Deck 16: Activity-Based-Costing: a Tool to Aid Decision Making

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/15

Play

Full screen (f)

Deck 16: Activity-Based-Costing: a Tool to Aid Decision Making

1

Suppose an action analysis report is prepared for the function mentioned above. What would be the "yellow margin" in the action analysis report? (Round to the nearest whole dollar.)

A)$229

B)$334

C)$279

D)$154

A)$229

B)$334

C)$279

D)$154

D

2

If a cost object such as a product or customer has a positive green margin, then:

A)its yellow margin will be positive.

B)its yellow margin may be either positive, negative, or zero.

C)its yellow margin will be negative.

D)its yellow margin will be zero.

A)its yellow margin will be positive.

B)its yellow margin may be either positive, negative, or zero.

C)its yellow margin will be negative.

D)its yellow margin will be zero.

B

3

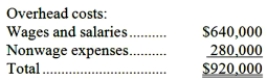

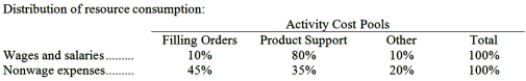

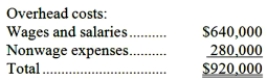

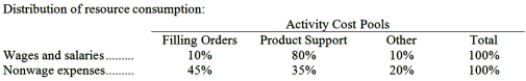

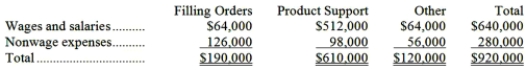

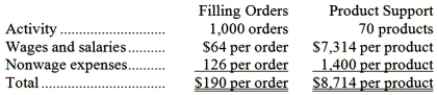

Goluski Company, a wholesale distributor, uses activity-based costing for its overhead costs. The company has provided the following data concerning its annual overhead costs and its activity based costing system:

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

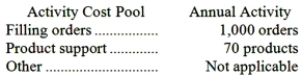

The amount of activity for the year is as follows: Required:

Required:

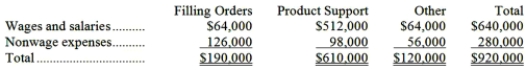

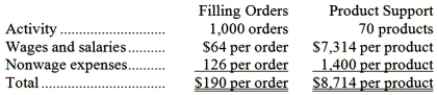

Compute the activity rates (i.e., cost per unit of activity) for the Filling Orders and Product Support activity cost pools:

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.The amount of activity for the year is as follows:

Required:

Required:Compute the activity rates (i.e., cost per unit of activity) for the Filling Orders and Product Support activity cost pools:

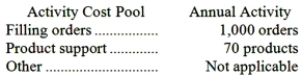

First-stage allocation  Activity rates (costs divided by activity)

Activity rates (costs divided by activity)

Activity rates (costs divided by activity)

Activity rates (costs divided by activity)

4

What would be the total overhead cost per order according to the activity based costing system? In other words, what would be the overall activity rate for the filling orders activity cost pool? (Round to the nearest whole cent.)

A)$54.00

B)$63.00

C)$58.50

D)$56.50

A)$54.00

B)$63.00

C)$58.50

D)$56.50

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

5

To the nearest whole dollar, how much wages and salaries cost would be allocated to a customer who made 4 orders in a year?

A)$15,756

B)$13,332

C)$10,908

D)$21,816

A)$15,756

B)$13,332

C)$10,908

D)$21,816

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

6

What would be the total overhead cost per customer according to the activity based costing system? In other words, what would be the overall activity rate for the customer support activity cost pool? (Round to the nearest whole dollar.)

A)$16,200

B)$18,900

C)$20,100

D)$21,600

A)$16,200

B)$18,900

C)$20,100

D)$21,600

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

7

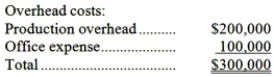

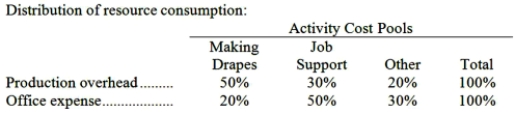

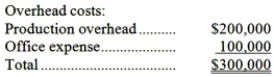

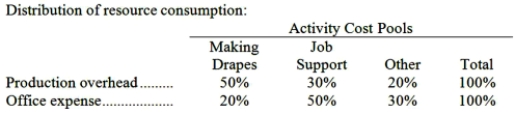

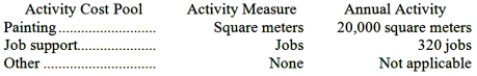

Inskeep Draperies makes custom draperies for homes and businesses. The company uses an activity-based costing system for its overhead costs. The company has provided the following data concerning its annual overhead costs and its activity cost pools.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

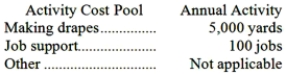

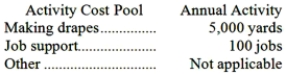

The amount of activity for the year is as follows: Required:

Required:

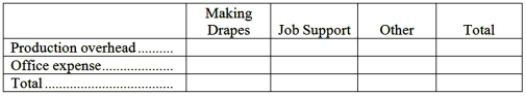

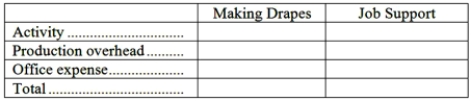

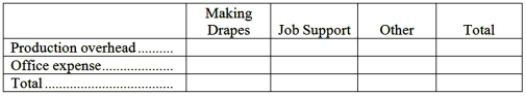

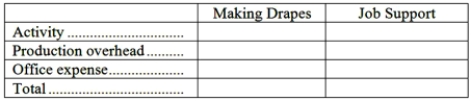

a. Prepare the first-stage allocation of overhead costs to the activity cost pools by filling in the table below: b. Compute the activity rates (i.e., cost per unit of activity) for the Making Drapes and Job Support activity cost pools by filling in the table below:

b. Compute the activity rates (i.e., cost per unit of activity) for the Making Drapes and Job Support activity cost pools by filling in the table below:  c. Prepare an action analysis report in good form of a job that involves making 70 yards of drapes and has direct materials and direct labor cost of $1,870. The sales revenue from this job is $3,700.

c. Prepare an action analysis report in good form of a job that involves making 70 yards of drapes and has direct materials and direct labor cost of $1,870. The sales revenue from this job is $3,700.

For purposes of this action analysis report, direct materials and direct labor should be classified as a Green cost; production overhead as a Red cost; and office expense as a Yellow cost.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.The amount of activity for the year is as follows:

Required:

Required:a. Prepare the first-stage allocation of overhead costs to the activity cost pools by filling in the table below:

b. Compute the activity rates (i.e., cost per unit of activity) for the Making Drapes and Job Support activity cost pools by filling in the table below:

b. Compute the activity rates (i.e., cost per unit of activity) for the Making Drapes and Job Support activity cost pools by filling in the table below:  c. Prepare an action analysis report in good form of a job that involves making 70 yards of drapes and has direct materials and direct labor cost of $1,870. The sales revenue from this job is $3,700.

c. Prepare an action analysis report in good form of a job that involves making 70 yards of drapes and has direct materials and direct labor cost of $1,870. The sales revenue from this job is $3,700.For purposes of this action analysis report, direct materials and direct labor should be classified as a Green cost; production overhead as a Red cost; and office expense as a Yellow cost.

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

8

If a cost object such as a product or customer has a positive yellow margin, then:

A)its red margin will be positive.

B)its red margin may be either positive, negative, or zero.

C)its red margin will be negative.

D)its red margin will be zero.

A)its red margin will be positive.

B)its red margin may be either positive, negative, or zero.

C)its red margin will be negative.

D)its red margin will be zero.

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

9

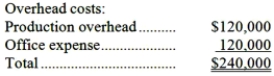

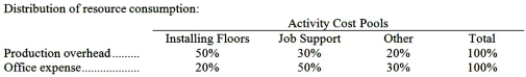

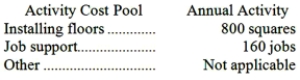

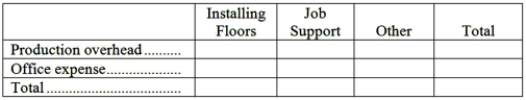

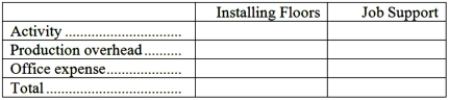

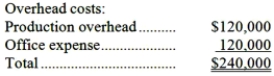

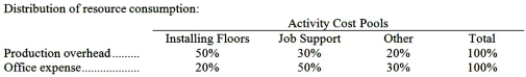

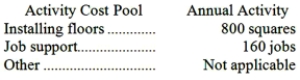

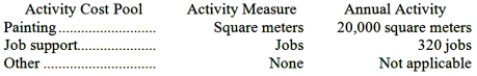

Hasher Hardwood Floors installs oak and other hardwood floors in homes and businesses. The company uses an activity-based costing system for its overhead costs. The company has provided the following data concerning its annual overhead costs and its activity based costing system:

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

The amount of activity for the year is as follows: A "square" is a measure of area that is roughly equivalent to 1,000 square feet.

A "square" is a measure of area that is roughly equivalent to 1,000 square feet.

Required:

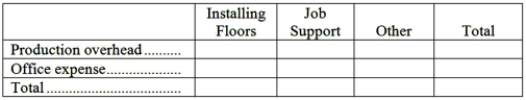

a. Prepare the first-stage allocation of overhead costs to the activity cost pools by filling in the table below: b. Compute the activity rates (i.e., cost per unit of activity) for the Installing Floors and Job Support activity cost pools by filling in the table below:

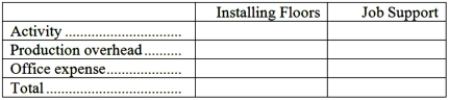

b. Compute the activity rates (i.e., cost per unit of activity) for the Installing Floors and Job Support activity cost pools by filling in the table below:  c. Compute the overhead cost, according to the activity-based costing system, of a job that involves installing 2.8 squares.

c. Compute the overhead cost, according to the activity-based costing system, of a job that involves installing 2.8 squares.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.The amount of activity for the year is as follows:

A "square" is a measure of area that is roughly equivalent to 1,000 square feet.

A "square" is a measure of area that is roughly equivalent to 1,000 square feet.Required:

a. Prepare the first-stage allocation of overhead costs to the activity cost pools by filling in the table below:

b. Compute the activity rates (i.e., cost per unit of activity) for the Installing Floors and Job Support activity cost pools by filling in the table below:

b. Compute the activity rates (i.e., cost per unit of activity) for the Installing Floors and Job Support activity cost pools by filling in the table below:  c. Compute the overhead cost, according to the activity-based costing system, of a job that involves installing 2.8 squares.

c. Compute the overhead cost, according to the activity-based costing system, of a job that involves installing 2.8 squares.

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

10

Suppose an action analysis report is prepared for the function mentioned above. What would be the "red margin" in the action analysis report? (Round to the nearest whole dollar.)

A)$(68)

B)$32

C)$(118)

D)$182

A)$(68)

B)$32

C)$(118)

D)$182

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following statements concerning ease of adjustment codes is incorrect?

A)"Green" costs adjust automatically to changes in activity.

B)"Yellow" costs could be adjusted to changes in activity, but such adjustments require management action; the adjustment is not automatic.

C)"Red" costs cannot be adjusted to changes in activity.

D)The costs of idle capacity and organization-sustaining costs are not assigned codes.

A)"Green" costs adjust automatically to changes in activity.

B)"Yellow" costs could be adjusted to changes in activity, but such adjustments require management action; the adjustment is not automatic.

C)"Red" costs cannot be adjusted to changes in activity.

D)The costs of idle capacity and organization-sustaining costs are not assigned codes.

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

12

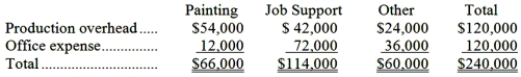

Jansen Painting paints the interiors and exteriors of homes and commercial buildings. The company uses an activity-based costing system for its overhead costs. The company has provided the following data concerning its activity-based costing system.  The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

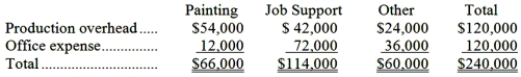

The company has already finished the first stage of the allocation process in which costs were allocated to the activity cost centers. The results are listed below: Required:

Required:

a. Compute the activity rates (i.e., cost per unit of activity) for the Painting and Job Support activity cost pools. Round off all calculations to the nearest whole cent.

b. Prepare an action analysis report in good form of a job that involves painting 97 square meters and has direct materials and direct labor cost of $3,150. The sales revenue from this job is $4,200.

For purposes of this action analysis report, direct materials and direct labor should be classified as a Green cost; production overhead as a Red cost; and office expense as a Yellow cost.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.The company has already finished the first stage of the allocation process in which costs were allocated to the activity cost centers. The results are listed below:

Required:

Required:a. Compute the activity rates (i.e., cost per unit of activity) for the Painting and Job Support activity cost pools. Round off all calculations to the nearest whole cent.

b. Prepare an action analysis report in good form of a job that involves painting 97 square meters and has direct materials and direct labor cost of $3,150. The sales revenue from this job is $4,200.

For purposes of this action analysis report, direct materials and direct labor should be classified as a Green cost; production overhead as a Red cost; and office expense as a Yellow cost.

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

13

An action analysis report provides more detail about costs and how they might adjust to changes in activity than a conventional activity-based costing analysis.

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

14

If a cost object such as a product or customer has a negative red margin, then:

A)its yellow margin will be positive.

B)its yellow margin may be positive, negative, or zero.

C)its yellow margin will be negative.

D)its yellow margin will be zero.

A)its yellow margin will be positive.

B)its yellow margin may be positive, negative, or zero.

C)its yellow margin will be negative.

D)its yellow margin will be zero.

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

15

According to the activity-based costing system, what was the total cost (including the costs of raw ingredients) of the function mentioned above? (Round to the nearest whole dollar.)

A)$1,868

B)$2,368

C)$2,568

D)$1,718

A)$1,868

B)$2,368

C)$2,568

D)$1,718

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck