Deck 4: Internal Controls, Accounting for Cash, and Ethics

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

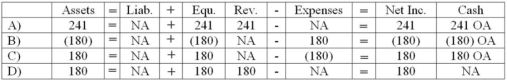

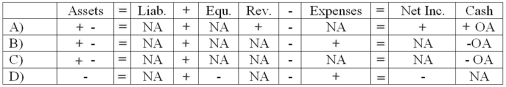

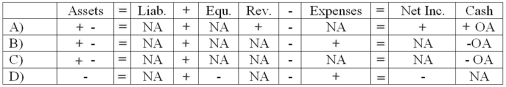

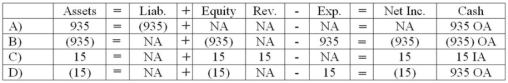

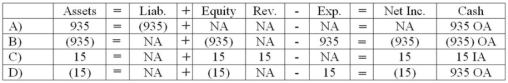

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

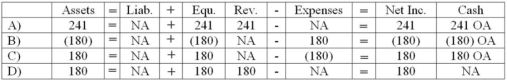

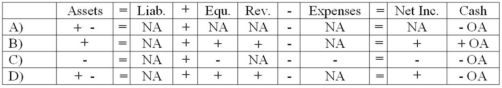

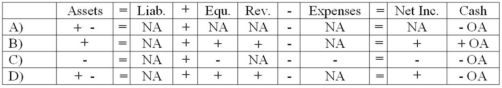

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/191

Play

Full screen (f)

Deck 4: Internal Controls, Accounting for Cash, and Ethics

1

Which of the following is not a generally recognized internal control procedure?

A) Establishment of clear lines of authority.

B) The minimization of labor cost.

C) Requiring regular vacations for employees.

D) Having employees covered by a fidelity bond.

A) Establishment of clear lines of authority.

B) The minimization of labor cost.

C) Requiring regular vacations for employees.

D) Having employees covered by a fidelity bond.

B

2

Which of the following is not a procedure for control of cash payments?

A) Checks should be properly authorized with approval signatures.

B) The business should provide written receipts to all cash customers.

C) All checks should be prenumbered.

D) Spoiled checks should be voided and retained.

A) Checks should be properly authorized with approval signatures.

B) The business should provide written receipts to all cash customers.

C) All checks should be prenumbered.

D) Spoiled checks should be voided and retained.

B

3

Which of the following is not considered an accounting control?

A) Performance evaluations of managers.

B) Requiring employees to take vacations or rotate job duties.

C) Bonding of employees.

D) Use of prenumbered documents.

A) Performance evaluations of managers.

B) Requiring employees to take vacations or rotate job duties.

C) Bonding of employees.

D) Use of prenumbered documents.

A

4

Which of the following is not a procedure for the control of cash receipts?

A) Immediate preparation of records of all cash receipts.

B) Giving customers written receipts for all monies paid.

C) Using prenumbered checks.

D) Depositing cash in the bank frequently.

A) Immediate preparation of records of all cash receipts.

B) Giving customers written receipts for all monies paid.

C) Using prenumbered checks.

D) Depositing cash in the bank frequently.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

5

An effective system of internal control is designed to detect the following except for:

A) collusion

B) fraud

C) theft

D) irregularities

A) collusion

B) fraud

C) theft

D) irregularities

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

6

Hyperion Company has established internal control policies and procedures in order to achieve the following objectives:

(1) Safeguard the company's assets

(2) Assure that the accounting records contain reliable information

(3) Evaluate management performance effectively

(4) Assure that employees comply with company policies

Which of these objectives are primarily achieved by accounting controls?

A) Objectives 1 and 2

B) Objectives 2 and 3

C) Objectives 3 and 4

D) Objectives 1 and 4

(1) Safeguard the company's assets

(2) Assure that the accounting records contain reliable information

(3) Evaluate management performance effectively

(4) Assure that employees comply with company policies

Which of these objectives are primarily achieved by accounting controls?

A) Objectives 1 and 2

B) Objectives 2 and 3

C) Objectives 3 and 4

D) Objectives 1 and 4

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following is not a reason why a business needs strong internal controls over cash?

A) A small volume of high-denomination currency represents a significant amount of value.

B) Ownership of cash is difficult to prove.

C) Cash has universal appeal.

D) Money is the common unit of measurement in business.

A) A small volume of high-denomination currency represents a significant amount of value.

B) Ownership of cash is difficult to prove.

C) Cash has universal appeal.

D) Money is the common unit of measurement in business.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

8

The following are strong control measures over cash receipts except

A) A record of all cash collections should be prepared immediately upon receipt.

B) Employees who receive cash should give customers a written receipt.

C) There should be a significant amount of cash on hand in order to avoid writing checks.

D) Cash receipts should be deposited in a bank as soon as possible.

A) A record of all cash collections should be prepared immediately upon receipt.

B) Employees who receive cash should give customers a written receipt.

C) There should be a significant amount of cash on hand in order to avoid writing checks.

D) Cash receipts should be deposited in a bank as soon as possible.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following statements concerning internal controls is true?

A) Internal administrative controls are designed to limit the amount of funds spent on investments.

B) The control procedure, separation of duties, prohibits the employment of a husband and wife or other closely related parties within the same company.

C) Internal accounting controls are limited to the policies and procedures used to protect the company from embezzlement.

D) A strong internal control system provides reasonable assurance that the objectives of a company will be accomplished.

A) Internal administrative controls are designed to limit the amount of funds spent on investments.

B) The control procedure, separation of duties, prohibits the employment of a husband and wife or other closely related parties within the same company.

C) Internal accounting controls are limited to the policies and procedures used to protect the company from embezzlement.

D) A strong internal control system provides reasonable assurance that the objectives of a company will be accomplished.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following is not a reason why a business needs strong internal controls over cash?

A) A small volume of high-denomination currency represents a significant amount of value.

B) Ownership of cash is difficult to prove.

C) Cash has universal appeal.

D) Money is the common unit of measurement in business.

A) A small volume of high-denomination currency represents a significant amount of value.

B) Ownership of cash is difficult to prove.

C) Cash has universal appeal.

D) Money is the common unit of measurement in business.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following is an internal control procedure used to safeguard a company's assets?

A) Timely deposits of cash receipts into a checking account.

B) Separation of duties.

C) Reconciliation of the bank statement.

D) All of these.

A) Timely deposits of cash receipts into a checking account.

B) Separation of duties.

C) Reconciliation of the bank statement.

D) All of these.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

12

A business's administrative controls are concerned with

A) Safeguarding a company's assets.

B) Assessing the extent of compliance with laws and company policies.

C) Ensuring the company has enough cash to operate effectively.

D) Ensuring the reliability of the accounting records.

A) Safeguarding a company's assets.

B) Assessing the extent of compliance with laws and company policies.

C) Ensuring the company has enough cash to operate effectively.

D) Ensuring the reliability of the accounting records.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following is not a feature of an internal control system?

A) Separation of duties so that fraud or theft requires collusion

B) Establishing clear lines of authority and responsibility

C) Using unnumbered receipts and purchase orders

D) Implementing physical controls such as locking cash in a safe

A) Separation of duties so that fraud or theft requires collusion

B) Establishing clear lines of authority and responsibility

C) Using unnumbered receipts and purchase orders

D) Implementing physical controls such as locking cash in a safe

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

14

Accounting controls are designed to:

A) eliminate collusion

B) evaluate performance for annual merit increases

C) ensure low employee turnover

D) safeguard company assets and ensure reliable accounting records

A) eliminate collusion

B) evaluate performance for annual merit increases

C) ensure low employee turnover

D) safeguard company assets and ensure reliable accounting records

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following is not one of the purposes of an internal control system?

A) Safeguarding the company's assets

B) Ensuring that the company is using the most effective marketing plan

C) The assessment of the degree of compliance with company policies and public laws

D) The evaluation of performance

A) Safeguarding the company's assets

B) Ensuring that the company is using the most effective marketing plan

C) The assessment of the degree of compliance with company policies and public laws

D) The evaluation of performance

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

16

The following are features of an internal control system except

A) Bonding employees to recover losses through insurance

B) Establishing proper procedures for processing transactions

C) Mandatory retirement at the age of 65

D) Hiring and training competent employees

A) Bonding employees to recover losses through insurance

B) Establishing proper procedures for processing transactions

C) Mandatory retirement at the age of 65

D) Hiring and training competent employees

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

17

To have a strong internal control system, a business must have good administrative controls. Administrative controls include:

A) the reconciliation of the bank statement.

B) the accuracy of the recording procedures.

C) assessing compliance with company policies.

D) maintenance of accurate inventory records.

A) the reconciliation of the bank statement.

B) the accuracy of the recording procedures.

C) assessing compliance with company policies.

D) maintenance of accurate inventory records.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

18

The following are strong internal control measures over cash disbursements except

A) All checks should be prenumbered.

B) Unused checks should be locked up.

C) The person approving the payment should also sign the check.

D) The payment must be recorded on the books by someone other than the check signer.

A) All checks should be prenumbered.

B) Unused checks should be locked up.

C) The person approving the payment should also sign the check.

D) The payment must be recorded on the books by someone other than the check signer.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following statements accurately describes a fidelity bond?

A) Insurance that the company buys to protect itself from loss due to employee dishonesty.

B) Proper procedures for processing accounting transactions.

C) Procedures to provide reasonable assurance that the objectives of a company are accomplished.

D) Guidelines that limit the actions and authority of different levels of management.

A) Insurance that the company buys to protect itself from loss due to employee dishonesty.

B) Proper procedures for processing accounting transactions.

C) Procedures to provide reasonable assurance that the objectives of a company are accomplished.

D) Guidelines that limit the actions and authority of different levels of management.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

20

Effective internal controls for cash include:

A) making cash payments by prenumbered check.

B) depositing cash in the bank on a timely basis.

C) giving written cash receipts to customers as evidence of payment.

D) all of these.

A) making cash payments by prenumbered check.

B) depositing cash in the bank on a timely basis.

C) giving written cash receipts to customers as evidence of payment.

D) all of these.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

21

The Sarbanes-Oxley Act

A) was prompted by corporate bankruptcies and audit failures.

B) limits an auditor's ability to provide non-audit services to a client.

C) clarifies the responsibility of a company's management for its financial statements.

D) all of these.

A) was prompted by corporate bankruptcies and audit failures.

B) limits an auditor's ability to provide non-audit services to a client.

C) clarifies the responsibility of a company's management for its financial statements.

D) all of these.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following statements about materiality is true.

A) Any amount above $100,000 should be considered to be material.

B) Any amount above $500,000 should be considered to be material.

C) Any amount above $1,000,000 should be considered to be material.

D) The definition of materiality depends on the size of a company.

A) Any amount above $100,000 should be considered to be material.

B) Any amount above $500,000 should be considered to be material.

C) Any amount above $1,000,000 should be considered to be material.

D) The definition of materiality depends on the size of a company.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

23

An element that is often present when fraud occurs is

A) The availability of an opportunity.

B) The existence of some form of pressure.

C) The ability to rationalize.

D) All of these.

A) The availability of an opportunity.

B) The existence of some form of pressure.

C) The ability to rationalize.

D) All of these.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

24

To reduce the likelihood of conflicts of interest, SOX prohibits registered public accounting firms from providing the following contemporaneously with the audit:

A) internal audit outsourcing

B) financial-information-system design and implementation

C) expert services

D) all of these.

A) internal audit outsourcing

B) financial-information-system design and implementation

C) expert services

D) all of these.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

25

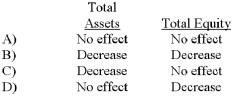

Wren Company accepted a check from Jay Company as payment for services rendered. Wren's bank statement revealed that the Jay check was an NSF check. What effect will the entry to record the NSF check have on the accounting equation of Wren Company?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

26

The most negative opinion that an auditor can express is the

A) Unqualified opinion

B) Qualified opinion

C) Adverse opinion

D) Disclaimer

A) Unqualified opinion

B) Qualified opinion

C) Adverse opinion

D) Disclaimer

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

27

How is a business's certified check treated in doing the business's bank reconciliation?

A) It is added to the bank balance.

B) It is subtracted from the book balance.

C) It is subtracted from the bank balance.

D) It is not included in doing the bank reconciliation.

A) It is added to the bank balance.

B) It is subtracted from the book balance.

C) It is subtracted from the bank balance.

D) It is not included in doing the bank reconciliation.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

28

In a company's bank reconciliation, an outstanding check is a check that:

A) is guaranteed for payment by the bank.

B) has been issued by the company but has not been presented to the bank for payment.

C) has been presented to the bank for payment but has not been reported on the bank statement.

D) has been written for an amount that is greater than the balance in the account holder's bank account.

A) is guaranteed for payment by the bank.

B) has been issued by the company but has not been presented to the bank for payment.

C) has been presented to the bank for payment but has not been reported on the bank statement.

D) has been written for an amount that is greater than the balance in the account holder's bank account.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

29

A financial statement audit is

A) a detailed examination of a company's financial statements

B) tests the reliability of the accounting system used to produce the financial statements

C) conducted by an independent auditor

D) all of the above

A) a detailed examination of a company's financial statements

B) tests the reliability of the accounting system used to produce the financial statements

C) conducted by an independent auditor

D) all of the above

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

30

A bank deposit made on June 30 did not appear on the June bank statement. In doing the June bank reconciliation, this deposit in transit should be

A) subtracted from the unadjusted book balance.

B) added to the unadjusted bank balance.

C) subtracted from the unadjusted bank balance.

D) added to the unadjusted book balance.

A) subtracted from the unadjusted book balance.

B) added to the unadjusted bank balance.

C) subtracted from the unadjusted bank balance.

D) added to the unadjusted book balance.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

31

The most effective way to reduce opportunities for ethical or criminal misconduct is:

A) to obtain fidelity bonds for all employees

B) to perform random physical counts frequently

C) to implement an effective system of internal controls

D) to perform extensive background checks before hiring employees

A) to obtain fidelity bonds for all employees

B) to perform random physical counts frequently

C) to implement an effective system of internal controls

D) to perform extensive background checks before hiring employees

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

32

Check no. 147 for $200 was outstanding as of September 30. In performing the September bank reconciliation, this outstanding check should be

A) subtracted from the unadjusted book balance.

B) subtracted from the unadjusted bank balance.

C) added to the unadjusted bank balance.

D) added to the unadjusted book balance.

A) subtracted from the unadjusted book balance.

B) subtracted from the unadjusted bank balance.

C) added to the unadjusted bank balance.

D) added to the unadjusted book balance.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

33

Independent auditors are

A) responsible for discovering fraud

B) responsible for providing reasonable assurance that financial statements are free of misstatements

C) responsible for providing absolute assurance that financial statements are free of errors

D) none of the above

A) responsible for discovering fraud

B) responsible for providing reasonable assurance that financial statements are free of misstatements

C) responsible for providing absolute assurance that financial statements are free of errors

D) none of the above

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

34

Osborn Company's unadjusted book balance at June 30, 2014 is $7,800. The company's bank statement reveals bank service charges of $45. Two credit memos are included in the bank statement: one for $900 which represents a collection of an account receivable that the bank made for Osborn and one for $10 which represents the amount of interest that Osborn had earned on its interest-bearing checking account in June. Based on this information, Osborn's true cash balance is:

A) $7,800.

B) $8,705.

C) $8,665.

D) $8,795.

A) $7,800.

B) $8,705.

C) $8,665.

D) $8,795.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following situations provides the most likely indication that fraud exists?

A) Exelon Corporation's earnings per share this quarter is 10% higher than last quarter.

B) Quantum Corporation's sales this year is 20% higher than last year's sales.

C) Papillon Product Inc.'s profits have increased each for the last 5 years, but its cash reserves have decreased steadily in the same time period.

D) Bobadilla Bookstores opened 10 new stores during the most recent quarter.

A) Exelon Corporation's earnings per share this quarter is 10% higher than last quarter.

B) Quantum Corporation's sales this year is 20% higher than last year's sales.

C) Papillon Product Inc.'s profits have increased each for the last 5 years, but its cash reserves have decreased steadily in the same time period.

D) Bobadilla Bookstores opened 10 new stores during the most recent quarter.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

36

An unqualified audit opinion:

A) Should be ignored by investors because the person issuing the opinion does not have the qualifications required to analyze financial statements.

B) Is the most favorable opinion auditors can express.

C) Is issued to alert investors to potential financial problems.

D) Is not issued by auditors who hold CPA certification.

A) Should be ignored by investors because the person issuing the opinion does not have the qualifications required to analyze financial statements.

B) Is the most favorable opinion auditors can express.

C) Is issued to alert investors to potential financial problems.

D) Is not issued by auditors who hold CPA certification.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following would result in the impairment of the auditor's independence?

A) The auditor does not have any immediate family members employed by the client.

B) The audit fee is based on a percentage of the company's net income for the year.

C) The auditor does not have any investment in the client's business.

D) The auditor serves on Dayton Inc.'s board of directors along with the client's CEO.

A) The auditor does not have any immediate family members employed by the client.

B) The audit fee is based on a percentage of the company's net income for the year.

C) The auditor does not have any investment in the client's business.

D) The auditor serves on Dayton Inc.'s board of directors along with the client's CEO.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

38

The following are examples of physical control over assets except

A) certificates of deposit should be kept in a fireproof vault

B) unannounced physical counts of equipment should be conducted randomly

C) serial numbers on equipment should be recorded

D) multiple personnel should have access to vaults in case of a calamity such as a fire

A) certificates of deposit should be kept in a fireproof vault

B) unannounced physical counts of equipment should be conducted randomly

C) serial numbers on equipment should be recorded

D) multiple personnel should have access to vaults in case of a calamity such as a fire

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

39

The most favorable opinion that an auditor can express is the

A) Unqualified opinion

B) Qualified opinion

C) Adverse opinion

D) Disclaimer

A) Unqualified opinion

B) Qualified opinion

C) Adverse opinion

D) Disclaimer

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

40

The confidentiality rules in the AICPA's code of ethics for CPAs prohibits accountants

A) from testifying against a former client in a court of law

B) from communicating with successor auditors

C) from obtaining legal counsel prior to disclosing information obtained in an accountant-client relationship

D) from voluntarily disclosing information obtained in an accountant-client relationship

A) from testifying against a former client in a court of law

B) from communicating with successor auditors

C) from obtaining legal counsel prior to disclosing information obtained in an accountant-client relationship

D) from voluntarily disclosing information obtained in an accountant-client relationship

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

41

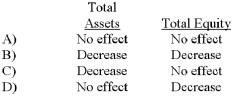

While performing the monthly bank reconciliation, the bookkeeper for Rathbun Pool Supply Company made the journal entry for a bank service charge of $49. Which of the following correctly shows the effect of the entry on the financial statements?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the item(s) would be subtracted from the company's unadjusted book balance to determine the true cash balance?

A) Item numbers 5 and 6

B) Item numbers 2, 3, and 5

C) Item numbers 1 and 3

D) Item number 5

A) Item numbers 5 and 6

B) Item numbers 2, 3, and 5

C) Item numbers 1 and 3

D) Item number 5

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

43

Link's entry to record the NSF check will

A) increase the Accounts Receivable account.

B) decrease the Cash account.

C) not affect the total amount of assets.

D) all of these.

A) increase the Accounts Receivable account.

B) decrease the Cash account.

C) not affect the total amount of assets.

D) all of these.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

44

In a bank reconciliation, a customer's NSF check included with the bank statement is:

A) deducted from the bank's cash balance to get the true cash balance.

B) added to the bank's cash balance to get the true cash balance.

C) deducted from the company's cash balance to get the true cash balance.

D) added to the company's cash balance to get the true cash balance.

A) deducted from the bank's cash balance to get the true cash balance.

B) added to the bank's cash balance to get the true cash balance.

C) deducted from the company's cash balance to get the true cash balance.

D) added to the company's cash balance to get the true cash balance.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

45

Dent Company's unadjusted bank balance at March 31, 2014 is $3,000. The bank reconciliation revealed outstanding checks amounting to $500 and deposits in transit of $300. Based on this information, Dent's true cash balance is:

A) $3,100.

B) $2,700.

C) $2,800.

D) $2,900.

A) $3,100.

B) $2,700.

C) $2,800.

D) $2,900.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

46

While performing its monthly bank reconciliation, the bookkeeper for the Partin Company discovered that a check written for $421 for advertising expense was recorded in the firm's books as $241. Which of the following shows the effect of the correcting entry on the financial statements?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

47

When a customer's NSF check is returned to a business with its bank statement, the business should make a journal entry increasing

A) Cash.

B) Accounts Receivable.

C) A net loss.

D) Expense for Bad Debts.

A) Cash.

B) Accounts Receivable.

C) A net loss.

D) Expense for Bad Debts.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

48

What documentation issued by a bank increases a company's checking account balance at the bank?

A) an account invoice

B) a debit memo

C) a credit memo

D) a certified check

A) an account invoice

B) a debit memo

C) a credit memo

D) a certified check

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

49

While performing the monthly bank reconciliation, the bookkeeper for Grace Corporation noted that a deposit of $100 (received from a customer on account) was recorded in the company books as $1,000. Which of the following shows the effect of the correcting entry on the financial statements?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the item(s) would be added to the unadjusted bank balance to determine the true cash balance?

A) Item numbers 3 and 6

B) Item number 5

C) Item numbers 3, 5, and 6

D) Item number 6

A) Item numbers 3 and 6

B) Item number 5

C) Item numbers 3, 5, and 6

D) Item number 6

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the item(s) would be subtracted from the unadjusted bank balance to determine the true cash balance?

A) Item numbers 3 and 6

B) Item number 5

C) Item numbers 3, 5, and 6

D) Item number 6

A) Item numbers 3 and 6

B) Item number 5

C) Item numbers 3, 5, and 6

D) Item number 6

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

52

Assuming that the unadjusted bank balance was $600, determine the unadjusted book balance.

A) $800.

B) $555.

C) $845.

D) $900.

A) $800.

B) $555.

C) $845.

D) $900.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the item(s) would be added to the company's unadjusted book balance to determine the true cash balance?

A) Item numbers 5 and 6

B) Item number 2

C) Item numbers 1 and 3

D) Item number 5

A) Item numbers 5 and 6

B) Item number 2

C) Item numbers 1 and 3

D) Item number 5

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

54

What documentation issued by a bank decreases the balance in a company's checking account balance at the bank?

A) a credit memos

B) credit entries

C) a debit memo

D) NSF checks

A) a credit memos

B) credit entries

C) a debit memo

D) NSF checks

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

55

At March 31, Bandstra Co. had a book balance in its cash account of $5,500. At the end of March the company determined that it had outstanding checks of $900, deposits in transit of $600, a bank service charge of $20, and an NSF check from a customer for $280. The true cash balance at March 31 is:

A) $5,200

B) $5,220

C) $5,500

D) $4,980

A) $5,200

B) $5,220

C) $5,500

D) $4,980

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

56

At the end of the month, Grant Entertainment Company showed a $9,300 book balance in its cash account. The following information was gathered by studying the bank statement and the company's cash records:

(1) deposits in transit amounted to $3,150

(2) outstanding checks were $6,200

(3) a $550 check had been incorrectly drawn on Grant's account by the bank

(4) NSF checks returned by the bank were $750

(5) bank service charge was $29

(6) credit memo for $75 for the collection of one of the company's account receivable

Based on the above information the true cash balance would be:

A) $6,250.

B) $8,596.

C) $6,096.

D) $9,146.

(1) deposits in transit amounted to $3,150

(2) outstanding checks were $6,200

(3) a $550 check had been incorrectly drawn on Grant's account by the bank

(4) NSF checks returned by the bank were $750

(5) bank service charge was $29

(6) credit memo for $75 for the collection of one of the company's account receivable

Based on the above information the true cash balance would be:

A) $6,250.

B) $8,596.

C) $6,096.

D) $9,146.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

57

How will a certified check be treated in a company's bank reconciliation?

A) As a deduction to the company's unadjusted book balance.

B) As an increase to the bank's unadjusted bank balance.

C) As a deduction to the bank's unadjusted bank balance.

D) None of these.

A) As a deduction to the company's unadjusted book balance.

B) As an increase to the bank's unadjusted bank balance.

C) As a deduction to the bank's unadjusted bank balance.

D) None of these.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

58

Rich Company's unadjusted book balance at October 31, 2014 is $2,550. The following information is available for the bank reconciliation.

Outstanding checks, $600

Deposits in transit, $450

Bank service charges, $90

Bank collected an accounts receivable for Rich Company, $1,000

NSF check written by one of Rich's customers, $600.

Based on this information Rich's true cash balance is:

A) $1,050.

B) $3,590.

C) $2,810.

D) $2,860.

Outstanding checks, $600

Deposits in transit, $450

Bank service charges, $90

Bank collected an accounts receivable for Rich Company, $1,000

NSF check written by one of Rich's customers, $600.

Based on this information Rich's true cash balance is:

A) $1,050.

B) $3,590.

C) $2,810.

D) $2,860.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

59

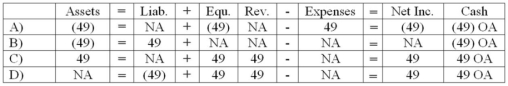

Krieger Company's bank statement included an NSF check written by one of its customers. What effect will the entry to recognize the NSF check have on the company's financial statements?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

60

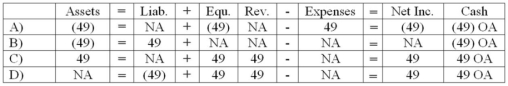

While preparing its bank reconciliation, Mart Company determined that its bank had collected for the company an account receivable in the amount of $950. The bank deducted a $15 collection fee. Which of the following shows the effect of the above event on the financial statements?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

61

One of the requirements of the code of ethics of the AICPA is that members must act in a way that serves the public interest.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

62

Effective separation of duties in an organization reduces the likelihood of theft.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

63

A well-designed system of internal controls will eliminate employee theft and fraud in a company.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

64

Effective separation of duties in a business allows the work of one employee to serve as a check on the work of other employees.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

65

In preparing a bank reconciliation, typical adjustments to the book balance include bank service charges, customer NSF checks, and interest earned on the account.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

66

In preparing a bank reconciliation, typical adjustments to the bank balance are deposits in transit and bank service charges.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

67

Internal controls that assess degree of compliance with company policies are classified as accounting controls.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

68

When a customer's NSF check is returned to a business with its bank statement, the business should make a journal entry increasing

A) Cash.

B) Accounts Receivable.

C) Accounts Payable.

D) Allowance for Doubtful Accounts.

A) Cash.

B) Accounts Receivable.

C) Accounts Payable.

D) Allowance for Doubtful Accounts.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

69

The April 30, 2014 bank statement for Tuttle Corporation shows an ending balance of $34,451. The unadjusted cash account balance was $28,350. The accountant for Tuttle gathered the following information:

1) April's deposit in transit was $4,240

2) The bank statement reports a service charge of $39

3) A credit memo included in the bank statement shows interest earned of $95

4) Outstanding checks totaled $10,935

5) The bank statement included a customer's $650 NSF check deposited in April

What is the true cash balance as of April 30, 2014?

A) $27,106

B) $27,756

C) $31,901

D) $31,996

1) April's deposit in transit was $4,240

2) The bank statement reports a service charge of $39

3) A credit memo included in the bank statement shows interest earned of $95

4) Outstanding checks totaled $10,935

5) The bank statement included a customer's $650 NSF check deposited in April

What is the true cash balance as of April 30, 2014?

A) $27,106

B) $27,756

C) $31,901

D) $31,996

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

70

The three elements that are typically present when fraud occurs are opportunity, pressure, and rationalization.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

71

A good system of internal controls cannot be overridden by collusion among employees.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

72

In performing bank reconciliations, outstanding checks are

A) Added to the unadjusted bank balance.

B) Subtracted from the unadjusted bank balance.

C) Added to the unadjusted book balance.

D) Subtracted from the unadjusted book balance.

A) Added to the unadjusted bank balance.

B) Subtracted from the unadjusted bank balance.

C) Added to the unadjusted book balance.

D) Subtracted from the unadjusted book balance.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

73

In preparing bank reconciliations, typical adjustments to the book balance include

A) outstanding checks.

B) correction of an error made by the bank.

C) interest earned on the checking account.

D) deposits in transit.

A) outstanding checks.

B) correction of an error made by the bank.

C) interest earned on the checking account.

D) deposits in transit.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

74

A bank statement debit memo describes a transaction that increases a customer's account balance.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

75

In preparing bank reconciliations, typical adjustments to the bank balance include

A) NSF checks.

B) interest earned on the account.

C) accounts or notes receivable collected by the bank.

D) deposits in transit.

A) NSF checks.

B) interest earned on the account.

C) accounts or notes receivable collected by the bank.

D) deposits in transit.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

76

When a customer's NSF check is returned to a business, the business should record an uncollectible account loss.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

77

A company's outside, independent auditors are responsible for expressing an opinion on the company's financial statements.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

78

The usual form for a bank reconciliation begins with the ending cash balance shown on the bank statement and reconciles it to the ending cash balance on the company's books.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

79

A company's outside, independent auditors are responsible for preparing its financial statements.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

80

The qualified opinion is the most favorable opinion that can be expressed by an independent auditor.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck