Deck 19: Accounting for Estates and Trusts

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

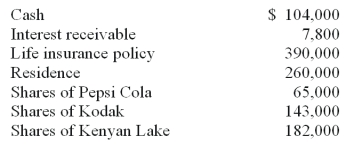

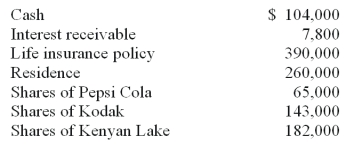

Question

Question

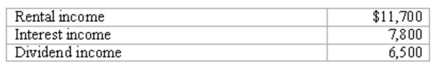

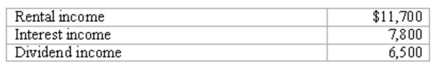

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/80

Play

Full screen (f)

Deck 19: Accounting for Estates and Trusts

1

The terms of a will currently undergoing probate are: "A gift to my brother David of $25,000 cash; to my son James, $50,000 from my savings account; and to my Daughter Lila, all of my remaining property." At the time of death, the balance in the savings account was $40,000, and there was additional cash (after payment of funeral expenses and all claims against the estate) of $70,000.

How much would James have received from the estate?

A) $50,000.

B) $40,000.

C) $25,000.

D) $45,000.

E) $30,000.

How much would James have received from the estate?

A) $50,000.

B) $40,000.

C) $25,000.

D) $45,000.

E) $30,000.

B

2

Under what circumstance does an estate have an executor?

A) When there is no valid will.

B) When the estate exceeds the dollar amount of the estate tax exemption.

C) When the will establishes a trust fund.

D) When the will is contested.

E) When the will names a specific person to administer the estate.

A) When there is no valid will.

B) When the estate exceeds the dollar amount of the estate tax exemption.

C) When the will establishes a trust fund.

D) When the will is contested.

E) When the will names a specific person to administer the estate.

E

3

Which of the following is usually not accounted for as an adjustment to a trust's income?

A) Ordinary repairs expense.

B) Rent expense.

C) Investment costs and commissions.

D) Insurance expense.

E) Property taxes.

A) Ordinary repairs expense.

B) Rent expense.

C) Investment costs and commissions.

D) Insurance expense.

E) Property taxes.

C

4

What is the process of abatement?

A) An attempt to determine the deceased's intentions when the terms of the will are unclear.

B) A reduction of various bequests when the estate is not adequate to satisfy them completely.

C) Selling of assets included in an estate to be able to pay creditors.

D) Payment of the claims of creditors.

E) The establishment of how the creditors will be paid.

A) An attempt to determine the deceased's intentions when the terms of the will are unclear.

B) A reduction of various bequests when the estate is not adequate to satisfy them completely.

C) Selling of assets included in an estate to be able to pay creditors.

D) Payment of the claims of creditors.

E) The establishment of how the creditors will be paid.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

5

A demonstrative legacy is a

A) gift of personal property that is directly identified.

B) cash gift from a particular source.

C) gift of estate property that remains after carrying out the other provisions of the will.

D) gift of real property.

E) gift of intangible property.

A) gift of personal property that is directly identified.

B) cash gift from a particular source.

C) gift of estate property that remains after carrying out the other provisions of the will.

D) gift of real property.

E) gift of intangible property.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

6

The provisions of a will currently undergoing probate are: "Two thousand shares of Dorn stock to my son; $30,000 in cash from my savings account to my brother; $50,000 in cash to my daughter; and any remaining property divided equally between my son and daughter."

Assume that, at the time of death, the estate included 1,200 shares of Dorn stock, $60,000 cash in the savings account, and $70,000 in cash from other sources. What would the son have received from the settlement of the estate?

A) 1,200 shares of Dorn stock and $35,000 cash.

B) 2,000 shares of Dorn stock and $10,000 cash.

C) 2,000 shares of Dorn stock and $25,000 cash.

D) 1,200 shares of Dorn stock and $10,000 cash.

E) 1,200 shares of Dorn stock and $25,000 cash.

Assume that, at the time of death, the estate included 1,200 shares of Dorn stock, $60,000 cash in the savings account, and $70,000 in cash from other sources. What would the son have received from the settlement of the estate?

A) 1,200 shares of Dorn stock and $35,000 cash.

B) 2,000 shares of Dorn stock and $10,000 cash.

C) 2,000 shares of Dorn stock and $25,000 cash.

D) 1,200 shares of Dorn stock and $10,000 cash.

E) 1,200 shares of Dorn stock and $25,000 cash.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

7

What guidelines must be followed to classify a transaction as associated with the principal of an estate or as an income transaction?

A) Generally accepted accounting principles.

B) Federal estate laws.

C) State estate laws.

D) The Internal Revenue Code.

E) The decedent's intentions or state laws.

A) Generally accepted accounting principles.

B) Federal estate laws.

C) State estate laws.

D) The Internal Revenue Code.

E) The decedent's intentions or state laws.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following is usually accounted for as an adjustment to a trust's principal?

A) Repairs expense.

B) Rent expense.

C) Investment costs and commissions.

D) Insurance expense.

E) Property taxes.

A) Repairs expense.

B) Rent expense.

C) Investment costs and commissions.

D) Insurance expense.

E) Property taxes.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

9

The terms of a will currently undergoing probate are: "A gift to my brother David of $25,000 cash; to my son James, $50,000 from my savings account; and to my Daughter Lila, all of my remaining property." At the time of death, the balance in the savings account was $40,000, and there was additional cash (after payment of funeral expenses and all claims against the estate) of $70,000.

How much would Lila have received from the estate?

A) $0.

B) $40,000.

C) $35,000.

D) $45,000.

E) $30,000.

How much would Lila have received from the estate?

A) $0.

B) $40,000.

C) $35,000.

D) $45,000.

E) $30,000.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following is not subtracted to arrive at the taxable value of an estate?

A) Liabilities.

B) Charitable bequests.

C) Funeral expenses.

D) Estate administration expenses.

E) Deduction for property conveyed to children of decedent.

A) Liabilities.

B) Charitable bequests.

C) Funeral expenses.

D) Estate administration expenses.

E) Deduction for property conveyed to children of decedent.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

11

A testamentary trust is a trust

A) intended to protect the assets of a minor.

B) that is managed by the trustor.

C) that is managed by an estate.

D) established by a living person.

E) established by a will.

A) intended to protect the assets of a minor.

B) that is managed by the trustor.

C) that is managed by an estate.

D) established by a living person.

E) established by a will.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

12

In a will, a devise is a

A) gift of personal property that is directly identified.

B) cash gift from a particular source.

C) gift of estate property that remains after carrying out the other provisions of the will.

D) gift of real property.

E) gift of intangible property.

A) gift of personal property that is directly identified.

B) cash gift from a particular source.

C) gift of estate property that remains after carrying out the other provisions of the will.

D) gift of real property.

E) gift of intangible property.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

13

The terms of a will currently undergoing probate are: "A gift to my brother David of $25,000 cash; to my son James, $50,000 from my savings account; and to my Daughter Lila, all of my remaining property." At the time of death, the balance in the savings account was $40,000, and there was additional cash (after payment of funeral expenses and all claims against the estate) of $70,000.

The gift to James is a

A) general legacy.

B) specific legacy.

C) demonstrative legacy.

D) residual legacy.

E) devise.

The gift to James is a

A) general legacy.

B) specific legacy.

C) demonstrative legacy.

D) residual legacy.

E) devise.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

14

In an executor's accounting for an estate, debts and other obligations are recorded

A) at book value.

B) at fair value.

C) on the date of payment.

D) as soon as they are discovered.

E) only if they are past due.

A) at book value.

B) at fair value.

C) on the date of payment.

D) as soon as they are discovered.

E) only if they are past due.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

15

The provisions of a will currently undergoing probate are: "Two thousand shares of Dorn stock to my son; $30,000 in cash from my savings account to my brother; $50,000 in cash to my daughter; and any remaining property divided equally between my son and daughter."

Assume that the estate included 1,200 shares of Dorn stock, $22,000 cash in the savings account, and $70,000 in cash from other sources. What would the daughter have received from the settlement of the estate?

A) $60,000 cash.

B) $50,000 cash.

C) $55,000 cash.

D) $62,000 cash.

E) $57,000 cash.

Assume that the estate included 1,200 shares of Dorn stock, $22,000 cash in the savings account, and $70,000 in cash from other sources. What would the daughter have received from the settlement of the estate?

A) $60,000 cash.

B) $50,000 cash.

C) $55,000 cash.

D) $62,000 cash.

E) $57,000 cash.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

16

Executor's fees and court costs for settling an estate usually

A) must be apportioned between the principal and the income of the estate.

B) are adjustments to the principal of the estate.

C) are adjustments to the income of the estate.

D) are subtracted from life insurance proceeds.

E) are ignored.

A) must be apportioned between the principal and the income of the estate.

B) are adjustments to the principal of the estate.

C) are adjustments to the income of the estate.

D) are subtracted from life insurance proceeds.

E) are ignored.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

17

When an estate does not have sufficient assets to satisfy all claims against it, what claim has the highest priority?

A) Expenses of administering the estate.

B) Federal income taxes.

C) State income taxes.

D) Medical expenses of the final illness.

E) Back wages owed to any employees.

A) Expenses of administering the estate.

B) Federal income taxes.

C) State income taxes.

D) Medical expenses of the final illness.

E) Back wages owed to any employees.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

18

When a person dies without leaving a valid will, how is the distribution of his or her property determined?

A) In accordance with federal inheritance laws.

B) In accordance with generally accepted accounting principles.

C) In accordance with a plan developed by the executor of the estate.

D) In accordance with state inheritance laws.

E) In accordance with common law.

A) In accordance with federal inheritance laws.

B) In accordance with generally accepted accounting principles.

C) In accordance with a plan developed by the executor of the estate.

D) In accordance with state inheritance laws.

E) In accordance with common law.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

19

The terms of a will currently undergoing probate are: "A gift to my brother David of $25,000 cash; to my son James, $50,000 from my savings account; and to my Daughter Lila, all of my remaining property." At the time of death, the balance in the savings account was $40,000, and there was additional cash (after payment of funeral expenses and all claims against the estate) of $70,000.

The gift to David is a

A) general legacy.

B) specific legacy.

C) demonstrative legacy.

D) residual legacy.

E) devise.

The gift to David is a

A) general legacy.

B) specific legacy.

C) demonstrative legacy.

D) residual legacy.

E) devise.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

20

The trustor is the

A) income beneficiary of the trust.

B) ultimate recipient of the principal from the trust.

C) fiduciary who manages the assets in the trust.

D) person who funds the trust.

E) person who disposes of the assets in the trust.

A) income beneficiary of the trust.

B) ultimate recipient of the principal from the trust.

C) fiduciary who manages the assets in the trust.

D) person who funds the trust.

E) person who disposes of the assets in the trust.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

21

Assume that Bob Smith dies on May 25, 2011. Mr. Smith's assets include the following: ABC Stock costing $30,000 but valued at $40,000; a house costing $280,000 but valued at $620,000; life insurance in the amount of $600,000; and cash from various sources totaling $50,700. Three credit cards in Mr. Smith's name had balances totaling $8,530 on the date of death. The estate paid funeral and final medical expenses in the amount of $50,492. There were no charitable gifts designated by the will, and Mr. Smith was single at the time of his death. What is the amount of the taxable estate?

A) $901,678.

B) $1,251,678.

C) $1,268,738.

D) $1,310,700.

E) $651,678.

A) $901,678.

B) $1,251,678.

C) $1,268,738.

D) $1,310,700.

E) $651,678.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following is normally viewed as an adjustment to the principal of an estate?

A) Ordinary repair expenses.

B) Insurance expenses.

C) Utility expenses.

D) Major repairs to rental property.

E) Property taxes.

A) Ordinary repair expenses.

B) Insurance expenses.

C) Utility expenses.

D) Major repairs to rental property.

E) Property taxes.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

23

The party to receive a distribution of principal from an estate is legally called a(n):

A) Principal grantee.

B) Corpus benefitor.

C) Estate receiver.

D) Remainderman.

E) Estate distributee.

A) Principal grantee.

B) Corpus benefitor.

C) Estate receiver.

D) Remainderman.

E) Estate distributee.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

24

What is the amount of the personal exemption on an estate income tax return?

A) $0.

B) $100.

C) $300.

D) $500.

E) $600.

A) $0.

B) $100.

C) $300.

D) $500.

E) $600.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

25

What are the goals of probate laws?

(1) Gather and preserve all of the decedent's property;

(2) Carry out an orderly and fair settlement of all debts;

(3) Discover and follow the decedent's intent for the remaining property

A) 1 only.

B) 2 only.

C) 3 only.

D) 1 and 2.

E) 1, 2, and 3.

(1) Gather and preserve all of the decedent's property;

(2) Carry out an orderly and fair settlement of all debts;

(3) Discover and follow the decedent's intent for the remaining property

A) 1 only.

B) 2 only.

C) 3 only.

D) 1 and 2.

E) 1, 2, and 3.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

26

The provisions of a will currently undergoing probate are: "One thousand shares of Wal-mart stock to my son; $10,000 in cash from my savings account to my brother; $5,000 in cash to my daughter; and any remaining property divided equally between my son and daughter." At the time of death, the estate included 1,000 shares of Wal-mart stock and $6,000 cash in the savings account. What would the brother have received from the settlement of the estate?

A) $0.

B) $5,000.

C) $6,000.

D) $10,000.

E) $11,000.

A) $0.

B) $5,000.

C) $6,000.

D) $10,000.

E) $11,000.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

27

A gift of any remaining estate property is a

A) general legacy.

B) specific legacy.

C) demonstrative legacy.

D) residual legacy.

E) devise.

A) general legacy.

B) specific legacy.

C) demonstrative legacy.

D) residual legacy.

E) devise.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following is not normally viewed as an adjustment to the principal of an estate?

A) Dividends declared prior to death.

B) Investment commissions and other costs.

C) Funeral expenses.

D) Insurance expenses.

E) Debts incurred prior to death.

A) Dividends declared prior to death.

B) Investment commissions and other costs.

C) Funeral expenses.

D) Insurance expenses.

E) Debts incurred prior to death.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

29

The estate of Bobbi Jones has the following provisions: total value of estate assets $2,000,000, amount specified to convey to a spouse $1,000,000, amount specified to convey to children $200,000, total debts 400,000, administrative expenses $50,000, and funeral expenses of $30,000. What is the value of the taxable estate?

A) $320,000.

B) $520,000.

C) $550,000.

D) $1,480,000.

E) $1,520,000.

A) $320,000.

B) $520,000.

C) $550,000.

D) $1,480,000.

E) $1,520,000.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

30

The provisions of a will currently undergoing probate are: "One thousand shares of Wal-mart stock to my son; $10,000 in cash from my savings account to my brother; $5,000 in cash to my daughter; and any remaining property divided equally between my son and daughter." At the time of death, the estate included 1,400 shares of Wal-mart stock and $25,000 cash in the savings account.

What would the son have received from the settlement of the estate?

A) 1,000 shares of Wal-mart stock and $15,000 cash

B) 1,000 shares of Wal-mart stock and $0 cash

C) 1,000 shares of Wal-mart stock and $10,000 cash

D) 1,200 shares of Wal-mart stock and $5,000 cash

E) 1,400 shares of Wal-mart stock and $5,000 cash

What would the son have received from the settlement of the estate?

A) 1,000 shares of Wal-mart stock and $15,000 cash

B) 1,000 shares of Wal-mart stock and $0 cash

C) 1,000 shares of Wal-mart stock and $10,000 cash

D) 1,200 shares of Wal-mart stock and $5,000 cash

E) 1,400 shares of Wal-mart stock and $5,000 cash

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

31

The provisions of a will currently undergoing probate are: "One thousand shares of Wal-mart stock to my son; $10,000 in cash from my savings account to my brother; $5,000 in cash to my daughter; and any remaining property divided equally between my son and daughter." At the time of death, the estate included 1,400 shares of Wal-mart stock and $25,000 cash in the savings account.

What is the remaining principal to be divided equally between the son and the daughter?

A) $10,000 cash

B) $15,000 cash

C) 400 shares of Wal-mart stock and $10,000 cash

D) 400 shares of Wal-mart stock and $15,000 cash

E) 1,000 shares of Wal-mart stock and $5,000 cash

What is the remaining principal to be divided equally between the son and the daughter?

A) $10,000 cash

B) $15,000 cash

C) 400 shares of Wal-mart stock and $10,000 cash

D) 400 shares of Wal-mart stock and $15,000 cash

E) 1,000 shares of Wal-mart stock and $5,000 cash

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

32

A gift that is specified in a will as "I leave $5,000 in cash to my son" is a

A) general legacy.

B) specific legacy.

C) demonstrative legacy.

D) residual legacy.

E) devise.

A) general legacy.

B) specific legacy.

C) demonstrative legacy.

D) residual legacy.

E) devise.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

33

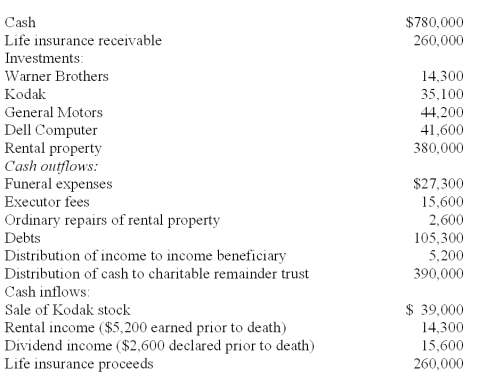

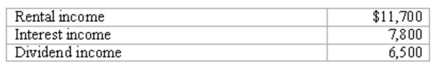

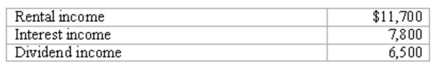

Jim Bowie died on April 1, 2011. The estate has the following gross asset valuation information:

The estate tax will be calculated using:

A) $73,000.

B) $75,000.

C) $76,000.

D) $80,000.

E) $81,000.

The estate tax will be calculated using:

A) $73,000.

B) $75,000.

C) $76,000.

D) $80,000.

E) $81,000.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

34

A gift that is specified in a will as "I leave my collection of baseball cards to my son" is a

A) general legacy.

B) specific legacy.

C) demonstrative legacy.

D) residual legacy.

E) devise.

A) general legacy.

B) specific legacy.

C) demonstrative legacy.

D) residual legacy.

E) devise.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

35

When there are not enough assets in the estate to satisfy all legacies in the will, the distribution schedule goes through a process of:

A) Ademption.

B) Amendment.

C) Abatement.

D) Accretion.

E) Aggregation.

A) Ademption.

B) Amendment.

C) Abatement.

D) Accretion.

E) Aggregation.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following is not a trust used for estate planning?

A) Minor's Section 2503(c) trust.

B) Alimony trust.

C) Credit shelter trust.

D) Revocable living trust.

E) Grantor retained annuity trust.

A) Minor's Section 2503(c) trust.

B) Alimony trust.

C) Credit shelter trust.

D) Revocable living trust.

E) Grantor retained annuity trust.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

37

A gift that is specified in a will as "I leave $5,000 in cash from my checking account to my daughter" is a

A) general legacy.

B) specific legacy.

C) demonstrative legacy.

D) residual legacy.

E) devise.

A) general legacy.

B) specific legacy.

C) demonstrative legacy.

D) residual legacy.

E) devise.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

38

For which type of trust is the income taxed in the grantor's individual income tax return?

A) Inter vivos trust.

B) Grantor trust.

C) Revocable living trust.

D) Family trust.

E) Irrevocable life insurance trust.

A) Inter vivos trust.

B) Grantor trust.

C) Revocable living trust.

D) Family trust.

E) Irrevocable life insurance trust.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

39

An executor will normally carry out all the following tasks except:

A) Distribute property to beneficiaries.

B) Settle claims against the decedent.

C) Inventory property existing at the date of death.

D) Prepare estate tax returns.

E) Account to the probate court.

A) Distribute property to beneficiaries.

B) Settle claims against the decedent.

C) Inventory property existing at the date of death.

D) Prepare estate tax returns.

E) Account to the probate court.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

40

After expenses of administering an estate, which claims would be next in a typical order of priority to establish which creditors will get paid?

(1) Funeral expenses.

(2) Medical expenses of the last illness.

(3) Debts and taxes given preference under laws.

(4) All other claims.

A) 1 and 2.

B) 2 and 3.

C) 3 and 4.

D) 1 and 4.

E) 2 and 4.

(1) Funeral expenses.

(2) Medical expenses of the last illness.

(3) Debts and taxes given preference under laws.

(4) All other claims.

A) 1 and 2.

B) 2 and 3.

C) 3 and 4.

D) 1 and 4.

E) 2 and 4.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

41

What are the three goals of probate laws?

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

42

How may real property be treated in identifying estate property subject to probate?

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

43

What choices does an executor of an estate have in determining the values of assets included in the estate for tax purposes?

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

44

What is the purpose of the Uniform Probate Code?

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

45

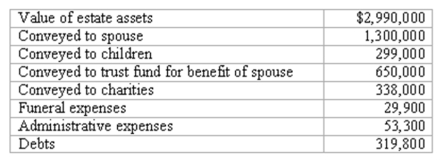

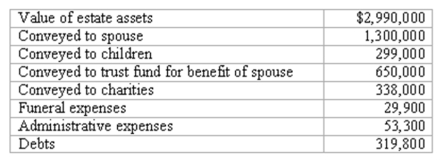

The estate of Kent Talbert reported the following information:

Required:

Prepare a schedule to show the amount of the taxable estate.

Required:

Prepare a schedule to show the amount of the taxable estate.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

46

What is the difference between an executor and an administrator?

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

47

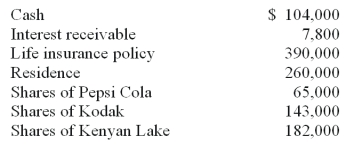

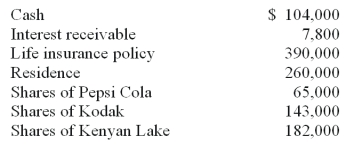

The following information pertains to 11 separate questions.

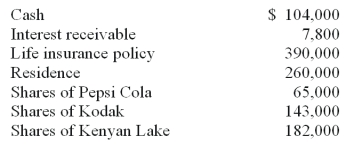

The executor of the Estate of Kate Tweed discovered the following assets (at fair value): The will of Kate Tweed had the following provisions:

The will of Kate Tweed had the following provisions:

$195,000 in cash went to Victor Vickery.

All shares of PepsiCo went to Duchess Doyle.

The residence went to Louis Tweed.

All other estate assets were to be liquidated with the resulting cash going to the Sacred Church of Liberty, Missouri.

Funeral expenses of $26,000 were paid.

Prepare the journal entry to record the transaction.

The executor of the Estate of Kate Tweed discovered the following assets (at fair value):

The will of Kate Tweed had the following provisions:

The will of Kate Tweed had the following provisions:$195,000 in cash went to Victor Vickery.

All shares of PepsiCo went to Duchess Doyle.

The residence went to Louis Tweed.

All other estate assets were to be liquidated with the resulting cash going to the Sacred Church of Liberty, Missouri.

Funeral expenses of $26,000 were paid.

Prepare the journal entry to record the transaction.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

48

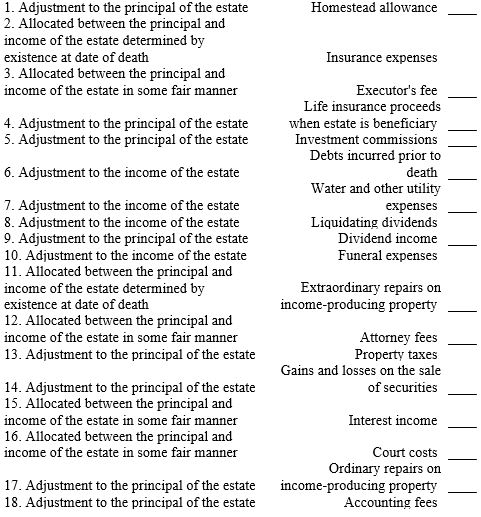

For each of the following situations, select the best answer concerning adjustments to principal and income of an estate. Assume that the will does not specify whether the item is to be classified as principal or income.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

49

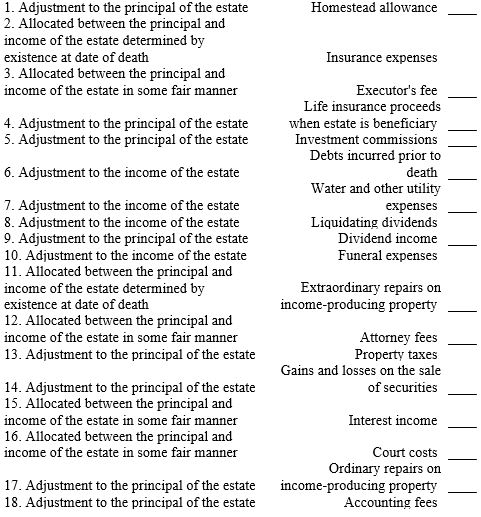

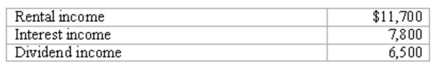

During the most recent year, an estate generated income of $26,000:  The interest income was conveyed immediately to the beneficiary stated in the decedent's will. Dividends of $1,560 were given to the decedent's church.

The interest income was conveyed immediately to the beneficiary stated in the decedent's will. Dividends of $1,560 were given to the decedent's church.

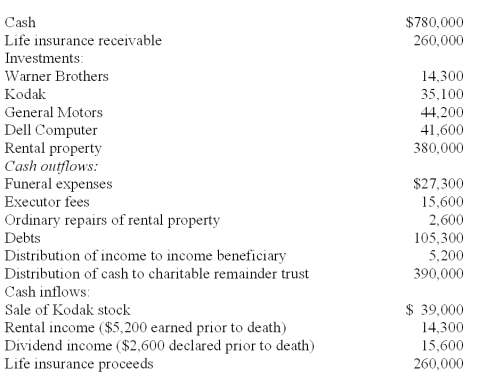

The executor of the estate of Yelbert Toper recorded the following information:

Assets discovered at death (at fair value):

Debts of $22,100 still remain to be paid. The shares of Dell stock were conveyed to the appropriate beneficiary. Executor fees are allocated based on total charges for principal and for income.

Required:

Prepare a charge and discharge statement for this estate.

The interest income was conveyed immediately to the beneficiary stated in the decedent's will. Dividends of $1,560 were given to the decedent's church.

The interest income was conveyed immediately to the beneficiary stated in the decedent's will. Dividends of $1,560 were given to the decedent's church.The executor of the estate of Yelbert Toper recorded the following information:

Assets discovered at death (at fair value):

Debts of $22,100 still remain to be paid. The shares of Dell stock were conveyed to the appropriate beneficiary. Executor fees are allocated based on total charges for principal and for income.

Required:

Prepare a charge and discharge statement for this estate.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

50

What are the four levels of claims in the order of priority of the Uniform Probate Code?

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

51

The following information pertains to 11 separate questions.

The executor of the Estate of Kate Tweed discovered the following assets (at fair value): The will of Kate Tweed had the following provisions:

The will of Kate Tweed had the following provisions:

$195,000 in cash went to Victor Vickery.

All shares of PepsiCo went to Duchess Doyle.

The residence went to Louis Tweed.

All other estate assets were to be liquidated with the resulting cash going to the Sacred Church of Liberty, Missouri.

Prepare the journal entry to record the property of the estate.

The executor of the Estate of Kate Tweed discovered the following assets (at fair value):

The will of Kate Tweed had the following provisions:

The will of Kate Tweed had the following provisions:$195,000 in cash went to Victor Vickery.

All shares of PepsiCo went to Duchess Doyle.

The residence went to Louis Tweed.

All other estate assets were to be liquidated with the resulting cash going to the Sacred Church of Liberty, Missouri.

Prepare the journal entry to record the property of the estate.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

52

During the most recent year, an estate generated income of $26,000:  The interest income was conveyed immediately to the beneficiary stated in the decedent's will. Dividends of $1,560 were given to the decedent's church.

The interest income was conveyed immediately to the beneficiary stated in the decedent's will. Dividends of $1,560 were given to the decedent's church.

Prepare a schedule to show the amount of federal income tax that must be paid.

The interest income was conveyed immediately to the beneficiary stated in the decedent's will. Dividends of $1,560 were given to the decedent's church.

The interest income was conveyed immediately to the beneficiary stated in the decedent's will. Dividends of $1,560 were given to the decedent's church.Prepare a schedule to show the amount of federal income tax that must be paid.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

53

Debts of $52,000 were discovered.

Prepare the journal entry to record the transaction.

Prepare the journal entry to record the transaction.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

54

What is meant by estate accounting?

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

55

The following information pertains to 11 separate questions.

The executor of the Estate of Kate Tweed discovered the following assets (at fair value): The will of Kate Tweed had the following provisions:

The will of Kate Tweed had the following provisions:

$195,000 in cash went to Victor Vickery.

All shares of PepsiCo went to Duchess Doyle.

The residence went to Louis Tweed.

All other estate assets were to be liquidated with the resulting cash going to the Sacred Church of Liberty, Missouri.

For the Estate of Kate Tweed, interest of $9,100 was collected.

Prepare the journal entry to record the collection.

The executor of the Estate of Kate Tweed discovered the following assets (at fair value):

The will of Kate Tweed had the following provisions:

The will of Kate Tweed had the following provisions:$195,000 in cash went to Victor Vickery.

All shares of PepsiCo went to Duchess Doyle.

The residence went to Louis Tweed.

All other estate assets were to be liquidated with the resulting cash going to the Sacred Church of Liberty, Missouri.

For the Estate of Kate Tweed, interest of $9,100 was collected.

Prepare the journal entry to record the collection.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

56

What is meant by "an individual dies intestate"?

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

57

In settling an estate, what is the meaning of the term legacy?

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

58

What is a remainderman of trust property?

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

59

During the most recent year, an estate generated income of $26,000:  The interest income was conveyed immediately to the beneficiary stated in the decedent's will. Dividends of $1,560 were given to the decedent's church.

The interest income was conveyed immediately to the beneficiary stated in the decedent's will. Dividends of $1,560 were given to the decedent's church.

Prepare a schedule to show the amount of taxable income.

The interest income was conveyed immediately to the beneficiary stated in the decedent's will. Dividends of $1,560 were given to the decedent's church.

The interest income was conveyed immediately to the beneficiary stated in the decedent's will. Dividends of $1,560 were given to the decedent's church.Prepare a schedule to show the amount of taxable income.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

60

In settling an estate, what is the meaning of the term devise?

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

61

An inter vivos trust was created by Isaac Posney. Isaac owned a large department store in Juggins, Utah. Adjacent to the store, Isaac also owned a tract of land that was used as an extra parking lot when the store was having a sale or during the Christmas season. Isaac expected the land to appreciate in value and eventually be sold for an office complex or additional stores.

Isaac placed the land into a charitable lead trust which would hold the land for ten years until Isaac's son would turn 21. At that time, title would be transferred to the son. The store will pay rent to use the land during the interim. The income generated each year from this usage will be given to a local church. The land was currently valued at $416,000.

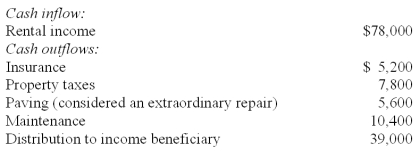

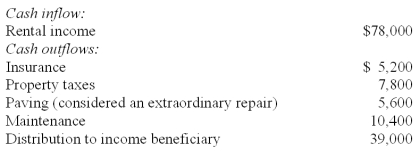

During the first year of this arrangement, the trustee recorded the following cash transactions:

Required:

Prepare all required journal entries for this trust fund including the entry to create the trust.

Isaac placed the land into a charitable lead trust which would hold the land for ten years until Isaac's son would turn 21. At that time, title would be transferred to the son. The store will pay rent to use the land during the interim. The income generated each year from this usage will be given to a local church. The land was currently valued at $416,000.

During the first year of this arrangement, the trustee recorded the following cash transactions:

Required:

Prepare all required journal entries for this trust fund including the entry to create the trust.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

62

The executor of Danny Mack's estate has listed the following properties at fair value: Cash $200,000, Life Insurance Receivable $500,000, Investment in Stocks and Bonds $50,000, Rental Property $100,000, and Personal Property $80,000. Additionally, the executor found $100,000 of various debts incurred before the decedent's death. The cost of Danny Mack's funeral was $20,000.

Prepare the journal entry to record payment of $20,000 in funeral expenses.

Prepare the journal entry to record payment of $20,000 in funeral expenses.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

63

The executor of Danny Mack's estate has listed the following properties at fair value: Cash $200,000, Life Insurance Receivable $500,000, Investment in Stocks and Bonds $50,000, Rental Property $100,000, and Personal Property $80,000. Additionally, the executor found $100,000 of various debts incurred before the decedent's death. The cost of Danny Mack's funeral was $20,000.

Prepare the journal entry to record the sales of the stocks and bonds for $120,000.

Prepare the journal entry to record the sales of the stocks and bonds for $120,000.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

64

The executor of Danny Mack's estate has listed the following properties at fair value: Cash $200,000, Life Insurance Receivable $500,000, Investment in Stocks and Bonds $50,000, Rental Property $100,000, and Personal Property $80,000. Additionally, the executor found $100,000 of various debts incurred before the decedent's death. The cost of Danny Mack's funeral was $20,000.

Prepare the journal entry to record the collection of the life insurance policy.

Prepare the journal entry to record the collection of the life insurance policy.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

65

The executor of Danny Mack's estate has listed the following properties at fair value: Cash $200,000, Life Insurance Receivable $500,000, Investment in Stocks and Bonds $50,000, Rental Property $100,000, and Personal Property $80,000. Additionally, the executor found $100,000 of various debts incurred before the decedent's death. The cost of Danny Mack's funeral was $20,000.

Prepare the journal entry to record the property of the estate.

Prepare the journal entry to record the property of the estate.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

66

The executor of Danny Mack's estate has listed the following properties at fair value: Cash $200,000, Life Insurance Receivable $500,000, Investment in Stocks and Bonds $50,000, Rental Property $100,000, and Personal Property $80,000. Additionally, the executor found $100,000 of various debts incurred before the decedent's death. The cost of Danny Mack's funeral was $20,000.

Prepare the journal entry to record ordinary repairs to the rental property of $5,000.

Prepare the journal entry to record ordinary repairs to the rental property of $5,000.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

67

The executor of Danny Mack's estate has listed the following properties at fair value: Cash $200,000, Life Insurance Receivable $500,000, Investment in Stocks and Bonds $50,000, Rental Property $100,000, and Personal Property $80,000. Additionally, the executor found $100,000 of various debts incurred before the decedent's death. The cost of Danny Mack's funeral was $20,000.

Prepare a Charge and Discharge Statement for the estate.

Prepare a Charge and Discharge Statement for the estate.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

68

The executor of Danny Mack's estate has listed the following properties at fair value: Cash $200,000, Life Insurance Receivable $500,000, Investment in Stocks and Bonds $50,000, Rental Property $100,000, and Personal Property $80,000. Additionally, the executor found $100,000 of various debts incurred before the decedent's death. The cost of Danny Mack's funeral was $20,000.

Prepare the journal entry to record the payment of the estate's liabilities for debts incurred prior to the decedent's death.

Prepare the journal entry to record the payment of the estate's liabilities for debts incurred prior to the decedent's death.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

69

The life insurance policy was collected.

Prepare the journal entry to record the transaction.

Prepare the journal entry to record the transaction.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

70

Additional debts of $78,000 were discovered. Debts totaling $130,000 were paid.

Prepare the journal entry to record the transaction.

Prepare the journal entry to record the transaction.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

71

Title to the residence was conveyed to Louis Tweed.

Prepare the journal entry to record the transaction.

Prepare the journal entry to record the transaction.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

72

The shares of Kodak were sold for $145,600.

Prepare the journal entry to record the transaction.

Prepare the journal entry to record the transaction.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

73

Administrative expenses of $13,000 were paid.

Prepare the journal entry to record the transaction.

Prepare the journal entry to record the transaction.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

74

The executor of Danny Mack's estate has listed the following properties at fair value: Cash $200,000, Life Insurance Receivable $500,000, Investment in Stocks and Bonds $50,000, Rental Property $100,000, and Personal Property $80,000. Additionally, the executor found $100,000 of various debts incurred before the decedent's death. The cost of Danny Mack's funeral was $20,000.

Prepare the journal entry for claims of $100,000 made against the estate for various debts incurred before the decedent's death, and $20,000 for funeral expense bills.

Prepare the journal entry for claims of $100,000 made against the estate for various debts incurred before the decedent's death, and $20,000 for funeral expense bills.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

75

During the current year, an estate generates the following income amounts: Rental income $10,000, Interest income 4,000, Dividend income 6,000. The rental income is conveyed immediately to the beneficiary stated in the decedent's will. Dividends of $2,000 are donated to the decedent's church. What amount of federal income tax must be paid by the estate?

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

76

The executor of Danny Mack's estate has listed the following properties at fair value: Cash $200,000, Life Insurance Receivable $500,000, Investment in Stocks and Bonds $50,000, Rental Property $100,000, and Personal Property $80,000. Additionally, the executor found $100,000 of various debts incurred before the decedent's death. The cost of Danny Mack's funeral was $20,000.

Prepare the journal entry to record interest of $5,000 that was earned on the bonds of the estate. Of this amount, $2,000 had been earned prior to death.

Prepare the journal entry to record interest of $5,000 that was earned on the bonds of the estate. Of this amount, $2,000 had been earned prior to death.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

77

The executor of Danny Mack's estate has listed the following properties at fair value: Cash $200,000, Life Insurance Receivable $500,000, Investment in Stocks and Bonds $50,000, Rental Property $100,000, and Personal Property $80,000. Additionally, the executor found $100,000 of various debts incurred before the decedent's death. The cost of Danny Mack's funeral was $20,000.

Prepare the journal entry to record the distribution of $4,000 to Anna Lee, an income beneficiary.

Prepare the journal entry to record the distribution of $4,000 to Anna Lee, an income beneficiary.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

78

An additional savings account of $15,600 was located by the executor.

Prepare the journal entry to record the transaction.

Prepare the journal entry to record the transaction.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

79

Cash of $195,000 was conveyed to the appropriate beneficiary.

Prepare the journal entry to record the transaction.

Prepare the journal entry to record the transaction.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

80

The executor of Danny Mack's estate has listed the following properties at fair value: Cash $200,000, Life Insurance Receivable $500,000, Investment in Stocks and Bonds $50,000, Rental Property $100,000, and Personal Property $80,000. Additionally, the executor found $100,000 of various debts incurred before the decedent's death. The cost of Danny Mack's funeral was $20,000.

Prepare the journal entry to record the collection of rental income of $10,000. $1,000 had been earned prior to the decedent's death.

Prepare the journal entry to record the collection of rental income of $10,000. $1,000 had been earned prior to the decedent's death.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck