Deck 22: Joint Arrangements

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/25

Play

Full screen (f)

Deck 22: Joint Arrangements

1

Wiseye Limited and Goodbody Limited agreed to form a joint operation to offer health services. To start the operation the joint operators agreed to contribute cash of €30 000 each. The joint operation will record which of the following entries to recognise this event?

A) DR Joint operator contributions

Cash

B)

C)

D)

A) DR Joint operator contributions

Cash

B)

C)

D)

2

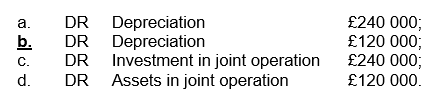

A joint operation holds Equipment with a carrying amount of £1 200 000. The two joint operators participating in this arrangement share control equally. They also depreciate Equipment using the straight-line method. The Equipment has a useful life of 5 years. At reporting date each joint operator must recognise the following entry, in relation to depreciation, in its records:

B

3

Company A Limited and Company B Limited formed a joint operation and share in the output of the joint operation 60:40. The joint operation paid a management fee of $20 000 to Company A Limited during the current period. The cost to Company A Limited of supplying the management service was $14 000. Company A Limited records the management fee revenue as follows:

A)

B)

C)

D)

A)

B)

C)

D)

4

A 50:50 joint operation was commenced between two participants. Participant One contributed cash of $50 000, and Participant Two contributed a Building with a fair value of $50 000 and a carrying amount of $40 000. Using the line-by-line method of accounting, Participant Two would record:

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following statements is not correct?

A) Joint arrangements may be entered into to manage risks involved in a project.

B) Joint arrangements may be entered into to provide the parties with access to new technology or new markets.

C) Joint arrangements require investors to have equal interests in the joint arrangement.

D) The key feature of a joint arrangement is that the parties involved have joint control over the decision making in relation to the joint arrangement.

A) Joint arrangements may be entered into to manage risks involved in a project.

B) Joint arrangements may be entered into to provide the parties with access to new technology or new markets.

C) Joint arrangements require investors to have equal interests in the joint arrangement.

D) The key feature of a joint arrangement is that the parties involved have joint control over the decision making in relation to the joint arrangement.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following is correct?

A) All joint arrangements which are not structured through a separate vehicle are classified as joint ventures;

B) For a joint venture, the rights pertain to the rights and obligations associated with individual assets and liabilities, whereas with a joint operation, the rights and obligations pertain to the net assets.

C) In considering the legal form of the separate vehicle if the legal form establishes rights to individual assets and obligations, the arrangement is a joint operation. If the legal form establishes rights to the net assets of the arrangement, then the arrangement is a joint venture.

D) Where the joint operators have designed the joint arrangement so that its activities primarily aim to provide the parties with an output it will be classified as a joint venture.

A) All joint arrangements which are not structured through a separate vehicle are classified as joint ventures;

B) For a joint venture, the rights pertain to the rights and obligations associated with individual assets and liabilities, whereas with a joint operation, the rights and obligations pertain to the net assets.

C) In considering the legal form of the separate vehicle if the legal form establishes rights to individual assets and obligations, the arrangement is a joint operation. If the legal form establishes rights to the net assets of the arrangement, then the arrangement is a joint venture.

D) Where the joint operators have designed the joint arrangement so that its activities primarily aim to provide the parties with an output it will be classified as a joint venture.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

7

Cash contributed to a joint operation was used to purchase Equipment (€100 000) and raw materials (€70 000). The following entry would be part of the overall recording of these transactions:

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

8

Three joint operators are involved in a joint operation that manufactures ships chandlery. At the beginning of the year the joint operation held €50 000 in cash. During the year the joint operation incurred the following expenses: Wages paid €20 000, Overheads accrued €10 000. Additionally creditors amounting to €40 000 were paid and the joint operators contributed €15 000 cash each to the joint operation. The balance of cash held by the joint operation at the end of the year is:

A) € 5000;

B) €25 000;

C) €35 000;

D) €75 000.

A) € 5000;

B) €25 000;

C) €35 000;

D) €75 000.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

9

A 50:50 joint operation was commenced between two participants. Participant One contributed cash of £50 000, and Participant Two contributed a Building with a fair value of £50 000. Using the line-by-line method of accounting, participant One would record:

A)

B)

.

C)

D)

A)

B)

.

C)

D)

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

10

The following information relates to Questions

A Ltd and B Ltd have established the AB Joint Operation. A Ltd has a 60% interest in the joint operation and B Ltd has a 40% interest.

A Ltd contributed an asset with a carrying amount of $90,000 and a fair value of $120,000 and B Ltd agreed to provide technical services to the joint operation over the first two years of operations. The fair value of the technical services was agreed to be $80,000 and the cost to provide the services was estimated at $65,000 at the inception of the joint operation.

-As part of its initial contribution entry B Ltd will record a:

A) Debit against the Services Receivable in JO account of $32,000;

B) Debit against the Plant in JO account of $36,000;

C) Credit against the Obligation to JO of $39,000;

D) Credit against the Gain on Provision of Services of $6,000.

A Ltd and B Ltd have established the AB Joint Operation. A Ltd has a 60% interest in the joint operation and B Ltd has a 40% interest.

A Ltd contributed an asset with a carrying amount of $90,000 and a fair value of $120,000 and B Ltd agreed to provide technical services to the joint operation over the first two years of operations. The fair value of the technical services was agreed to be $80,000 and the cost to provide the services was estimated at $65,000 at the inception of the joint operation.

-As part of its initial contribution entry B Ltd will record a:

A) Debit against the Services Receivable in JO account of $32,000;

B) Debit against the Plant in JO account of $36,000;

C) Credit against the Obligation to JO of $39,000;

D) Credit against the Gain on Provision of Services of $6,000.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

11

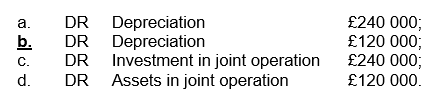

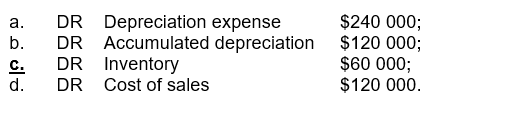

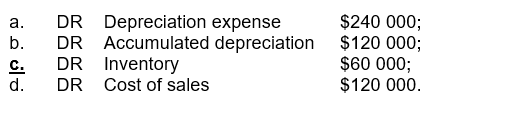

On 1 July 20X0, the Ears & Eyes Joint Operation was established. The two joint operators participating in this arrangement, Ears Ltd and Eyes Ltd, share control equally. Both joint operators contributed cash to establish the joint operation. The joint operation holds equipment with a carrying amount of $1 200 000. Both joint operators depreciate equipment using the straight-line method and the depreciation is regarded a cost of production. The equipment has a useful life of 5 years. At 30 June 20X1 Ears Ltd had sold all inventory distributed to it and Eyes Ltd had sold 50% of the inventory distributed to it.

At 30 June 20X1 Venturer Eyes must recognise the following entry, in relation to depreciation, in its records:

At 30 June 20X1 Venturer Eyes must recognise the following entry, in relation to depreciation, in its records:

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

12

Company A Limited and Company B Limited formed a joint operation and share in the output of the joint operation 60:40. The joint operation paid a management fee of £20 000 to Company A Limited during the current period. The cost to Company A Limited of supplying the management service was £14 000. The amount of profit that Company A Limited will recognise in relation to the provision of the management fee to the joint operation is:

A) NIL

B) £2 400

C) £3 600

D) £6 000

A) NIL

B) £2 400

C) £3 600

D) £6 000

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

13

The following information relates to Questions

A Ltd and B Ltd have established the AB Joint Operation. A Ltd has a 60% interest in the joint operation and B Ltd has a 40% interest.

A Ltd contributed an asset with a carrying amount of $90,000 and a fair value of $120,000 and B Ltd agreed to provide technical services to the joint operation over the first two years of operations. The fair value of the technical services was agreed to be $80,000 and the cost to provide the services was estimated at $65,000 at the inception of the joint operation.

-As part of its initial contribution entry A Ltd will record a:

A) Debit against the Services Receivable in JO account of $32,000;

B) Debit against the Plant in JO account of $54,000;

C) Credit against the Plant of $120,000;

D) Credit against the Gain on Sale of Plant of $18,000.

A Ltd and B Ltd have established the AB Joint Operation. A Ltd has a 60% interest in the joint operation and B Ltd has a 40% interest.

A Ltd contributed an asset with a carrying amount of $90,000 and a fair value of $120,000 and B Ltd agreed to provide technical services to the joint operation over the first two years of operations. The fair value of the technical services was agreed to be $80,000 and the cost to provide the services was estimated at $65,000 at the inception of the joint operation.

-As part of its initial contribution entry A Ltd will record a:

A) Debit against the Services Receivable in JO account of $32,000;

B) Debit against the Plant in JO account of $54,000;

C) Credit against the Plant of $120,000;

D) Credit against the Gain on Sale of Plant of $18,000.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

14

In relation to the supply of a service to a joint operation by one of the joint operators, which of the following statements is correct?

A) a joint operator can recognise 100% of the earned through the supply of services to the joint operation;

B) a joint operator is entitled to recognise a profit from the supply of services to itself;

C) a joint operator cannot earn a profit on supplying services to itself;

D) a joint operator is not able to recognise the service revenue or service cost for the services supplied to the joint operation.

A) a joint operator can recognise 100% of the earned through the supply of services to the joint operation;

B) a joint operator is entitled to recognise a profit from the supply of services to itself;

C) a joint operator cannot earn a profit on supplying services to itself;

D) a joint operator is not able to recognise the service revenue or service cost for the services supplied to the joint operation.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

15

IFRS 11, provides that joint control exists where:

A) no single party is in a position to control the activity unilaterally;

B) the decisions in areas essential to the goals of the joint arrangement do not require the consent of the parties;

C) no one party may be appointed as the manager of the joint arrangement;

D) one party alone has power to control the strategic operating decisions of the joint arrangement.

A) no single party is in a position to control the activity unilaterally;

B) the decisions in areas essential to the goals of the joint arrangement do not require the consent of the parties;

C) no one party may be appointed as the manager of the joint arrangement;

D) one party alone has power to control the strategic operating decisions of the joint arrangement.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

16

The particular relationship between parties that signifies the existence of a joint arrangement is:

A) significant influence by one party over the other party;

B) control over the operating policies of one party by another party;

C) shared influence by two parties over the activities of another party;

D) joint control by the parties over the activities of an operation.

A) significant influence by one party over the other party;

B) control over the operating policies of one party by another party;

C) shared influence by two parties over the activities of another party;

D) joint control by the parties over the activities of an operation.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

17

A 60:40 joint operation was commenced between two participants. Participant One contributed cash of $60 000, and Participant Two agreed to provide technical services to the joint operation over a period of two years. The fair value of the services was determined to be $40 000 and the cost to provide the services was estimated to be $35 000.

Using the line-by-line method of accounting, participant Two would record:

A)

B)

C) DR Cash in JO

CR Obligation to JO

D)

Using the line-by-line method of accounting, participant Two would record:

A)

B)

C) DR Cash in JO

CR Obligation to JO

D)

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following statements is not true in relation to joint control?

A) each party must have an equal interest for joint control to exist

B) joint control exists only where there is contractually agreed sharing of control

C) entities over which a party has joint control are accounted for in accordance with IFRS 11 Joint Arrangements

D) joint control requires the unanimous consent of the parties sharing control

A) each party must have an equal interest for joint control to exist

B) joint control exists only where there is contractually agreed sharing of control

C) entities over which a party has joint control are accounted for in accordance with IFRS 11 Joint Arrangements

D) joint control requires the unanimous consent of the parties sharing control

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

19

Three joint operators agree to an arrangement in which they have an equal share in an agricultural joint operation. The work undertaken in setting up the joint operation cost £300 000 and each operator contributed in cash. Each operator will need to recognise the following accounting entry:

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

20

Company A Limited and Company B Limited formed a joint operation and share equally in the output of the joint operation. The joint operation paid a management fee of £20 000 to Company A Limited during the current period. The cost to Company A Limited of supplying the management service was £14 000. Company A Limited records the management fee revenue as follows:

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

21

The following information relates to Questions

On 1 July20X0, Abel Ltd entered into a 50:50 joint operation with Tasman Ltd to develop an oil field off the south coast of Tasmania. Each operator's initial contribution was €2 million. Abel contributed €1 million cash and equipment with a fair value of €1 million and a book value of €500,000. Tasman's contributed €2 million cash.

Additional information:

Production costs for the JO for the year ended 30 June 20X1 were:

The remaining useful life of the equipment contributed by Abel is 5 years.

Tasman is responsible for the day to day management of JO and has recognised the management fee received during the year as revenue. The costs of providing these management services to JO was €225,000.

Tasman has sold all of the oil distributed to it and Abel has sold 50% of the oil distributed to it by 30 June 20X1.

An extract of JO's balance sheet at 30 June 20X1 shows:

-Tasman Ltd's initial contribution entry will include a debit to the Cash in JO account of:

A) €1 000 000;

B) €1 500 000;

C) €2 000 000;

D) €3 000 000.

On 1 July20X0, Abel Ltd entered into a 50:50 joint operation with Tasman Ltd to develop an oil field off the south coast of Tasmania. Each operator's initial contribution was €2 million. Abel contributed €1 million cash and equipment with a fair value of €1 million and a book value of €500,000. Tasman's contributed €2 million cash.

Additional information:

Production costs for the JO for the year ended 30 June 20X1 were:

The remaining useful life of the equipment contributed by Abel is 5 years.

Tasman is responsible for the day to day management of JO and has recognised the management fee received during the year as revenue. The costs of providing these management services to JO was €225,000.

Tasman has sold all of the oil distributed to it and Abel has sold 50% of the oil distributed to it by 30 June 20X1.

An extract of JO's balance sheet at 30 June 20X1 shows:

-Tasman Ltd's initial contribution entry will include a debit to the Cash in JO account of:

A) €1 000 000;

B) €1 500 000;

C) €2 000 000;

D) €3 000 000.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

22

When eliminating any unrealised profit arising when a joint operator provides services to a joint operation the profit is eliminated against:

A) the investment in the joint operation;

B) retained earnings;

C) work in progress, finished goods and other inventory related accounts;

D) cost of sales.

A) the investment in the joint operation;

B) retained earnings;

C) work in progress, finished goods and other inventory related accounts;

D) cost of sales.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

23

When a joint operator is accounting for an interest in joint operation it is required to recognise all of the following in its financial statements:

A) I;

B) II;

C) III;

D) IV.

A) I;

B) II;

C) III;

D) IV.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

24

The following information relates to Questions

On 1 July20X0, Abel Ltd entered into a 50:50 joint operation with Tasman Ltd to develop an oil field off the south coast of Tasmania. Each operator's initial contribution was €2 million. Abel contributed €1 million cash and equipment with a fair value of €1 million and a book value of €500,000. Tasman's contributed €2 million cash.

Additional information:

Production costs for the JO for the year ended 30 June 20X1 were:

The remaining useful life of the equipment contributed by Abel is 5 years.

Tasman is responsible for the day to day management of JO and has recognised the management fee received during the year as revenue. The costs of providing these management services to JO was €225,000.

Tasman has sold all of the oil distributed to it and Abel has sold 50% of the oil distributed to it by 30 June 20X1.

An extract of JO's balance sheet at 30 June 20X1 shows:

-The value of inventory distributed to Abel Ltd by the joint venture and subsequently sold by 30 June 20X1 is:

A) €425 000;

B) €850 000;

C) €900 000;

D) €1 700 000.

On 1 July20X0, Abel Ltd entered into a 50:50 joint operation with Tasman Ltd to develop an oil field off the south coast of Tasmania. Each operator's initial contribution was €2 million. Abel contributed €1 million cash and equipment with a fair value of €1 million and a book value of €500,000. Tasman's contributed €2 million cash.

Additional information:

Production costs for the JO for the year ended 30 June 20X1 were:

The remaining useful life of the equipment contributed by Abel is 5 years.

Tasman is responsible for the day to day management of JO and has recognised the management fee received during the year as revenue. The costs of providing these management services to JO was €225,000.

Tasman has sold all of the oil distributed to it and Abel has sold 50% of the oil distributed to it by 30 June 20X1.

An extract of JO's balance sheet at 30 June 20X1 shows:

-The value of inventory distributed to Abel Ltd by the joint venture and subsequently sold by 30 June 20X1 is:

A) €425 000;

B) €850 000;

C) €900 000;

D) €1 700 000.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

25

The following information relates to Questions

On 1 July20X0, Abel Ltd entered into a 50:50 joint operation with Tasman Ltd to develop an oil field off the south coast of Tasmania. Each operator's initial contribution was €2 million. Abel contributed €1 million cash and equipment with a fair value of €1 million and a book value of €500,000. Tasman's contributed €2 million cash.

Additional information:

Production costs for the JO for the year ended 30 June 20X1 were:

The remaining useful life of the equipment contributed by Abel is 5 years.

Tasman is responsible for the day to day management of JO and has recognised the management fee received during the year as revenue. The costs of providing these management services to JO was €225,000.

Tasman has sold all of the oil distributed to it and Abel has sold 50% of the oil distributed to it by 30 June 20X1.

An extract of JO's balance sheet at 30 June 20X1 shows:

-Which of the following will not form part of Abel Ltd's initial contribution entry?

A) Debit against the Cash in JO account of €1 500 000;

B) Debit against the Equipment in JO account of €500 000;

C) Credit against the Cash of €1 000 000;

D) Credit against the Gain on Equipment of €250 000.

On 1 July20X0, Abel Ltd entered into a 50:50 joint operation with Tasman Ltd to develop an oil field off the south coast of Tasmania. Each operator's initial contribution was €2 million. Abel contributed €1 million cash and equipment with a fair value of €1 million and a book value of €500,000. Tasman's contributed €2 million cash.

Additional information:

Production costs for the JO for the year ended 30 June 20X1 were:

The remaining useful life of the equipment contributed by Abel is 5 years.

Tasman is responsible for the day to day management of JO and has recognised the management fee received during the year as revenue. The costs of providing these management services to JO was €225,000.

Tasman has sold all of the oil distributed to it and Abel has sold 50% of the oil distributed to it by 30 June 20X1.

An extract of JO's balance sheet at 30 June 20X1 shows:

-Which of the following will not form part of Abel Ltd's initial contribution entry?

A) Debit against the Cash in JO account of €1 500 000;

B) Debit against the Equipment in JO account of €500 000;

C) Credit against the Cash of €1 000 000;

D) Credit against the Gain on Equipment of €250 000.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck