Deck 6: Accounting for Long-Term Operational Assets

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/150

Play

Full screen (f)

Deck 6: Accounting for Long-Term Operational Assets

1

Which of the following would be classified as a long-term operational asset?

A) Accounts Receivable.

B) Prepaid Insurance.

C) Office Equipment.

D) Inventory.

A) Accounts Receivable.

B) Prepaid Insurance.

C) Office Equipment.

D) Inventory.

C

2

Rodriquez Company paid $375,000 for a basket purchase that included office furniture, a building and land. An appraiser provided the following estimates of the market values of the assets if they had been purchased separately: Office furniture, $75,000; Building, $320,000; Land, $36,000. Based on this information the amount of cost that would be allocated to the office furniture is

A) $58,250.

B) $65,255.

C) $75,000.

D) $78,422.

A) $58,250.

B) $65,255.

C) $75,000.

D) $78,422.

B

3

On January 1, 2014, Rubens Company made a basket purchase including land, a building and equipment for $380,000. The appraised values of the assets are $20,000 for the land, $340,000 for the building and $40,000 for equipment. Rubens uses the double declining balance method of depreciation for the equipment which is estimated to have a useful life of five years and a salvage value of $5,000. For 2014, the depreciation expense on the equipment is:

A) $7,600

B) $13,200

C) $9,120

D) $15,200

A) $7,600

B) $13,200

C) $9,120

D) $15,200

D

4

Which one of the following would not be classified as an intangible operational asset?

A) Patent

B) Copyright

C) Iron Ore Deposit

D) Goodwill

A) Patent

B) Copyright

C) Iron Ore Deposit

D) Goodwill

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

5

Benton Corporation acquired real estate that contained land, building and equipment. The property cost Benton $825,000. Benton paid $175,000 in cash and issued a Note Payable for the remainder of the cost. An appraisal of the property reported the following values: Land, $85,000; Building, $625,000; and Equipment, $250,000.

What value will be recorded for the building?

A) $113,932

B) $406,901

C) $537,109

D) $625,000

What value will be recorded for the building?

A) $113,932

B) $406,901

C) $537,109

D) $625,000

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following would be classified as a tangible asset?

A) Copyright.

B) Goodwill.

C) Timber reserves.

D) Patent.

A) Copyright.

B) Goodwill.

C) Timber reserves.

D) Patent.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

7

Which method of depreciation is used by most U. S. companies for financial reporting purposes?

A) straight line

B) units of production

C) double declining balance

D) LIFO

A) straight line

B) units of production

C) double declining balance

D) LIFO

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following is not classified as Property, Plant and Equipment?

A) Computers

B) Goodwill

C) Machinery

D) Office furniture

A) Computers

B) Goodwill

C) Machinery

D) Office furniture

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

9

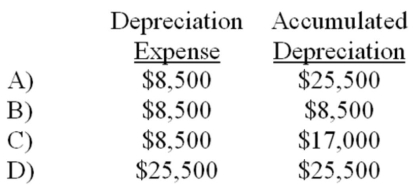

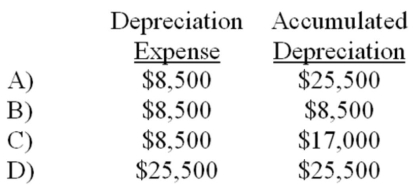

On January 1, 2014, Racine Company purchased equipment that cost $55,000 cash. The equipment had an expected useful life of six years and an estimated salvage value of $4,000. Assuming that Racine depreciates its assets under the straight-line method, the amount of depreciation expense appearing on the December 31, 2015 income statement and the amount of accumulated depreciation appearing on the December 31, 2015 balance sheet would be:

A) Choice A

B) Choice B

C) Choice C

D) Choice D

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

10

On January 1, 2014, Rowley Company purchased a truck that cost $22,000. The truck had an expected useful life of 5 years and a $4,000 salvage value. The amount of depreciation expense recognized in 2014 assuming that Rowley uses the double declining balance method is:

A) $4,320.

B) $5,280.

C) $7,200.

D) $8,800.

A) $4,320.

B) $5,280.

C) $7,200.

D) $8,800.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following is an intangible asset with an identifiable useful life?

A) copyrights

B) renewable franchises

C) goodwill

D) trademarks

A) copyrights

B) renewable franchises

C) goodwill

D) trademarks

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

12

Zabinski Co. paid $150,000 for a purchase that included land, building, and office furniture. An appraiser provided the following estimates of the market values of the assets if they had been purchased separately: Land, $20,000, Building, $150,000, and Office furniture, $30,000. Based on this information the cost that would be allocated to the land is

A) $17,500.

B) $20,000.

C) $25,000.

D) $15,000.

A) $17,500.

B) $20,000.

C) $25,000.

D) $15,000.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

13

On January 1, 2014, Rugh Company purchased equipment with a list price of $12,000 with a 2% cash discount. The equipment was delivered under terms of FOB destination and freight costs amounted to $400. A total of $1,000 was paid for installation and testing. During the first year, Rugh paid $300 for insurance on the equipment and another $250 for routine maintenance and repairs. Rugh uses the units-of-production method of depreciation. Useful life is estimated at 5 years or 300,000 units and estimated salvage value is $2,000. During 2014, the equipment produced 60,000 units. What is the amount of depreciation for 2014?

A) $2,152

B) $2,352

C) $2,552

D) $2,632

A) $2,152

B) $2,352

C) $2,552

D) $2,632

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following is considered an accelerated depreciation method?

A) straight line

B) units of production

C) LIFO

D) double declining balance

A) straight line

B) units of production

C) LIFO

D) double declining balance

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following terms is used to identify the process of expense recognition for buildings and equipment?

A) Amortization

B) Depletion

C) Depreciation

D) Revision

A) Amortization

B) Depletion

C) Depreciation

D) Revision

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

16

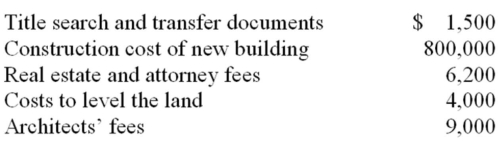

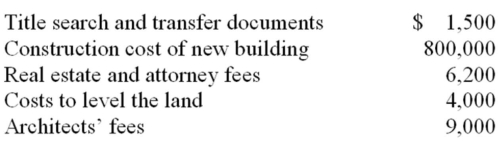

On January 6, 2014, the Eldorado Corporation purchased a tract of land for a factory site for $500,000. An existing building on the site was demolished and the new factory was completed on October 11, 2014. Additional cost data are shown below:  Which of the following correctly states the cost that should be recorded for (a) the land and (b) the new building?

Which of the following correctly states the cost that should be recorded for (a) the land and (b) the new building?

A) $501,500/$819,200

B) $511,700/$809,000

C) $520,700/$800,000

D) $555,700/$809,000

Which of the following correctly states the cost that should be recorded for (a) the land and (b) the new building?

Which of the following correctly states the cost that should be recorded for (a) the land and (b) the new building?A) $501,500/$819,200

B) $511,700/$809,000

C) $520,700/$800,000

D) $555,700/$809,000

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

17

On March 1, Zane Company purchased a new stamping machine with a list price of $24,000. The company paid cash for the machine; therefore, it was allowed a 3% discount. Other costs associated with the machine were: transportation costs, $1,270; sales tax paid, $1,680; installation costs, $450; routine maintenance during the first month of operation, $500. The cost recorded for the machine was:

A) $23,730.

B) $24,000.

C) $25,960.

D) $26,680.

A) $23,730.

B) $24,000.

C) $25,960.

D) $26,680.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following would not be classified as a tangible long-term asset?

A) Delivery trucks

B) Trademarks

C) Land

D) Oil and gas reserves

A) Delivery trucks

B) Trademarks

C) Land

D) Oil and gas reserves

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

19

Mobley Company purchased an asset with a list price of $35,000. Mobley received a 2% cash discount. The asset was delivered under terms FOB shipping point, and freight costs amounted to $700. Mobley paid $1,500 to have the asset installed. Insurance costs to protect the asset from fire and theft amounted to $400 for the first year of operations. Based on this information, the cost recorded in the asset account would be

A) $36,500.

B) $36,900.

C) $35,000.

D) $35,800.

A) $36,500.

B) $36,900.

C) $35,000.

D) $35,800.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

20

Benton Corporation acquired real estate that contained land, building and equipment. The property cost Benton $825,000. Benton paid $175,000 in cash and issued a Note Payable for the remainder of the cost. An appraisal of the property reported the following values: Land, $85,000; Building, $625,000; and Equipment, $250,000.

Assume that Benton uses the units-of-production method when depreciating its equipment. Benton estimates that the purchased equipment will produce 1,200,000 units over its 5 years useful life and has salvage value of $7,500. Benton produced 265,000 units with the equipment by the end of the first year of purchase. The equipment costs 214,841.89. What amount will Benton record for depreciation expense on the equipment in the first year?

A) $8,408

B) $41,469

C) $45,788

D) $82,938

Assume that Benton uses the units-of-production method when depreciating its equipment. Benton estimates that the purchased equipment will produce 1,200,000 units over its 5 years useful life and has salvage value of $7,500. Benton produced 265,000 units with the equipment by the end of the first year of purchase. The equipment costs 214,841.89. What amount will Benton record for depreciation expense on the equipment in the first year?

A) $8,408

B) $41,469

C) $45,788

D) $82,938

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

21

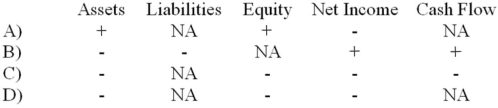

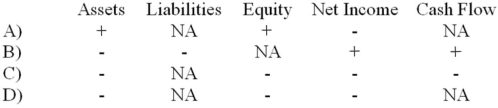

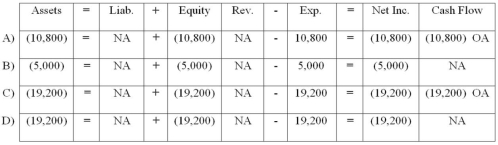

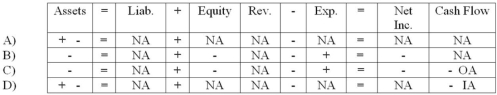

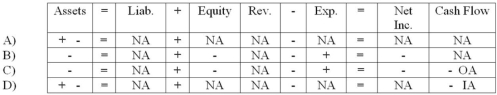

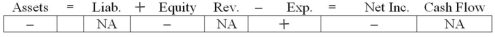

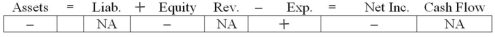

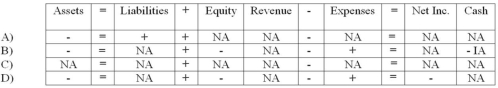

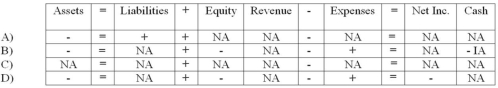

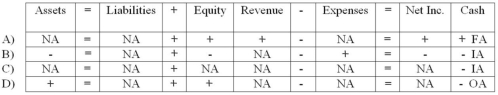

Clark Company paid cash to purchase equipment on January 1, 2014. Select the answer that shows how the recognition of depreciation expense in 2014 would affect assets, liabilities, equity, net income, and cash flow (+ means increase, - decrease, and NA not affected).

A) Choice A

B) Choice B

C) Choice C

D) Choice D

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

22

On January 1, 2014 Morgan Co. purchased a truck that cost $32,000. The truck had an expected useful life of 10 years and a $5,000 salvage value. The amount of depreciation expense recognized in 2015 assuming that Morgan uses the double declining-balance method is:

A) $4,320.

B) $5,120.

C) $5,400.

D) $6,400.

A) $4,320.

B) $5,120.

C) $5,400.

D) $6,400.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

23

On January 1, 2010, Desmet Company purchased office equipment that cost $15,000 cash. The equipment was delivered under terms FOB shipping point, and transportation cost was $1,000. The equipment had a five year useful life and a $1,200 expected salvage value.

Using straight line depreciation, determine the amount of depreciation expense and the amount of accumulated depreciation that would appear on the December 31, 2014 financial statements.

A) $2,960/$2,960.

B) $2,608/$7,824.

C) $2,960/$8,880.

D) $2,600/$7,800.

Using straight line depreciation, determine the amount of depreciation expense and the amount of accumulated depreciation that would appear on the December 31, 2014 financial statements.

A) $2,960/$2,960.

B) $2,608/$7,824.

C) $2,960/$8,880.

D) $2,600/$7,800.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

24

Reno Company purchased equipment on January 1, 2010 for $82,000. The equipment is estimated to have a 5-year life and a salvage value of $5,000. The company used the straight-line depreciation method.

At the beginning of 2015, Reno revised the expected life to eight years. The annual amount of depreciation expense for each of the remaining years would be:

A) $6,220.

B) $7,160.

C) $6,160.

D) $7,700.

At the beginning of 2015, Reno revised the expected life to eight years. The annual amount of depreciation expense for each of the remaining years would be:

A) $6,220.

B) $7,160.

C) $6,160.

D) $7,700.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

25

At the end of the current accounting period, Washta Co. recorded depreciation of $25,000 on its equipment. The effect of this entry on the company's balance sheet is to:

A) decrease assets and increase liabilities.

B) decrease owners' equity and increase liabilities.

C) decrease assets and increase owners' equity.

D) decrease owners' equity and decrease assets.

A) decrease assets and increase liabilities.

B) decrease owners' equity and increase liabilities.

C) decrease assets and increase owners' equity.

D) decrease owners' equity and decrease assets.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

26

On January 1, 2010, Desmet Company purchased office equipment that cost $15,000 cash. The equipment was delivered under terms FOB shipping point, and transportation cost was $1,000. The equipment had a five year useful life and a $1,200 expected salvage value.

If Desmet Company had used the double-declining balance depreciation method, the depreciation expense appearing on the 2014 income statement would be:

A) $2,131.

B) $2,304.

C) $5,920.

D) $6,420.

If Desmet Company had used the double-declining balance depreciation method, the depreciation expense appearing on the 2014 income statement would be:

A) $2,131.

B) $2,304.

C) $5,920.

D) $6,420.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

27

Reno Company purchased equipment on January 1, 2010 for $82,000. The equipment is estimated to have a 5-year life and a salvage value of $5,000. The company used the straight-line depreciation method.

If the original expected life remained the same (i.e., 5-years), but at the beginning of 2015 the salvage value were revised to $6,000, the annual depreciation expense for each of the remaining years would be:

A) $14,900.

B) $9,333.

C) $17,900.

D) $14,675.

If the original expected life remained the same (i.e., 5-years), but at the beginning of 2015 the salvage value were revised to $6,000, the annual depreciation expense for each of the remaining years would be:

A) $14,900.

B) $9,333.

C) $17,900.

D) $14,675.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

28

Rouse Company owned an asset that had cost $32,000. The company sold the asset on January 1, 2014 for $8,000. Accumulated depreciation on the day of sale amounted to $26,000. Based on this information, the sale would result in:

A) an $8,000 increase in total assets.

B) a $6,000 cash inflow in the financing activities section of the cash flow statement.

C) a $2,000 decrease in total assets.

D) an $8,000 cash inflow in the investing activities section of the cash flow statement.

A) an $8,000 increase in total assets.

B) a $6,000 cash inflow in the financing activities section of the cash flow statement.

C) a $2,000 decrease in total assets.

D) an $8,000 cash inflow in the investing activities section of the cash flow statement.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

29

Laurens Company purchased equipment that cost $10,000 on January 1, 2014. The asset had an expected useful life of five years and an estimated salvage value of $2,000. Laurens uses the straight-line method for the recognition of depreciation expense. At the beginning of the fourth year of usage, the company revised its estimated salvage value to $1,000. Based on this information, the amount of depreciation expense to be recognized at the end of 2015 is:

A) $4,200.

B) $2,100.

C) $1,600.

D) $1,000.

A) $4,200.

B) $2,100.

C) $1,600.

D) $1,000.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

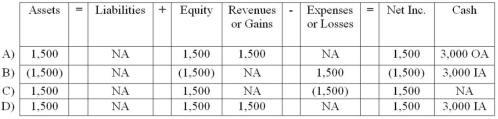

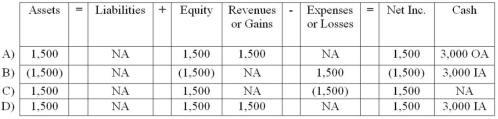

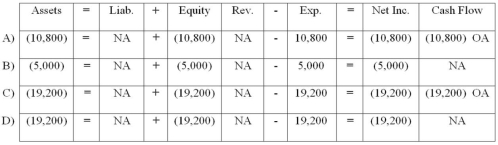

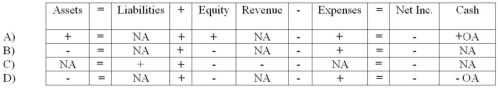

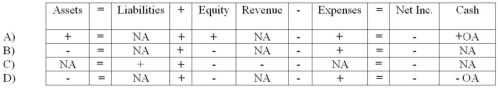

30

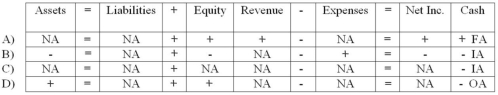

On September 10, 2014, Barden Company sold a piece of equipment for $3,000. The equipment had an original cost of $17,000 and accumulated depreciation of $15,500 at the time of the sale. Which of the following correctly shows the effect of the sale on the 2014 financial statements?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

31

On January 1, 2014, Gray Company purchased a new company car for $36,000. The car has an expected salvage value of $6,000. The company estimates that the car will be driven 100,000 miles over its life and uses units of production to determine depreciation expense. The car was driven 20,000 miles in 2014. At the beginning of 2015 the company revised the estimated total life to 120,000 miles. If 26,000 miles were driven in 2015, the amount of depreciation expense for the year would be

A) $7,800.

B) $6,500.

C) $6,240.

D) $6,040.

A) $7,800.

B) $6,500.

C) $6,240.

D) $6,040.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

32

On January 1, 2010, Desmet Company purchased office equipment that cost $15,000 cash. The equipment was delivered under terms FOB shipping point, and transportation cost was $1,000. The equipment had a five year useful life and a $1,200 expected salvage value.

Assume that Desmet Company sold the office equipment on December 31, 2014 for $6,000, the amount of net income or (net loss) appearing on the December 31, 2014 income statement would be

A) ($1,120).

B) $2,960.

C) ($2,040).

D) $3,880.

Assume that Desmet Company sold the office equipment on December 31, 2014 for $6,000, the amount of net income or (net loss) appearing on the December 31, 2014 income statement would be

A) ($1,120).

B) $2,960.

C) ($2,040).

D) $3,880.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

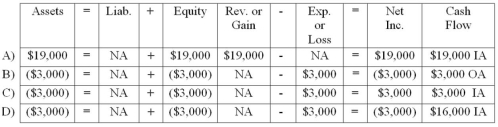

33

Remsen, Inc. purchased equipment that cost $48,000. The equipment had a useful life of 5 years and a $5,000 salvage value. Remsen used the double-declining-balance method to depreciate its assets. Which of the following choices accurately reflects how the recognition of the first year's depreciation would affect the company's financial statements?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

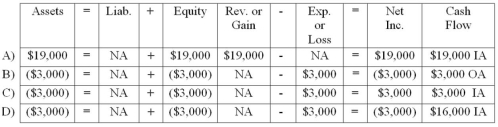

34

An asset with a book value of $19,000 is sold for $16,000. Which of the following answers would accurately represent the effects of the sale on the financial statements? (Note: The answers show the net effect on the total amount under each category. For example, if cash increased by $100 and Accounts Receivable decreased by $70, a net $30 increase would be shown in the assets column.)

A) Choice A

B) Choice B

C) Choice C

D) Choice D

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

35

On January 1, 2014, Santa Fe Company purchased a truck that cost $34,000. The truck had an expected useful life of 5 years and a $4,000 salvage value. Based on this information alone:

A) The amount of depreciation expense recognized in 2015 would be greater if Santa Fe depreciates the asset under the straight-line method than if the double declining balance method is used.

B) The total amount of depreciation expense recognized over the five year useful life will be greater under the double declining balance method than the straight-line method.

C) At the end of 2015, the amount in accumulated depreciation account will be less if the double declining balance method is used than it would be if the straight-line method is used.

D) The amount of depreciation expense recognized in 2015 would be greater if Santa Fe depreciates the asset under the straight-line method than if the double declining balance method is used and at the end of 2015, the amount in accumulated depreciation account will be less if the double declining balance method is used than it would be if the straight-line method is used.

A) The amount of depreciation expense recognized in 2015 would be greater if Santa Fe depreciates the asset under the straight-line method than if the double declining balance method is used.

B) The total amount of depreciation expense recognized over the five year useful life will be greater under the double declining balance method than the straight-line method.

C) At the end of 2015, the amount in accumulated depreciation account will be less if the double declining balance method is used than it would be if the straight-line method is used.

D) The amount of depreciation expense recognized in 2015 would be greater if Santa Fe depreciates the asset under the straight-line method than if the double declining balance method is used and at the end of 2015, the amount in accumulated depreciation account will be less if the double declining balance method is used than it would be if the straight-line method is used.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

36

Sweetwater Company paid cash to prolong the useful life of one of its assets. Which of the following choices accurately reflects how this event would affect Sweetwater's financial statements?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

37

Philips Corporation purchased a truck that cost $26,000. The company expected to drive the truck 100,000 miles. The truck had an estimated salvage value of $2,000. If the truck is driven 36,000 miles in the current accounting period, which of the following amounts should be recognized as depreciation expense?

A) $8,280.

B) $9,360.

C) $8,000.

D) $8,640.

A) $8,280.

B) $9,360.

C) $8,000.

D) $8,640.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following statements is true with regard to depreciation expense?

A) A company should use the depreciation method that best matches expense recognition with the use of the asset.

B) A company using straight line will show a smaller book value for assets than if the same company uses double declining balance.

C) Choosing double declining balance over straight line will produce a greater total depreciation expense over the asset's life.

D) Different companies in the same industry will always depreciate similar assets by the same methods.

A) A company should use the depreciation method that best matches expense recognition with the use of the asset.

B) A company using straight line will show a smaller book value for assets than if the same company uses double declining balance.

C) Choosing double declining balance over straight line will produce a greater total depreciation expense over the asset's life.

D) Different companies in the same industry will always depreciate similar assets by the same methods.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

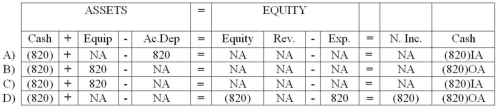

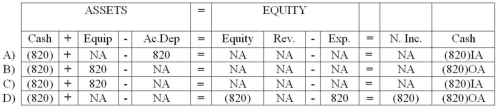

39

On January 1, 2014, Snyder Company spent $820 on an asset (a machine) to improve its quality. The machine had been purchased on January 1, 2010 for $4,200 and had an estimated salvage value of $600 and a useful life of five years. Which of the following correctly shows the effects of the 2014 expenditure on the financial statements?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

40

Flynn Company experienced an accounting event that affected its financial statements as indicated below:  Which of the following accounting events could have caused these effects on Flynn's statements?

Which of the following accounting events could have caused these effects on Flynn's statements?

A) Recognized depletion expense on a copper mine.

B) Recognized depreciation expense under the double declining balance method.

C) Amortized patent cost under the straight-line method.

D) All of these.

Which of the following accounting events could have caused these effects on Flynn's statements?

Which of the following accounting events could have caused these effects on Flynn's statements?A) Recognized depletion expense on a copper mine.

B) Recognized depreciation expense under the double declining balance method.

C) Amortized patent cost under the straight-line method.

D) All of these.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

41

The recognition of depletion expense acts to

A) decrease assets and equity and increase cash flow from operating expenses.

B) increase cash flow from operating activities and does not affect the amount of total assets.

C) increase assets, equity, and cash flow from operating activities.

D) decrease assets and equity, with no effect on cash flow.

A) decrease assets and equity and increase cash flow from operating expenses.

B) increase cash flow from operating activities and does not affect the amount of total assets.

C) increase assets, equity, and cash flow from operating activities.

D) decrease assets and equity, with no effect on cash flow.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

42

What term is used to describe the situation where the value of an intangible asset may be significantly diminished?

A) Amortization

B) Depreciation

C) Depletion

D) Impairment

A) Amortization

B) Depreciation

C) Depletion

D) Impairment

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

43

On January 1, 2014, Ziskin Company spent $3,000 on an asset (equipment) to improve its quality. The asset had been purchased on January 1, 2009 for $14,000. The asset had a $2,000 salvage value and a 6-year life. Ziskin uses straight-line depreciation. What would be the amount of depreciation expense for 2014?

A) $4,500.

B) $3,000.

C) $6,000.

D) $7,200.

A) $4,500.

B) $3,000.

C) $6,000.

D) $7,200.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

44

The Harlow Company purchased the Hampton Company for $600,000 cash. The fair market value of Hampton's assets was $520,000 and the company had liabilities of $30,000. What amount of goodwill should Harlow record related to the purchase of Hampton Company?

A) $110,000

B) $50,000

C) $80,000

D) $0

A) $110,000

B) $50,000

C) $80,000

D) $0

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

45

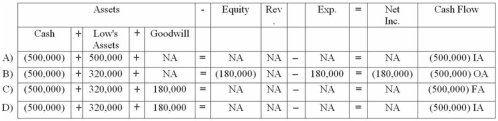

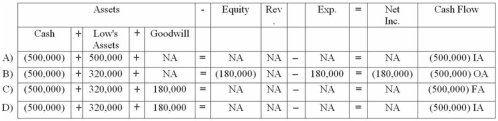

Evenbeck Company purchased Ferguson Company for $500,000 cash. The fair market value of Ferguson's assets was $320,000 and the company had no liabilities. Which of the following choices would reflect the purchase on Evenbeck's financial statements?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following terms is applied to long-term assets that have no physical substance and provide rights, privileges and special opportunities to businesses?

A) Current Assets

B) Intangible Assets

C) Natural Resources

D) Property, Plant and Equipment

A) Current Assets

B) Intangible Assets

C) Natural Resources

D) Property, Plant and Equipment

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

47

Parker Company purchased Eynon Corporation in 2009, recording $80,000 in goodwill at the time of purchase. In January, 2014, Parker decides that the value of the goodwill has declined substantially due to local economic and demographic changes. Parker estimates that the true value of the goodwill should only be $30,000. Which of the following shows the effect of this situation on the financial statements?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

48

On January 1, 2010, Rusu Company purchased an asset that had cost $26,000. The asset had a 6-year useful life and an estimated salvage value of $2,000. Rusu depreciates its assets on the straight-line basis. On January 1, 2014 the company spent $12,000 to improve the quality of the asset. Based on this information the recognition of depreciation expense in 2014 would act to:

A) increase total assets by $7,000.

B) reduce total equity by $7,000.

C) reduce total assets by $12,000.

D) increase total equity by $10,000.

A) increase total assets by $7,000.

B) reduce total equity by $7,000.

C) reduce total assets by $12,000.

D) increase total equity by $10,000.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

49

On January 1, 2014, the Falbo Company purchased a copyright for $12,000. Falbo estimates the remaining useful life of the copyright to be 6 years.

Which of the following correctly shows the effect of the first year's amortization of Falbo's copyright?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Which of the following correctly shows the effect of the first year's amortization of Falbo's copyright?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

50

On January 1, 2014, Stetson Company paid $160,000 to obtain a patent. Stetson expected to use the patent for 5 years before it became technologically obsolete. Based on this information, the amount of amortization expense on the December 31, 2014 income statement and the book value of the patent on the December 31, 2014 balance sheet would be:

A) $32,000/$64,000.

B) $32,000/$96,000.

C) $64,000/$64,000.

D) $64,000/$96,000.

A) $32,000/$64,000.

B) $32,000/$96,000.

C) $64,000/$64,000.

D) $64,000/$96,000.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following assets is not considered to have an indefinite useful life?

A) copyright

B) goodwill

C) renewable franchise

D) trademark

A) copyright

B) goodwill

C) renewable franchise

D) trademark

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

52

On January 1, 2014, Ziskin Company spent $3,000 on an asset to improve its quality. The asset had been purchased on January 1, 2009 for $14,000. The asset had a $2,000 salvage value and a 6-year life. Ziskin uses straight-line depreciation. What would be the book value of the asset on January 1, 2015?

A) $11,000.

B) $8,000.

C) $6,000.

D) $7,200.

A) $11,000.

B) $8,000.

C) $6,000.

D) $7,200.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

53

Zabrinski Company purchased oil rights on July 1, 2014 for $3,200,000. If 200,000 barrels of oil are expected to be extracted over the asset's life and 30,000 barrels are extracted and sold in 2014, the amount of depletion expense recorded on December 31, 2014 would be:

A) $480,000.

B) $540,000.

C) $320,000.

D) $200,000.

A) $480,000.

B) $540,000.

C) $320,000.

D) $200,000.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following would most likely not be depreciated or amortized using the straight-line method?

A) Copyrights.

B) Franchise.

C) Timber reserves.

D) Trademark.

A) Copyrights.

B) Franchise.

C) Timber reserves.

D) Trademark.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

55

On January 1, 2014, the Falbo Company purchased a copyright for $12,000. Falbo estimates the remaining useful life of the copyright to be 6 years.

Which of the following correctly shows the effect of Falbo's purchase of the copyright on its financial statements?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Which of the following correctly shows the effect of Falbo's purchase of the copyright on its financial statements?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

56

Yu Company purchased a producing oil well for $5,000,000. The well was expected to produce 500,000 barrels of oil over its useful life. During 2014 the company extracted 120,000 barrels of oil. The oil was sold for $40 per barrel. Assuming that the company incurred $1,440,000 in operating expenses other than depletion during 2014, how much net income would Yu report in 2014?

A) $2,160,000

B) $480,000

C) $3,360,000

D) $3,560,000

A) $2,160,000

B) $480,000

C) $3,360,000

D) $3,560,000

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

57

The fair value of the assets and liabilities for Zane's Restaurant were $450,000 and $160,000, respectively. If Reiner Company pays $325,000 cash for the restaurant and assumes its existing liabilities, what amount of goodwill would Reiner record?

A) $25,000.

B) $35,000.

C) $55,000.

D) $125,000.

A) $25,000.

B) $35,000.

C) $55,000.

D) $125,000.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following terms is used to identify the expense recognition for intangible assets?

A) amortization.

B) depletion.

C) depreciation.

D) allocation.

A) amortization.

B) depletion.

C) depreciation.

D) allocation.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

59

On April 1, 2014, Marlin Company purchased a producing oil well at a cash cost of $3,500,000. It is estimated that 500,000 barrels of oil can be produced over the remaining life of the well. By December 31, 2014, 25,000 barrels of oil had been produced and sold. The amount of depletion expense on this well for 2014 would be:

A) $17,500.

B) $200,000.

C) $175,000.

D) $12,000.

A) $17,500.

B) $200,000.

C) $175,000.

D) $12,000.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following assets is considered to have an indefinite useful life?

A) goodwill

B) copyright

C) patent

D) all of these

A) goodwill

B) copyright

C) patent

D) all of these

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

61

When a building is purchased simultaneously with land, the purchase price must be allocated between the building and the land.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

62

Generally accepted accounting principles require that, when the estimated useful life of a long-term asset is changed, previously-issued financial statements are not revised.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

63

A copyright is an intangible asset with an indefinite useful life.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

64

Title search and document costs incurred to purchase a building are expensed in the period the building is acquired.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

65

A trademark is an intangible asset with an indefinite useful life.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

66

Double-declining-balance depreciation produces more depreciation in the later years of an asset's life than does the straight-line method.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

67

Filemyr Corporation, a U.S. business, is a direct competitor of the Hyakawa Company, a Japanese firm. The two firms not only compete for customers, but also for investment capital. In 2014, each company spent about $3,000,000 U.S. dollars or the equivalent on research and development. US GAAP requires the entire amount to be expensed, while Japan requires its businesses to capitalize R&D and expense it over its useful life. Assuming the treatment of R&D is the only difference between the two firms, which of the following is correct?

A) Filemyr will have higher total assets than Hyakawa in 2014.

B) Hyakawa will have a lower net income for 2014.

C) Filemyr will have a higher debt-to-assets ratio than Hyakawa in 2014.

D) There will be no differences between the two companies' financial statements for 2014.

A) Filemyr will have higher total assets than Hyakawa in 2014.

B) Hyakawa will have a lower net income for 2014.

C) Filemyr will have a higher debt-to-assets ratio than Hyakawa in 2014.

D) There will be no differences between the two companies' financial statements for 2014.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following should be the main determinant in the selection of the depreciation method for long-term operational assets?

A) The method that best matches the pattern of asset use.

B) The method that is most convenient to compute.

C) The method that provides the greatest return to the stockholders.

D) The method that provides the best tax advantage.

A) The method that best matches the pattern of asset use.

B) The method that is most convenient to compute.

C) The method that provides the greatest return to the stockholders.

D) The method that provides the best tax advantage.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

69

Accumulated Depreciation is a temporary account that is closed each year.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

70

Which of the following statements is correct regarding accounting treatment of goodwill?

A) Goodwill is recorded as an asset and then amortized over a period of 5 years.

B) Goodwill is recorded as an asset. It is not amortized but must be tested for impairment each year.

C) Goodwill is recorded as an asset and amortized over 40 years unless its value decreases.

D) Goodwill is expensed immediately in the year of purchase.

A) Goodwill is recorded as an asset and then amortized over a period of 5 years.

B) Goodwill is recorded as an asset. It is not amortized but must be tested for impairment each year.

C) Goodwill is recorded as an asset and amortized over 40 years unless its value decreases.

D) Goodwill is expensed immediately in the year of purchase.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

71

Gains and losses are reported as non-operating items on the income statement.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

72

A substantial amount spent to improve the quality or extend the life of a long-term asset is a revenue expenditure.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

73

Which of the following measurements would not be affected by the choice of depreciation methods?

A) debt to assets ratio

B) total assets

C) the ratio of current assets to current liabilities

D) return on equity ratio

A) debt to assets ratio

B) total assets

C) the ratio of current assets to current liabilities

D) return on equity ratio

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

74

Recognizing depreciation expense on equipment or a building is an asset use transaction.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

75

With an accelerated depreciation method, an asset can be depreciated below its salvage value.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

76

Different depreciation methods affect the total amount of depreciation that can be taken over an asset's useful life.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

77

The use of estimates and revision of estimates are uncommon in financial reporting.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

78

Which of the following industries would most likely have the highest ratio of sales revenue to property, plant and equipment?

A) Airline

B) Consumer product manufacturing company

C) Electric utility

D) Stock brokerage

A) Airline

B) Consumer product manufacturing company

C) Electric utility

D) Stock brokerage

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

79

The depreciable cost of a long-term asset is the difference between its original cost and its salvage value.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

80

When several long-term assets are purchased in a single transaction, the purchase price is allocated among the assets based on their relative fair values.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck