Deck 12: Budgeting for Planning and Control

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/43

Play

Full screen (f)

Deck 12: Budgeting for Planning and Control

1

The statement that is not true is:

A)Preparing operating budgets for service businesses is normally simpler than preparing them for retailers or manufacturers

B)A service business does not need to prepare a cash budget

C)GST estimates need to be included in a cash budget

D)The emphasis in budgeting for not-for profit organisations tends to be on cash flows and the final cash position rather than on profits,income and expenditure

A)Preparing operating budgets for service businesses is normally simpler than preparing them for retailers or manufacturers

B)A service business does not need to prepare a cash budget

C)GST estimates need to be included in a cash budget

D)The emphasis in budgeting for not-for profit organisations tends to be on cash flows and the final cash position rather than on profits,income and expenditure

A service business does not need to prepare a cash budget

2

Purchases of buildings and equipment are formally planned in the:

A)Selling and administrative expense budget

B)Budgeted balance sheet

C)Depreciation budget

D)Capital expenditure budget

A)Selling and administrative expense budget

B)Budgeted balance sheet

C)Depreciation budget

D)Capital expenditure budget

D

3

It is true in relation to cash budgets that:

A)They are prepared by entities that sell entirely on credit

B)They include depreciation

C)They are based on preparing a projected bank reconciliation

D)They are the last budget to be prepared

A)They are prepared by entities that sell entirely on credit

B)They include depreciation

C)They are based on preparing a projected bank reconciliation

D)They are the last budget to be prepared

A

4

Information for Rambo Corporation's cash budget is: Each unit sells for $12 and 80% of sales are on credit.Credit sales are collected as follows: 25% in the quarter of the sale and the balance in the following quarter.How many dollars of 3rd quarter sales will be collected in cash in the 4th quarter?

A)$225

B)$2,160

C)$180

D)$2,700

A)$225

B)$2,160

C)$180

D)$2,700

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

5

Which statement relating to the provision of motivation as a benefit of budgeting is not true?

A)When all levels of management participate in preparing the budget it has a better chance of acceptance

B)The budgeted level of performance should be beyond that attainable with a reasonably amount of effort,to provide employees with a challenge

C)An improperly prepared budget may have an adverse effect on motivation

D)To increase the chances of acceptance the budget is best approached from the bottom up

A)When all levels of management participate in preparing the budget it has a better chance of acceptance

B)The budgeted level of performance should be beyond that attainable with a reasonably amount of effort,to provide employees with a challenge

C)An improperly prepared budget may have an adverse effect on motivation

D)To increase the chances of acceptance the budget is best approached from the bottom up

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

6

The statement relating to a master budget that is not true is:

A)Budget targets are fixed and not subject to revision

B)It is a set of interrelated budgets

C)It is normally overseen by a budget committee

D)It is typically prepared for a one-year period that coincides with the entity's financial year

A)Budget targets are fixed and not subject to revision

B)It is a set of interrelated budgets

C)It is normally overseen by a budget committee

D)It is typically prepared for a one-year period that coincides with the entity's financial year

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

7

The following information was reported in the cash budget:

How much cash will the company have to borrow in order to meet its required needs?

A)$0

B)$34,000

C)$22,000

D)$6,000

How much cash will the company have to borrow in order to meet its required needs?

A)$0

B)$34,000

C)$22,000

D)$6,000

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

8

The primary purpose of a budget is:

A)To show how resources will be acquired and used

B)To determine which managers are not doing a good job

C)To identify who should be promoted

D)To find the cheapest source of supplies and expenses

A)To show how resources will be acquired and used

B)To determine which managers are not doing a good job

C)To identify who should be promoted

D)To find the cheapest source of supplies and expenses

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

9

The statement relating to a budget that is not true is:

A)It is a detailed plan

B)It is a management tool

C)It provides many of the performance targets used in responsibility accounting

D)It is prepared on an historical basis

A)It is a detailed plan

B)It is a management tool

C)It provides many of the performance targets used in responsibility accounting

D)It is prepared on an historical basis

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

10

The sales budget for Lyn's Clothing Co for the first three months of the year is expected to be $30,000,$40,000 and $50,000 with 40% of each month's sales being on credit.Collections of accounts receivable are scheduled at 25% during the month of sale,70% during the month following the sale with 5% uncollectable.The total budgeted cash receipts from sales for the second month will be:

A)$36,400

B)$38,000

C)$43,600

D)$52,000

A)$36,400

B)$38,000

C)$43,600

D)$52,000

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

11

Tidal Co has the following transactions in 2011,its first year of operations: What is the cash balance at 31 December 2011?

A)$150 000

B)$170 000

C)$210 000

D)$280 000

A)$150 000

B)$170 000

C)$210 000

D)$280 000

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

12

Betsy Manufacturing is preparing its purchases budget for the 2nd quarter of the year.The following information is given in units: Sales forecast for 2nd quarter = 1000

How many units should be purchased in the 2nd quarter?

A)900

B)1000

C)1150

D)1250

How many units should be purchased in the 2nd quarter?

A)900

B)1000

C)1150

D)1250

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

13

The method which would not be used to forecast sales is:

A)Extrapolation of past sales

B)Predictions by senior management

C)Statistical or mathematical techniques

D)Working out the maximum production that can be achieved

A)Extrapolation of past sales

B)Predictions by senior management

C)Statistical or mathematical techniques

D)Working out the maximum production that can be achieved

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

14

Budgeting for a retailer requires a purchases budget to be prepared.When budgeting for a manufacturer the purchases budget is replaced by which budget?

A)Expense budget

B)Budgeted income statement

C)Production budget

D)Budgeted cost of sales

A)Expense budget

B)Budgeted income statement

C)Production budget

D)Budgeted cost of sales

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

15

The best explanation of goal congruence is

A)All segments working towards the overall goals set by the organisation

B)Telling lower levels of management what to do and how to do it

C)Rewarding managers who reach their performance targets

D)All the companies in an industry working together to solve problems

A)All segments working towards the overall goals set by the organisation

B)Telling lower levels of management what to do and how to do it

C)Rewarding managers who reach their performance targets

D)All the companies in an industry working together to solve problems

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

16

Radak Inc plans to produce 30 000 units per month during 2011.Sales are projected at 25 000 for January and will increase 4% per month thereafter.There are zero units on hand at 1 January 2011.How many units will be on hand at 28 February 2011?

A)5,000

B)9,000

C)11,960

D)13,000

A)5,000

B)9,000

C)11,960

D)13,000

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

17

The following information relates to the 2011 budgets:

Projected Cost of Sales for 2011 is:

A)$185,000

B)$200,000

C)$215,000

D)$235,000

Projected Cost of Sales for 2011 is:

A)$185,000

B)$200,000

C)$215,000

D)$235,000

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

18

The first and last steps respectively in the developing a master budget are:

A)Forecasting sales; estimating expenses

B)Preparation of the sales budget; preparation of the capital expenditure budget

C)Identifying goals; preparation of a set of budgeted financial statements

D)Identifying goals; preparation of the cash budget

A)Forecasting sales; estimating expenses

B)Preparation of the sales budget; preparation of the capital expenditure budget

C)Identifying goals; preparation of a set of budgeted financial statements

D)Identifying goals; preparation of the cash budget

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

19

How many of these are the benefits of budgeting?

? ensures future events will never catch management by surprise

? establishes organisational goals

? is a means of coordination

? forces planning to take place

A)One

B)Two

C)Three

D)Four

? ensures future events will never catch management by surprise

? establishes organisational goals

? is a means of coordination

? forces planning to take place

A)One

B)Two

C)Three

D)Four

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

20

Which statement is true?

A)Most firms prepare cash budgets for periods of 5 years or more

B)The bank figure in the budgeted balance sheet comes from the cash budget

C)Budgeted retained profits is calculated as opening balance less budgeted profits plus budgeted dividends

D)GST can be ignored when preparing budgets

A)Most firms prepare cash budgets for periods of 5 years or more

B)The bank figure in the budgeted balance sheet comes from the cash budget

C)Budgeted retained profits is calculated as opening balance less budgeted profits plus budgeted dividends

D)GST can be ignored when preparing budgets

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

21

The c___________ expenditure budget shows the planned acquisition of facilities and equipment for the period.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

22

A budget performance report is being prepared and will be sent to the appropriate segment manager.Which term best describes the type of costs and income that should be included in this report?

A)Administrative

B)Fixed

C)Unfavourable

D)Controllable

A)Administrative

B)Fixed

C)Unfavourable

D)Controllable

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

23

Large favourable variances between actual and planned performance may indicate:

A)Budget income targets may need to be revised upwards in the future

B)That the firm must be operating efficiently

C)That actual expenses were higher than budgeted expenses

D)That actual income was too high and should be revised downwards in the future

A)Budget income targets may need to be revised upwards in the future

B)That the firm must be operating efficiently

C)That actual expenses were higher than budgeted expenses

D)That actual income was too high and should be revised downwards in the future

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

24

The statement concerning responsibility accounting that is untrue is:

A)For successful budgeting responsibility must be clearly defined

B)A manager is held responsible for the activities of his/her department

C)The choice of responsibility centres in an organisation depends on its characteristics

D)Responsibility centres are usually determined by differences in the product the firm produces

A)For successful budgeting responsibility must be clearly defined

B)A manager is held responsible for the activities of his/her department

C)The choice of responsibility centres in an organisation depends on its characteristics

D)Responsibility centres are usually determined by differences in the product the firm produces

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

25

Which of these is part of the financial set of budgets?

A)Production budget

B)Sales budget

C)Expense budget

D)Cash budget

A)Production budget

B)Sales budget

C)Expense budget

D)Cash budget

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

26

A benefit of budgeting is that it helps to c______________ the various segments of the organisation by making each manager aware of how the different activities fit together.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

27

The untrue statement is:

A)A properly prepared budget is a motivating device

B)An improperly prepared budget can have a negative effect on motivation

C)Managers should be given sole responsibility for setting their own budget targets so that they are motivated to achieve these targets

D)The budgeted level of performance should be attainable with a reasonably efficient amount of effort.

A)A properly prepared budget is a motivating device

B)An improperly prepared budget can have a negative effect on motivation

C)Managers should be given sole responsibility for setting their own budget targets so that they are motivated to achieve these targets

D)The budgeted level of performance should be attainable with a reasonably efficient amount of effort.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

28

A b_____________ is a detailed plan that shows how resources are expected to be acquired and used during a specified time period.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

29

The master budget consists of two major parts,the o_______________ budget and the financial budget.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

30

It is not necessary in the control phase of budgeting to:

A)Decide on management action

B)Compare actual performance with budget estimates

C)Provide timely information to management

D)Investigate all variances

A)Decide on management action

B)Compare actual performance with budget estimates

C)Provide timely information to management

D)Investigate all variances

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

31

G__________ congruence occurs when the managers of an entity accept the organisational goals as their own.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

32

Budgets that give details of the income and costs of projected activities needed to achieve satisfactory profit results are known as:

A)financial budgets

B)master budgets

C)operating budgets

D)cash budgets

A)financial budgets

B)master budgets

C)operating budgets

D)cash budgets

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

33

Having the budget imposed by senior management is known as _____ down budgeting.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

34

The direct labour budget is developed from:

A)The cash budget

B)The production budget

C)The materials budget

D)The budgeted income statement

A)The cash budget

B)The production budget

C)The materials budget

D)The budgeted income statement

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following budgets is prepared after the cash budget?

A)Capital expenditure budget

B)Budgeted balance sheet

C)Manufacturing overhead budget

D)Production budget

A)Capital expenditure budget

B)Budgeted balance sheet

C)Manufacturing overhead budget

D)Production budget

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

36

For a budget to be most effective it is best approached from a:

A)top down approach

B)bottom up approach

C)middle management approach

D)democratic approach

A)top down approach

B)bottom up approach

C)middle management approach

D)democratic approach

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

37

Virtually every phase of the master budget for a manufacturer is dependent on:

A)the cash forecast

B)the production forecast

C)the sales forecast

D)the capital expenditure forecast

A)the cash forecast

B)the production forecast

C)the sales forecast

D)the capital expenditure forecast

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

38

Virtually every phase of the master budget is dependent on the s__________ forecast.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

39

If budgeted sales revenue is $210,000 and actual sales revenue is $250,000,and budgeted expenses are $125,000 and actual expenses are $172,000,the profit variance for the period is:

A)$87,000F

B)$87,000U

C)$7,000 F

D)$7,000 U

A)$87,000F

B)$87,000U

C)$7,000 F

D)$7,000 U

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

40

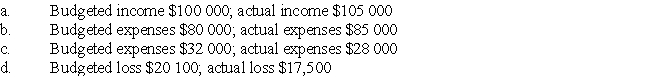

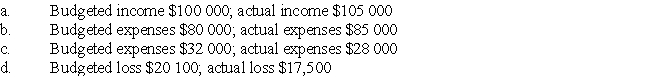

Identify the unfavourable variance.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

41

It would be unreasonable to hold a manager responsible for items beyond his/her control therefore only c___________________ costs should be included in the budgeted performance report.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

42

Budget p________________ reports compare actual and budget performance to determine favourable or unfavourable variances.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck

43

The c__________ b__________ shows projected cash receipts and projected cash payments during the period.

Unlock Deck

Unlock for access to all 43 flashcards in this deck.

Unlock Deck

k this deck