Deck 2: Costing Systems- Job Order Costing

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/80

Play

Full screen (f)

Deck 2: Costing Systems- Job Order Costing

1

In a job order costing system, when overhead costs are applied, they increase the Work in Process Inventory account.

True

2

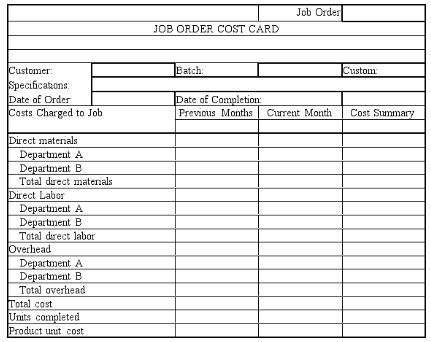

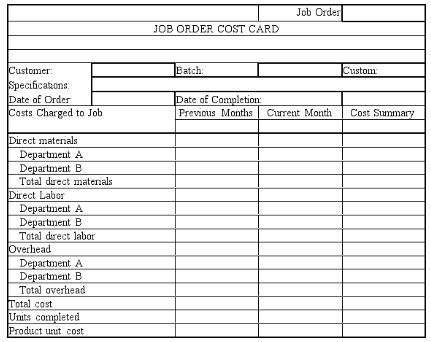

Costs for individual jobs are maintained on job order cost cards when job order costing is in use.

True

3

In a job order costing system, product costs are traced to work cells.

False

4

In a job order costing system, at the end of the accounting period, the balance in the subsidiary ledger for unfinished jobs should equal the ending balance in the Work in Process Inventory account.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

5

In a job order costing system, when the goods are sold, the Cost of Goods Sold account is increased, and the Finished Goods Inventory account is decreased for the selling price of the goods sold.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

6

Job order cost cards for incomplete jobs make up the subsidiary ledger for the Finished Goods Inventory account.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

7

In a job order costing system, indirect labor costs incurred are charged to the Work in Process Inventory account.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

8

In a job order costing system, when supplies are issued from inventory to production, the Overhead account is increased.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

9

In a job order costing system, the Factory Payroll account is a clearing account.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

10

In a job order costing system, the transfer of overhead costs to the Work in Process Inventory account must take place before product unit costs can be computed.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

11

In a job order costing system, indirect labor costs are transferred to the Overhead account by increasing the Factory Payroll account and decreasing the Overhead account.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

12

The production process determines the product costing system needed.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

13

When a job has been completed, all of the costs assigned to that job order are moved to the Finished Goods Inventory account.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

14

Job order costing is used by companies that make large or unique products.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

15

Unique products are produced in a continuous flow production process.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

16

A basic part of a job order costing system is the set of procedures and entries used to record the costs incurred for materials, labor, and overhead.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

17

The typical product costing system in a factory incorporates parts of both job order costing and process costing to create a hybrid system.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

18

Few actual production processes fit the definitions of job order costing or process costing exactly.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

19

Unlike a job order costing system, a process costing system is not restricted to one Work in Process Inventory account.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

20

The types of computations for costs to be transferred out of Work in Process Inventory differ if the production process involves multiple departments rather than a single department.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

21

If applied overhead exceeds actual overhead, cost of goods sold must be reduced by the amount of the overcharge in a job order costing system.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

22

To prepare financial statements at the end of the accounting period, the actual overhead cost for the period and the estimated overhead that was applied during the period must be reconciled in a job order costing system.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

23

The flow of costs into a Work in Process Inventory account is very similar for job order and process costing systems.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

24

A job order cost card is a type of subsidiary ledger.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

25

The ending balance in the Work in Process Inventory account is supported by individual Overhead account balances.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

26

In a job order costing system, a separate job order cost card is used for each individual job.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following accurately describes a difference between job order and process costing systems?

A) In job order costing systems, overhead costs are treated as product costs, whereas in process costing systems, overhead costs are treated as period costs.

B) Job order costing systems do not need to assign costs to production, whereas process costing systems do.

C) In job order costing systems, costs are traced to products, whereas in process costing systems, costs are traced to processes, departments and work cells.

D) Since costs are assigned to products in a job order costing system, selling costs are treated as product costs in the job order costing system, whereas they are treated as period costs in process costing systems.

A) In job order costing systems, overhead costs are treated as product costs, whereas in process costing systems, overhead costs are treated as period costs.

B) Job order costing systems do not need to assign costs to production, whereas process costing systems do.

C) In job order costing systems, costs are traced to products, whereas in process costing systems, costs are traced to processes, departments and work cells.

D) Since costs are assigned to products in a job order costing system, selling costs are treated as product costs in the job order costing system, whereas they are treated as period costs in process costing systems.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

28

Job costs in a service organization end up in the Finished Goods Inventory account when a job is completed.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

29

In a service organization using a job order costing system, actual overhead will be the same as applied overhead.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

30

When the amount of overhead applied differs from actual, the dollar amount it is usually written off to

A) Cost of Goods Sold.

B) Work in Process Inventory.

C) Finished Goods Inventory.

D) Miscellaneous Expense.

A) Cost of Goods Sold.

B) Work in Process Inventory.

C) Finished Goods Inventory.

D) Miscellaneous Expense.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following is not an objective of product costing systems?

A) To provide information for cost planning

B) To assist in the preparation of the income statement

C) To determine the optimal amount of products to manufacture

D) To provide information for product pricing

A) To provide information for cost planning

B) To assist in the preparation of the income statement

C) To determine the optimal amount of products to manufacture

D) To provide information for product pricing

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

32

After a job is completed, the product unit cost can be determined from the job order cost card.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

33

A zero balance in Finished Goods Inventory at the start of the period means all previously completed products have been shipped.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following products probably would be manufactured using a job order costing system?

A) Paper

B) Baseball

C) Computer monitors

D) Company business cards

A) Paper

B) Baseball

C) Computer monitors

D) Company business cards

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

35

In cost-plus contracts, the "plus" is the sales price.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

36

Accounting for the incurrence of __________ does not change significantly between job order costing and process costing.

A) selling expenses

B) direct materials and conversion costs

C) direct materials costs

D) conversion costs

A) selling expenses

B) direct materials and conversion costs

C) direct materials costs

D) conversion costs

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

37

Product costs appear on the income statement in the form of

A) cost of goods sold.

B) materials inventory.

C) sales commissions.

D) none of these.

A) cost of goods sold.

B) materials inventory.

C) sales commissions.

D) none of these.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following is not a characteristic of a job order costing system?

A) Uses only one Work in Process Inventory account

B) Uses job cost cards to keep track of each job in process

C) Assigns costs to specific batches of products

D) Measures costs for a set time period

A) Uses only one Work in Process Inventory account

B) Uses job cost cards to keep track of each job in process

C) Assigns costs to specific batches of products

D) Measures costs for a set time period

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

39

Regardless of the cost accounting system used, when the products are completed, they are transferred from work in process inventory to finished goods inventory.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

40

The type of product costing system used by a company is dictated by the

A) project manager.

B) production process.

C) company president.

D) plant supervisor.

A) project manager.

B) production process.

C) company president.

D) plant supervisor.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

41

The total of the dollar amounts on the job order cost cards that have not been completed would be equal to the

A) cost of goods completed.

B) balance in the Finished Goods Inventory account.

C) Cost of Goods Sold account.

D) balance in the Work in Process Inventory account.

A) cost of goods completed.

B) balance in the Finished Goods Inventory account.

C) Cost of Goods Sold account.

D) balance in the Work in Process Inventory account.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

42

The balance in the Work in Process Inventory account on April 1 was $26,800, and the balance on April 30 was $22,600. Costs incurred during the month were as follows: direct materials, $41,250; direct labor, $21,300; and overhead, $32,600. What amount was transferred to the Finished Goods Inventory account for April?

A) $99,350

B) $4,200

C) $90,350

D) $121,950

A) $99,350

B) $4,200

C) $90,350

D) $121,950

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

43

The _________ provide(s) the most direct means of calculating unit costs for a job.

A) job order cost card

B) Finished Goods Inventory account

C) general ledger

D) Overhead and Work in Process Inventory accounts

A) job order cost card

B) Finished Goods Inventory account

C) general ledger

D) Overhead and Work in Process Inventory accounts

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

44

Actual overhead during the year was more than applied overhead, the journal entry to close the Overhead account for the difference?

A) Overhead XX

?Cost of Goods Sold XX

B) Cost of Goods Sold XX

Overhead XX

C) Overhead XX

Finished Goods Inventory XX

D) Cost of Goods Sold XX

Finished Goods Inventory XX

A) Overhead XX

?Cost of Goods Sold XX

B) Cost of Goods Sold XX

Overhead XX

C) Overhead XX

Finished Goods Inventory XX

D) Cost of Goods Sold XX

Finished Goods Inventory XX

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

45

In a job order costing system, the purchase of materials on account should be recorded as follows:

A) Materials Inventory XX

Work in Process Inventory XX

B) Materials Inventory XX

Accounts Payable XX

C) Work in Process Inventory XX

Accounts Payable XX

D) Accounts Payable XX

Materials Inventory XX

A) Materials Inventory XX

Work in Process Inventory XX

B) Materials Inventory XX

Accounts Payable XX

C) Work in Process Inventory XX

Accounts Payable XX

D) Accounts Payable XX

Materials Inventory XX

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

46

If the applied overhead is more than actual overhead, which of the following is part of the entry?

A) A credit to the Overhead account

B) A debit to the Overhead account

C) A debit to the Cost of Goods Sold account

D) A debit to the Work in Process Inventory account

A) A credit to the Overhead account

B) A debit to the Overhead account

C) A debit to the Cost of Goods Sold account

D) A debit to the Work in Process Inventory account

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

47

Under a job order costing system, the dollar amount of the entry involved in the transfer of goods from work in process to finished goods is the total of the costs charged to all jobs

A) started during the period.

B) completed and sold during the period.

C) completed during the period.

D) started and completed during the period.

A) started during the period.

B) completed and sold during the period.

C) completed during the period.

D) started and completed during the period.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

48

When Dimock Construction's Designer House #10 is completed, Dimock's

A) work in process is increased.

B) total assets are increased.

C) work in process is decreased.

D) total assets are decreased.

A) work in process is increased.

B) total assets are increased.

C) work in process is decreased.

D) total assets are decreased.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

49

Unit costs for each job are computed by dividing

A) estimated total costs by planned units to be produced.

B) actual costs by actual units sold.

C) cost of direct materials, direct labor, and overhead by number of units produced.

D) estimated total costs by actual units produced.

A) estimated total costs by planned units to be produced.

B) actual costs by actual units sold.

C) cost of direct materials, direct labor, and overhead by number of units produced.

D) estimated total costs by actual units produced.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

50

The following information is available at the end of the period for the completed Job 713:

What is the unit cost for Job 713?

A) $3.94

B) $3.89

C) $4.00

D) $4.09

What is the unit cost for Job 713?

A) $3.94

B) $3.89

C) $4.00

D) $4.09

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

51

When direct materials are issued from inventory to production under a job order costing system, an increase is recorded in

A) Overhead.

B) Work in Process Inventory.

C) Materials Inventory.

D) Finished Goods Inventory.

A) Overhead.

B) Work in Process Inventory.

C) Materials Inventory.

D) Finished Goods Inventory.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

52

The balance in the Work in Process account equals the

A) balance in the Finished Goods Inventory account.

B) balance in the Cost of Goods Sold account.

C) balances on the job cost sheets of uncompleted jobs.

D) balance in the Overhead account.

A) balance in the Finished Goods Inventory account.

B) balance in the Cost of Goods Sold account.

C) balances on the job cost sheets of uncompleted jobs.

D) balance in the Overhead account.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

53

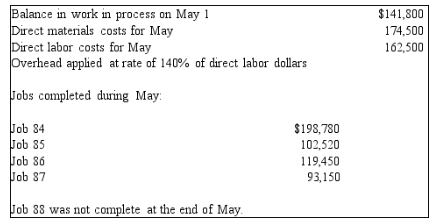

The following information is available at the end of May:

If $72,400 of materials were charged to Job 88's job cost card, how much overhead was applied to Job 88?

A) $35,100

B) $70,000

C) $72,400

D) $120,000

If $72,400 of materials were charged to Job 88's job cost card, how much overhead was applied to Job 88?

A) $35,100

B) $70,000

C) $72,400

D) $120,000

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

54

Applied overhead exceeds actual overhead when the

A) Overhead account has a credit balance.

B) journal entry to account for the difference involves a debit to Cost of Goods Sold.

C) Overhead account has a debit balance.

D) company has overspent in the overhead cost area.

A) Overhead account has a credit balance.

B) journal entry to account for the difference involves a debit to Cost of Goods Sold.

C) Overhead account has a debit balance.

D) company has overspent in the overhead cost area.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

55

If there is a credit balance in the Factory Payroll Payable at the end of the accounting period, it represents

A) the amount by which applied payroll was greater than actual payroll.

B) the amount by which actual payroll was greater than applied payroll.

C) labor costs which have not yet been distributed.

D) an amount that should be charged to Cost of Goods Sold.

A) the amount by which applied payroll was greater than actual payroll.

B) the amount by which actual payroll was greater than applied payroll.

C) labor costs which have not yet been distributed.

D) an amount that should be charged to Cost of Goods Sold.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

56

Service organizations incur little or no cost for

A) applied overhead.

B) actual overhead.

C) materials.

D) labor.

A) applied overhead.

B) actual overhead.

C) materials.

D) labor.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

57

Costs assigned to the building of a house should appear on the income statement when

A) the house is completed.

B) the house is sold.

C) the purchase order to manufacture the house is received.

D) cash is collected for the sale of the house.

A) the house is completed.

B) the house is sold.

C) the purchase order to manufacture the house is received.

D) cash is collected for the sale of the house.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

58

In a job order costing system, the subsidiary ledger for the Work in Process Inventory account consists of

A) time cards.

B) conversion cost cards.

C) job order cost cards.

D) product cost cards.

A) time cards.

B) conversion cost cards.

C) job order cost cards.

D) product cost cards.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

59

Which one of the following entries includes the initial application of indirect labor to production?

A) Work in Process Inventory XX

Overhead XX

B) Overhead XX

Work in Process Inventory XX

C) Overhead XX

Factory Payroll XX

D) Factory Payroll XX

Overhead XX

A) Work in Process Inventory XX

Overhead XX

B) Overhead XX

Work in Process Inventory XX

C) Overhead XX

Factory Payroll XX

D) Factory Payroll XX

Overhead XX

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

60

The basic document for keeping track of costs in a job order costing system is a

A) job order cost card.

B) labor time card.

C) process cost report.

D) materials requisition form.

A) job order cost card.

B) labor time card.

C) process cost report.

D) materials requisition form.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

61

Explain the similarities and differences between job order costing and process costing. Focus on the characteristics of each type of system.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

62

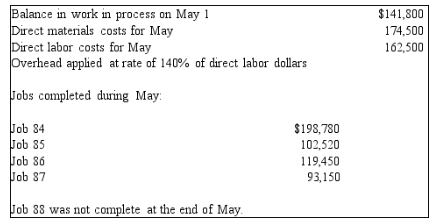

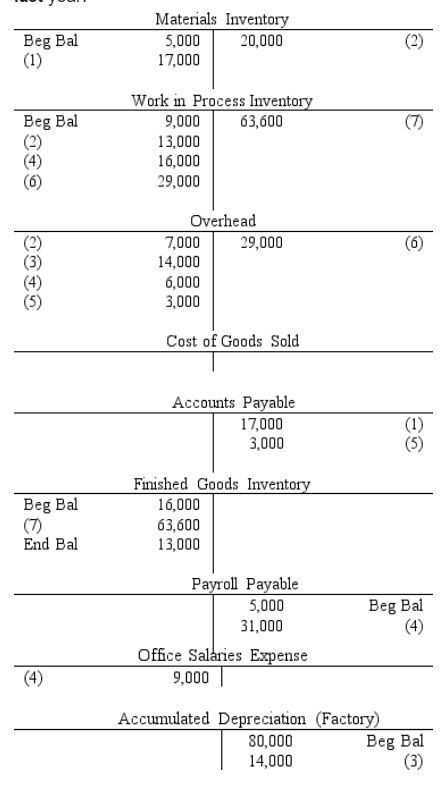

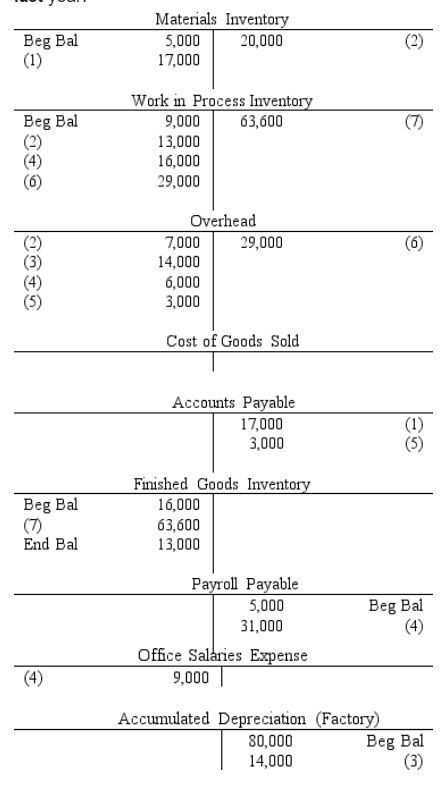

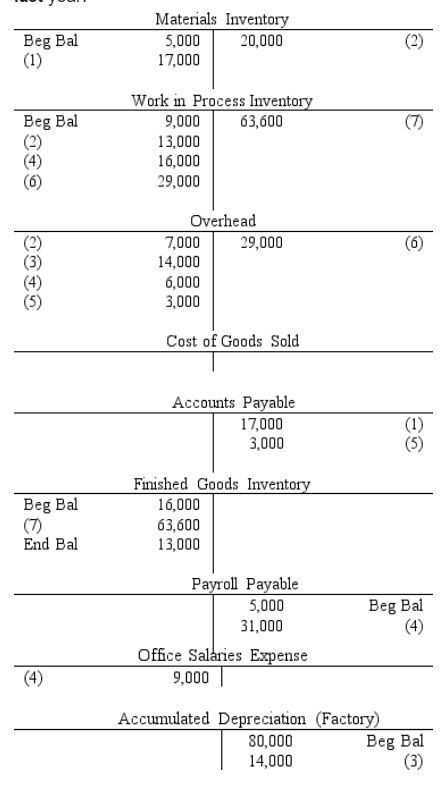

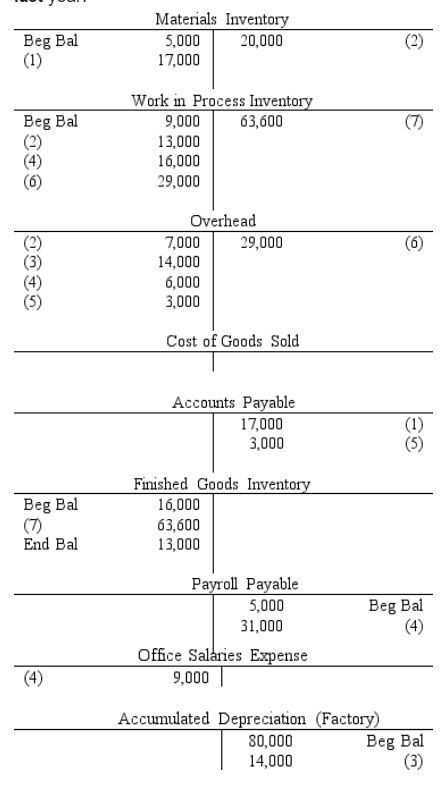

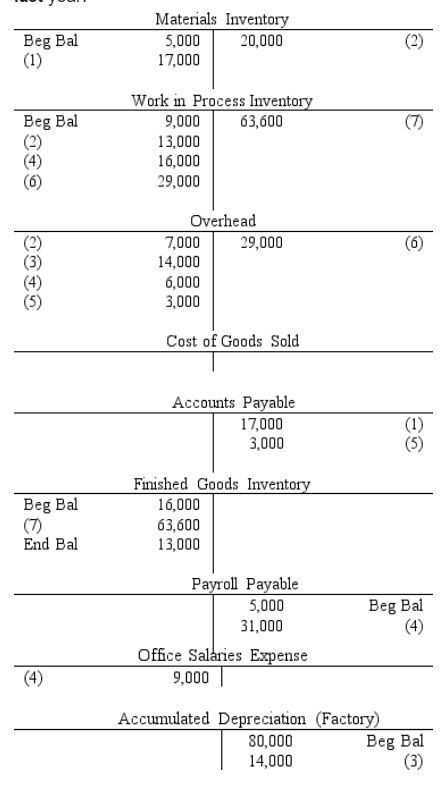

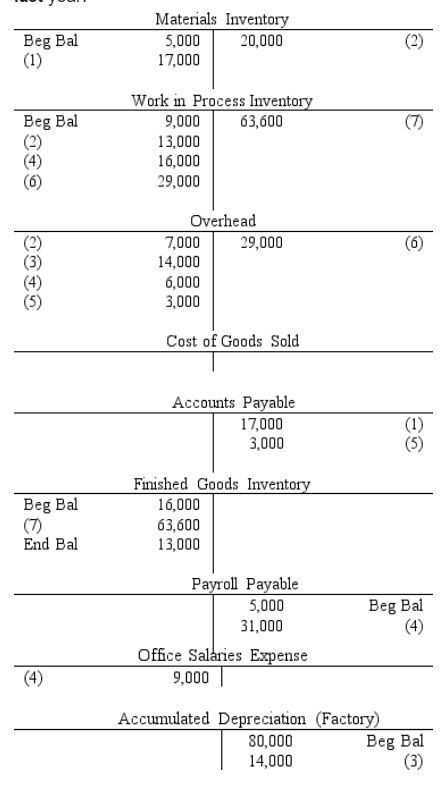

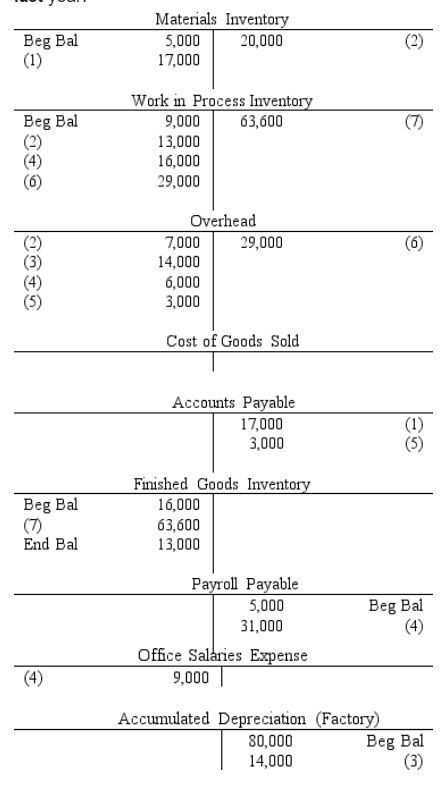

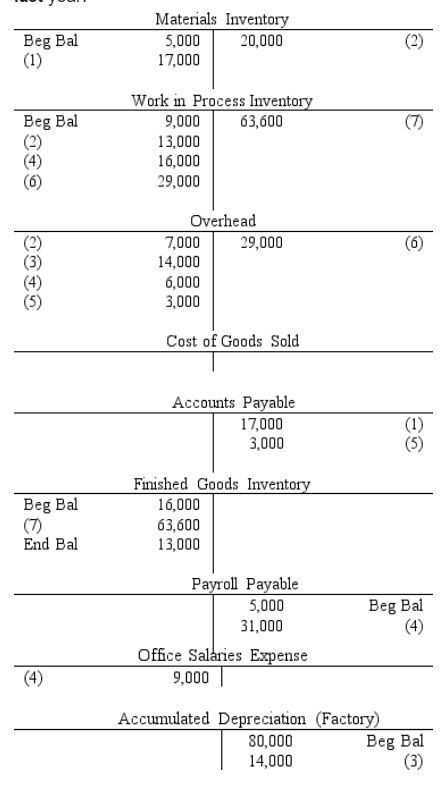

The following partially completed T accounts summarize the transactions of Carlton Company for last year:

At the end of the year, the company closes out the balance in the Overhead account to Cost of Goods Sold.

-

The cost of goods manufactured is

A) $59,600.

B) $61,600.

C) $62,600.

D) $63,600.

At the end of the year, the company closes out the balance in the Overhead account to Cost of Goods Sold.

-

The cost of goods manufactured is

A) $59,600.

B) $61,600.

C) $62,600.

D) $63,600.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

63

The Work in Process Inventory account for Corbett Company for the month ended June 30 appears below.

Overhead is applied based on direct labor dollars. Direct material costs for the one job remaining in work in process on June 30 was $12,300.

a. What was the overhead rate used to apply overhead to jobs?

b. Determine the amount of direct labor charged to the one remaining job.

Overhead is applied based on direct labor dollars. Direct material costs for the one job remaining in work in process on June 30 was $12,300.

a. What was the overhead rate used to apply overhead to jobs?

b. Determine the amount of direct labor charged to the one remaining job.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

64

Bear Country produces hand-carved wooden bears and uses a job order costing system. The following are data on the three jobs worked on in the company's first month of operations:

Overhead cost is applied to job orders on the basis of direct labor hours at a predetermined rate of $10 per hour. The Smokey and Rocky bears were completed during the month, and the Curious bears remained in work in process at the end of the month.

a. Compute the cost transferred to finished goods during the month.

b. Compute the unit cost for a Rocky bear.

Overhead cost is applied to job orders on the basis of direct labor hours at a predetermined rate of $10 per hour. The Smokey and Rocky bears were completed during the month, and the Curious bears remained in work in process at the end of the month.

a. Compute the cost transferred to finished goods during the month.

b. Compute the unit cost for a Rocky bear.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following could not be learned by analyzing job order cost cards?

A) The balance of Work in Process Inventory at the end of the period

B) The cost of all jobs done for a particular customer

C) The completion time of jobs yet to be completed

D) The type of products ordered by a particular customer

A) The balance of Work in Process Inventory at the end of the period

B) The cost of all jobs done for a particular customer

C) The completion time of jobs yet to be completed

D) The type of products ordered by a particular customer

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

66

Taylor Company manufactures guitars and uses a job order costing system with a predetermined overhead rate of 110 percent per direct labor dollar.

On September 11, 20xx, Those Guys ordered 200 beginner guitars which were completed on October 13, 20xx. The Job Order number is 1031. Complete the job order cost card based on the following information:

On September 11, 20xx, Those Guys ordered 200 beginner guitars which were completed on October 13, 20xx. The Job Order number is 1031. Complete the job order cost card based on the following information:

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

67

During the first month of the current accounting period, Southern California Company experienced a devastating loss due to a fire. Many of the accounting records were lost and the company is now trying to recreate the lost information. Fragments of data found include the following:

1. A portion of the budget indicates that the overhead rate was $10 per direct labor hour.

2. Job 74 was in process and had incurred $9,600 of direct materials and $14,000 of direct labor (1,000 hours). The company has a single hourly wage rate.

3. During the month, 4,500 direct labor hours were worked.

4. Actual overhead costs were $48,000. No indirect materials were used.

5. The Materials Inventory account had a beginning balance of $28,000 and an ending balance of $18,000.

6. The Finished Goods Inventory account had a beginning balance of $12,000 and an ending balance of $26,000.

7. The Work in Process Inventory account had a beginning balance of $17,000.

8. The Cost of Goods Sold is $171,000.

Calculate the following amounts:

a. Ending Work in Process Inventory account balance, Job No. 74

b. Cost of goods completed

c. Amount of overhead under- or overapplied.

d. Direct materials used

e. Direct materials purchased

1. A portion of the budget indicates that the overhead rate was $10 per direct labor hour.

2. Job 74 was in process and had incurred $9,600 of direct materials and $14,000 of direct labor (1,000 hours). The company has a single hourly wage rate.

3. During the month, 4,500 direct labor hours were worked.

4. Actual overhead costs were $48,000. No indirect materials were used.

5. The Materials Inventory account had a beginning balance of $28,000 and an ending balance of $18,000.

6. The Finished Goods Inventory account had a beginning balance of $12,000 and an ending balance of $26,000.

7. The Work in Process Inventory account had a beginning balance of $17,000.

8. The Cost of Goods Sold is $171,000.

Calculate the following amounts:

a. Ending Work in Process Inventory account balance, Job No. 74

b. Cost of goods completed

c. Amount of overhead under- or overapplied.

d. Direct materials used

e. Direct materials purchased

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

68

Pretty Pillows, Mfg., manufactures silk throw pillows. Last month the company produced 3,890 pillows. Using job order costing, determine the product unit cost for one pillow based on the following costs: production facility utilities, $1,600; depreciation on production equipment, $650; indirect materials, $400; direct materials, $5,300; indirect labor, $1,000; direct labor, $3,500; sales commissions, $4,000; president's salary, $8,000; insurance on production facility, $1,000; advertising expense, $900; rent on production facility, $6,000; rent on sales office, $4,000; and legal expense, $600. Carry your answer to two decimal places.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

69

The following partially completed T accounts summarize the transactions of Carlton Company for last year:

At the end of the year, the company closes out the balance in the Overhead account to Cost of Goods Sold.

-

The cost of goods sold (after adjusting for under- or overapplied overhead) is

A) $64,600.

B) $65,600.

C) $66,600.

D) 67,600

At the end of the year, the company closes out the balance in the Overhead account to Cost of Goods Sold.

-

The cost of goods sold (after adjusting for under- or overapplied overhead) is

A) $64,600.

B) $65,600.

C) $66,600.

D) 67,600

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

70

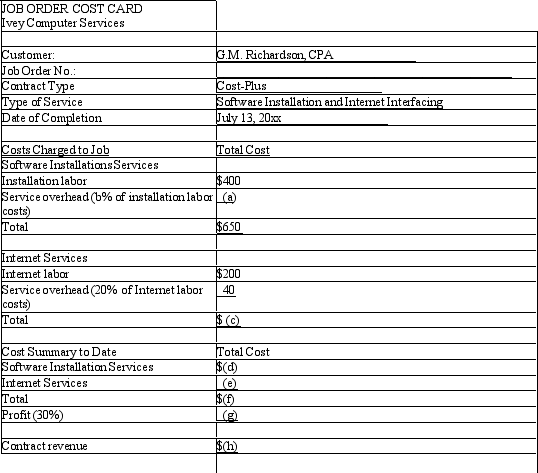

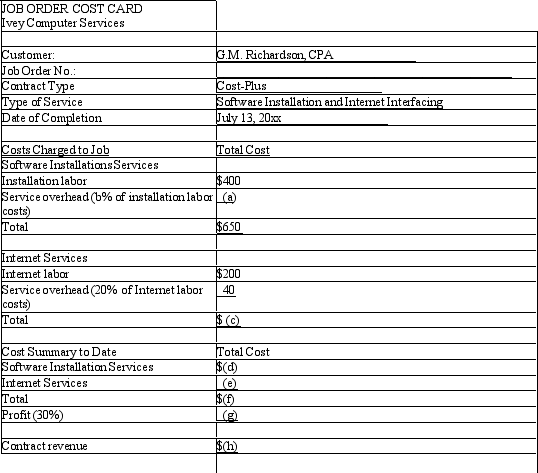

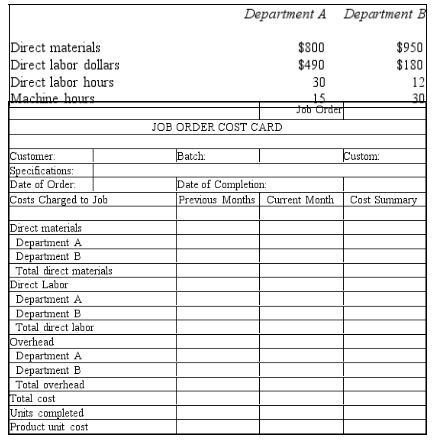

G. M. Richardson, CPA, entered into a cost-plus contract with Ivey Computer Services for software installation and Internet interfacing in her accounting practice. The following is Ivey Computer Services' job cost card for this job. Ivey's profit factor is 30 percent of total costs. Complete the following card, as indicated:

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

71

The following partially completed T accounts summarize the transactions of Carlton Company for last year:

At the end of the year, the company closes out the balance in the Overhead account to Cost of Goods Sold.

-

The applied overhead is

A) $28,000.

B) $29,000.

C) $30,000.

D) $40,000.

At the end of the year, the company closes out the balance in the Overhead account to Cost of Goods Sold.

-

The applied overhead is

A) $28,000.

B) $29,000.

C) $30,000.

D) $40,000.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

72

Morgan & Morgan is a small firm that assists clients in the preparation of their tax returns. The firm has five accountants and five researchers, and it uses job order costing to determine the cost of each client's return. The firm is divided into two departments: (1) Preparation and (2) Research & Planning. Each department has its own overhead application rate. The Preparation Department's rate is based on accountant labor costs and Research & Planning is based on the number of research hours. The following is the company's estimates for the current year's operations.

Client No. 2006-713 was completed during April of the current year and incurred the following costs and hours:

a. Compute the overhead rates to be used by both departments.

b. Determine the cost of Client No. 2006-713, by department and in total.

Client No. 2006-713 was completed during April of the current year and incurred the following costs and hours:

a. Compute the overhead rates to be used by both departments.

b. Determine the cost of Client No. 2006-713, by department and in total.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

73

As related to a job order costing system, answer the following short questions:

a. What is a job order costing system? Identify three kinds of companies that would use such as system.

b. What is a job order?

c. What is the purpose of a job order cost card? Identify the kinds of information recorded on it.

a. What is a job order costing system? Identify three kinds of companies that would use such as system.

b. What is a job order?

c. What is the purpose of a job order cost card? Identify the kinds of information recorded on it.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

74

The following partially completed T accounts summarize the transactions of Carlton Company for last year:

At the end of the year, the company closes out the balance in the Overhead account to Cost of Goods Sold.

-

The indirect labor cost is

A) $6,000.

B) $13,000.

C) $16,000.

D) $31,000.

At the end of the year, the company closes out the balance in the Overhead account to Cost of Goods Sold.

-

The indirect labor cost is

A) $6,000.

B) $13,000.

C) $16,000.

D) $31,000.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

75

When a job is completed in a service organization, the job costs are transferred to the

A) Work in Process Inventory account.

B) Finished Goods Inventory account.

C) Cost of Goods Sold account.

D) Cost of Services account.

A) Work in Process Inventory account.

B) Finished Goods Inventory account.

C) Cost of Goods Sold account.

D) Cost of Services account.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

76

In cost-plus contracts, the "plus" represents

A) sales price.

B) profit, based on the amount of costs incurred.

C) overapplied overhead costs.

D) the amount of any cost overruns.

A) sales price.

B) profit, based on the amount of costs incurred.

C) overapplied overhead costs.

D) the amount of any cost overruns.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

77

The following partially completed T accounts summarize the transactions of Carlton Company for last year:

At the end of the year, the company closes out the balance in the Overhead account to Cost of Goods Sold.

-

The cost of direct materials used in production is

A) $12,000.

B) $13,000.

C) $16,000.

D) $20,000.

At the end of the year, the company closes out the balance in the Overhead account to Cost of Goods Sold.

-

The cost of direct materials used in production is

A) $12,000.

B) $13,000.

C) $16,000.

D) $20,000.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

78

Logan Company uses a job order costing system. A predetermined overhead rate of $7 per machine hour in Department A and 220 percent per direct labor dollar in Department B has been established based upon the following information at the beginning of the year:

Job 19 for 100 units is started in Department A and completed in Department

B. Determine the total cost of Job 19 and complete the job cost card based on the following information:

Job 19 for 100 units is started in Department A and completed in Department

B. Determine the total cost of Job 19 and complete the job cost card based on the following information:

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

79

Quicker Company uses a job order costing system. On May 1, Quicker Company's Work in Process Inventory account shows a beginning balance of $161,000. Production activity for May was as follows: Materials costing $91,000, along with operating supplies of $18,000, were requisitioned into production. Quicker Company's total payroll was $316,000, of which $77,000 was indirect labor. Overhead is applied at a rate of 120 percent of direct labor cost. Quicker's Cost of Goods Sold for the month of May was $692,000. Finished Goods Inventory was $71,500 on May 1 and $84,000 on May 31. (Quicker does not close out overhead accounts until year-end.)

a. Calculate Quicker's cost of goods completed for May.

b. Calculate Quicker's work in process ending inventory (May 31).

c. One of the jobs that was started in May, Job 266, was completed in June. Job 266 was 200 special-order lamps. The following costs had been applied to Job 266 as of June 1: direct materials, $1,400; direct labor, $1,800; overhead, $2,160. In June, $580 in direct materials cost and $900 of direct labor cost were added to complete Job 266. What was the cost per unit for Job 266? (Show your computations.)

a. Calculate Quicker's cost of goods completed for May.

b. Calculate Quicker's work in process ending inventory (May 31).

c. One of the jobs that was started in May, Job 266, was completed in June. Job 266 was 200 special-order lamps. The following costs had been applied to Job 266 as of June 1: direct materials, $1,400; direct labor, $1,800; overhead, $2,160. In June, $580 in direct materials cost and $900 of direct labor cost were added to complete Job 266. What was the cost per unit for Job 266? (Show your computations.)

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

80

Teddy's To Hug, produces Teddy Bears for heart patients. Last month the company produced 5,000 bears. Using job order costing, determine the product unit cost for one bear based on the following costs: production facility utilities, $600; depreciation on production equipment, $550; indirect materials, $450; direct materials, $1,300; indirect labor, $900; direct labor, $2,500; sales commissions, $3,000; president's salary, $5,000; insurance on production facility, $700; advertising expense, $600; rent on production facility, $5,000; rent on sales office, $3,000; and legal expense, $300. Carry your answer to two decimal places.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck