Deck 1: Managerial Accounting and Cost Concepts

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/166

Play

Full screen (f)

Deck 1: Managerial Accounting and Cost Concepts

1

Manufacturing overhead combined with direct materials is known as conversion cost.

False

2

Indirect costs,such as manufacturing overhead,are always fixed costs.

False

3

Committed fixed costs are fixed costs that are not controllable.

False

4

Discretionary fixed costs arise from annual decisions by management to spend in certain fixed cost areas.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

5

Property taxes and insurance premiums paid on a factory building are examples of manufacturing overhead.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

6

In external financial reports,factory utilities costs may be included in an asset account on the balance sheet at the end of the period.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

7

Even if operations are interrupted or cut back,committed fixed costs remain largely unchanged in the short term because the costs of restoring them later are likely to be far greater than any short-run savings that might be realized.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

8

When the level of activity increases,total variable cost will increase.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

9

The concept of the relevant range does not apply to fixed costs.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

10

Advertising costs are considered product costs for external financial reports because they are incurred in order to promote specific products.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

11

Direct material costs are generally variable costs.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

12

A mixed cost is partially variable and partially fixed.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

13

Depreciation is always considered a product cost for external financial reporting purposes in a manufacturing firm.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

14

A variable cost is a cost whose cost per unit varies as the activity level rises and falls.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

15

All costs incurred in a merchandising firm are considered to be period costs.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

16

In order for a cost to be variable it must vary with either units produced or units sold.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

17

Automation results in a shift away from variable costs toward more fixed costs.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

18

Selling and administrative expenses are product costs under generally accepted accounting principles.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

19

Traditional format income statements are prepared primarily for external reporting purposes.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

20

A decrease in production will ordinarily result in an increase in fixed production costs per unit.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

21

For a lamp manufacturing company,the cost of the insurance on its vehicles that deliver lamps to customers is best described as a:

A)prime cost.

B)manufacturing overhead cost.

C)period cost.

D)differential (incremental)cost of a lamp.

A)prime cost.

B)manufacturing overhead cost.

C)period cost.

D)differential (incremental)cost of a lamp.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

22

The following costs should be considered by a law firm to be indirect costs of defending a particular client in court: rent on the law firm's offices,the law firm's receptionist's wages,the costs of heating the law firm's offices,and the depreciation on the personal computer in the office of the attorney who has been assigned the client.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

23

The following would typically be considered indirect costs of manufacturing a particular Boeing 747 to be delivered to Singapore Airlines: electricity to run production equipment,the factory manager's salary,and the cost of the General Electric jet engines installed on the aircraft.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

24

In a contribution format income statement,sales minus cost of goods sold equals the gross margin.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

25

Manufacturing overhead consists of:

A)all manufacturing costs.

B)indirect materials but not indirect labor.

C)all manufacturing costs,except direct materials and direct labor.

D)indirect labor but not indirect materials.

A)all manufacturing costs.

B)indirect materials but not indirect labor.

C)all manufacturing costs,except direct materials and direct labor.

D)indirect labor but not indirect materials.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following should NOT be included as part of manufacturing overhead at a company that makes office furniture?

A)Sheet steel in a file cabinet made by the company.

B)Manufacturing equipment depreciation.

C)Idle time for direct labor.

D)Taxes on a factory building.

A)Sheet steel in a file cabinet made by the company.

B)Manufacturing equipment depreciation.

C)Idle time for direct labor.

D)Taxes on a factory building.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

27

In a traditional format income statement for a merchandising company,the cost of goods sold reports the product costs attached to the merchandise sold during the period.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

28

In any decision making situation,sunk costs are irrelevant and should be ignored.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following costs would not be included as part of manufacturing overhead?

A)Insurance on sales vehicles.

B)Depreciation of production equipment.

C)Lubricants for production equipment.

D)Direct labor overtime premium.

A)Insurance on sales vehicles.

B)Depreciation of production equipment.

C)Lubricants for production equipment.

D)Direct labor overtime premium.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

30

The advertising costs that Pepsi incurred to air its commercials during the Super Bowl can best be described as a:

A)variable cost.

B)fixed cost.

C)product cost.

D)prime cost.

A)variable cost.

B)fixed cost.

C)product cost.

D)prime cost.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

31

Although the contribution format income statement is useful for external reporting purposes,it has serious limitations when used for internal purposes because it does not distinguish between fixed and variable costs.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

32

The following costs should be considered direct costs of providing delivery room services to a particular mother and her baby: the costs of drugs administered in the operating room,the attending physician's fees,and a portion of the liability insurance carried by the hospital to cover the delivery room.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

33

The wages of factory maintenance personnel would usually be considered to be:

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

34

Each of the following would be a period cost except:

A)the salary of the company president's secretary.

B)the cost of a general accounting office.

C)depreciation of a machine used in manufacturing.

D)sales commissions.

A)the salary of the company president's secretary.

B)the cost of a general accounting office.

C)depreciation of a machine used in manufacturing.

D)sales commissions.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

35

Conversion cost consists of which of the following?

A)Manufacturing overhead cost.

B)Direct materials and direct labor cost.

C)Direct labor cost.

D)Direct labor and manufacturing overhead cost.

A)Manufacturing overhead cost.

B)Direct materials and direct labor cost.

C)Direct labor cost.

D)Direct labor and manufacturing overhead cost.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

36

The cost of leasing production equipment is classified as:

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

37

The traditional format income statement is used as an internal planning and decision-making tool.Its emphasis on cost behavior aids cost-volume-profit analysis,management performance appraisals,and budgeting.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following costs is an example of a period rather than a product cost?

A)Depreciation on production equipment.

B)Wages of salespersons.

C)Wages of production machine operators.

D)Insurance on production equipment.

A)Depreciation on production equipment.

B)Wages of salespersons.

C)Wages of production machine operators.

D)Insurance on production equipment.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following would be considered a product cost for external financial reporting purposes?

A)Cost of a warehouse used to store finished goods.

B)Cost of guided public tours through the company's facilities.

C)Cost of travel necessary to sell the manufactured product.

D)Cost of sand spread on the factory floor to absorb oil from manufacturing machines.

A)Cost of a warehouse used to store finished goods.

B)Cost of guided public tours through the company's facilities.

C)Cost of travel necessary to sell the manufactured product.

D)Cost of sand spread on the factory floor to absorb oil from manufacturing machines.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

40

In a contribution format income statement for a merchandising company,cost of goods sold is a variable cost that gets included in the "Variable expenses" portion of the income statement.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

41

The salary of the president of a manufacturing company would be classified as which of the following?

A)Product cost

B)Period cost

C)Manufacturing overhead

D)Direct labor

A)Product cost

B)Period cost

C)Manufacturing overhead

D)Direct labor

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following would NOT be treated as a product cost for external financial reporting purposes?

A)Depreciation on a factory building.

B)Salaries of factory workers.

C)Indirect labor in the factory.

D)Advertising expenses.

A)Depreciation on a factory building.

B)Salaries of factory workers.

C)Indirect labor in the factory.

D)Advertising expenses.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

43

An example of a committed fixed cost is:

A)a training program for salespersons.

B)executive travel expenses.

C)property taxes on the factory building.

D)new product research and development.

A)a training program for salespersons.

B)executive travel expenses.

C)property taxes on the factory building.

D)new product research and development.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following statements regarding fixed costs is incorrect?

A)Expressing fixed costs on a per unit basis usually is the best approach for decision making.

B)Fixed costs expressed on a per unit basis will decrease with increases in activity.

C)Total fixed costs are constant within the relevant range.

D)Fixed costs expressed on a per unit basis will increase with decreases in activity.

A)Expressing fixed costs on a per unit basis usually is the best approach for decision making.

B)Fixed costs expressed on a per unit basis will decrease with increases in activity.

C)Total fixed costs are constant within the relevant range.

D)Fixed costs expressed on a per unit basis will increase with decreases in activity.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

45

Variable cost:

A)increases on a per unit basis as the number of units produced increases.

B)remains constant on a per unit basis as the number of units produced increases.

C)remains the same in total as production increases.

D)decreases on a per unit basis as the number of units produced increases.

A)increases on a per unit basis as the number of units produced increases.

B)remains constant on a per unit basis as the number of units produced increases.

C)remains the same in total as production increases.

D)decreases on a per unit basis as the number of units produced increases.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

46

The following costs were incurred in September: Prime costs during the month totaled:

A)$79,000

B)$120,000

C)$62,000

D)$40,000

A)$79,000

B)$120,000

C)$62,000

D)$40,000

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

47

Which one of the following costs should NOT be considered a direct cost of serving a particular customer who orders a customized personal computer by phone directly from the manufacturer?

A)The cost of the hard disk drive installed in the computer.

B)The cost of shipping the computer to the customer.

C)The cost of leasing a machine on a monthly basis that automatically tests hard disk drives before they are installed in computers.

D)The cost of packaging the computer for shipment.

A)The cost of the hard disk drive installed in the computer.

B)The cost of shipping the computer to the customer.

C)The cost of leasing a machine on a monthly basis that automatically tests hard disk drives before they are installed in computers.

D)The cost of packaging the computer for shipment.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

48

During the month of September,direct labor cost totaled $11,000 and direct labor cost was 40% of prime cost.If total manufacturing costs during September were $73,000,the manufacturing overhead was:

A)$16,500

B)$27,500

C)$62,000

D)$45,500

A)$16,500

B)$27,500

C)$62,000

D)$45,500

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

49

Last month,when 10,000 units of a product were manufactured,the cost per unit was $60.At this level of activity,variable costs are 50% of total unit costs.If 10,500 units are manufactured next month and cost behavior patterns remain unchanged the:

A)total variable cost will remain unchanged.

B)fixed costs will increase in total.

C)variable cost per unit will increase.

D)total cost per unit will decrease.

A)total variable cost will remain unchanged.

B)fixed costs will increase in total.

C)variable cost per unit will increase.

D)total cost per unit will decrease.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

50

When a decision is made among a number of alternatives,the benefit that is lost by choosing one alternative over another is the:

A)realized cost.

B)opportunity cost.

C)conversion cost.

D)accrued cost.

A)realized cost.

B)opportunity cost.

C)conversion cost.

D)accrued cost.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

51

The term "relevant range" means the range of activity over which:

A)relevant costs are incurred.

B)costs may fluctuate.

C)production may vary.

D)the assumptions about fixed and variable cost behavior are reasonably valid.

A)relevant costs are incurred.

B)costs may fluctuate.

C)production may vary.

D)the assumptions about fixed and variable cost behavior are reasonably valid.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

52

Within the relevant range,variable cost per unit will:

A)increase as the level of activity increases.

B)remain constant.

C)decrease as the level of activity increases.

D)none of these.

A)increase as the level of activity increases.

B)remain constant.

C)decrease as the level of activity increases.

D)none of these.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

53

Aberge Company's manufacturing overhead is 60% of its total conversion costs.If direct labor is $38,000 and if direct materials are $21,000,the manufacturing overhead is:

A)$57,000

B)$88,500

C)$25,333

D)$31,500

A)$57,000

B)$88,500

C)$25,333

D)$31,500

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

54

The following costs were incurred in September: Conversion costs during the month totaled:

A)$50,000

B)$59,000

C)$137,000

D)$67,000

A)$50,000

B)$59,000

C)$137,000

D)$67,000

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

55

In describing the cost formula equation Y = a + bX,which of the following statements is correct?

A)"X" is the dependent variable.

B)"a" is the fixed component.

C)In the high-low method,"b" equals change in activity divided by change in costs.

D)As "X" increases "Y" decreases.

A)"X" is the dependent variable.

B)"a" is the fixed component.

C)In the high-low method,"b" equals change in activity divided by change in costs.

D)As "X" increases "Y" decreases.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

56

The term differential cost refers to:

A)a difference in cost which results from selecting one alternative instead of another.

B)the benefit forgone by selecting one alternative instead of another.

C)a cost which does not involve any dollar outlay but which is relevant to the decision-making process.

D)a cost which continues to be incurred even though there is no activity.

A)a difference in cost which results from selecting one alternative instead of another.

B)the benefit forgone by selecting one alternative instead of another.

C)a cost which does not involve any dollar outlay but which is relevant to the decision-making process.

D)a cost which continues to be incurred even though there is no activity.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

57

In September direct labor was 40% of conversion cost.If the manufacturing overhead for the month was $66,000 and the direct materials cost was $20,000,the direct labor cost was:

A)$13,333

B)$44,000

C)$99,000

D)$30,000

A)$13,333

B)$44,000

C)$99,000

D)$30,000

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

58

The salary paid to the production manager in a factory is:

A)a variable cost.

B)part of prime cost.

C)part of conversion cost.

D)both a variable cost and a prime cost.

A)a variable cost.

B)part of prime cost.

C)part of conversion cost.

D)both a variable cost and a prime cost.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following costs is often important in decision making,but is omitted from conventional accounting records?

A)Fixed cost.

B)Sunk cost.

C)Opportunity cost.

D)Indirect cost.

A)Fixed cost.

B)Sunk cost.

C)Opportunity cost.

D)Indirect cost.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

60

Conversion costs do NOT include:

A)depreciation.

B)direct materials.

C)indirect labor.

D)indirect materials.

A)depreciation.

B)direct materials.

C)indirect labor.

D)indirect materials.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

61

At an activity level of 9,200 machine-hours in a month,Nooner Corporation's total variable production engineering cost is $761,300 and its total fixed production engineering cost is $154,008.What would be the total production engineering cost per unit,both fixed and variable,at an activity level of 9,300 machine-hours in a month? Assume that this level of activity is within the relevant range.

A)$98.42

B)$99.49

C)$99.31

D)$98.96

A)$98.42

B)$99.49

C)$99.31

D)$98.96

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

62

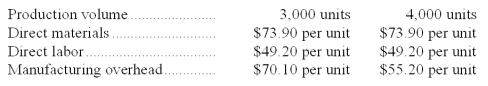

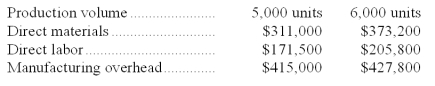

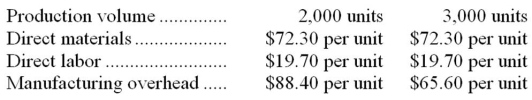

Carbaugh Corporation has provided the following production and average cost data for two levels of monthly production volume.The company produces a single product.  The best estimate of the total cost to manufacture 3,300 units is closest to:

The best estimate of the total cost to manufacture 3,300 units is closest to:

A)$637,560

B)$612,975

C)$588,390

D)$619,680

The best estimate of the total cost to manufacture 3,300 units is closest to:

The best estimate of the total cost to manufacture 3,300 units is closest to:A)$637,560

B)$612,975

C)$588,390

D)$619,680

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

63

At a volume of 10,000 units,Company P incurs $30,000 in factory overhead costs,including $10,000 in fixed costs.Assuming that this activity is within the relevant range,if volume increases to 12,000 units,Company P would expect to incur total factory overhead costs of:

A)$36,000

B)$34,000

C)$30,000

D)$32,000

A)$36,000

B)$34,000

C)$30,000

D)$32,000

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

64

Anaconda Mining Company shipped 9,000 tons of copper concentrate for $450,000 in March and 11,000 tons for $549,000 in April.Shipping costs for 12,000 tons to be shipped in May would be expected to be:

A)$548,780

B)$549,020

C)$594,000

D)$598,500

A)$548,780

B)$549,020

C)$594,000

D)$598,500

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

65

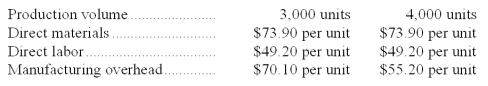

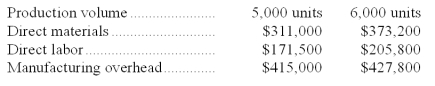

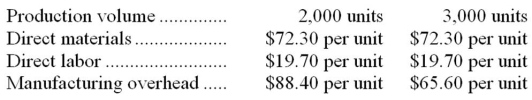

Bakker Corporation has provided the following production and average cost data for two levels of monthly production volume.The company produces a single product. The best estimate of the total variable manufacturing cost per unit is:

A)$89.70

B)$131.80

C)$19.50

D)$112.30

A)$89.70

B)$131.80

C)$19.50

D)$112.30

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

66

At an activity level of 4,400 units in a month,Goldbach Corporation's total variable maintenance and repair cost is $313,632 and its total fixed maintenance and repair cost is $93,104.What would be the total maintenance and repair cost,both fixed and variable,at an activity level of 4,600 units in a month? Assume that this level of activity is within the relevant range.

A)$420,992

B)$425,224

C)$415,980

D)$406,736

A)$420,992

B)$425,224

C)$415,980

D)$406,736

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

67

Blore Corporation reports that at an activity level of 7,300 units,its total variable cost is $511,803 and its total fixed cost is $76,650.What would be the total cost,both fixed and variable,at an activity level of 7,500 units? Assume that this level of activity is within the relevant range.

A)$604,575

B)$602,475

C)$596,514

D)$588,453

A)$604,575

B)$602,475

C)$596,514

D)$588,453

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

68

A manufacturing company prepays its insurance coverage for a three-year period.The premium for the three years is $2,700 and is paid at the beginning of the first year.Eighty percent of the premium applies to manufacturing operations and 20% applies to selling and administrative activities.What amounts should be considered product and period costs respectively for the first year of coverage?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

69

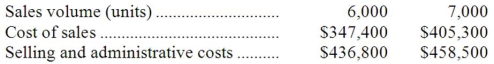

Haras Corporation is a wholesaler that sells a single product.Management has provided the following cost data for two levels of monthly sales volume.The company sells the product for $141.30 per unit.  The best estimate of the total variable cost per unit is:

The best estimate of the total variable cost per unit is:

A)$123.40

B)$79.60

C)$57.90

D)$130.70

The best estimate of the total variable cost per unit is:

The best estimate of the total variable cost per unit is:A)$123.40

B)$79.60

C)$57.90

D)$130.70

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

70

Jumpst Corporation uses the cost formula Y = $3,600 + $0.30X for the maintenance cost in Department B,where X is machine-hours.The August budget is based on 20,000 hours of planned machine time.Maintenance cost expected to be incurred during August is:

A)$3,600

B)$6,000

C)$6,300

D)$9,600

A)$3,600

B)$6,000

C)$6,300

D)$9,600

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

71

Given the cost formula,Y = $9,000 + $2.50X,total cost for an activity level of 3,000 units would be:

A)$9,750

B)$12,000

C)$16,500

D)$7,500

A)$9,750

B)$12,000

C)$16,500

D)$7,500

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

72

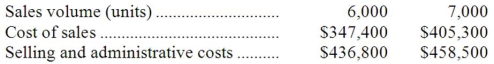

Iadanza Corporation is a wholesaler that sells a single product.Management has provided the following cost data for two levels of monthly sales volume.The company sells the product for $195.70 per unit. The best estimate of the total contribution margin when 6,300 units are sold is:

A)$752,220

B)$638,190

C)$100,170

D)$177,030

A)$752,220

B)$638,190

C)$100,170

D)$177,030

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

73

Given the cost formula Y = $15,000 + $5X,total cost at an activity level of 8,000 units would be:

A)$23,000

B)$15,000

C)$55,000

D)$40,000

A)$23,000

B)$15,000

C)$55,000

D)$40,000

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

74

Edeen Corporation has provided the following production and total cost data for two levels of monthly production volume.The company produces a single product.  The best estimate of the total variable manufacturing cost per unit is:

The best estimate of the total variable manufacturing cost per unit is:

A)$62.20

B)$96.50

C)$109.30

D)$12.80

The best estimate of the total variable manufacturing cost per unit is:

The best estimate of the total variable manufacturing cost per unit is:A)$62.20

B)$96.50

C)$109.30

D)$12.80

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

75

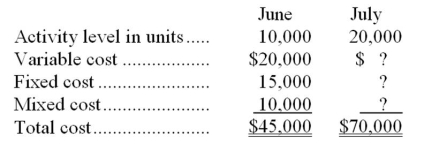

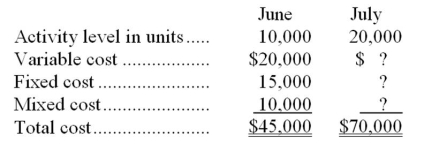

The following data pertains to activity and costs for two months:  Assuming that these activity levels are within the relevant range,the mixed cost for July was:

Assuming that these activity levels are within the relevant range,the mixed cost for July was:

A)$10,000

B)$35,000

C)$15,000

D)$40,000

Assuming that these activity levels are within the relevant range,the mixed cost for July was:

Assuming that these activity levels are within the relevant range,the mixed cost for July was:A)$10,000

B)$35,000

C)$15,000

D)$40,000

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

76

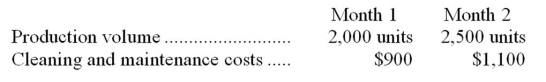

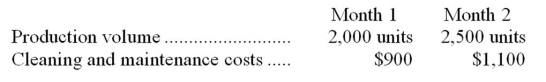

The following data pertains to activity and the cost of cleaning and maintenance for two recent months:  The best estimate of the total month 1 variable cost for cleaning and maintenance is:

The best estimate of the total month 1 variable cost for cleaning and maintenance is:

A)$300

B)$500

C)$800

D)$100

The best estimate of the total month 1 variable cost for cleaning and maintenance is:

The best estimate of the total month 1 variable cost for cleaning and maintenance is: A)$300

B)$500

C)$800

D)$100

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

77

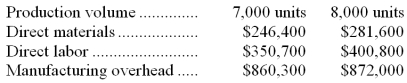

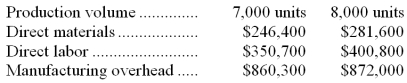

Dabney Corporation has provided the following production and total cost data for two levels of monthly production volume.The company produces a single product.  The best estimate of the total monthly fixed manufacturing cost is:

The best estimate of the total monthly fixed manufacturing cost is:

A)$778,400

B)$1,457,400

C)$1,505,900

D)$1,554,400

The best estimate of the total monthly fixed manufacturing cost is:

The best estimate of the total monthly fixed manufacturing cost is:A)$778,400

B)$1,457,400

C)$1,505,900

D)$1,554,400

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

78

Anderwald Corporation has provided the following production and average cost data for two levels of monthly production volume.The company produces a single product.  The best estimate of the total monthly fixed manufacturing cost is:

The best estimate of the total monthly fixed manufacturing cost is:

A)$360,800

B)$136,800

C)$196,800

D)$176,800

The best estimate of the total monthly fixed manufacturing cost is:

The best estimate of the total monthly fixed manufacturing cost is:A)$360,800

B)$136,800

C)$196,800

D)$176,800

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

79

Gambarini Corporation is a wholesaler that sells a single product.Management has provided the following cost data for two levels of monthly sales volume.The company sells the product for $197.80 per unit. The best estimate of the total monthly fixed cost is:

A)$541,800

B)$1,192,100

C)$1,099,200

D)$1,145,650

A)$541,800

B)$1,192,100

C)$1,099,200

D)$1,145,650

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

80

Average maintenance costs are $1.50 per machine-hour at an activity level of 8,000 machine-hours and $1.20 per machine-hour at an activity level of 13,000 machine-hours.Assuming that this activity is within the relevant range,total expected maintenance cost for a budgeted activity level of 10,000 machine-hours would be closest to:

A)$16,128

B)$15,000

C)$13,440

D)$11,433

A)$16,128

B)$15,000

C)$13,440

D)$11,433

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck