Deck 21: Internal, Operational, and Compliance Auditing

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/48

Play

Full screen (f)

Deck 21: Internal, Operational, and Compliance Auditing

1

The work of internal auditors is primarily for the benefit of management and the board of directors.

True

2

Evaluation of internal control is one of the general sections of the IIA's Standards of the Professional Practice of Internal Auditing.

False

3

Internal auditing is considered to be part of an organization's:

A) Accounting system.

B) Control activities.

C) Monitoring.

D) External controls.

A) Accounting system.

B) Control activities.

C) Monitoring.

D) External controls.

C

4

When auditing an entity's financial statements in accordance with Government Auditing Standards (the "Yellow Book"), an auditor is required to report on:

I) Noteworthy accomplishments of the program.

II) The scope of the auditor's testing of internal controls.

A) I only.

B) II only.

C) Both I and II.

D) Neither I nor II.

I) Noteworthy accomplishments of the program.

II) The scope of the auditor's testing of internal controls.

A) I only.

B) II only.

C) Both I and II.

D) Neither I nor II.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

5

The operational auditors' preliminary conclusions about potential problem areas are summarized as:

A) The definition of purpose.

B) The audit program.

C) The preliminary survey.

D) The audit report.

A) The definition of purpose.

B) The audit program.

C) The preliminary survey.

D) The audit report.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

6

The passage of the Foreign Corrupt Practices Act increased the demand for internal auditing.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

7

In operational auditing, the preliminary survey serves as a guide for the development of the audit program.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

8

When auditing an entity's financial statements in accordance with Government Auditing Standards (the "Yellow Book"), an auditor is required to report on:

I) Recommendations for actions to improve operations.

II) The scope of the auditor's tests of compliance with laws and regulations.

A) I only.

B) II only.

C) Both I and II.

D) Neither I nor II.

I) Recommendations for actions to improve operations.

II) The scope of the auditor's tests of compliance with laws and regulations.

A) I only.

B) II only.

C) Both I and II.

D) Neither I nor II.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

9

Compliance procedures are tests of an organization's controls.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following is not required of an individual seeking to become a certified internal auditor?

A) Two years work experience in internal auditing or its equivalent.

B) Successful completion of a two-day examination.

C) A baccalaureate degree from an accredited college.

D) One year of supervisory experience.

A) Two years work experience in internal auditing or its equivalent.

B) Successful completion of a two-day examination.

C) A baccalaureate degree from an accredited college.

D) One year of supervisory experience.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

11

When no weaknesses in internal control are discovered during an operational audit, the appropriate report will be either standard unqualified or unqualified with explanatory language.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

12

Under the Single Audit Act, the auditor must apply procedures to test for compliance and test the effectiveness of controls for:

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

13

In an audit in accordance with the Single Audit Act of 1984, the auditors must test compliance with the significant requirements of all major programs.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following is not one of the attribute standards of the IIA's Standards for the Professional Practice of Internal Auditing?

A) Independence and objectivity.

B) Outsourcing.

C) Proficiency and professional care.

D) Purpose, authority, and responsibility.

A) Independence and objectivity.

B) Outsourcing.

C) Proficiency and professional care.

D) Purpose, authority, and responsibility.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

15

In an audit in accordance with Government Auditing Standards, the auditors are required to perform tests beyond those of an audit in accordance with generally accepted auditing standards relating to internal control over major federal assistance programs.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

16

A comprehensive examination of an operating unit or a complete organization to evaluate its systems, controls, and performance, as measured by management's objectives is called a(an):

A) Compilation.

B) Consultation.

C) Operational Audit.

D) "Yellow Book" audit.

A) Compilation.

B) Consultation.

C) Operational Audit.

D) "Yellow Book" audit.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

17

For the highest degree of independence, the director of internal auditing should report directly to:

A) The controller.

B) The audit committee of the board of directors.

C) The executive vice-president.

D) The chief accountant.

A) The controller.

B) The audit committee of the board of directors.

C) The executive vice-president.

D) The chief accountant.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

18

Operational audits are primarily concerned with whether an organization follows appropriate laws and regulations.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

19

An audit in accordance with the Single Audit Act does not involve reporting upon:

A) Compliance with provisions of laws that may have a direct and material effect on each major federal financial assistance program.

B) Financial statements.

C) Internal control over operations.

D) Schedule of expenditures of federal awards.

A) Compliance with provisions of laws that may have a direct and material effect on each major federal financial assistance program.

B) Financial statements.

C) Internal control over operations.

D) Schedule of expenditures of federal awards.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

20

The first internal auditors were primarily concerned with operational auditing.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

21

The GAO standards of reporting for governmental financial audits incorporate the AICPA standards of reporting and prescribe supplemental standards to satisfy the unique needs of governmental audits. Which of the following is a supplemental reporting standard for audits in accordance with Government Auditing Standards?

A) A report on the entity's internal control.

B) Material indications of illegal acts should be reported in a document with distribution restricted to senior officials of the entity audited.

C) Instances of abuse, fraud, mismanagement, and waste should be reported to the organization with legal oversight authority over the entity audited.

D) All privileged and confidential information discovered should be reported to the senior officials of the organization that arranged for the audit.

A) A report on the entity's internal control.

B) Material indications of illegal acts should be reported in a document with distribution restricted to senior officials of the entity audited.

C) Instances of abuse, fraud, mismanagement, and waste should be reported to the organization with legal oversight authority over the entity audited.

D) All privileged and confidential information discovered should be reported to the senior officials of the organization that arranged for the audit.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

22

In an audit in accordance with Government Auditing Standards, the auditors are required to provide a report on:

A) Compliance applicable to major federal programs.

B) The Schedule of financial assistance received.

C) Compliance with laws and regulations which are required to be tested by generally accepted auditing standards.

D) Internal control systems used in administering federal assistance programs.

A) Compliance applicable to major federal programs.

B) The Schedule of financial assistance received.

C) Compliance with laws and regulations which are required to be tested by generally accepted auditing standards.

D) Internal control systems used in administering federal assistance programs.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

23

Management is beginning to take corrective action on personnel department deficiencies reported during the last internal audit. According to the IIA's Standards, the internal auditor should:

A) Oversee the corrective action.

B) Postpone the next audit of the personnel department until the corrective action is completed.

C) Refrain from judging whether the corrective action will remedy the deficiencies.

D) Follow up to see that the corrective action satisfies the audit recommendations.

A) Oversee the corrective action.

B) Postpone the next audit of the personnel department until the corrective action is completed.

C) Refrain from judging whether the corrective action will remedy the deficiencies.

D) Follow up to see that the corrective action satisfies the audit recommendations.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

24

In an audit in accordance with generally accepted auditing standards, the auditors must test compliance with those laws and regulations that:

A) Have a direct and material effect on the financial statements.

B) Have a direct and material effect on major federal programs.

C) Have a material direct or indirect effect on the financial statements.

D) Have a material effect on major or non-major programs.

A) Have a direct and material effect on the financial statements.

B) Have a direct and material effect on major federal programs.

C) Have a material direct or indirect effect on the financial statements.

D) Have a material effect on major or non-major programs.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

25

According to the IIA's Standards, an internal auditor's working papers should be reviewed by the:

A) Management of the department being audited.

B) Management of the internal auditing department.

C) Audit committee of the board of directors.

D) Management of the organization's security division.

A) Management of the department being audited.

B) Management of the internal auditing department.

C) Audit committee of the board of directors.

D) Management of the organization's security division.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

26

Interviewing operating personnel, identifying the objectives of the auditee, identifying standards used to evaluate performance, and assessing the risk inherent in the auditee's operations are activities typically performed in which phase of an internal audit?

A) The fieldwork phase.

B) The preliminary survey phase.

C) The audit programming phase.

D) The reporting phase.

A) The fieldwork phase.

B) The preliminary survey phase.

C) The audit programming phase.

D) The reporting phase.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

27

The primary purpose of the internal auditors' evaluation of internal control is to:

A) Determine if management has planned and implemented activities needed to attain goals and objectives.

B) Determine the extent of tests of controls needed during field work.

C) Identify areas for fraud investigation.

D) Determine if employees have incompatible duties that have compromised the control environment.

A) Determine if management has planned and implemented activities needed to attain goals and objectives.

B) Determine the extent of tests of controls needed during field work.

C) Identify areas for fraud investigation.

D) Determine if employees have incompatible duties that have compromised the control environment.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

28

Costs paid with federal assistance that appear to be in violation of a law or regulation are known as:

A) Questioned costs.

B) Noncompliance costs.

C) Improper costs.

D) Illegal costs.

A) Questioned costs.

B) Noncompliance costs.

C) Improper costs.

D) Illegal costs.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

29

Compliance auditing procedures are:

A) Tests of controls.

B) Observation procedures.

C) Substantive procedures.

D) Confirmation procedures.

A) Tests of controls.

B) Observation procedures.

C) Substantive procedures.

D) Confirmation procedures.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

30

In governmental accounting, emphasis is placed on:

A) Total assets owned by the governmental entity.

B) Generating income from funds employed.

C) Expenditures of funds.

D) The flow of funds through the income statement.

A) Total assets owned by the governmental entity.

B) Generating income from funds employed.

C) Expenditures of funds.

D) The flow of funds through the income statement.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

31

In an audit in accordance with Government Auditing Standards, the auditors are required to provide a report on:

A) Compliance with general requirements.

B) The schedule of financial assistance received.

C) The organization's internal control.

D) Findings and questioned costs.

A) Compliance with general requirements.

B) The schedule of financial assistance received.

C) The organization's internal control.

D) Findings and questioned costs.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

32

Requirements of federal financial assistance programs that involve significant national policy are known as:

A) Specific requirements.

B) Major program requirements.

C) General requirements.

D) Primary requirements.

A) Specific requirements.

B) Major program requirements.

C) General requirements.

D) Primary requirements.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

33

Kent is auditing an entity's compliance with requirements governing a major federal financial assistance program in accordance with the Single Audit Act. Kent detected noncompliance with requirements that have a material effect on that program. Kent's report on compliance should express a(an):

A) Unqualified opinion with a separate explanatory paragraph.

B) Qualified opinion or an adverse opinion.

C) Adverse opinion or a disclaimer of opinion.

D) Limited assurance on the items tested.

A) Unqualified opinion with a separate explanatory paragraph.

B) Qualified opinion or an adverse opinion.

C) Adverse opinion or a disclaimer of opinion.

D) Limited assurance on the items tested.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

34

An operational audit report which deals with the scrap disposal function in a manufacturing company is most likely to address:

A) The efficiency and effectiveness of the scrap disposal function and include any findings requiring corrective action.

B) Whether the scrap material inventory is reported as a current asset.

C) Whether the physical inventory count of the scrap material agrees with the recorded amount.

D) Whether the scrap materials inventory is valued at the lower of cost or market.

A) The efficiency and effectiveness of the scrap disposal function and include any findings requiring corrective action.

B) Whether the scrap material inventory is reported as a current asset.

C) Whether the physical inventory count of the scrap material agrees with the recorded amount.

D) Whether the scrap materials inventory is valued at the lower of cost or market.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

35

A primary purpose of operational auditing standards is to provide:

A) A means of assurance that internal control is operating effectively.

B) Aid to the independent auditor in conducting the audit of financial statements.

C) The results of internal examinations of financial and accounting matters to the company's top-level management.

D) A measure of management performance in meeting organizational goals.

A) A means of assurance that internal control is operating effectively.

B) Aid to the independent auditor in conducting the audit of financial statements.

C) The results of internal examinations of financial and accounting matters to the company's top-level management.

D) A measure of management performance in meeting organizational goals.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

36

The scope of an internal audit is initially defined by the:

A) Audit objectives.

B) Scheduling and time estimates.

C) Preliminary survey.

D) Audit program.

A) Audit objectives.

B) Scheduling and time estimates.

C) Preliminary survey.

D) Audit program.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

37

The internal auditing department provides information about control and quality of performance to:

A) Management and the board of directors.

B) A level in the organization sufficient to ensure acceptance of all recommendations.

C) Outside agencies for regulatory and financial compliance.

D) Any member of the organization upon request.

A) Management and the board of directors.

B) A level in the organization sufficient to ensure acceptance of all recommendations.

C) Outside agencies for regulatory and financial compliance.

D) Any member of the organization upon request.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

38

When performing an audit of a city in accordance with the Single Audit Act, an auditor should adhere to:

A) Standards for the Professional Practice of Internal Auditing.

B) Government Auditing Standards.

C) Operational Auditing Standards.

D) Financial Accounting Standards.

A) Standards for the Professional Practice of Internal Auditing.

B) Government Auditing Standards.

C) Operational Auditing Standards.

D) Financial Accounting Standards.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following types of audits is designed to determine that an organization has complied with the specific requirements of major financial assistance programs?

A) An audit in accordance with Government Auditing Standards.

B) A single audit.

C) An audit in accordance with generally accepted auditing standards.

D) An operational audit.

A) An audit in accordance with Government Auditing Standards.

B) A single audit.

C) An audit in accordance with generally accepted auditing standards.

D) An operational audit.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

40

A legal aid society provides free legal aid to low-income individuals with funds passed-through the state welfare department from the U.S. Department of Health and Human Services. In this situation, which organization is the primary recipient of the funds?

A) The state welfare department.

B) The Department of Health and Human Services.

C) The legal aid society.

D) The individual receiving the aid.

A) The state welfare department.

B) The Department of Health and Human Services.

C) The legal aid society.

D) The individual receiving the aid.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

41

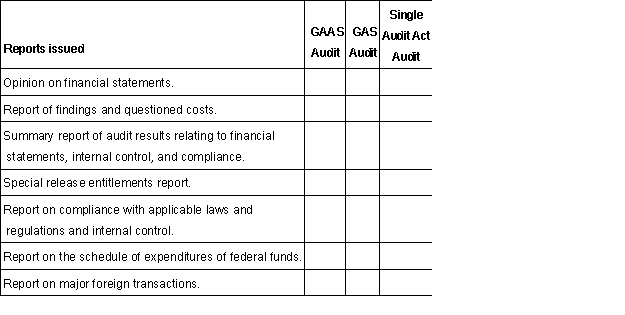

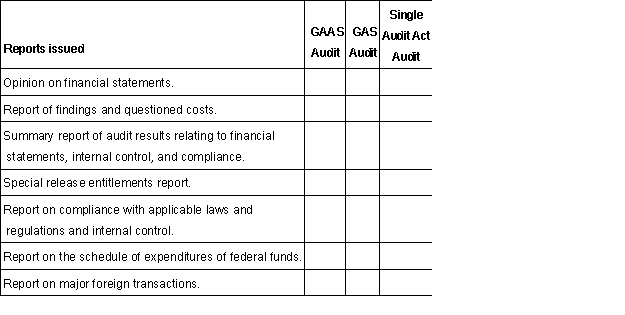

Governmental entities and other recipients of governmental financial assistance, depending upon the circumstances, may be subject to an audit in accordance with generally accepted auditing standards (GAAS audit), Government Auditing Standards (GAS audit) and the Federal Single Audit Act (Single Audit Act audit). Place an X by the proper reports issued by auditors for each of these audits on the following:

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

42

In planning an operational audit, an on-site survey could assist with all of the following, except:

A) Obtaining auditee comments and suggestions on control problems.

B) Obtaining preliminary information on internal control.

C) Identifying areas for audit emphasis.

D) Evaluating the effectiveness of the internal control.

A) Obtaining auditee comments and suggestions on control problems.

B) Obtaining preliminary information on internal control.

C) Identifying areas for audit emphasis.

D) Evaluating the effectiveness of the internal control.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

43

Among the Dodd-Frank Wall Street Reform and Consumer Protection Act's requirements is one requiring:

A) CPA examinations of broker-dealer internal control over compliance.

B) Quarterly reporting by all SEC registrants.

C) CPA audit of SEC registrant interim statements.

D) Severe penalties for companies implementing more than one questionable act reporting channel.

A) CPA examinations of broker-dealer internal control over compliance.

B) Quarterly reporting by all SEC registrants.

C) CPA audit of SEC registrant interim statements.

D) Severe penalties for companies implementing more than one questionable act reporting channel.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

44

Many government and nonprofit organizations are required to have an audit in accordance with Government Auditing Standards.

a. Who develops Government Auditing Standards?

b. Describe the requirements of an audit in accordance with Government Auditing Standards.

c. Describe the auditors' responsibilities for testing for compliance with laws and regulations in an audit in accordance with Government Auditing Standards.

a. Who develops Government Auditing Standards?

b. Describe the requirements of an audit in accordance with Government Auditing Standards.

c. Describe the auditors' responsibilities for testing for compliance with laws and regulations in an audit in accordance with Government Auditing Standards.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

45

Operational auditing has grown in importance over the last few decades.

a. Define operational auditing.

b. Who are the major users of operational audit reports.

c. List the phases of an operational audit.

a. Define operational auditing.

b. Who are the major users of operational audit reports.

c. List the phases of an operational audit.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

46

The Dodd-Frank Act requires auditors to report on broker-dealer compliance with internal control:

A) Over financial reporting as of year-end.

B) Operational effectiveness as of year-end.

C) Over compliance with various SEC requirements during the most recent fiscal year.

D) In conjunction with the Foreign Corrupt Practices Act.

A) Over financial reporting as of year-end.

B) Operational effectiveness as of year-end.

C) Over compliance with various SEC requirements during the most recent fiscal year.

D) In conjunction with the Foreign Corrupt Practices Act.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

47

Internal auditors are an important part of the internal control structures of all types of organizations.

a. Describe the objectives of an internal auditing function.

b. Explain two ways that internal auditors may maintain independence with respect to the activities that they audit.

a. Describe the objectives of an internal auditing function.

b. Explain two ways that internal auditors may maintain independence with respect to the activities that they audit.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following best describes the scope of internal auditing as it has developed to date?

A) Internal auditing involves appraising the economy and efficiency with which resources are employed.

B) Internal auditing involves evaluating compliance with policies, plans, procedures, laws, and regulations.

C) Internal auditing has evolved to verifying the existence of assets and reviewing the means of safeguarding assets.

D) Internal auditing has evolved to more of an operational orientation from a financial orientation.

A) Internal auditing involves appraising the economy and efficiency with which resources are employed.

B) Internal auditing involves evaluating compliance with policies, plans, procedures, laws, and regulations.

C) Internal auditing has evolved to verifying the existence of assets and reviewing the means of safeguarding assets.

D) Internal auditing has evolved to more of an operational orientation from a financial orientation.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck