Deck 21: Flexible Budgets and Standard Costing

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/177

Play

Full screen (f)

Deck 21: Flexible Budgets and Standard Costing

1

Sales variances allow managers to focus on sales mix as well as sales quantities.

True

2

Management by exception allows managers to focus on the most significant variances in performance.

True

3

Standard costs can serve as a basis for evaluating actual performance.

True

4

Sales variances may be computed in a manner similar to cost variances-that is, computing both price and volume variances.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

5

Cost variances are ignored under management by exception.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

6

Fixed budget performance reports compare actual results with the expected amounts in the fixed budget.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

7

Companies promoting continuous improvement strive to achieve practical standards rather than ideal standards.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

8

Standard material, labor, and overhead costs can be obtained from standard cost tables published by the Institute of Management Accountants.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

9

Within the same budget performance report, it is impossible to have both favorable and unfavorable variances.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

10

A budget performance report that includes variances can have variances caused by both price differences and quantity differences.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

11

Another name for a static budget is a variable budget.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

12

A fixed budget performance report never provides useful information for evaluating variances.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

13

When standard costs are used, factory overhead is assigned to products with a predetermined standard overhead rate.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

14

An overhead cost variance is the difference between the actual overhead incurred for the period and the standard overhead applied.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

15

Standard costs provide a basis for assessing the reasonableness of actual costs incurred for producing a product or service.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

16

Fixed budgets are also known as flexible budgets.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

17

A cost variance is the difference between actual cost and standard cost.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

18

The amounts in a flexible budget are based on one expected level of sales or production.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

19

Variable budget is another name for a flexible budget.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

20

A cost variance equals the sum of the quantity variance and the price variance.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

21

The purchasing department is often responsible for the events that create a direct materials price variance.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

22

The difference between actual and standard cost caused by the difference between the actual quantity and the standard quantity is called the:

A) Controllable variance.

B) Standard variance.

C) Budget variance.

D) Quantity variance.

E) Price variance.

A) Controllable variance.

B) Standard variance.

C) Budget variance.

D) Quantity variance.

E) Price variance.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

23

A direct labor cost variance may be broken down into a controllable variance and a volume variance.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

24

Standard costs are used to measure:

A) Price and quantity variances.

B) Price variances only.

C) Quantity variances only.

D) Price, quantity, and sales variances.

E) Quantity and sales variances.

A) Price and quantity variances.

B) Price variances only.

C) Quantity variances only.

D) Price, quantity, and sales variances.

E) Quantity and sales variances.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

25

A variable or flexible budget is so named because it only focuses on variable costs.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

26

The costs that should be incurred under normal conditions to produce a specific product or component or to perform a specific service are:

A) Variable costs.

B) Fixed costs.

C) Standard costs.

D) Product costs.

E) Period costs.

A) Variable costs.

B) Fixed costs.

C) Standard costs.

D) Product costs.

E) Period costs.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

27

One possible explanation for direct labor rate and efficiency variances is the use of workers with different skill levels.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

28

The difference between actual and standard cost caused by the difference between the actual price and the standard price is called the:

A) Standard variance.

B) Quantity variance.

C) Volume variance.

D) Controllable variance.

E) Price variance.

A) Standard variance.

B) Quantity variance.

C) Volume variance.

D) Controllable variance.

E) Price variance.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

29

A volume variance is the difference between overhead at maximum production volume and that at the budgeted production volume.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

30

When the actual cost of direct materials used exceeds the standard cost, the company must have experienced an unfavorable direct materials price variance.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

31

A flexible budget expresses all costs on a per unit basis.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

32

Standard costs are:

A) Actual costs incurred to produce a specific product or perform a service.

B) Preset costs for delivering a product or service under normal conditions.

C) Established by the IMA.

D) Rarely achieved.

E) Uniform among companies within an industry.

A) Actual costs incurred to produce a specific product or perform a service.

B) Preset costs for delivering a product or service under normal conditions.

C) Established by the IMA.

D) Rarely achieved.

E) Uniform among companies within an industry.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

33

Although a fixed budget is only useful over the relevant range of operations, a flexible budget is useful over all possible production levels.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

34

If cost variances are material, they should always be closed directly to Cost of Goods Sold.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

35

The difference between the actual cost incurred and the standard cost is called the:

A) Flexible variance.

B) Price variance.

C) Cost variance.

D) Controllable variance.

E) Volume variance.

A) Flexible variance.

B) Price variance.

C) Cost variance.

D) Controllable variance.

E) Volume variance.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

36

A flexible budget expresses variable costs on a per unit basis and fixed costs on a total basis.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

37

An unfavorable variance is recorded with a debit.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

38

An analytical technique used by management to focus on the most significant variances and give less attention to the areas where performance is satisfactory is known as:

A) Controllable management.

B) Management by variance.

C) Performance management.

D) Management by objectives.

E) Management by exception.

A) Controllable management.

B) Management by variance.

C) Performance management.

D) Management by objectives.

E) Management by exception.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

39

A process of examining the differences between actual and budgeted costs and describing them in terms of the amounts that resulted from price and quantity differences is called:

A) Cost analysis.

B) Flexible budgeting.

C) Variable analysis.

D) Cost variable analysis.

E) Cost variance analysis.

A) Cost analysis.

B) Flexible budgeting.

C) Variable analysis.

D) Cost variable analysis.

E) Cost variance analysis.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

40

A favorable direct materials price variance might lead to an unfavorable direct materials quantity variance because the company purchased cheap materials.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

41

A planning budget based on a single predicted amount of sales or production volume is called a:

A) Sales budget.

B) Standard budget.

C) Flexible budget.

D) Fixed budget.

E) Variable budget.

A) Sales budget.

B) Standard budget.

C) Flexible budget.

D) Fixed budget.

E) Variable budget.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

42

Based on predicted production of 12,000 units, a company anticipates $150,000 of fixed costs and $123,000 of variable costs. The flexible budget amounts of fixed and variable costs for 10,000 units are:

A) $125,000 fixed and $102,500 variable.

B) $125,000 fixed and $123,000 variable.

C) $102,500 fixed and $150,000 variable.

D) $150,000 fixed and $123,000 variable.

E) $150,000 fixed and $102,500 variable.

A) $125,000 fixed and $102,500 variable.

B) $125,000 fixed and $123,000 variable.

C) $102,500 fixed and $150,000 variable.

D) $150,000 fixed and $123,000 variable.

E) $150,000 fixed and $102,500 variable.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

43

A company's flexible budget for 12,000 units of production showed sales, $48,000; variable costs, $18,000; and fixed costs, $16,000. The operating income expected if the company produces and sells 16,000 units is:

A) $2,667

B) $14,000

C) $18,667

D) $24,000

E) $35,000

A) $2,667

B) $14,000

C) $18,667

D) $24,000

E) $35,000

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

44

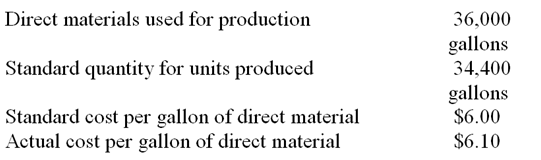

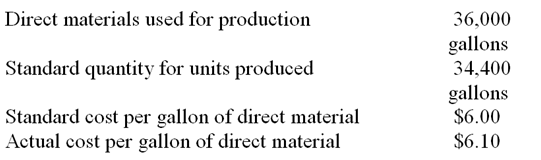

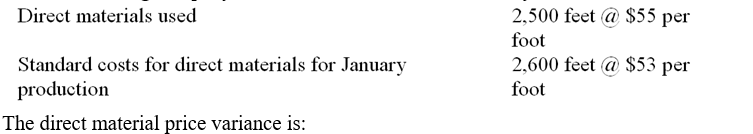

Kermit Enterprises has collected the following data on one of its products:

-The direct materials price variance is:

A) $30,000 favorable.

B) $30,000 unfavorable.

C) $22,500 favorable.

D) $37,500 unfavorable.

E) $37,500 favorable.

-The direct materials price variance is:

A) $30,000 favorable.

B) $30,000 unfavorable.

C) $22,500 favorable.

D) $37,500 unfavorable.

E) $37,500 favorable.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

45

Variable budget is another name for:

A) Cash budget.

B) Flexible budget.

C) Fixed budget.

D) Manufacturing budget.

E) Rolling budget.

A) Cash budget.

B) Flexible budget.

C) Fixed budget.

D) Manufacturing budget.

E) Rolling budget.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

46

Product A has a sales price of $10 per unit. Based on a 10,000-unit production level, the variable costs are $6 per unit and the fixed costs are $3 per unit. Using a flexible budget for 12,500 units, what is the budgeted operating income from Product A?

A) $12,500

B) $25,000

C) $20,000

D) $30,000

E) $35,000

A) $12,500

B) $25,000

C) $20,000

D) $30,000

E) $35,000

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

47

A performance report compares the differences between:

A) Actual results and predicted results.

B) Actual results over several periods.

C) Predicted results over several periods.

D) Predicted results over several levels of activity.

E) Predicted results and standard results.

A) Actual results and predicted results.

B) Actual results over several periods.

C) Predicted results over several periods.

D) Predicted results over several levels of activity.

E) Predicted results and standard results.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

48

Based on predicted production of 22,000 units, a company anticipates $15,000 of fixed costs and $27,500 of variable costs. The flexible budget amounts of fixed and variable costs for 16,000 units are:

A) $10,910 fixed and $20,000 variable.

B) $10,910 fixed and $27,500 variable.

C) $20,000 fixed and $15,000 variable.

D) $15,000 fixed and $20,000 variable.

E) $15,000 fixed and $27,500 variable.

A) $10,910 fixed and $20,000 variable.

B) $10,910 fixed and $27,500 variable.

C) $20,000 fixed and $15,000 variable.

D) $15,000 fixed and $20,000 variable.

E) $15,000 fixed and $27,500 variable.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

49

A report based on predicted amounts of revenues and expenses corresponding to the actual level of output is called a:

A) Rolling budget.

B) Production budget.

C) Flexible budget.

D) Merchandise purchases budget.

E) Fixed budget.

A) Rolling budget.

B) Production budget.

C) Flexible budget.

D) Merchandise purchases budget.

E) Fixed budget.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

50

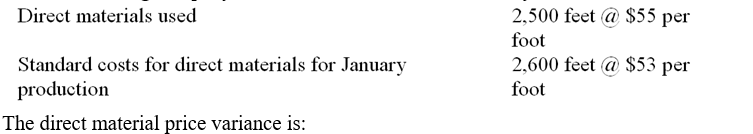

Kyle, Inc., has collected the following data on one of its products:

-The direct materials price variance is:

A) $13,750 unfavorable.

B) $16,250 unfavorable.

C) $16,250 favorable.

D) $30,000 unfavorable.

E) $33,000 favorable.

-The direct materials price variance is:

A) $13,750 unfavorable.

B) $16,250 unfavorable.

C) $16,250 favorable.

D) $30,000 unfavorable.

E) $33,000 favorable.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

51

Kermit Enterprises has collected the following data on one of its products:

-The direct materials quantity variance is:

A) $30,000 favorable.

B) $30,000 unfavorable.

C) $22,500 favorable.

D) $37,500 unfavorable.

E) $37,500 favorable.

-The direct materials quantity variance is:

A) $30,000 favorable.

B) $30,000 unfavorable.

C) $22,500 favorable.

D) $37,500 unfavorable.

E) $37,500 favorable.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

52

An internal report that helps management analyze the difference between actual performance and budgeted performance based on the actual sales volume (or other level of activity), and which presents the differences between actual and budgeted amounts as variances, is called a(n):

A) Sales budget performance report.

B) Flexible budget performance report.

C) Master budget performance report.

D) Static budget performance report.

E) Operating budget performance report.

A) Sales budget performance report.

B) Flexible budget performance report.

C) Master budget performance report.

D) Static budget performance report.

E) Operating budget performance report.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

53

Static budget is another name for:

A) Standard budget.

B) Flexible budget.

C) Variable budget.

D) Fixed budget.

E) Rolling budget.

A) Standard budget.

B) Flexible budget.

C) Variable budget.

D) Fixed budget.

E) Rolling budget.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

54

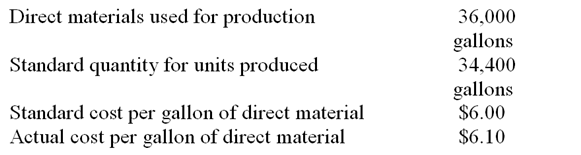

Kyle, Inc., has collected the following data on one of its products:

-The actual cost of the direct materials used is:

A) $133,750

B) $150,000

C) $106,250

D) $158,750

E) $120,000

-The actual cost of the direct materials used is:

A) $133,750

B) $150,000

C) $106,250

D) $158,750

E) $120,000

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

55

The entry to record the material variances would include a:

A) Credit to Goods in Process for $133,750.

B) Debit to Direct Material Price Variance for $13,750.

C) Credit to Direct Material Quantity Variance for $13,750.

D) Debit to Goods in Process for $120,000.

E) Debit to Raw Materials for $120,000.

A) Credit to Goods in Process for $133,750.

B) Debit to Direct Material Price Variance for $13,750.

C) Credit to Direct Material Quantity Variance for $13,750.

D) Debit to Goods in Process for $120,000.

E) Debit to Raw Materials for $120,000.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

56

An internal report that compares actual cost and sales amounts with budgeted amounts and identifies the differences between them as favorable or unfavorable variances is called a:

A) Performance report.

B) Production report.

C) Budget report.

D) Variance report.

E) Standard report.

A) Performance report.

B) Production report.

C) Budget report.

D) Variance report.

E) Standard report.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

57

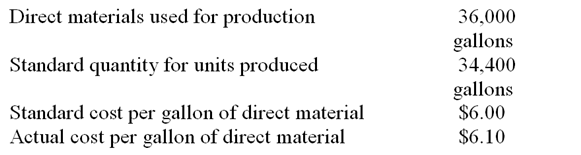

Kyle, Inc., has collected the following data on one of its products:

-The direct materials quantity variance is:

A) $30,000 favorable.

B) $13,750 unfavorable.

C) $16,250 favorable.

D) $30,000 unfavorable.

E) $13,750 favorable.

-The direct materials quantity variance is:

A) $30,000 favorable.

B) $13,750 unfavorable.

C) $16,250 favorable.

D) $30,000 unfavorable.

E) $13,750 favorable.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

58

Sales analysis is useful for:

A) Planning purposes only.

B) Budgeting purposes only.

C) Control purposes only.

D) Planning and control purposes.

E) Planning and budgeting purposes.

A) Planning purposes only.

B) Budgeting purposes only.

C) Control purposes only.

D) Planning and control purposes.

E) Planning and budgeting purposes.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

59

A flexible budget is prepared:

A) Before the operating period only.

B) After the operating period only.

C) During the operating period only.

D) At any time in the planning period.

E) A flexible budget should never be prepared.

A) Before the operating period only.

B) After the operating period only.

C) During the operating period only.

D) At any time in the planning period.

E) A flexible budget should never be prepared.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

60

Which department is often responsible for the direct materials price variance?

A) The accounting department.

B) The production department.

C) The purchasing department.

D) The finance department.

E) The budgeting department.

A) The accounting department.

B) The production department.

C) The purchasing department.

D) The finance department.

E) The budgeting department.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

61

The following company information is available:

The direct materials price variance is:

A) $10,000 unfavorable.

B) $13,200 unfavorable.

C) $9,600 unfavorable.

D) $3,600 unfavorable.

E) $13,200 favorable.

The direct materials price variance is:

A) $10,000 unfavorable.

B) $13,200 unfavorable.

C) $9,600 unfavorable.

D) $3,600 unfavorable.

E) $13,200 favorable.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

62

Bartels Corp. produces woodcarvings. It takes 2 hours of direct labor to produce a carving. Bartels' standard labor cost is $12 per hour. During August, Bartels produced 10,000 carvings and used 21,040 hours of direct labor at a total cost of $250,376. What is Bartels' labor efficiency variance for August?

A) $10,376 unfavorable.

B) $2,104 unfavorable.

C) $2,104 favorable.

D) $12,480 unfavorable.

E) $12,480 favorable.

A) $10,376 unfavorable.

B) $2,104 unfavorable.

C) $2,104 favorable.

D) $12,480 unfavorable.

E) $12,480 favorable.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

63

A company has established 5 pounds of Material M at $2 per pound as the standard for the material in its Product A. The company has just produced 1,000 units of this product, using 5,200 pounds of Material M that cost $9,880.

-The direct materials quantity variance is:

A) $400 unfavorable.

B) $120 favorable.

C) $400 favorable.

D) $520 favorable.

E) $520 unfavorable.

-The direct materials quantity variance is:

A) $400 unfavorable.

B) $120 favorable.

C) $400 favorable.

D) $520 favorable.

E) $520 unfavorable.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

64

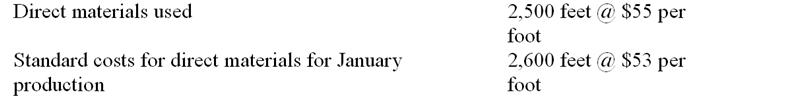

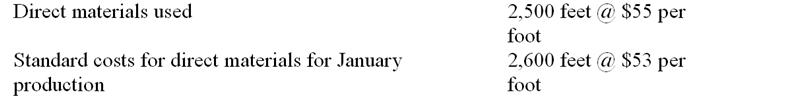

The following company information is available for January:

The direct material quantity variance is:

A) $5,000 favorable.

B) $300 favorable.

C) $5,300 unfavorable.

D) $5,000 unfavorable.

E) $5,300 favorable.

The direct material quantity variance is:

A) $5,000 favorable.

B) $300 favorable.

C) $5,300 unfavorable.

D) $5,000 unfavorable.

E) $5,300 favorable.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

65

A job was budgeted to require 3 hours of labor per unit at $8.00 per hour. The job consisted of 8,000 units and was completed in 22,000 hours at a total labor cost of $198,000.

-What is the labor rate variance?

A) $22,000 unfavorable.

B) $16,000 unfavorable.

C) $6,000 unfavorable.

D) $16,000 favorable.

E) $22,000 favorable.

-What is the labor rate variance?

A) $22,000 unfavorable.

B) $16,000 unfavorable.

C) $6,000 unfavorable.

D) $16,000 favorable.

E) $22,000 favorable.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

66

Bradford Company budgeted 4,000 pounds of material costing $5.00 per pound to produce 2,000 units. The company actually used 4,500 pounds that cost $5.10 per pound to produce 2,000 units.

-What is the direct materials price variance?

A) $400 unfavorable.

B) $450 unfavorable.

C) $2,500 unfavorable.

D) $2,550 unfavorable.

E) $2,950 unfavorable.

-What is the direct materials price variance?

A) $400 unfavorable.

B) $450 unfavorable.

C) $2,500 unfavorable.

D) $2,550 unfavorable.

E) $2,950 unfavorable.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

67

Use the following data to find the direct labor efficiency variance.

A) $6,125 unfavorable.

B) $7,000 unfavorable.

C) $7,000 favorable.

D) $12,250 favorable.

E) $6,125 favorable.

A) $6,125 unfavorable.

B) $7,000 unfavorable.

C) $7,000 favorable.

D) $12,250 favorable.

E) $6,125 favorable.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

68

A company has established 5 pounds of Material M at $2 per pound as the standard for the material in its Product A. The company has just produced 1,000 units of this product, using 5,200 pounds of Material M that cost $9,880.

-The direct materials price variance is:

A) $520 unfavorable.

B) $400 unfavorable.

C) $120 favorable.

D) $520 favorable.

E) $400 favorable.

-The direct materials price variance is:

A) $520 unfavorable.

B) $400 unfavorable.

C) $120 favorable.

D) $520 favorable.

E) $400 favorable.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

69

The standard materials cost to produce one unit of Product M is 6 pounds of material at a standard price of $50 per pound. In manufacturing 8,000 units, 47,000 pounds of material were used at a cost of $51 per pound. What is the total direct material cost variance?

A) $48,000 unfavorable.

B) $51,000 favorable.

C) $51,000 unfavorable.

D) $3,000 favorable.

E) $3,000 unfavorable.

A) $48,000 unfavorable.

B) $51,000 favorable.

C) $51,000 unfavorable.

D) $3,000 favorable.

E) $3,000 unfavorable.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

70

Bartels Corp. produces woodcarvings. It takes 2 hours of direct labor to produce a carving. Bartels' standard labor cost is $12 per hour. During August, Bartels produced 10,000 carvings and used 21,040 hours of direct labor at a total cost of $250,376. What is Bartels' labor rate variance for August?

A) $10,376 unfavorable.

B) $2,104 unfavorable.

C) $2,104 favorable.

D) $12,480 unfavorable.

E) $12,480 favorable.

A) $10,376 unfavorable.

B) $2,104 unfavorable.

C) $2,104 favorable.

D) $12,480 unfavorable.

E) $12,480 favorable.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

71

Bradford Company budgeted 4,000 pounds of material costing $5.00 per pound to produce 2,000 units. The company actually used 4,500 pounds that cost $5.10 per pound to produce 2,000 units.

-What is the direct materials quantity variance?

A) $400 unfavorable.

B) $450 unfavorable.

C) $2,500 unfavorable.

D) $2,550 unfavorable.

E) $2,950 unfavorable.

-What is the direct materials quantity variance?

A) $400 unfavorable.

B) $450 unfavorable.

C) $2,500 unfavorable.

D) $2,550 unfavorable.

E) $2,950 unfavorable.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

72

The following company information is available for January: The direct material price variance is:

A) $5,000 favorable.

B) $300 favorable.

C) $5,300 unfavorable.

D) $5,000 unfavorable.

E) $5,300 favorable.

A) $5,000 favorable.

B) $300 favorable.

C) $5,300 unfavorable.

D) $5,000 unfavorable.

E) $5,300 favorable.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

73

A job was budgeted to require 3 hours of labor per unit at $8.00 per hour. The job consisted of 8,000 units and was completed in 22,000 hours at a total labor cost of $198,000.

-What is the total labor efficiency variance?

A) $22,000 unfavorable.

B) $16,000 unfavorable.

C) $6,000 unfavorable.

D) $16,000 favorable.

E) $22,000 favorable.

-What is the total labor efficiency variance?

A) $22,000 unfavorable.

B) $16,000 unfavorable.

C) $6,000 unfavorable.

D) $16,000 favorable.

E) $22,000 favorable.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

74

The following company information is available:

The direct materials quantity variance is:

A) $1,824 favorable.

B) $1,424 favorable.

C) $400 favorable.

D) $1,824 unfavorable.

E) $1,424 unfavorable.

The direct materials quantity variance is:

A) $1,824 favorable.

B) $1,424 favorable.

C) $400 favorable.

D) $1,824 unfavorable.

E) $1,424 unfavorable.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

75

The entry to record the labor costs and variances would include a:

A) debit to Goods in Process for $198,000.

B) credit to Factory Payroll for $192,000.

C) debit to Direct Labor Cost Variance for $6,000.

D) credit to Direct Labor Cost Variance for $6,000.

E) credit to Direct Labor Efficiency Variance for $16,000.

A) debit to Goods in Process for $198,000.

B) credit to Factory Payroll for $192,000.

C) debit to Direct Labor Cost Variance for $6,000.

D) credit to Direct Labor Cost Variance for $6,000.

E) credit to Direct Labor Efficiency Variance for $16,000.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

76

Use the following data to find the total direct labor cost variance.

A) $6,125 unfavorable.

B) $7,000 unfavorable.

C) $7,000 favorable.

D) $12,250 favorable.

E) $6,125 favorable.

A) $6,125 unfavorable.

B) $7,000 unfavorable.

C) $7,000 favorable.

D) $12,250 favorable.

E) $6,125 favorable.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

77

The following company information is available:

The direct materials quantity variance is:

A) $10,000 unfavorable.

B) $13,200 unfavorable.

C) $9,600 unfavorable.

D) $3,600 unfavorable.

E) $13,200 favorable.

The direct materials quantity variance is:

A) $10,000 unfavorable.

B) $13,200 unfavorable.

C) $9,600 unfavorable.

D) $3,600 unfavorable.

E) $13,200 favorable.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

78

Use the following data to find the direct labor rate variance.

A) $6,125 unfavorable.

B) $7,000 unfavorable.

C) $7,000 favorable.

D) $12,250 favorable.

E) $6,125 favorable.

A) $6,125 unfavorable.

B) $7,000 unfavorable.

C) $7,000 favorable.

D) $12,250 favorable.

E) $6,125 favorable.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

79

Bartels Corp. produces woodcarvings. It takes 2 hours of direct labor to produce a carving. Bartels' standard labor cost is $12 per hour. During August, Bartels produced 10,000 carvings and used 21,040 hours of direct labor at a total cost of $250,376. What is Bartels' labor cost variance for August?

A) $10,376 unfavorable.

B) $2,104 unfavorable.

C) $2,104 favorable.

D) $12,480 unfavorable.

E) $12,480 favorable.

A) $10,376 unfavorable.

B) $2,104 unfavorable.

C) $2,104 favorable.

D) $12,480 unfavorable.

E) $12,480 favorable.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

80

A job was budgeted to require 3 hours of labor per unit at $8.00 per hour. The job consisted of 8,000 units and was completed in 22,000 hours at a total labor cost of $198,000.

-What is the total labor cost variance?

A) $22,000 unfavorable.

B) $16,000 unfavorable.

C) $6,000 unfavorable.

D) $16,000 favorable.

E) $22,000 favorable.

-What is the total labor cost variance?

A) $22,000 unfavorable.

B) $16,000 unfavorable.

C) $6,000 unfavorable.

D) $16,000 favorable.

E) $22,000 favorable.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck