Deck 15: Activity-Based Absorption Costing

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/12

Play

Full screen (f)

Deck 15: Activity-Based Absorption Costing

1

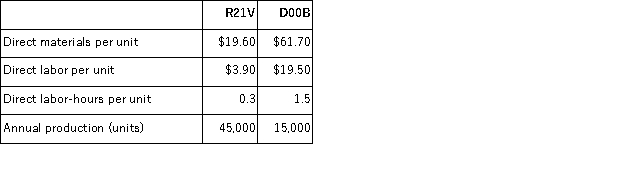

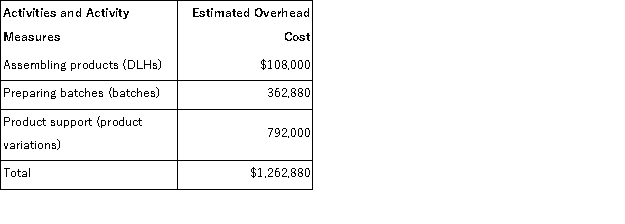

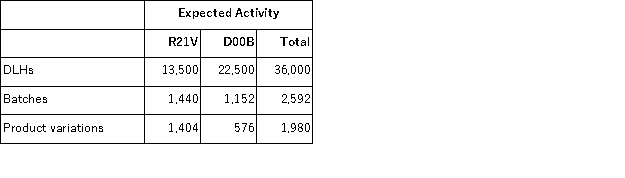

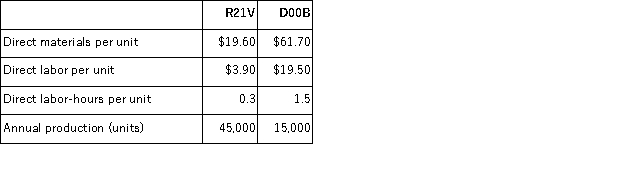

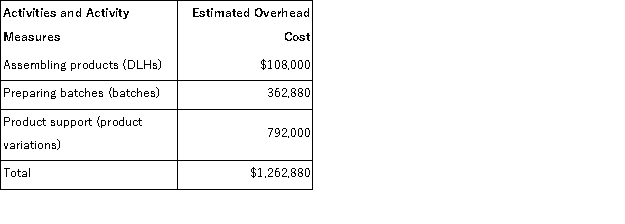

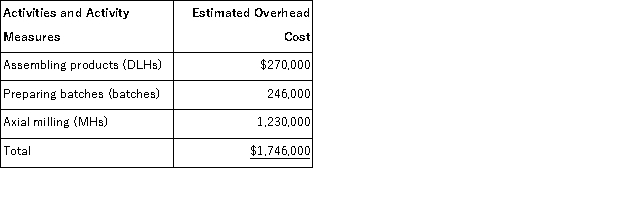

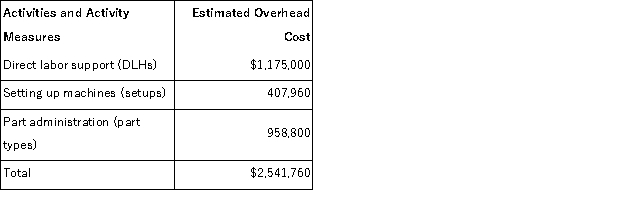

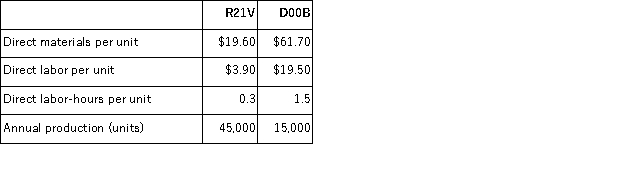

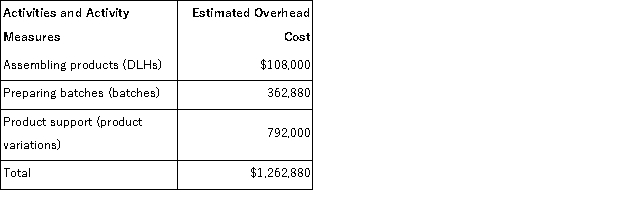

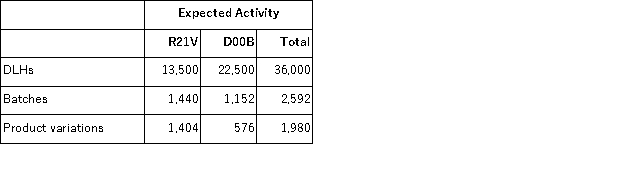

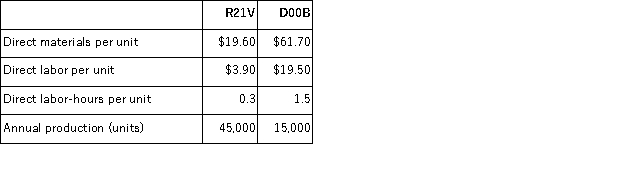

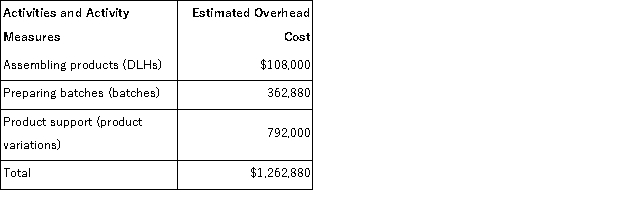

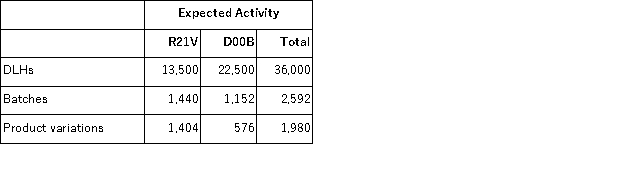

(Appendix 4A)Pacchiana Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs).The company has two products,R21V and D00B,about which it has provided the following data:  The company's estimated total manufacturing overhead for the year is $1,262,880 and the company's estimated total direct labor-hours for the year is 36,000. The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

The company's estimated total manufacturing overhead for the year is $1,262,880 and the company's estimated total direct labor-hours for the year is 36,000. The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

The unit product cost of product D00B under the activity-based costing system is closest to:

The unit product cost of product D00B under the activity-based costing system is closest to:

A)$111.81

B)$133.82

C)$81.20

D)$30.61

The company's estimated total manufacturing overhead for the year is $1,262,880 and the company's estimated total direct labor-hours for the year is 36,000. The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

The company's estimated total manufacturing overhead for the year is $1,262,880 and the company's estimated total direct labor-hours for the year is 36,000. The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

The unit product cost of product D00B under the activity-based costing system is closest to:

The unit product cost of product D00B under the activity-based costing system is closest to:A)$111.81

B)$133.82

C)$81.20

D)$30.61

A

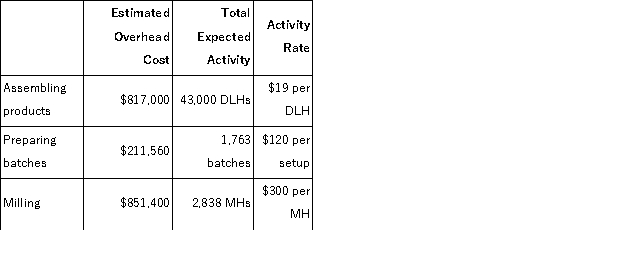

Explanation: The activity rates for each activity cost pool are computed as follows:

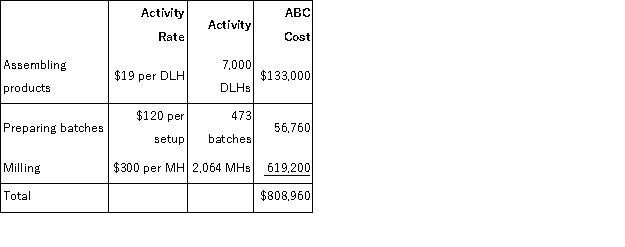

The overhead cost charged to Product D00B is:

The overhead cost charged to Product D00B is:

Overhead per unit of Product D00B = $459,180 ÷ 15,000 units = $30.61 per unit

Overhead per unit of Product D00B = $459,180 ÷ 15,000 units = $30.61 per unit

Explanation: The activity rates for each activity cost pool are computed as follows:

The overhead cost charged to Product D00B is:

The overhead cost charged to Product D00B is: Overhead per unit of Product D00B = $459,180 ÷ 15,000 units = $30.61 per unit

Overhead per unit of Product D00B = $459,180 ÷ 15,000 units = $30.61 per unit

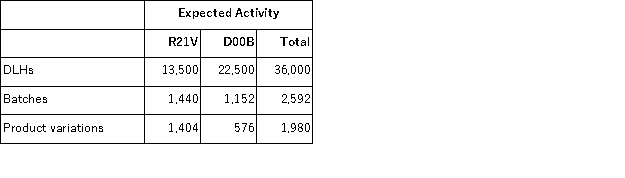

2

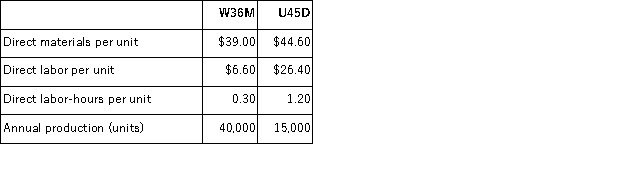

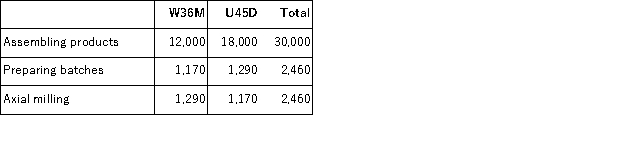

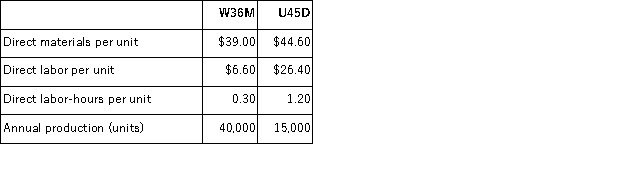

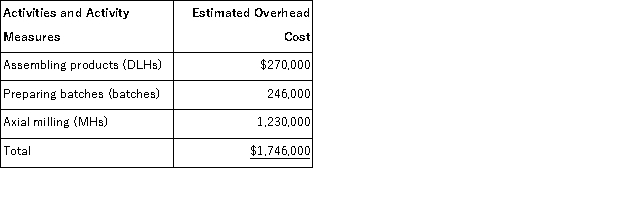

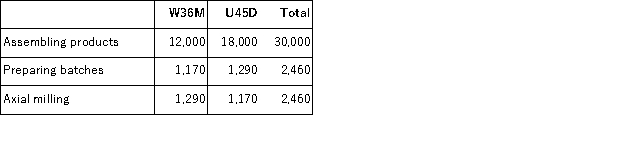

(Appendix 4A)Delaware Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs).The company has two products,W36M and U45D,about which it has provided the following data:  The company's estimated total manufacturing overhead for the year is $1,746,000 and the company's estimated total direct labor-hours for the year is 30,000.

The company's estimated total manufacturing overhead for the year is $1,746,000 and the company's estimated total direct labor-hours for the year is 30,000.

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

Required:

Required:

a.Determine the manufacturing overhead cost per unit of each of the company's two products under the traditional costing system.

b.Determine the manufacturing overhead cost per unit of each of the company's two products under activity-based costing system.

The company's estimated total manufacturing overhead for the year is $1,746,000 and the company's estimated total direct labor-hours for the year is 30,000.

The company's estimated total manufacturing overhead for the year is $1,746,000 and the company's estimated total direct labor-hours for the year is 30,000.The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

Required:

Required:a.Determine the manufacturing overhead cost per unit of each of the company's two products under the traditional costing system.

b.Determine the manufacturing overhead cost per unit of each of the company's two products under activity-based costing system.

a.Traditional Manufacturing Overhead Costs

Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base = $1,746,000 ÷ 30,000 DLHs = $58.20 per DLH b.ABC Manufacturing Overhead Costs

b.ABC Manufacturing Overhead Costs  Overhead cost for W36M

Overhead cost for W36M  Overhead cost for U45D

Overhead cost for U45D

Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base = $1,746,000 ÷ 30,000 DLHs = $58.20 per DLH

b.ABC Manufacturing Overhead Costs

b.ABC Manufacturing Overhead Costs  Overhead cost for W36M

Overhead cost for W36M  Overhead cost for U45D

Overhead cost for U45D

3

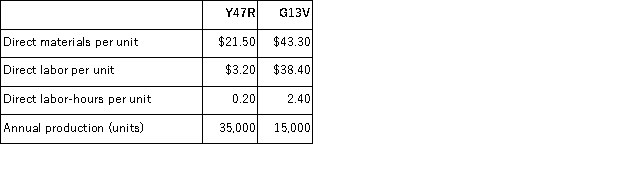

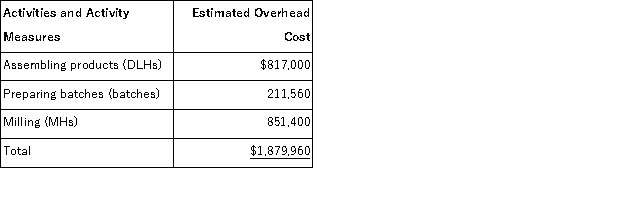

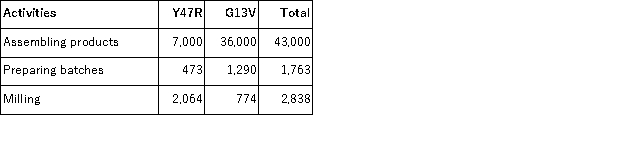

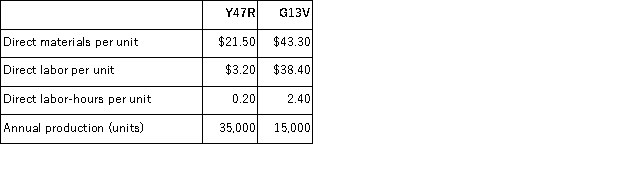

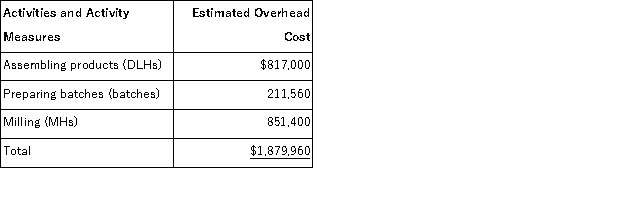

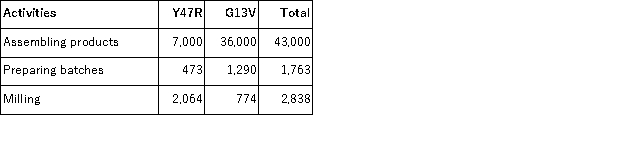

(Appendix 4A)Riha Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs).The company has two products,Y47R and G13V,about which it has provided the following data:  The company's estimated total manufacturing overhead for the year is $1,879,960 and the company's estimated total direct labor-hours for the year is 43,000.

The company's estimated total manufacturing overhead for the year is $1,879,960 and the company's estimated total direct labor-hours for the year is 43,000.

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

Required:

Required:

a.Determine the unit product cost of each of the company's two products under the traditional costing system.

b.Determine the unit product cost of each of the company's two products under activity-based costing system.

The company's estimated total manufacturing overhead for the year is $1,879,960 and the company's estimated total direct labor-hours for the year is 43,000.

The company's estimated total manufacturing overhead for the year is $1,879,960 and the company's estimated total direct labor-hours for the year is 43,000.The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

Required:

Required:a.Determine the unit product cost of each of the company's two products under the traditional costing system.

b.Determine the unit product cost of each of the company's two products under activity-based costing system.

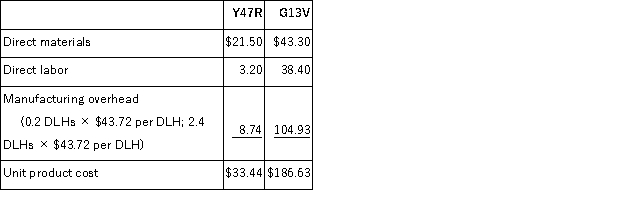

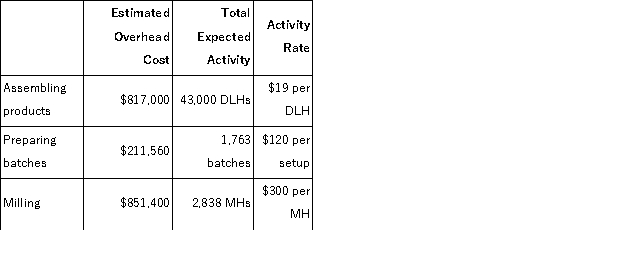

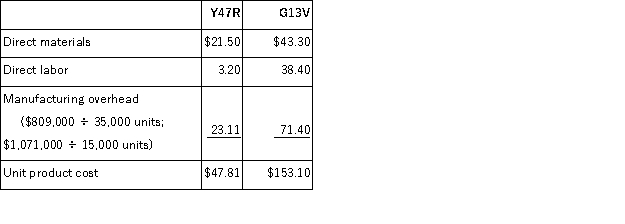

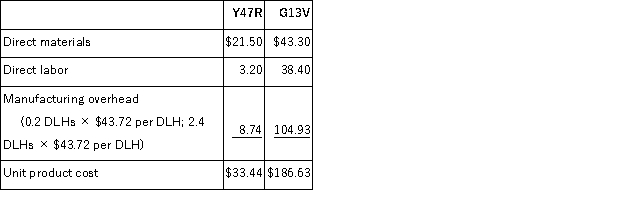

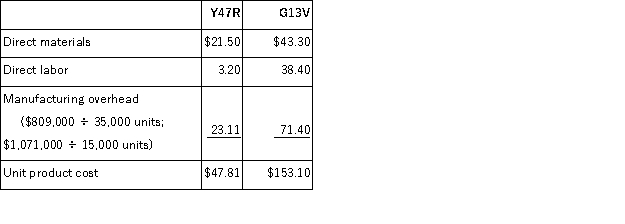

a.Traditional Unit Product Costs

Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base = $1,879,960 ÷ 43,000 DLHs = $43.72 per DLH b.ABC Unit Product Costs

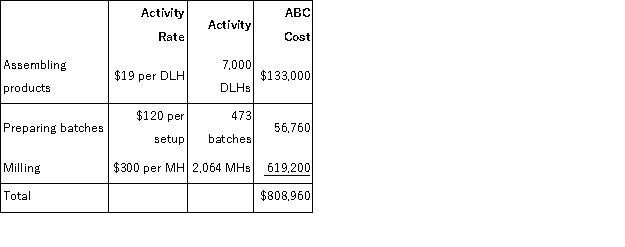

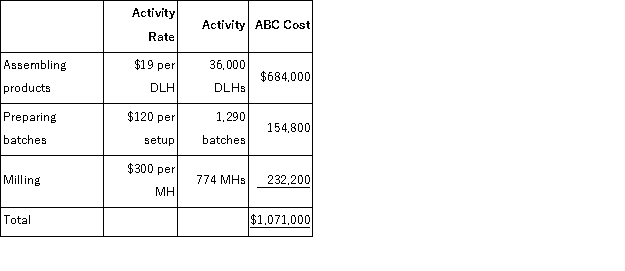

b.ABC Unit Product Costs  Overhead cost for Y47R

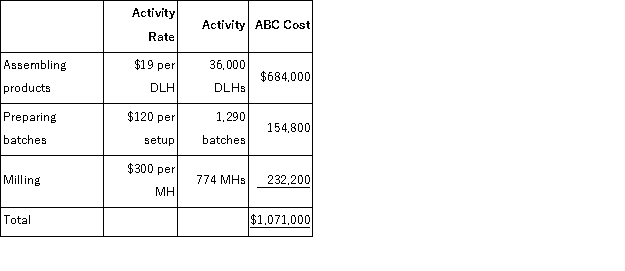

Overhead cost for Y47R  Overhead cost for G13V

Overhead cost for G13V

Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base = $1,879,960 ÷ 43,000 DLHs = $43.72 per DLH

b.ABC Unit Product Costs

b.ABC Unit Product Costs  Overhead cost for Y47R

Overhead cost for Y47R  Overhead cost for G13V

Overhead cost for G13V

4

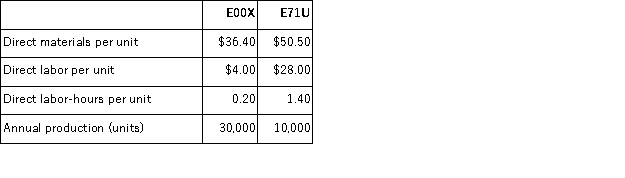

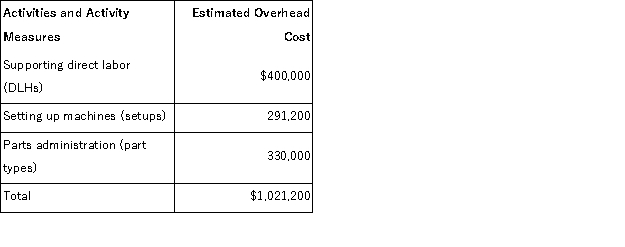

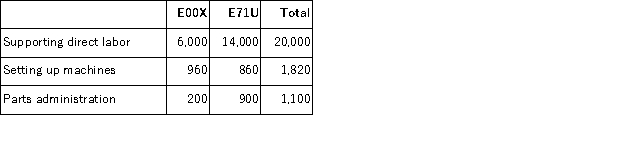

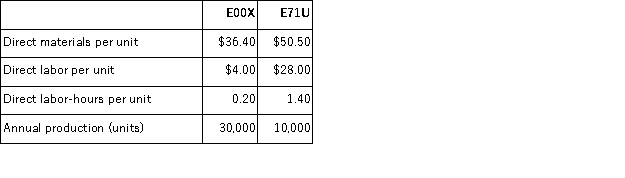

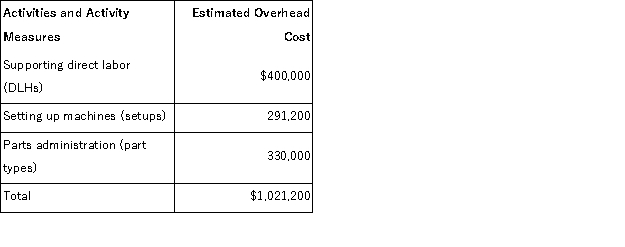

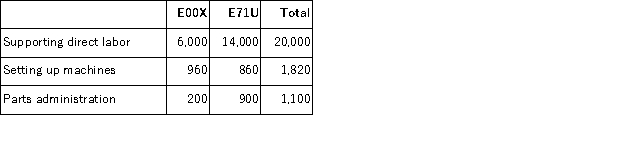

(Appendix 4A)Hoffhines Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs).The company has two products,E00X and E71U,about which it has provided the following data:  The company's estimated total manufacturing overhead for the year is $1,021,200 and the company's estimated total direct labor-hours for the year is 20,000.

The company's estimated total manufacturing overhead for the year is $1,021,200 and the company's estimated total direct labor-hours for the year is 20,000.

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

Required:

Required:

a.Determine the manufacturing overhead cost per unit of each of the company's two products under the traditional costing system.

b.Determine the manufacturing overhead cost per unit of each of the company's two products under activity-based costing system.

The company's estimated total manufacturing overhead for the year is $1,021,200 and the company's estimated total direct labor-hours for the year is 20,000.

The company's estimated total manufacturing overhead for the year is $1,021,200 and the company's estimated total direct labor-hours for the year is 20,000.The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

Required:

Required:a.Determine the manufacturing overhead cost per unit of each of the company's two products under the traditional costing system.

b.Determine the manufacturing overhead cost per unit of each of the company's two products under activity-based costing system.

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

5

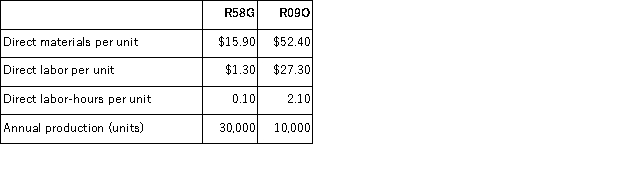

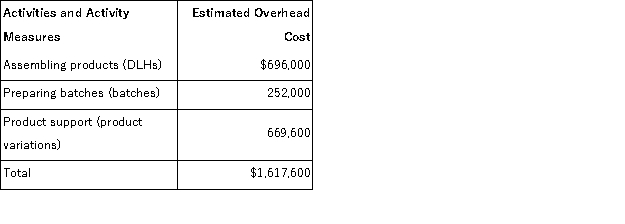

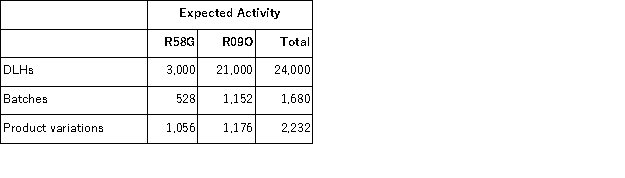

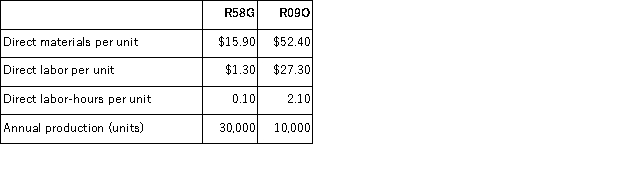

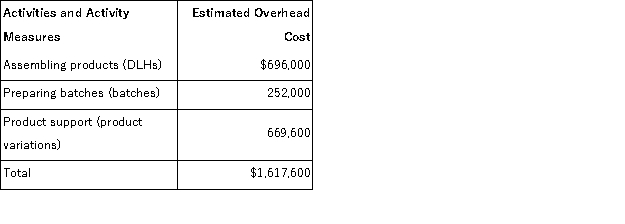

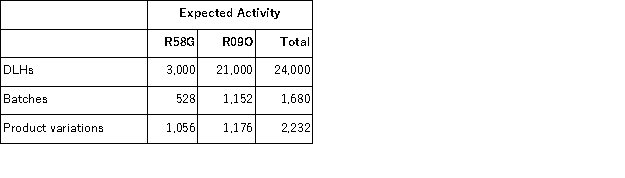

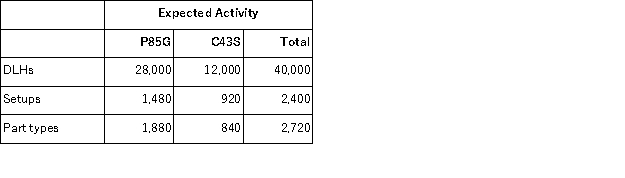

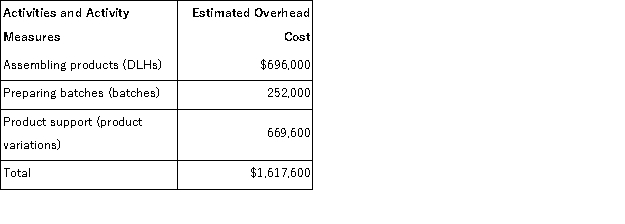

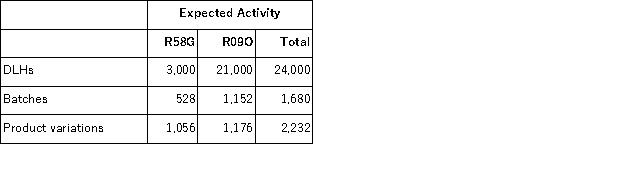

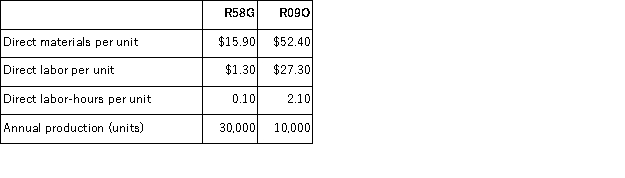

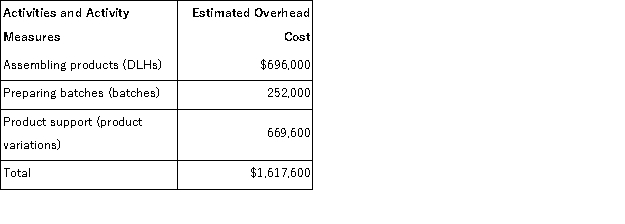

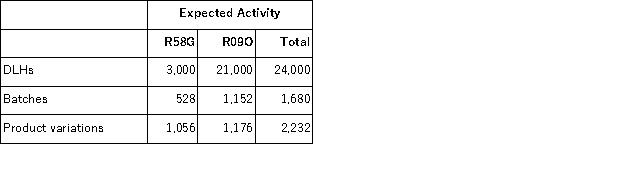

(Appendix 4A)Binegar Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs).The company has two products,R58G and R09O,about which it has provided the following data:  The company's estimated total manufacturing overhead for the year is $1,617,600 and the company's estimated total direct labor-hours for the year is 24,000. The company is considering using a form of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

The company's estimated total manufacturing overhead for the year is $1,617,600 and the company's estimated total direct labor-hours for the year is 24,000. The company is considering using a form of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

The manufacturing overhead that would be applied to a unit of product R09O under the activity-based costing system is closest to:

The manufacturing overhead that would be applied to a unit of product R09O under the activity-based costing system is closest to:

A)$113.46

B)$255.00

C)$141.54

D)$17.28

The company's estimated total manufacturing overhead for the year is $1,617,600 and the company's estimated total direct labor-hours for the year is 24,000. The company is considering using a form of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

The company's estimated total manufacturing overhead for the year is $1,617,600 and the company's estimated total direct labor-hours for the year is 24,000. The company is considering using a form of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

The manufacturing overhead that would be applied to a unit of product R09O under the activity-based costing system is closest to:

The manufacturing overhead that would be applied to a unit of product R09O under the activity-based costing system is closest to:A)$113.46

B)$255.00

C)$141.54

D)$17.28

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

6

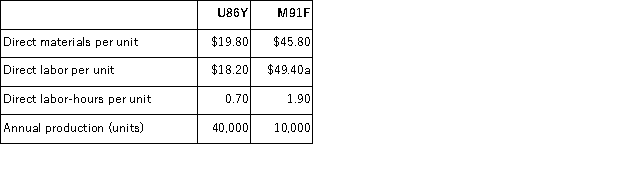

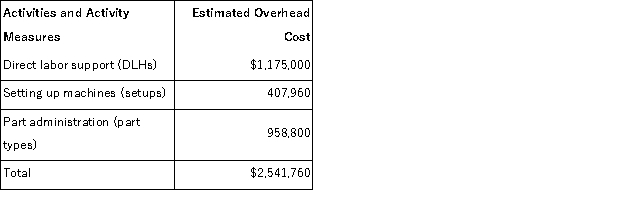

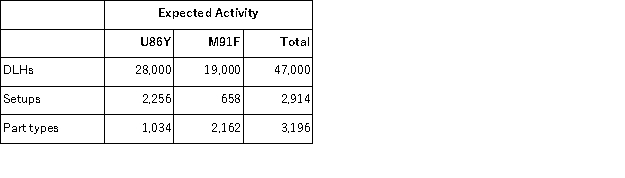

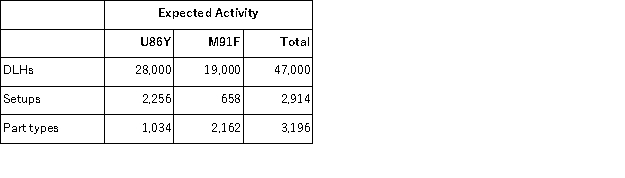

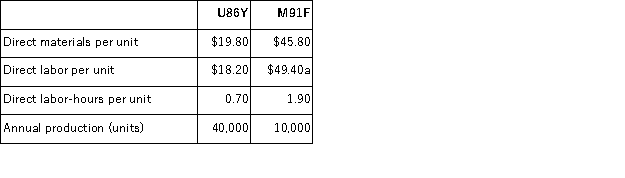

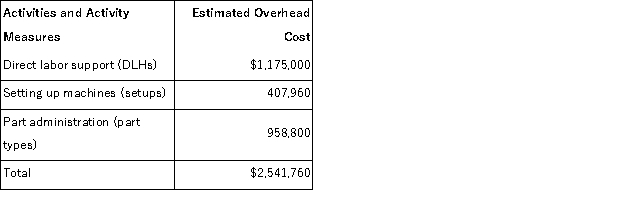

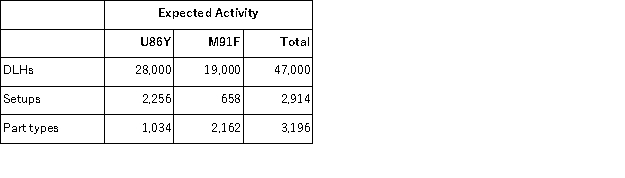

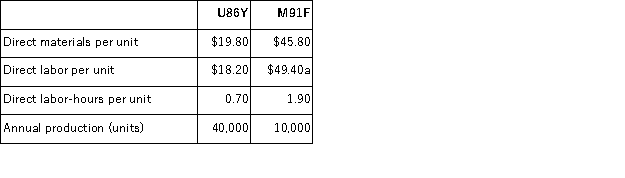

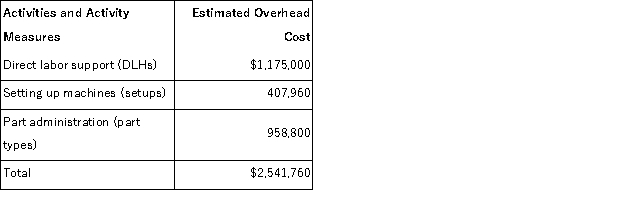

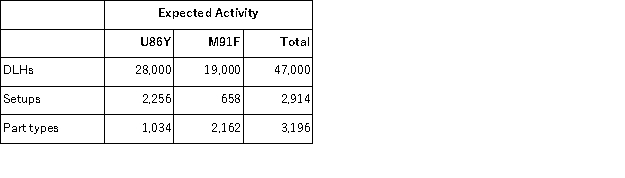

(Appendix 4A)Kebort Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs).The company has two products,U86Y and M91F,about which it has provided the following data:  The company's estimated total manufacturing overhead for the year is $2,541,760 and the company's estimated total direct labor-hours for the year is 47,000. The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

The company's estimated total manufacturing overhead for the year is $2,541,760 and the company's estimated total direct labor-hours for the year is 47,000. The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

The unit product cost of product M91F under the activity-based costing system is closest to:

The unit product cost of product M91F under the activity-based costing system is closest to:

A)$95.20

B)$121.57

C)$216.77

D)$197.95

The company's estimated total manufacturing overhead for the year is $2,541,760 and the company's estimated total direct labor-hours for the year is 47,000. The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

The company's estimated total manufacturing overhead for the year is $2,541,760 and the company's estimated total direct labor-hours for the year is 47,000. The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

The unit product cost of product M91F under the activity-based costing system is closest to:

The unit product cost of product M91F under the activity-based costing system is closest to:A)$95.20

B)$121.57

C)$216.77

D)$197.95

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

7

(Appendix 4A)Pacchiana Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs).The company has two products,R21V and D00B,about which it has provided the following data:  The company's estimated total manufacturing overhead for the year is $1,262,880 and the company's estimated total direct labor-hours for the year is 36,000. The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

The company's estimated total manufacturing overhead for the year is $1,262,880 and the company's estimated total direct labor-hours for the year is 36,000. The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

The unit product cost of product R21V under the company's traditional costing system is closest to:

The unit product cost of product R21V under the company's traditional costing system is closest to:

A)$34.02

B)$24.40

C)$41.36

D)$23.50

The company's estimated total manufacturing overhead for the year is $1,262,880 and the company's estimated total direct labor-hours for the year is 36,000. The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

The company's estimated total manufacturing overhead for the year is $1,262,880 and the company's estimated total direct labor-hours for the year is 36,000. The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

The unit product cost of product R21V under the company's traditional costing system is closest to:

The unit product cost of product R21V under the company's traditional costing system is closest to:A)$34.02

B)$24.40

C)$41.36

D)$23.50

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

8

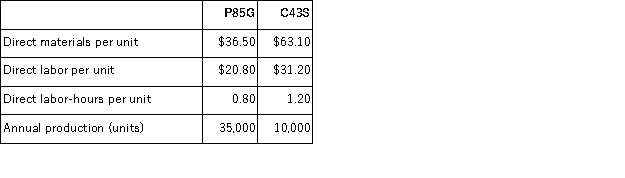

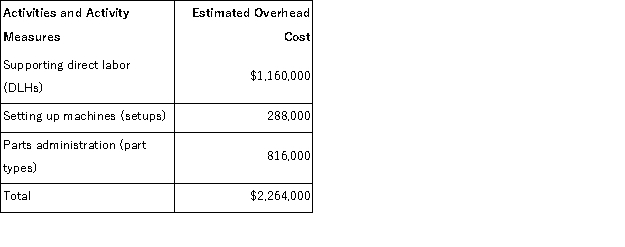

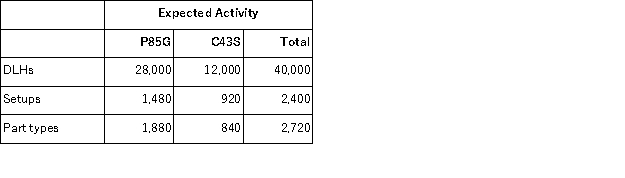

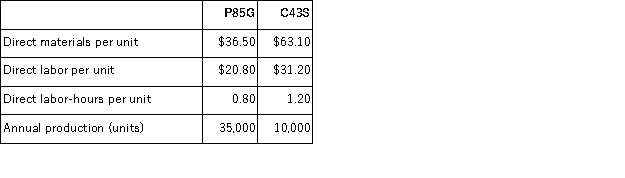

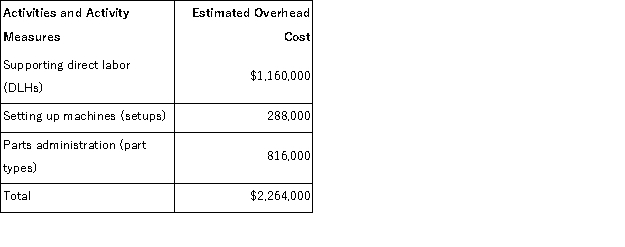

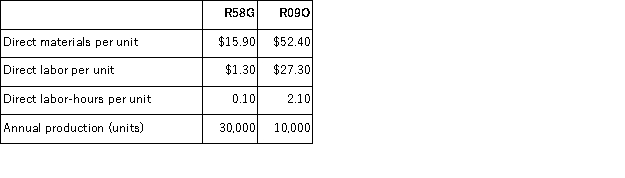

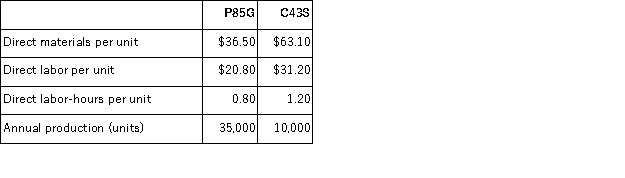

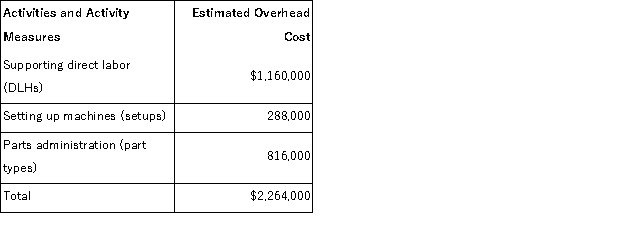

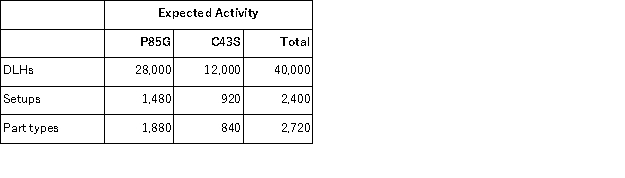

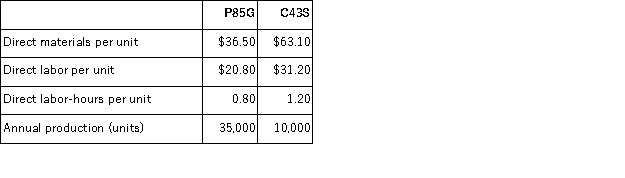

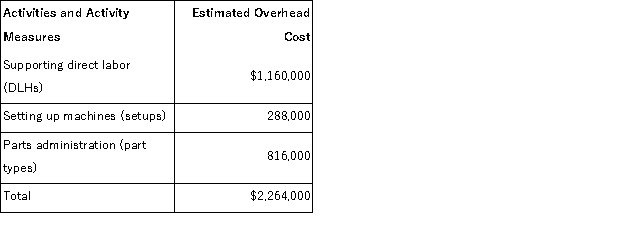

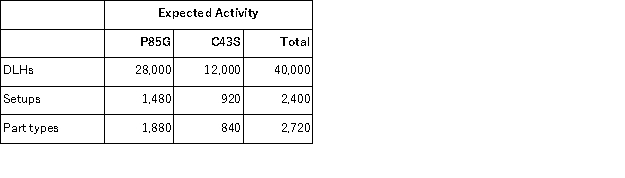

(Appendix 4A)Koszyk Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs).The company has two products,P85G and C43S,about which it has provided the following data:  The company's estimated total manufacturing overhead for the year is $2,264,000 and the company's estimated total direct labor-hours for the year is 40,000. The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

The company's estimated total manufacturing overhead for the year is $2,264,000 and the company's estimated total direct labor-hours for the year is 40,000. The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

The manufacturing overhead that would be applied to a unit of product P85G under the company's traditional costing system is closest to:

The manufacturing overhead that would be applied to a unit of product P85G under the company's traditional costing system is closest to:

A)$89.67

B)$45.28

C)$44.39

D)$23.20

The company's estimated total manufacturing overhead for the year is $2,264,000 and the company's estimated total direct labor-hours for the year is 40,000. The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

The company's estimated total manufacturing overhead for the year is $2,264,000 and the company's estimated total direct labor-hours for the year is 40,000. The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

The manufacturing overhead that would be applied to a unit of product P85G under the company's traditional costing system is closest to:

The manufacturing overhead that would be applied to a unit of product P85G under the company's traditional costing system is closest to:A)$89.67

B)$45.28

C)$44.39

D)$23.20

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

9

(Appendix 4A)Binegar Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs).The company has two products,R58G and R09O,about which it has provided the following data:  The company's estimated total manufacturing overhead for the year is $1,617,600 and the company's estimated total direct labor-hours for the year is 24,000. The company is considering using a form of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

The company's estimated total manufacturing overhead for the year is $1,617,600 and the company's estimated total direct labor-hours for the year is 24,000. The company is considering using a form of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

The manufacturing overhead that would be applied to a unit of product R58G under the company's traditional costing system is closest to:

The manufacturing overhead that would be applied to a unit of product R58G under the company's traditional costing system is closest to:

A)$6.74

B)$16.10

C)$22.84

D)$2.90

The company's estimated total manufacturing overhead for the year is $1,617,600 and the company's estimated total direct labor-hours for the year is 24,000. The company is considering using a form of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

The company's estimated total manufacturing overhead for the year is $1,617,600 and the company's estimated total direct labor-hours for the year is 24,000. The company is considering using a form of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

The manufacturing overhead that would be applied to a unit of product R58G under the company's traditional costing system is closest to:

The manufacturing overhead that would be applied to a unit of product R58G under the company's traditional costing system is closest to:A)$6.74

B)$16.10

C)$22.84

D)$2.90

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

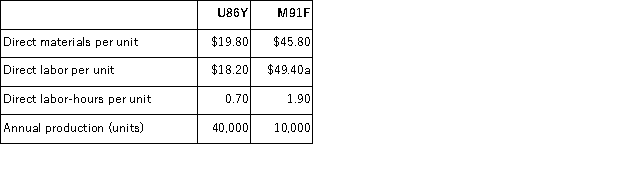

10

(Appendix 4A)Kebort Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs).The company has two products,U86Y and M91F,about which it has provided the following data:  The company's estimated total manufacturing overhead for the year is $2,541,760 and the company's estimated total direct labor-hours for the year is 47,000. The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

The company's estimated total manufacturing overhead for the year is $2,541,760 and the company's estimated total direct labor-hours for the year is 47,000. The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

The unit product cost of product U86Y under the company's traditional costing system is closest to:

The unit product cost of product U86Y under the company's traditional costing system is closest to:

A)$71.15

B)$55.50

C)$75.86

D)$38.00

The company's estimated total manufacturing overhead for the year is $2,541,760 and the company's estimated total direct labor-hours for the year is 47,000. The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

The company's estimated total manufacturing overhead for the year is $2,541,760 and the company's estimated total direct labor-hours for the year is 47,000. The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

The unit product cost of product U86Y under the company's traditional costing system is closest to:

The unit product cost of product U86Y under the company's traditional costing system is closest to:A)$71.15

B)$55.50

C)$75.86

D)$38.00

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

11

(Appendix 4A)Koszyk Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs).The company has two products,P85G and C43S,about which it has provided the following data:  The company's estimated total manufacturing overhead for the year is $2,264,000 and the company's estimated total direct labor-hours for the year is 40,000. The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

The company's estimated total manufacturing overhead for the year is $2,264,000 and the company's estimated total direct labor-hours for the year is 40,000. The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

The manufacturing overhead that would be applied to a unit of product C43S under the activity-based costing system is closest to:

The manufacturing overhead that would be applied to a unit of product C43S under the activity-based costing system is closest to:

A)$71.04

B)$138.96

C)$67.92

D)$11.04

The company's estimated total manufacturing overhead for the year is $2,264,000 and the company's estimated total direct labor-hours for the year is 40,000. The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

The company's estimated total manufacturing overhead for the year is $2,264,000 and the company's estimated total direct labor-hours for the year is 40,000. The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

The manufacturing overhead that would be applied to a unit of product C43S under the activity-based costing system is closest to:

The manufacturing overhead that would be applied to a unit of product C43S under the activity-based costing system is closest to:A)$71.04

B)$138.96

C)$67.92

D)$11.04

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

12

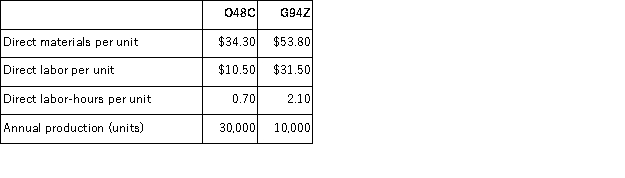

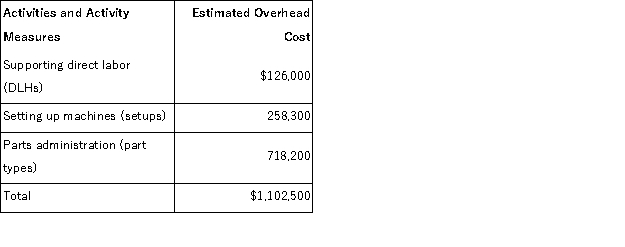

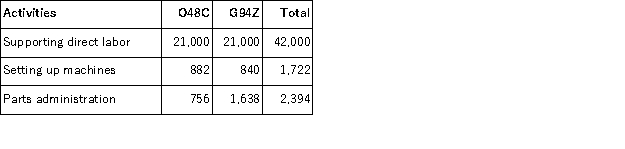

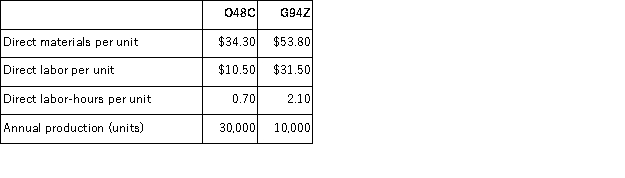

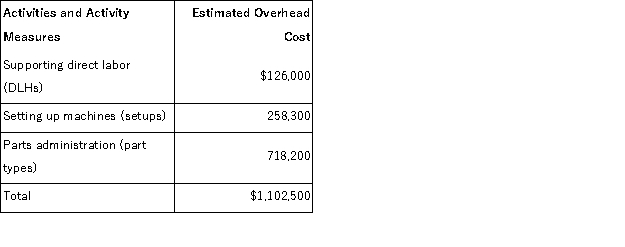

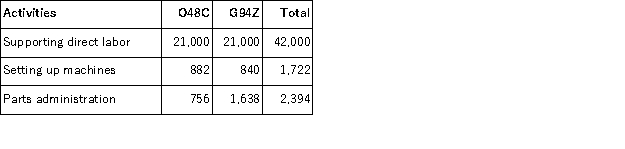

(Appendix 4A)Guinta Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs).The company has two products,O48C and G94Z,about which it has provided the following data:  The company's estimated total manufacturing overhead for the year is $1,102,500 and the company's estimated total direct labor-hours for the year is 42,000.

The company's estimated total manufacturing overhead for the year is $1,102,500 and the company's estimated total direct labor-hours for the year is 42,000.

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

Required:

Required:

a.Determine the unit product cost of each of the company's two products under the traditional costing system.

b.Determine the unit product cost of each of the company's two products under activity-based costing system.

The company's estimated total manufacturing overhead for the year is $1,102,500 and the company's estimated total direct labor-hours for the year is 42,000.

The company's estimated total manufacturing overhead for the year is $1,102,500 and the company's estimated total direct labor-hours for the year is 42,000.The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

Required:

Required:a.Determine the unit product cost of each of the company's two products under the traditional costing system.

b.Determine the unit product cost of each of the company's two products under activity-based costing system.

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck