Deck 10: Partnerships: Termination and Liquidation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/69

Play

Full screen (f)

Deck 10: Partnerships: Termination and Liquidation

1

The following account balances were available for the Perry, Quincy, and Renquist partnership just before it entered liquidation: Inlcuded in Perry's capital balance is a $20,000 partnership loan owed to Perry. Perry, Quincy, and Renquist shared profits and losses in a ratio of 2:4:4. Liquidation expenses were expected to be $15,000.

All partners were solvent.

-What would be the minimum amount for which the noncash assets must have been sold,in order for Quincy to receive some cash from the liquidation?

A)Any amount in excess of $170,000.

B)Any amount in excess of $190,000.

C)Any amount in excess of $260,000.

D)Any amount in excess of $280,000.

E)Any amount in excess of $300,000.

All partners were solvent.

-What would be the minimum amount for which the noncash assets must have been sold,in order for Quincy to receive some cash from the liquidation?

A)Any amount in excess of $170,000.

B)Any amount in excess of $190,000.

C)Any amount in excess of $260,000.

D)Any amount in excess of $280,000.

E)Any amount in excess of $300,000.

Any amount in excess of $190,000.

2

A local partnership was considering the possibility of liquidation since one of the partners (Ding) was personally insolvent. Capital balances at that time were as follows. Profits and losses were divided on a 4:2:2:2 basis, respectively. Creditors of partner Ding filed a $25,000 claim against the partnership's assets. At that time, the partnership held noncash assets reported at $360,000 and liabilities of $120,000. There was no cash on hand at the time.

-If the assets could be sold for $228,000,what is the minimum amount that Ding's creditors would have received?

A)$36,000.

B)$0.

C)$2,500.

D)$38,720.

E)$67,250.

-If the assets could be sold for $228,000,what is the minimum amount that Ding's creditors would have received?

A)$36,000.

B)$0.

C)$2,500.

D)$38,720.

E)$67,250.

$2,500.

3

The Henry, Isaac, and Jacobs partnership was about to enter liquidation with the following account balances: Estimated expenses of liquidation were $5,000. Henry, Isaac, and Jacobs shared profits and losses in a ratio of 2:4:4.

-What amount of cash was available for safe payments,based on the above information?

A)$30,000.

B)$85,000.

C)$25,000.

D)$35,000.

E)$40,000.

-What amount of cash was available for safe payments,based on the above information?

A)$30,000.

B)$85,000.

C)$25,000.

D)$35,000.

E)$40,000.

$25,000.

4

Dancey,Reese,Newman,and Jahn were partners who shared profits and losses on a 4:2:2:2 basis,respectively.They were beginning to liquidate their business.At the start of the process,capital balances were as follows: Which one of the following statements is true for a predistribution plan?

A)The first available $16,000 would go to Newman.The next $12,000 would go $8,000 to Dancey and $4,000 to Newman.The following $32,000 would be shared by Dancey,Reese,and Newman.The total distribution would be $60,000 before all four partners share any further payments equally.

B)The first available $16,000 would go to Newman.The next $12,000 would go $8,000 to Dancey and $4,000 to Newman.The following $32,000 would be shared by Dancey,Reese,and Newman.The total distribution would be $60,000 before all four partners share any further payments in their profit and loss sharing ratios.

C)The first $20,000 would go to Newman.The next $8,000 would go to Dancey.The next $12,000 would be shared by Dancey,Reese,and Newman.The total distribution would be $40,000 before all four partners share any further payments equally.

D)The first available $8,000 would go to Newman.The next $4,000 would be split equally between Dancey and Newman.The following $12,000 would be shared by Dancey,Reese,and Newman.The total distribution would be $24,000 before all four partners share any further payments equally.

E)The first available $8,000 would go to Newman.The next $4,000 would be split equally between Dancey and Newman.The following $12,000 would be shared by Dancey,Reese,and Newman.The total distribution would be $24,000 before all four partners share any further payments in their profit and loss sharing ratios.

A)The first available $16,000 would go to Newman.The next $12,000 would go $8,000 to Dancey and $4,000 to Newman.The following $32,000 would be shared by Dancey,Reese,and Newman.The total distribution would be $60,000 before all four partners share any further payments equally.

B)The first available $16,000 would go to Newman.The next $12,000 would go $8,000 to Dancey and $4,000 to Newman.The following $32,000 would be shared by Dancey,Reese,and Newman.The total distribution would be $60,000 before all four partners share any further payments in their profit and loss sharing ratios.

C)The first $20,000 would go to Newman.The next $8,000 would go to Dancey.The next $12,000 would be shared by Dancey,Reese,and Newman.The total distribution would be $40,000 before all four partners share any further payments equally.

D)The first available $8,000 would go to Newman.The next $4,000 would be split equally between Dancey and Newman.The following $12,000 would be shared by Dancey,Reese,and Newman.The total distribution would be $24,000 before all four partners share any further payments equally.

E)The first available $8,000 would go to Newman.The next $4,000 would be split equally between Dancey and Newman.The following $12,000 would be shared by Dancey,Reese,and Newman.The total distribution would be $24,000 before all four partners share any further payments in their profit and loss sharing ratios.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

5

A local partnership was in the process of liquidating and reported the following capital balances: Douglass indicated that the $14,000 deficit would be covered by a forthcoming contribution. However, the two remaining partners asked to receive the $31,000 that was then in the cash account.

-How much of this money should Justice receive?

A)$15,467.

B)$15,533.

C)$17,333.

D)$16,533.

E)$15,867.

-How much of this money should Justice receive?

A)$15,467.

B)$15,533.

C)$17,333.

D)$16,533.

E)$15,867.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

6

A local partnership was considering the possibility of liquidation since one of the partners (Ding) was personally insolvent. Capital balances at that time were as follows. Profits and losses were divided on a 4:2:2:2 basis, respectively. Creditors of partner Ding filed a $25,000 claim against the partnership's assets. At that time, the partnership held noncash assets reported at $360,000 and liabilities of $120,000. There was no cash on hand at the time.

-If the assets could be sold,for $228,000 what is the minimum amount that Tillman's creditors would have received?

A)$36,000.

B)$0.

C)$2,500.

D)$38,250.

E)$67,250.

-If the assets could be sold,for $228,000 what is the minimum amount that Tillman's creditors would have received?

A)$36,000.

B)$0.

C)$2,500.

D)$38,250.

E)$67,250.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

7

When a partnership is insolvent and a partner has a deficit capital balance,that partner is legally required to:

A)declare personal bankruptcy.

B)initiate legal proceedings against the partnership.

C)contribute cash to the partnership.

D)deliver a note payable to the partnership with specific payment terms.

E)None of the above.The partner has no legal responsibility to cover the capital deficit balance.

A)declare personal bankruptcy.

B)initiate legal proceedings against the partnership.

C)contribute cash to the partnership.

D)deliver a note payable to the partnership with specific payment terms.

E)None of the above.The partner has no legal responsibility to cover the capital deficit balance.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

8

The Keaton,Lewis,and Meador partnership had the following balance sheet just before entering liquidation: Keaton,Lewis,and Meador share profits and losses in a ratio of 2:4:4.Noncash assets were sold for $60,000.How much will each partner receive in the liquidation?

A)Option A

B)Option B

C)Option C

D)Option D

E)Option E

A)Option A

B)Option B

C)Option C

D)Option D

E)Option E

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

9

The Keaton,Lewis,and Meador partnership had the following balance sheet just before entering liquidation: Keaton,Lewis,and Meador share profits and losses in a ratio of 2:4:4.The partnership feels confident it will be able to eventually sell the noncash assets and wants to distribute some cash before paying liabilities.How much would each partner receive of a total $60,000 distribution of cash?

A)Option A

B)Option B

C)Option C

D)Option D

E)Option E

A)Option A

B)Option B

C)Option C

D)Option D

E)Option E

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

10

The Abrams,Bartle,and Creighton partnership began the process of liquidation with the following balance sheet: Abrams,Bartle,and Creighton share profits and losses in a ratio of 3:2:5.Liquidation expenses are expected to be $12,000.

After the liquidation expenses of $12,000 were paid and the noncash assets sold,Creighton had a deficit of $8,000.For what amount were the noncash assets sold?

A)$170,000.

B)$264,000.

C)$158,000.

D)$146,000.

E)$185,000.

After the liquidation expenses of $12,000 were paid and the noncash assets sold,Creighton had a deficit of $8,000.For what amount were the noncash assets sold?

A)$170,000.

B)$264,000.

C)$158,000.

D)$146,000.

E)$185,000.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

11

Dancey,Reese,Newman,and Jahn were partners who shared profits and losses on a 4:2:2:2 basis,respectively.They were beginning to liquidate their business.At the start of the process,capital balances were as follows: Which one of the following statements is true for a predistribution plan?

A)The first available $16,000 would go to Newman.

B)The first available $20,000 would go to Dancey.

C)The first available $8,000 would go to Jahn.

D)The first available $8,000 would go to Newman.

E)The first available $4,000 would go to Jahn.

A)The first available $16,000 would go to Newman.

B)The first available $20,000 would go to Dancey.

C)The first available $8,000 would go to Jahn.

D)The first available $8,000 would go to Newman.

E)The first available $4,000 would go to Jahn.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

12

A local partnership was considering the possibility of liquidation since one of the partners (Ding) was personally insolvent. Capital balances at that time were as follows. Profits and losses were divided on a 4:2:2:2 basis, respectively. Creditors of partner Ding filed a $25,000 claim against the partnership's assets. At that time, the partnership held noncash assets reported at $360,000 and liabilities of $120,000. There was no cash on hand at the time.

-If the assets could be sold for $228,000,what is the minimum amount that Laurel's creditors would have received?

A)$36,000.

B)$0.

C)$2,500.

D)$38,250.

E)$67,250.

-If the assets could be sold for $228,000,what is the minimum amount that Laurel's creditors would have received?

A)$36,000.

B)$0.

C)$2,500.

D)$38,250.

E)$67,250.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

13

The Henry, Isaac, and Jacobs partnership was about to enter liquidation with the following account balances: Estimated expenses of liquidation were $5,000. Henry, Isaac, and Jacobs shared profits and losses in a ratio of 2:4:4.

-Before liquidating any assets,the partners determined the amount of cash available for safe payments.How should the amount of safe cash payments be distributed?

A)In a ratio of 2:4:4 among all the partners.

B)$18,333 to Henry and $16,667 to Jacobs.

C)In a ratio of 1:2 between Henry and Jacobs.

D)$15,000 to Henry and $10,000 to Jacobs.

E)$21,667 to Henry and $3,333 to Jacobs.

-Before liquidating any assets,the partners determined the amount of cash available for safe payments.How should the amount of safe cash payments be distributed?

A)In a ratio of 2:4:4 among all the partners.

B)$18,333 to Henry and $16,667 to Jacobs.

C)In a ratio of 1:2 between Henry and Jacobs.

D)$15,000 to Henry and $10,000 to Jacobs.

E)$21,667 to Henry and $3,333 to Jacobs.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

14

The Abrams,Bartle,and Creighton partnership began the process of liquidation with the following balance sheet: Abrams,Bartle,and Creighton share profits and losses in a ratio of 3:2:5.Liquidation expenses are expected to be $12,000.

The noncash assets were sold for $134,000.Which partner(s)would have had to contribute assets to the partnership to cover a deficit in his or her capital account?

A)Abrams.

B)Bartle.

C)Creighton.

D)Abrams and Creighton.

E)Abrams and Bartle.

The noncash assets were sold for $134,000.Which partner(s)would have had to contribute assets to the partnership to cover a deficit in his or her capital account?

A)Abrams.

B)Bartle.

C)Creighton.

D)Abrams and Creighton.

E)Abrams and Bartle.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

15

A local partnership was considering the possibility of liquidation since one of the partners (Ding) was personally insolvent. Capital balances at that time were as follows. Profits and losses were divided on a 4:2:2:2 basis, respectively. Creditors of partner Ding filed a $25,000 claim against the partnership's assets. At that time, the partnership held noncash assets reported at $360,000 and liabilities of $120,000. There was no cash on hand at the time.

-If the assets could be sold for $228,000,what is the minimum amount that Ezzard's creditors would have received?

A)$36,000.

B)$0.

C)$2,500.

D)$38,250.

E)$67,250.

-If the assets could be sold for $228,000,what is the minimum amount that Ezzard's creditors would have received?

A)$36,000.

B)$0.

C)$2,500.

D)$38,250.

E)$67,250.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

16

A local partnership was in the process of liquidating and reported the following capital balances: Douglass indicated that the $14,000 deficit would be covered by a forthcoming contribution. However, the two remaining partners asked to receive the $31,000 that was then in the cash account.

-How much of this money should Zobart receive?

A)$15,467.

B)$14,467.

C)$17,333.

D)$15,633.

E)$15,867.

-How much of this money should Zobart receive?

A)$15,467.

B)$14,467.

C)$17,333.

D)$15,633.

E)$15,867.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

17

The Abrams,Bartle,and Creighton partnership began the process of liquidation with the following balance sheet: Abrams,Bartle,and Creighton share profits and losses in a ratio of 3:2:5.Liquidation expenses are expected to be $12,000.

If the noncash assets were sold for $234,000,what amount of the loss would have been allocated to Bartle?

A)$43,200.

B)$46,800.

C)$40,000.

D)$42,400.

E)$43,100.

If the noncash assets were sold for $234,000,what amount of the loss would have been allocated to Bartle?

A)$43,200.

B)$46,800.

C)$40,000.

D)$42,400.

E)$43,100.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

18

The Henry, Isaac, and Jacobs partnership was about to enter liquidation with the following account balances: Estimated expenses of liquidation were $5,000. Henry, Isaac, and Jacobs shared profits and losses in a ratio of 2:4:4.

-Before liquidating any assets,the partners determined the amount of cash for safe payments and distributed it.The noncash assets were then sold for $120,000,and the liquidation expenses of $5,000 were paid.How much of the $120,000 would be distributed to the partners? (Hint: Either a predistribution plan or a schedule of safe payments would be appropriate for solving this item. )

A)Option A

B)Option B

C)Option C

D)Option D

E)Option E

-Before liquidating any assets,the partners determined the amount of cash for safe payments and distributed it.The noncash assets were then sold for $120,000,and the liquidation expenses of $5,000 were paid.How much of the $120,000 would be distributed to the partners? (Hint: Either a predistribution plan or a schedule of safe payments would be appropriate for solving this item. )

A)Option A

B)Option B

C)Option C

D)Option D

E)Option E

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

19

The Keaton,Lewis,and Meador partnership had the following balance sheet just before entering liquidation: Keaton,Lewis,and Meador share profits and losses in a ratio of 2:4:4.Noncash assets were sold for $180,000.Liquidation expenses were $10,000.

Assume that Lewis was personally insolvent and could not contribute any assets to the partnership,while Keaton and Meador were both solvent.What amount of cash would Keaton have received from the distribution of partnership assets?

A)$38,000.

B)$30,000.

C)$24,000.

D)$34,000.

E)$31,600.

Assume that Lewis was personally insolvent and could not contribute any assets to the partnership,while Keaton and Meador were both solvent.What amount of cash would Keaton have received from the distribution of partnership assets?

A)$38,000.

B)$30,000.

C)$24,000.

D)$34,000.

E)$31,600.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

20

The following account balances were available for the Perry, Quincy, and Renquist partnership just before it entered liquidation: Inlcuded in Perry's capital balance is a $20,000 partnership loan owed to Perry. Perry, Quincy, and Renquist shared profits and losses in a ratio of 2:4:4. Liquidation expenses were expected to be $15,000.

All partners were solvent.

-What amount would noncash assets need to be sold for in order for any partner to receive some cash?

A)$185,000

B)$170,000

C)$165,000

D)$95,000

E)$90,000

All partners were solvent.

-What amount would noncash assets need to be sold for in order for any partner to receive some cash?

A)$185,000

B)$170,000

C)$165,000

D)$95,000

E)$90,000

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

21

Which one of the following statements is correct?

A)If a partner of a liquidating partnership is unable to pay a capital account deficit,the deficit is absorbed by the other partners in the profit and loss ratio of those partners.

B)Gains and losses from the sale of noncash assets are divided in the ratio of the partners' capital account balances if there is no income-sharing plan in the partnership contract.

C)A loan receivable from a partner is added to the partner's capital account balance in the preparation of a cash distribution plan.

D)Partners may not receive any cash before partnership creditors receive cash when liquidating a partnership.

E)All cash payments to partners are made using their profit and loss ratio when liquidating the partnership.

A)If a partner of a liquidating partnership is unable to pay a capital account deficit,the deficit is absorbed by the other partners in the profit and loss ratio of those partners.

B)Gains and losses from the sale of noncash assets are divided in the ratio of the partners' capital account balances if there is no income-sharing plan in the partnership contract.

C)A loan receivable from a partner is added to the partner's capital account balance in the preparation of a cash distribution plan.

D)Partners may not receive any cash before partnership creditors receive cash when liquidating a partnership.

E)All cash payments to partners are made using their profit and loss ratio when liquidating the partnership.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

22

What accounting transactions are not recorded by an accountant during partnership liquidation?

A)The conversion of partnership assets into cash.

B)The allocation of gains and losses from sales of assets.

C)The payment of liabilities and expenses.

D)The initiation of legal action by creditors of the partnership.

E)Writeoff of remaining unpaid debts.

A)The conversion of partnership assets into cash.

B)The allocation of gains and losses from sales of assets.

C)The payment of liabilities and expenses.

D)The initiation of legal action by creditors of the partnership.

E)Writeoff of remaining unpaid debts.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

23

A local partnership has assets of cash of $5,000 and a building recorded at $80,000. All liabilities have been paid. The partners capital accounts are as follows Harry $40,000, Landers $30,000 and Waters 15,000. The partners share profits and losses 4:4:2.

-If the building is sold for $50,000,how much cash will Waters receive in the final settlement?

A)$5,000.

B)$9,000.

C)$18,000.

D)$28,000.

E)$55,000.

-If the building is sold for $50,000,how much cash will Waters receive in the final settlement?

A)$5,000.

B)$9,000.

C)$18,000.

D)$28,000.

E)$55,000.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

24

A local partnership has assets of cash of $5,000 and a building recorded at $80,000. All liabilities have been paid. The partners capital accounts are as follows Harry $40,000, Landers $30,000 and Waters 15,000. The partners share profits and losses 4:4:2.

-If the building is sold for $50,000,how much cash will Harry receive in the final settlement?

A)$5,000.

B)$9,000.

C)$18,000.

D)$28,000.

E)$55,000.

-If the building is sold for $50,000,how much cash will Harry receive in the final settlement?

A)$5,000.

B)$9,000.

C)$18,000.

D)$28,000.

E)$55,000.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

25

What is the purpose of a predistribution plan?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

26

What is the preferred method of resolving a partner's deficit balance,according to the Uniform Partnership Act?

A)Partners never have a deficit balance.

B)The other partners must contribute personal assets to cover the deficit balance.

C)The partnership must sell assets in order to cover the deficit balance.

D)The partner with a deficit balance must contribute personal assets to cover the deficit balance.

E)The partner with a deficit balance contributes personal assets only if those personal assets exceed personal liabilities.

A)Partners never have a deficit balance.

B)The other partners must contribute personal assets to cover the deficit balance.

C)The partnership must sell assets in order to cover the deficit balance.

D)The partner with a deficit balance must contribute personal assets to cover the deficit balance.

E)The partner with a deficit balance contributes personal assets only if those personal assets exceed personal liabilities.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following could result in the termination and liquidation of a partnership?

1)Partners are incompatible and choose to cease operations.

2)There are excessive losses that are expected to continue.

3)Retirement of a partner.

A)1 only

B)1 and 2 only

C)2 and 3 only

D)3 only

E)1,2,and 3

1)Partners are incompatible and choose to cease operations.

2)There are excessive losses that are expected to continue.

3)Retirement of a partner.

A)1 only

B)1 and 2 only

C)2 and 3 only

D)3 only

E)1,2,and 3

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

28

White, Sands, and Luke has the following capital balances and profit and loss ratios:

$60,000 (30%), $100,000 (20%) and $200,000 (50%).

The partnership has received a predistribution plan.

-How would $200,000 be distributed?

A.

B.

C.

D.

E.

A)Option A

B)Option B

C)Option C

D)Option D

E)Option E

$60,000 (30%), $100,000 (20%) and $200,000 (50%).

The partnership has received a predistribution plan.

-How would $200,000 be distributed?

A.

B.

C.

D.

E.

A)Option A

B)Option B

C)Option C

D)Option D

E)Option E

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

29

Gonda,Herron,and Morse is considering possible liquidation because partner Morse is personally insolvent.The partners have the following capital balances: $60,000,$70,000,and $40,000,respectively,and share profits and losses 30%,45%,and 25%,respectively.The partnership has $200,000 in noncash assets that can be sold for $150,000.The partnership has $10,000 cash on hand,and $40,000 in liabilities.What is the minimum that partner Morse's creditors would receive if they have filed a claim for $50,000?

A)$0.

B)$27,500.

C)$45,000.

D)$47,500.

E)$50,000.

A)$0.

B)$27,500.

C)$45,000.

D)$47,500.

E)$50,000.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

29

The partnership of Rayne,Marin,and Fulton was being liquidated by the partners.Rayne was insolvent and did not have enough assets to pay all his personal creditors.Under what conditions might Rayne's personal creditors have claimed some of the partnership assets?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

30

What is the role of the accountant during the liquidation process?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following statements is true concerning the distribution of safe payments?

A)The distribution of safe payments assumes that any capital deficit balances will prove to be a total loss to the partnership.

B)Safe payments are equal to the recorded capital balances of partners with positive capital balances.

C)The distribution of safe payments may only be made after all liabilities have been paid.

D)In computing safe payments,partners with positive capital balances are assumed to absorb an equal share of any deficit balance(s).

E)There are no safe payments until the liquidation is complete.

A)The distribution of safe payments assumes that any capital deficit balances will prove to be a total loss to the partnership.

B)Safe payments are equal to the recorded capital balances of partners with positive capital balances.

C)The distribution of safe payments may only be made after all liabilities have been paid.

D)In computing safe payments,partners with positive capital balances are assumed to absorb an equal share of any deficit balance(s).

E)There are no safe payments until the liquidation is complete.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

32

A local partnership has assets of cash of $130,000 and land recorded at $700,000. All liabilities have been paid and the partners are all personally insolvent. The partners' capital accounts are as follows Roberts, $500,000, Ferry, $300,000 and Mones, $30,000. The partners share profits and losses 5:3:2.

-If the land is sold for $450,000,how much cash will Mones receive in the final settlement?

A)$0.

B)$15,000.

C)$300,000.

D)$217,500.

E)$362,500.

-If the land is sold for $450,000,how much cash will Mones receive in the final settlement?

A)$0.

B)$15,000.

C)$300,000.

D)$217,500.

E)$362,500.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

33

Harding,Jones,and Sandy is in the process of liquidating and the partners have the following capital balances;24,000,24,000,and (9,000)respectively.The partners share all profits and losses 16%,48%,and 36%,respectively.Sandy has indicated that the (9,000)deficit will be covered with a forthcoming contribution.The remaining partners have requested to immediately receive $20,000 in cash that is available.How should this cash be distributed?

A)Harding $5,000;Jones $15,000.

B)Harding $17,000;Jones $3,000.

C)Harding $11,154;Jones $8,846.

D)Harding $14,297;Jones $5,703.

E)Harding $12,500;Jones $7,500.

A)Harding $5,000;Jones $15,000.

B)Harding $17,000;Jones $3,000.

C)Harding $11,154;Jones $8,846.

D)Harding $14,297;Jones $5,703.

E)Harding $12,500;Jones $7,500.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

34

A local partnership has assets of cash of $130,000 and land recorded at $700,000. All liabilities have been paid and the partners are all personally insolvent. The partners' capital accounts are as follows Roberts, $500,000, Ferry, $300,000 and Mones, $30,000. The partners share profits and losses 5:3:2.

-If the land is sold for $450,000,how much cash will Roberts receive in the final settlement?

A)$0.

B)$30,000.

C)$217,500.

D)$362,500.

E)$502,500.

-If the land is sold for $450,000,how much cash will Roberts receive in the final settlement?

A)$0.

B)$30,000.

C)$217,500.

D)$362,500.

E)$502,500.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

35

White, Sands, and Luke has the following capital balances and profit and loss ratios:

$60,000 (30%), $100,000 (20%) and $200,000 (50%).

The partnership has received a predistribution plan.

-How would $90,000 be distributed?

A)Option A

B)Option B

C)Option C

D)Option D

E)Option E

$60,000 (30%), $100,000 (20%) and $200,000 (50%).

The partnership has received a predistribution plan.

-How would $90,000 be distributed?

A)Option A

B)Option B

C)Option C

D)Option D

E)Option E

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

36

What financial schedule would be prepared for a partnership that has begun liquidation but has not yet completed the process? What is the purpose of this schedule?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

37

The Arnold,Bates,Carlton,and Delbert partnership was liquidating.It had paid all its liabilities and had some assets yet to be sold.The partners had capital account balances of ($50,000),$90,000,$110,000,and $130,000.There was $40,000 cash available for distribution to the partners.What procedures would be followed to determine the amount of cash that could safely be distributed to each partner?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

38

Xygote,Yen,and Zen were partners who were liquidating their partnership.Each partner was insolvent.All assets had been liquidated and all liabilities had been paid.How should any remaining cash have been distributed to the partners?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

39

Which item is not shown on the schedule of partnership liquidation?

A)Current cash balances.

B)Property owned by the partnership.

C)Liabilities still to be paid.

D)Personal assets of the partners.

E)Current capital balances of the partners.

A)Current cash balances.

B)Property owned by the partnership.

C)Liabilities still to be paid.

D)Personal assets of the partners.

E)Current capital balances of the partners.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following statements is false concerning the partnership Schedule of Liquidation?

A)Liquidations may take a considerable length of time to complete.

B)Frequent reporting by the accountant is rarely necessary.

C)The Schedule of Liquidation provides a listing of transactions to date,current cash,and capital balances.

D)The Schedule of Liquidation provides a listing of property still held by the partnership as well as liabilities remaining unpaid.

E)The Schedule of Liquidation keeps creditors and partners apprised of the results of the process of dissolution.

A)Liquidations may take a considerable length of time to complete.

B)Frequent reporting by the accountant is rarely necessary.

C)The Schedule of Liquidation provides a listing of transactions to date,current cash,and capital balances.

D)The Schedule of Liquidation provides a listing of property still held by the partnership as well as liabilities remaining unpaid.

E)The Schedule of Liquidation keeps creditors and partners apprised of the results of the process of dissolution.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

41

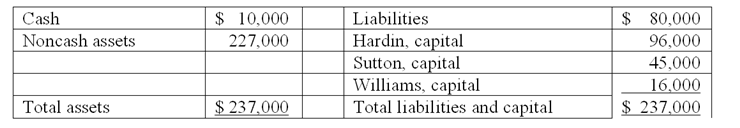

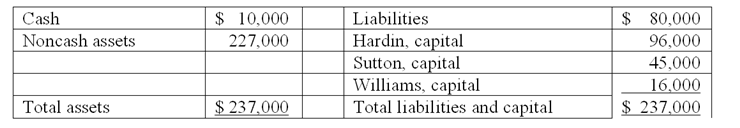

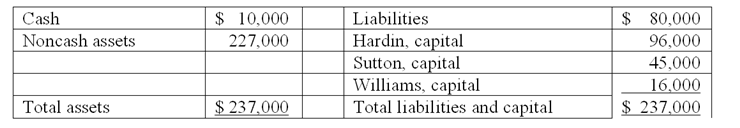

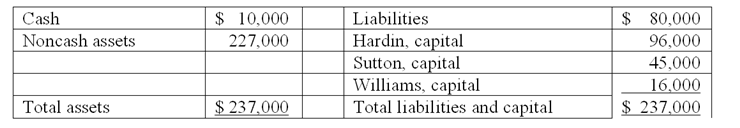

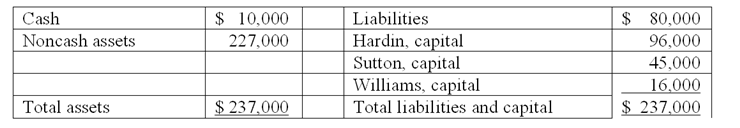

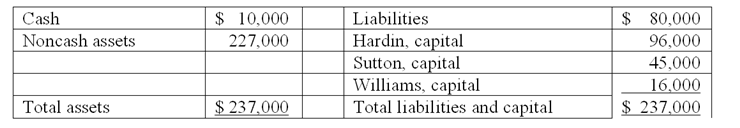

Hardin, Sutton, and Williams has operated a local business as a partnership for several years. All profits and losses have been allocated in a 3:2:1 ratio, respectively. Recently, Williams has undergone personal financial problems, and is insolvent. To satisfy Williams' creditors, the partnership has decided to liquidate.

The following balance sheet has been produced:

loss (Schedule B)}\\ \hline\text {Total} \\ \hline \end{array} \begin{array}{|c|} \hline \text { Hardin } \\ \hline \$ 96,000 \\ \hline \underline{(48,000)}\\ \hline\$ 48,000 \\ \hline(19,500) \\ \hline \$ 28.500 \\ \hline \end{array} \begin{array}{l|} \hline\text { Sutton } \\ \hline \$ 45,000 \\ \hline \underline{(32,000)}\\ \hline\$ 13,000 \\ \hline \underline{(13,000)}\\ \hline\underline{{\$ \quad 0}}\\ \hline \end{array} \begin{array}{l|} \hline\text { Williams } \\ \hline\$ 16,000 \\ \hline\underline{(16,000) }\\ \hline \$ \quad 0 \\ \hline\underline{ \quad 0} \\ \hline \$\underline{\quad 0}\\ \hline \end{array} \end{array}" class="answers-bank-image d-inline" loading="lazy" >During the liquidation process, the following transactions take place:

loss (Schedule B)}\\ \hline\text {Total} \\ \hline \end{array} \begin{array}{|c|} \hline \text { Hardin } \\ \hline \$ 96,000 \\ \hline \underline{(48,000)}\\ \hline\$ 48,000 \\ \hline(19,500) \\ \hline \$ 28.500 \\ \hline \end{array} \begin{array}{l|} \hline\text { Sutton } \\ \hline \$ 45,000 \\ \hline \underline{(32,000)}\\ \hline\$ 13,000 \\ \hline \underline{(13,000)}\\ \hline\underline{{\$ \quad 0}}\\ \hline \end{array} \begin{array}{l|} \hline\text { Williams } \\ \hline\$ 16,000 \\ \hline\underline{(16,000) }\\ \hline \$ \quad 0 \\ \hline\underline{ \quad 0} \\ \hline \$\underline{\quad 0}\\ \hline \end{array} \end{array}" class="answers-bank-image d-inline" loading="lazy" >During the liquidation process, the following transactions take place:

- Noncash assets are sold for $116,000.

- Liquidation expenses of $12,000 are paid. No further expenses are expected.

- Safe capital distributions are made to the partners.

- Payment is made of all business liabilities.

- Any deficit capital balances are deemed to be uncollectible.

-Develop a predistribution plan for this partnership,assuming $12,000 of liquidation expenses are expected to be paid.

The following balance sheet has been produced:

loss (Schedule B)}\\ \hline\text {Total} \\ \hline \end{array} \begin{array}{|c|} \hline \text { Hardin } \\ \hline \$ 96,000 \\ \hline \underline{(48,000)}\\ \hline\$ 48,000 \\ \hline(19,500) \\ \hline \$ 28.500 \\ \hline \end{array} \begin{array}{l|} \hline\text { Sutton } \\ \hline \$ 45,000 \\ \hline \underline{(32,000)}\\ \hline\$ 13,000 \\ \hline \underline{(13,000)}\\ \hline\underline{{\$ \quad 0}}\\ \hline \end{array} \begin{array}{l|} \hline\text { Williams } \\ \hline\$ 16,000 \\ \hline\underline{(16,000) }\\ \hline \$ \quad 0 \\ \hline\underline{ \quad 0} \\ \hline \$\underline{\quad 0}\\ \hline \end{array} \end{array}" class="answers-bank-image d-inline" loading="lazy" >During the liquidation process, the following transactions take place:

loss (Schedule B)}\\ \hline\text {Total} \\ \hline \end{array} \begin{array}{|c|} \hline \text { Hardin } \\ \hline \$ 96,000 \\ \hline \underline{(48,000)}\\ \hline\$ 48,000 \\ \hline(19,500) \\ \hline \$ 28.500 \\ \hline \end{array} \begin{array}{l|} \hline\text { Sutton } \\ \hline \$ 45,000 \\ \hline \underline{(32,000)}\\ \hline\$ 13,000 \\ \hline \underline{(13,000)}\\ \hline\underline{{\$ \quad 0}}\\ \hline \end{array} \begin{array}{l|} \hline\text { Williams } \\ \hline\$ 16,000 \\ \hline\underline{(16,000) }\\ \hline \$ \quad 0 \\ \hline\underline{ \quad 0} \\ \hline \$\underline{\quad 0}\\ \hline \end{array} \end{array}" class="answers-bank-image d-inline" loading="lazy" >During the liquidation process, the following transactions take place:- Noncash assets are sold for $116,000.

- Liquidation expenses of $12,000 are paid. No further expenses are expected.

- Safe capital distributions are made to the partners.

- Payment is made of all business liabilities.

- Any deficit capital balances are deemed to be uncollectible.

-Develop a predistribution plan for this partnership,assuming $12,000 of liquidation expenses are expected to be paid.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

42

Hardin, Sutton, and Williams has operated a local business as a partnership for several years. All profits and losses have been allocated in a 3:2:1 ratio, respectively. Recently, Williams has undergone personal financial problems, and is insolvent. To satisfy Williams' creditors, the partnership has decided to liquidate.

The following balance sheet has been produced:

During the liquidation process, the following transactions take place:

During the liquidation process, the following transactions take place:

- Noncash assets are sold for $116,000.

- Liquidation expenses of $12,000 are paid. No further expenses are expected.

- Safe capital distributions are made to the partners.

- Payment is made of all business liabilities.

- Any deficit capital balances are deemed to be uncollectible.

-Prepare journal entries to record the actual liquidation transactions.

The following balance sheet has been produced:

During the liquidation process, the following transactions take place:

During the liquidation process, the following transactions take place:- Noncash assets are sold for $116,000.

- Liquidation expenses of $12,000 are paid. No further expenses are expected.

- Safe capital distributions are made to the partners.

- Payment is made of all business liabilities.

- Any deficit capital balances are deemed to be uncollectible.

-Prepare journal entries to record the actual liquidation transactions.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

43

As of January 1,2011,the partnership of Canton,Yulls,and Garr had the following account balances and percentages for the sharing of profits and losses:

The partnership incurred losses in recent years and decided to liquidate.The liquidation expenses were expected to be $10,000.

-How much of the existing cash balance could be distributed safely to partners at this time?

The partnership incurred losses in recent years and decided to liquidate.The liquidation expenses were expected to be $10,000.

-How much of the existing cash balance could be distributed safely to partners at this time?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

44

On January 1,2011,the partners of Won,Cadel,and Dax (who shared profits and losses in the ratio of 5:3:2,respectively)decided to liquidate their partnership.The trial balance at this date was as follows:

The partners planned a program of piecemeal conversion of the business assets to minimize liquidation losses.All available cash,less an amount retained to provide for future expenses,was to be distributed to the partners at the end of each month.A summary of liquidation transactions follows:

-Prepare a schedule to calculate the safe installment payments to be made to the partners at the end of February.

The partners planned a program of piecemeal conversion of the business assets to minimize liquidation losses.All available cash,less an amount retained to provide for future expenses,was to be distributed to the partners at the end of each month.A summary of liquidation transactions follows:

-Prepare a schedule to calculate the safe installment payments to be made to the partners at the end of February.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

45

What events or circumstances might force the termination of a partnership and liquidation of its assets?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

46

On January 1,2011,the partners of Won,Cadel,and Dax (who shared profits and losses in the ratio of 5:3:2,respectively)decided to liquidate their partnership.The trial balance at this date was as follows:

The partners planned a program of piecemeal conversion of the business assets to minimize liquidation losses.All available cash,less an amount retained to provide for future expenses,was to be distributed to the partners at the end of each month.A summary of liquidation transactions follows:

-Prepare a schedule to calculate the safe payments to be made to the partners at the end of January.

The partners planned a program of piecemeal conversion of the business assets to minimize liquidation losses.All available cash,less an amount retained to provide for future expenses,was to be distributed to the partners at the end of each month.A summary of liquidation transactions follows:

-Prepare a schedule to calculate the safe payments to be made to the partners at the end of January.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

47

A partnership had the following account balances: Cash,$91,000;Other Assets,$702,000;Liabilities,$338,000;Polk,Capital (50% of profits and losses),$221,000;Garfield,Capital (30%),$143,000;Arthur,Capital (20%),$91,000.The company liquidated and $10,400 became available to the partners.

Required:

Who would have received the $10,400?

Required:

Who would have received the $10,400?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

48

The Amos,Billings,and Cleaver partnership had two assets: (1)cash of $40,000 and (2)an investment with a book value of $110,000.The ratio for sharing profits and losses is 2:1:1.The balances in the capital accounts were:

Amos,capital: $45,000

Billings,capital: $75,000

Cleaver,capital: $30,000

Required:

If the investment was sold for $80,000,how much cash would each partner have received?

Amos,capital: $45,000

Billings,capital: $75,000

Cleaver,capital: $30,000

Required:

If the investment was sold for $80,000,how much cash would each partner have received?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

49

If the noncash assets are sold for $105,000,what would be the maximum amount of cash that Canton could expect to receive?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

50

Hardin, Sutton, and Williams has operated a local business as a partnership for several years. All profits and losses have been allocated in a 3:2:1 ratio, respectively. Recently, Williams has undergone personal financial problems, and is insolvent. To satisfy Williams' creditors, the partnership has decided to liquidate.

The following balance sheet has been produced:

During the liquidation process, the following transactions take place:

During the liquidation process, the following transactions take place:

- Noncash assets are sold for $116,000.

- Liquidation expenses of $12,000 are paid. No further expenses are expected.

- Safe capital distributions are made to the partners.

- Payment is made of all business liabilities.

- Any deficit capital balances are deemed to be uncollectible.

-Compute safe cash payments after the noncash assets have been sold and the liquidation expenses have been paid.

The following balance sheet has been produced:

During the liquidation process, the following transactions take place:

During the liquidation process, the following transactions take place:- Noncash assets are sold for $116,000.

- Liquidation expenses of $12,000 are paid. No further expenses are expected.

- Safe capital distributions are made to the partners.

- Payment is made of all business liabilities.

- Any deficit capital balances are deemed to be uncollectible.

-Compute safe cash payments after the noncash assets have been sold and the liquidation expenses have been paid.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

51

What would be the maximum amount Garr might have to contribute to the partnership to eliminate a deficit balance in his account?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

52

Why is a Schedule of Liquidation prepared?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

53

On January 1,2011,the partners of Won,Cadel,and Dax (who shared profits and losses in the ratio of 5:3:2,respectively)decided to liquidate their partnership.The trial balance at this date was as follows:

The partners planned a program of piecemeal conversion of the business assets to minimize liquidation losses.All available cash,less an amount retained to provide for future expenses,was to be distributed to the partners at the end of each month.A summary of liquidation transactions follows:

-Prepare a schedule to calculate the safe payments to be made to the partners at the end of March.

The partners planned a program of piecemeal conversion of the business assets to minimize liquidation losses.All available cash,less an amount retained to provide for future expenses,was to be distributed to the partners at the end of each month.A summary of liquidation transactions follows:

-Prepare a schedule to calculate the safe payments to be made to the partners at the end of March.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

54

The Albert,Boynton,and Creamer partnership was in the process of liquidating its assets and going out of business.Albert,Boynton,and Creamer had capital account balances of $80,000,$120,000,and $200,000,respectively,and shared profits and losses in the ratio of 1:3:2.Equipment that had cost $90,000 and had a book value of $60,000 was sold for $24,000 cash.

Required:

Prepare the appropriate journal entry to record the sale of the equipment,distributing any gain or loss directly to the partners.

Required:

Prepare the appropriate journal entry to record the sale of the equipment,distributing any gain or loss directly to the partners.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

55

What should occur when a solvent partner has a deficit balance?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

56

For a partnership,how should liquidation gains and losses be accounted for?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

57

What is a safe cash payment?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

58

As of January 1,2011,the partnership of Canton,Yulls,and Garr had the following account balances and percentages for the sharing of profits and losses:

The partnership incurred losses in recent years and decided to liquidate.The liquidation expenses were expected to be $10,000.

-How much cash should each partner receive at this time,pursuant to a proposed schedule of liquidation?

The partnership incurred losses in recent years and decided to liquidate.The liquidation expenses were expected to be $10,000.

-How much cash should each partner receive at this time,pursuant to a proposed schedule of liquidation?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

59

Jones,Marge,and Tate LLP decided to dissolve and liquidate the partnership on September 30,2011.After realization of a portion of the noncash assets,the capital account balances were Jones $50,000;Marge $40,000;and Tate $15,000.Cash of $35,000 and other assets with a carrying amount of $100,000 were on hand.Creditors' claims totaled $30,000.Jones,Marge,and Tate shared net income and losses in a 2:1:1 ratio,respectively.

Prepare a working paper to compute the amount of cash that may be paid to creditors and to partners at this time,assuming that no partner is solvent.

Prepare a working paper to compute the amount of cash that may be paid to creditors and to partners at this time,assuming that no partner is solvent.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

60

A partnership held three assets: Cash,$13,000;Land,$45,000;and a Building,$65,000.There were no recorded liabilities.The partners anticipated that expenses required to liquidate their partnership would amount to $6,000.Capital balances were as follows:

King,Capital: $32,700

Murphy,Capital: 36,400

Madison,Capital: 26,000

Pond,Capital: 27,900

The partners shared profits and losses 30:30:20:20,respectively.

Required:

Prepare a proposed schedule of liquidation,showing how cash could be safely distributed to the partners at this time.

King,Capital: $32,700

Murphy,Capital: 36,400

Madison,Capital: 26,000

Pond,Capital: 27,900

The partners shared profits and losses 30:30:20:20,respectively.

Required:

Prepare a proposed schedule of liquidation,showing how cash could be safely distributed to the partners at this time.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

61

The partners of Donald,Chief & Berry LLP decided to liquidate on August 1,2011.The balance sheet of the partnership is as follows,with the profit and loss ratio of 25%,45%,and 30%,respectively.

The disposal of Other assets with a carrying amount of $200,000 realized $140,000,and all available cash was distributed.

-Prepare the journal entry for Donald,Chief & Berry LLP on August 1,2011,to record the offset of the loan receivable from Donald.

The disposal of Other assets with a carrying amount of $200,000 realized $140,000,and all available cash was distributed.

-Prepare the journal entry for Donald,Chief & Berry LLP on August 1,2011,to record the offset of the loan receivable from Donald.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

62

The partners of Donald,Chief & Berry LLP decided to liquidate on August 1,2011.The balance sheet of the partnership is as follows,with the profit and loss ratio of 25%,45%,and 30%,respectively.

The disposal of Other assets with a carrying amount of $200,000 realized $140,000,and all available cash was distributed.

-Prepare the journal entry for Donald,Chief & Berry LLP on August 1,2011,to record the realization of Other assets.

The disposal of Other assets with a carrying amount of $200,000 realized $140,000,and all available cash was distributed.

-Prepare the journal entry for Donald,Chief & Berry LLP on August 1,2011,to record the realization of Other assets.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

63

The partners of Donald,Chief & Berry LLP decided to liquidate on August 1,2011.The balance sheet of the partnership is as follows,with the profit and loss ratio of 25%,45%,and 30%,respectively.

The disposal of Other assets with a carrying amount of $200,000 realized $140,000,and all available cash was distributed.

-Prepare the journal entry for Donald,Chief & Berry LLP on August 1,2011,to record payment of liabilities.

The disposal of Other assets with a carrying amount of $200,000 realized $140,000,and all available cash was distributed.

-Prepare the journal entry for Donald,Chief & Berry LLP on August 1,2011,to record payment of liabilities.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

64

The balance sheet of Rogers,Dennis & Berry LLP prior to liquidation included the following:

The three partners shared net income and losses in a 5:3:2 ratio,respectively.Noncash assets were sold for $60,000.Creditors were paid in full,partners were paid $35,000,and the balance of cash was retained pending future developments.

-Record the journal entry for the sale of the noncash assets.

The three partners shared net income and losses in a 5:3:2 ratio,respectively.Noncash assets were sold for $60,000.Creditors were paid in full,partners were paid $35,000,and the balance of cash was retained pending future developments.

-Record the journal entry for the sale of the noncash assets.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

65

The balance sheet of Rogers,Dennis & Berry LLP prior to liquidation included the following:

The three partners shared net income and losses in a 5:3:2 ratio,respectively.Noncash assets were sold for $60,000.Creditors were paid in full,partners were paid $35,000,and the balance of cash was retained pending future developments.

-Record the journal entry for payment of outstanding liabilities to the creditors.

The three partners shared net income and losses in a 5:3:2 ratio,respectively.Noncash assets were sold for $60,000.Creditors were paid in full,partners were paid $35,000,and the balance of cash was retained pending future developments.

-Record the journal entry for payment of outstanding liabilities to the creditors.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

66

The balance sheet of Rogers,Dennis & Berry LLP prior to liquidation included the following:

The three partners shared net income and losses in a 5:3:2 ratio,respectively.Noncash assets were sold for $60,000.Creditors were paid in full,partners were paid $35,000,and the balance of cash was retained pending future developments.

-Determine the cash to be retained and prepare a schedule to distribute $35,000 cash to the partners.

The three partners shared net income and losses in a 5:3:2 ratio,respectively.Noncash assets were sold for $60,000.Creditors were paid in full,partners were paid $35,000,and the balance of cash was retained pending future developments.

-Determine the cash to be retained and prepare a schedule to distribute $35,000 cash to the partners.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

67

The balance sheet of Rogers,Dennis & Berry LLP prior to liquidation included the following:

The three partners shared net income and losses in a 5:3:2 ratio,respectively.Noncash assets were sold for $60,000.Creditors were paid in full,partners were paid $35,000,and the balance of cash was retained pending future developments.

-Record the journal entry for the cash distribution to the partners.

The three partners shared net income and losses in a 5:3:2 ratio,respectively.Noncash assets were sold for $60,000.Creditors were paid in full,partners were paid $35,000,and the balance of cash was retained pending future developments.

-Record the journal entry for the cash distribution to the partners.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

68

Prepare the schedule to compute the cash payments to the partners.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck