Deck 18: Shareholders Equity Key

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

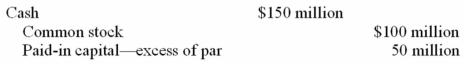

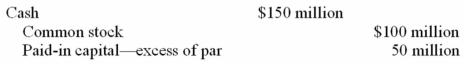

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/213

Play

Full screen (f)

Deck 18: Shareholders Equity Key

1

In terms of business volume, the dominant form of business organization is the:

A)Partnership.

B)Corporation.

C)Limited liability company.

D)Proprietorship.

A)Partnership.

B)Corporation.

C)Limited liability company.

D)Proprietorship.

B

2

Paid-in capital must consist solely of amounts invested by shareholders.

False

3

Under GAAP, the declaration of a property dividend may require the recognition of a gain or loss if the fair value of the property is different from its carrying value on the declaration date.

True

4

Two of the three primary account classifications within shareholders' equity are:

A)Preferred stock and retained earnings.

B)The par value of common stock and retained earnings.

C)Paid-in capital and retained earnings.

D)Preferred and common stock.

A)Preferred stock and retained earnings.

B)The par value of common stock and retained earnings.

C)Paid-in capital and retained earnings.

D)Preferred and common stock.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

5

Outstanding common stock is:

A)Stock that is performing well on the New York Stock Exchange.

B)Stock that has been authorized by the state for issue.

C)Stock held in the corporate treasury.

D)Stock in the hands of shareholders.

A)Stock that is performing well on the New York Stock Exchange.

B)Stock that has been authorized by the state for issue.

C)Stock held in the corporate treasury.

D)Stock in the hands of shareholders.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

6

Investors should be wary of stock buybacks during down times because the resulting decrease in shares and increase in earnings per share can be used to mask a slowdown in earnings growth.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

7

The corporate charter sometimes is known as (a):

A)Articles of incorporation.

B)Statement of organization.

C)By-laws.

D)Registration statement.

A)Articles of incorporation.

B)Statement of organization.

C)By-laws.

D)Registration statement.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

8

Noncash assets received as consideration for the issue of stock are always valued based on the fair value of the stock.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

9

The net assets of a corporation are equal to:

A)Contributed capital.

B)Retained earnings.

C)Shareholders' equity.

D)None of the above.

A)Contributed capital.

B)Retained earnings.

C)Shareholders' equity.

D)None of the above.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

10

Stock dividends cause a reduction in retained earnings, but they never reduce total shareholders' equity.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

11

Stock designated as preferred usually has preferential rights over other classes of stock relative to dividends and liquidating distributions.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

12

Treasury stock transactions never increase retained earnings or net income.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

13

Corporations are formed in accordance with:

A)The Model Business Corporation Act.

B)Federal statutes.

C)The laws of individual states.

D)Federal trade commission regulations.

A)The Model Business Corporation Act.

B)Federal statutes.

C)The laws of individual states.

D)Federal trade commission regulations.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

14

Issued stock refers to the number of shares:

A)Outstanding plus treasury shares.

B)Shares issued for cash.

C)In the hands of shareholders.

D)That may be issued under state law.

A)Outstanding plus treasury shares.

B)Shares issued for cash.

C)In the hands of shareholders.

D)That may be issued under state law.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

15

The Model Business Corporation Act:

A)Uses the words "common" and "preferred" in describing distinguishing characteristics of stock.

B)Defines legal capital as the amount of net assets not available for distribution to shareholders.

C)Provides guidance for choosing an appropriate par value for new issues of stock.

D)Has affected the laws of most states.

A)Uses the words "common" and "preferred" in describing distinguishing characteristics of stock.

B)Defines legal capital as the amount of net assets not available for distribution to shareholders.

C)Provides guidance for choosing an appropriate par value for new issues of stock.

D)Has affected the laws of most states.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

16

Dividends in arrears on cumulative preferred stock are liabilities to be paid at a later date.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

17

Mandatorily redeemable preferred stock is reported as a liability.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

18

Details of each class of stock must be reported:

A)On the face of the balance sheet only.

B)In disclosure notes only.

C)On the face of the balance sheet or in disclosure notes.

D)On the face of the balance sheet and in disclosure notes.

A)On the face of the balance sheet only.

B)In disclosure notes only.

C)On the face of the balance sheet or in disclosure notes.

D)On the face of the balance sheet and in disclosure notes.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

19

Cash dividends become a binding liability as of the record date.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

20

Restrictions on retained earnings must be disclosed in the body of the balance sheet.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

21

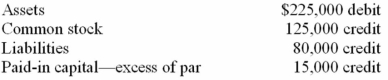

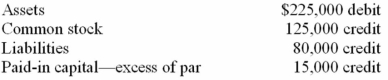

The changes in account balances for Allen Inc. for 2013 are as follows:  Assuming the only changes in retained earnings in 2013 were for net income and a $25,000 dividend, what was net income for 2013?

Assuming the only changes in retained earnings in 2013 were for net income and a $25,000 dividend, what was net income for 2013?

A)$30,000.

B)$20,000.

C)$15,000.

D)$5,000.

Assuming the only changes in retained earnings in 2013 were for net income and a $25,000 dividend, what was net income for 2013?

Assuming the only changes in retained earnings in 2013 were for net income and a $25,000 dividend, what was net income for 2013?A)$30,000.

B)$20,000.

C)$15,000.

D)$5,000.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

22

What was the amount of net income earned by Levi during 2013?

A)$0.

B)$40 million.

C)$62 million.

D)Cannot be determined from the given information.

A)$0.

B)$40 million.

C)$62 million.

D)Cannot be determined from the given information.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

23

What ($ in 000s) was shareholders' equity as of December 31, 2013?

A)$29,600.

B)$35,600.

C)$30,400.

D)$28,600.

A)$29,600.

B)$35,600.

C)$30,400.

D)$28,600.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

24

The 2014 sale of half of the treasury stock would:

A)Reduce income before tax by $60,000.

B)Reduce retained earnings by $60,000.

C)Increase total shareholders' equity by $300,000.

D)Decrease retained earnings by $40,000.

A)Reduce income before tax by $60,000.

B)Reduce retained earnings by $60,000.

C)Increase total shareholders' equity by $300,000.

D)Decrease retained earnings by $40,000.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

25

A statement of comprehensive income does not include:

A)Gains resulting from the return on assets exceeding expectations.

B)Gains and losses on unsold held-to-maturity securities.

C)Losses resulting from the return on pension assets falling short of expectations.

D)Prior service cost.

A)Gains resulting from the return on assets exceeding expectations.

B)Gains and losses on unsold held-to-maturity securities.

C)Losses resulting from the return on pension assets falling short of expectations.

D)Prior service cost.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

26

The common stock account in a company's balance sheet is measured as:

A)The number of common shares outstanding multiplied by the stock's par value per share.

B)The number of common shares outstanding multiplied by the stock's current market value per share.

C)The number of common shares issued multiplied by the stock's par value per share.

D)None of the above is correct.

A)The number of common shares outstanding multiplied by the stock's par value per share.

B)The number of common shares outstanding multiplied by the stock's current market value per share.

C)The number of common shares issued multiplied by the stock's par value per share.

D)None of the above is correct.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

27

Roberto Corporation was organized on January 1, 2013. The firm was authorized to issue 100,000 shares of $5 par common stock. During 2013, Roberto had the following transactions relating to shareholders' equity: Issued 10,000 shares of common stock at $7 per share.

Issued 20,000 shares of common stock at $8 per share.

Reported a net income of $100,000.

Paid dividends of $50,000.

Purchased 3,000 shares of treasury stock at $10 (part of the 20,000 shares issued at $8).

What is total shareholders' equity at the end of 2013?

A)$270,000.

B)$300,000.

C)$250,000.

D)$200,000.

Issued 20,000 shares of common stock at $8 per share.

Reported a net income of $100,000.

Paid dividends of $50,000.

Purchased 3,000 shares of treasury stock at $10 (part of the 20,000 shares issued at $8).

What is total shareholders' equity at the end of 2013?

A)$270,000.

B)$300,000.

C)$250,000.

D)$200,000.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

28

Accumulated other comprehensive income:

A)is a liability.

B)might include prior service cost from pension plan amendments.

C)includes accumulated pension expense.

D)is reported in the income statement.

A)is a liability.

B)might include prior service cost from pension plan amendments.

C)includes accumulated pension expense.

D)is reported in the income statement.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

29

Heidi Aurora Imports issued shares of the company's Class B stock. Heidi Aurora Imports should report the stock in the company's statement of financial position:

A)Among liabilities if the shares are mandatorily redeemable or redeemable at the option of the shareholder.

B)As equity unless the shares are mandatorily redeemable.

C)As equity unless the shares are redeemable at the option of the issuer.

D)Among liabilities unless the shares are mandatorily redeemable.

A)Among liabilities if the shares are mandatorily redeemable or redeemable at the option of the shareholder.

B)As equity unless the shares are mandatorily redeemable.

C)As equity unless the shares are redeemable at the option of the issuer.

D)Among liabilities unless the shares are mandatorily redeemable.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

30

A statement of comprehensive income does not include:

A)Net income.

B)Losses resulting from the return on pension assets exceeding expectations.

C)Losses from changes in estimates regarding the PBO.

D)Prior service cost.

A)Net income.

B)Losses resulting from the return on pension assets exceeding expectations.

C)Losses from changes in estimates regarding the PBO.

D)Prior service cost.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

31

What was the average price (rounded to the nearest dollar) of the additional shares issued by Levi in 2013?

A)$5 per share.

B)$26 per share.

C)$39 per share.

D)Cannot be determined from the given information.

A)$5 per share.

B)$26 per share.

C)$39 per share.

D)Cannot be determined from the given information.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

32

Characteristics of the corporate form that have led to the growth of this form of business ownership include all of the following except:

A)Ease of raising capital.

B)Low government regulation.

C)Limited liability.

D)Ease of ownership transfer.

A)Ease of raising capital.

B)Low government regulation.

C)Limited liability.

D)Ease of ownership transfer.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

33

When preferred stock carries a redemption privilege, the shareholders may:

A)Purchase new shares as they become available.

B)Exchange their preferred shares for common shares.

C)Surrender the preferred shares for a specified amount of cash.

D)Purchase treasury shares ahead of common shareholders.

A)Purchase new shares as they become available.

B)Exchange their preferred shares for common shares.

C)Surrender the preferred shares for a specified amount of cash.

D)Purchase treasury shares ahead of common shareholders.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

34

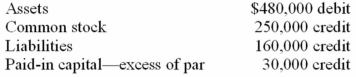

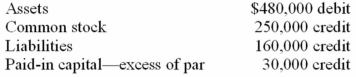

The changes in account balances for Elder Company for 2013 are as follows:  Assuming the only changes in retained earnings in 2013 were for net income and a $50,000 dividend, what was net income for 2013?

Assuming the only changes in retained earnings in 2013 were for net income and a $50,000 dividend, what was net income for 2013?

A)$40,000.

B)$60,000.

C)$70,000.

D)$90,000.

Assuming the only changes in retained earnings in 2013 were for net income and a $50,000 dividend, what was net income for 2013?

Assuming the only changes in retained earnings in 2013 were for net income and a $50,000 dividend, what was net income for 2013?A)$40,000.

B)$60,000.

C)$70,000.

D)$90,000.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

35

What would shareholders' equity be as of December 31, 2014?

A)Amount is not shown.

B)$5,760,000.

C)$5,820,000.

D)$6,760,000.

A)Amount is not shown.

B)$5,760,000.

C)$5,820,000.

D)$6,760,000.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

36

What ($ in 000s) was shareholders' equity as of December 31, 2014?

A)$38,100.

B)$37,450.

C)$38,450.

D)$38,350.

A)$38,100.

B)$37,450.

C)$38,450.

D)$38,350.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

37

What was shareholders' equity as of December 31, 2013?

A)$7,020,000.

B)$6,440,000.

C)$6,420,000.

D)$6,400,000.

A)$7,020,000.

B)$6,440,000.

C)$6,420,000.

D)$6,400,000.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

38

How many of Levi's common shares were outstanding on 12/31/2012?

A)14 million.

B)9 million.

C)5 million.

D)None of the above is correct.

A)14 million.

B)9 million.

C)5 million.

D)None of the above is correct.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

39

What was the average price of the additional treasury shares purchased by Levi during 2013?

A)$11 per share.

B)$12 per share.

C)$12.50 per share.

D)None of the above is correct.

A)$11 per share.

B)$12 per share.

C)$12.50 per share.

D)None of the above is correct.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

40

Accumulated other comprehensive income is reported:

A)In the balance sheet as an asset.

B)In the balance sheet as a liability.

C)In the balance sheet as a component of shareholders' equity.

D)In the statement of comprehensive income.

A)In the balance sheet as an asset.

B)In the balance sheet as a liability.

C)In the balance sheet as a component of shareholders' equity.

D)In the statement of comprehensive income.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

41

The par value of common stock represents:

A)The arbitrary dollar amount assigned to a share of stock.

B)The liquidation value of a share.

C)The book value of a share of stock.

D)The amount received when the stock was issued.

A)The arbitrary dollar amount assigned to a share of stock.

B)The liquidation value of a share.

C)The book value of a share of stock.

D)The amount received when the stock was issued.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

42

Share issue costs refer to the costs of obtaining the legal, promotional, and accounting services necessary to effect the sale of shares. The costs reduce the net cash proceeds from selling the shares and thus paid-in capital-excess of par, and are:

A)Not recorded separately.

B)Recorded as an asset.

C)Recorded as a liability.

D)Amortized over time.

A)Not recorded separately.

B)Recorded as an asset.

C)Recorded as a liability.

D)Amortized over time.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

43

In February 2013, Despot declared cash dividends of $12 million to be paid in April of that year. What effect did the April transaction have on Despot's accounts?

A)Decreased assets and liabilities.

B)Decreased assets and shareholders' equity.

C)Increased liabilities and decreased shareholders' equity.

D)None of the above is correct.

A)Decreased assets and liabilities.

B)Decreased assets and shareholders' equity.

C)Increased liabilities and decreased shareholders' equity.

D)None of the above is correct.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

44

Paid-in capital in excess of par is reported:

A)As a reduction of shareholders' equity.

B)As a noncurrent asset.

C)As a noncurrent liability.

D)As an increase in shareholders' equity.

A)As a reduction of shareholders' equity.

B)As a noncurrent asset.

C)As a noncurrent liability.

D)As an increase in shareholders' equity.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

45

The shareholders' equity of Green Corporation includes $200,000 of $1 par common stock and $400,000 par value of 6% cumulative preferred stock. The board of directors of Green declared cash dividends of $50,000 in 2013 after paying $20,000 cash dividends in each of 2012 and 2011. What is the amount of dividends common shareholders will receive in 2013?

A)$18,000.

B)$26,000.

C)$28,000.

D)$32,000.

A)$18,000.

B)$26,000.

C)$28,000.

D)$32,000.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

46

When stock is issued in exchange for property, the best evidence of fair value might be any of the following except:

A)The appraised value of the property received.

B)The selling price of the stock in a recent transaction.

C)The price of the stock quoted on the stock exchange.

D)The average book value of outstanding stock.

A)The appraised value of the property received.

B)The selling price of the stock in a recent transaction.

C)The price of the stock quoted on the stock exchange.

D)The average book value of outstanding stock.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following transactions decreases retained earnings?

A)A property dividend.

B)A stock dividend.

C)A cash dividend.

D)All of the above are correct.

A)A property dividend.

B)A stock dividend.

C)A cash dividend.

D)All of the above are correct.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

48

The preemptive right refers to the shareholder's right to:

A)Maintain a proportional ownership interest in the corporation.

B)Vote for members of the board of directors.

C)Receive a share of dividends.

D)Share in profits proportionally with all other stockholders.

A)Maintain a proportional ownership interest in the corporation.

B)Vote for members of the board of directors.

C)Receive a share of dividends.

D)Share in profits proportionally with all other stockholders.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

49

The owners of a corporation are its shareholders. If a corporation has only one class of shares, they typically are labeled common shares. Each of the following are ownership rights held by common shareholders, unless specifically withheld by agreement, except:

A)The right to vote on policy issues.

B)The right to share in profits when dividends are declared (in proportion to the percentage of shares owned by the shareholder).

C)The right to dividends equal to a stated rate time par value (if dividends are paid).

D)The right to share in the distribution of any assets remaining at liquidation after other claims are satisfied.

A)The right to vote on policy issues.

B)The right to share in profits when dividends are declared (in proportion to the percentage of shares owned by the shareholder).

C)The right to dividends equal to a stated rate time par value (if dividends are paid).

D)The right to share in the distribution of any assets remaining at liquidation after other claims are satisfied.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

50

Rick Co. had 30 million shares of $1 par common stock outstanding at January 1, 2013. In October 2013, Rick Co.'s Board of Directors declared and distributed a 1% common stock dividend when the market value of its common stock was $60 per share. In recording this transaction, Rick would:

A)Debit retained earnings for $18 million.

B)Credit paid-in capital-excess of par for $18 million.

C)Credit common stock for $18 million.

D)None of the above is correct.

A)Debit retained earnings for $18 million.

B)Credit paid-in capital-excess of par for $18 million.

C)Credit common stock for $18 million.

D)None of the above is correct.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

51

When more than one security is sold for a single price and the total selling price is not equal to the sum of the market prices, the cash received is allocated between the securities based on:

A)Relative book values.

B)Par values.

C)Relative market values.

D)The earnings per share.

A)Relative book values.

B)Par values.

C)Relative market values.

D)The earnings per share.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

52

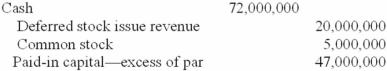

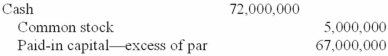

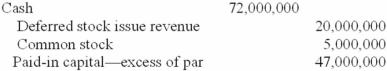

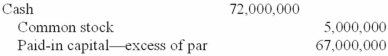

Olsson Corporation received a check from its underwriters for $72 million. This was for the issue of one million of its $5 par stock that the underwriters expect to sell for $72 per share. Which is the correct entry to record the issue of the stock?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

53

The shareholders' equity of Red Corporation includes $200,000 of $1 par common stock and $400,000 par value of 6% cumulative preferred stock. The board of directors of Red declared cash dividends of $50,000 in 2013 after paying $20,000 cash dividends in 2012 and $40,000 in 2011. What is the amount of dividends common shareholders will receive in 2013?

A)$18,000.

B)$22,000.

C)$26,000.

D)$28,000.

A)$18,000.

B)$22,000.

C)$26,000.

D)$28,000.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

54

When stock traded on an active exchange is issued for a machine:

A)No entry is recorded until restrictions are lifted.

B)An asset is recorded for the fair value of the stock.

C)An asset is recorded for the appraised value of the machine.

D)Paid-in capital is increased by the appraised value of the machine.

A)No entry is recorded until restrictions are lifted.

B)An asset is recorded for the fair value of the stock.

C)An asset is recorded for the appraised value of the machine.

D)Paid-in capital is increased by the appraised value of the machine.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

55

Despot declared a property dividend to give marketable securities to its common stockholders. The securities had cost Despot $7 million and currently have a fair value of $16 million. Which of the following would be included in recording the property dividend declaration?

A)Increase in a liability for $16 million.

B)Decrease in retained earnings for $7 million.

C)Decrease in marketable securities by $16 million.

D)All of the above are correct.

A)Increase in a liability for $16 million.

B)Decrease in retained earnings for $7 million.

C)Decrease in marketable securities by $16 million.

D)All of the above are correct.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

56

Poodle Corporation was organized on January 3, 2013. The firm was authorized to issue 100,000 shares of $5 par common stock. During 2013, Poodle had the following transactions relating to shareholders' equity: Issued 30,000 shares of common stock at $7 per share.

Issued 20,000 shares of common stock at $8 per share.

Reported a net income of $100,000.

Paid dividends of $50,000.

What is total paid-in capital at the end of 2013?

A)$420,000.

B)$370,000.

C)$470,000.

D)$320,000.

Issued 20,000 shares of common stock at $8 per share.

Reported a net income of $100,000.

Paid dividends of $50,000.

What is total paid-in capital at the end of 2013?

A)$420,000.

B)$370,000.

C)$470,000.

D)$320,000.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

57

In January 2013, Despot recorded a transaction with this journal entry:  The transaction was for the:

The transaction was for the:

A)Issue of 2 million shares of common stock at par value.

B)Issue of common stock for $150 million in cash.

C)Receipt of $20 per share for a new stock issue.

D)All of the above are correct.

The transaction was for the:

The transaction was for the:A)Issue of 2 million shares of common stock at par value.

B)Issue of common stock for $150 million in cash.

C)Receipt of $20 per share for a new stock issue.

D)All of the above are correct.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

58

Common shareholders usually have all of the following rights except:

A)To share in the profits.

B)To share in assets upon liquidation.

C)To elect a board of directors.

D)To participate in the day-to-day operations.

A)To share in the profits.

B)To share in assets upon liquidation.

C)To elect a board of directors.

D)To participate in the day-to-day operations.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

59

The par value of shares issued is normally recorded in the:

A)Paid-in capital in excess of par account.

B)Common stock account.

C)Retained earnings account.

D)Appropriated retained earnings account.

A)Paid-in capital in excess of par account.

B)Common stock account.

C)Retained earnings account.

D)Appropriated retained earnings account.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

60

Authorized common stock refers to the total number of shares:

A)Outstanding.

B)Issued.

C)Issued and outstanding.

D)That can be issued.

A)Outstanding.

B)Issued.

C)Issued and outstanding.

D)That can be issued.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

61

When preferred stock is purchased by the issuing corporation at a price below the original issue price and the stock is retired, the transaction:

A)Increases net income for the year.

B)Increases retained earnings.

C)Increases revenue for the year.

D)Increases paid-in capital share repurchase.

A)Increases net income for the year.

B)Increases retained earnings.

C)Increases revenue for the year.

D)Increases paid-in capital share repurchase.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

62

On October 1, 2013, Chief Corporation declared and issued a 10% stock dividend. Before this date, Chief had 80,000 shares of $5 par common stock outstanding. The market value of Chief Corporation on the date of declaration was $10 per share. As a result of this dividend, Chief's retained earnings will:

A)Decrease by $80,000.

B)Not change.

C)Decrease by $40,000.

D)Increase by $80,000.

A)Decrease by $80,000.

B)Not change.

C)Decrease by $40,000.

D)Increase by $80,000.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

63

When treasury shares are sold at a price above cost:

A)A gain account is credited.

B)A loss is reported.

C)A revenue account is credited.

D)Paid-in capital is increased.

A)A gain account is credited.

B)A loss is reported.

C)A revenue account is credited.

D)Paid-in capital is increased.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

64

Treasury stock transactions never increase retained earnings or net income.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

65

In 2011, Winn, Inc., issued $1 par value common stock for $35 per share. No other common stock transactions occurred until July 31, 2013, when Winn acquired some of the issued shares for $30 per share and retired them. Which of the following statements correctly states an effect of this acquisition and retirement?

A)2013 net income is decreased.

B)Additional paid-in capital is decreased.

C)2013 net income is increased.

D)Retained earnings is increaseD.The entries to record the stock issuance and subsequent acquisition and retirement (per share) are as follows:

A)2013 net income is decreased.

B)Additional paid-in capital is decreased.

C)2013 net income is increased.

D)Retained earnings is increaseD.The entries to record the stock issuance and subsequent acquisition and retirement (per share) are as follows:

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

66

When treasury stock is purchased for an amount greater than its par value, what is the effect on total shareholders' equity?

A)Increase.

B)Decrease.

C)No effect.

D)Cannot tell from the given information.

A)Increase.

B)Decrease.

C)No effect.

D)Cannot tell from the given information.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

67

Restrictions on retained earnings must be disclosed in the body of the balance sheet.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

68

Treasury shares are most often reported as:

A)A reduction of total shareholders' equity.

B)A reduction of total paid-in capital.

C)A reduction to retained earnings.

D)An expense on the income statement.

A)A reduction of total shareholders' equity.

B)A reduction of total paid-in capital.

C)A reduction to retained earnings.

D)An expense on the income statement.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

69

Montgomery & Co., a well-established law firm, provided 500 hours of its time to Fink Corporation in exchange for 1,000 shares of Fink's $5 par common stock. Montgomery's usual billing rate is $700 per hour, and Fink's stock has a book value of $250 per share. By what amount will Fink's paid-in capital-excess of par increase for this transaction?

A)$345,000.

B)$295,000.

C)$350,000.

D)$300,000.

A)$345,000.

B)$295,000.

C)$350,000.

D)$300,000.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

70

Boxer Company owned 20,000 shares of King Company that were purchased in 2011 for $500,000. On May 1, 2013, Boxer declared a property dividend of 1 share of King for every 10 shares of Boxer stock. On that date, there were 50,000 shares of Boxer stock outstanding. The market value of the King stock was $30 per share on the date of declaration and $32 per share on the date of distribution. By how much is retained earnings reduced by the property dividend?

A)$0.

B)$150,000.

C)$160,000.

D)$300,000.

A)$0.

B)$150,000.

C)$160,000.

D)$300,000.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

71

Mandatorily redeemable preferred stock is reported as a liability.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

72

Preferred stock is called preferred because it usually has two preferences. These preferences relate to:

A)Dividends and voting rights.

B)Par value and dividends.

C)The preemptive right and voting rights.

D)Assets at liquidation and dividends.

A)Dividends and voting rights.

B)Par value and dividends.

C)The preemptive right and voting rights.

D)Assets at liquidation and dividends.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

73

The retained earnings balance reported in the balance sheet typically is not affected by:

A)Net income.

B)A prior period adjustment.

C)Dividends paid.

D)Restrictions.

A)Net income.

B)A prior period adjustment.

C)Dividends paid.

D)Restrictions.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

74

When treasury shares are resold at a price below cost:

A)Paid-in capital and/or retained earnings is reduced.

B)Paid-in capital and/or retained earnings is increased.

C)Retained earnings is always reduced.

D)A loss is taken on the income statement.

A)Paid-in capital and/or retained earnings is reduced.

B)Paid-in capital and/or retained earnings is increased.

C)Retained earnings is always reduced.

D)A loss is taken on the income statement.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

75

Noncash assets received as consideration for the issue of stock are always valued based on the fair value of the stock.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

76

Investors should be wary of stock buybacks during down times because the resulting decrease in shares and increase in earnings per share can be used to mask a slowdown in earnings growth.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

77

Paid-in capital must consist solely of amounts invested by shareholders.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

78

Retained earnings represent a company's:

A)Undistributed net income.

B)Undistributed net assets.

C)Extra paid-in capital.

D)Undistributed cash.

A)Undistributed net income.

B)Undistributed net assets.

C)Extra paid-in capital.

D)Undistributed cash.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

79

Retained earnings represent:

A)Earned capital.

B)Cash.

C)Assets.

D)Net assets.

A)Earned capital.

B)Cash.

C)Assets.

D)Net assets.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck

80

Coy, Inc., initially issued 200,000 shares of $1 par value stock for $1,000,000 in 2011. In 2012, the company repurchased 20,000 shares for $200,000. In 2013, 10,000 of the repurchased shares were resold for $160,000. In its balance sheet dated December 31, 2013, Coy, Inc.'s treasury stock account shows a balance of:

A)$0.

B)$40,000.

C)$100,000.

D)$200,000.

A)$0.

B)$40,000.

C)$100,000.

D)$200,000.

Unlock Deck

Unlock for access to all 213 flashcards in this deck.

Unlock Deck

k this deck