Deck 8: Process Costing Systems

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/67

Play

Full screen (f)

Deck 8: Process Costing Systems

1

Organisation-sustaining activities are activities of the general organisation that support specific products

False

2

Bristol Electronics produces wide range of electronic products. The company has a labour based costing system that was introduced in the 1970s and is now considering implementing an activity based costing (ABC) system. Managers are concerned about how they should compare the ABC data with the existing costing system.

Selected data from the management accounts for the year ending 31st December 2000

Data for 3 products only

- Determine the total overhead cost for product B using the using the activity based data

A)£26,667

B)£50,000

C)£46,733

D)£21,000

Selected data from the management accounts for the year ending 31st December 2000

Data for 3 products only

- Determine the total overhead cost for product B using the using the activity based data

A)£26,667

B)£50,000

C)£46,733

D)£21,000

£46,733

3

Personnel administration is an example of a

A)unit-level activity.

B)batch-level activity.

C)product-level activity.

D)organisation-sustaining activity.

A)unit-level activity.

B)batch-level activity.

C)product-level activity.

D)organisation-sustaining activity.

D

4

Bristol Electronics produces wide range of electronic products. The company has a labour based costing system that was introduced in the 1970s and is now considering implementing an activity based costing (ABC) system. Managers are concerned about how they should compare the ABC data with the existing costing system.

Selected data from the management accounts for the year ending 31st December 2000

Data for 3 products only

- Determine the total overhead cost for product B using the number of hours to apply overhead

A)£41,667

B)£51,667

C)£25,000

D)£35,000

Selected data from the management accounts for the year ending 31st December 2000

Data for 3 products only

- Determine the total overhead cost for product B using the number of hours to apply overhead

A)£41,667

B)£51,667

C)£25,000

D)£35,000

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

5

Bristol Electronics produces wide range of electronic products. The company has a labour based costing system that was introduced in the 1970s and is now considering implementing an activity based costing (ABC) system. Managers are concerned about how they should compare the ABC data with the existing costing system.

Selected data from the management accounts for the year ending 31st December 2000

Data for 3 products only

- Determine the total overhead cost for product B using the number of hours to apply overhead

A)£16,667

B)£50,000

C)£21,667

D)£21,000

Selected data from the management accounts for the year ending 31st December 2000

Data for 3 products only

- Determine the total overhead cost for product B using the number of hours to apply overhead

A)£16,667

B)£50,000

C)£21,667

D)£21,000

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

6

Bristol Electronics produces wide range of electronic products. The company has a labour based costing system that was introduced in the 1970s and is now considering implementing an activity based costing (ABC) system. Managers are concerned about how they should compare the ABC data with the existing costing system.

Selected data from the management accounts for the year ending 31st December 2000

Data for 3 products only

-Determine the total unit cost for product B using the activity based data

A)£21.72

B)£41.67

C)£25.00

D)£44.37

Selected data from the management accounts for the year ending 31st December 2000

Data for 3 products only

-Determine the total unit cost for product B using the activity based data

A)£21.72

B)£41.67

C)£25.00

D)£44.37

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

7

Bristol Electronics produces wide range of electronic products. The company has a labour based costing system that was introduced in the 1970s and is now considering implementing an activity based costing (ABC) system. Managers are concerned about how they should compare the ABC data with the existing costing system.

Selected data from the management accounts for the year ending 31st December 2000

Data for 3 products only

-Determine the total overhead cost for product C using the using the activity based data

A)£44,667

B)£58,600

C)£6,890

D)£59,133

Selected data from the management accounts for the year ending 31st December 2000

Data for 3 products only

-Determine the total overhead cost for product C using the using the activity based data

A)£44,667

B)£58,600

C)£6,890

D)£59,133

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

8

An action analysis report reconciles activity-based costing product costs with traditional product costs based on direct labour

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

9

Bristol Electronics produces wide range of electronic products. The company has a labour based costing system that was introduced in the 1970s and is now considering implementing an activity based costing (ABC) system. Managers are concerned about how they should compare the ABC data with the existing costing system.

Selected data from the management accounts for the year ending 31st December 2000

Data for 3 products only

- Determine the total unit cost for product C using the number of hours to apply overhead

A)£20.33

B)£8.33

C)£16.67

D)£21.67

Selected data from the management accounts for the year ending 31st December 2000

Data for 3 products only

- Determine the total unit cost for product C using the number of hours to apply overhead

A)£20.33

B)£8.33

C)£16.67

D)£21.67

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

10

Bristol Electronics produces wide range of electronic products. The company has a labour based costing system that was introduced in the 1970s and is now considering implementing an activity based costing (ABC) system. Managers are concerned about how they should compare the ABC data with the existing costing system.

Selected data from the management accounts for the year ending 31st December 2000

Data for 3 products only

-Determine the total unit cost for product B using the number of hours to apply overhead

A)£20.00

B)£46.00

C)£25.00

D)£21.67

Selected data from the management accounts for the year ending 31st December 2000

Data for 3 products only

-Determine the total unit cost for product B using the number of hours to apply overhead

A)£20.00

B)£46.00

C)£25.00

D)£21.67

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

11

Leeds Catering uses activity-based costing for its overhead costs. The company has provided the following data concerning the activity rates in its activity-based costing system:

The number of meals served is the measure of activity for the Preparing Meals activity cost pool. The number of functions catered is used as the activity measure for the Arranging Functions activity cost pool.

Management would like to know whether the company made any money on a recent function at which 90 meals were served. The company catered the function for a fixed price of £25.00 per meal. The cost of the raw ingredients for the meals was £13.90 per meal. This cost is in addition to the costs of wages, supplies, and other expenses detailed above.

For the purposes of preparing action analyses, management has assigned ease of adjustment codes to the costs as follows: wages are classified as a Yellow cost; supplies and raw ingredients as a Green cost; and other expenses as a Red cost. Suppose an action analysis report is prepared for the function mentioned above.

- What would be the 'yellow margin' in the action analysis report? (Round to the nearest whole pound.)

A)£421

B)£601

C)£496

D)£546

The number of meals served is the measure of activity for the Preparing Meals activity cost pool. The number of functions catered is used as the activity measure for the Arranging Functions activity cost pool.

Management would like to know whether the company made any money on a recent function at which 90 meals were served. The company catered the function for a fixed price of £25.00 per meal. The cost of the raw ingredients for the meals was £13.90 per meal. This cost is in addition to the costs of wages, supplies, and other expenses detailed above.

For the purposes of preparing action analyses, management has assigned ease of adjustment codes to the costs as follows: wages are classified as a Yellow cost; supplies and raw ingredients as a Green cost; and other expenses as a Red cost. Suppose an action analysis report is prepared for the function mentioned above.

- What would be the 'yellow margin' in the action analysis report? (Round to the nearest whole pound.)

A)£421

B)£601

C)£496

D)£546

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

12

Bristol Electronics produces wide range of electronic products. The company has a labour based costing system that was introduced in the 1970s and is now considering implementing an activity based costing (ABC) system. Managers are concerned about how they should compare the ABC data with the existing costing system.

Selected data from the management accounts for the year ending 31st December 2000

Data for 3 products only

-Determine the total overhead cost for product A using the using the activity based data

A)£9,133

B)£20,000

C)£21,667

D)£21,000

Selected data from the management accounts for the year ending 31st December 2000

Data for 3 products only

-Determine the total overhead cost for product A using the using the activity based data

A)£9,133

B)£20,000

C)£21,667

D)£21,000

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

13

Bristol Electronics produces wide range of electronic products. The company has a labour based costing system that was introduced in the 1970s and is now considering implementing an activity based costing (ABC) system. Managers are concerned about how they should compare the ABC data with the existing costing system.

Selected data from the management accounts for the year ending 31st December 2000

Data for 3 products only

-Determine the total overhead cost for product A using the number of hours to apply overhead

A)£16,667

B)£50,000

C)£21,667

D)£21,000

Selected data from the management accounts for the year ending 31st December 2000

Data for 3 products only

-Determine the total overhead cost for product A using the number of hours to apply overhead

A)£16,667

B)£50,000

C)£21,667

D)£21,000

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

14

Bristol Electronics produces wide range of electronic products. The company has a labour based costing system that was introduced in the 1970s and is now considering implementing an activity based costing (ABC) system. Managers are concerned about how they should compare the ABC data with the existing costing system.

Selected data from the management accounts for the year ending 31st December 2000

Data for 3 products only

- Determine the total unit cost for product A using the activity based data

A)£31.00

B)£46.45

C)£16.13

D)£24.13

Selected data from the management accounts for the year ending 31st December 2000

Data for 3 products only

- Determine the total unit cost for product A using the activity based data

A)£31.00

B)£46.45

C)£16.13

D)£24.13

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

15

Leeds Catering uses activity-based costing for its overhead costs. The company has provided the following data concerning the activity rates in its activity-based costing system:

The number of meals served is the measure of activity for the Preparing Meals activity cost pool. The number of functions catered is used as the activity measure for the Arranging Functions activity cost pool.

Management would like to know whether the company made any money on a recent function at which 90 meals were served. The company catered the function for a fixed price of £25.00 per meal. The cost of the raw ingredients for the meals was £13.90 per meal. This cost is in addition to the costs of wages, supplies, and other expenses detailed above.

For the purposes of preparing action analyses, management has assigned ease of adjustment codes to the costs as follows: wages are classified as a Yellow cost; supplies and raw ingredients as a Green cost; and other expenses as a Red cost. Suppose an action analysis report is prepared for the function mentioned above.

-. What would be the 'red margin' in the action analysis report? (Round to the nearest whole pound.)

A)£263

B)£113

C)£163

D)£413

The number of meals served is the measure of activity for the Preparing Meals activity cost pool. The number of functions catered is used as the activity measure for the Arranging Functions activity cost pool.

Management would like to know whether the company made any money on a recent function at which 90 meals were served. The company catered the function for a fixed price of £25.00 per meal. The cost of the raw ingredients for the meals was £13.90 per meal. This cost is in addition to the costs of wages, supplies, and other expenses detailed above.

For the purposes of preparing action analyses, management has assigned ease of adjustment codes to the costs as follows: wages are classified as a Yellow cost; supplies and raw ingredients as a Green cost; and other expenses as a Red cost. Suppose an action analysis report is prepared for the function mentioned above.

-. What would be the 'red margin' in the action analysis report? (Round to the nearest whole pound.)

A)£263

B)£113

C)£163

D)£413

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

16

Property taxes and insurance is an example of a cost that would be considered to be

A)Unit-level.

B)Batch-level.

C)Product-level.

D)Organisation-sustaining.

A)Unit-level.

B)Batch-level.

C)Product-level.

D)Organisation-sustaining.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

17

Matt Company uses activity-based costing. The company has two products: A andB. The annual production and sales of Product A is 8,000 units and of Product B is 6,000 units. There are three activity cost pools, with estimated total cost and expected activity as follows:

The cost per unit of Product A under activity-based costing is closest to

A)£2.40.

B)£3.90.

C)£10.59.

D)£6.60.

The cost per unit of Product A under activity-based costing is closest to

A)£2.40.

B)£3.90.

C)£10.59.

D)£6.60.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

18

Bristol Electronics produces wide range of electronic products. The company has a labour based costing system that was introduced in the 1970s and is now considering implementing an activity based costing (ABC) system. Managers are concerned about how they should compare the ABC data with the existing costing system.

Selected data from the management accounts for the year ending 31st December 2000

Data for 3 products only

- Determine the total unit cost for product C using the activity based data

A)£23.72

B)£21.33

C)£46.67

D)£21.67

Selected data from the management accounts for the year ending 31st December 2000

Data for 3 products only

- Determine the total unit cost for product C using the activity based data

A)£23.72

B)£21.33

C)£46.67

D)£21.67

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

19

Managing and sustaining product diversity requires many more overhead resources such as production schedulers and product design engineers than managing and sustaining a single product. The costs of these resources can be accurately allocated to products on the basis of direct labour-hours

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

20

Leeds Catering uses activity-based costing for its overhead costs. The company has provided the following data concerning the activity rates in its activity-based costing system:

The number of meals served is the measure of activity for the Preparing Meals activity cost pool. The number of functions catered is used as the activity measure for the Arranging Functions activity cost pool.

Management would like to know whether the company made any money on a recent function at which 90 meals were served. The company catered the function for a fixed price of £25.00 per meal. The cost of the raw ingredients for the meals was £13.90 per meal. This cost is in addition to the costs of wages, supplies, and other expenses detailed above.

For the purposes of preparing action analyses, management has assigned ease of adjustment codes to the costs as follows: wages are classified as a Yellow cost; supplies and raw ingredients as a Green cost; and other expenses as a Red cost. Suppose an action analysis report is prepared for the function mentioned above.

-According to the activity-based costing system, what was the total cost (including the costs of raw ingredients) of the function mentioned above? (Round to the nearest whole pound.)

A)£1,487

B)£1,337

C)£2,187

D)£1,987

The number of meals served is the measure of activity for the Preparing Meals activity cost pool. The number of functions catered is used as the activity measure for the Arranging Functions activity cost pool.

Management would like to know whether the company made any money on a recent function at which 90 meals were served. The company catered the function for a fixed price of £25.00 per meal. The cost of the raw ingredients for the meals was £13.90 per meal. This cost is in addition to the costs of wages, supplies, and other expenses detailed above.

For the purposes of preparing action analyses, management has assigned ease of adjustment codes to the costs as follows: wages are classified as a Yellow cost; supplies and raw ingredients as a Green cost; and other expenses as a Red cost. Suppose an action analysis report is prepared for the function mentioned above.

-According to the activity-based costing system, what was the total cost (including the costs of raw ingredients) of the function mentioned above? (Round to the nearest whole pound.)

A)£1,487

B)£1,337

C)£2,187

D)£1,987

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

21

When combining activities in an activity-based costing system, batch-level activities should be combined with unit-level activities whenever possible

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

22

If a cost object such as a product or customer has a positive green margin, then

A)its yellow margin will be positive.

B)its yellow margin may be either positive, negative, or zero.

C)its yellow margin will be negative.

D)its yellow margin will be zero.

A)its yellow margin will be positive.

B)its yellow margin may be either positive, negative, or zero.

C)its yellow margin will be negative.

D)its yellow margin will be zero.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

23

Paul Company has two products: A andB. The company uses activity-based costing. The estimated total cost and expected activity for each of the company's three activity cost pools are as follows:

The activity rate under the activity-based costing system for Activity 3 is closest to

A)£70.45.

B)£28.87.

C)£19.47.

D)£58.40.

The activity rate under the activity-based costing system for Activity 3 is closest to

A)£70.45.

B)£28.87.

C)£19.47.

D)£58.40.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

24

Jennifer Company has two products: A andB. The company uses activity-based costing. The estimated total cost and expected activity for each of the company's three activity cost pools are as follows.

The activity rate under the activity-based costing system for Activity 3 is closest to

A)£36.24.

B)£38.44.

C)£84.56.

D)£115.33.

The activity rate under the activity-based costing system for Activity 3 is closest to

A)£36.24.

B)£38.44.

C)£84.56.

D)£115.33.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

25

Jasmine Company uses activity-based costing. The company has two products: A andB. The annual production and sales of Product A is 10,000 units and of Product B is 4,000 units. There are three activity cost pools, with estimated total cost and expected activity as follows:

The cost per unit of Product A under activity-based costing is closest to

A)£6.00.

B)£9.70.

C)£1.50.

D)£3.00.

The cost per unit of Product A under activity-based costing is closest to

A)£6.00.

B)£9.70.

C)£1.50.

D)£3.00.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

26

A transaction driver is

A)An event that causes a transaction to begin.

B)A measure of the amount of time required to perform an activity.

C)An event that causes a transaction to end.

D)A simple count of the number of times an activity occurs.

A)An event that causes a transaction to begin.

B)A measure of the amount of time required to perform an activity.

C)An event that causes a transaction to end.

D)A simple count of the number of times an activity occurs.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

27

Anola Company has two products: A andB. The company uses activity-based costing. The estimated total cost and expected activity for each of the company's three activity cost pools are as follows:

The activity rate under the activity-based costing system for Activity 3 is closest to

A)£30.00.

B)£30.50.

C)£90.00.

D)£67.78.

The activity rate under the activity-based costing system for Activity 3 is closest to

A)£30.00.

B)£30.50.

C)£90.00.

D)£67.78.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

28

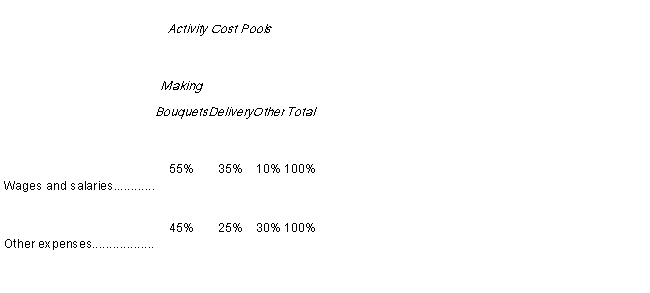

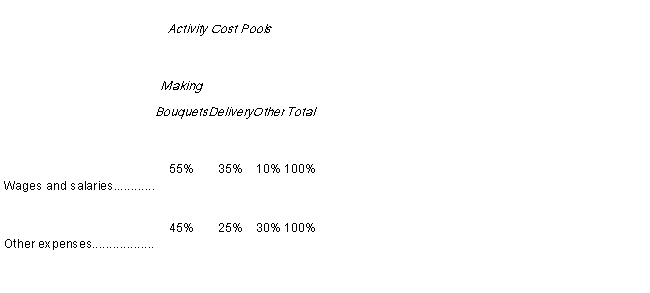

Forrest Florist specialises in large floral bouquets for hotels and other commercial spaces. The company has provided the following data concerning its annual overhead costs and its activity based costing system:

Overhead costs:

Distribution of resource consumption:

The 'Other' activity cost pool consists of the costs of idle capacity and organisation-sustaining costs.

The amount of activity for the year is as follows:

- What would be the total overhead cost per bouquet according to the activity based costing system? In other words, what would be the overall activity rate for the making bouquets activity cost pool? (Round your answer to the nearest whole pence.)

A)£2.75

B)£2.83

C)£3.03

D)£2.48

Overhead costs:

Distribution of resource consumption:

The 'Other' activity cost pool consists of the costs of idle capacity and organisation-sustaining costs.

The amount of activity for the year is as follows:

- What would be the total overhead cost per bouquet according to the activity based costing system? In other words, what would be the overall activity rate for the making bouquets activity cost pool? (Round your answer to the nearest whole pence.)

A)£2.75

B)£2.83

C)£3.03

D)£2.48

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

29

Customer-level activities relate to specific customers and are not tied to any specific products

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

30

Costs classified as batch-level costs should depend on the number of batches processed rather than on the number of units produced, the number of units sold, or other measures of volume

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

31

An activity-based costing system that is designed for internal decision-making will not conform to generally accepted accounting principles because:

A)some manufacturing costs (i.e., the costs of idle capacity and organisation-sustaining costs) will not be assigned to products

B)some non-manufacturing costs are assigned to products.

C)first-stage allocations may be based on subjective interview data.

D)all of the above are reasons why an activity-based costing system that is designed for internal decision-making will not conform to generally accepted accounting principles.

A)some manufacturing costs (i.e., the costs of idle capacity and organisation-sustaining costs) will not be assigned to products

B)some non-manufacturing costs are assigned to products.

C)first-stage allocations may be based on subjective interview data.

D)all of the above are reasons why an activity-based costing system that is designed for internal decision-making will not conform to generally accepted accounting principles.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

32

In activity-based costing, activity (i.e., overhead) rates must be computed on the basis of the budgeted or the expected activity of the period

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

33

Angel Corporation uses activity-based costing to determine product costs for external financial reports. The company has provided the following data concerning its activity-based costing system:

The activity rate for the batch setup activity cost pool is closest to:

A)£48.40

B)£38.70

C)£74.30

D)£193.50

The activity rate for the batch setup activity cost pool is closest to:

A)£48.40

B)£38.70

C)£74.30

D)£193.50

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

34

Angel Corporation uses activity-based costing to determine product costs for external financial reports. The company has provided the following data concerning its activity-based costing system:

Assuming that actual activity turns out to be the same as expected activity, the total amount of overhead cost allocated to Product X would be closest to:

A)£371,700

B)£387,000

C)£268,300

D)£149,000

Assuming that actual activity turns out to be the same as expected activity, the total amount of overhead cost allocated to Product X would be closest to:

A)£371,700

B)£387,000

C)£268,300

D)£149,000

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

35

In activity-based costing, there are a number of activity cost pools, each of which is allocated to products and other costing objects using its own unique measure of activity

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

36

Vex Corporation manufactures a variety of products. In the past, Vex had been using a traditional overhead allocation system based on machine-hours. For the current year, Vex decided to switch to an activity-based costing system using machine-hours and the number of inspections as measures of activity. Information on these measures of activity and related overhead rates for the current year are as follows:

Job #812 for the current year required 15 machine-hours and 2 inspections. Would this job have been overcosted or undercosted under the traditional system and by how much?

A)Undercosted by £36

B)Undercosted by £44

C)Overcosted by £80

D)Undercosted by £80

Job #812 for the current year required 15 machine-hours and 2 inspections. Would this job have been overcosted or undercosted under the traditional system and by how much?

A)Undercosted by £36

B)Undercosted by £44

C)Overcosted by £80

D)Undercosted by £80

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following statements concerning ease of adjustment codes is incorrect

A)'Green' costs adjust automatically to changes in activity.

B)'Yellow' costs could be adjusted to changes in activity, but such adjustments require management action; the adjustment is not automatic.

C)'Red' costs cannot be adjusted to changes in activity.

D)The costs of idle capacity and organisation-sustaining costs are not assigned codes.

A)'Green' costs adjust automatically to changes in activity.

B)'Yellow' costs could be adjusted to changes in activity, but such adjustments require management action; the adjustment is not automatic.

C)'Red' costs cannot be adjusted to changes in activity.

D)The costs of idle capacity and organisation-sustaining costs are not assigned codes.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

38

If a cost object such as a product or customer has a negative red margin, then

A)its yellow margin will be positive.

B)its yellow margin may be positive, negative, or zero.

C)its yellow margin will be negative.

D)its yellow margin will be zero.

A)its yellow margin will be positive.

B)its yellow margin may be positive, negative, or zero.

C)its yellow margin will be negative.

D)its yellow margin will be zero.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

39

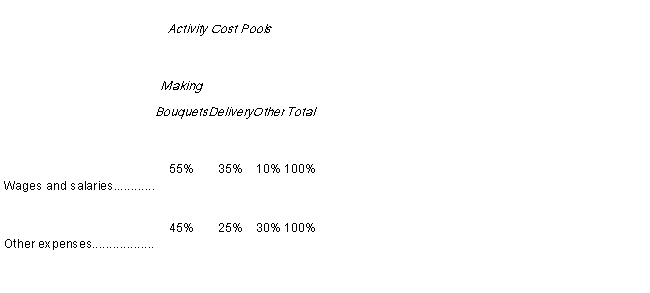

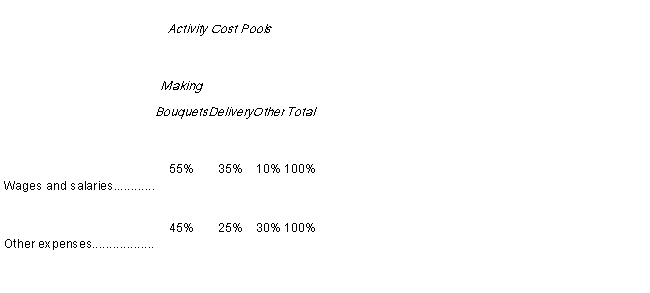

Forrest Florist specialises in large floral bouquets for hotels and other commercial spaces. The company has provided the following data concerning its annual overhead costs and its activity based costing system:

Overhead costs:

Distribution of resource consumption:

The 'Other' activity cost pool consists of the costs of idle capacity and organisation-sustaining costs.

The amount of activity for the year is as follows:

- What would be the total overhead cost per delivery according to the activity based costing system? In other words, what would be the overall activity rate for the deliveries activity cost pool? (Round your answer to the nearest whole pence).

A)£27.50

B)£38.50

C)£33.00

D)£34.50

Overhead costs:

Distribution of resource consumption:

The 'Other' activity cost pool consists of the costs of idle capacity and organisation-sustaining costs.

The amount of activity for the year is as follows:

- What would be the total overhead cost per delivery according to the activity based costing system? In other words, what would be the overall activity rate for the deliveries activity cost pool? (Round your answer to the nearest whole pence).

A)£27.50

B)£38.50

C)£33.00

D)£34.50

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

40

Bridget Company uses activity-based costing. The company has two products: A andB. The annual production and sales of Product A is 2,000 units and of Product B is 3,000 units. There are three activity cost pools, with estimated total cost and expected activity as follows.

The cost per unit of Product A under activity-based costing is closest to

A)£6.00.

B)£9.60.

C)£8.63.

D)£13.80.

The cost per unit of Product A under activity-based costing is closest to

A)£6.00.

B)£9.60.

C)£8.63.

D)£13.80.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

41

A duration driver is

A)A simple count of the number of times an activity occurs.

B)An activity measure that is used for the life of the company.

C)A measure of the amount of time required to perform an activity.

D)An activity measure that is used for the life of an activity-based costing system.

A)A simple count of the number of times an activity occurs.

B)An activity measure that is used for the life of the company.

C)A measure of the amount of time required to perform an activity.

D)An activity measure that is used for the life of an activity-based costing system.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

42

The practice of assigning the costs of idle capacity to products can result in unstable unit product costs

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

43

Reach Consulting Corporation has its headquarters in Chicago and operates from three branch offices in Portland, Dallas, and Miami. Reach's headquarter activities are assigned to two activity cost pools: General Service and Research Service. These costs are then allocated to the three branch offices. Information for next year related to this activity-based costing system is as follows:

Estimated branch data for next year is as follows:

How much of the headquarters cost allocation should Dallas expect to receive next year

A)£280,000

B)£409,500

C)£472,500

D)£504,000

Estimated branch data for next year is as follows:

How much of the headquarters cost allocation should Dallas expect to receive next year

A)£280,000

B)£409,500

C)£472,500

D)£504,000

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

44

Lindsey Company uses activity-based costing. The company has two products: A andB. The annual production and sales of Product A is 5,000 units and of Product B is 2,000 units. There are three activity cost pools, with estimated total cost and expected activity as follows:

The cost per unit of Product A under activity-based costing is closest to

A)£14.11.

B)£13.77.

C)£7.00.

D)£17.70.

The cost per unit of Product A under activity-based costing is closest to

A)£14.11.

B)£13.77.

C)£7.00.

D)£17.70.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

45

Nick Company has two products: A andB. The company uses activity-based costing. The estimated total cost and expected activity for each of the company's three activity cost pools are as follows:

The activity rate under the activity-based costing system for Activity 3 is closest to

A)£525.00.

B)£44.65.

C)£105.00.

D)£205.00.

The activity rate under the activity-based costing system for Activity 3 is closest to

A)£525.00.

B)£44.65.

C)£105.00.

D)£205.00.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

46

In activity-based costing, some manufacturing costs may be excluded from product costs.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

47

An activity-based costing system should include all of the activities carried out in an organisation because any simplification will inevitably result in inaccuracy

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

48

Activity-based costing is a costing method that is designed to provide managers with product cost information for external financial reports

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

49

Designing a new product is an example of a

A)Unit-level activity.

B)Batch-level activity.

C)Product-level activity.

D)Organisation-sustaining activity.

A)Unit-level activity.

B)Batch-level activity.

C)Product-level activity.

D)Organisation-sustaining activity.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

50

The costs of a particular department should not be split up among activity cost pools in an activity-based costing system.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

51

Transaction drivers usually take more effort to record than duration drivers

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

52

In general, duration drivers are more accurate measures of the consumption of resources than transaction drivers

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

53

Khalika Company has two products: A andB. The company uses activity-based costing. The estimated total cost and expected activity for each of the company's three activity cost pools are as follows:

The activity rate under the activity-based costing system for Activity 3 is closest to

A)£31.18.

B)£25.21.

C)£57.17.

D)£66.45.

The activity rate under the activity-based costing system for Activity 3 is closest to

A)£31.18.

B)£25.21.

C)£57.17.

D)£66.45.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

54

If a cost object such as a product or customer has a negative green margin, then

A)its yellow margin will be positive.

B)its yellow margin may be either positive or negative.

C)its yellow margin will be negative.

D)its yellow margin will be zero.

A)its yellow margin will be positive.

B)its yellow margin may be either positive or negative.

C)its yellow margin will be negative.

D)its yellow margin will be zero.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following activities would be classified as a batch-level activity in the Lindsey Company

A)Setting up equipment.

B)Designing a new product.

C)Training employees.

D)Milling a part required for the final product.

A)Setting up equipment.

B)Designing a new product.

C)Training employees.

D)Milling a part required for the final product.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

56

Selena Company has two products: A andB. The company uses activity-based costing. The estimated total cost and expected activity for each of the company's three activity cost pools are as follows:

The activity rate under the activity-based costing system for Activity 3 is closest to

A)£46.33.

B)£21.67.

C)£65.00.

D)£18.53.

The activity rate under the activity-based costing system for Activity 3 is closest to

A)£46.33.

B)£21.67.

C)£65.00.

D)£18.53.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

57

Annika Company uses activity-based costing. The company has two products: A andB. The annual production and sales of Product A is 4,000 units and of Product B is 1,000 units. There are three activity cost pools, with estimated total cost and expected activity as follows:

The cost per unit of Product A under activity-based costing is closest to

A)£20.40.

B)£10.00.

C)£18.15.

D)£17.00.

The cost per unit of Product A under activity-based costing is closest to

A)£20.40.

B)£10.00.

C)£18.15.

D)£17.00.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

58

Purchase order processing is an example of a

A)Unit-level activity.

B)Batch-level activity.

C)Product-level activity.

D)Organisation-sustaining activity.

A)Unit-level activity.

B)Batch-level activity.

C)Product-level activity.

D)Organisation-sustaining activity.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following is not a limitation of activity-based costing

A) Maintaining an activity-based costing system is more costly than maintaining a traditional direct labour-based costing system.

B) Changing from a traditional direct labour-based costing system to an activity-based costing system changes product margins and other key performance indicators used by managers. Such changes are often resisted by managers.

C) In practice, most managers insist on fully allocating all costs to products, customers, and other costing objects in an activity-based costing system. This results in overstated costs.

D) More accurate product costs may result in increasing the selling prices of some products.

A) Maintaining an activity-based costing system is more costly than maintaining a traditional direct labour-based costing system.

B) Changing from a traditional direct labour-based costing system to an activity-based costing system changes product margins and other key performance indicators used by managers. Such changes are often resisted by managers.

C) In practice, most managers insist on fully allocating all costs to products, customers, and other costing objects in an activity-based costing system. This results in overstated costs.

D) More accurate product costs may result in increasing the selling prices of some products.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

60

If a cost object such as a product or customer has a positive red margin, then

A)its green margin will be positive.

B)its green margin may be positive, negative, or zero.

C)its green margin will be negative.

D)its green margin will be zero.

A)its green margin will be positive.

B)its green margin may be positive, negative, or zero.

C)its green margin will be negative.

D)its green margin will be zero.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

61

ABC always gives you a very accurate product cost. Discuss.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

62

Write an explanation in your own words to John Tower of Classic Brass Ltd (p278/9 of Ch 8) at to why they are losing tehri high volume business.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

63

ABC is mainly limited to cost cutting exercises. Discuss.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

64

Compare and contrast ABC and traditional Absorption Costing methods . Is ABC always the right answer? Explain.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

65

Outline the advantages and disadvantages of using the simplified ABC approach.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

66

Distinguish between unit, batch, product and customer level activities.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

67

Explain why ABC is particularly useful for service companies.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck