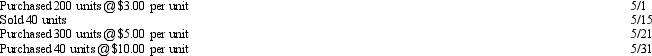

Rubric, Inc. provided the following inventory transaction summary for May:

In addition, it has been determined that Rubric's inventory at the beginning of the month was $400.00 (200 units). What was Rubric's cost per unit at the end of May, using the moving average method?

A) $3.00

B) $2.00

C) $4.00

D) $6.00

In addition, it has been determined that Rubric's inventory at the beginning of the month was $400.00 (200 units). What was Rubric's cost per unit at the end of May, using the moving average method?

A) $3.00

B) $2.00

C) $4.00

D) $6.00

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

53

Exhibit 7-2 Edwards Co. purchased raw materials with a cost of $95,000 on March 2, 2014. Credit terms of 3/20, n/60 applied.

-Refer to Exhibit 7-2. If Edwards uses the net method and pays for the purchase on March 18, 2014, what amount is recorded in the Purchase Discounts Taken account?

A) $0

B) $2,850

C) $5,000

D) $3,000

-Refer to Exhibit 7-2. If Edwards uses the net method and pays for the purchase on March 18, 2014, what amount is recorded in the Purchase Discounts Taken account?

A) $0

B) $2,850

C) $5,000

D) $3,000

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

54

Eller Company uses a periodic inventory system. Relevant inventory information for the year follows:

At year-end, 50 units remain in inventory. What is the cost of the ending inventory on a LIFO basis?

A) $7,950

B) $7,100

C) $8,750

D) $8,450

At year-end, 50 units remain in inventory. What is the cost of the ending inventory on a LIFO basis?

A) $7,950

B) $7,100

C) $8,750

D) $8,450

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

55

Exhibit 7-4 RJ, Inc. had the following activity for an inventory item during June:

-Refer to Exhibit 7-4. Assuming RJ, Inc. uses a periodic weighted average cost flow assumption, ending inventory for June would be

A) $512

B) $560

C) $768

D) $720

-Refer to Exhibit 7-4. Assuming RJ, Inc. uses a periodic weighted average cost flow assumption, ending inventory for June would be

A) $512

B) $560

C) $768

D) $720

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

56

Exhibit 7-3 Davis Co. had the following inventory activity during April:

-Refer to Exhibit 7-3. Assuming Davis uses a perpetual LIFO cost flow assumption, ending inventory at April 30 would be

A) $880

B) $920

C) $1,090

D) $1,890

-Refer to Exhibit 7-3. Assuming Davis uses a perpetual LIFO cost flow assumption, ending inventory at April 30 would be

A) $880

B) $920

C) $1,090

D) $1,890

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

57

Exhibit 7-4 RJ, Inc. had the following activity for an inventory item during June:

-Refer to Exhibit 7-4. Assuming RJ uses a perpetual moving average cost flow assumption, cost of goods sold for June would be

A) $512

B) $560

C) $768

D) $720

-Refer to Exhibit 7-4. Assuming RJ uses a perpetual moving average cost flow assumption, cost of goods sold for June would be

A) $512

B) $560

C) $768

D) $720

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

58

On July 1, Maxwell Company had 40 units of inventory at a cost of $6 per unit. July purchases and sales were as follows:

The cost of goods sold during July was $272. Maxwell must use:

A) FIFO

B) LIFO perpetual

C) weighted average

D) LIFO periodic

The cost of goods sold during July was $272. Maxwell must use:

A) FIFO

B) LIFO perpetual

C) weighted average

D) LIFO periodic

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

59

La Grange, Inc. reported sales of $1,200 in October and a gross profit of $370. The company had an October 1 inventory of 60 units that had a total cost of $300. October purchases and sales were as follows:

La Grange, Inc., must use

A) LIFO perpetual

B) FIFO

C) weighted average

D) LIFO periodic

La Grange, Inc., must use

A) LIFO perpetual

B) FIFO

C) weighted average

D) LIFO periodic

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

60

Exhibit 7-3 Davis Co. had the following inventory activity during April:

-Refer to Exhibit 7-3. Assuming Davis uses a periodic LIFO cost flow assumption, ending inventory at April 30 would be

A) $880

B) $920

C) $1,090

D) $1,890

-Refer to Exhibit 7-3. Assuming Davis uses a periodic LIFO cost flow assumption, ending inventory at April 30 would be

A) $880

B) $920

C) $1,090

D) $1,890

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

61

IFRS does not allow the use of LIFO because it

A) would have to be allowed for tax reporting in each country

B) would result in too many overstatements of income

C) is inconsistent with any presumed physical flow of inventory

D) would have to be the only method permitted

A) would have to be allowed for tax reporting in each country

B) would result in too many overstatements of income

C) is inconsistent with any presumed physical flow of inventory

D) would have to be the only method permitted

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

62

Which one of the following cost flow assumptions provides the lowest inventory value in periods of rising prices?

A) FIFO periodic

B) LIFO periodic

C) FIFO perpetual

D) moving average

A) FIFO periodic

B) LIFO periodic

C) FIFO perpetual

D) moving average

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

63

For companies that have little change in the characteristics of their inventory items, the most appropriate method for computing a cost index for dollar-value LIFO is the

A) inventory pool method

B) double-extension method

C) weighted average method

D) link-chain method

A) inventory pool method

B) double-extension method

C) weighted average method

D) link-chain method

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

64

For the year in which prices rise, adoption of a "just-in-time" inventory system will most likely result in

A) a permanent increase in the size of the inventory

B) a reduction in income taxes

C) an increase in total assets

D) an increase in income

A) a permanent increase in the size of the inventory

B) a reduction in income taxes

C) an increase in total assets

D) an increase in income

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

65

Which one of the following is not an advantage of using the FIFO cost flow assumption?

A) produces lowest net income in periods of rising prices

B) provides a relevant ending inventory value

C) is not as susceptible to profit manipulation by management

D) does not produce unusual results when inventory liquidation occurs

A) produces lowest net income in periods of rising prices

B) provides a relevant ending inventory value

C) is not as susceptible to profit manipulation by management

D) does not produce unusual results when inventory liquidation occurs

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

66

Which one of the following is not an advantage of LIFO?

A) In periods of rising prices, less income taxes are paid.

B) In periods of rising prices, less holding gains are reported in net income.

C) Record keeping and financial statement preparation are easier.

D) Conservative income statements and balance sheet disclosures result from rising prices.

A) In periods of rising prices, less income taxes are paid.

B) In periods of rising prices, less holding gains are reported in net income.

C) Record keeping and financial statement preparation are easier.

D) Conservative income statements and balance sheet disclosures result from rising prices.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

67

Which one of the following statements is true?

A) Income manipulation is difficult under LIFO.

B) Accounting principles do not require that the inventory cost flow approximate the physical flow of goods.

C) Companies may use LIFO for tax purposes and FIFO in the financial statements.

D) In periods of declining prices, LIFO will result in the payment of lower income taxes.

A) Income manipulation is difficult under LIFO.

B) Accounting principles do not require that the inventory cost flow approximate the physical flow of goods.

C) Companies may use LIFO for tax purposes and FIFO in the financial statements.

D) In periods of declining prices, LIFO will result in the payment of lower income taxes.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following is not a disadvantage of using the FIFO cost flow assumption?

A) creates the highest outflow for income taxes during periods of rising prices

B) does not match current costs against current revenues

C) includes all the holding gains in income during periods of rising prices

D) provides a relevant ending inventory value

A) creates the highest outflow for income taxes during periods of rising prices

B) does not match current costs against current revenues

C) includes all the holding gains in income during periods of rising prices

D) provides a relevant ending inventory value

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

69

Dollar-value LIFO uses

A) current cost only

B) cost indexes only

C) current cost and cost indexes

D) numerous detailed records from either a physical count or perpetual records

A) current cost only

B) cost indexes only

C) current cost and cost indexes

D) numerous detailed records from either a physical count or perpetual records

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

70

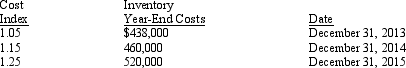

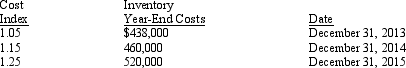

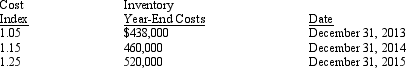

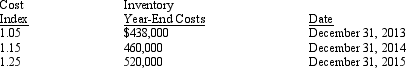

Exhibit 7-5 Sullivan Produce Co. switched from FIFO to LIFO on January 1, 2013, for external reporting and income tax purposes, while retaining FIFO for internal reports. On that date, the FIFO inventory equaled $360,000. The ensuing three-year period resulted in the following:

-Refer to Exhibit 7-5. The ending inventory at December 31, 2015, using the dollar-value LIFO method would be

A) $422,000

B) $402,000

C) $426,000

D) $420,400

-Refer to Exhibit 7-5. The ending inventory at December 31, 2015, using the dollar-value LIFO method would be

A) $422,000

B) $402,000

C) $426,000

D) $420,400

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

71

Which one of the following is an advantage of LIFO?

A) In periods of rising prices, less income taxes are paid.

B) In periods of rising prices, more holding gains are reported in net income.

C) Record keeping and financial statement preparation are easier.

D) Conservative income statements and balance sheet disclosures result from falling prices.

A) In periods of rising prices, less income taxes are paid.

B) In periods of rising prices, more holding gains are reported in net income.

C) Record keeping and financial statement preparation are easier.

D) Conservative income statements and balance sheet disclosures result from falling prices.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

72

Which one of the following sets of inventory cost flow assumptions is not susceptible to profit manipulation by management?

A) FIFO and specific identification

B) LIFO and average cost

C) FIFO and average cost

D) LIFO and specific identification

A) FIFO and specific identification

B) LIFO and average cost

C) FIFO and average cost

D) LIFO and specific identification

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

73

Trip Corp. began business in 2013. On December 31, 2013, Trip's single pool of inventory was valued at $300,000, using the dollar-value LIFO inventory method. On December 31, 2014, the value of Trip's inventory at current costs was $450,000. The 2014 year-end cost index was 120. What was the value of Trip's inventory at the end of 2014, using the dollar-value LIFO method?

A) $375,000

B) $390,000

C) $480,000

D) $540,000

A) $375,000

B) $390,000

C) $480,000

D) $540,000

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

74

Exhibit 7-5 Sullivan Produce Co. switched from FIFO to LIFO on January 1, 2013, for external reporting and income tax purposes, while retaining FIFO for internal reports. On that date, the FIFO inventory equaled $360,000. The ensuing three-year period resulted in the following:

-Refer to Exhibit 7-5. The ending inventory at December 31, 2014, using the dollar-value LIFO method would be

A) $400,000

B) $402,000

C) $406,000

D) $424,000

-Refer to Exhibit 7-5. The ending inventory at December 31, 2014, using the dollar-value LIFO method would be

A) $400,000

B) $402,000

C) $406,000

D) $424,000

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

75

Which one of the following is not a disadvantage of the LIFO inventory cost flow assumption?

A) the impact of LIFO liquidation profits

B) failure to match the most recent costs with revenue

C) the possibility of income manipulation by management

D) impaired comparability between companies using LIFO

A) the impact of LIFO liquidation profits

B) failure to match the most recent costs with revenue

C) the possibility of income manipulation by management

D) impaired comparability between companies using LIFO

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

76

The second step in calculating dollar-value LIFO is to

A) compute the change in the inventory level for the year at base-year cost

B) roll back the ending inventory cost to base-year costs

C) value the total ending inventory at current-year costs

D) roll forward the increase to current-year cost by applying the current-year conversion index

A) compute the change in the inventory level for the year at base-year cost

B) roll back the ending inventory cost to base-year costs

C) value the total ending inventory at current-year costs

D) roll forward the increase to current-year cost by applying the current-year conversion index

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

77

Taylor Company changed its inventory cost flow assumption from FIFO to LIFO in a period of rising prices. What was the result of the change on ending inventory in the year of the change?

A) increased ending inventory

B) decreased ending inventory

C) no change in ending inventory

D) cannot be determined from the information given

A) increased ending inventory

B) decreased ending inventory

C) no change in ending inventory

D) cannot be determined from the information given

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

78

Which of the following cannot be used as the current cost in dollar-value LIFO calculations?

A) the cost of the first acquisitions in a year

B) the cost of the last acquisitions in a year

C) the cost of the acquisitions in the middle of a year

D) the average cost of all acquisitions in a year

A) the cost of the first acquisitions in a year

B) the cost of the last acquisitions in a year

C) the cost of the acquisitions in the middle of a year

D) the average cost of all acquisitions in a year

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

79

IFRS and GAAP are similar for all of the following inventory accounting standards except IFRS

A) do not allow the inclusion of overhead in inventory

B) have provisions for use of the LIFO cost flow assumption

C) exclude the weighted average approach to inventory valuation

D) require the same cost flow assumption for all inventories that are similar in nature and use

A) do not allow the inclusion of overhead in inventory

B) have provisions for use of the LIFO cost flow assumption

C) exclude the weighted average approach to inventory valuation

D) require the same cost flow assumption for all inventories that are similar in nature and use

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

80

Which inventory cost flow assumption is not allowed for financial reporting in many foreign countries?

A) specific identification

B) average

C) FIFO

D) LIFO

A) specific identification

B) average

C) FIFO

D) LIFO

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck