Deck 25: Rewarding Business Performance

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

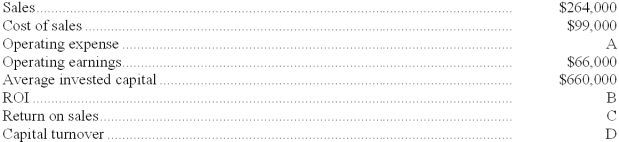

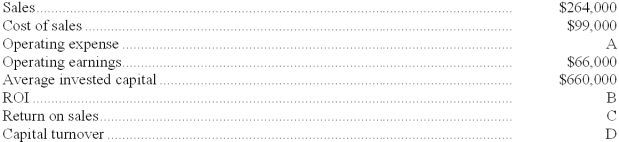

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/71

Play

Full screen (f)

Deck 25: Rewarding Business Performance

1

Accounting systems do not offer any benefit to management in generating and focusing employee motivation.

False

2

To increase return on sales, a manager could decrease cost of goods sold while increasing revenues.

True

3

The value chain starts with the supplier and ends with the consumer.

True

4

A common criticism of capital ROI as a performance measurement criterion is that it encourages a long-term orientation sometimes to the detriment of shorter-term planning.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

5

Residual income is calculated by subtracting the minimum acceptable return on the average invested capital from the operating income.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

6

Return on investment (ROI) tells us how much earnings can be expected for the average invested dollar.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

7

Capital turnover is calculated by dividing operating income by invested capital.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

8

Stock based performance evaluation of managers is considered more risky than accounting based performance evaluation.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

9

A stock option is a right to sell a certain number of shares at a specific price sometime in the future.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

10

Operating earnings rather than net income is used to compute return on sales.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

11

Residual income is the difference between net operating income at breakeven and actual net operating income.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

12

Capital turnover is equal to sales divided by total investment.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

13

The value chain consists of only those activities that increase the selling price of a product as it is distributed to a customer.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

14

The balanced scorecard approach attempts to measure whether an organization is meeting its strategic goals.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

15

Capital turnover can be improved by reducing invested capital while keeping sales constant.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

16

Most organizations try to achieve their goals by providing incentives to employees who use resources wisely.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

17

The main objective of the balanced scorecard system of performance measurement is achieving the organization's strategic goals.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

18

Return on investment indicates the profitability that can be expected from one dollar of sales.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

19

The return on investment is calculated by multiplying the capital turnover by the return on sales.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

20

Using only ROI as a business performance measure often leads to the best decisions.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

21

Bonuses may be used to reward employees who meet performance goals.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

22

EVA stands for "evaluating value added" performance.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

23

What is the capital turnover for Mahen, Inc.?

A) 166%.

B) 5%.

C) 10%.

D) 60%.

A) 166%.

B) 5%.

C) 10%.

D) 60%.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following accounting system characteristics cannot generate motivation?

A) Creating and setting goals.

B) Measuring progress towards those goals.

C) Allocating rewards towards goal achievement.

D) Balancing debits and credits.

A) Creating and setting goals.

B) Measuring progress towards those goals.

C) Allocating rewards towards goal achievement.

D) Balancing debits and credits.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

25

A system that considers the earnings per sales dollar and the investment used to generate those sales dollars is called:

A) The economic value added system.

B) The balanced scorecard system.

C) The Dupont system.

D) The residual income system.

A) The economic value added system.

B) The balanced scorecard system.

C) The Dupont system.

D) The residual income system.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

26

What is the return on sales for Mahen, Inc.?

A) 5%.

B) 6%.

C) 10%.

D) 20%.

A) 5%.

B) 6%.

C) 10%.

D) 20%.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following is not a measure used by the financial perspective lens of the balanced scorecard?

A) ROI.

B) EVA.

C) Residual income.

D) Net operating income.

A) ROI.

B) EVA.

C) Residual income.

D) Net operating income.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following is not one of the strategies of the financial perspective lens of the balanced scorecard?

A) Improve shareholder perspectives.

B) Improve credit rating.

C) Improve customer relations.

D) Reduce risk.

A) Improve shareholder perspectives.

B) Improve credit rating.

C) Improve customer relations.

D) Reduce risk.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

29

One of the strategies of the business process perspective lens of the balanced scorecard is to improve the quality of the manufacturing process. Which of the following is not one of the measures?

A) Number of on-time deliveries.

B) Machine downtime.

C) Percent of orders filled.

D) Scrap as a percentage of raw materials.

A) Number of on-time deliveries.

B) Machine downtime.

C) Percent of orders filled.

D) Scrap as a percentage of raw materials.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

30

In considering customer's needs, the balanced scorecard method will look at:

A) Market share growth and customer retention.

B) Return on sales and sales turnover.

C) Residual income and return on investment.

D) Organizational procedures and information systems.

A) Market share growth and customer retention.

B) Return on sales and sales turnover.

C) Residual income and return on investment.

D) Organizational procedures and information systems.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

31

The set of activities necessary to create and distribute a desirable product or service to a customer is known as:

A) A customer perspective.

B) Business process perspective.

C) Balanced scorecard.

D) Value chain.

A) A customer perspective.

B) Business process perspective.

C) Balanced scorecard.

D) Value chain.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following is not one of the components of the DuPont system for measuring and evaluating business performance?

A) Return on sales.

B) Return on investment.

C) Inventory turnover.

D) Capital turnover.

A) Return on sales.

B) Return on investment.

C) Inventory turnover.

D) Capital turnover.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following is not one of the balanced scorecard lenses?

A) Financial perspective.

B) Learning and growth perspective.

C) Production perspective.

D) Business process perspective.

A) Financial perspective.

B) Learning and growth perspective.

C) Production perspective.

D) Business process perspective.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

34

Residual income can be defined as:

A) That income left over after dividends are paid out.

B) Operating earnings minus return on investment.

C) Operating earnings minus a minimum acceptable return.

D) Operating earnings minus a minimum acceptable return, times invested capital.

A) That income left over after dividends are paid out.

B) Operating earnings minus return on investment.

C) Operating earnings minus a minimum acceptable return.

D) Operating earnings minus a minimum acceptable return, times invested capital.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

35

Which ratio tells managers about how the invested capital is generating sales dollars?

A) Return on investment.

B) Receivable turnover.

C) Capital turnover.

D) Return on sales.

A) Return on investment.

B) Receivable turnover.

C) Capital turnover.

D) Return on sales.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following is not a strategy of the learning and growth lens of a balanced scorecard?

A) Improve employee relations.

B) Improve customer relations.

C) Improve employee productivity.

D) Increase new product development.

A) Improve employee relations.

B) Improve customer relations.

C) Improve employee productivity.

D) Increase new product development.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

37

The value chain usually starts with the _________ and ends with the ___________.

A) Supplier, customer

B) Retailer, wholesaler

C) Customer, retailer

D) Retailer, customer

A) Supplier, customer

B) Retailer, wholesaler

C) Customer, retailer

D) Retailer, customer

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following is not a reason for using a measure such as ROI?

A) To motivate employees to act in accordance with the goals of the organization.

B) To motivate employees towards short-term planning rather than long-term planning.

C) To motivate employees to accept a project that would benefit their own division but not necessarily the firm as a whole.

D) To motivate employees to act solely on their own best interest.

A) To motivate employees to act in accordance with the goals of the organization.

B) To motivate employees towards short-term planning rather than long-term planning.

C) To motivate employees to accept a project that would benefit their own division but not necessarily the firm as a whole.

D) To motivate employees to act solely on their own best interest.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

39

What is the return on investment for Mahen, Inc?

A) 5%.

B) 6%.

C) 10%.

D) 20%.

A) 5%.

B) 6%.

C) 10%.

D) 20%.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

40

The return on investment is calculated by:

A) Multiplying the capital turnover by the return on sales.

B) Dividing the capital turnover by the return on sales.

C) Dividing average invested capital by sales.

D) Multiplying operating income by capital turnover.

A) Multiplying the capital turnover by the return on sales.

B) Dividing the capital turnover by the return on sales.

C) Dividing average invested capital by sales.

D) Multiplying operating income by capital turnover.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

41

What is division's Y ROI for product B?

A) 12.0%.

B) 10.0%.

C) 11.0%.

D) 12.5%.

A) 12.0%.

B) 10.0%.

C) 11.0%.

D) 12.5%.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

42

Identify the criticisms of using ROI (Return on investment) as the only performance measure.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

43

How is the balanced scorecard used to identify, evaluate, and reward business performance?

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

44

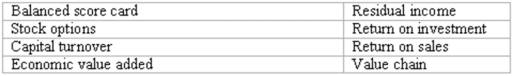

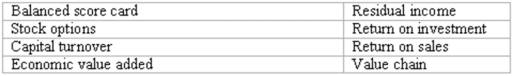

Listed below are eight accounting terms introduced or emphasized in this chapter:

Each of the following statements may (or may not) describe one of these technical terms. In the space provided, indicate the accounting term described, or answer "none" if the statement does not correctly describe any of the terms.

(a) _______ is the amount by which operating earnings exceeds a minimum acceptable return on the average invested capital. The minimum rate of return represents the opportunity cost of using the invested capital.

(b) ______ is the operating income divided by the average invested capital associated with the generation of that income.

(c) ________ is computed by dividing the operating income by the total sales for a particular business segment or product line. It tells managers the amount of earnings generated from a dollar of sales.

(d) ________ give an employee the right to purchase a pre-specified number of shares at a pre-specified price within a certain future time period. They provide incentives for managers to increase stock prices.

(e) _______ is the set of activities necessary to create and distribute a desirable product or service to a customer.

(f) _______ is a specific type of residual income. It is computed by multiplying after-tax weighted average cost of capital by total assets minus current liabilities, and subtracting that product from the after-tax operating income.

(g) _______ is a measure created by dividing sales by the average invested capital to generate those sales. It tells managers the amount of sales generated by a dollar of invested capital.

(h) _______ is a system for performance measurement that links a company's strategy to specific goals, assesses progress towards those goals, and measures specific initiatives to achieve those goals. It is a systematic attempt to create a business performance measurement process that integrates objectives across four business lenses to achieve the organization's strategic goals.

Each of the following statements may (or may not) describe one of these technical terms. In the space provided, indicate the accounting term described, or answer "none" if the statement does not correctly describe any of the terms.

(a) _______ is the amount by which operating earnings exceeds a minimum acceptable return on the average invested capital. The minimum rate of return represents the opportunity cost of using the invested capital.

(b) ______ is the operating income divided by the average invested capital associated with the generation of that income.

(c) ________ is computed by dividing the operating income by the total sales for a particular business segment or product line. It tells managers the amount of earnings generated from a dollar of sales.

(d) ________ give an employee the right to purchase a pre-specified number of shares at a pre-specified price within a certain future time period. They provide incentives for managers to increase stock prices.

(e) _______ is the set of activities necessary to create and distribute a desirable product or service to a customer.

(f) _______ is a specific type of residual income. It is computed by multiplying after-tax weighted average cost of capital by total assets minus current liabilities, and subtracting that product from the after-tax operating income.

(g) _______ is a measure created by dividing sales by the average invested capital to generate those sales. It tells managers the amount of sales generated by a dollar of invested capital.

(h) _______ is a system for performance measurement that links a company's strategy to specific goals, assesses progress towards those goals, and measures specific initiatives to achieve those goals. It is a systematic attempt to create a business performance measurement process that integrates objectives across four business lenses to achieve the organization's strategic goals.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

45

Identify and explain the components of management compensation and the tradeoffs that compensation designers make.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

46

What is division's Y ROI for product A?

A) 12.0%.

B) 10.0%.

C) 11.0%.

D) 12.5%.

A) 12.0%.

B) 10.0%.

C) 11.0%.

D) 12.5%.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

47

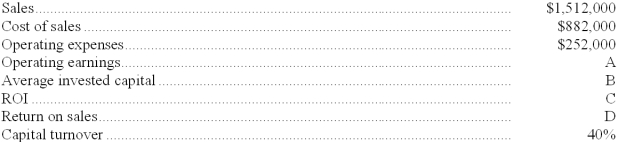

The Lastrom company provided the following information regarding its operations: What is Lastrom's ROI for the year ending 2012?

Refer To: 25-50

A) 2.48%.

B) 2.72%.

C) 2.40%.

D) 2.50%.

Refer To: 25-50

A) 2.48%.

B) 2.72%.

C) 2.40%.

D) 2.50%.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

48

Explain the importance of incentive systems for motivating performance.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

49

What is the capital turnover for Brookes, Inc.?

A) 38%.

B) 54%.

C) 70%.

D) 86%.

A) 38%.

B) 54%.

C) 70%.

D) 86%.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

50

What is the return on sales for Brookes, Inc.?

A) 13%.

B) 19%.

C) 9%.

D) 70%.

A) 13%.

B) 19%.

C) 9%.

D) 70%.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

51

Calculate the residual income assuming the following information:

A) $156,000.

B) $108,000.

C) $219,000.

D) $45,000.

A) $156,000.

B) $108,000.

C) $219,000.

D) $45,000.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

52

Morgan Company has a ROI of 5% and a capital turnover of 8%. What is its return on sales?

A) 133%.

B) 75%.

C) 62.5%.

D) Some other percentage.

A) 133%.

B) 75%.

C) 62.5%.

D) Some other percentage.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

53

The Parry company provided the following information regarding its operations: What is Parry's ROI for the year ending 2012?

A) 1.50%.

B) 2.72%.

C) 1.76%.

D) 1.82%.

A) 1.50%.

B) 2.72%.

C) 1.76%.

D) 1.82%.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

54

Define the measurement model known as the DuPont system used for evaluating business performance.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

55

Management compensation plans:

A) May be affected by adopting International Financial Reporting Standards since earnings under IFRS are typically higher than GAAP earnings.

B) May be affected by adopting International Financial Reporting Standards since earnings under IFRS are typically lower than GAAP earnings.

C) Will not be affected by IFRS since earnings are equivalent to GAAP.

D) Are decided by shareholders who do not consider GAAP or IFRS when deciding how much compensation managers receive.

A) May be affected by adopting International Financial Reporting Standards since earnings under IFRS are typically higher than GAAP earnings.

B) May be affected by adopting International Financial Reporting Standards since earnings under IFRS are typically lower than GAAP earnings.

C) Will not be affected by IFRS since earnings are equivalent to GAAP.

D) Are decided by shareholders who do not consider GAAP or IFRS when deciding how much compensation managers receive.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

56

Assuming division Y's manager has an opportunity to undertake an investment that would require a $500,000 investment and yield $40,000 in net operating income for its product B, what would be the ROI for the entire division?

A) 11.0%.

B) 10%.

C) 9%.

D) 8%.

A) 11.0%.

B) 10%.

C) 9%.

D) 8%.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

57

Calculate and explain residual income and economic value added.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

58

Clancy Stores has sales of $1,574,000, cost of sales of $653,000, and operating expenses of $292,000. What is Clancy's return on sales?

A) 58.5%.

B) 41.5%.

C) 60%.

D) 40%.

A) 58.5%.

B) 41.5%.

C) 60%.

D) 40%.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

59

Dwyer Company's ROI is 6% and its return on sales is 16%. What is its capital turnover?

A) 3%.

B) 37.5%.

C) 300%.

D) Some other percentage.

A) 3%.

B) 37.5%.

C) 300%.

D) Some other percentage.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

60

What is the return on investment for Brookes, Inc?

A) 70%.

B) 19%.

C) 13%.

D) 9%.

A) 70%.

B) 19%.

C) 13%.

D) 9%.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following are not part of the components of the DuPont system for measuring and evaluating business performance?

A) Return on sales.

B) Residual income.

C) Return on investment.

D) Capital turnover.

E) Number of patents.

A) Return on sales.

B) Residual income.

C) Return on investment.

D) Capital turnover.

E) Number of patents.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following is not represented in the balanced scorecard?

A) A learning and growth perspective.

B) The internal business process perspective.

C) The government's perspective.

D) The customers' perspective.

E) The financial perspective.

A) A learning and growth perspective.

B) The internal business process perspective.

C) The government's perspective.

D) The customers' perspective.

E) The financial perspective.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following is not likely to be included in the typical components of management compensation?

A) Company stock options.

B) Cash bonuses.

C) Free meals.

D) Fixed salary.

E) Company stock.

A) Company stock options.

B) Cash bonuses.

C) Free meals.

D) Fixed salary.

E) Company stock.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

64

State the four performance lenses in a balanced scorecard and state at least two measures for each of them.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

65

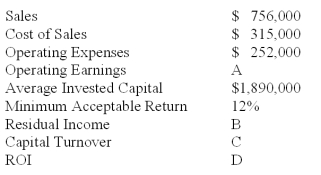

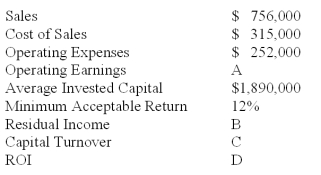

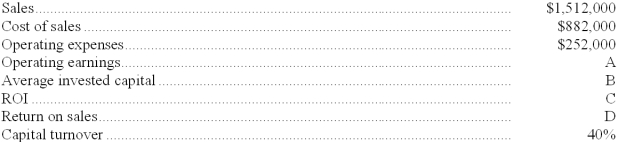

The following information is available for the Hancock Company.

Compute the answers for items A-D.

Compute the answers for items A-D.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

66

Premo Pens is a division of InCommunicato, Inc. Premo generates annual revenue of $162,000, operating earnings of $55,000, and has average assets of $400,000. InCommunicato expects its divisions to earn a minimum required return of 12 percent. Which of the following does not represent either return on sales, residual income, or return on investment for Premo Pens?

A) 13.75%.

B) $7,000.

C) 34%.

D) 40.5%.

E) $9,000.

A) 13.75%.

B) $7,000.

C) 34%.

D) 40.5%.

E) $9,000.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

67

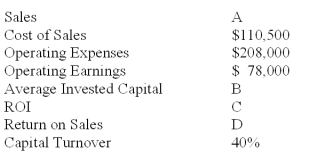

The following information regarding Greenwich Company is available:

Compute the answers for items A-D.

Compute the answers for items A-D.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

68

State the four performance lenses in a balanced scorecard and briefly describe each of them.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

69

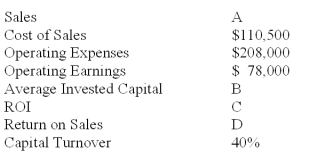

The following information regarding the Duncan Company is available:

Compute the answers for items A-D.

Compute the answers for items A-D.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

70

The following information regarding Baron Company is available:

Compute the answers for items A-D.

Compute the answers for items A-D.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

71

Criticisms of return on investment as the only performance measure include:

A) ROI focuses on short-term decisions.

B) ROI is focused on only one component of the value chain.

C) Managers evaluated based only on ROI are sometimes motivated not to make an investment that is in the best interest of the organization as a whole.

D) All of the above.

A) ROI focuses on short-term decisions.

B) ROI is focused on only one component of the value chain.

C) Managers evaluated based only on ROI are sometimes motivated not to make an investment that is in the best interest of the organization as a whole.

D) All of the above.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck