Deck 15: Global Business and Accounting

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

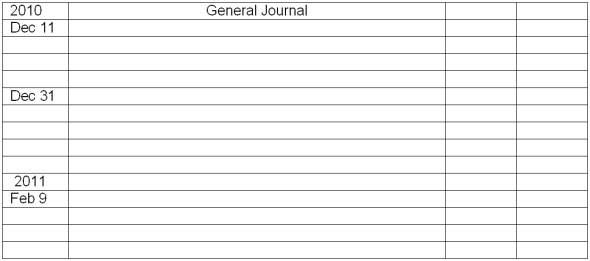

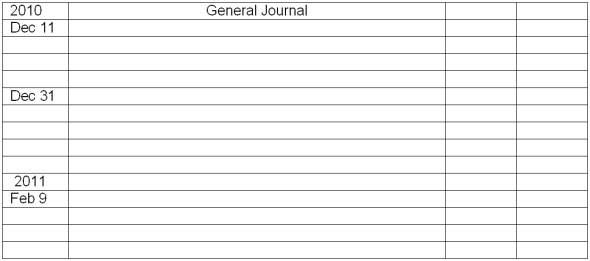

Question

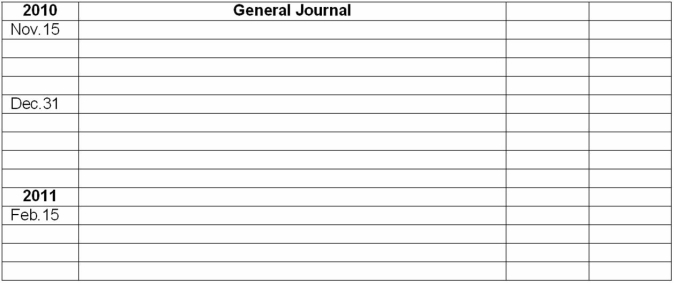

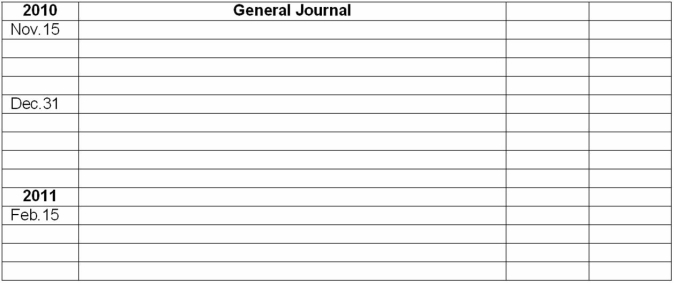

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/95

Play

Full screen (f)

Deck 15: Global Business and Accounting

1

Whenever an American corporation sells merchandise to a foreign company, the transaction must be stipulated in U.S. dollars.

False

2

The standards issued by the International Accounting Standards Board must be followed by all multinational companies.

False

3

Having a liability that is fixed in terms of a foreign currency results in a loss for the debtor if the exchange rate falls between the transaction date and the payment date.

False

4

An American corporation making purchases from foreign companies will experience gains and losses from exchange rate fluctuations if (a) the purchase prices are stated in terms of the foreign currency and (b) the purchases are made on account.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

5

One of the most important requirements of the Foreign Corrupt Practices Act is the maintenance of an adequate system of international reporting.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

6

An international joint venture involves the creation of a new company that is owned by two or more firms from different countries.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

7

The Foreign Corrupt Practices Act distinguishes between influence peddling and facilitating payments. Peddling is prohibited, while facilitating payments are allowed.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

8

The Foreign Corrupt Practices Act allows Americans doing business in countries where bribes are legal to also negotiate bribes.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

9

Differences in accounting practices among countries reflect the different sources of capital in those countries.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

10

A company has a "hedged position" when it has similar amounts of accounts receivable and accounts payable in that same foreign currency.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

11

Hedging refers to the strategy of taking offsetting positions so that gains in one currency offset losses in another currency.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

12

Although cultural differences are significant in business dealings, they pose no difficulties to the design and implementation of an accounting system.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

13

Payments made by American companies to motivate foreign officials to undertake actions more rapidly than they might otherwise are prohibited by the Foreign Corrupt Practices Act.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

14

In a planned economy, the government uses central planning to allocate resources and determines output among various segments of the economy.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

15

Cultural traits in the United States include high uncertainty avoidance and a long-term orientation.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

16

An exchange rate represents the price of one currency stated in terms of another.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

17

In a planned economy, ownership of land and the means of production are private and markets dictate the allocation of resources and the output among segments of the economy.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

18

The statement that "the yen has fallen against the dollar" means that the yen has become less valuable relative to the dollar.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

19

A wholly owned international subsidiary exists when a company owns 100% of the equity in a U.S. foreign subsidiary.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

20

The accounting profession has been slow to develop in Asian countries because of strict governmental control of accounting regulations.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

21

A dollar that is stronger than the British pound would make travel to the United States more attractive to British citizens.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

22

An International joint venture is:

A) A company owed by two or more companies from different countries.

B) A contractual agreement between a company and a foreign party.

C) A company that owns 100 percent of a foreign company.

D) A company that owns more than 75 percent of a foreign company.

A) A company owed by two or more companies from different countries.

B) A contractual agreement between a company and a foreign party.

C) A company that owns 100 percent of a foreign company.

D) A company that owns more than 75 percent of a foreign company.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

23

Making accurate estimates of costs is a challenge for global companies.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

24

Multicountry tax laws do not affect the cost of doing business in global markets.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

25

On November 1, a French company purchased machinery from an American company for 800,000 euros when the exchange rate was $0.83. When preparing financial statements on December 31, assuming the rate for Euros was $0.88, what amount of gain or loss should the American company report?

A) $40,000 gain.

B) $40,000 loss.

C) $19,000 gain.

D) No gain or loss would be reported.

A) $40,000 gain.

B) $40,000 loss.

C) $19,000 gain.

D) No gain or loss would be reported.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

26

An increase in the exchange rate between a transaction date and the date of payment will cause the debtor to incur a loss.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

27

"Convergence" means abandoning a country's financial reporting standards and replacing them with the International financial Reporting Standard.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

28

To convert a dollar amount into a foreign currency divide the dollar amount by the exchange rate.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

29

Accounting practices are affected by all of the following except:

A) Political systems.

B) Economic systems.

C) Technology and infrastructure.

D) Management knowledge of accounting practices.

A) Political systems.

B) Economic systems.

C) Technology and infrastructure.

D) Management knowledge of accounting practices.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

30

Establishing international accounting standards is the responsibility of:

A) Securities and Exchange Commission.

B) International Accounting Standards Board.

C) Financial Accounting Standards Board.

D) Accounting Association of America.

A) Securities and Exchange Commission.

B) International Accounting Standards Board.

C) Financial Accounting Standards Board.

D) Accounting Association of America.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

31

A U. S. public corporation's decision to globalize impacts all of following except:

A) Internal procedures.

B) Who owns stock in the company.

C) Production processes.

D) Accounting outputs.

A) Internal procedures.

B) Who owns stock in the company.

C) Production processes.

D) Accounting outputs.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

32

"Adoption" means replacing current financial reporting standards with International Financial Reporting Standards.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

33

Accounting as a profession did not exist in England prior to 1988.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

34

Gains and losses from fluctuations in exchange rates should be shown on the:

A) Balance sheet.

B) Income statement.

C) Statement of changes to owners' equity.

D) Statement of cash flows.

A) Balance sheet.

B) Income statement.

C) Statement of changes to owners' equity.

D) Statement of cash flows.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

35

China, Japan, and Australia have amended their current standards to converge with International Financial Reporting Standards, but the United States has chosen not to adopt the International Financial Reporting Standards.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

36

Future contracts are used by companies to hedge against losses in foreign currencies.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

37

As foreign exchange rates fall, importers based in the United States will lose and exporters will gain.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

38

To convert a foreign currency into dollars, divide the foreign currency by the foreign exchange rate.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

39

Companies choose a standard exchange rate to compute the cost buildup in their domestic currency.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

40

An international joint venture is a company owned by two or more companies from different countries.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

41

The price of one currency stated in terms of another currency is the:

A) Current ratio.

B) Exchange rate.

C) Facilitating payment.

D) International clearing price.

A) Current ratio.

B) Exchange rate.

C) Facilitating payment.

D) International clearing price.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

42

Of the following globalization strategies, which would be least demanding in terms of the quantity and variety of accounting information required?

A) Exporting.

B) International licensing.

C) Joint ventures.

D) Establishing a wholly owned foreign subsidiary.

A) Exporting.

B) International licensing.

C) Joint ventures.

D) Establishing a wholly owned foreign subsidiary.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

43

Low individualism and high long-term orientation is indicative of which culture?

A) United States.

B) Great Britain.

C) Japan.

D) Germany.

A) United States.

B) Great Britain.

C) Japan.

D) Germany.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

44

In Japan, financial reporting requirements are based primarily on the need to provide information to:

A) Investors.

B) Government agencies.

C) Banks.

D) U.S. subsidiaries of Japanese companies.

A) Investors.

B) Government agencies.

C) Banks.

D) U.S. subsidiaries of Japanese companies.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

45

Samson Corporation buys a foreign currency future contract as a hedging strategy to protect against possible losses from fluctuations in a particular foreign exchange. This strategy suggests that Samson Corporation has:

A) Foreign accounts payable and expects the exchange rate to fall.

B) Foreign accounts receivable and expects the exchange rate to rise.

C) Foreign accounts payable and expects the exchange rate to rise.

D) Foreign accounts receivable and expects the exchange rate to fall.

A) Foreign accounts payable and expects the exchange rate to fall.

B) Foreign accounts receivable and expects the exchange rate to rise.

C) Foreign accounts payable and expects the exchange rate to rise.

D) Foreign accounts receivable and expects the exchange rate to fall.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

46

A corporation that uses a strategy of hedging all contracts specifying a foreign currency (i.e. foreign accounts receivable and foreign accounts payable):

A) Will always be better off than if the contracts were not hedged.

B) Recognizes a net loss if the foreign exchange rate increases.

C) Avoids net losses from fluctuations in foreign exchange rates.

D) Recognizes a net gain if the foreign exchange rate increases.

A) Will always be better off than if the contracts were not hedged.

B) Recognizes a net loss if the foreign exchange rate increases.

C) Avoids net losses from fluctuations in foreign exchange rates.

D) Recognizes a net gain if the foreign exchange rate increases.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following organizations is responsible for developing uniform worldwide accounting standards?

A) The Securities Exchange Commission.

B) The International Accounting Standards Board.

C) The Financial Accounting Standards Board.

D) The International Organization of Accounting Boards.

A) The Securities Exchange Commission.

B) The International Accounting Standards Board.

C) The Financial Accounting Standards Board.

D) The International Organization of Accounting Boards.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

48

Consider the following statement: "A strong dollar rose sharply against the British pound, but fell slightly against the Japanese yen." This statement indicates that:

A) The British pound is a stronger currency than the Japanese yen.

B) The exchange rate for the yen, stated in dollars, is rising.

C) The exchange rate for the pound, stated in dollars, is rising.

D) The exchange rate for the yen, stated in pounds, is falling.

A) The British pound is a stronger currency than the Japanese yen.

B) The exchange rate for the yen, stated in dollars, is rising.

C) The exchange rate for the pound, stated in dollars, is rising.

D) The exchange rate for the yen, stated in pounds, is falling.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

49

Assume the exchange rate for the Canadian dollar is rising relative to the U.S. dollar. An American company will incur losses from this rising exchange rate if it is making:

A) Credit sales to Canadian companies at prices stated in Canadian dollars.

B) Credit purchases from Canadian companies at prices stated in U.S. dollars.

C) Credit sales to Canadian companies at prices stated in U.S. dollars.

D) Credit purchases from Canadian companies at prices stated in Canadian dollars.

A) Credit sales to Canadian companies at prices stated in Canadian dollars.

B) Credit purchases from Canadian companies at prices stated in U.S. dollars.

C) Credit sales to Canadian companies at prices stated in U.S. dollars.

D) Credit purchases from Canadian companies at prices stated in Canadian dollars.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

50

Blue Waters is an American company that does business with several Japanese corporations. In recent months, Blue Waters has been reporting losses from increases in the exchange rate of the Japanese yen. The majority of Blue Waters transactions with the Japanese companies probably consist of:

A) Credit sales at prices stated in U.S. dollars.

B) Credit sales at prices stated in Japanese yen.

C) Credit purchases at prices stated in U.S. dollars.

D) Credit purchases at prices stated in Japanese yen.

A) Credit sales at prices stated in U.S. dollars.

B) Credit sales at prices stated in Japanese yen.

C) Credit purchases at prices stated in U.S. dollars.

D) Credit purchases at prices stated in Japanese yen.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

51

If the exchange rate for a foreign currency (stated in dollars) has risen, a dollar will purchase:

A) An increased amount of that foreign currency.

B) An unchanged amount of that foreign currency.

C) A smaller amount of that foreign currency.

D) An undetermined amount of that foreign currency.

A) An increased amount of that foreign currency.

B) An unchanged amount of that foreign currency.

C) A smaller amount of that foreign currency.

D) An undetermined amount of that foreign currency.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

52

A contract giving the right to receive a specified quantity of foreign currency at a future date is known as:

A) Hedging.

B) Exchange rates.

C) Maquilladora.

D) Future contracts.

A) Hedging.

B) Exchange rates.

C) Maquilladora.

D) Future contracts.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

53

Under the Foreign Corrupt Practices Act, American business firms are required to:

A) Refuse to transact business in countries that sanction official corruption.

B) Report all bribery attempts to the International Monetary Fund and World Bank.

C) Maintain an adequate system of internal control limiting access to company assets to authorized personnel.

D) Maintain a list of all personnel employed by the company during the last 10 years.

A) Refuse to transact business in countries that sanction official corruption.

B) Report all bribery attempts to the International Monetary Fund and World Bank.

C) Maintain an adequate system of internal control limiting access to company assets to authorized personnel.

D) Maintain a list of all personnel employed by the company during the last 10 years.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

54

Assume the exchange rate for the Mexican Peso is falling relative to the U.S. dollar. An American company will incur losses from this falling exchange rate if the company is making:

A) Credit sales to Mexican companies at prices stated in U.S. dollars.

B) Credit purchases from Mexican companies at prices stated in U.S. dollars.

C) Credit sales to Mexican companies at prices stated in Mexican Pesos.

D) Credit purchases from Mexican companies at prices stated in Mexican Pesos.

A) Credit sales to Mexican companies at prices stated in U.S. dollars.

B) Credit purchases from Mexican companies at prices stated in U.S. dollars.

C) Credit sales to Mexican companies at prices stated in Mexican Pesos.

D) Credit purchases from Mexican companies at prices stated in Mexican Pesos.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

55

The number of pounds equal to $50,000 on this date is:

A) 31,250.

B) 80,000.

C) 32,500.

D) Depends upon whether the item is a receivable or a payable.

A) 31,250.

B) 80,000.

C) 32,500.

D) Depends upon whether the item is a receivable or a payable.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

56

"Convergence" means abandoning a country's financial reporting standards and replacing them with:

A) International Accounting Standards.

B) International Financial Accounting Standards.

C) Generally Accepted Accounting Principles.

D) Securities and Exchange Commission Principles.

A) International Accounting Standards.

B) International Financial Accounting Standards.

C) Generally Accepted Accounting Principles.

D) Securities and Exchange Commission Principles.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following does not affect the cost associated with producing and selling goods and services in global markets?

A) Tariffs.

B) Duties.

C) Special trade zones.

D) Sales or Use tax rates in the United States.

A) Tariffs.

B) Duties.

C) Special trade zones.

D) Sales or Use tax rates in the United States.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

58

When the government uses central planning to allocate resources and to determine output among various segments of the economy, this is known as:

A) A dictatorship.

B) A democracy.

C) A planned economy.

D) A market economy.

A) A dictatorship.

B) A democracy.

C) A planned economy.

D) A market economy.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

59

Gains and losses from fluctuations in exchange rates on transactions carried out in a foreign currency are reported in:

A) The balance sheet, as an adjustment to stockholders' equity.

B) The income statement.

C) The footnotes to the financial statements.

D) The statement of retained earnings.

A) The balance sheet, as an adjustment to stockholders' equity.

B) The income statement.

C) The footnotes to the financial statements.

D) The statement of retained earnings.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following is true about foreign trade zones?

A) They are illegal in the United States.

B) Goods imported into these designated U.S. areas are duty free until they leave the zone.

C) They have a special excise tax.

D) They are areas outside the United States that offer special tax treatments.

A) They are illegal in the United States.

B) Goods imported into these designated U.S. areas are duty free until they leave the zone.

C) They have a special excise tax.

D) They are areas outside the United States that offer special tax treatments.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

61

Prepare journal entries for the following transactions for Inter-Global Co.

October 10: Purchased merchandise on account from Le Monde, a French company, for 80,000 euros. The exchange rate was $0.82.

November 2: Paid Le Monde for the merchandise purchased on October 1. The exchange rate at this date was $0.83.

November 15: Sold merchandise to Nippon, a Japanese company for 300,000 yen on account. The rate of exchange was $0.0091.

November 20: The Japanese company paid the full amount. The exchange rate was $0.0090.

December 5: Sold merchandise to Ponti, an Italian company for $24,000. The exchange rate is $0.81. The Italian company agrees to pay in U.S. dollars.

December 18: Collected the full amount from the Italian company.

October 10: Purchased merchandise on account from Le Monde, a French company, for 80,000 euros. The exchange rate was $0.82.

November 2: Paid Le Monde for the merchandise purchased on October 1. The exchange rate at this date was $0.83.

November 15: Sold merchandise to Nippon, a Japanese company for 300,000 yen on account. The rate of exchange was $0.0091.

November 20: The Japanese company paid the full amount. The exchange rate was $0.0090.

December 5: Sold merchandise to Ponti, an Italian company for $24,000. The exchange rate is $0.81. The Italian company agrees to pay in U.S. dollars.

December 18: Collected the full amount from the Italian company.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

62

The number of dollars equivalent to 5,250,000 on this date is:

A) $40,110.00.

B) $687,172.50.

C) $87,225.50.

D) Depends upon whether the item is a receivable or a payable.

A) $40,110.00.

B) $687,172.50.

C) $87,225.50.

D) Depends upon whether the item is a receivable or a payable.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

63

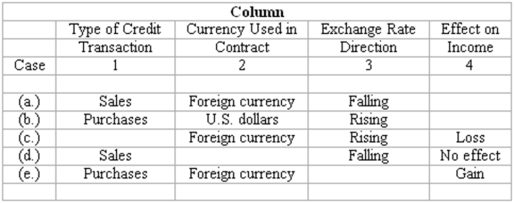

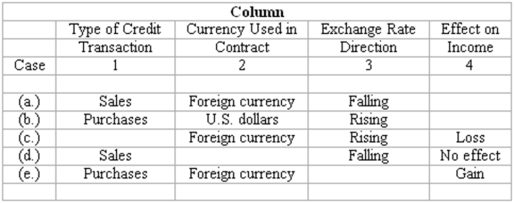

Foreign currency transactions

The following table summarizes the facts of five independent cases (labeled a through e) of American companies engaging in credit transactions with foreign corporations while the foreign exchange rate is fluctuating:

Instructions:

After evaluating the information about each case, fill the blank space that has been left in one of the four columns denoted by a yellow color.

The content of each column and the word or words that you should enter in the blank spaces are described below:

Column 1 indicates the type of credit transaction in which the American company engaged with the foreign corporations. The answer entered in this column should be either "Sales" or "Purchases."

Column 2 indicates the currency in which the invoice price is stated. The answer may be either "U.S. dollars" or "Foreign currency."

Column 3 indicates the direction in which the foreign currency exchange rate has moved between the date of the credit transaction and the date of settlement. The answer in this column may be either "Rising" or "Falling."

Column 4 indicates the effect of the exchange rate fluctuation upon the income of the American company. The answers entered in this column are to be selected from the following: "Gain," "Loss," or "No effect."

The following table summarizes the facts of five independent cases (labeled a through e) of American companies engaging in credit transactions with foreign corporations while the foreign exchange rate is fluctuating:

Instructions:

After evaluating the information about each case, fill the blank space that has been left in one of the four columns denoted by a yellow color.

The content of each column and the word or words that you should enter in the blank spaces are described below:

Column 1 indicates the type of credit transaction in which the American company engaged with the foreign corporations. The answer entered in this column should be either "Sales" or "Purchases."

Column 2 indicates the currency in which the invoice price is stated. The answer may be either "U.S. dollars" or "Foreign currency."

Column 3 indicates the direction in which the foreign currency exchange rate has moved between the date of the credit transaction and the date of settlement. The answer in this column may be either "Rising" or "Falling."

Column 4 indicates the effect of the exchange rate fluctuation upon the income of the American company. The answers entered in this column are to be selected from the following: "Gain," "Loss," or "No effect."

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

64

Hayden, Inc. purchased knobs from a Greek company for 185,000 Euros. On the purchase date the exchange rate was $0.80 per Euro, but when Hayden paid the liability, the exchange rate was $0.70 per Euro. When this foreign account payable was paid, Hayden, Inc., recorded a:

A) Debit to Inventory of $18,500.

B) Loss of $18,500.

C) Credit to Accounts Payable of $148,000.

D) Gain of $18,500.

A) Debit to Inventory of $18,500.

B) Loss of $18,500.

C) Credit to Accounts Payable of $148,000.

D) Gain of $18,500.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

65

Trente Switch and Signal sold equipment to a Canadian transportation company at a price of 300,000 Canadian dollars with payment due in 60 days. On the date of sale, the exchange rate was 1.50 Canadian dollars per U.S. dollar. Trente decided to hedge the risk of currency fluctuations by purchasing 300,000 Canadian dollars with payment due in 60 days. If the exchange rate in 60 days is 1.25 Canadian dollars per U.S. dollar, Trente Switch and Signal will:

A) Recognize a net gain of $40,000 on the two transactions.

B) Recognize a $40,000 gain when it collects the receivable and incur a $40,000 loss when it pays the liability.

C) Incur a $40,000 loss when it collects the receivable and recognize a $40,000 gain when it pays the liability.

D) Incur a net loss of $40,000 on the two transactions.

A) Recognize a net gain of $40,000 on the two transactions.

B) Recognize a $40,000 gain when it collects the receivable and incur a $40,000 loss when it pays the liability.

C) Incur a $40,000 loss when it collects the receivable and recognize a $40,000 gain when it pays the liability.

D) Incur a net loss of $40,000 on the two transactions.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

66

Walblue imports a desk from a French manufacturer for sale in its chain of U.S. stores. The cost of a desk to Walblue is 3,700 euros (€). What is the dollar cost of one of these desks if the exchange rate is currently 1.117 euros per U.S. dollar? (round to nearest cent)

A) $1,117.00.

B) $4,132.90.

C) $3,312.44.

D) $3,700.00.

A) $1,117.00.

B) $4,132.90.

C) $3,312.44.

D) $3,700.00.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

67

Rochester, Inc. purchased cameras from a Japanese company at a price of 4 million yen. On the purchase date, the exchange rate was $0.0100 per Japanese yen, but when Rochester, Inc., paid the liability, the exchange rate was $0.0103 per yen. When this foreign account payable was paid, Rochester, Inc., recorded a:

A) Debit to Inventory of $1,200.

B) Loss of $1,200.

C) Credit to Accounts Payable of $41,200.

D) Gain of $1,200.

A) Debit to Inventory of $1,200.

B) Loss of $1,200.

C) Credit to Accounts Payable of $41,200.

D) Gain of $1,200.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

68

At the current exchange rate of $1.40 per British pound, a one-day pass to Worldwide Theme Park of Florida sells for 45 pounds at travel agencies throughout Great Britain. If the exchange rate increases to $1.70 per pound, what will happen to the price of a one-day pass sold in Great Britain?

A) The price will be unchanged.

B) The price will fall to 37 pounds.

C) The price will increase to 54 pounds.

D) The price will fall by 12 pounds.

A) The price will be unchanged.

B) The price will fall to 37 pounds.

C) The price will increase to 54 pounds.

D) The price will fall by 12 pounds.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

69

Flynn Corporation purchased bicycles from a British manufacturer at a price of 45,000 British pounds on November 15, 2011with payment due in 60 days. Using the following exchange rates, what gain or loss from currency fluctuations should be recognized in 2011 and 2012, respectively? Nov. 15, 2011 $1.70 per British pound

Dec) 31, 2011 $1.75 per British pound

Jan) 15, 2012 $1.73 per British pound

A) A $2,250 loss in 2011 and a $900 gain in 2012.

B) No gain or loss in 2011 and a $1,350 loss in 2012.

C) A $2,250 gain in 2011 and a $900 loss in 2012.

D) No gain or loss in 2011 and a $1,350 gain in 2012.

Dec) 31, 2011 $1.75 per British pound

Jan) 15, 2012 $1.73 per British pound

A) A $2,250 loss in 2011 and a $900 gain in 2012.

B) No gain or loss in 2011 and a $1,350 loss in 2012.

C) A $2,250 gain in 2011 and a $900 loss in 2012.

D) No gain or loss in 2011 and a $1,350 gain in 2012.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

70

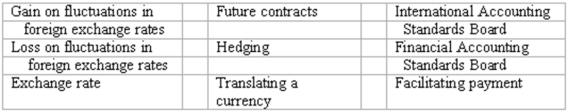

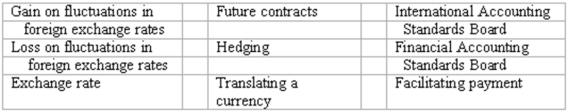

Accounting terminology

Listed below are nine technical accounting terms introduced in this chapter:

Each of the following statements may (or may not) describe one of these technical terms. In the space provided below each statement, indicate the accounting term described, or answer "None" if the statement does not correctly describe any of the terms.

_____ (a) The strategy of creating offsetting positions so that losses from currency fluctuations will be offset by gains resulting from the same fluctuations.

_____ (b) The price of foreign currency, stated in terms of the domestic currency.

_____ (c) An item likely to appear in the income statements of American-based importers when foreign exchange rates are rising.

_____ (d) The organization responsible for developing uniform worldwide accounting standards.

_____ (e) Payments made to foreign officials to expedite paperwork.

_____ (f ) The process of restating an amount of foreign currency in terms of the equivalent number of U.S. dollars.

_____ (g ) An item likely to appear in the income statements of American-based exporters when foreign exchange rates are falling.

Listed below are nine technical accounting terms introduced in this chapter:

Each of the following statements may (or may not) describe one of these technical terms. In the space provided below each statement, indicate the accounting term described, or answer "None" if the statement does not correctly describe any of the terms.

_____ (a) The strategy of creating offsetting positions so that losses from currency fluctuations will be offset by gains resulting from the same fluctuations.

_____ (b) The price of foreign currency, stated in terms of the domestic currency.

_____ (c) An item likely to appear in the income statements of American-based importers when foreign exchange rates are rising.

_____ (d) The organization responsible for developing uniform worldwide accounting standards.

_____ (e) Payments made to foreign officials to expedite paperwork.

_____ (f ) The process of restating an amount of foreign currency in terms of the equivalent number of U.S. dollars.

_____ (g ) An item likely to appear in the income statements of American-based exporters when foreign exchange rates are falling.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

71

Exchange rates and hedging

On October 1 2011, Glenn Company accepted a shipment of beer from Germany. The purchase contract specifies payment of 3,000,000 euros is to be made on December 1, 2011. The exchange rate on October 1, 2011 was: $1 = 1.4 euros.

Instructions:

(a) If the exchange rate on December 1 2011 is: $1 = 1.18 Euros, what amount of gain or loss due to the exchange rate fluctuation will be recognized on the purchase?

(b) On October 1, Glenn's analysts were forecasting the exchange rate to be: $1 = 1.20 Euros on December 1, 2011. Glenn can enter into a hedging contract on October 1, 2011 whereby the bank would accept $2,480,000 in exchange for 3,000,000 Euros on December 1. The bank will charge a $2,000 fee to enter into the agreement. Should Glenn enter into the hedge agreement?

(c) If Glenn enters into the hedging contract, what will be the exchange gain/loss recorded on December 1, 2011?

On October 1 2011, Glenn Company accepted a shipment of beer from Germany. The purchase contract specifies payment of 3,000,000 euros is to be made on December 1, 2011. The exchange rate on October 1, 2011 was: $1 = 1.4 euros.

Instructions:

(a) If the exchange rate on December 1 2011 is: $1 = 1.18 Euros, what amount of gain or loss due to the exchange rate fluctuation will be recognized on the purchase?

(b) On October 1, Glenn's analysts were forecasting the exchange rate to be: $1 = 1.20 Euros on December 1, 2011. Glenn can enter into a hedging contract on October 1, 2011 whereby the bank would accept $2,480,000 in exchange for 3,000,000 Euros on December 1. The bank will charge a $2,000 fee to enter into the agreement. Should Glenn enter into the hedge agreement?

(c) If Glenn enters into the hedging contract, what will be the exchange gain/loss recorded on December 1, 2011?

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

72

The Foreign Corrupt Practices Act (FCPA) imposes _____ for managers who engage in bribes.

A) Fines

B) Deportation

C) Quotas

D) Taxes

A) Fines

B) Deportation

C) Quotas

D) Taxes

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

73

The Foreign Corrupt Practices Act (FCPA) affects all of the following except:

A) United States companies.

B) Foreign companies operating in the United States.

C) Foreign companies operating solely in their home country.

D) Affiliates and agents of a United States company or a foreign company operating in the United States.

A) United States companies.

B) Foreign companies operating in the United States.

C) Foreign companies operating solely in their home country.

D) Affiliates and agents of a United States company or a foreign company operating in the United States.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

74

Barter Corp. sold American telecommunications equipment to a British company for 650,000 pounds. On the sale date, the exchange rate was $1.65 per British pound, but when Barter received payment from its customer, the exchange rate was $1.60 per pound. When the foreign receivable was collected, Barter Enterprises:

A) Credited Sales for $32,500.

B) Debited Cash for $1,040,000.

C) Credited Gain on Fluctuation of Foreign Currency for $32,500.

D) Debited Loss on Fluctuation of Foreign Currency for $32,500.

A) Credited Sales for $32,500.

B) Debited Cash for $1,040,000.

C) Credited Gain on Fluctuation of Foreign Currency for $32,500.

D) Debited Loss on Fluctuation of Foreign Currency for $32,500.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

75

Tuliptime, Inc. sold American fashions to a Japanese company at a price of 4 million yen. On the sale date, the exchange rate was $.0100 per Japanese yen, but when Tuliptime received payment from its customer, the exchange rate was $.0103 per yen. When the foreign receivable was collected, Tuliptime:

A) Credited Sales for $1,200.

B) Debited Cash for $40,000.

C) Credited Gain on Fluctuation of Foreign Currency for $1,200.

D) Debited Loss on Fluctuation of Foreign Currency for $1,200.

A) Credited Sales for $1,200.

B) Debited Cash for $40,000.

C) Credited Gain on Fluctuation of Foreign Currency for $1,200.

D) Debited Loss on Fluctuation of Foreign Currency for $1,200.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

76

Exact Instruments sold equipment to a British research group at a price of 70,000 British pounds on December 1, 2011 with payment due in 90 days. Using the following exchange rates, what gain or loss from currency fluctuations should be recognized in 2011 and 2012, respectively? Dec. 1, 2011 $1.78 per British pound

Dec) 31, 2011 $1.82 per British pound

Mar) 1, 2012 $1.77 per British pound

A) A $2,800 loss in 2011 and a$3,500 gain in 2012.

B) No gain or loss in 2011 and a $700 loss in 2012.

C) A $2,800 gain in 2011 and a $3,500 loss in 2012.

D) No gain or loss in 2011 and a $700 gain in 2012.

Dec) 31, 2011 $1.82 per British pound

Mar) 1, 2012 $1.77 per British pound

A) A $2,800 loss in 2011 and a$3,500 gain in 2012.

B) No gain or loss in 2011 and a $700 loss in 2012.

C) A $2,800 gain in 2011 and a $3,500 loss in 2012.

D) No gain or loss in 2011 and a $700 gain in 2012.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

77

The number of dollars equivalent to 50,000 on this date is:

A) 31,250.

B) 80,000.

C) 32,500.

D) Depends upon whether the item is a receivable or a payable.

A) 31,250.

B) 80,000.

C) 32,500.

D) Depends upon whether the item is a receivable or a payable.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

78

Importing transactions-journal entries

Striking Furs imports furs from Canada. In the space provided below, prepare journal entries to record the following events.

Dec. 11, 2010: Purchased furs from Capable Trappers, Ltd., a Canadian corporation, at a price of 25,000 Canadian dollars, due in 60 days. The current exchange rate is $0.85 U.S. dollars per Canadian dollar. (Striking uses the perpetual inventory method; debit the Inventory account.)

Dec. 31, 2010: Striking made a year-end adjusting entry relating to the account payable to Capable Trappers. The exchange rate at year-end is $0.89 U.S. dollars per Canadian dollar.

Feb. 9, 2011: Issued a check for $21,750 (U.S. dollars) to National Bank in full settlement of the liability to Capable Trappers, Ltd. The exchange rate at this date is $0.87 U.S. dollars per Canadian dollar.

Striking Furs imports furs from Canada. In the space provided below, prepare journal entries to record the following events.

Dec. 11, 2010: Purchased furs from Capable Trappers, Ltd., a Canadian corporation, at a price of 25,000 Canadian dollars, due in 60 days. The current exchange rate is $0.85 U.S. dollars per Canadian dollar. (Striking uses the perpetual inventory method; debit the Inventory account.)

Dec. 31, 2010: Striking made a year-end adjusting entry relating to the account payable to Capable Trappers. The exchange rate at year-end is $0.89 U.S. dollars per Canadian dollar.

Feb. 9, 2011: Issued a check for $21,750 (U.S. dollars) to National Bank in full settlement of the liability to Capable Trappers, Ltd. The exchange rate at this date is $0.87 U.S. dollars per Canadian dollar.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

79

Exporting transactions-journal entries

Jung Farms exports wheat to Germany. In the space provided below, prepare journal entries to record the following events.

Nov. 15, 2010: Sold wheat to a German restaurant chain at a price of 2 million euros, due in 90 days. The current exchange rate is $0.80 U.S. dollars per euro. (Jung uses the periodic inventory method.)

Dec. 3, 2010: Jung made a year-end adjusting entry relating to the account receivable from the German restaurant chain. The exchange rate at year-end is $0.85 U.S. dollars per Euro.

Feb. 15, 2011: Received a check for $1,640,000 from the InterContinental Bank in full settlement of the receivable from the German restaurant chain. The exchange rate at this date is $0.82 U.S. dollars per euro.

Jung Farms exports wheat to Germany. In the space provided below, prepare journal entries to record the following events.

Nov. 15, 2010: Sold wheat to a German restaurant chain at a price of 2 million euros, due in 90 days. The current exchange rate is $0.80 U.S. dollars per euro. (Jung uses the periodic inventory method.)

Dec. 3, 2010: Jung made a year-end adjusting entry relating to the account receivable from the German restaurant chain. The exchange rate at year-end is $0.85 U.S. dollars per Euro.

Feb. 15, 2011: Received a check for $1,640,000 from the InterContinental Bank in full settlement of the receivable from the German restaurant chain. The exchange rate at this date is $0.82 U.S. dollars per euro.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

80

The number of Japanese yen equivalent to $40,000 on this date is: (rounded to whole )

A) 3,056,000.

B) 5,235,602.

C) 5,245,745.

D) Depends upon whether the item is a receivable or a payable.

A) 3,056,000.

B) 5,235,602.

C) 5,245,745.

D) Depends upon whether the item is a receivable or a payable.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck