Deck 7: Accounting for Sales and Accounts Receivable

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

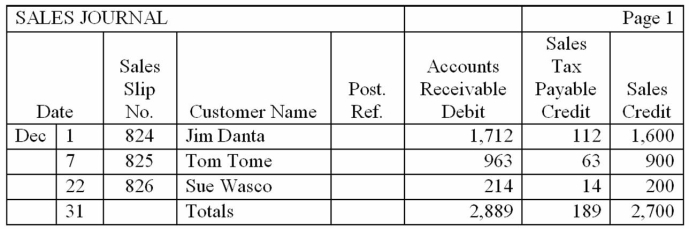

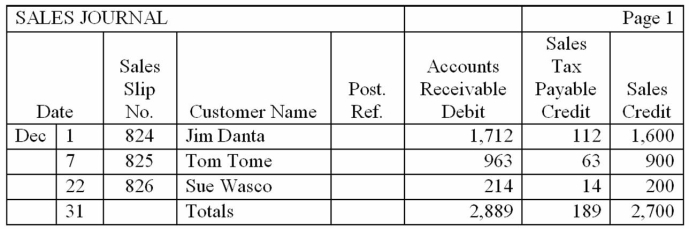

Question

Question

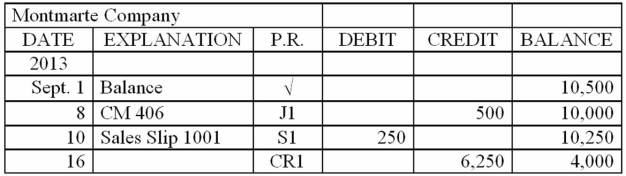

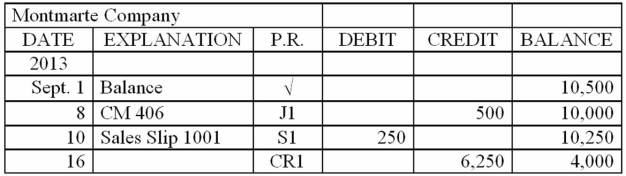

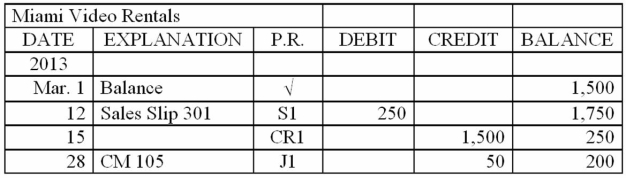

Question

Question

Question

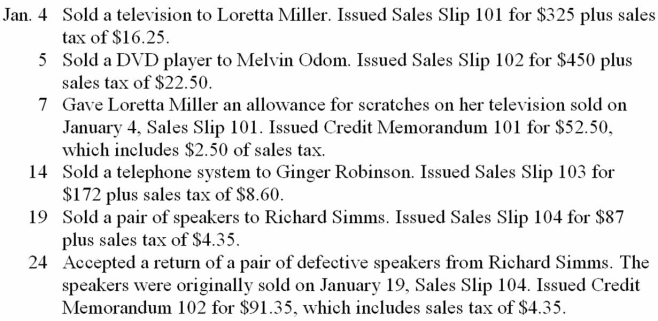

Question

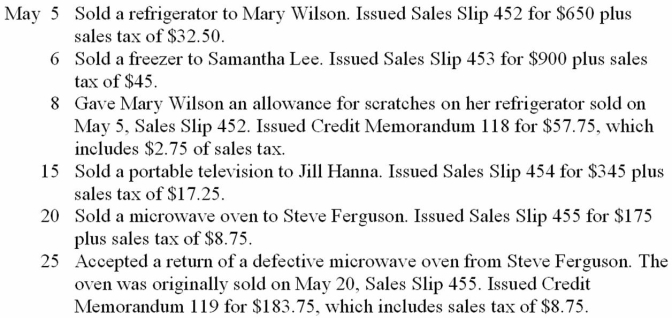

Question

Question

Question

Question

Question

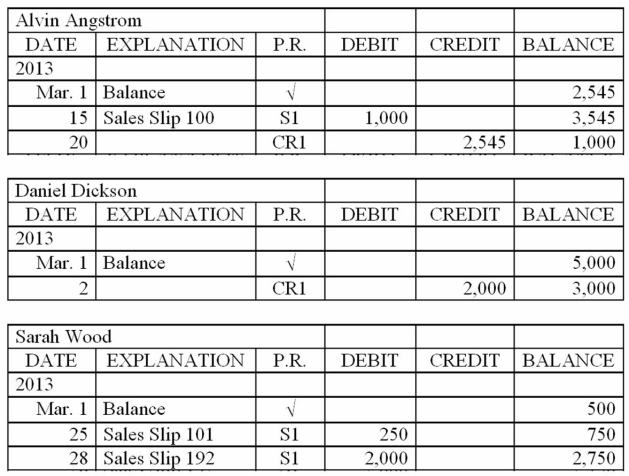

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/83

Play

Full screen (f)

Deck 7: Accounting for Sales and Accounts Receivable

1

The balance of a customer's account in the accounts receivable ledger is circled to show that it is a debit amount.

False

2

A merchandising business sells goods that it produces.

False

3

The individual amounts in the Accounts Receivable Debit column of a sales journal should be posted to the accounts receivable subsidiary ledger, and the column total should be posted to the Accounts Receivable account in the general ledger.

True

4

The Sales Returns and Allowances account has a normal debit balance.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

5

A business that sells goods and services directly to individual consumers is called a(n) ____________________ business.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

6

The entry to record a sale of merchandise on credit that is subject to sales tax includes a(n) ____________________ to Sales Tax Payable.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

7

To indicate that the column totals of the sales journal have been posted, a check mark is entered under the column total.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

8

In a small business, the customer accounts are usually kept in alphabetical order.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

9

After all postings have been made, the totals of the balances in the accounts receivable subsidiary ledger should equal the balance of the Accounts Receivable account in the general ledger.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

10

For a retailer, bank credit card sales are like cash sales.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

11

The source document for an entry in the sales journal is a(n) ____________________.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

12

The balance of the Sales Returns and Allowances account is subtracted from the balance of the Accounts Receivable account in the Assets section of the balance sheet.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

13

In some states, a firm receives a discount for paying the amount of sales tax due on time.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

14

A wholesale business does not need a Sales Tax Payable account.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

15

A(n) ____________________ business sells goods that it purchases in finished form for resale.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

16

A sales return or a sales allowance is usually recorded in the sales journal.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

17

When a business makes a sale on a bank credit card, the business is responsible for collecting from the customer.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

18

The stock of goods kept on hand to sell to consumers is called _________________________.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

19

The abbreviation S1 in the Posting Reference column of an account shows that the data was posted from page 1 of the sales journal.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

20

A customer who returns goods or receives an allowance is entitled to a credit for the appropriate amount of sales tax if tax was charged on the original sale.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

21

The Sales account is classified as

A) a liability account.

B) an asset account.

C) a contra account.

D) a revenue account.

A) a liability account.

B) an asset account.

C) a contra account.

D) a revenue account.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

22

The ____________________ ledger contains accounts for credit customers.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

23

To indicate that an amount has been posted from the sales journal to the accounts receivable subsidiary ledger, a(n) ____________________ is placed in the Posting Reference column of the journal.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

24

In a firm that uses special journals, the purchase of merchandise on credit is recorded in the

A) cash payments journal.

B) cash receipts journal.

C) purchases journal.

D) general journal.

A) cash payments journal.

B) cash receipts journal.

C) purchases journal.

D) general journal.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

25

In a firm that uses special journals, the acceptance of a return of merchandise from a credit customer is recorded in the

A) cash receipts journal.

B) sales journal.

C) cash payments journal.

D) general journal.

A) cash receipts journal.

B) sales journal.

C) cash payments journal.

D) general journal.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

26

In a firm that uses special journals, the collection of sums on account from credit customers is recorded in the

A) cash payments journal.

B) cash receipts journal.

C) sales journal.

D) purchases journal.

A) cash payments journal.

B) cash receipts journal.

C) sales journal.

D) purchases journal.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

27

A list of all unpaid balances in the accounts receivable subsidiary ledger is called a(n) ____________________ of accounts receivable.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

28

A(n) ____________________ journal is a journal that is used to record only one type of transaction.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

29

A(n) ____________________ is a business form that is issued to a credit customer upon acceptance of the return of damaged goods.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

30

In a firm that uses special journals, a sale of merchandise on credit is recorded in the

A) cash payments journal.

B) cash receipts journal.

C) sales journal.

D) purchases journal.

A) cash payments journal.

B) cash receipts journal.

C) sales journal.

D) purchases journal.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

31

In a firm that uses special journals, the issuance of a check to pay a creditor on account is recorded in the

A) cash payments journal.

B) cash receipts journal.

C) sales journal.

D) purchases journal.

A) cash payments journal.

B) cash receipts journal.

C) sales journal.

D) purchases journal.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

32

The reductions from list prices that many wholesale businesses offer their customers are called ____________________ discounts.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

33

The Sales Returns and Allowances account has a normal ____________________ balance.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

34

Sales Tax Payable is classified as a(n) ____________________ account.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

35

In a firm that uses special journals, an allowance given for damaged merchandise is recorded in the

A) cash payments journal.

B) cash receipts journal.

C) purchases journal.

D) general journal.

A) cash payments journal.

B) cash receipts journal.

C) purchases journal.

D) general journal.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

36

A ledger that contains accounts of a single type is called a(n) ____________________ ledger.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

37

In a firm that uses special journals, the sale of merchandise for cash is recorded in the

A) cash payments journal.

B) cash receipts journal.

C) sales journal.

D) purchases journal.

A) cash payments journal.

B) cash receipts journal.

C) sales journal.

D) purchases journal.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

38

A firm that sells goods that it purchases for re-sale is a

A) service business.

B) merchandising business.

C) manufacturing business.

D) non-profit business.

A) service business.

B) merchandising business.

C) manufacturing business.

D) non-profit business.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

39

When an accounts receivable subsidiary ledger is used, the Accounts Receivable account in the general ledger is considered to be a(n) ____________________ account.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

40

In a firm that uses special journals, an additional cash investment received from the owner is recorded in the

A) cash receipts journal.

B) sales journal.

C) cash payments journal.

D) general journal.

A) cash receipts journal.

B) sales journal.

C) cash payments journal.

D) general journal.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

41

If a firm had sales of $50,000 during a period and sales returns and allowances of $4,000, its net sales were

A) $54,000.

B) $50,000.

C) $46,000.

D) $4,000.

A) $54,000.

B) $50,000.

C) $46,000.

D) $4,000.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

42

A wholesale business sells goods with a list price of $900 and a trade discount of 40 percent. The net price is

A) $360.00.

B) $540.00.

C) $900.00.

D) $940.00.

A) $360.00.

B) $540.00.

C) $900.00.

D) $940.00.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

43

The amount used by wholesalers to record sales in its sales journal is

A) the retail price.

B) the list price.

C) the net price.

D) the original price.

A) the retail price.

B) the list price.

C) the net price.

D) the original price.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

44

An example of a merchandising company is a

A) bookstore

B) restaurant

C) hair salon

D) real estate office

A) bookstore

B) restaurant

C) hair salon

D) real estate office

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

45

The entry to record a return by a credit customer of defective merchandise on which no sales tax was charged includes

A) a debit to Sales and a credit to Accounts Receivable.

B) a debit to Sales and a credit to Sales Returns and Allowances.

C) a debit to Sales Returns and Allowances and a credit to Accounts Receivable.

D) a debit to Accounts Receivable and a credit to Sales Returns and Allowances.

A) a debit to Sales and a credit to Accounts Receivable.

B) a debit to Sales and a credit to Sales Returns and Allowances.

C) a debit to Sales Returns and Allowances and a credit to Accounts Receivable.

D) a debit to Accounts Receivable and a credit to Sales Returns and Allowances.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

46

Hugh Snow returned merchandise to Farley Co. The entry on the books of Farley company to record the return of merchandise from Hugh Snow would include a:

A) Debit Accounts Payable

B) Credit to Purchase Returns and Allowances

C) Debit to Account Receivable

D) Debit Sales Returns and Allowances

A) Debit Accounts Payable

B) Credit to Purchase Returns and Allowances

C) Debit to Account Receivable

D) Debit Sales Returns and Allowances

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

47

If a firm does not have a sales returns and allowances journal, the entries for these transactions are made in

A) the sales journal.

B) the general journal.

C) the cash receipts journal.

D) the cash payments journal.

A) the sales journal.

B) the general journal.

C) the cash receipts journal.

D) the cash payments journal.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

48

After all postings have been made, the total of the schedule of accounts receivable should equal

A) the balance of the Sales account.

B) the total of the Accounts Receivable Debit column in the sales journal.

C) the balance of the Accounts Receivable account in the general ledger.

D) the total of all sales on account for the accounting period.

A) the balance of the Sales account.

B) the total of the Accounts Receivable Debit column in the sales journal.

C) the balance of the Accounts Receivable account in the general ledger.

D) the total of all sales on account for the accounting period.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

49

To find the balance due from an individual customer, the accountant would refer to

A) the sales journal.

B) the Sales account in the general ledger.

C) the accounts receivable subsidiary ledger.

D) the Accounts Receivable account in the general ledger.

A) the sales journal.

B) the Sales account in the general ledger.

C) the accounts receivable subsidiary ledger.

D) the Accounts Receivable account in the general ledger.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

50

On Deck Sports Memorabilia store sells a Babe Ruth rookie card for $4,600 on account. If the sales tax on the sale is 8%, what is the amount debited to Accounts Receivable?

A) $4,232

B) $4,968

C) $4,600

D) $4,592

A) $4,232

B) $4,968

C) $4,600

D) $4,592

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

51

The Sales Returns and Allowances account is classified as

A) an asset account.

B) a contra asset account.

C) an expense account.

D) a contra revenue account.

A) an asset account.

B) a contra asset account.

C) an expense account.

D) a contra revenue account.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

52

On the Income Statement, Sales Returns and Allowances have the effect of

A) Increasing total revenue

B) Increasing total expenses

C) Decreasing total revenue

D) Decreasing total expenses

A) Increasing total revenue

B) Increasing total expenses

C) Decreasing total revenue

D) Decreasing total expenses

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

53

Merchandise is sold on credit for $600 plus 5 percent sales tax. The entry in the sales journal will include a debit to Accounts Receivable for

A) $600.00.

B) $603.50.

C) $605.50.

D) $630.00.

A) $600.00.

B) $603.50.

C) $605.50.

D) $630.00.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following statements is not correct?

A) Postings to the accounts receivable subsidiary ledger are usually made once a month on the last day of the month.

B) Before any posting to the subsidiary ledger takes place, the equality of the debits and credits recorded in the sales journal are proved by comparing the column totals.

C) Before any posting to the general ledger takes place, the equality of the debits and credits recorded in the sales journal are proved by comparing the column totals.

D) When special journals are used, postings to the accounts receivable account in the general ledger are usually made once a month on the last day of the month.

A) Postings to the accounts receivable subsidiary ledger are usually made once a month on the last day of the month.

B) Before any posting to the subsidiary ledger takes place, the equality of the debits and credits recorded in the sales journal are proved by comparing the column totals.

C) Before any posting to the general ledger takes place, the equality of the debits and credits recorded in the sales journal are proved by comparing the column totals.

D) When special journals are used, postings to the accounts receivable account in the general ledger are usually made once a month on the last day of the month.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following statements is correct?

A) The sales journal is used for recording both cash sales and credit sales.

B) Since the sales journal is used for a single purpose, there is no need to enter any descriptions.

C) To provide an adequate audit trail, sales on credit should be recorded in both the sales journal and the general journal.

D) The complete information for each sale of merchandise on credit can be recorded on one line of the cash receipts journal.

A) The sales journal is used for recording both cash sales and credit sales.

B) Since the sales journal is used for a single purpose, there is no need to enter any descriptions.

C) To provide an adequate audit trail, sales on credit should be recorded in both the sales journal and the general journal.

D) The complete information for each sale of merchandise on credit can be recorded on one line of the cash receipts journal.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

56

A retailer recorded the following in June: cash sales $2,000; credit sales, $9,000; sales returns and allowances, $1,000. Assuming the sales tax rate is 7 percent, the entry to record the sales tax payment includes a debit to Sales Tax Payable for

A) $560.

B) $630.

C) $700.

D) $770.

A) $560.

B) $630.

C) $700.

D) $770.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following describes Sales Tax Payable?

A) A revenue account with a normal credit balance.

B) A liability account with a normal debit balance.

C) A liability account with a normal credit balance.

D) An asset account with a normal debit balance.

A) A revenue account with a normal credit balance.

B) A liability account with a normal debit balance.

C) A liability account with a normal credit balance.

D) An asset account with a normal debit balance.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

58

The Sales Returns and Allowances account is presented

A) on the balance sheet as a deduction from Accounts Receivable.

B) on the income statement as a deduction from Sales.

C) on the income statement as an addition to Sales.

D) on the balance sheet as a deduction from Capital.

A) on the balance sheet as a deduction from Accounts Receivable.

B) on the income statement as a deduction from Sales.

C) on the income statement as an addition to Sales.

D) on the balance sheet as a deduction from Capital.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following statements is not correct?

A) Use of a sales journal eliminates repetition in posting individual entries to the Accounts Receivable account in the general ledger.

B) A journal that is used to record only one type of a transaction is called a special journal.

C) The sales slip is the source document for sales on credit transactions.

D) If the firm must collect sales tax on retail transactions, the sales journal should have a Sales Tax Payable Debit column.

A) Use of a sales journal eliminates repetition in posting individual entries to the Accounts Receivable account in the general ledger.

B) A journal that is used to record only one type of a transaction is called a special journal.

C) The sales slip is the source document for sales on credit transactions.

D) If the firm must collect sales tax on retail transactions, the sales journal should have a Sales Tax Payable Debit column.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

60

In a sales journal used to record taxable sales, the total of the Accounts Receivable column should equal

A) the sum of the totals of the Sales Tax Payable column and the Sales column.

B) the difference between the total of the Sales Tax Payable column and the total of the Sales column.

C) the total of the Sales column.

D) the total of the Sales Tax Payable column.

A) the sum of the totals of the Sales Tax Payable column and the Sales column.

B) the difference between the total of the Sales Tax Payable column and the total of the Sales column.

C) the total of the Sales column.

D) the total of the Sales Tax Payable column.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

61

Read the description of following transactions that are required during the accounting period for Mario's Electronics. Determine the account and amount to be debited and the account and amount to be credited.

A. Gave a $300 allowance to a credit customer for damaged merchandise. The original sale involved a 10 percent sales tax.

B. Accepted a return of $150 in merchandise from a credit customer. The original sale involved 5 percent sales tax.

C. Sold $200 in merchandise for cash. The transaction involved 8 percent sales tax.

D. Received a check for $50 from a credit customer on account.

E. Sold $1,200 in merchandise on credit. The transaction did not involve sales tax.

A. Gave a $300 allowance to a credit customer for damaged merchandise. The original sale involved a 10 percent sales tax.

B. Accepted a return of $150 in merchandise from a credit customer. The original sale involved 5 percent sales tax.

C. Sold $200 in merchandise for cash. The transaction involved 8 percent sales tax.

D. Received a check for $50 from a credit customer on account.

E. Sold $1,200 in merchandise on credit. The transaction did not involve sales tax.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

62

The amount of the trade discount taken by the customer is recorded as a(n)

A) asset.

B) liability.

C) expense.

D) sales recorded net of trade discounts.

A) asset.

B) liability.

C) expense.

D) sales recorded net of trade discounts.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following describes Sales Returns and Allowances?

A) A revenue account with a normal credit balance.

B) An expense account with a normal debit balance.

C) A contra revenue account with a normal debit balance.

D) A contra expense account with a normal credit balance.

A) A revenue account with a normal credit balance.

B) An expense account with a normal debit balance.

C) A contra revenue account with a normal debit balance.

D) A contra expense account with a normal credit balance.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

64

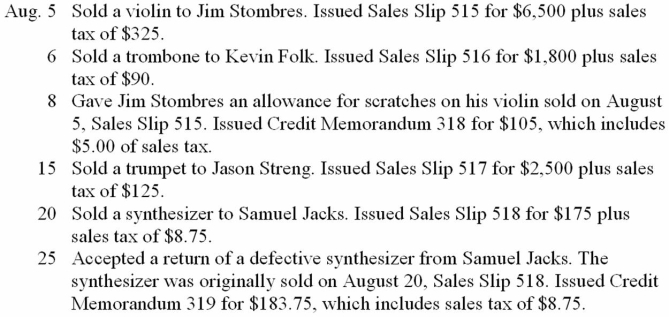

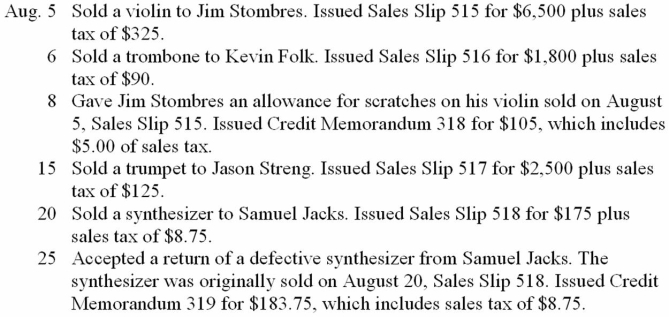

All That Jazz Music Store had the following transactions during the month of August 2013. Record the transactions on page 15 of a sales journal and page 18 of a general journal. Total, prove, and rule the sales journal as of August 31.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

65

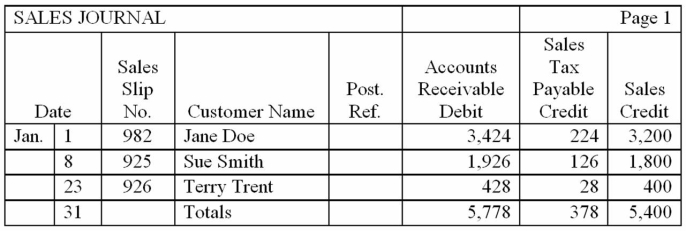

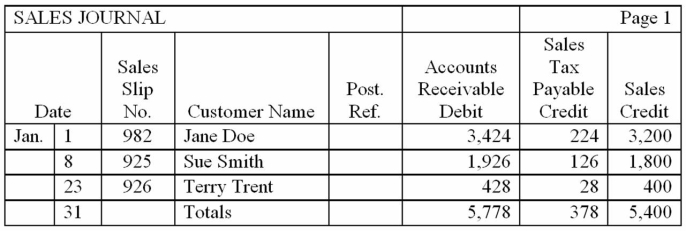

The sales journal for Simon Company is shown below. Describe how the amounts would be posted to the accounts receivable subsidiary ledger accounts.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

66

The sales journal for Carothers Company is shown below. Describe how the amounts would be posted to the general ledger accounts.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

67

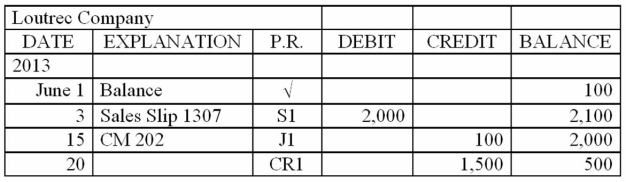

One of the customer accounts from the accounts receivable ledger for Rogers Flooring is shown below. Explain each of the entries that have been posted to this customer's subsidiary ledger account.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

68

Kay Sadia sold merchandise for $8,750 subject to a 6% sales tax. The entry in the sales journal will include a debit to Accounts Receivable for

A) $9,275.00

B) $8,225.00

C) $8,750.00

D) $8,462.00

A) $9,275.00

B) $8,225.00

C) $8,750.00

D) $8,462.00

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

69

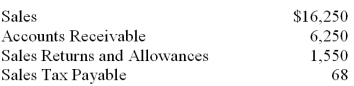

Selected balances from the general ledger of the Valley Video Rentals on May 31, 2013, are listed below. Use the appropriate data to prepare the Revenue section of the firm's income statement for the month ended May 31, 2013.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

70

Barnett's Electronics Store had the following transactions during the month of January 2013. Record the transactions on page 1 of a sales journal and page 1 of a general journal. Total, prove, and rule the sales journal as of January 31.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

71

Bradley's Appliance Store had the following transactions during the month of May 2013. Record the transactions on page 5 of a sales journal and page 8 of a general journal. Total, prove, and rule the sales journal as of May 31.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

72

Selected balances from the general ledger of the All Star Video Rentals on July 31, 2013, are listed below. Use the appropriate data to prepare the Revenue section of the firm's income statement for the month ended July 31, 2013.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

73

One of the customer accounts from the accounts receivable ledger for Paragon Consulting Services is shown below. Explain each of the entries that have been posted to this customer's subsidiary ledger account.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

74

Read the description of following transactions that are required during the accounting period for Drummond Consulting Services. Determine the account to be debited and the account to be credited.

A. Sold merchandise on credit. The transaction involved sales tax.

B. Accepted a return of merchandise from a credit customer. The original sale involved sales tax.

C. Received a check from a credit customer on account.

D. Sold merchandise on credit. The transaction did not involve sales tax.

E. Gave an allowance to a credit customer for damaged merchandise. The original sale involved sales tax.

A. Sold merchandise on credit. The transaction involved sales tax.

B. Accepted a return of merchandise from a credit customer. The original sale involved sales tax.

C. Received a check from a credit customer on account.

D. Sold merchandise on credit. The transaction did not involve sales tax.

E. Gave an allowance to a credit customer for damaged merchandise. The original sale involved sales tax.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

75

Hour Place Clock Shop sold a grandfather clock for $2,250 subject to a 9% sales tax. The entry in the sales journal will include a debit to Accounts Receivable for

A) $2,250.00

B) $2,092.50

C) $2,452.50

D) $2,362.00

A) $2,250.00

B) $2,092.50

C) $2,452.50

D) $2,362.00

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

76

The accounts receivable ledger for Acme Auto Parts is shown below. Prepare a schedule of accounts receivable as of March 31, 2013.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

77

A wholesale firm made sales with the following list prices and trade discounts. Calculate the amount the firm will use to record each sale in the sales journal. Show your calculation.

A. List price of $900 and trade discount of 45 percent.

B. List price of $500 and trade discount of 35 percent.

C. List Price of $1,600 and trade discounts of 25 and 15 percent.

A. List price of $900 and trade discount of 45 percent.

B. List price of $500 and trade discount of 35 percent.

C. List Price of $1,600 and trade discounts of 25 and 15 percent.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

78

One of the customer accounts from the accounts receivable ledger for Toulouse Company is shown below. Explain each of the entries that have been posted to this customer's subsidiary ledger account.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

79

Hour Place Clock Shop sold a grandfather clock for $2,250 subject to a 9% sales tax. The entry in the sales journal will include a credit to Sales for

A) $2,250.00

B) $2,092.50

C) $2,452.50

D) $2,362.00

A) $2,250.00

B) $2,092.50

C) $2,452.50

D) $2,362.00

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

80

Selected balances from the general ledger of the Loren Company on March 31, 2013, are listed below. Use the appropriate data to prepare the Revenue section of the firm's income statement for the month ended March 31, 2013.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck