Deck 7: Cash and Receivables

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

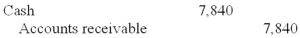

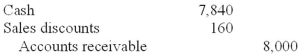

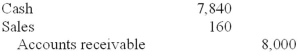

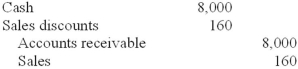

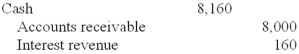

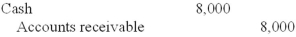

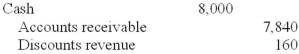

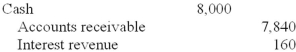

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/164

Play

Full screen (f)

Deck 7: Cash and Receivables

1

The net method of accounting for cash discounts requires adjusting entries for discounts taken.

False

2

The journal entry to record the replenishment of a petty cash fund includes a credit to the petty cash fund.

False

3

Cash equivalents would include investments in marketable equity securities as long as management intends to sell the securities in the next three months.

False

4

In a good system of internal control, the person who initiates a transaction should be allowed to effectively control the processing of the transaction through its final inclusion in the accounting records.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

5

Recognizing sales returns when they occur could result in an overstatement of income in the period of the related sale.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

6

Discounts on notes receivable are recognized as interest earned over the term of the related note.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

7

Using the balance sheet approach, bad debt expense is an indirect result of estimating the net realizable value of accounts receivable.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

8

Securitization of receivables is a type of secured borrowing.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

9

In a bank reconciliation, adjustments to the book balance could include adding or subtracting company errors.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

10

Depending on the circumstances, the classification of a compensating balance may be either current or noncurrent, and the arrangement should be disclosed in the notes.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

11

When a creditor's receivable becomes impaired due to a troubled debt restructuring, the receivable is revalued based on the discounted present value of currently expected cash flows at the loan's original effective rate.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

12

Under IFRS, transfer of risks and rewards of ownership, rather than transfer of control, is the primary factor determining whether a factored receivable can be treated as sold rather than as part of a secured borrowing.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

13

The income statement approach to estimating bad debts requires an adjusting entry at the end of the period to reduce receivables to net realizable value.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

14

From a financial accounting perspective, the main purposes of a system of internal control are to improve the accuracy and reliability of accounting information and to safeguard assets.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

15

Under IFRS, accounts receivable can be accounted for as "available for sale" if that approach is elected upon initial recognition of the receivable.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

16

Under IFRS, accounts receivable can be accounted for at fair value whenever company management wants to do so.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

17

The receivables turnover ratio provides a way for an analyst to assess the effectiveness of a company in managing its investment in receivables.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

18

Under IFRS, an overdraft in a cash account at one bank can be offset against a positive balance in the account at another bank for purposes of reporting cash on the company's balance sheet.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

19

Unless specific sales criteria are met, the factoring of accounts receivable with recourse is accounted for as a loan.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

20

In a bank reconciliation, adjustments to the bank balance could include adding deposits in transit and deducting bank service charges.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

21

Cash may not include:

A)Foreign currency.

B)Money orders.

C)Restricted cash.

D)Undeposited customer checks.

A)Foreign currency.

B)Money orders.

C)Restricted cash.

D)Undeposited customer checks.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

22

Under IFRS, accounts receivable impairments due to troubled debt restructuring are not recognized.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

23

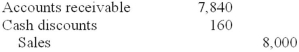

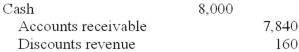

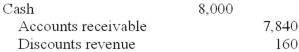

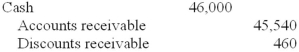

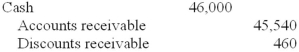

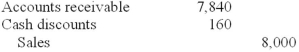

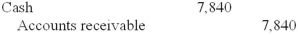

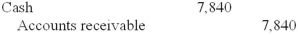

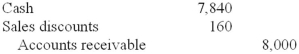

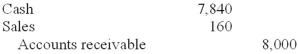

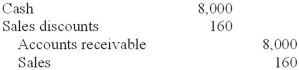

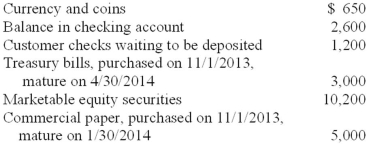

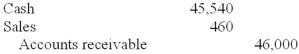

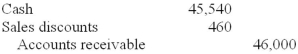

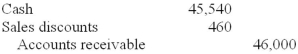

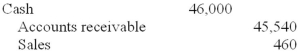

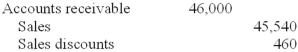

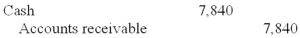

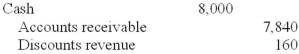

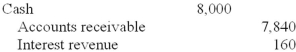

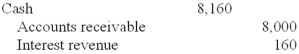

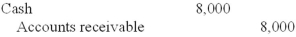

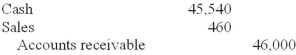

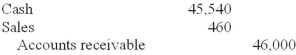

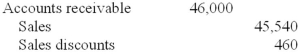

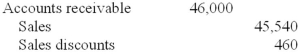

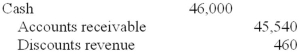

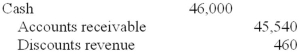

What entry would Cherokee make on November 10?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

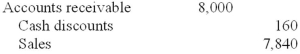

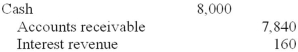

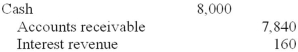

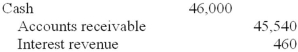

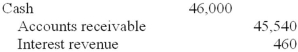

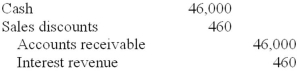

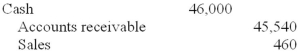

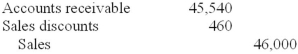

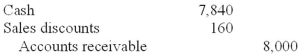

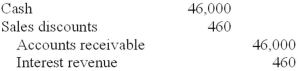

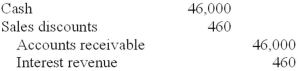

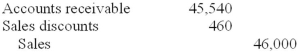

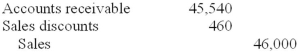

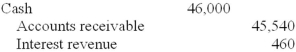

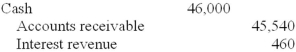

24

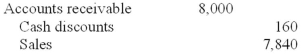

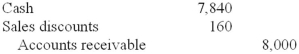

What is the correct entry for Flores on December 5, assuming the correct payment was received on that date?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

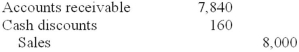

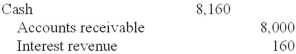

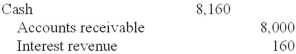

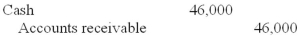

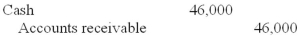

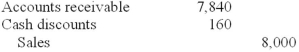

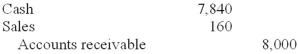

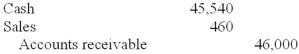

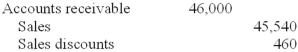

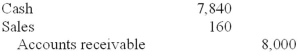

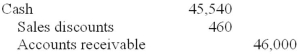

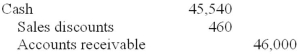

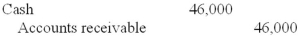

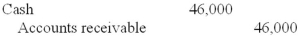

25

What entry would Oswego make on June 10, assuming the customer made the correct payment on that date?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

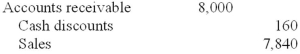

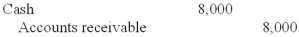

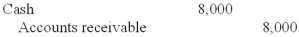

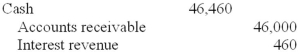

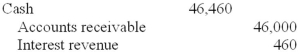

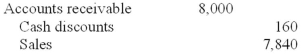

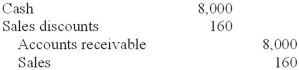

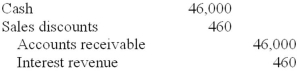

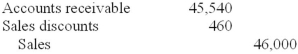

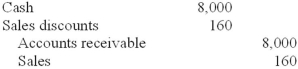

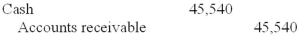

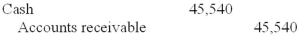

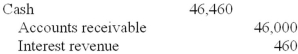

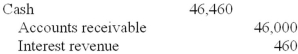

26

What is the correct entry for Flores on November 10?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following is true about reporting cash under IFRS?

A)Cash accounts include loans made to customers, but not to related parties.

B)Overdrafts typically cannot be offset against positive balance in other cash accounts on the balance sheet.

C)Cash overdrafts are not allowed.

D)Overdrafts typically are not shown as current liabilities on the balance sheet.

A)Cash accounts include loans made to customers, but not to related parties.

B)Overdrafts typically cannot be offset against positive balance in other cash accounts on the balance sheet.

C)Cash overdrafts are not allowed.

D)Overdrafts typically are not shown as current liabilities on the balance sheet.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

28

Compensating balances represent:

A)Funds in a bank account that can't be spent.

B)Balances in a payroll checking account.

C)Accounts that are subject to bank service charges.

D)Accounts on which banks pay interest, e.g., NOW accounts.

A)Funds in a bank account that can't be spent.

B)Balances in a payroll checking account.

C)Accounts that are subject to bank service charges.

D)Accounts on which banks pay interest, e.g., NOW accounts.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

29

What is the correct entry for Flores on November 17, assuming the correct payment was received on that date?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

30

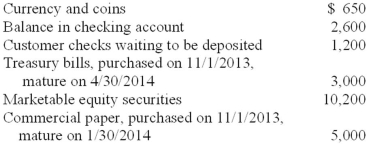

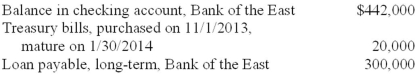

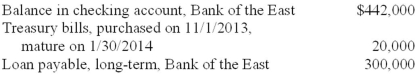

Cashmere Soap Corporation had the following items listed in its trial balance at 12/31/2013:  What amount will Cashmere Soap include in its year-end balance sheet as cash and cash equivalents?

What amount will Cashmere Soap include in its year-end balance sheet as cash and cash equivalents?

A)$9,450.

B)$12,450.

C)$7,450.

D)$19,650.

What amount will Cashmere Soap include in its year-end balance sheet as cash and cash equivalents?

What amount will Cashmere Soap include in its year-end balance sheet as cash and cash equivalents?A)$9,450.

B)$12,450.

C)$7,450.

D)$19,650.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

31

Important elements of an internal control system for cash disbursements include each of the following except:

A)Only authorized personnel should sign checks.

B)All expenditures should be authorized before a check is prepared.

C)All disbursements, other than very small disbursements, should be made by check.

D)The same person that prepares the check should also record it in the proper journal.

A)Only authorized personnel should sign checks.

B)All expenditures should be authorized before a check is prepared.

C)All disbursements, other than very small disbursements, should be made by check.

D)The same person that prepares the check should also record it in the proper journal.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

32

What entry would Oswego make on April 23, assuming the customer made the correct payment on that date?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

33

Cash equivalents do not include:

A)Money market funds.

B)High grade marketable equity securities.

C)U.S.treasury bills.

D)Commercial paper.

A)Money market funds.

B)High grade marketable equity securities.

C)U.S.treasury bills.

D)Commercial paper.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

34

COSO defines internal control as a process, affected by an entity's board of directors, management, and other personnel, designed to provide reasonable assurance regarding the achievement of objectives in:

A)Effectiveness and efficiency of operations.

B)Reliability of financial advice.

C)Compliance with local ordinances.

D)All of the above are correct.

A)Effectiveness and efficiency of operations.

B)Reliability of financial advice.

C)Compliance with local ordinances.

D)All of the above are correct.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

35

Logistics Company had the following items listed in its trial balance at 12/31/2013:  Included in the checking account balance is $50,000 of restricted cash that Bank of the East requires as a compensating balance for the $300,000 note. What amount will Logistics include in its year-end balance sheet as cash and cash equivalents?

Included in the checking account balance is $50,000 of restricted cash that Bank of the East requires as a compensating balance for the $300,000 note. What amount will Logistics include in its year-end balance sheet as cash and cash equivalents?

A)$412,000.

B)$462,000.

C)$392,000.

D)$442,000.

Included in the checking account balance is $50,000 of restricted cash that Bank of the East requires as a compensating balance for the $300,000 note. What amount will Logistics include in its year-end balance sheet as cash and cash equivalents?

Included in the checking account balance is $50,000 of restricted cash that Bank of the East requires as a compensating balance for the $300,000 note. What amount will Logistics include in its year-end balance sheet as cash and cash equivalents?A)$412,000.

B)$462,000.

C)$392,000.

D)$442,000.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

36

If Wilson reports under IFRS, its 12/31/2013 balance sheet would show what cash balance?

A)($5,000).

B)$55,000.

C)$60,000.

D)None of the above.

A)($5,000).

B)$55,000.

C)$60,000.

D)None of the above.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

37

What entry would Oswego make on April 12?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

38

If Wilson reports under U.S. GAAP, its 12/31/2013 balance sheet would show what cash balance?

A)($5,000).

B)$55,000.

C)$60,000.

D)None of the above.

A)($5,000).

B)$55,000.

C)$60,000.

D)None of the above.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

39

Cash that is restricted and not available for current operations is reported in the balance sheet as:

A)Equity.

B)Investments.

C)Liabilities.

D)A separate section between liabilities and equity.

A)Equity.

B)Investments.

C)Liabilities.

D)A separate section between liabilities and equity.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

40

What entry would Cherokee make on November 17, assuming the correct payment was received on that date?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

41

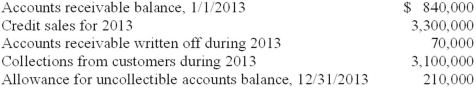

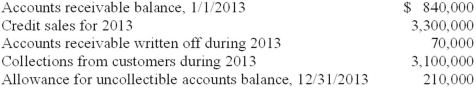

The following information relates to Halloran Co.'s accounts receivable for 2013:  What amount should Halloran report for accounts receivable, before allowances, at December 31, 2013?

What amount should Halloran report for accounts receivable, before allowances, at December 31, 2013?

A)$1,040,000.

B)$970,000.

C)$760,000.

D)None of the above.

What amount should Halloran report for accounts receivable, before allowances, at December 31, 2013?

What amount should Halloran report for accounts receivable, before allowances, at December 31, 2013?A)$1,040,000.

B)$970,000.

C)$760,000.

D)None of the above.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

42

Calistoga's adjusted allowance for uncollectible accounts at December 31, 2013, is:

A)$1,575.

B)$1,505.

C)$1,650.

D)$1,720.

A)$1,575.

B)$1,505.

C)$1,650.

D)$1,720.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

43

Collection of accounts receivable that previously have been written off results in an increase in cash and an increase in:

A)Accounts receivable.

B)Allowance for uncollectible accounts.

C)Bad debts expense.

D)Retained earnings.

A)Accounts receivable.

B)Allowance for uncollectible accounts.

C)Bad debts expense.

D)Retained earnings.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

44

The allowance for uncollectible accounts is a:

A)Deferred charge to expense.

B)Contra asset account.

C)Deferred revenue account.

D)Quasi-liability account.

A)Deferred charge to expense.

B)Contra asset account.

C)Deferred revenue account.

D)Quasi-liability account.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

45

Accounts receivable are normally reported at the:

A)Present value of future cash receipts.

B)Current value plus accrued interest.

C)Expected amount to be received.

D)Current value less expected collection costs.

A)Present value of future cash receipts.

B)Current value plus accrued interest.

C)Expected amount to be received.

D)Current value less expected collection costs.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

46

What entry would Cherokee make on December 10, assuming the correct payment was received on that date?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

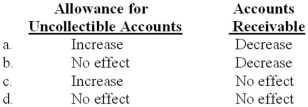

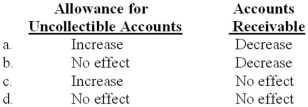

47

A company uses the allowance method to account for bad debts. What is the effect on each of the following accounts of the collection of an account previously written off?

A)Option a

B)Option b

C)Option c

D)Option d

A)Option a

B)Option b

C)Option c

D)Option d

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

48

Calistoga's 2013 bad debt expense is:

A)$1,720.

B)$1,650.

C)$1,505.

D)$1,575.

A)$1,720.

B)$1,650.

C)$1,505.

D)$1,575.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

49

Calistoga's accounts receivable at December 31, 2013, are:

A)$467,000.

B)$473,280.

C)$465,280.

D)$469,280.

A)$467,000.

B)$473,280.

C)$465,280.

D)$469,280.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

50

What entry would Harvey's make on April 23, assuming the customer made the correct payment on that date?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following does not change the balance in accounts receivable?

A)Returns on credit sales.

B)Collections from customers.

C)Bad debts expense adjusting entry.

D)Write-offs.

A)Returns on credit sales.

B)Collections from customers.

C)Bad debts expense adjusting entry.

D)Write-offs.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

52

Memorex Disks sells computer disk drives with right-of-return privileges. Returns are material and reasonably predictable. Memorex should:

A)Not record sales until the right to return has expired.

B)Record an allowance for sales returns in the year of the sale.

C)Debit sales returns in the period of the return.

D)Debit sales in the period of the return.

A)Not record sales until the right to return has expired.

B)Record an allowance for sales returns in the year of the sale.

C)Debit sales returns in the period of the return.

D)Debit sales in the period of the return.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

53

Chez Fred Bakery estimates the allowance for uncollectible accounts at 3% of the ending balance of accounts receivable. During 2013, Chez Fred's credit sales and collections were $125,000 and $131,000, respectively. What was the balance of accounts receivable on January 1, 2013, if $180 in accounts receivable were written off during 2013 and if the allowance account had a balance of $750 on December 31, 2013?

A)$5,820.

B)$31,000.

C)$31,180.

D)None of the above is correct.

A)$5,820.

B)$31,000.

C)$31,180.

D)None of the above is correct.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

54

Tom's Textiles shipped the wrong material to a customer, who refused to accept the order. Upon receipt of the material, Tom's would credit accounts receivable and debit:

A)Sales.

B)Sales discount.

C)Sales returns.

D)Sales allowances.

A)Sales.

B)Sales discount.

C)Sales returns.

D)Sales allowances.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

55

False Value's 2013 income statement would report net sales of:

A)$622,000.

B)$607,000.

C)$646,000.

D)$611,000.

A)$622,000.

B)$607,000.

C)$646,000.

D)$611,000.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

56

Gershwin Wallcovering Inc. shipped the wrong shade of paint to a customer. The customer agreed to keep the paint upon being offered a 15% price reduction. Gershwin would record this reduction by crediting accounts receivable and debiting:

A)Sales.

B)Sales discounts.

C)Sales returns.

D)Sales allowances.

A)Sales.

B)Sales discounts.

C)Sales returns.

D)Sales allowances.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

57

What is the balance in the allowance for sales returns account at the end of 2013?

A)$11,000.

B)$39,000.

C)$43,000.

D)$21,000.

A)$11,000.

B)$39,000.

C)$43,000.

D)$21,000.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

58

What entry would Harvey's make on April 12?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

59

What entry would Harvey's make on June 10, assuming the customer made the correct payment on that date?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

60

The balance in accounts receivable at the beginning of 2013 was $300. During 2013, $1,600 of credit sales were recorded. If the ending balance in accounts receivable was $250 and $100 in accounts receivable were written off during the year, the amount of cash collected from customers during 2013 was:

A)$1,600.

B)$1,650.

C)$1,550.

D)$1,900.

A)$1,600.

B)$1,650.

C)$1,550.

D)$1,900.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

61

As of January 1, 2013, Farley Co. had a credit balance of $520,000 in its allowance for uncollectible accounts. Based on experience, 2% of Farley's credit sales have been uncollectible. During 2013, Farley wrote off $650,000 of accounts receivable. Credit sales for 2013 were $18,000,000. In its December 31, 2013, balance sheet, what amount should Farley report as allowance for uncollectible accounts?

A)$230,000.

B)$360,000.

C)$590,000.

D)$880,000.

A)$230,000.

B)$360,000.

C)$590,000.

D)$880,000.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

62

Nontrade receivables do not include:

A)Sales to customers.

B)Loans to employees.

C)Income tax refund receivable.

D)Advances to affiliated companies.

A)Sales to customers.

B)Loans to employees.

C)Income tax refund receivable.

D)Advances to affiliated companies.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

63

If a company uses the balance sheet approach to estimate bad debt expense, bad debt expense for a period can be determined by:

A)Multiplying net credit sales by the bad debt experience ratio.

B)Adding the beginning balance in the allowance for uncollectible accounts to the provision for uncollectible accounts and deducting the desired ending balance in the allowance for uncollectible accounts.

C)Multiplying ending accounts receivable in each age category by the expected loss ratio for each age category.

D)Taking the difference between the unadjusted balance in the allowance account and the desired balance.

A)Multiplying net credit sales by the bad debt experience ratio.

B)Adding the beginning balance in the allowance for uncollectible accounts to the provision for uncollectible accounts and deducting the desired ending balance in the allowance for uncollectible accounts.

C)Multiplying ending accounts receivable in each age category by the expected loss ratio for each age category.

D)Taking the difference between the unadjusted balance in the allowance account and the desired balance.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

64

Priscilla's Exotic Pets discounted a note receivable without recourse and the sales criteria were met. The discounting is recorded as:

A)A secured borrowing.

B)Only note disclosure of the arrangement is required.

C)A sale.

D)None of the above.

A)A secured borrowing.

B)Only note disclosure of the arrangement is required.

C)A sale.

D)None of the above.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

65

As of December 31, 2013, Amy Jo's Appliances had unadjusted account balances in accounts receivable of $311,000 and $970 in the allowance for uncollectible accounts, following 2013 write-offs of $6,450 in bad debts. An analysis of Amy Jo's December 31, 2013, accounts receivable suggests that the allowance for uncollectible accounts should be 2% of accounts receivable. Bad debt expense for 2013 should be:

A)$6,220.

B)$6,450.

C)$5,250.

D)None of the above is correct.

A)$6,220.

B)$6,450.

C)$5,250.

D)None of the above is correct.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

66

What bad debt expense would Dinty report in its first-year income statement?

A)$50,000.

B)$82,000.

C)$114,000.

D)Can't be determined from the given information.

A)$50,000.

B)$82,000.

C)$114,000.

D)Can't be determined from the given information.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

67

Drebin Security Systems sold merchandise to a customer in exchange for a $50,000, five-year, noninterest-bearing note when an equivalent loan would carry 10% interest. Drebin would record sales revenue on the date of sale equal to:

A)$50,000.

B)Zero.

C)The future value of $50,000 using a 10% interest rate.

D)The present value of $50,000 using a 10% interest rate.

A)$50,000.

B)Zero.

C)The future value of $50,000 using a 10% interest rate.

D)The present value of $50,000 using a 10% interest rate.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

68

A note receivable Mild Max Cycles discounted with recourse was dishonored on its maturity date. Mild Max would debit:

A)A loss on dishonored receivable.

B)A receivable.

C)Dishonored note expense.

D)Interest expense.

A)A loss on dishonored receivable.

B)A receivable.

C)Dishonored note expense.

D)Interest expense.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

69

Rahal's 2013 bad debt expense is:

A)$2,100.

B)$2,340.

C)$4,080.

D)None of the above is correct.

A)$2,100.

B)$2,340.

C)$4,080.

D)None of the above is correct.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

70

Which of the following is recorded by a credit to accounts receivable?

A)Sale of inventory on account.

B)Estimating the annual allowance for uncollectible accounts.

C)Estimating annual sales returns.

D)Write-off of bad debts.

A)Sale of inventory on account.

B)Estimating the annual allowance for uncollectible accounts.

C)Estimating annual sales returns.

D)Write-off of bad debts.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

71

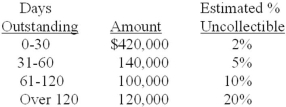

The following information pertains to Jacobsen Co.'s accounts receivable at December 31, 2013:  During 2013, Jacobsen wrote off $18,000 in receivables and recovered $6,000 that had been written off in prior years. Jacobsen's December 31, 2012, allowance for uncollectible accounts was $40,000. Under the aging method, what amount of allowance for uncollectible accounts should Jacobsen report at December 31, 2013?

During 2013, Jacobsen wrote off $18,000 in receivables and recovered $6,000 that had been written off in prior years. Jacobsen's December 31, 2012, allowance for uncollectible accounts was $40,000. Under the aging method, what amount of allowance for uncollectible accounts should Jacobsen report at December 31, 2013?

A)$28,000.

B)$31,400.

C)$55,400.

D)$49,400.

During 2013, Jacobsen wrote off $18,000 in receivables and recovered $6,000 that had been written off in prior years. Jacobsen's December 31, 2012, allowance for uncollectible accounts was $40,000. Under the aging method, what amount of allowance for uncollectible accounts should Jacobsen report at December 31, 2013?

During 2013, Jacobsen wrote off $18,000 in receivables and recovered $6,000 that had been written off in prior years. Jacobsen's December 31, 2012, allowance for uncollectible accounts was $40,000. Under the aging method, what amount of allowance for uncollectible accounts should Jacobsen report at December 31, 2013?A)$28,000.

B)$31,400.

C)$55,400.

D)$49,400.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

72

As of December 31, 2012, Gill Co. reported accounts receivable of $216,000 and an allowance for uncollectible accounts of $8,400. During 2013, accounts receivable increased by $22,000, and $7,800 of bad debts were written off. An analysis of Gill Co.'s December 31, 2013, accounts receivable suggests that the allowance for uncollectible accounts should be 3% of accounts receivable. Bad debt expense for 2013 would be:

A)$6,540.

B)$7,800.

C)$7,140.

D)None of the above is correct.

A)$6,540.

B)$7,800.

C)$7,140.

D)None of the above is correct.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

73

When you use an aging schedule approach for estimating uncollectible accounts:

A)Bad debts expense is measured indirectly, and the allowance for uncollectible accounts balance is measured directly.

B)Bad debts expense is measured indirectly, and the allowance for uncollectible accounts balance is measured indirectly.

C)Bad debts expense is measured directly, and the allowance for uncollectible accounts balance is measured directly.

D)Bad debts expense is measured directly, and the allowance for uncollectible accounts balance is measured indirectly.

A)Bad debts expense is measured indirectly, and the allowance for uncollectible accounts balance is measured directly.

B)Bad debts expense is measured indirectly, and the allowance for uncollectible accounts balance is measured indirectly.

C)Bad debts expense is measured directly, and the allowance for uncollectible accounts balance is measured directly.

D)Bad debts expense is measured directly, and the allowance for uncollectible accounts balance is measured indirectly.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

74

Long-term notes receivable issued for noncash assets at an unrealistically low interest rate will be:

A)Discounted at an imputed interest rate.

B)Recorded at the contract amount.

C)Recorded at an amount equal to the future cash flows.

D)Accounted for on the installment basis.

A)Discounted at an imputed interest rate.

B)Recorded at the contract amount.

C)Recorded at an amount equal to the future cash flows.

D)Accounted for on the installment basis.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

75

What accounts receivable balance would Dinty report in its first year-end balance sheet?

A)$196,000.

B)$218,000.

C)$230,000.

D)None of the above is correct.

A)$196,000.

B)$218,000.

C)$230,000.

D)None of the above is correct.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

76

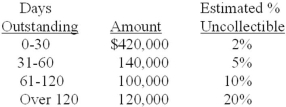

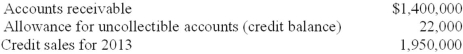

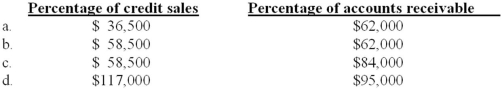

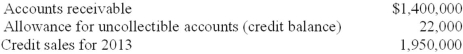

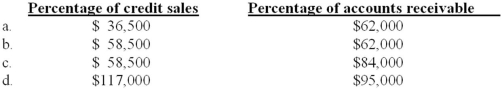

San Mateo Company had the following account balances at December 31, 2013, before recording bad debt expense for the year:  San Mateo is considering the following approaches for estimating bad debts for 2013: • Based on 3% of credit sales

San Mateo is considering the following approaches for estimating bad debts for 2013: • Based on 3% of credit sales

• Based on 6% of year-end accounts receivable

What amount should San Mateo charge to bad debt expense at the end of 2013 under each method?

A)Option a

B)Option b

C)Option c

D)Option d

San Mateo is considering the following approaches for estimating bad debts for 2013: • Based on 3% of credit sales

San Mateo is considering the following approaches for estimating bad debts for 2013: • Based on 3% of credit sales• Based on 6% of year-end accounts receivable

What amount should San Mateo charge to bad debt expense at the end of 2013 under each method?

A)Option a

B)Option b

C)Option c

D)Option d

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

77

Baker Inc. acquired equipment from the manufacturer on 10/1/2013 and gave a noninterest-bearing note in exchange. Baker is obligated to pay $918,000 on 4/1/2014 to satisfy the obligation in full. If Baker accrued interest of $9,000 on the note in its 2013 year-end financial statements, what is its imputed annual interest rate?

A)2%.

B)4%.

C)6%.

D)None of the above is correct.

A)2%.

B)4%.

C)6%.

D)None of the above is correct.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

78

In Dinty's adjusting entry for bad debts at year-end, which of these would be included?

A)Debit to bad debt expense for $114,000.

B)Credit to allowance for uncollectible accounts for $82,000.

C)Debit to accounts receivable for $32,000.

D)All of the above are correct.

A)Debit to bad debt expense for $114,000.

B)Credit to allowance for uncollectible accounts for $82,000.

C)Debit to accounts receivable for $32,000.

D)All of the above are correct.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

79

Rahal's accounts receivable at December 31, 2013, are:

A)$90,500.

B)$88,160.

C)$82,500.

D)$80,160.

A)$90,500.

B)$88,160.

C)$82,500.

D)$80,160.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

80

Rahal's adjusted allowance for uncollectible accounts at December 31, 2013, is:

A)$4,340.

B)$4,100.

C)$3,800.

D)$4,040.

A)$4,340.

B)$4,100.

C)$3,800.

D)$4,040.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck