Deck 5: Planning Budgeting and Behaviour

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/70

Play

Full screen (f)

Deck 5: Planning Budgeting and Behaviour

1

European International has 3 separate business units in the following countries. Data for each of the business units is given below:

-If the business unit in Spain expects to produce and sell 2,000 units next month, the total expected manufacturing cost would be

A)£39,000.

B)£39,500.

C)£40,500.

D)£38,750.

-If the business unit in Spain expects to produce and sell 2,000 units next month, the total expected manufacturing cost would be

A)£39,000.

B)£39,500.

C)£40,500.

D)£38,750.

£39,500.

2

European International has 3 separate business units in the following countries. Data for each of the business units is given below:

-If the business unit in France plans to produce and sell 4,000 units next month, the expected gross margin would be

A)£41,000.

B)£37,000.

C)£68,000.

D)£57,500.

-If the business unit in France plans to produce and sell 4,000 units next month, the expected gross margin would be

A)£41,000.

B)£37,000.

C)£68,000.

D)£57,500.

£68,000.

3

European International has 3 separate business units in the following countries. Data for each of the business units is given below:

-

For planning, control, and decision-making purposes

A)fixed costs should be converted to a per unit basis.

B)discretionary fixed costs should be eliminated.

C)variable costs should be ignored.

D)mixed costs should be separated into their variable and fixed components.

-

For planning, control, and decision-making purposes

A)fixed costs should be converted to a per unit basis.

B)discretionary fixed costs should be eliminated.

C)variable costs should be ignored.

D)mixed costs should be separated into their variable and fixed components.

mixed costs should be separated into their variable and fixed components.

4

Contribution margin is defined as sales less discretionary fixed costs

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

5

European International has 3 separate business units in the following countries. Data for each of the business units is given below:

-

If the business unit in Spain plans to produce and sell 4,000 units next month, the expected gross margin would be

A)£71,000.

B)£77,000.

C)£78,000.

D)£76,500.

-

If the business unit in Spain plans to produce and sell 4,000 units next month, the expected gross margin would be

A)£71,000.

B)£77,000.

C)£78,000.

D)£76,500.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

6

European International has 3 separate business units in the following countries. Data for each of the business units is given below:

-If the business unit in France expects to produce and sell 5,000 units next month, the expected net operating income would be

A)£51,250.

B)£42,750.

C)£71,000.

D)£62,500.

-If the business unit in France expects to produce and sell 5,000 units next month, the expected net operating income would be

A)£51,250.

B)£42,750.

C)£71,000.

D)£62,500.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

7

When more than one factor causes variations in the variable element of a mixed cost, multiple regression analysis should be used.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

8

In describing the cost equation, Y = a + bX, 'a' is

A)the dependent variable, cost.

B)the independent variable, the level of activity.

C)the total fixed costs.

D)the variable cost per unit of activity.

A)the dependent variable, cost.

B)the independent variable, the level of activity.

C)the total fixed costs.

D)the variable cost per unit of activity.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

9

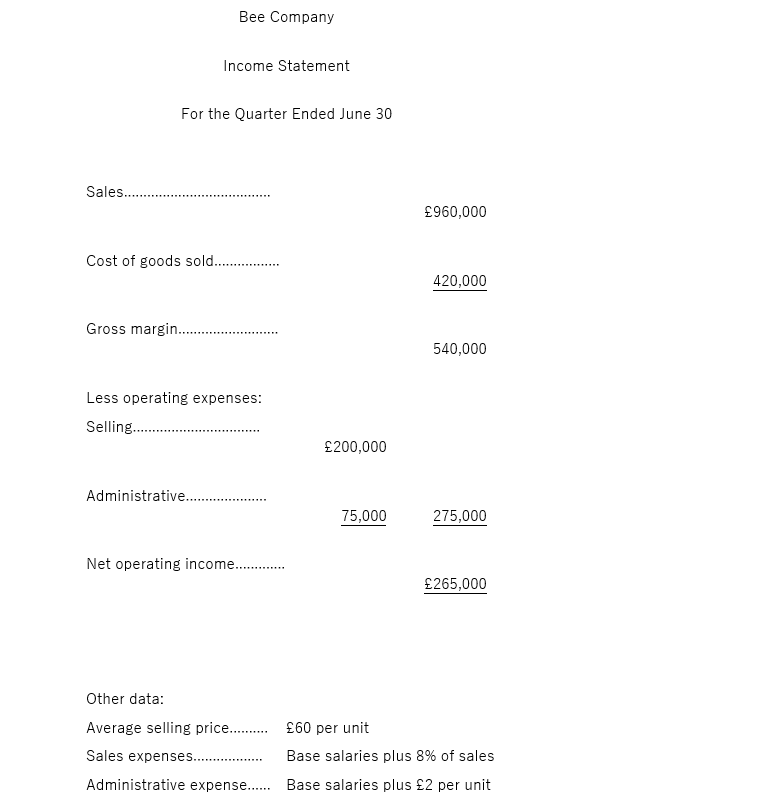

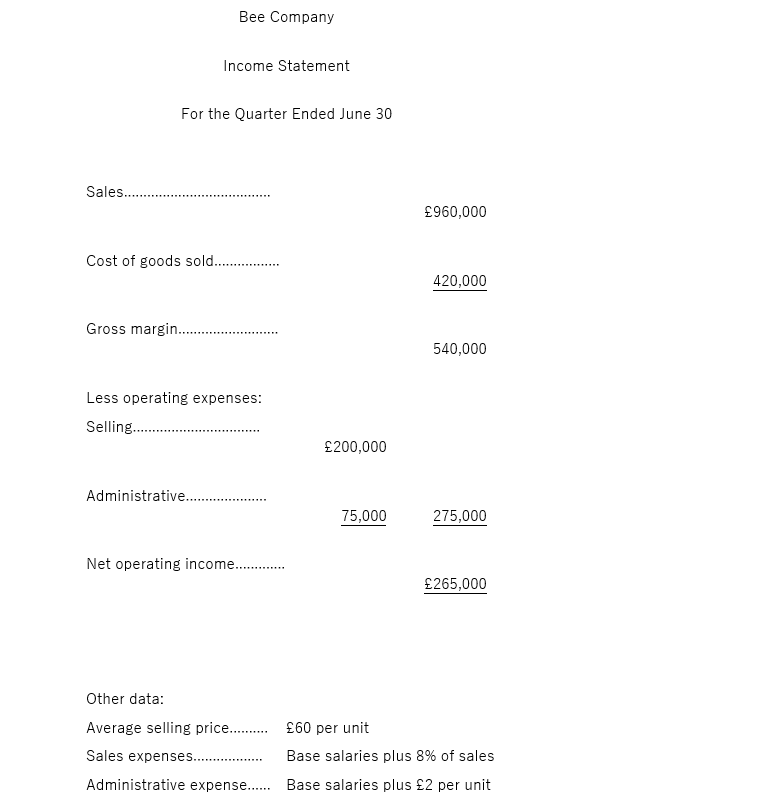

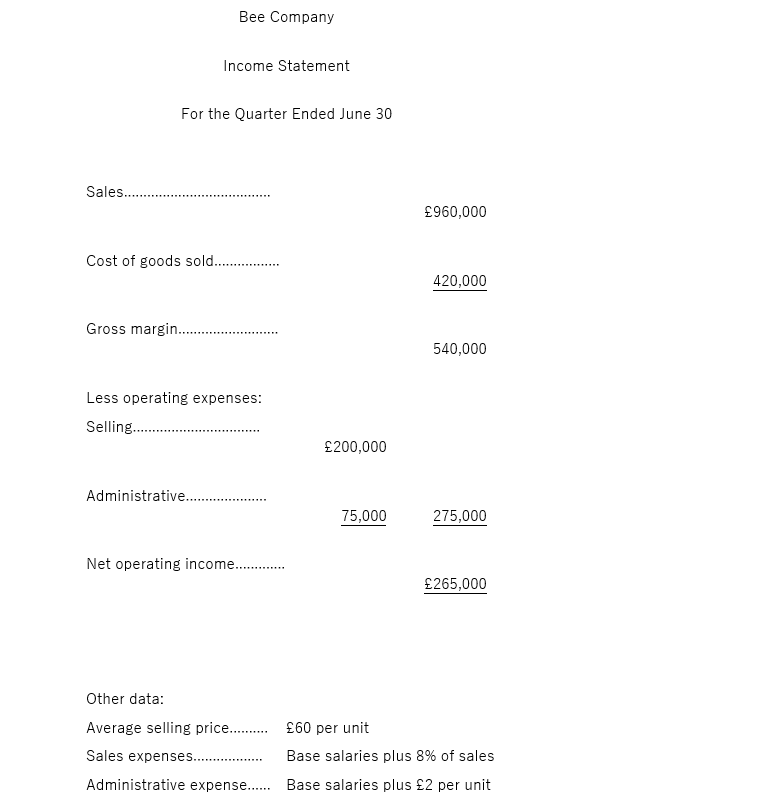

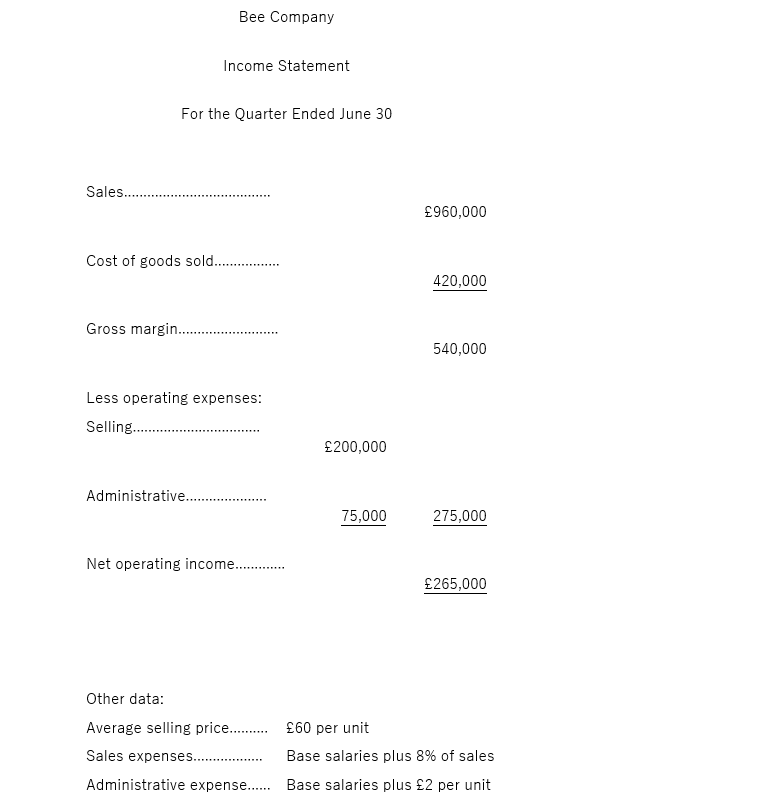

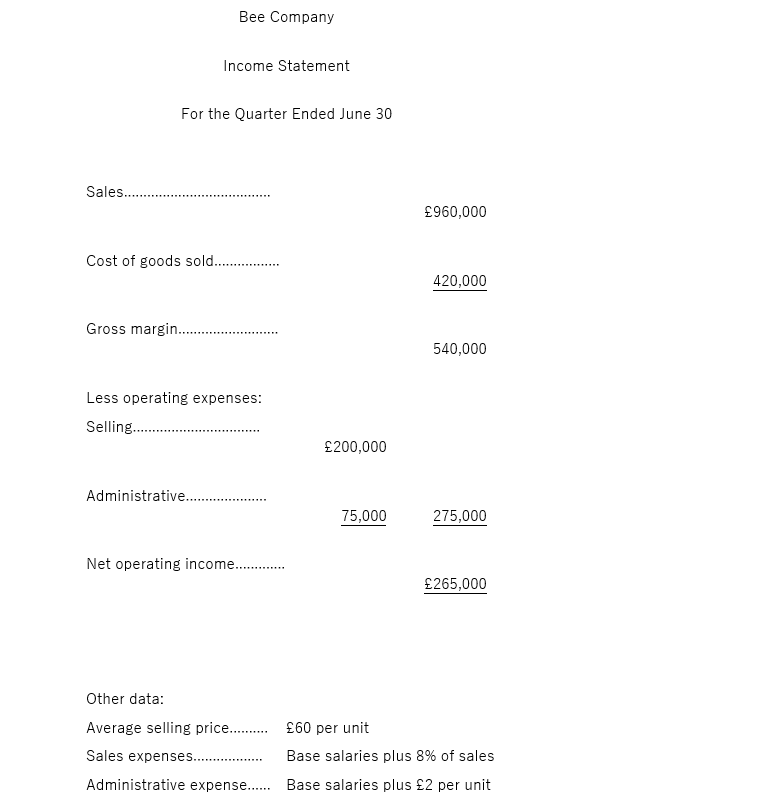

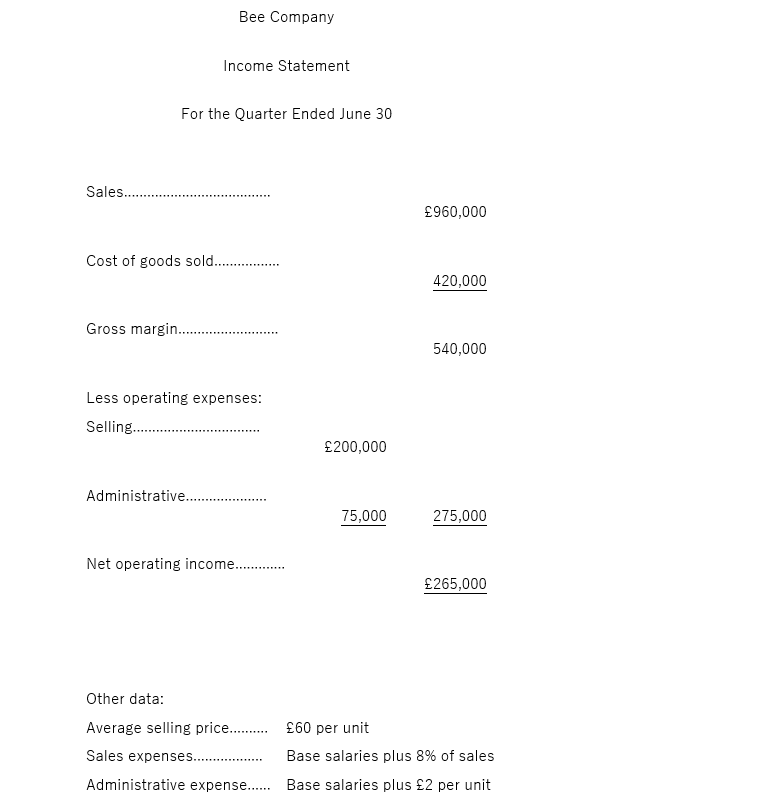

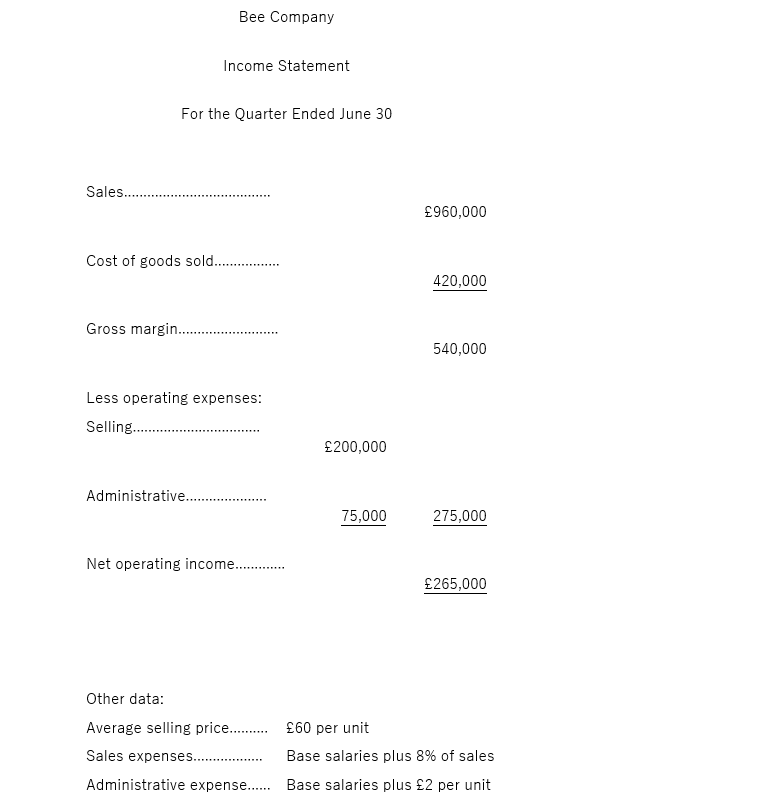

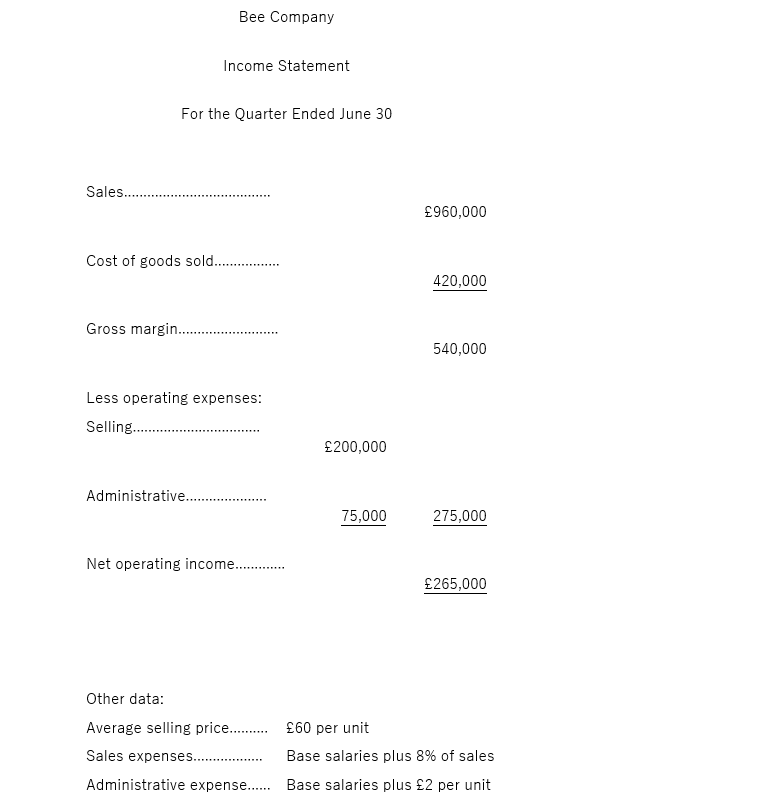

Bee Company is a honey wholesaler. An income statement and other data for the second quarter of the year are given below:

-If 24,000 units are sold during the third quarter and this activity is within the relevant range, Bee Company's expected contribution margin would be

A)£646,800.

B)£762,000.

C)£810,000.

D)£760,080.

-If 24,000 units are sold during the third quarter and this activity is within the relevant range, Bee Company's expected contribution margin would be

A)£646,800.

B)£762,000.

C)£810,000.

D)£760,080.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

10

Bee Company is a honey wholesaler. An income statement and other data for the second quarter of the year are given below:

-Bee Company's contribution margin for the second quarter is

A)£463,200.

B)£540,000.

C)£851,200.

D)£431,200.

-Bee Company's contribution margin for the second quarter is

A)£463,200.

B)£540,000.

C)£851,200.

D)£431,200.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

11

European International has 3 separate business units in the following countries. Data for each of the business units is given below:

-If the business unit in Italy expects to produce and sell 2,000 units next month, the total expected manufacturing cost would be

A)£44,000.

B)£49,000.

C)£45,500.

D)£45,000.

-If the business unit in Italy expects to produce and sell 2,000 units next month, the total expected manufacturing cost would be

A)£44,000.

B)£49,000.

C)£45,500.

D)£45,000.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

12

European International has 3 separate business units in the following countries. Data for each of the business units is given below:

-If the business unit in Spain expects to produce and sell 5,000 units next month, the expected net operating income would be

A)£41,250.

B)£48,700.

C)£45,700.

D)£42,500.

-If the business unit in Spain expects to produce and sell 5,000 units next month, the expected net operating income would be

A)£41,250.

B)£48,700.

C)£45,700.

D)£42,500.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

13

European International has 3 separate business units in the following countries. Data for each of the business units is given below:

-

If the business unit in Spain plans to produce sell 3,000 units next month, the expected contribution margin would be

A)£33,060.

B)£34,250.

C)£29,750.

D)£96,500.

-

If the business unit in Spain plans to produce sell 3,000 units next month, the expected contribution margin would be

A)£33,060.

B)£34,250.

C)£29,750.

D)£96,500.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

14

European International has 3 separate business units in the following countries. Data for each of the business units is given below:

-If the business unit in France expects to produce and sell 2,000 units next month, the total expected manufacturing cost would be

A)£34,000.

B)£39,000.

C)£45,500.

D)£38,000.

-If the business unit in France expects to produce and sell 2,000 units next month, the total expected manufacturing cost would be

A)£34,000.

B)£39,000.

C)£45,500.

D)£38,000.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

15

Bee Company is a honey wholesaler. An income statement and other data for the second quarter of the year are given below:

-Bee Company's net operating income for the second quarter using the contribution approach is

A)£156,200.

B)£685,000.

C)£431,200.

D)£265,000.

-Bee Company's net operating income for the second quarter using the contribution approach is

A)£156,200.

B)£685,000.

C)£431,200.

D)£265,000.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

16

European International has 3 separate business units in the following countries. Data for each of the business units is given below:

-

If the business unit in Italy plans to produce sell 3,000 units next month, the expected contribution margin would be

A)£34,750.

B)£30,300.

C)£26,500.

D)£56,250.

-

If the business unit in Italy plans to produce sell 3,000 units next month, the expected contribution margin would be

A)£34,750.

B)£30,300.

C)£26,500.

D)£56,250.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

17

The term 'relevant range' refers to the levels of activity within which the assumptions relative to cost behavior are valid.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

18

European International has 3 separate business units in the following countries. Data for each of the business units is given below:

-If the business unit in Italy expects to produce and sell 5,000 units next month, the expected net operating income would be

A)£41,250.

B)£42,750.

C)£42,000.

D)£40,000.

-If the business unit in Italy expects to produce and sell 5,000 units next month, the expected net operating income would be

A)£41,250.

B)£42,750.

C)£42,000.

D)£40,000.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

19

When the activity level is expected to decline within the relevant range, what effects would be anticipated with respect to each of the following?

A)Fixed cost per unit - INCREASE; Variable cost per unit - NO CHANGE

B)Fixed cost per unit - INCREASE; Variable cost per unit - INCREASE

C)Fixed cost per unit - NO CHANGE; Variable cost per unit - NO CHANGE

D)Fixed cost per unit - NO CHANGE; Variable cost per unit - INCREASE

A)Fixed cost per unit - INCREASE; Variable cost per unit - NO CHANGE

B)Fixed cost per unit - INCREASE; Variable cost per unit - INCREASE

C)Fixed cost per unit - NO CHANGE; Variable cost per unit - NO CHANGE

D)Fixed cost per unit - NO CHANGE; Variable cost per unit - INCREASE

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

20

Bee Company is a honey wholesaler. An income statement and other data for the second quarter of the year are given below:

-Bee Company's cost formula for total operating expenses, with 'X' equal to the number of units sold would be

A)Y = £123,200 + £4.80X.

B)Y = £123,200 + £6.80X.

C)Y = £275,000 + £4.80X.

D)Y = £166,200 + £6.80X.

-Bee Company's cost formula for total operating expenses, with 'X' equal to the number of units sold would be

A)Y = £123,200 + £4.80X.

B)Y = £123,200 + £6.80X.

C)Y = £275,000 + £4.80X.

D)Y = £166,200 + £6.80X.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

21

Marger, Inc., provided the following data for two recent months:

-Which of the following classifications best describes the behavior of Cost W?

A)Variable

B)Fixed

C)Mixed

D)None of the above

-Which of the following classifications best describes the behavior of Cost W?

A)Variable

B)Fixed

C)Mixed

D)None of the above

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

22

The planning horizon for a discretionary fixed cost usually encompasses many years.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

23

The Blaine Company is a highly automated manufacturer. At an activity level of 6,000 machine setups, total overhead costs equal £240,000. Of this amount, depreciation totals £80,000 (all fixed) and lubrication totals £72,000 (all variable). The remaining £88,000 of the total overhead cost consists of utility cost (mixed). At an activity level of 9,000 setups, utility cost totals £112,000.

Assume that the relevant range includes all of the activity levels mentioned in this problem.

-The variable cost per setup for utilities is most likely closest to

A)£ 8.00 per setup.

B)£12.44 per setup.

C)£ 4.00 per setup.

D)£14.66 per setup.

Assume that the relevant range includes all of the activity levels mentioned in this problem.

-The variable cost per setup for utilities is most likely closest to

A)£ 8.00 per setup.

B)£12.44 per setup.

C)£ 4.00 per setup.

D)£14.66 per setup.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

24

Within a relevant range, the amount of variable cost per unit

A)differs at each activity level.

B)remains constant at each activity level.

C)increases as activity increases.

D)decreases as activity increases.

A)differs at each activity level.

B)remains constant at each activity level.

C)increases as activity increases.

D)decreases as activity increases.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

25

Carr Company reports the following data for the first six months of the year: MachineElectrica

-

Using the least-squares regression method, the estimated monthly fixed component of the electrical cost is closest to

A)£5.

B)£20.

C)£6.

D)£10.

-

Using the least-squares regression method, the estimated monthly fixed component of the electrical cost is closest to

A)£5.

B)£20.

C)£6.

D)£10.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

26

The concept of the relevant range does not apply when dealing with step variable costs

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

27

An example of a committed fixed cost would be

A)taxes on real estate.

B)management development programs.

C)public relations.

D)advertising programs.

A)taxes on real estate.

B)management development programs.

C)public relations.

D)advertising programs.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

28

If the business unit in Italy plans to produce and sell 4,000 units next month, the expected gross margin would be

A)£81,000.

B)£83,000.

C)£68,750.

D)£87,000.

A)£81,000.

B)£83,000.

C)£68,750.

D)£87,000.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

29

The Blaine Company is a highly automated manufacturer. At an activity level of 6,000 machine setups, total overhead costs equal £240,000. Of this amount, depreciation totals £80,000 (all fixed) and lubrication totals £72,000 (all variable). The remaining £88,000 of the total overhead cost consists of utility cost (mixed). At an activity level of 9,000 setups, utility cost totals £112,000.

Assume that the relevant range includes all of the activity levels mentioned in this problem.

-

The total fixed overhead costs for Blaine Company are most likely closest to

A)£112,000.

B)£120,000.

C)£ 40,000.

D)£ 80,000.

Assume that the relevant range includes all of the activity levels mentioned in this problem.

-

The total fixed overhead costs for Blaine Company are most likely closest to

A)£112,000.

B)£120,000.

C)£ 40,000.

D)£ 80,000.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

30

The following data pertains to activity and maintenance costs for two recent years:

Using the high-low method, the cost formula for maintenance would be:

A)£1.50 per unit.

B)£1.25 per unit.

C)£3,000 plus £1.50 per unit.

D)£6,000 plus £0.75 per unit.

Using the high-low method, the cost formula for maintenance would be:

A)£1.50 per unit.

B)£1.25 per unit.

C)£3,000 plus £1.50 per unit.

D)£6,000 plus £0.75 per unit.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

31

Factory overhead is an example of a

A)mixed cost.

B)fixed cost.

C)variable cost.

D)irrelevant cost.

A)mixed cost.

B)fixed cost.

C)variable cost.

D)irrelevant cost.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

32

One difference between a step variable cost and a fixed cost is the width of the step

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

33

Carr Company reports the following data for the first six months of the year: MachineElectrica

-Using the least-squares regression method, the estimated variable electrical cost per machine hour is closest to

A)£0.91.

B)£0.10.

C)£0.20.

D)£0.25.

-Using the least-squares regression method, the estimated variable electrical cost per machine hour is closest to

A)£0.91.

B)£0.10.

C)£0.20.

D)£0.25.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

34

On an income statement prepared by the traditional approach, costs are organised and presented according to function.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

35

The Blaine Company is a highly automated manufacturer. At an activity level of 6,000 machine setups, total overhead costs equal £240,000. Of this amount, depreciation totals £80,000 (all fixed) and lubrication totals £72,000 (all variable). The remaining £88,000 of the total overhead cost consists of utility cost (mixed). At an activity level of 9,000 setups, utility cost totals £112,000.

Assume that the relevant range includes all of the activity levels mentioned in this problem.

-If 7,800 setups are projected for the next period, total expected overhead cost would be closest to

A)£156,000.

B)£236,000.

C)£214,400.

D)£276,000.

Assume that the relevant range includes all of the activity levels mentioned in this problem.

-If 7,800 setups are projected for the next period, total expected overhead cost would be closest to

A)£156,000.

B)£236,000.

C)£214,400.

D)£276,000.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

36

Marger, Inc., provided the following data for two recent months:

-

Which of the following classifications best describes the behavior of Cost U

A)Variable

B)Fixed

C)Mixed

D)None of the above

-

Which of the following classifications best describes the behavior of Cost U

A)Variable

B)Fixed

C)Mixed

D)None of the above

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following costs, if expressed on a per unit basis, would be expected to vary inversely with the level of production and sales?

A)Sales commissions.

B)Fixed manufacturing overhead.

C)Variable manufacturing overhead.

D)Direct materials.

A)Sales commissions.

B)Fixed manufacturing overhead.

C)Variable manufacturing overhead.

D)Direct materials.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

38

Marger, Inc., provided the following data for two recent months:

-Which of the following classifications best describes the behavior of Cost T?

A)Variable

B)Fixed

C)Mixed

D)None of the above

-Which of the following classifications best describes the behavior of Cost T?

A)Variable

B)Fixed

C)Mixed

D)None of the above

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

39

The relative proportion of variable, fixed, and mixed costs in a firm is known as the firm's

A)contribution margin.

B)cost structure.

C)product mix.

D)relevant range.

A)contribution margin.

B)cost structure.

C)product mix.

D)relevant range.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

40

Total production costs for Gallop, Inc. are budgeted at £230,000 for 50,000 units of budgeted output and at £280,000 for 60,000 units of budgeted output. Because of the need for additional facilities, budgeted fixed costs for 60,000 units are 25% more than budgeted fixed costs for 50,000 units. How much is Gallop's budgeted variable cost per unit of output

A)£1.60.

B)£1.67.

C)£3.00.

D)£5.00.

A)£1.60.

B)£1.67.

C)£3.00.

D)£5.00.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

41

Discretionary fixed costs

A)have a planning horizon that covers many years.

B)may be reduced for short periods of time with minimal damage to the long-run goals of the organisation.

C)cannot be reduced for even short periods of time without resulting in significant damage to the long-run goals of the organization.

D)are most effectively controlled through the effective utilization of facilities and organization.

A)have a planning horizon that covers many years.

B)may be reduced for short periods of time with minimal damage to the long-run goals of the organisation.

C)cannot be reduced for even short periods of time without resulting in significant damage to the long-run goals of the organization.

D)are most effectively controlled through the effective utilization of facilities and organization.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

42

The R2 (i.e., R-squared) is a measure of the goodness-of-fit in least-squares regression, True or

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

43

A merchandising company typically will have a high proportion of which type of cost in its cost structure

A)Variable.

B)Fixed.

C)Semivariable.

D)Step-variable.

A)Variable.

B)Fixed.

C)Semivariable.

D)Step-variable.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

44

A disadvantage of the high-low method of cost analysis is that

A)it cannot be used when there are a very large number of observations.

B)it is too time consuming to apply.

C)it uses two extreme data points, which may not be representative of normal conditions.

D)it relies totally on the judgment of the person performing the cost analysis.

A)it cannot be used when there are a very large number of observations.

B)it is too time consuming to apply.

C)it uses two extreme data points, which may not be representative of normal conditions.

D)it relies totally on the judgment of the person performing the cost analysis.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

45

Account analysis is a method for analysing cost behavior in which each account under consideration is classified as either variable or fixed based upon the analyst's prior knowledge of how the cost in the account behaves.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

46

Rible Company has observed that at an activity level of 8,000 units the cost for maintenance is £15,000, and at 10,000 units the cost for maintenance is £16,500. Using the high-low method, the cost formula for maintenance is

A)£15,000 plus £0.15 per unit.

B)£9,000 plus £0.75 per unit.

C)£1.65 per unit.

D)£1.875 per unit.

A)£15,000 plus £0.15 per unit.

B)£9,000 plus £0.75 per unit.

C)£1.65 per unit.

D)£1.875 per unit.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

47

The cost of goods sold in a merchandising firm typically would be classified as a

A)fixed cost.

B)variable cost.

C)step-variable cost.

D)mixed cost.

A)fixed cost.

B)variable cost.

C)step-variable cost.

D)mixed cost.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

48

If the business unit in France plans to produce sell 3,000 units next month, the expected contribution margin would be

A)£30,750.

B)£74,250.

C)£26,750.

D)£96,500.

A)£30,750.

B)£74,250.

C)£26,750.

D)£96,500.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following types of firms likely would have a high proportion of variable costs in its cost structure?

A)Public utility

B)Airline.

C)Fast food outlet.

D)Architectural firm.

A)Public utility

B)Airline.

C)Fast food outlet.

D)Architectural firm.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

50

Compton Company is a wholesale distributor of educational CD-ROMs. The company's records indicate the following:

-Using the high-low method of analysis, what are the company's estimated total fixed operating expenses per year?

A)£60,000

B)£174,000

C)£150,000

D)£162,000

-Using the high-low method of analysis, what are the company's estimated total fixed operating expenses per year?

A)£60,000

B)£174,000

C)£150,000

D)£162,000

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

51

Compton Company is a wholesale distributor of educational CD-ROMs. The company's records indicate the following:

-What is the company's contribution margin for this year?

A)£315,000

B)(£667,500)

C)£375,000

D)£213,000

-What is the company's contribution margin for this year?

A)£315,000

B)(£667,500)

C)£375,000

D)£213,000

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

52

A variable cost remains constant in total amount, but varies per unit of activity

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

53

The high-low method uses cost and activity data from just two periods to establish a cost formula

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

54

Committed fixed costs are those that relate to the investment in facilities, equipment and the basic organisational structure of a company, True or

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

55

Compton Company is a wholesale distributor of educational CD-ROMs. The company's records indicate the following:

-

Using the high-low method of analysis, what are the company's estimated variable operating expenses per unit

A)£0.24

B)£4.17

C)£0.88

D)£0.96

-

Using the high-low method of analysis, what are the company's estimated variable operating expenses per unit

A)£0.24

B)£4.17

C)£0.88

D)£0.96

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

56

The contribution approach to the income statement classifies costs by function rather than by behavior

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

57

If the level of activity increases within the relevant range

A)variable cost per unit and total fixed costs also increase.

B)fixed cost per unit and total variable cost also increases.

C)total cost will increase and fixed cost per unit will decrease.

D)variable cost per unit and total cost also increases.

A)variable cost per unit and total fixed costs also increase.

B)fixed cost per unit and total variable cost also increases.

C)total cost will increase and fixed cost per unit will decrease.

D)variable cost per unit and total cost also increases.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

58

Stott Company requires one dockhand for every 500 packages loaded daily. The wages for these dockhands would be classified as

A)variable.

B)mixed.

C)step-variable.

D)curvilinear.

A)variable.

B)mixed.

C)step-variable.

D)curvilinear.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

59

Fixed cost remains constant if expressed on a unit basis

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

60

The contribution format is widely used for preparing external financial statements

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

61

In practice, how practical is it to split costs into fixed and variable ones?

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

62

An example of a discretionary fixed cost would be

A)taxes on the factory.

B)depreciation on manufacturing equipment.

C)insurance.

D)research and development.

A)taxes on the factory.

B)depreciation on manufacturing equipment.

C)insurance.

D)research and development.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

63

When the level of activity increases within the relevant range, how does each of the following change

A)Average cost per unit INCREASES; Total variable cost INCREASES; Fixed cost per unit INCREASES

B)Average cost per unit INCREASES; Total variable cost - NO CHANGE; Fixed cost per unit INCREASES

C)Average cost per unit DECREASES; Total variable cost - NO CHANGE; Fixed cost per unit DECREASES

D)Average cost per unit DECREASES; Total variable cost INCREASES; Fixed cost per unit DECREASES

A)Average cost per unit INCREASES; Total variable cost INCREASES; Fixed cost per unit INCREASES

B)Average cost per unit INCREASES; Total variable cost - NO CHANGE; Fixed cost per unit INCREASES

C)Average cost per unit DECREASES; Total variable cost - NO CHANGE; Fixed cost per unit DECREASES

D)Average cost per unit DECREASES; Total variable cost INCREASES; Fixed cost per unit DECREASES

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

64

Explain the reasoning for splitting cost into fixed and variable. Explain the different ways in which this is important.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

65

Paine Company wishes to determine the fixed portion of its electrical costs (a mixed cost). Management believes that the variable portion of the electrical costs is driven by machine-hours. Information for the previous three months follows:

Using the high-low method, the fixed portion of the company's electrical costs would be estimated to be closest to:

A)£283.

B)£327.

C)£375.

D)£408.

Using the high-low method, the fixed portion of the company's electrical costs would be estimated to be closest to:

A)£283.

B)£327.

C)£375.

D)£408.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

66

3: Explain and differentiate between fixed, variable, semi-variable and semi-fixed costs.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

67

Differentiate between cost analysis from an accounting point of view and an engineering approach.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

68

Is labour a fixed or variable cost? Explain.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

69

How does the distinction between fixed and variable costs vary between a service and a manufacturing operation?

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

70

Explain the differences between Committed and Discretionary costs. Why is it important to differentiate?

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck