Deck 7: Job Costing

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

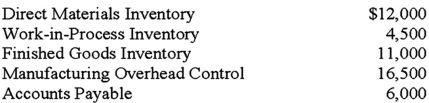

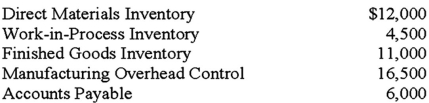

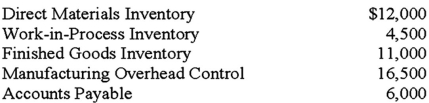

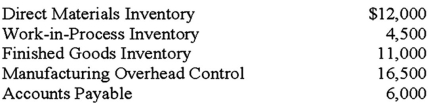

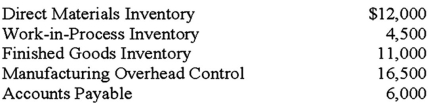

Question

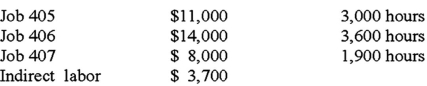

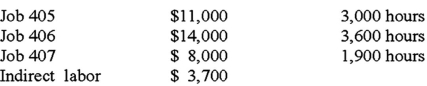

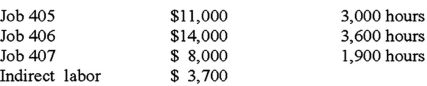

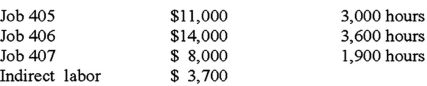

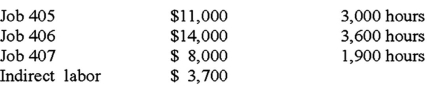

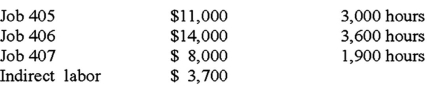

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

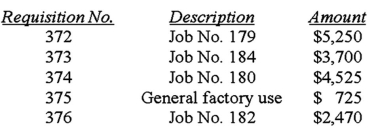

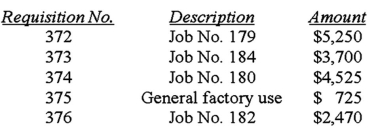

Question

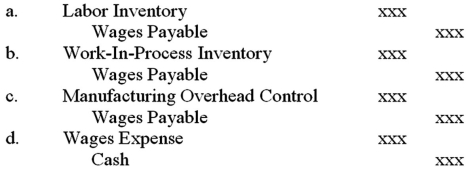

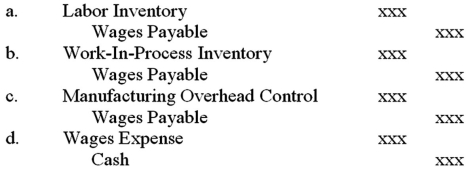

Question

Question

Question

Question

Question

Question

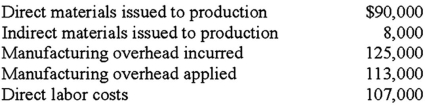

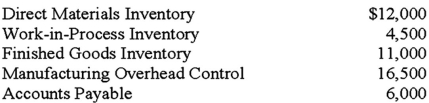

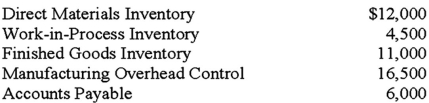

Question

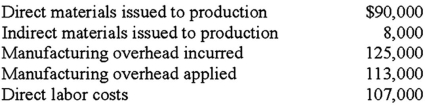

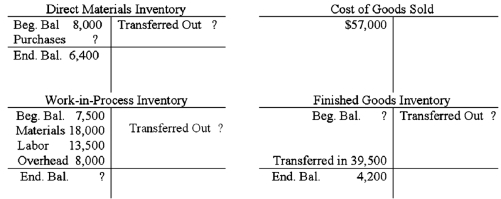

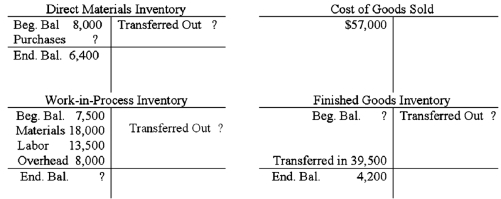

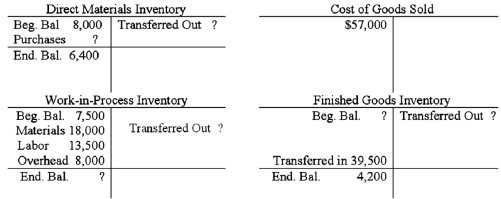

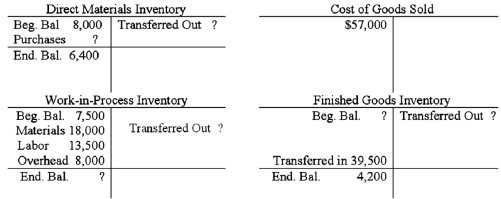

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/91

Play

Full screen (f)

Deck 7: Job Costing

1

Overapplied overhead occurs when the actual overhead costs incurred during a period are greater than the overhead costs applied during the period.An overapplied overhead situation occurs when the applied overhead exceeds the actual overhead incurred.

False

2

The journal entry to apply manufacturing overhead costs to completed jobs credits either Applied Manufacturing Overhead or Manufacturing Overhead (Control).The credit can be made to either account depending on the organization's chart of accounts.

True

3

A job is a product or service that can be easily and conveniently distinguished from other products/services.This is a definition of a job.

True

4

Underapplied overhead occurs when the actual overhead costs incurred during a period are greater than the overhead costs applied during the period.An underapplied overhead situation occurs when the actual overhead incurred exceeds the applied overhead.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

5

Service organizations,by their nature,cannot have a balance in Work-in-Process Inventory.A service may take several accounting periods to complete so there may very well be a Work-in-Process.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

6

It is unethical to intentionally charge costs to the wrong job.It is unethical to knowingly do something wrong.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

7

Actual costing does not use a predetermined overhead rate to apply manufacturing overhead costs to jobs completed during the period.The application rate is based on the actual costs incurred during the period.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

8

The periodic allocation of manufacturing overhead costs to job cost sheets is based on an event,not a transaction.The allocation of manufacturing overhead takes place at the end of a period (Work-in-Process)or the completion of a job (transfer to Finished Goods Inventory).

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

9

Accounting for direct materials and direct labor is easier than accounting for manufacturing overhead costs.This is because direct costs are traceable to jobs while overhead is allocated.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

10

Service organizations generally use the same job costing procedures as manufacturers.The difference is the product being produced is intangible.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

11

The journal entry to record actual manufacturing overhead for indirect material debits Manufacturing Overhead (Control)and credits Accounts Payable.The credit is to materials inventory.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

12

One difference between jobs and projects is the account titles used in the costing process.The main difference is the length of time to complete the work.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

13

The journal entry to record actual manufacturing overhead for indirect labor debits Manufacturing Overhead (Control)and credits Work-in-Process inventory.The credit should be to Wages Payable.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

14

Indirect material and indirect labor are two examples of manufacturing overhead costs.Indirect material and labor are included in overhead because they are considered to be insignificant in cost (material)and not directly related to the job (labor).

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

15

Job shops have three types of inventory accounts: Direct Materials,Work-in-Process,and Finished Goods.This is a correct statement as far as inventory accounts.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

16

At the end of the accounting period,manufacturing overhead costs are applied to uncompleted jobs using the same predetermined overhead rate that is used to apply manufacturing overhead costs to completed jobs.The same overhead rate is applied to all manufacturing activity during the business year.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

17

Normal costing uses the actual allocation base activity to apply manufacturing overhead costs to jobs during the period.Normal costing uses the actual allocation base activity to apply manufacturing overhead costs to jobs during the period.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

18

The cost in the ending Finished Goods inventory account consists of the direct materials,direct labor,and manufacturing overhead of all jobs still in process at the end of the period.The ending Finished Goods inventory account consists of the direct materials,direct labor,and manufacturing overhead of all jobs that have been completed.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

19

Job cost sheets are used in accounting systems as a subsidiary ledger for the Work-in-Process account.Job cost sheets contain the details of the unfinished work;and constitute the subsidiary ledger for Work-in-Process,Finished Goods,and Cost of Goods Sold.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

20

The predetermined overhead rate is computed by dividing the estimated activity of the allocation base into the estimated manufacturing overhead costs.Rate = estimated overhead/estimated activity.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

21

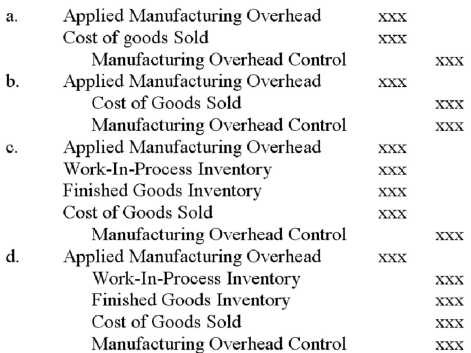

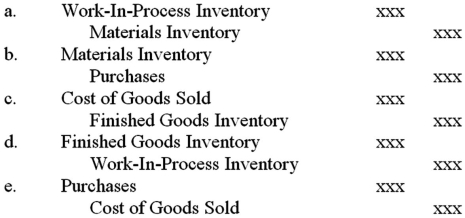

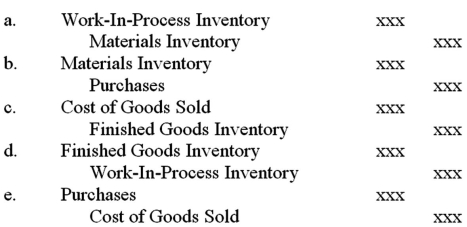

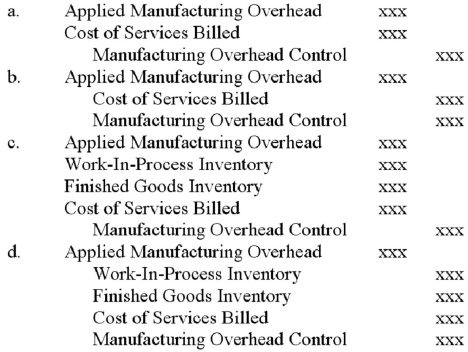

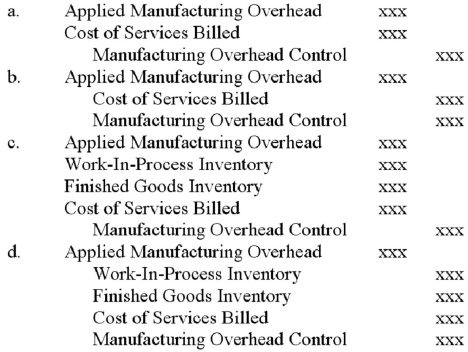

The journal entry to write-off an insignificant underapplied overhead balance at the end of an accounting period is:

A)a.

B)B.

C)C.

D)D.The most conservative method is to write-off the immaterial amount directly to Cost of Goods SolD.

A)a.

B)B.

C)C.

D)D.The most conservative method is to write-off the immaterial amount directly to Cost of Goods SolD.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following documents is used as the basis for posting to the direct materials section of the job cost sheet?

A)Purchase requisition.

B)Materials requisition.

C)Receiving report.

D)Purchase order.

A)Purchase requisition.

B)Materials requisition.

C)Receiving report.

D)Purchase order.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

23

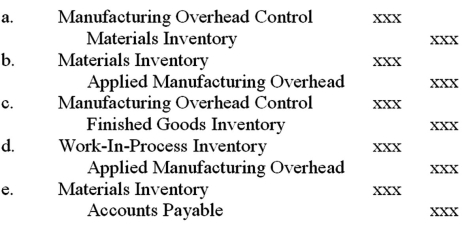

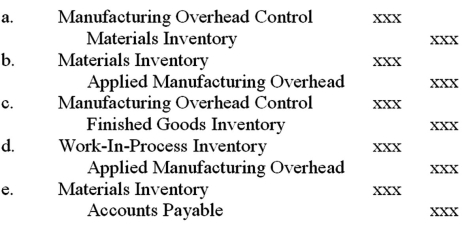

The journal entry to record the actual manufacturing overhead costs for indirect material is:

A)a.

B)B.

C)C.

D)D.

A)a.

B)B.

C)C.

D)D.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

24

Underapplied overhead occurs when the balance in the Manufacturing Overhead Control account is:

A)greater than the balance in the Applied Manufacturing Overhead account.

B)equal to the balance in the Applied Manufacturing Overhead account.

C)less than the balance in the Applied Manufacturing Overhead account.

D)less than the balance in the Finished Goods Inventory account.

A)greater than the balance in the Applied Manufacturing Overhead account.

B)equal to the balance in the Applied Manufacturing Overhead account.

C)less than the balance in the Applied Manufacturing Overhead account.

D)less than the balance in the Finished Goods Inventory account.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

25

For which of the following businesses would a job order cost system be appropriate?

A)Auto repair shop.

B)Crude oil refinery.

C)Drug manufacturer.

D)Root beer producer.

A)Auto repair shop.

B)Crude oil refinery.

C)Drug manufacturer.

D)Root beer producer.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

26

If a company multiplies its predetermined overhead rate by the actual activity level of its allocation base,it is using:

A)standard costing.

B)normal costing.

C)actual costing.

D)budget costing.

A)standard costing.

B)normal costing.

C)actual costing.

D)budget costing.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

27

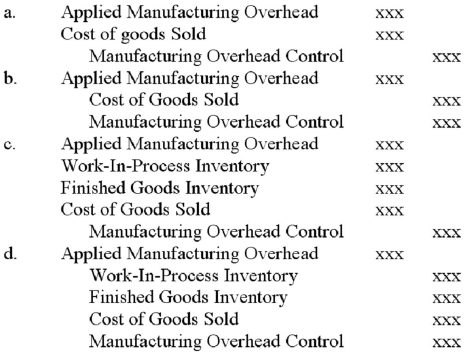

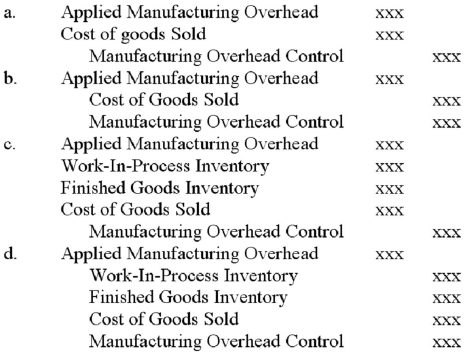

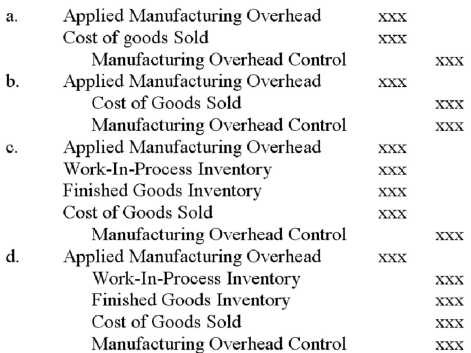

The journal entry to write-off a significant underapplied overhead balance at the end of an accounting period is:

A)a.

B)B.

C)C.

D)D.Significant underapplied (and overapplied)overhead balances should be allocated to the three accounts that have overheaD.

A)a.

B)B.

C)C.

D)D.Significant underapplied (and overapplied)overhead balances should be allocated to the three accounts that have overheaD.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

28

In a job costing system,the dollar amount in the journal entry that transfers the costs of jobs from Work-in-Process Inventory to Finished Goods Inventory is the sum of the costs charged to all jobs:

A)sold during the period.

B)completed during the period.

C)in process during the period.

D)started in process during the perioD.

A)sold during the period.

B)completed during the period.

C)in process during the period.

D)started in process during the perioD.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following statements is (are)true regarding product costing? (A)A job is a cost object that can be easily and conveniently distinguished from other cost objects.(B)Job cost sheets are used in accounting systems as a subsidiary ledger for the Work-in-Process account.

A)Only A is true.

B)Only B is true.

C)Both A and B are true.

D)Neither A nor B is true.

A)Only A is true.

B)Only B is true.

C)Both A and B are true.

D)Neither A nor B is true.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

30

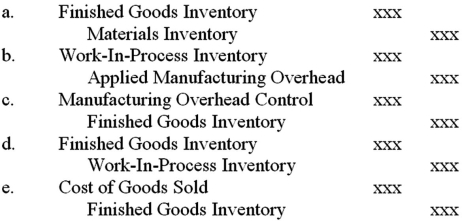

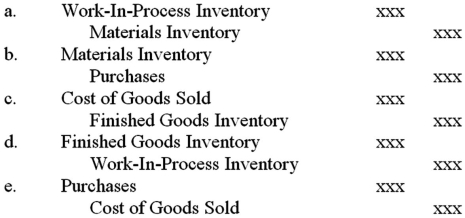

The journal entry to record the completion of a job in a job costing system is:

A)a.

B)B.

C)C.

D)D.

A)a.

B)B.

C)C.

D)D.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

31

If a company multiplies its actual overhead rate by the actual activity level of its allocation base,it is using:

A)standard costing.

B)normal costing.

C)actual costing.

D)budget costing.

A)standard costing.

B)normal costing.

C)actual costing.

D)budget costing.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

32

The journal entry to record the completion of a job in a job order cost system is:

A)a.

B)B.

C)C.

D)D.

A)a.

B)B.

C)C.

D)D.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

33

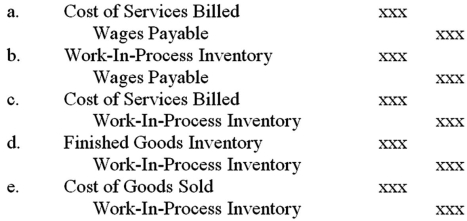

The journal entry to record the completion of a contract in a job costing system for a service firm is:

A)a.

B)B.

C)C.

D)D.

A)a.

B)B.

C)C.

D)D.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following documents is used as the basis for posting to the direct labor section of the job cost sheet?

A)Purchase requisition.

B)Materials requisition.

C)Receiving report.

D)Purchase order.

E)Time card.

A)Purchase requisition.

B)Materials requisition.

C)Receiving report.

D)Purchase order.

E)Time card.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

35

What are the transfers-out from the Finished Goods Inventory called?

A)Cost of Goods Manufactured.

B)Cost of Goods Available.

C)Cost of Goods Completed.

D)Cost of Goods SolD.When transfers occur from Finished Goods Inventory they go to Cost of Goods SolD.

A)Cost of Goods Manufactured.

B)Cost of Goods Available.

C)Cost of Goods Completed.

D)Cost of Goods SolD.When transfers occur from Finished Goods Inventory they go to Cost of Goods SolD.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following companies would most likely use job costing?

A)Paper manufacturer.

B)Paint producer.

C)Breakfast cereal maker.

D)Advertising agency.

A)Paper manufacturer.

B)Paint producer.

C)Breakfast cereal maker.

D)Advertising agency.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

37

The journal entry to record requisitions of material for new jobs started during the period is:

A)a.

B)B.

C)C.

D)D.

A)a.

B)B.

C)C.

D)D.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

38

One of the primary differences between job costing for service and manufacturing companies is service firms generally:

A)use fewer direct materials.

B)have less direct labor.

C)do not use predetermined overhead rates.

D)have no Work-in-Process Inventory.

A)use fewer direct materials.

B)have less direct labor.

C)do not use predetermined overhead rates.

D)have no Work-in-Process Inventory.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following accounts is used to accumulate the actual manufacturing overhead costs incurred during a period?

A)Applied Manufacturing Overhead.

B)Work-in-Process Inventory.

C)Manufacturing Overhead Control.

D)Cost of Goods SolD.

A)Applied Manufacturing Overhead.

B)Work-in-Process Inventory.

C)Manufacturing Overhead Control.

D)Cost of Goods SolD.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following statements is (are)true regarding the application of manufacturing overhead? (A)Manufacturing overhead is only recorded on the job cost sheets when (a)financial statements are prepared or a job is completed.(B)Overapplied overhead occurs when the actual overhead costs incurred during a period are greater than the overhead costs applied during the period.

A)Only A is true.

B)Only B is true.

C)Both A and B are true.

D)Neither A nor B is true.

A)Only A is true.

B)Only B is true.

C)Both A and B are true.

D)Neither A nor B is true.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

41

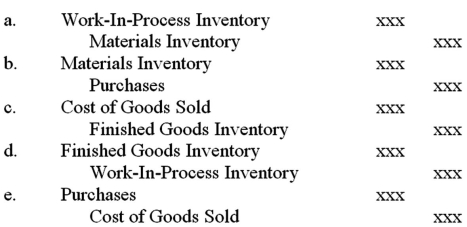

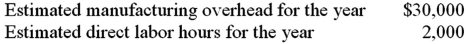

Two jobs were worked on during the year: Job A-101 and Job A-102.The number of direct labor-hours spent on Job A-101 and Job A-102 were 1,200 and 1,000,respectively.The actual manufacturing overhead was $37,000.What is the predetermined manufacturing overhead rate per direct labor hour for the year?

Two jobs were worked on during the year: Job A-101 and Job A-102.The number of direct labor-hours spent on Job A-101 and Job A-102 were 1,200 and 1,000,respectively.The actual manufacturing overhead was $37,000.What is the predetermined manufacturing overhead rate per direct labor hour for the year?A)$15.

B)$20.

C)$25.

D)$30.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

42

Manufacturing overhead applied on the basis of direct labor-hours was $120,000,while actual manufacturing overhead incurred was $124,000 for the month of April.Which of the following is always true given the statement above?

A)Overhead was overapplied by $4,000.

B)Overhead was underapplied by $4,000.

C)Actual direct labor-hours exceeded budgeted direct labor-hours.

D)Actual direct labor-hours were less than budgeted direct labor-hours.

A)Overhead was overapplied by $4,000.

B)Overhead was underapplied by $4,000.

C)Actual direct labor-hours exceeded budgeted direct labor-hours.

D)Actual direct labor-hours were less than budgeted direct labor-hours.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

43

Before prorating the manufacturing overhead costs at the end of 2012,the Cost of Goods Sold and Finished Goods Inventory had applied overhead costs of $57,500 and $20,000 in them,respectively.There was no Work-in-Process at the beginning or end of 2012.During the year,manufacturing overhead costs of $74,000 were actually incurred.The balance in the Applied Manufacturing Overhead was $77,500 at the end of 2012.If the under or overapplied overhead is prorated between Cost of Goods Sold and the inventory accounts,how much will be allocated to the Finished Goods Inventory?

A)$903.

B)$1,217.

C)$1,283.

D)$2,597.

A)$903.

B)$1,217.

C)$1,283.

D)$2,597.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

44

The Update Company does not maintain backup documents for its computer files.In June,some of the current data were lost,and you have been asked to help reconstruct the data.The following beginning balances on June 1 are known:  Reviewing old documents and interviewing selected employees have generated the following additional information: The production superintendent's job cost sheets indicated that materials of $2,600 were included in the June 30 Work-in-Process Inventory.Also,300 direct labor-hours had been paid at $6.00 per hour for the jobs in process on June 30.The Accounts Payable account is only for direct material purchases.The clerk remembers clearly that the balance in the Accounts Payable on June 30 was $8,000.An analysis of canceled checks indicated payments of $40,000 were made to suppliers during June.Payroll records indicate that 5,200 direct labor-hours were recorded for June.It was verified that there were no variations in pay rates among employees during June.Records at the warehouse indicate that the Finished Goods Inventory totaled $16,000 on June 30.Another record kept manually indicates that the Cost of Goods Sold in June totaled $84,000.The predetermined overhead rate was based on an estimated 60,000 direct labor-hours for the year and an estimated $180,000 in manufacturing overhead costs.What is the ending balance in the Work-in-Process Inventory on June 30?

Reviewing old documents and interviewing selected employees have generated the following additional information: The production superintendent's job cost sheets indicated that materials of $2,600 were included in the June 30 Work-in-Process Inventory.Also,300 direct labor-hours had been paid at $6.00 per hour for the jobs in process on June 30.The Accounts Payable account is only for direct material purchases.The clerk remembers clearly that the balance in the Accounts Payable on June 30 was $8,000.An analysis of canceled checks indicated payments of $40,000 were made to suppliers during June.Payroll records indicate that 5,200 direct labor-hours were recorded for June.It was verified that there were no variations in pay rates among employees during June.Records at the warehouse indicate that the Finished Goods Inventory totaled $16,000 on June 30.Another record kept manually indicates that the Cost of Goods Sold in June totaled $84,000.The predetermined overhead rate was based on an estimated 60,000 direct labor-hours for the year and an estimated $180,000 in manufacturing overhead costs.What is the ending balance in the Work-in-Process Inventory on June 30?

A)$4,800.

B)$5,300.

C)$9,300.

D)$9,800.

Reviewing old documents and interviewing selected employees have generated the following additional information: The production superintendent's job cost sheets indicated that materials of $2,600 were included in the June 30 Work-in-Process Inventory.Also,300 direct labor-hours had been paid at $6.00 per hour for the jobs in process on June 30.The Accounts Payable account is only for direct material purchases.The clerk remembers clearly that the balance in the Accounts Payable on June 30 was $8,000.An analysis of canceled checks indicated payments of $40,000 were made to suppliers during June.Payroll records indicate that 5,200 direct labor-hours were recorded for June.It was verified that there were no variations in pay rates among employees during June.Records at the warehouse indicate that the Finished Goods Inventory totaled $16,000 on June 30.Another record kept manually indicates that the Cost of Goods Sold in June totaled $84,000.The predetermined overhead rate was based on an estimated 60,000 direct labor-hours for the year and an estimated $180,000 in manufacturing overhead costs.What is the ending balance in the Work-in-Process Inventory on June 30?

Reviewing old documents and interviewing selected employees have generated the following additional information: The production superintendent's job cost sheets indicated that materials of $2,600 were included in the June 30 Work-in-Process Inventory.Also,300 direct labor-hours had been paid at $6.00 per hour for the jobs in process on June 30.The Accounts Payable account is only for direct material purchases.The clerk remembers clearly that the balance in the Accounts Payable on June 30 was $8,000.An analysis of canceled checks indicated payments of $40,000 were made to suppliers during June.Payroll records indicate that 5,200 direct labor-hours were recorded for June.It was verified that there were no variations in pay rates among employees during June.Records at the warehouse indicate that the Finished Goods Inventory totaled $16,000 on June 30.Another record kept manually indicates that the Cost of Goods Sold in June totaled $84,000.The predetermined overhead rate was based on an estimated 60,000 direct labor-hours for the year and an estimated $180,000 in manufacturing overhead costs.What is the ending balance in the Work-in-Process Inventory on June 30?A)$4,800.

B)$5,300.

C)$9,300.

D)$9,800.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

45

The following selected data were taken from the books of the Bixby Box Company.The company uses job costing to account for manufacturing costs.The data relate to June operations.A)Materials and supplies were requisitioned from the stores clerk as follows: Job 405,material X,$7,000.Job 406,material X,$3,000;material Y,$6,000.Job 407,material X,$7,000;material Y,$3,200.For general factory use: materials A,B,and C,$2,300.B)Time tickets for the month were chargeable as follows:  C)Other information:

C)Other information:

Factory paychecks for $36,700 were issued during the month.Various factory overhead charges of $19,400 were incurred on account.Depreciation of factory equipment for the month was $5,400.Factory overhead was applied to jobs at the rate of $3.50 per direct labor hour.Job orders completed during the month: Job 405 and Job 406.Selling and administrative costs were $2,100.Factory overhead is closed out only at the end of the year.The end of the month Work-in-Process Inventory balance would be:

A)$18,200.

B)$24,850.

C)$64,100.

D)$88,950.

C)Other information:

C)Other information:Factory paychecks for $36,700 were issued during the month.Various factory overhead charges of $19,400 were incurred on account.Depreciation of factory equipment for the month was $5,400.Factory overhead was applied to jobs at the rate of $3.50 per direct labor hour.Job orders completed during the month: Job 405 and Job 406.Selling and administrative costs were $2,100.Factory overhead is closed out only at the end of the year.The end of the month Work-in-Process Inventory balance would be:

A)$18,200.

B)$24,850.

C)$64,100.

D)$88,950.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

46

The following selected data were taken from the books of the Bixby Box Company.The company uses job costing to account for manufacturing costs.The data relate to June operations.A)Materials and supplies were requisitioned from the stores clerk as follows: Job 405,material X,$7,000.Job 406,material X,$3,000;material Y,$6,000.Job 407,material X,$7,000;material Y,$3,200.For general factory use: materials A,B,and C,$2,300.B)Time tickets for the month were chargeable as follows:  C)Other information:

C)Other information:

Factory paychecks for $36,700 were issued during the month.Various factory overhead charges of $19,400 were incurred on account.Depreciation of factory equipment for the month was $5,400.Factory overhead was applied to jobs at the rate of $3.50 per direct labor hour.Job orders completed during the month: Job 405 and Job 406.Selling and administrative costs were $2,100.Factory overhead is closed out only at the end of the year.If Job 406 was sold on account for $41,500,how much gross profit would be recognized for the job?

A)$3,800.

B)$5,900.

C)$18,500.

D)$35,600.

C)Other information:

C)Other information:Factory paychecks for $36,700 were issued during the month.Various factory overhead charges of $19,400 were incurred on account.Depreciation of factory equipment for the month was $5,400.Factory overhead was applied to jobs at the rate of $3.50 per direct labor hour.Job orders completed during the month: Job 405 and Job 406.Selling and administrative costs were $2,100.Factory overhead is closed out only at the end of the year.If Job 406 was sold on account for $41,500,how much gross profit would be recognized for the job?

A)$3,800.

B)$5,900.

C)$18,500.

D)$35,600.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

47

The following selected data were taken from the books of the Bixby Box Company.The company uses job costing to account for manufacturing costs.The data relate to June operations.A)Materials and supplies were requisitioned from the stores clerk as follows: Job 405,material X,$7,000.Job 406,material X,$3,000;material Y,$6,000.Job 407,material X,$7,000;material Y,$3,200.For general factory use: materials A,B,and C,$2,300.B)Time tickets for the month were chargeable as follows:  C)Other information:

C)Other information:

Factory paychecks for $36,700 were issued during the month.Various factory overhead charges of $19,400 were incurred on account.Depreciation of factory equipment for the month was $5,400.Factory overhead was applied to jobs at the rate of $3.50 per direct labor hour.Job orders completed during the month: Job 405 and Job 406.Selling and administrative costs were $2,100.Factory overhead is closed out only at the end of the year.The balance in the factory overhead account would represent the fact that overhead was:

A)$1,050 underapplied.

B)$3,150 underapplied.

C)$1,250 overapplied.

D)$4,350 overapplieD.Manufacturing Overhead Control = $2,300 + 3,700 + 19,400 + 5,400 = $30,800 - Applied Manufacturing Overhead $29,750 = $1,050 UnderapplieD.

C)Other information:

C)Other information:Factory paychecks for $36,700 were issued during the month.Various factory overhead charges of $19,400 were incurred on account.Depreciation of factory equipment for the month was $5,400.Factory overhead was applied to jobs at the rate of $3.50 per direct labor hour.Job orders completed during the month: Job 405 and Job 406.Selling and administrative costs were $2,100.Factory overhead is closed out only at the end of the year.The balance in the factory overhead account would represent the fact that overhead was:

A)$1,050 underapplied.

B)$3,150 underapplied.

C)$1,250 overapplied.

D)$4,350 overapplieD.Manufacturing Overhead Control = $2,300 + 3,700 + 19,400 + 5,400 = $30,800 - Applied Manufacturing Overhead $29,750 = $1,050 UnderapplieD.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

48

The Work-in-Process Inventory account of a manufacturing firm has a balance of $2,400 at the end of an accounting period.The job cost sheets of two uncompleted jobs show charges of $400 and $200 for materials used,and charges of $300 and $500 for direct labor used.Overhead is applied as a percentage of direct labor costs.The predetermined rate is:

A)41.7%.

B)80.0%.

C)125.0%.

D)240.0%.

A)41.7%.

B)80.0%.

C)125.0%.

D)240.0%.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

49

The following events took place at a manufacturing company for the current year: (1)Purchased $95,000 in direct materials.(2)Incurred labor costs as follows: (a)direct,$56,000 and (b)indirect,$13,600.(3)Other manufacturing overhead was $107,000,excluding indirect labor.(4)Transferred 80% of the materials to the manufacturing assembly line.(5)Completed 65% of the Work-in-Process during the year.(6)Sold 85% of the completed goods.(7)There were no beginning inventories.What is the value of the ending Work-in-Process Inventory?

A)$13,261.50.

B)$14,259.00.

C)$88,410.00.

D)$95,060.50.

A)$13,261.50.

B)$14,259.00.

C)$88,410.00.

D)$95,060.50.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

50

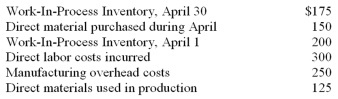

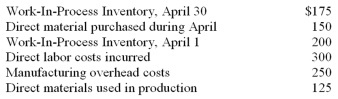

Compute the Work-in-Process transferred to the finished goods warehouse on April 30 using the following information:

A)$650.

B)$675.

C)$700.

D)$750.

A)$650.

B)$675.

C)$700.

D)$750.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

51

The following events took place at a manufacturing company for the current year: (1)Purchased $95,000 in direct materials.(2)Incurred labor costs as follows: (a)direct,$56,000 and (b)indirect,$13,600.(3)Other manufacturing overhead was $107,000,excluding indirect labor.(4)Transferred 80% of the materials to the manufacturing assembly line.(5)Completed 65% of the Work-in-Process during the year.(6)Sold 85% of the completed goods.(7)There were no beginning inventories.What is the company's Cost of Goods Sold?

A)$164,190.00.

B)$139,561.50.

C)$252,600.00.

D)$214,710.50.

A)$164,190.00.

B)$139,561.50.

C)$252,600.00.

D)$214,710.50.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

52

The predetermined overhead rate for manufacturing overhead for 2012 is $4.00 per direct labor hour.Employees are expected to earn $5.00 per hour and the company is planning on paying its employees $100,000 during the year.However,only 75% of the employees are classified as "direct labor." What was the estimated manufacturing overhead for 2012?

A)$60,000.

B)$75,000.

C)$80,000.

D)$93,750.

A)$60,000.

B)$75,000.

C)$80,000.

D)$93,750.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

53

The following events took place at a manufacturing company for the current year: (1)Purchased $95,000 in direct materials.(2)Incurred labor costs as follows: (a)direct,$56,000 and (b)indirect,$13,600.(3)Other manufacturing overhead was $107,000,excluding indirect labor.(4)Transferred 80% of the materials to the manufacturing assembly line.(5)Completed 65% of the Work-in-Process during the year.(6)Sold 85% of the completed goods.(7)There were no beginning inventories.What is the value of the ending Finished Goods Inventory?

A)$13,261.50.

B)$24,628.50.

C)$26,481.00.

D)$164,190.00.

A)$13,261.50.

B)$24,628.50.

C)$26,481.00.

D)$164,190.00.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

54

Complex jobs that take multiple time periods and require the work of many different departments,divisions,or subcontractors are called:

A)clients.

B)projects.

C)customers.

D)contracts.

A)clients.

B)projects.

C)customers.

D)contracts.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

55

Before prorating the manufacturing overhead costs at the end of 2012,the Cost of Goods Sold and Finished Goods Inventory had applied overhead costs of $57,500 and $20,000 in them,respectively.There was no Work-in-Process at the beginning or end of 2012.During the year,manufacturing overhead costs of $74,000 were actually incurred.The balance in the Applied Manufacturing Overhead was $77,500 at the end of 2012.If the under- or overapplied overhead is prorated between Cost of Goods Sold and the inventory accounts,how much will be the Cost of Goods Sold after the proration?

A)$58,403.

B)$56,597.

C)$60,197.

D)$54,903.

A)$58,403.

B)$56,597.

C)$60,197.

D)$54,903.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

56

![<strong> Two jobs were worked on during the year: Job A-101 and Job A-102.The number of direct labor-hours spent on Job A-101 and Job A-102 were 1,200 and 1,000,respectively.The actual manufacturing overhead was $37,000.What is the amount of the under- or overapplied manufacturing overhead?</strong> A)$1,000 underapplied. B)$3,000 overapplied. C)$4,000 underapplied. D)$7,000 overapplieD.$37,000 - [$15 × (1,200 + 1,000)] = $4,000 underapplieD.](https://storage.examlex.com/TB2418/11eaa0c0_1e04_3b02_80dc_cd0a69121992_TB2418_00.jpg) Two jobs were worked on during the year: Job A-101 and Job A-102.The number of direct labor-hours spent on Job A-101 and Job A-102 were 1,200 and 1,000,respectively.The actual manufacturing overhead was $37,000.What is the amount of the under- or overapplied manufacturing overhead?

Two jobs were worked on during the year: Job A-101 and Job A-102.The number of direct labor-hours spent on Job A-101 and Job A-102 were 1,200 and 1,000,respectively.The actual manufacturing overhead was $37,000.What is the amount of the under- or overapplied manufacturing overhead?A)$1,000 underapplied.

B)$3,000 overapplied.

C)$4,000 underapplied.

D)$7,000 overapplieD.$37,000 - [$15 × (1,200 + 1,000)] = $4,000 underapplieD.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

57

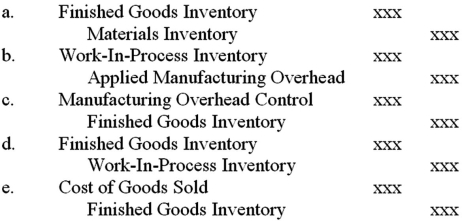

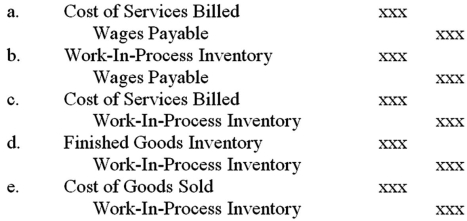

The journal entry to write-off an insignificant overapplied overhead balance at the end of an accounting period for a service firm is:

A)a.

B)B.

C)C.

D)D.The most conservative method is to write-off the immaterial amount directly to Cost of Goods SolD.

A)a.

B)B.

C)C.

D)D.The most conservative method is to write-off the immaterial amount directly to Cost of Goods SolD.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

58

Two jobs were worked on during the year: Job A-101 and Job A-102.The number of direct labor-hours spent on Job A-101 and Job A-102 were 1,200 and 1,000,respectively.The actual manufacturing overhead was $37,000.What was the amount of manufacturing overhead applied to Job A-101?

Two jobs were worked on during the year: Job A-101 and Job A-102.The number of direct labor-hours spent on Job A-101 and Job A-102 were 1,200 and 1,000,respectively.The actual manufacturing overhead was $37,000.What was the amount of manufacturing overhead applied to Job A-101?A)$16,000.

B)$18,000.

C)$24,000.

D)$44,000.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

59

The general journal entry to record the issuance of the materials represented by the following materials requisitions for the month includes:

A)a debit to Materials Inventory,$15,945.

B)a debit to Materials Inventory,$16,670.

C)a debit to Work-in-Process Inventory,$15,945.

D)a credit to Work-in-Process Inventory,$15,945.

A)a debit to Materials Inventory,$15,945.

B)a debit to Materials Inventory,$16,670.

C)a debit to Work-in-Process Inventory,$15,945.

D)a credit to Work-in-Process Inventory,$15,945.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

60

The following events took place at a manufacturing company for the current year: (1)Purchased $95,000 in direct materials.(2)Incurred labor costs as follows: (a)direct,$56,000 and (b)indirect,$13,600.(3)Other manufacturing overhead was $107,000,excluding indirect labor.(4)Transferred 80% of the materials to the manufacturing assembly line.(5)Completed 65% of the Work-in-Process during the year.(6)Sold 85% of the completed goods.(7)There were no beginning inventories.What is the journal entry to record the direct labor costs for the period?

A)a.

B)B.

C)C.

D)D.Direct labor costs are traced to the Work-in-Process;any indirect labor would go to manufacturing overheaD.

A)a.

B)B.

C)C.

D)D.Direct labor costs are traced to the Work-in-Process;any indirect labor would go to manufacturing overheaD.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

61

In a traditional job order costing system,the issue of indirect materials to a production department increases: (CPA adapted)

A)stores control.

B)work-in-Process control.

C)factory overhead control.

D)factory overhead applieD.Indirect material is overhead-it increases Manufacturing Overhead Control.

A)stores control.

B)work-in-Process control.

C)factory overhead control.

D)factory overhead applieD.Indirect material is overhead-it increases Manufacturing Overhead Control.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

62

Scottso Corporation applies overhead using an actual costing approach.Budgeted factory overhead was $266,400,budgeted machine-hours were 18,500.Actual factory overhead was $287,920,actual machine-hours were 19,050.How much overhead would be applied to production?

A)$266,400.

B)$274,320.

C)$279,607.

D)$287,920.

A)$266,400.

B)$274,320.

C)$279,607.

D)$287,920.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following approaches allocates overhead by multiplying an actual overhead rate × actual activity?

A)Actual costing.

B)Normal costing.

C)Regression costing.

D)Standard costing.

A)Actual costing.

B)Normal costing.

C)Regression costing.

D)Standard costing.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following actions do not cause an impropriety in job costing?

A)Misstating the stage of completion.

B)Choosing to use normal costing rather than actual costing.

C)Charging costs to the wrong job.

D)Choosing an allocation method based on the results rather than choosing the method based on resource usage.

A)Misstating the stage of completion.

B)Choosing to use normal costing rather than actual costing.

C)Charging costs to the wrong job.

D)Choosing an allocation method based on the results rather than choosing the method based on resource usage.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

65

Scottso Corporation applies overhead using a normal costing approach based upon machine-hours.Budgeted factory overhead was $266,400,budgeted machine-hours were 18,500.Actual factory overhead was $287,920,actual machine-hours were 19,050.How much is the Over- or underapplied overhead?

A)$21,520 underapplied.

B)$13,600 underapplied.

C)$7,920 overapplied.

D)$0.

A)$21,520 underapplied.

B)$13,600 underapplied.

C)$7,920 overapplied.

D)$0.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

66

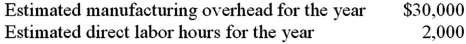

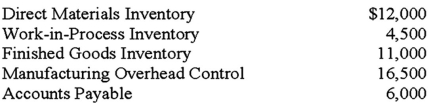

Under Pick Co.'s job order costing system,manufacturing overhead is applied to Work-in-Process using a predetermined annual overhead rate.During January,Pick's transactions included the following:  Pick had neither beginning nor ending inventory in Work-in-Process Inventory.What was the cost of jobs completed in January? (CPA adapted)

Pick had neither beginning nor ending inventory in Work-in-Process Inventory.What was the cost of jobs completed in January? (CPA adapted)

A)$302,000.

B)$310,000.

C)$322,000.

D)$330,000.

Pick had neither beginning nor ending inventory in Work-in-Process Inventory.What was the cost of jobs completed in January? (CPA adapted)

Pick had neither beginning nor ending inventory in Work-in-Process Inventory.What was the cost of jobs completed in January? (CPA adapted)A)$302,000.

B)$310,000.

C)$322,000.

D)$330,000.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

67

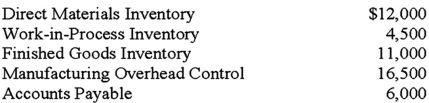

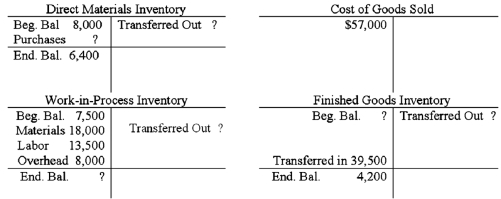

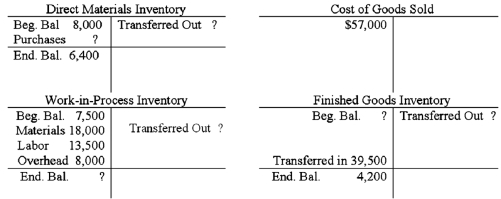

The financial records for the Lee Manufacturing Company have been destroyed in a fire.The following information has been obtained from a separate set of books maintained by the cost accountant.The cost accountant now asks for your assistance in computing the missing amounts.  What is the value of the ending Work-in-Process inventory balance?

What is the value of the ending Work-in-Process inventory balance?

A)$0.

B)$4,200.

C)$7,500.

D)$8,000.

What is the value of the ending Work-in-Process inventory balance?

What is the value of the ending Work-in-Process inventory balance?A)$0.

B)$4,200.

C)$7,500.

D)$8,000.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

68

Scottso Corporation applies overhead using a normal costing approach based upon machine-hours.Budgeted factory overhead was $232,750,budgeted machine-hours were 17,500.Actual factory overhead was $227,830,actual machine-hours were 16,150.How much overhead would be applied to production?

A)$214,795.

B)$227,830.

C)$232,750.

D)$246,875.

A)$214,795.

B)$227,830.

C)$232,750.

D)$246,875.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following approaches allocates overhead by multiplying a predetermined overhead rate × actual activity?

A)Actual costing.

B)Normal costing.

C)Regression costing.

D)Standard costing.

A)Actual costing.

B)Normal costing.

C)Regression costing.

D)Standard costing.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

70

The financial records for the Lee Manufacturing Company have been destroyed in a fire.The following information has been obtained from a separate set of books maintained by the cost accountant.The cost accountant now asks for your assistance in computing the missing amounts.  What is the amount of the materials purchased?

What is the amount of the materials purchased?

A)$14,400.

B)$16,400.

C)$18,000.

D)$19,600.

What is the amount of the materials purchased?

What is the amount of the materials purchased?A)$14,400.

B)$16,400.

C)$18,000.

D)$19,600.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

71

The following are Mill Co.'s production costs for October:  What amount of costs should be traced to specific products in the production process? (CPA adapted)

What amount of costs should be traced to specific products in the production process? (CPA adapted)

A)$194,000.

B)$190,000.

C)$100,000.

D)$90,000.

What amount of costs should be traced to specific products in the production process? (CPA adapted)

What amount of costs should be traced to specific products in the production process? (CPA adapted)A)$194,000.

B)$190,000.

C)$100,000.

D)$90,000.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

72

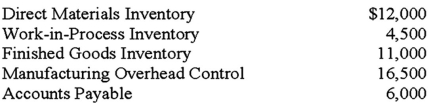

The Update Company does not maintain backup documents for its computer files.In June,some of the current data were lost,and you have been asked to help reconstruct the data.The following beginning balances on June 1 are known:  Reviewing old documents and interviewing selected employees have generated the following additional information: The production superintendent's job cost sheets indicated that materials of $2,600 were included in the June 30 Work-in-Process Inventory.Also,300 direct labor-hours had been paid at $6.00 per hour for the jobs in process on June 30.The Accounts Payable account is only for direct material purchases.The clerk remembers clearly that the balance in the Accounts Payable on June 30 was $8,000.An analysis of canceled checks indicated payments of $40,000 were made to suppliers during June.Payroll records indicate that 5,200 direct labor-hours were recorded for June.It was verified that there were no variations in pay rates among employees during June.Records at the warehouse indicate that the Finished Goods Inventory totaled $16,000 on June 30.Another record kept manually indicates that the Cost of Goods Sold in June totaled $84,000.The predetermined overhead rate was based on an estimated 60,000 direct labor-hours for the year and an estimated $180,000 in manufacturing overhead costs.What is the ending balance in the Direct Materials Inventory on June 30?

Reviewing old documents and interviewing selected employees have generated the following additional information: The production superintendent's job cost sheets indicated that materials of $2,600 were included in the June 30 Work-in-Process Inventory.Also,300 direct labor-hours had been paid at $6.00 per hour for the jobs in process on June 30.The Accounts Payable account is only for direct material purchases.The clerk remembers clearly that the balance in the Accounts Payable on June 30 was $8,000.An analysis of canceled checks indicated payments of $40,000 were made to suppliers during June.Payroll records indicate that 5,200 direct labor-hours were recorded for June.It was verified that there were no variations in pay rates among employees during June.Records at the warehouse indicate that the Finished Goods Inventory totaled $16,000 on June 30.Another record kept manually indicates that the Cost of Goods Sold in June totaled $84,000.The predetermined overhead rate was based on an estimated 60,000 direct labor-hours for the year and an estimated $180,000 in manufacturing overhead costs.What is the ending balance in the Direct Materials Inventory on June 30?

A)$6,000.

B)$10,500.

C)$11,000.

D)$15,000.

Reviewing old documents and interviewing selected employees have generated the following additional information: The production superintendent's job cost sheets indicated that materials of $2,600 were included in the June 30 Work-in-Process Inventory.Also,300 direct labor-hours had been paid at $6.00 per hour for the jobs in process on June 30.The Accounts Payable account is only for direct material purchases.The clerk remembers clearly that the balance in the Accounts Payable on June 30 was $8,000.An analysis of canceled checks indicated payments of $40,000 were made to suppliers during June.Payroll records indicate that 5,200 direct labor-hours were recorded for June.It was verified that there were no variations in pay rates among employees during June.Records at the warehouse indicate that the Finished Goods Inventory totaled $16,000 on June 30.Another record kept manually indicates that the Cost of Goods Sold in June totaled $84,000.The predetermined overhead rate was based on an estimated 60,000 direct labor-hours for the year and an estimated $180,000 in manufacturing overhead costs.What is the ending balance in the Direct Materials Inventory on June 30?

Reviewing old documents and interviewing selected employees have generated the following additional information: The production superintendent's job cost sheets indicated that materials of $2,600 were included in the June 30 Work-in-Process Inventory.Also,300 direct labor-hours had been paid at $6.00 per hour for the jobs in process on June 30.The Accounts Payable account is only for direct material purchases.The clerk remembers clearly that the balance in the Accounts Payable on June 30 was $8,000.An analysis of canceled checks indicated payments of $40,000 were made to suppliers during June.Payroll records indicate that 5,200 direct labor-hours were recorded for June.It was verified that there were no variations in pay rates among employees during June.Records at the warehouse indicate that the Finished Goods Inventory totaled $16,000 on June 30.Another record kept manually indicates that the Cost of Goods Sold in June totaled $84,000.The predetermined overhead rate was based on an estimated 60,000 direct labor-hours for the year and an estimated $180,000 in manufacturing overhead costs.What is the ending balance in the Direct Materials Inventory on June 30?A)$6,000.

B)$10,500.

C)$11,000.

D)$15,000.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

73

The Update Company does not maintain backup documents for its computer files.In June,some of the current data were lost,and you have been asked to help reconstruct the data.The following beginning balances on June 1 are known:  Reviewing old documents and interviewing selected employees have generated the following additional information: The production superintendent's job cost sheets indicated that materials of $2,600 were included in the June 30 Work-in-Process Inventory.Also,300 direct labor-hours had been paid at $6.00 per hour for the jobs in process on June 30.The Accounts Payable account is only for direct material purchases.The clerk remembers clearly that the balance in the Accounts Payable on June 30 was $8,000.An analysis of canceled checks indicated payments of $40,000 were made to suppliers during June.Payroll records indicate that 5,200 direct labor-hours were recorded for June.It was verified that there were no variations in pay rates among employees during June.Records at the warehouse indicate that the Finished Goods Inventory totaled $16,000 on June 30.Another record kept manually indicates that the Cost of Goods Sold in June totaled $84,000.The predetermined overhead rate was based on an estimated 60,000 direct labor-hours for the year and an estimated $180,000 in manufacturing overhead costs.What is the Cost of Goods Manufactured for June?

Reviewing old documents and interviewing selected employees have generated the following additional information: The production superintendent's job cost sheets indicated that materials of $2,600 were included in the June 30 Work-in-Process Inventory.Also,300 direct labor-hours had been paid at $6.00 per hour for the jobs in process on June 30.The Accounts Payable account is only for direct material purchases.The clerk remembers clearly that the balance in the Accounts Payable on June 30 was $8,000.An analysis of canceled checks indicated payments of $40,000 were made to suppliers during June.Payroll records indicate that 5,200 direct labor-hours were recorded for June.It was verified that there were no variations in pay rates among employees during June.Records at the warehouse indicate that the Finished Goods Inventory totaled $16,000 on June 30.Another record kept manually indicates that the Cost of Goods Sold in June totaled $84,000.The predetermined overhead rate was based on an estimated 60,000 direct labor-hours for the year and an estimated $180,000 in manufacturing overhead costs.What is the Cost of Goods Manufactured for June?

A)$89,000.

B)$84,000.

C)$94,000.

D)$99,000.

Reviewing old documents and interviewing selected employees have generated the following additional information: The production superintendent's job cost sheets indicated that materials of $2,600 were included in the June 30 Work-in-Process Inventory.Also,300 direct labor-hours had been paid at $6.00 per hour for the jobs in process on June 30.The Accounts Payable account is only for direct material purchases.The clerk remembers clearly that the balance in the Accounts Payable on June 30 was $8,000.An analysis of canceled checks indicated payments of $40,000 were made to suppliers during June.Payroll records indicate that 5,200 direct labor-hours were recorded for June.It was verified that there were no variations in pay rates among employees during June.Records at the warehouse indicate that the Finished Goods Inventory totaled $16,000 on June 30.Another record kept manually indicates that the Cost of Goods Sold in June totaled $84,000.The predetermined overhead rate was based on an estimated 60,000 direct labor-hours for the year and an estimated $180,000 in manufacturing overhead costs.What is the Cost of Goods Manufactured for June?

Reviewing old documents and interviewing selected employees have generated the following additional information: The production superintendent's job cost sheets indicated that materials of $2,600 were included in the June 30 Work-in-Process Inventory.Also,300 direct labor-hours had been paid at $6.00 per hour for the jobs in process on June 30.The Accounts Payable account is only for direct material purchases.The clerk remembers clearly that the balance in the Accounts Payable on June 30 was $8,000.An analysis of canceled checks indicated payments of $40,000 were made to suppliers during June.Payroll records indicate that 5,200 direct labor-hours were recorded for June.It was verified that there were no variations in pay rates among employees during June.Records at the warehouse indicate that the Finished Goods Inventory totaled $16,000 on June 30.Another record kept manually indicates that the Cost of Goods Sold in June totaled $84,000.The predetermined overhead rate was based on an estimated 60,000 direct labor-hours for the year and an estimated $180,000 in manufacturing overhead costs.What is the Cost of Goods Manufactured for June?A)$89,000.

B)$84,000.

C)$94,000.

D)$99,000.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

74

Scottso Corporation applies overhead using an actual costing approach.Budgeted factory overhead was $266,400,budgeted machine-hours were 18,500.Actual factory overhead was $287,920,actual machine-hours were 19,050.How much is the Over- or underapplied overhead?

A)$21,520 underapplied.

B)$13,600 underapplied.

C)$7,920 overapplied.

D)$0.

A)$21,520 underapplied.

B)$13,600 underapplied.

C)$7,920 overapplied.

D)$0.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

75

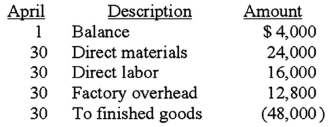

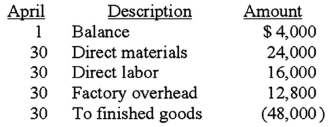

Birk Co.uses a job order costing system.The following debits (credits)appeared in Birk's work-in-process account for the month of April:  Birk applies overhead to production at a predetermined rate of 80% of direct labor cost.Job No.5,the only job still in process on April 30 has been charged with direct labor of $2,000.What was the amount of direct material charged to Job No.5? (CPA adapted)

Birk applies overhead to production at a predetermined rate of 80% of direct labor cost.Job No.5,the only job still in process on April 30 has been charged with direct labor of $2,000.What was the amount of direct material charged to Job No.5? (CPA adapted)

A)$3,000.

B)$5,200.

C)$8,800.

D)$24,000.

Birk applies overhead to production at a predetermined rate of 80% of direct labor cost.Job No.5,the only job still in process on April 30 has been charged with direct labor of $2,000.What was the amount of direct material charged to Job No.5? (CPA adapted)

Birk applies overhead to production at a predetermined rate of 80% of direct labor cost.Job No.5,the only job still in process on April 30 has been charged with direct labor of $2,000.What was the amount of direct material charged to Job No.5? (CPA adapted)A)$3,000.

B)$5,200.

C)$8,800.

D)$24,000.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

76

The financial records for the Lee Manufacturing Company have been destroyed in a fire.The following information has been obtained from a separate set of books maintained by the cost accountant.The cost accountant now asks for your assistance in computing the missing amounts.  What is the value of the beginning Finished Goods Inventory?

What is the value of the beginning Finished Goods Inventory?

A)$0.

B)$4,200.

C)$13,300.

D)$21,700.

What is the value of the beginning Finished Goods Inventory?

What is the value of the beginning Finished Goods Inventory?A)$0.

B)$4,200.

C)$13,300.

D)$21,700.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

77

Scottso Corporation applies overhead using a normal costing approach based upon machine-hours.Budgeted factory overhead was $266,400,budgeted machine-hours were 18,500.Actual factory overhead was $287,920,actual machine-hours were 19,050.How much overhead would be applied to production?

A)$266,400.

B)$274,320.

C)$279,607.

D)$287,920.

A)$266,400.

B)$274,320.

C)$279,607.

D)$287,920.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

78

The Update Company does not maintain backup documents for its computer files.In June,some of the current data were lost,and you have been asked to help reconstruct the data.The following beginning balances on June 1 are known:  Reviewing old documents and interviewing selected employees have generated the following additional information: The production superintendent's job cost sheets indicated that materials of $2,600 were included in the June 30 Work-in-Process Inventory.Also,300 direct labor-hours had been paid at $6.00 per hour for the jobs in process on June 30.The Accounts Payable account is only for direct material purchases.The clerk remembers clearly that the balance in the Accounts Payable on June 30 was $8,000.An analysis of canceled checks indicated payments of $40,000 were made to suppliers during June.Payroll records indicate that 5,200 direct labor-hours were recorded for June.It was verified that there were no variations in pay rates among employees during June.Records at the warehouse indicate that the Finished Goods Inventory totaled $16,000 on June 30.Another record kept manually indicates that the Cost of Goods Sold in June totaled $84,000.The predetermined overhead rate was based on an estimated 60,000 direct labor-hours for the year and an estimated $180,000 in manufacturing overhead costs.What is the amount of direct materials purchased during June?

Reviewing old documents and interviewing selected employees have generated the following additional information: The production superintendent's job cost sheets indicated that materials of $2,600 were included in the June 30 Work-in-Process Inventory.Also,300 direct labor-hours had been paid at $6.00 per hour for the jobs in process on June 30.The Accounts Payable account is only for direct material purchases.The clerk remembers clearly that the balance in the Accounts Payable on June 30 was $8,000.An analysis of canceled checks indicated payments of $40,000 were made to suppliers during June.Payroll records indicate that 5,200 direct labor-hours were recorded for June.It was verified that there were no variations in pay rates among employees during June.Records at the warehouse indicate that the Finished Goods Inventory totaled $16,000 on June 30.Another record kept manually indicates that the Cost of Goods Sold in June totaled $84,000.The predetermined overhead rate was based on an estimated 60,000 direct labor-hours for the year and an estimated $180,000 in manufacturing overhead costs.What is the amount of direct materials purchased during June?

A)$38,000.

B)$40,000.

C)$42,000.

D)$43,000.

Reviewing old documents and interviewing selected employees have generated the following additional information: The production superintendent's job cost sheets indicated that materials of $2,600 were included in the June 30 Work-in-Process Inventory.Also,300 direct labor-hours had been paid at $6.00 per hour for the jobs in process on June 30.The Accounts Payable account is only for direct material purchases.The clerk remembers clearly that the balance in the Accounts Payable on June 30 was $8,000.An analysis of canceled checks indicated payments of $40,000 were made to suppliers during June.Payroll records indicate that 5,200 direct labor-hours were recorded for June.It was verified that there were no variations in pay rates among employees during June.Records at the warehouse indicate that the Finished Goods Inventory totaled $16,000 on June 30.Another record kept manually indicates that the Cost of Goods Sold in June totaled $84,000.The predetermined overhead rate was based on an estimated 60,000 direct labor-hours for the year and an estimated $180,000 in manufacturing overhead costs.What is the amount of direct materials purchased during June?

Reviewing old documents and interviewing selected employees have generated the following additional information: The production superintendent's job cost sheets indicated that materials of $2,600 were included in the June 30 Work-in-Process Inventory.Also,300 direct labor-hours had been paid at $6.00 per hour for the jobs in process on June 30.The Accounts Payable account is only for direct material purchases.The clerk remembers clearly that the balance in the Accounts Payable on June 30 was $8,000.An analysis of canceled checks indicated payments of $40,000 were made to suppliers during June.Payroll records indicate that 5,200 direct labor-hours were recorded for June.It was verified that there were no variations in pay rates among employees during June.Records at the warehouse indicate that the Finished Goods Inventory totaled $16,000 on June 30.Another record kept manually indicates that the Cost of Goods Sold in June totaled $84,000.The predetermined overhead rate was based on an estimated 60,000 direct labor-hours for the year and an estimated $180,000 in manufacturing overhead costs.What is the amount of direct materials purchased during June?A)$38,000.

B)$40,000.

C)$42,000.

D)$43,000.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following approaches allocates overhead by multiplying a predetermined rate × standard activity?

A)Actual costing.

B)Normal costing.

C)Regression costing.

D)Standard costing.

A)Actual costing.

B)Normal costing.

C)Regression costing.

D)Standard costing.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

80

The Update Company does not maintain backup documents for its computer files.In June,some of the current data were lost,and you have been asked to help reconstruct the data.The following beginning balances on June 1 are known:  Reviewing old documents and interviewing selected employees have generated the following additional information: The production superintendent's job cost sheets indicated that materials of $2,600 were included in the June 30 Work-in-Process Inventory.Also,300 direct labor-hours had been paid at $6.00 per hour for the jobs in process on June 30.The Accounts Payable account is only for direct material purchases.The clerk remembers clearly that the balance in the Accounts Payable on June 30 was $8,000.An analysis of canceled checks indicated payments of $40,000 were made to suppliers during June.Payroll records indicate that 5,200 direct labor-hours were recorded for June.It was verified that there were no variations in pay rates among employees during June.Records at the warehouse indicate that the Finished Goods Inventory totaled $16,000 on June 30.Another record kept manually indicates that the Cost of Goods Sold in June totaled $84,000.The predetermined overhead rate was based on an estimated 60,000 direct labor-hours for the year and an estimated $180,000 in manufacturing overhead costs.How much manufacturing overhead was applied to the Work-in-Process Inventory during June?

Reviewing old documents and interviewing selected employees have generated the following additional information: The production superintendent's job cost sheets indicated that materials of $2,600 were included in the June 30 Work-in-Process Inventory.Also,300 direct labor-hours had been paid at $6.00 per hour for the jobs in process on June 30.The Accounts Payable account is only for direct material purchases.The clerk remembers clearly that the balance in the Accounts Payable on June 30 was $8,000.An analysis of canceled checks indicated payments of $40,000 were made to suppliers during June.Payroll records indicate that 5,200 direct labor-hours were recorded for June.It was verified that there were no variations in pay rates among employees during June.Records at the warehouse indicate that the Finished Goods Inventory totaled $16,000 on June 30.Another record kept manually indicates that the Cost of Goods Sold in June totaled $84,000.The predetermined overhead rate was based on an estimated 60,000 direct labor-hours for the year and an estimated $180,000 in manufacturing overhead costs.How much manufacturing overhead was applied to the Work-in-Process Inventory during June?

A)$12,000.

B)$15,600.

C)$18,400.

D)$20,500.

Reviewing old documents and interviewing selected employees have generated the following additional information: The production superintendent's job cost sheets indicated that materials of $2,600 were included in the June 30 Work-in-Process Inventory.Also,300 direct labor-hours had been paid at $6.00 per hour for the jobs in process on June 30.The Accounts Payable account is only for direct material purchases.The clerk remembers clearly that the balance in the Accounts Payable on June 30 was $8,000.An analysis of canceled checks indicated payments of $40,000 were made to suppliers during June.Payroll records indicate that 5,200 direct labor-hours were recorded for June.It was verified that there were no variations in pay rates among employees during June.Records at the warehouse indicate that the Finished Goods Inventory totaled $16,000 on June 30.Another record kept manually indicates that the Cost of Goods Sold in June totaled $84,000.The predetermined overhead rate was based on an estimated 60,000 direct labor-hours for the year and an estimated $180,000 in manufacturing overhead costs.How much manufacturing overhead was applied to the Work-in-Process Inventory during June?

Reviewing old documents and interviewing selected employees have generated the following additional information: The production superintendent's job cost sheets indicated that materials of $2,600 were included in the June 30 Work-in-Process Inventory.Also,300 direct labor-hours had been paid at $6.00 per hour for the jobs in process on June 30.The Accounts Payable account is only for direct material purchases.The clerk remembers clearly that the balance in the Accounts Payable on June 30 was $8,000.An analysis of canceled checks indicated payments of $40,000 were made to suppliers during June.Payroll records indicate that 5,200 direct labor-hours were recorded for June.It was verified that there were no variations in pay rates among employees during June.Records at the warehouse indicate that the Finished Goods Inventory totaled $16,000 on June 30.Another record kept manually indicates that the Cost of Goods Sold in June totaled $84,000.The predetermined overhead rate was based on an estimated 60,000 direct labor-hours for the year and an estimated $180,000 in manufacturing overhead costs.How much manufacturing overhead was applied to the Work-in-Process Inventory during June?A)$12,000.

B)$15,600.

C)$18,400.

D)$20,500.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck