Deck 15: Transfer Pricing

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

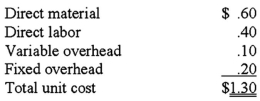

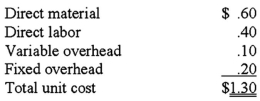

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

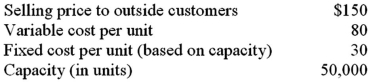

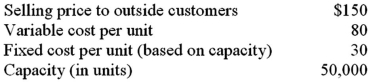

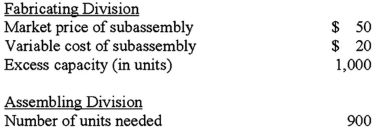

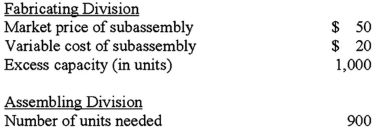

Question

Question

Question

Question

Question

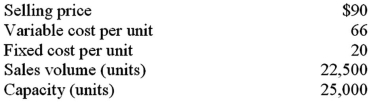

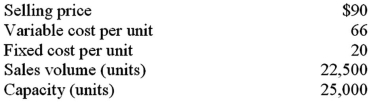

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/82

Play

Full screen (f)

Deck 15: Transfer Pricing

1

A transfer made at cost does not motivate the selling division to transfer its goods or services internally.There is no profit for the selling division.

True

2

In the United States,more companies use cost-based transfer prices than market-based transfer prices.Numerous surveys have shown this to be true.

True

3

Transfer prices cannot be used for decision making,product costing,or performance evaluation.Transfer pricing is used in decision making,product costing,and performance evaluation.

False

4

A market price-based transfer price policy allows the selling division to determine the price for transfers between divisions within the same organization.The market determines the price,not the division.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

5

A perfect intermediate market exists if buyers can buy and sellers can sell outside of the organization.A perfect market exists when buyers and sellers can have unlimited transactions with no impact on prices.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

6

From an organization's viewpoint,transfer prices have no effect on total profits assuming the transfer occurs between the two responsibility centers.Total profits are unaffected,divisional profits will have effects but they off-set.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

7

In general,the optimal transfer price for a division is the sum of its outlay costs and the opportunity cost of not transferring its goods to another division.It is the opportunity cost of the resource at the point of the transfer.Normally this is the lost contribution by not selling outside.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

8

Tax avoidance is unethical when inflated transfer prices are used in international transactions to shift profits from a division in one country to a division in another country.The key is "inflated" prices.Market based prices would not be unethical.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

9

The GAAP financial reporting rules for segments require that all companies use transfer prices based on market prices.GAAP does not specify what method must be used for transfer pricing except for the oil and gas industry.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

10

The use of an optimal transfer price eliminates potential conflicts between an organization's interests and the divisional manager's interest.Conflicts may be reduced,but will not be eliminated.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

11

A transfer price is the value assigned to the transfer of goods or services between divisions within the same organization.This is the definition of transfer pricing.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

12

A selling division at capacity is indifferent between selling to outsiders and transferring inside at the market price.The profit would be the same in either case.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

13

Transfer prices are not used to record the exchange between two cost centers within the same organization.Transfer prices are used for profit and investment centers.Cost centers are not concerned with profits.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

14

When actual costs are used as the basis for a transfer,inefficiencies of the selling division are transferred to the buying division.The selling division has no incentive to minimize the inefficiencies since they can all be passed on.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

15

An organization that has significant foreign operations must disclose how its transfer prices are established between domestic and foreign divisions.This is a requirement of GAAP.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

16

In general,negotiated transfer prices fall in a range between the selling division's differential costs and the buying division's market price.The seller's differential costs are the lowest the seller would accept;the buyer's market price is the highest the buyer would be willing to pay.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

17

If an intermediate market exists but divisions are prohibited from buying or selling from the outside,the intermediate market can be ignored in determining the optimal transfer price.Since the divisions are prohibited,the outside price is irrelevant.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

18

In interstate transactions,transfers can reduce an organization's tax liability when the selling division is in a lower tax jurisdiction than the buying division.The transfers can in effect move profits from one jurisdiction to another.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

19

When a perfect intermediate market exists,the optimal transfer price is the intermediate market price.In a perfect market,the market price is optimal.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

20

If a transfer has no effect on divisional profit,risk-neutral managers will be indifferent between making the transfer or not.Since there is no effect on profit,there is no risk.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

21

The general principle on setting transfer prices that are in the organization's best interests is:

A)outlay cost plus opportunity cost of the resource at the point of transfer.

B)variable costs plus opportunity cost of the resource at the point of transfer.

C)lost contribution margin less the allocated fixed costs for the selling division.

D)gross margin for the buying division plus the gross margin for the selling division.

A)outlay cost plus opportunity cost of the resource at the point of transfer.

B)variable costs plus opportunity cost of the resource at the point of transfer.

C)lost contribution margin less the allocated fixed costs for the selling division.

D)gross margin for the buying division plus the gross margin for the selling division.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following responsibility centers is affected by the use of market-based transfer prices?

A)Cost center.

B)Profit center.

C)Revenue center.

D)Production center.

A)Cost center.

B)Profit center.

C)Revenue center.

D)Production center.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

23

An intermediate market is perfect when:

A)there is no quality differences between inside and outside suppliers.

B)there is no quality differences between inside and outside customers.

C)buyers and sellers can sell any quantity without affecting the market price.

D)buyers and sellers are motivated to make decisions that are consistent with those of the organization.

A)there is no quality differences between inside and outside suppliers.

B)there is no quality differences between inside and outside customers.

C)buyers and sellers can sell any quantity without affecting the market price.

D)buyers and sellers are motivated to make decisions that are consistent with those of the organization.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

24

The transfer price that should be used by top management in evaluating whether a division should buy within the company or from an outside supplier is:

A)negotiated transfer price.

B)transfer price based on full cost.

C)transfer price based on variable cost.

D)transfer price based on an open market price.

A)negotiated transfer price.

B)transfer price based on full cost.

C)transfer price based on variable cost.

D)transfer price based on an open market price.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

25

Cost-based transfer prices that include a normal markup to the costs act as a surrogate for:

A)negotiated market prices.

B)opportunity costs.

C)differential costs.

D)market prices.

A)negotiated market prices.

B)opportunity costs.

C)differential costs.

D)market prices.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following is not an appropriate use of transfer pricing?

A)Product costing.

B)Decision making.

C)Establishing standards.

D)Evaluating performance.

A)Product costing.

B)Decision making.

C)Establishing standards.

D)Evaluating performance.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

27

An internal transfer between two divisions is in the best economic interest of the entire organization when:

A)the variable costs plus the opportunity cost of the selling division is greater than the external price for the buying division.

B)the variable costs plus the opportunity cost of the selling division is less than the external price for the buying division.

C)there is excess capacity in the buying division with no alternative use.

D)there is no established market prices for the buying division.

A)the variable costs plus the opportunity cost of the selling division is greater than the external price for the buying division.

B)the variable costs plus the opportunity cost of the selling division is less than the external price for the buying division.

C)there is excess capacity in the buying division with no alternative use.

D)there is no established market prices for the buying division.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

28

A division can sell externally for $40 per unit.Its variable manufacturing costs are $15 per unit,and its variable marketing costs are $6 per unit.What is the opportunity cost of transferring internally,assuming the division is operating at capacity?

A)$15.

B)$19.

C)$21.

D)$25.

A)$15.

B)$19.

C)$21.

D)$25.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

29

Some managers prefer to use cost rather than market price in controlling transfers between divisions.If cost is to be used,then it should be:

A)full cost.

B)direct cost.

C)variable cost.

D)standard cost.

A)full cost.

B)direct cost.

C)variable cost.

D)standard cost.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

30

Top management intervention in settling transfer pricing disputes between two divisions should be avoided unless

A)there is no intermediate markets.

B)the intermediate market is imperfect.

C)there is an extraordinarily large order.

D)there is no opportunity costs.

A)there is no intermediate markets.

B)the intermediate market is imperfect.

C)there is an extraordinarily large order.

D)there is no opportunity costs.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

31

If the selling division has excess capacity,the transfer price should be set at its:

A)differential outlay costs.

B)differential outlay costs plus the foregone contribution to the organization of making the transfer internally.

C)selling price less the variable costs.

D)selling price less the variable costs plus the foregone contribution to the organization of making the transfer internally.

A)differential outlay costs.

B)differential outlay costs plus the foregone contribution to the organization of making the transfer internally.

C)selling price less the variable costs.

D)selling price less the variable costs plus the foregone contribution to the organization of making the transfer internally.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following transfer pricing methods must be used in segment reporting by the oil and gas industry?

A)Absorption cost.

B)Differential cost.

C)Negotiated market price.

D)Market price.

A)Absorption cost.

B)Differential cost.

C)Negotiated market price.

D)Market price.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following statements is (are)true? (A)If a transfer has no effect on divisional profit,managers will be indifferent between making the transfer or not.(B)If an intermediate market exists but divisions are prohibited from buying or selling from the outside,the intermediate market can be ignored in determining the optimal transfer price.

A)Only A is true.

B)Only B is true.

C)Both A and B are true.

D)Neither A nor B is true.

A)Only A is true.

B)Only B is true.

C)Both A and B are true.

D)Neither A nor B is true.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

34

In general,if a potential transfer has no effect on divisional profits:

A)no transfer will take place between the divisions.

B)managers will be indifferent between making the transfer or not.

C)the organization should not intervene to force a transfer.

D)the optimal transfer price is the opportunity cost for the buying division.

A)no transfer will take place between the divisions.

B)managers will be indifferent between making the transfer or not.

C)the organization should not intervene to force a transfer.

D)the optimal transfer price is the opportunity cost for the buying division.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

35

When there is no intermediate market:

A)there is no optimal transfer price.

B)the selling division cannot transfer its goods internally.

C)the buying division cannot purchase its goods externally.

D)there is no reason for top management to intervene in transfer pricing disputes.

A)there is no optimal transfer price.

B)the selling division cannot transfer its goods internally.

C)the buying division cannot purchase its goods externally.

D)there is no reason for top management to intervene in transfer pricing disputes.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

36

Given a competitive outside market for identical intermediate goods,what is the BEST transfer price,assuming all relevant information is readily available?

A)Standard production cost per unit.

B)Market price of the intermediate goods.

C)Actual full cost per unit plus a normal markup.

D)Market price of the final goods less any opportunity costs.

A)Standard production cost per unit.

B)Market price of the intermediate goods.

C)Actual full cost per unit plus a normal markup.

D)Market price of the final goods less any opportunity costs.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

37

Transfer prices would not be used by:

A)production centers.

B)investment centers.

C)profit centers.

D)cost centers.

A)production centers.

B)investment centers.

C)profit centers.

D)cost centers.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following statements is (are)false? (A)From an organization's viewpoint,transfer prices have no effect on total profits assuming the transfer occurs between the two responsibility centers.(B)A transfer price is the value assigned to the transfer of goods or services between divisions within the same organization.

A)Only A is false.

B)Only B is false.

C)Both A and B are false.

D)Neither A nor B is false.

A)Only A is false.

B)Only B is false.

C)Both A and B are false.

D)Neither A nor B is false.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

39

The optimal transfer price when there are intermediate markets is:

A)full cost.

B)outlay costs.

C)variable cost.

D)market prices.

A)full cost.

B)outlay costs.

C)variable cost.

D)market prices.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

40

Multinational firms often face conflicting pressures when developing transfer pricing policies.Tax avoidance results when:

A)inflated transfer prices are used to reduce the profits of divisions in high tax-rate countries.

B)inflated transfer prices are used to reduce the profits of divisions in low tax-rate countries.

C)cost-based transfer prices are used instead of market transfer prices in high tax-rate countries.

D)cost-based transfer prices are used instead of negotiated market transfer prices in low tax-rate countries.

A)inflated transfer prices are used to reduce the profits of divisions in high tax-rate countries.

B)inflated transfer prices are used to reduce the profits of divisions in low tax-rate countries.

C)cost-based transfer prices are used instead of market transfer prices in high tax-rate countries.

D)cost-based transfer prices are used instead of negotiated market transfer prices in low tax-rate countries.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

41

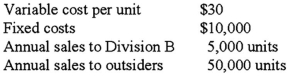

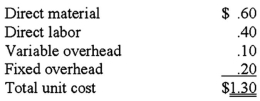

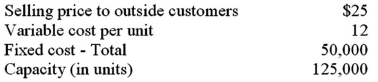

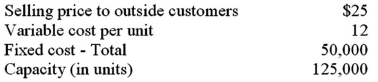

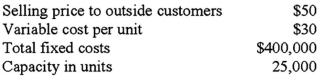

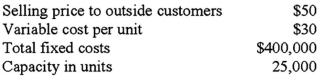

A company has two divisions,A and B,each operated as a profit center.Division A charges Division B $35 per unit (for each unit transferred to Division B).Other data for Division A are as follows:  Division A is planning to raise its transfer price to $50 per unit.Division B can purchase units at $40 per unit from outsiders,but doing so would idle Division A's facilities (now committed to producing units for Division B),Division A cannot increase its sales to outsiders.From the perspective of the company as a whole,from who should Division B acquire the units,assuming Division B's market is unaffected?

Division A is planning to raise its transfer price to $50 per unit.Division B can purchase units at $40 per unit from outsiders,but doing so would idle Division A's facilities (now committed to producing units for Division B),Division A cannot increase its sales to outsiders.From the perspective of the company as a whole,from who should Division B acquire the units,assuming Division B's market is unaffected?

A)Outside vendors.

B)Division A,but only at the variable cost per unit.

C)Division A,but only until fixed costs are covered,then should purchase from outside vendors.

D)Division A,in spite of the increased transfer price.

Division A is planning to raise its transfer price to $50 per unit.Division B can purchase units at $40 per unit from outsiders,but doing so would idle Division A's facilities (now committed to producing units for Division B),Division A cannot increase its sales to outsiders.From the perspective of the company as a whole,from who should Division B acquire the units,assuming Division B's market is unaffected?

Division A is planning to raise its transfer price to $50 per unit.Division B can purchase units at $40 per unit from outsiders,but doing so would idle Division A's facilities (now committed to producing units for Division B),Division A cannot increase its sales to outsiders.From the perspective of the company as a whole,from who should Division B acquire the units,assuming Division B's market is unaffected?A)Outside vendors.

B)Division A,but only at the variable cost per unit.

C)Division A,but only until fixed costs are covered,then should purchase from outside vendors.

D)Division A,in spite of the increased transfer price.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

42

Division A has variable manufacturing costs of $25 per unit and fixed costs of $5 per unit.Division A is operating at capacity,what is the opportunity cost of an internal transfer when the market price is $35?

A)$5.

B)$10.

C)$25.

D)$30.

A)$5.

B)$10.

C)$25.

D)$30.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

43

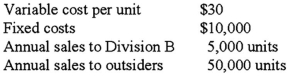

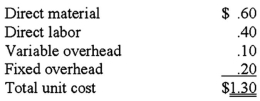

Cohasset Company currently manufactures all component parts used in the manufacture of various hand tools.Hurley Division produces a steel handle used in three different tools.The budget for these handles is 120,000 units with the following unit cost.  Ironwood Division purchases 20,000 handles from Hurley Division and completes the hand tools.An outside supplier,R & M Steel,has offered to supply 20,000 units of the handle to Ironwood Division for $1.25 per unit.Hurley currently has idle capacity that cannot be used.What is the cost impact to Cohasset as a whole of purchasing from R & M Steel? (CMA adapted)

Ironwood Division purchases 20,000 handles from Hurley Division and completes the hand tools.An outside supplier,R & M Steel,has offered to supply 20,000 units of the handle to Ironwood Division for $1.25 per unit.Hurley currently has idle capacity that cannot be used.What is the cost impact to Cohasset as a whole of purchasing from R & M Steel? (CMA adapted)

A)increase the handle unit cost by $0.05.

B)increase the handle unit cost by $0.15.

C)decrease the handle unit cost by $0.15.

D)decrease the handle unit cost by $0.25.

Ironwood Division purchases 20,000 handles from Hurley Division and completes the hand tools.An outside supplier,R & M Steel,has offered to supply 20,000 units of the handle to Ironwood Division for $1.25 per unit.Hurley currently has idle capacity that cannot be used.What is the cost impact to Cohasset as a whole of purchasing from R & M Steel? (CMA adapted)

Ironwood Division purchases 20,000 handles from Hurley Division and completes the hand tools.An outside supplier,R & M Steel,has offered to supply 20,000 units of the handle to Ironwood Division for $1.25 per unit.Hurley currently has idle capacity that cannot be used.What is the cost impact to Cohasset as a whole of purchasing from R & M Steel? (CMA adapted)A)increase the handle unit cost by $0.05.

B)increase the handle unit cost by $0.15.

C)decrease the handle unit cost by $0.15.

D)decrease the handle unit cost by $0.25.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

44

Chipper Division of Acme Corp.sells 80,000 units of part Z-25 to the outside market.Part Z-25 sells for $40,has a variable cost of $22,and a fixed cost per unit of $10.Chipper has a capacity to produce 100,000 units per period.Jones Division currently purchases 10,000 units of part Z-25 from Chipper for $40.Jones has been approached by an outside supplier willing to supply the parts for $36.What is the effect on Acme's overall profit if Chipper ACCEPTS the outside price and Jones continues to buy inside?

A)No change.

B)$140,000 decrease in Acme profits.

C)$80,000 decrease in Acme profits.

D)$40,000 increase in Acme profits.

A)No change.

B)$140,000 decrease in Acme profits.

C)$80,000 decrease in Acme profits.

D)$40,000 increase in Acme profits.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

45

Chipper Division of Acme Corp.sells 80,000 units of part Z-25 to the outside market.Part Z-25 sells for $40,has a variable cost of $22,and a fixed cost per unit of $10.Chipper has a capacity to produce 100,000 units per period.Jones Division currently purchases 10,000 units of part Z-25 from Chipper for $40.Jones has been approached by an outside supplier willing to supply the parts for $36.If Acme uses a negotiated transfer pricing system,what is the minimum transfer price that should be charged for this transaction?

A)$40.

B)$36.

C)$32.

D)$22.

A)$40.

B)$36.

C)$32.

D)$22.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

46

Chipper Division of Acme Corp.sells 80,000 units of part Z-25 to the outside market.Part Z-25 sells for $40,has a variable cost of $22,and a fixed cost per unit of $10.Chipper has a capacity to produce 100,000 units per period.Jones Division currently purchases 10,000 units of part Z-25 from Chipper for $40.Jones has been approached by an outside supplier willing to supply the parts for $36.What is the effect on Acme's overall profit if Chipper REFUSES the outside price and Jones decides to buy outside?

A)No change.

B)$140,000 decrease in Acme profits.

C)$80,000 decrease in Acme profits.

D)$40,000 increase in Acme profits.

A)No change.

B)$140,000 decrease in Acme profits.

C)$80,000 decrease in Acme profits.

D)$40,000 increase in Acme profits.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

47

A company is highly centralized.Division X,which is operating at capacity,produces a component that it currently sells in a perfectly competitive market for $13 per unit.At the current level of production,the fixed cost of producing this component is $4 per unit and the variable cost is $7 per unit.Division Y would like to purchase this component from Division X.The price that Division X should charge Division Y per unit for this component is:

A)$7.

B)$11.

C)$13.

D)$15.

A)$7.

B)$11.

C)$13.

D)$15.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

48

Chipper Division of Acme Corp.sells 80,000 units of part Z-25 to the outside market.Part Z-25 sells for $40,has a variable cost of $22,and a fixed cost per unit of $10.Chipper has a capacity to produce 100,000 units per period.Jones Division currently purchases 10,000 units of part Z-25 from Chipper for $40.Jones has been approached by an outside supplier willing to supply the parts for $36.If Acme uses a negotiated transfer pricing system,what is the maximum transfer price that should be charged for this transaction?

A)$40.

B)$36.

C)$32.

D)$22.

A)$40.

B)$36.

C)$32.

D)$22.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

49

Avery Corporation has two divisions,A and B,which are both organized as profit centers;Division A produces and sells widgets to Division B and to outside customers.Division A has total costs of $35,$20 of which are variable.Division A is operating significantly below capacity and sells the widgets for $50.Division B has received an offer from an outsider vendor to supply all the widgets it needs (20,000 widgets)at a cost of $45.The manager of Division B is considering the offer but wants to approach Division A first.What is the maximum transfer price from Division A to Division B?

A)$20.

B)$35.

C)$45.

D)$50.

A)$20.

B)$35.

C)$45.

D)$50.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

50

Cohasset Company currently manufactures all component parts used in the manufacture of various hand tools.Hurley Division produces a steel handle used in three different tools.The budget for these handles is 120,000 units with the following unit cost.  Ironwood Division purchases 20,000 handles from Hurley Division and completes the hand tools.An outside supplier,R & M Steel,has offered to supply 20,000 units of the handle to Ironwood Division for $1.25 per unit.Hurley currently has idle capacity that cannot be used.If Cohasset would like to develop a range of transfer prices,what would be the maximum transfer price that Ironwood would be willing to pay?

Ironwood Division purchases 20,000 handles from Hurley Division and completes the hand tools.An outside supplier,R & M Steel,has offered to supply 20,000 units of the handle to Ironwood Division for $1.25 per unit.Hurley currently has idle capacity that cannot be used.If Cohasset would like to develop a range of transfer prices,what would be the maximum transfer price that Ironwood would be willing to pay?

A)$1.00.

B)$1.10.

C)$1.25.

D)$1.30.

Ironwood Division purchases 20,000 handles from Hurley Division and completes the hand tools.An outside supplier,R & M Steel,has offered to supply 20,000 units of the handle to Ironwood Division for $1.25 per unit.Hurley currently has idle capacity that cannot be used.If Cohasset would like to develop a range of transfer prices,what would be the maximum transfer price that Ironwood would be willing to pay?

Ironwood Division purchases 20,000 handles from Hurley Division and completes the hand tools.An outside supplier,R & M Steel,has offered to supply 20,000 units of the handle to Ironwood Division for $1.25 per unit.Hurley currently has idle capacity that cannot be used.If Cohasset would like to develop a range of transfer prices,what would be the maximum transfer price that Ironwood would be willing to pay?A)$1.00.

B)$1.10.

C)$1.25.

D)$1.30.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

51

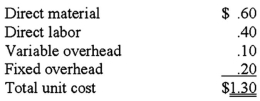

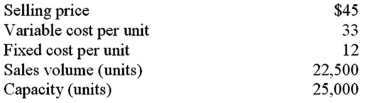

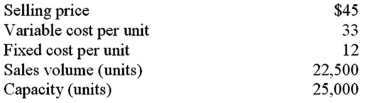

You have been provided with the following information for Division X of a decentralized company:  Division W would like to purchase all of its units internally.Division W needs 6,000 units each period and currently pays $42 per unit to an outside firm.What is the lowest price that Division X could accept from Division W? Assume that Division W wants to use a sole supplier and will not purchase less than 6,000 from a supplier.

Division W would like to purchase all of its units internally.Division W needs 6,000 units each period and currently pays $42 per unit to an outside firm.What is the lowest price that Division X could accept from Division W? Assume that Division W wants to use a sole supplier and will not purchase less than 6,000 from a supplier.

A)$45.

B)$42.

C)$40.

D)$38.

Division W would like to purchase all of its units internally.Division W needs 6,000 units each period and currently pays $42 per unit to an outside firm.What is the lowest price that Division X could accept from Division W? Assume that Division W wants to use a sole supplier and will not purchase less than 6,000 from a supplier.

Division W would like to purchase all of its units internally.Division W needs 6,000 units each period and currently pays $42 per unit to an outside firm.What is the lowest price that Division X could accept from Division W? Assume that Division W wants to use a sole supplier and will not purchase less than 6,000 from a supplier.A)$45.

B)$42.

C)$40.

D)$38.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

52

Cruises,Inc. ,operates two divisions: (1)a management division that owns and manages cruise ships in the Florida Keys and (2)a repair division that operates a dry dock in Marble Sand Florida.The repair division works on company ships,as well as other large-hull ships.The repair division has an estimated variable cost of $28.50 per labor-hour.The repair division has a backlog of work for outside ships.They charge $48.00 per hour for labor,which is standard for this type of work.The management division complained that it could hire its own repair workers for $30.00 per hour,including leasing an adequate work area.What is the minimum transfer price per hour that the repair division should obtain for its services,assuming it is operating at capacity?

A)$28.50.

B)$30.00.

C)$39.00.

D)$46.50.

E)$48.00.

A)$28.50.

B)$30.00.

C)$39.00.

D)$46.50.

E)$48.00.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

53

Cruises,Inc. ,operates two divisions: (1)a management division that owns and manages cruise ships in the Florida Keys and (2)a repair division that operates a dry dock in Marble Sand Florida.The repair division works on company ships,as well as other large-hull ships.The repair division has an estimated variable cost of $28.50 per labor-hour.The repair division has a backlog of work for outside ships.They charge $48.00 per hour for labor,which is standard for this type of work.The management division complained that it could hire its own repair workers for $30.00 per hour,including leasing an adequate work area.What is the maximum transfer price per hour that the management division should pay?

A)$28.50.

B)$30.00.

C)$39.00.

D)$46.50.

A)$28.50.

B)$30.00.

C)$39.00.

D)$46.50.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

54

Cohasset Company currently manufactures all component parts used in the manufacture of various hand tools.Hurley Division produces a steel handle used in three different tools.The budget for these handles is 120,000 units with the following unit cost.  Ironwood Division purchases 20,000 handles from Hurley Division and completes the hand tools.An outside supplier,R & M Steel,has offered to supply 20,000 units of the handle to Ironwood Division for $1.25 per unit.Hurley currently has idle capacity that cannot be used.If Cohasset would like to develop a range of transfer prices,what would be the minimum transfer price that Hurley would be willing to accept?

Ironwood Division purchases 20,000 handles from Hurley Division and completes the hand tools.An outside supplier,R & M Steel,has offered to supply 20,000 units of the handle to Ironwood Division for $1.25 per unit.Hurley currently has idle capacity that cannot be used.If Cohasset would like to develop a range of transfer prices,what would be the minimum transfer price that Hurley would be willing to accept?

A)$1.00.

B)$1.10.

C)$1.25.

D)$1.30.

Ironwood Division purchases 20,000 handles from Hurley Division and completes the hand tools.An outside supplier,R & M Steel,has offered to supply 20,000 units of the handle to Ironwood Division for $1.25 per unit.Hurley currently has idle capacity that cannot be used.If Cohasset would like to develop a range of transfer prices,what would be the minimum transfer price that Hurley would be willing to accept?

Ironwood Division purchases 20,000 handles from Hurley Division and completes the hand tools.An outside supplier,R & M Steel,has offered to supply 20,000 units of the handle to Ironwood Division for $1.25 per unit.Hurley currently has idle capacity that cannot be used.If Cohasset would like to develop a range of transfer prices,what would be the minimum transfer price that Hurley would be willing to accept?A)$1.00.

B)$1.10.

C)$1.25.

D)$1.30.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

55

Given the following data for Division L:  Division N would like to purchase 10,000 units from Division L at a price of $125 per unit.Division L has no excess capacity to handle Division N's requirements.Division N currently purchases from an outside supplier at a price of $140.If Division L accepts a $125 price internally,the company,as a whole,will be better or worse off by:

Division N would like to purchase 10,000 units from Division L at a price of $125 per unit.Division L has no excess capacity to handle Division N's requirements.Division N currently purchases from an outside supplier at a price of $140.If Division L accepts a $125 price internally,the company,as a whole,will be better or worse off by:

A)$600,000

B)$(100,000)

C)$115,000

D)$250,000

Division N would like to purchase 10,000 units from Division L at a price of $125 per unit.Division L has no excess capacity to handle Division N's requirements.Division N currently purchases from an outside supplier at a price of $140.If Division L accepts a $125 price internally,the company,as a whole,will be better or worse off by:

Division N would like to purchase 10,000 units from Division L at a price of $125 per unit.Division L has no excess capacity to handle Division N's requirements.Division N currently purchases from an outside supplier at a price of $140.If Division L accepts a $125 price internally,the company,as a whole,will be better or worse off by:A)$600,000

B)$(100,000)

C)$115,000

D)$250,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

56

Avery Corporation has two divisions,A and B,which are both organized as profit centers;Division A produces and sells widgets to Division B and to outside customers.Division A has total costs of $35,$20 of which are variable.Division A is operating significantly below capacity and sells the widgets for $50.Division B has received an offer from an outsider vendor to supply all the widgets it needs (20,000 widgets)at a cost of $45.The manager of Division B is considering the offer but wants to approach Division A first.What is the minimum transfer price from Division A to Division B?

A)$20.

B)$35.

C)$45.

D)$50.

A)$20.

B)$35.

C)$45.

D)$50.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

57

Given the following data for Division X:  Division Y would like to purchase 15,000 units each period from Division X.Division X has ample excess capacity to handle all of Division Y's needs.Division Y now purchases from an outside supplier at a price of $20.If Division X refuses to accept an $18 price internally,the company,as a whole,will be worse off by:

Division Y would like to purchase 15,000 units each period from Division X.Division X has ample excess capacity to handle all of Division Y's needs.Division Y now purchases from an outside supplier at a price of $20.If Division X refuses to accept an $18 price internally,the company,as a whole,will be worse off by:

A)$30,000.

B)$75,000.

C)$90,000.

D)$120,000.

Division Y would like to purchase 15,000 units each period from Division X.Division X has ample excess capacity to handle all of Division Y's needs.Division Y now purchases from an outside supplier at a price of $20.If Division X refuses to accept an $18 price internally,the company,as a whole,will be worse off by:

Division Y would like to purchase 15,000 units each period from Division X.Division X has ample excess capacity to handle all of Division Y's needs.Division Y now purchases from an outside supplier at a price of $20.If Division X refuses to accept an $18 price internally,the company,as a whole,will be worse off by:A)$30,000.

B)$75,000.

C)$90,000.

D)$120,000.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

58

Avery Corporation has two divisions,A and B,which are both organized as profit centers;Division A produces and sells widgets to Division B and to outside customers.Division A has total costs of $35,$20 of which are variable.Division A is operating significantly below capacity and sells the widgets for $50.Division B has received an offer from an outsider vendor to supply all the widgets it needs (20,000 widgets)at a cost of $45.The manager of Division B is considering the offer but wants to approach Division A first.What would be the profit impact to Avery Corporation as a whole if Division B purchased the 20,000 widgets it needs from the outside vendor for $45?

A)No change in profit to Avery.

B)$100,000 increase in profits.

C)$100,000 decrease in profits.

D)$500,000 decrease in profits.

A)No change in profit to Avery.

B)$100,000 increase in profits.

C)$100,000 decrease in profits.

D)$500,000 decrease in profits.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

59

Cruises,Inc. ,operates two divisions: (1)a management division that owns and manages cruise ships in the Florida Keys and (2)a repair division that operates a dry dock in Marble Sand Florida.The repair division works on company ships,as well as other large-hull ships.The repair division has an estimated variable cost of $28.50 per labor-hour.The repair division has a backlog of work for outside ships.They charge $48.00 per hour for labor,which is standard for this type of work.The management division complained that it could hire its own repair workers for $30.00 per hour,including leasing an adequate work area.If the repair division had idle capacity,what is the minimum transfer price that the repair division should obtain?

A)$28.50.

B)$30.00.

C)$39.00.

D)$46.50.

A)$28.50.

B)$30.00.

C)$39.00.

D)$46.50.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

60

Given the following data for Division A:  Assume that Division A is selling all it can produce to outside customers.If it sells to Division B,$1 can be avoided in variable cost per unit.Division B is presently purchasing from an outside supplier at $38 per unit.From the point of view of the company as a whole,any sales to Division B should be priced at:

Assume that Division A is selling all it can produce to outside customers.If it sells to Division B,$1 can be avoided in variable cost per unit.Division B is presently purchasing from an outside supplier at $38 per unit.From the point of view of the company as a whole,any sales to Division B should be priced at:

A)$40.

B)$39.

C)$38.

D)$37.

E)The company would not want the transfer to take place.

Assume that Division A is selling all it can produce to outside customers.If it sells to Division B,$1 can be avoided in variable cost per unit.Division B is presently purchasing from an outside supplier at $38 per unit.From the point of view of the company as a whole,any sales to Division B should be priced at:

Assume that Division A is selling all it can produce to outside customers.If it sells to Division B,$1 can be avoided in variable cost per unit.Division B is presently purchasing from an outside supplier at $38 per unit.From the point of view of the company as a whole,any sales to Division B should be priced at:A)$40.

B)$39.

C)$38.

D)$37.

E)The company would not want the transfer to take place.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

61

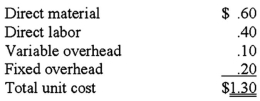

Parkside Inc.has several divisions that operate as decentralized profit centers.Parkside's Entertainment Division manufactures video arcade equipment using the products of two of Parkside's other divisions.The Plastics Division manufactures plastic components,one type that is made exclusively for the Entertainment Division,while other less complex components are sold to outside markets.The products of the Video Cards Division are sold in a competitive market;however,one video card model is also used by the Entertainment Division.The actual costs per unit used by the Entertainment Division follow: (CMA adapted)  The Plastics Division sells its commercial products at full cost plus a 25% markup and believes the proprietary plastic component made for the Entertainment Division would sell for $6.25 per unit on the open market.The market price of the video card used by the Entertainment Division is $10.98 per unit.A per-unit transfer price from the Video Cards Division to the Entertainment Division at full cost,$9.15,would:

The Plastics Division sells its commercial products at full cost plus a 25% markup and believes the proprietary plastic component made for the Entertainment Division would sell for $6.25 per unit on the open market.The market price of the video card used by the Entertainment Division is $10.98 per unit.A per-unit transfer price from the Video Cards Division to the Entertainment Division at full cost,$9.15,would:

A)allow evaluation of both divisions on a competitive basis.

B)satisfy the Video Cards Division's profit desire by allowing recovery of opportunity costs.

C)provide no profit incentive for the Video Cards Division to control or reduce costs.

D)encourage the Entertainment Division to purchase video cards from an outside source.

The Plastics Division sells its commercial products at full cost plus a 25% markup and believes the proprietary plastic component made for the Entertainment Division would sell for $6.25 per unit on the open market.The market price of the video card used by the Entertainment Division is $10.98 per unit.A per-unit transfer price from the Video Cards Division to the Entertainment Division at full cost,$9.15,would:

The Plastics Division sells its commercial products at full cost plus a 25% markup and believes the proprietary plastic component made for the Entertainment Division would sell for $6.25 per unit on the open market.The market price of the video card used by the Entertainment Division is $10.98 per unit.A per-unit transfer price from the Video Cards Division to the Entertainment Division at full cost,$9.15,would:A)allow evaluation of both divisions on a competitive basis.

B)satisfy the Video Cards Division's profit desire by allowing recovery of opportunity costs.

C)provide no profit incentive for the Video Cards Division to control or reduce costs.

D)encourage the Entertainment Division to purchase video cards from an outside source.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

62

Division A has variable manufacturing costs of $50 per unit and fixed costs of $10 per unit.Assuming that Division A is operating significantly below capacity,what is the optimal transfer price of an internal transfer when the market price is $75?

A)$20.

B)$25.

C)$50.

D)$60.

A)$20.

B)$25.

C)$50.

D)$60.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

63

The Eastern division sells goods internally to the Western division of the same company.The quoted external price in industry publications from a supplier near Eastern is $200 per ton plus transportation.It costs $20 per ton to transport the goods to Western.Eastern's actual market cost per ton to buy the direct materials to make the transferred product is $100.Actual per-ton direct labor is $50.Other actual costs of storage and handling are $40.The company president selects a $220 transfer price.This is an example of: (CIA adapted)

A)market-based transfer pricing.

B)cost-based transfer pricing.

C)negotiated transfer pricing.

D)cost plus 20% transfer pricing.

A)market-based transfer pricing.

B)cost-based transfer pricing.

C)negotiated transfer pricing.

D)cost plus 20% transfer pricing.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

64

A division can sell externally for $60 per unit.Its variable manufacturing costs are $35 per unit,and its variable marketing costs are $12 per unit.What is the opportunity cost of transferring internally,assuming the division is operating at capacity?

A)$13.

B)$25.

C)$35.

D)$47.

A)$13.

B)$25.

C)$35.

D)$47.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

65

Cascade Cliffs,Inc. ,operates two divisions: (1)a management division that owns and manages bulk carriers on the Great Lakes and (2)a repair division that operates a dry dock in Cheboygan,Michigan.The repair division works on company ships,as well as other large-hull ships.The repair division has an estimated variable cost of $37 per labor-hour.The repair division has a backlog of work for outside ships.They charge $70.00 per hour for labor,which is standard for this type of work.The management division complained that it could hire its own repair workers for $45.00 per hour,including leasing an adequate work area.What is the maximum transfer price per hour that the management division should pay?

A)$33.00.

B)$37.00.

C)$45.00.

D)$70.00.

A)$33.00.

B)$37.00.

C)$45.00.

D)$70.00.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

66

Parkside Inc.has several divisions that operate as decentralized profit centers.Parkside's Entertainment Division manufactures video arcade equipment using the products of two of Parkside's other divisions.The Plastics Division manufactures plastic components,one type that is made exclusively for the Entertainment Division,while other less complex components are sold to outside markets.The products of the Video Cards Division are sold in a competitive market;however,one video card model is also used by the Entertainment Division.The actual costs per unit used by the Entertainment Division follow: (CMA adapted)  The Plastics Division sells its commercial products at full cost plus a 25% markup and believes the proprietary plastic component made for the Entertainment Division would sell for $6.25 per unit on the open market.The market price of the video card used by the Entertainment Division is $10.98 per unit.Assume that the Entertainment Division is able to purchase a large quantity of video cards from an outside source at $8.70 per unit.The Video Cards Division,having excess capacity,agrees to lower its transfer price to $8.70 per unit.This action would:

The Plastics Division sells its commercial products at full cost plus a 25% markup and believes the proprietary plastic component made for the Entertainment Division would sell for $6.25 per unit on the open market.The market price of the video card used by the Entertainment Division is $10.98 per unit.Assume that the Entertainment Division is able to purchase a large quantity of video cards from an outside source at $8.70 per unit.The Video Cards Division,having excess capacity,agrees to lower its transfer price to $8.70 per unit.This action would:

A)optimize the profit goals of the Entertainment Division while subverting the profit goals of Parkside Inc.

B)allow evaluation of both divisions on the same basis.

C)subvert the profit goals of the Video Cards Division while optimizing the profit goals of the Entertainment Division.

D)optimize the overall profit goals of Parkside Inc.

The Plastics Division sells its commercial products at full cost plus a 25% markup and believes the proprietary plastic component made for the Entertainment Division would sell for $6.25 per unit on the open market.The market price of the video card used by the Entertainment Division is $10.98 per unit.Assume that the Entertainment Division is able to purchase a large quantity of video cards from an outside source at $8.70 per unit.The Video Cards Division,having excess capacity,agrees to lower its transfer price to $8.70 per unit.This action would:

The Plastics Division sells its commercial products at full cost plus a 25% markup and believes the proprietary plastic component made for the Entertainment Division would sell for $6.25 per unit on the open market.The market price of the video card used by the Entertainment Division is $10.98 per unit.Assume that the Entertainment Division is able to purchase a large quantity of video cards from an outside source at $8.70 per unit.The Video Cards Division,having excess capacity,agrees to lower its transfer price to $8.70 per unit.This action would:A)optimize the profit goals of the Entertainment Division while subverting the profit goals of Parkside Inc.

B)allow evaluation of both divisions on the same basis.

C)subvert the profit goals of the Video Cards Division while optimizing the profit goals of the Entertainment Division.

D)optimize the overall profit goals of Parkside Inc.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

67

A division can sell externally for $60 per unit.Its variable manufacturing costs are $35 per unit,and its variable marketing costs are $12 per unit.What is the optimal transfer price for transferring internally,assuming the division is operating at capacity?

A)$12.

B)$35.

C)$47.

D)$60.

A)$12.

B)$35.

C)$47.

D)$60.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

68

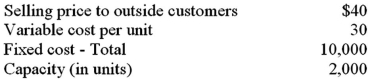

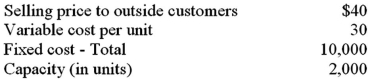

An appropriate transfer price between two divisions of The Stark Company can be determined from the following data: (CIA adapted)  What is the natural bargaining range for the two divisions?

What is the natural bargaining range for the two divisions?

A)Between $20 and $50.

B)Between $50 and $70.

C)Any amount less than $50.

D)$50 is the only acceptable transfer price.

What is the natural bargaining range for the two divisions?

What is the natural bargaining range for the two divisions?A)Between $20 and $50.

B)Between $50 and $70.

C)Any amount less than $50.

D)$50 is the only acceptable transfer price.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

69

The Alpha Division of a company,which is operating at capacity,produces and sells 1,000 units of a certain electronic component in a perfectly competitive market.Revenue and cost data are as follows: (CIA adapted)  The minimum transfer price that should be charged to the Beta Division of the same company for each component is:

The minimum transfer price that should be charged to the Beta Division of the same company for each component is:

A)$12.

B)$34.

C)$46.

D)$50.

The minimum transfer price that should be charged to the Beta Division of the same company for each component is:

The minimum transfer price that should be charged to the Beta Division of the same company for each component is:A)$12.

B)$34.

C)$46.

D)$50.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

70

Cascade Cliffs,Inc. ,operates two divisions: (1)a management division that owns and manages bulk carriers on the Great Lakes and (2)a repair division that operates a dry dock in Cheboygan,Michigan.The repair division works on company ships,as well as other large-hull ships.The repair division has an estimated variable cost of $37 per labor-hour.The repair division has a backlog of work for outside ships.They charge $70.00 per hour for labor,which is standard for this type of work.The management division complained that it could hire its own repair workers for $45.00 per hour,including leasing an adequate work area.What is the minimum transfer price per hour that the repair division should obtain for its services,assuming it is operating at capacity?

A)$33.00.

B)$37.00.

C)$45.00.

D)$70.00.

A)$33.00.

B)$37.00.

C)$45.00.

D)$70.00.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

71

Cascade Cliffs,Inc. ,operates two divisions: (1)a management division that owns and manages bulk carriers on the Great Lakes and (2)a repair division that operates a dry dock in Cheboygan,Michigan.The repair division works on company ships,as well as other large-hull ships.The repair division has an estimated variable cost of $37 per labor-hour.The repair division has a backlog of work for outside ships.They charge $70.00 per hour for labor,which is standard for this type of work.The management division complained that it could hire its own repair workers for $45.00 per hour,including leasing an adequate work area.If the repair division had idle capacity,what is the minimum transfer price that the repair division should obtain?

A)$33.00.

B)$37.00.

C)$45.00.

D)$70.00.

A)$33.00.

B)$37.00.

C)$45.00.

D)$70.00.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

72

Division A has variable manufacturing costs of $50 per unit and fixed costs of $10 per unit.Assuming that Division A is operating at capacity,what is the opportunity cost of an internal transfer when the market price is $75?

A)$20.

B)$25.

C)$50.

D)$60.

A)$20.

B)$25.

C)$50.

D)$60.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

73

You have been provided with the following information for Division Sell of a decentralized company:  Division Buy would like to purchase all of its units internally.Division Buy needs 6,000 units each period and currently pays $84 per unit to an outside firm.What is the lowest price that Division Sell could accept from Division Buy? (Assume that Division Buy wants to use a sole supplier and will not purchase less than 6,000 from a supplier. )

Division Buy would like to purchase all of its units internally.Division Buy needs 6,000 units each period and currently pays $84 per unit to an outside firm.What is the lowest price that Division Sell could accept from Division Buy? (Assume that Division Buy wants to use a sole supplier and will not purchase less than 6,000 from a supplier. )

A)$90.

B)$84.

C)$80.

D)$66.

Division Buy would like to purchase all of its units internally.Division Buy needs 6,000 units each period and currently pays $84 per unit to an outside firm.What is the lowest price that Division Sell could accept from Division Buy? (Assume that Division Buy wants to use a sole supplier and will not purchase less than 6,000 from a supplier. )

Division Buy would like to purchase all of its units internally.Division Buy needs 6,000 units each period and currently pays $84 per unit to an outside firm.What is the lowest price that Division Sell could accept from Division Buy? (Assume that Division Buy wants to use a sole supplier and will not purchase less than 6,000 from a supplier. )A)$90.

B)$84.

C)$80.

D)$66.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following is the most significant disadvantage of a cost-based transfer price? (CIA adapted)

A)Requires internally developed information.

B)Imposes market effects on company operations.

C)Requires externally developed information.

D)May not promote long-term efficiencies.

A)Requires internally developed information.

B)Imposes market effects on company operations.

C)Requires externally developed information.

D)May not promote long-term efficiencies.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

75

Given the following information for Division K:  Division L would like to purchase internally from Division K.Division L now purchases 5,000 units each period from outside suppliers at $49 per unit.Division K has ample excess capacity to handle all of Division L's needs.What is the lowest price that Division K could accept?

Division L would like to purchase internally from Division K.Division L now purchases 5,000 units each period from outside suppliers at $49 per unit.Division K has ample excess capacity to handle all of Division L's needs.What is the lowest price that Division K could accept?

A)$50.00.

B)$49.00.

C)$46.00.

D)$39.50.

E)$30.00.

Division L would like to purchase internally from Division K.Division L now purchases 5,000 units each period from outside suppliers at $49 per unit.Division K has ample excess capacity to handle all of Division L's needs.What is the lowest price that Division K could accept?

Division L would like to purchase internally from Division K.Division L now purchases 5,000 units each period from outside suppliers at $49 per unit.Division K has ample excess capacity to handle all of Division L's needs.What is the lowest price that Division K could accept?A)$50.00.

B)$49.00.

C)$46.00.

D)$39.50.

E)$30.00.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

76

A limitation of transfer prices based on actual cost is that they: (CIA adapted)

A)charge inefficiencies to the department that is transferring the goods.

B)charge inefficiencies to the department that is receiving the goods.

C)must be adjusted by some markup.

D)lack clarity and administrative convenience.

A)charge inefficiencies to the department that is transferring the goods.

B)charge inefficiencies to the department that is receiving the goods.

C)must be adjusted by some markup.

D)lack clarity and administrative convenience.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

77

Parkside Inc.has several divisions that operate as decentralized profit centers.Parkside's Entertainment Division manufactures video arcade equipment using the products of two of Parkside's other divisions.The Plastics Division manufactures plastic components,one type that is made exclusively for the Entertainment Division,while other less complex components are sold to outside markets.The products of the Video Cards Division are sold in a competitive market;however,one video card model is also used by the Entertainment Division.The actual costs per unit used by the Entertainment Division follow: (CMA adapted)  The Plastics Division sells its commercial products at full cost plus a 25% markup and believes the proprietary plastic component made for the Entertainment Division would sell for $6.25 per unit on the open market.The market price of the video card used by the Entertainment Division is $10.98 per unit.Assume that the Plastics Division has excess capacity and it has negotiated a transfer price of $5.60 per plastic component with the Entertainment Division.This price will:

The Plastics Division sells its commercial products at full cost plus a 25% markup and believes the proprietary plastic component made for the Entertainment Division would sell for $6.25 per unit on the open market.The market price of the video card used by the Entertainment Division is $10.98 per unit.Assume that the Plastics Division has excess capacity and it has negotiated a transfer price of $5.60 per plastic component with the Entertainment Division.This price will:

A)cause the Plastics Division to reduce the number of commercial plastic components it manufactures.

B)motivate both divisions as estimated profits are shared.

C)encourage the Entertainment Division to seek an outside source for plastic components.

D)demotivate the Plastics Division causing mediocre performance.

The Plastics Division sells its commercial products at full cost plus a 25% markup and believes the proprietary plastic component made for the Entertainment Division would sell for $6.25 per unit on the open market.The market price of the video card used by the Entertainment Division is $10.98 per unit.Assume that the Plastics Division has excess capacity and it has negotiated a transfer price of $5.60 per plastic component with the Entertainment Division.This price will:

The Plastics Division sells its commercial products at full cost plus a 25% markup and believes the proprietary plastic component made for the Entertainment Division would sell for $6.25 per unit on the open market.The market price of the video card used by the Entertainment Division is $10.98 per unit.Assume that the Plastics Division has excess capacity and it has negotiated a transfer price of $5.60 per plastic component with the Entertainment Division.This price will:A)cause the Plastics Division to reduce the number of commercial plastic components it manufactures.

B)motivate both divisions as estimated profits are shared.

C)encourage the Entertainment Division to seek an outside source for plastic components.

D)demotivate the Plastics Division causing mediocre performance.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

78

Division A has variable manufacturing costs of $50 per unit and fixed costs of $10 per unit.Assuming that Division A is operating at capacity,what is the optimal transfer price of an internal transfer when the market price is $75?

A)$20.

B)$25.

C)$50.

D)$60.

E)$75.

A)$20.

B)$25.

C)$50.

D)$60.

E)$75.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

79

A large manufacturing company has several autonomous divisions that sell their products in perfectly competitive external markets as well as internally to the other divisions of the company.Top management expects each of its divisional managers to take actions that will maximize the organization's goal as well as their own goals.Top management also promotes a sustained level of management effort of all of its divisional managers.Under these circumstances,for products exchanged between divisions,the transfer price that will generally lead to optimal decisions for the manufacturing company would be a transfer price equal to the: (CIA adapted)

A)full cost of the product.

B)full cost of the product plus a markup.

C)variable cost of the product plus a markup.

D)market price of the product.

A)full cost of the product.

B)full cost of the product plus a markup.

C)variable cost of the product plus a markup.

D)market price of the product.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

80

Division B has variable manufacturing costs of $50 per unit and fixed costs of $10 per unit.Assuming that Division B is operating significantly below capacity,what is the opportunity cost of an internal transfer when the market price is $75?

A)$0.

B)$25.

C)$50.

D)$60.

A)$0.

B)$25.

C)$50.

D)$60.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck