Deck 18: Introduction to Macroeconomics: Unemployment, Inflation, and Economic Fluctuations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

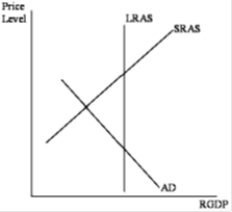

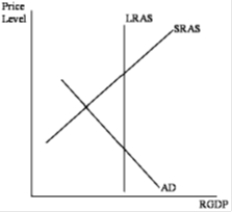

Question

Question

Question

Question

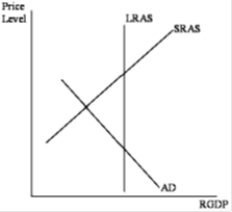

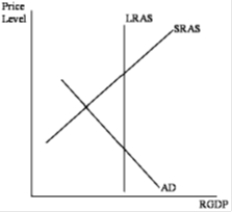

Question

Question

Question

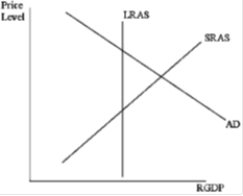

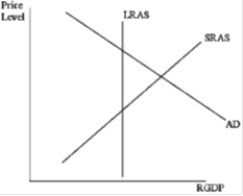

Question

Question

Question

Question

Question

Question

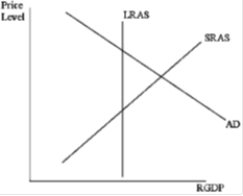

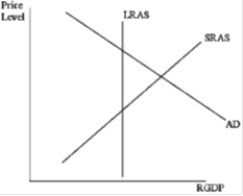

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/152

Play

Full screen (f)

Deck 18: Introduction to Macroeconomics: Unemployment, Inflation, and Economic Fluctuations

1

Higher rates of interest increase the opportunity cost of holding money balances.

True

2

People hold money for transactions purposes, precautionary reasons, and asset purposes.

True

3

An increase in the supply of money would decrease the interest rate and increase aggregate demand, other things equal.

True

4

Above the equilibrium nominal interest rate, there is a surplus of money.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

5

When the Fed is pursuing contractionary monetary policy it will tend to depreciate the value of the dollar and hence increase net exports, other things equal.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

6

If there is currently a recessionary gap in the economy the Fed could work toward recovery by increasing the money supply and decreasing the interest rate.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

7

When the Fed is pursuing expansionary monetary policy it will tend to reduce the demand for the dollar and increase net exports, other things equal.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

8

When Fed policy is addressing either a contractionary or inflationary gap, interest rates will be changed in the same direction as the intended change in real GDP.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

9

When money demand increases, the Fed cannot keep both the money supply from rising and the interest rate from rising.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

10

When money demand shifts, the Fed must choose between targeting the money supply and targeting the interest rate; it cannot target both.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

11

If there is currently an inflationary gap in the economy the Fed could work toward recovery through an open market sale of government securities.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

12

The demand for money will increase when either the price level or real GDP increases.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

13

The money supply is very sensitive to changes in the rate of interest.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

14

Monetary policy can influence interest rates, which in turn can change spending.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

15

The interest rate that the Fed currently targets is the federal funds rate.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

16

Higher rates of interest increase the opportunity cost of holding money balances.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

17

The supply and demand for money intersect at the equilibrium real interest rate, while the supply and demand curves for loanable funds intersect at the equilibrium real interest rate.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

18

When the supply of money is vertical, changes in money demand will not change the equilibrium quantity of money in existence.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

19

At a higher nominal interest rate, the demand for money decreases.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

20

When choosing how much money they wish to hold in their financial portfolios, people trade off money's advantage of liquidity against the opportunity cost of holding money rather than other financial assets.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

21

If nominal interest rates rise, what will happen to demand for money?

A)It will increase.

B)It will decrease.

C)Nothing; the economy will move to a new quantity demanded at a new interest rate.

D)It depends on what happens to other determinants of demand for money like prices or income.

A)It will increase.

B)It will decrease.

C)Nothing; the economy will move to a new quantity demanded at a new interest rate.

D)It depends on what happens to other determinants of demand for money like prices or income.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

22

When there is a liquidity trap, when the Fed adds bank reserves, there is a large effect on borrowing, investment and aggregate demand.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

23

Quantitative easing involved Fed purchases of long term securities rather than short term securities.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

24

If economic recovery has already occurred by the time the effects of expansionary monetary policy are felt, it could cause an inflation problem rather than curing a recession problem.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

25

If money supply and money demand both increased:

A)nominal interest rates would increase and investment would increase.

B)nominal interest rates would increase and investment would decrease.

C)nominal interest rates would decrease and investment would increase.

D)the change in nominal interest rates and investment would be indeterminate.

A)nominal interest rates would increase and investment would increase.

B)nominal interest rates would increase and investment would decrease.

C)nominal interest rates would decrease and investment would increase.

D)the change in nominal interest rates and investment would be indeterminate.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

26

The supply-of-money curve is almost perfectly inelastic because:

A)as interest rates rise, people will want to be supplied with more loans.

B)the Fed makes more money available in response to higher interest rates.

C)banks generally find loans more profitable than keeping their assets as cash in their vaults or reserve deposits at the Fed, whether interest rates are 4% or 10%.

D)the Fed lowers the discount rate as interest rates rise.

A)as interest rates rise, people will want to be supplied with more loans.

B)the Fed makes more money available in response to higher interest rates.

C)banks generally find loans more profitable than keeping their assets as cash in their vaults or reserve deposits at the Fed, whether interest rates are 4% or 10%.

D)the Fed lowers the discount rate as interest rates rise.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

27

The quantity of money demanded varies ____ with the nominal interest rate, but the supply of money is almost perfectly ____ with respect to nominal interest rates.

A)inversely; elastic

B)directly; elastic

C)inversely; inelastic

D)directly; inelastic

A)inversely; elastic

B)directly; elastic

C)inversely; inelastic

D)directly; inelastic

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

28

If money supply increases, P will rise as long as V and Q remain constant.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

29

In an open economy, when the Fed increases the supply of money, it will increase net exports and aggregate demand.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

30

The problem of time lags in making policy changes is less acute for monetary policy than it is for fiscal policy.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

31

Velocity represents the average number of times that a dollar is used in purchasing final goods and services in a one-year period.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

32

In the long run, inflation results from increases in a nation's money supply that exceed increases in its output of goods and services.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

33

The Fed can force the banking system to decrease the money supply by tightening monetary policy, but it cannot force the banking system to increase the money supply by loosening monetary policy.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

34

The Fed sometimes works to partly offset or even neutralize the effects of fiscal policy with monetary policy

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

35

If inflation is the major problem in the economy, which of the following would be an appropriate monetary policy response?

A)decreasing government spending

B)decreasing the discount rate

C)decreasing reserve requirements

D)none of the above

A)decreasing government spending

B)decreasing the discount rate

C)decreasing reserve requirements

D)none of the above

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

36

According to the growth version of the quantiy theory of money, the growth rate of the money supply equals the inflation rate plus the growth rate of real output.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

37

The steeper the short-run aggregate supply curve over the relevant range, the more contractionary monetary policy will reduce prices and the less it will decrease real output.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

38

If inflation is the major problem in the economy, which of the following would be an appropriate monetary policy response?

A)decreasing reserve requirements

B)increasing the discount rate

C)buying government bonds

D)none of the above

A)decreasing reserve requirements

B)increasing the discount rate

C)buying government bonds

D)none of the above

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

39

Policy makers have adequate information to know what appropriate monetary policies to adopt.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

40

The lag before the full effects of monetary policy on inflation are felt is longer than the lag before its effects on real output and unemployment are felt.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following increases Money Demand?

A)Lower nominal interest rates.

B)Higher nominal interest rates.

C)Higher real GDP

D)Lower real GDP

A)Lower nominal interest rates.

B)Higher nominal interest rates.

C)Higher real GDP

D)Lower real GDP

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

42

If the Fed wanted to reduce the federal funds interest rate, it might:

A)increase the discount rate.

B)increase the required reserve ratio.

C)buy government securities.

D)sell government securities.

A)increase the discount rate.

B)increase the required reserve ratio.

C)buy government securities.

D)sell government securities.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following pairs of policies have inconsistent effects on aggregate demand?

A)A tax increase and an increase in the money supply.

B)A transfer payment increase and an increase in the money supply.

C)A reduction in government purchases and a reduction of the money supply.

D)none of the above

A)A tax increase and an increase in the money supply.

B)A transfer payment increase and an increase in the money supply.

C)A reduction in government purchases and a reduction of the money supply.

D)none of the above

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

44

If the demand for money decreases, but the Fed keeps the money supply the same:

A)nominal interest rates will rise and aggregate demand will fall.

B)nominal interest rates will rise and aggregate demand will rise.

C)nominal interest rates will fall and aggregate demand will fall.

D)nominal interest rates will fall and aggregate demand will rise.

A)nominal interest rates will rise and aggregate demand will fall.

B)nominal interest rates will rise and aggregate demand will rise.

C)nominal interest rates will fall and aggregate demand will fall.

D)nominal interest rates will fall and aggregate demand will rise.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

45

If the demand for money increases, but the Fed keeps the money supply the same:

A)nominal interest rates will rise and aggregate demand will fall.

B)nominal interest rates will rise and aggregate demand will rise.

C)nominal interest rates will fall and aggregate demand will fall.

D)nominal interest rates will fall and aggregate demand will rise.

A)nominal interest rates will rise and aggregate demand will fall.

B)nominal interest rates will rise and aggregate demand will rise.

C)nominal interest rates will fall and aggregate demand will fall.

D)nominal interest rates will fall and aggregate demand will rise.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

46

The most likely impact of an unanticipated increase in the money supply is a(n):

A)increase in the real interest rate, which in turn stimulates investment and GDP.

B)decrease in the real interest rate, which in turn stimulates investment and GDP.

C)decrease in real output, which causes the real interest rate to decline and in turn stimulate investment and GDP.

D)increase in real output, which causes the real interest rate to decline.

A)increase in the real interest rate, which in turn stimulates investment and GDP.

B)decrease in the real interest rate, which in turn stimulates investment and GDP.

C)decrease in real output, which causes the real interest rate to decline and in turn stimulate investment and GDP.

D)increase in real output, which causes the real interest rate to decline.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

47

When interest rates are higher:

A)the opportunity cost of holding monetary assets is higher, and the quantity of money demanded, but not the demand for money, is lower.

B)the opportunity cost of holding monetary assets is higher, and the demand for money increases.

C)the opportunity cost of holding monetary assets is lower, and the quantity of money demanded, but not the demand for money, is greater.

D)the opportunity cost of holding monetary assets is lower, and the demand for money increases.

A)the opportunity cost of holding monetary assets is higher, and the quantity of money demanded, but not the demand for money, is lower.

B)the opportunity cost of holding monetary assets is higher, and the demand for money increases.

C)the opportunity cost of holding monetary assets is lower, and the quantity of money demanded, but not the demand for money, is greater.

D)the opportunity cost of holding monetary assets is lower, and the demand for money increases.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

48

If unemployment is the major problem in the economy, which of the following would be an appropriate monetary policy response?

A)decrease the required reserve ratio

B)decrease the interest rate the Fed pays on bank reserves

C)buy government bonds

D)all of the above

A)decrease the required reserve ratio

B)decrease the interest rate the Fed pays on bank reserves

C)buy government bonds

D)all of the above

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

49

Other things equal, the level of real GDP will tend to increase in the short run:

A)if reserve requirements are decreased.

B)if the Fed decreases the interest rate it pays on bank reserves

C)if there is an open market purchase by the Fed.

D)all of the above

A)if reserve requirements are decreased.

B)if the Fed decreases the interest rate it pays on bank reserves

C)if there is an open market purchase by the Fed.

D)all of the above

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

50

The ________ interest is the relevant interest rate in the money market; the __________ interest rate is the relevant interest rate in the loanable funds market.

A)Nominal; nominal.

B)Nominal; real

C)Real; nominal

D)Real; real

A)Nominal; nominal.

B)Nominal; real

C)Real; nominal

D)Real; real

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following is true?

A)The quantity of money demanded varies inversely with the nominal rate of interest.

B)Money market equilibrium occurs at that nominal interest rate where the quantity of money demanded equals the quantity of money supplied.

C)Rising national income will shift the demand for money to the right, leading to a new higher equilibrium nominal interest rate.

D)All of the above are true.

A)The quantity of money demanded varies inversely with the nominal rate of interest.

B)Money market equilibrium occurs at that nominal interest rate where the quantity of money demanded equals the quantity of money supplied.

C)Rising national income will shift the demand for money to the right, leading to a new higher equilibrium nominal interest rate.

D)All of the above are true.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

52

The primary reason that money is demanded is for:

A)transaction purposes.

B)asset purposes.

C)precautionary reasons.

D)investment purposes.

A)transaction purposes.

B)asset purposes.

C)precautionary reasons.

D)investment purposes.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

53

When money demand decreases, the Fed can choose between:

A)increasing interest rates or increasing the supply of money.

B)increasing interest rates or decreasing the supply of money.

C)decreasing interest rates or increasing the supply of money.

D)decreasing interest rates or decreasing the supply of money.

A)increasing interest rates or increasing the supply of money.

B)increasing interest rates or decreasing the supply of money.

C)decreasing interest rates or increasing the supply of money.

D)decreasing interest rates or decreasing the supply of money.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

54

Ceteris paribus, which of the following situations would result in the largest quantity of money demanded?

A)When nominal GDP = $1.4 trillion and the interest rate is 3 percent.

B)When nominal GDP = $1.4 trillion and the interest rate is 6 percent.

C)When nominal GDP = $1.2 trillion and the interest rate is 5 percent.

D)When nominal GDP = $800 billion and the interest rate is 4 percent.

A)When nominal GDP = $1.4 trillion and the interest rate is 3 percent.

B)When nominal GDP = $1.4 trillion and the interest rate is 6 percent.

C)When nominal GDP = $1.2 trillion and the interest rate is 5 percent.

D)When nominal GDP = $800 billion and the interest rate is 4 percent.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

55

Profitable investment is most effectively promoted when:

A)the money supply and price level are stable.

B)inflation is rising rapidly.

C)monetary policy is unanticipated.

D)persistent inflation increases uncertainty.

A)the money supply and price level are stable.

B)inflation is rising rapidly.

C)monetary policy is unanticipated.

D)persistent inflation increases uncertainty.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

56

If unemployment is the major problem in the economy, which of the following would be an appropriate monetary policy response?

A)decrease taxes

B)decrease the discount rate

C)sell government bonds

D)all of the above

A)decrease taxes

B)decrease the discount rate

C)sell government bonds

D)all of the above

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following pairs of policies shift aggregate demand in the same direction?

A)A tax increase and an increase in the money supply.

B)A transfer payment decrease and an increase in the money supply.

C)A reduction in government purchases and decline in the money supply.

D)An increase in government purchases and a decline in the money supply.

A)A tax increase and an increase in the money supply.

B)A transfer payment decrease and an increase in the money supply.

C)A reduction in government purchases and decline in the money supply.

D)An increase in government purchases and a decline in the money supply.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

58

An unexpected change in nominal interest rate changes real interest rate by ____ in the short run.

A)a smaller amount

B)a larger amount

C)the same amount

D)an indeterminate percent

A)a smaller amount

B)a larger amount

C)the same amount

D)an indeterminate percent

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

59

When the Fed unexpectedly increases the money supply, it will cause an increase in aggregate demand because:

A)real interest rates will fall, stimulating business investment and consumer purchases.

B)the dollar will depreciate on the foreign exchange market, leading to an increase in net exports.

C)lower interest rates will tend to increase asset prices, which increases wealth and thereby stimulates current consumption.

D)of all the above reasons.

A)real interest rates will fall, stimulating business investment and consumer purchases.

B)the dollar will depreciate on the foreign exchange market, leading to an increase in net exports.

C)lower interest rates will tend to increase asset prices, which increases wealth and thereby stimulates current consumption.

D)of all the above reasons.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

60

If the Fed wanted to reduce the federal funds interest rate, it might:

A)decrease the interest rate it pays on bank reserves.

B)decrease the required reserve ratio.

C)buy government securities.

D)Do any of the above.

A)decrease the interest rate it pays on bank reserves.

B)decrease the required reserve ratio.

C)buy government securities.

D)Do any of the above.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

61

Other things equal, monetary policy to offset a contractionary gap will tend to

A)Increase the money supply and lower interest rates

B)Increase the money supply and increase interest rates

C)Decrease the money supply and lower interest rates

D)Decrease the money supply and increase interest rates

A)Increase the money supply and lower interest rates

B)Increase the money supply and increase interest rates

C)Decrease the money supply and lower interest rates

D)Decrease the money supply and increase interest rates

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

62

An increase in the money supply:

A)will definitely result in inflation if unemployment is high and there is much unused industrial capacity.

B)shifts the aggregate demand curve to the left.

C)will probably result in inflation if the economy is fully employed.

D)causes interest rates to rise.

A)will definitely result in inflation if unemployment is high and there is much unused industrial capacity.

B)shifts the aggregate demand curve to the left.

C)will probably result in inflation if the economy is fully employed.

D)causes interest rates to rise.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

63

An expansionary monetary policy is likely to increase real output more than just temporarily:

A)when actual output currently is beyond the economy's long-run capacity.

B)when the economy currently is at full employment.

C)when the economy currently operates at less than capacity.

D)at virtually any output level.

A)when actual output currently is beyond the economy's long-run capacity.

B)when the economy currently is at full employment.

C)when the economy currently operates at less than capacity.

D)at virtually any output level.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

64

When changes in the supply of money are implemented, it makes interest rates change in the _____ direction as the shift in the money supply curve and makes aggregate demand change in the _____ direction as the shift in the money supply curve.

A)Same; same.

B)Same; opposite.

C)opposite; same.

D)Opposite; opposite.

A)Same; same.

B)Same; opposite.

C)opposite; same.

D)Opposite; opposite.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

65

When the economy is initially at full employment:

A)contractionary monetary policy can result in increased real output, but only in the short run.

B)contractionary monetary policy can result in increased real output in both the short run and long run.

C)contractionary monetary policy can result in decreased real output, but only in the short run.

D)contractionary monetary policy can result in decreased real output in both the short run and long run.

A)contractionary monetary policy can result in increased real output, but only in the short run.

B)contractionary monetary policy can result in increased real output in both the short run and long run.

C)contractionary monetary policy can result in decreased real output, but only in the short run.

D)contractionary monetary policy can result in decreased real output in both the short run and long run.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

66

Based on the situation depicted in the graph below, which of the following would be an appropriate monetary policy response?

A)increase reserve requirements

B)increase the interest rate the Fed pays on bank reserves

C)buy government bonds

D)none of the above

A)increase reserve requirements

B)increase the interest rate the Fed pays on bank reserves

C)buy government bonds

D)none of the above

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

67

The money supply and money demand curves are _____ and ______ respectively.

A)Vertical; downward sloping.

B)Upward sloping; vertical

C)Upward sloping, downward sloping

D)None of the above

A)Vertical; downward sloping.

B)Upward sloping; vertical

C)Upward sloping, downward sloping

D)None of the above

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

68

When the money supply decreases, other things being equal,

A)real interest rates fall and investment spending rises.

B)real interest rates fall and investment spending falls.

C)real interest rates rise and investment spending falls.

D)real interest rates rise and investment spending rises.

A)real interest rates fall and investment spending rises.

B)real interest rates fall and investment spending falls.

C)real interest rates rise and investment spending falls.

D)real interest rates rise and investment spending rises.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

69

The Fed would engage in ____ it wanted to address an inflationary gap.

A)expansionary monetary policy

B)contractionary monetary policy

C)contractionary fiscal policy

D)expansionary fiscal policy

A)expansionary monetary policy

B)contractionary monetary policy

C)contractionary fiscal policy

D)expansionary fiscal policy

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

70

Based on the situation depicted in the graph below, which of the following would be an appropriate monetary policy response?

A)decrease reserve requirements

B)decrease the discount rate

C)buy government bonds

D)none of the above

A)decrease reserve requirements

B)decrease the discount rate

C)buy government bonds

D)none of the above

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

71

Below the equilibrium level of nominal interest rates, there is a _______ of money and money interest rates will tend to _____ as a result.

A)Shortage; fall.

B)Shortage; rise.

C)Surplus, fall.

D)Surplus; rise.

A)Shortage; fall.

B)Shortage; rise.

C)Surplus, fall.

D)Surplus; rise.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

72

If the Fed sells bonds, the short run impact of this policy will tend to include:

A)an increase in the inflation rate.

B)a reduction in unemployment.

C)an increase in real output.

D)an increase in real interest rates.

A)an increase in the inflation rate.

B)a reduction in unemployment.

C)an increase in real output.

D)an increase in real interest rates.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

73

Based on the situation depicted in the graph below, which of the following would be an appropriate monetary policy response?

A)increase reserve requirements

B)increase the discount rate

C)sell government bonds

D)none of the above

A)increase reserve requirements

B)increase the discount rate

C)sell government bonds

D)none of the above

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

74

Monetary policy designed to offset an inflationary gap would:

A)Increase interest rates and increase aggregate demand.

B)Increase interest rates and decrease aggregate demand.

C)Decrease interest rates and increase aggregate demand

D)Decrease interest rates and decrease aggregate demand.

A)Increase interest rates and increase aggregate demand.

B)Increase interest rates and decrease aggregate demand.

C)Decrease interest rates and increase aggregate demand

D)Decrease interest rates and decrease aggregate demand.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

75

Other things equal, in an open economy, monetary policy to offset a contractionary gap will tend to

A)Lower the exchange value of the dollar and lower net exports.

B)Lower the exchange value of the dollar and raise net exports.

C)Raise the exchange value of the dollar and lower net exports.

D)Raise the exchange value of the dollar and raise net exports.

A)Lower the exchange value of the dollar and lower net exports.

B)Lower the exchange value of the dollar and raise net exports.

C)Raise the exchange value of the dollar and lower net exports.

D)Raise the exchange value of the dollar and raise net exports.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

76

Other things equal, in an open economy, monetary policy to offset an inflationary gap will tend to

A)Lower the exchange value of the dollar and lower net exports.

B)Lower the exchange value of the dollar and raise net exports.

C)Raise the exchange value of the dollar and lower net exports.

D)Raise the exchange value of the dollar and raise net exports.

A)Lower the exchange value of the dollar and lower net exports.

B)Lower the exchange value of the dollar and raise net exports.

C)Raise the exchange value of the dollar and lower net exports.

D)Raise the exchange value of the dollar and raise net exports.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following decreases Money Demand?

A)Lower nominal interest rates.

B)Higher nominal interest rates.

C)A higher price level

D)A lower price level

A)Lower nominal interest rates.

B)Higher nominal interest rates.

C)A higher price level

D)A lower price level

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

78

Starting at full employment (RGDPNR),

A)expansionary monetary policy can potentially result in increased real output, but only in the short run.

B)expansionary monetary policy can potentially result in increased real output in both the short run and long run.

C)contractionary monetary policy can potentially result in increased real output, but only in the short run.

D)contractionary monetary policy can potentially result in increased real output in both the short run and long run.

A)expansionary monetary policy can potentially result in increased real output, but only in the short run.

B)expansionary monetary policy can potentially result in increased real output in both the short run and long run.

C)contractionary monetary policy can potentially result in increased real output, but only in the short run.

D)contractionary monetary policy can potentially result in increased real output in both the short run and long run.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

79

Based on the situation depicted in the graph below, which of the following would be an appropriate monetary policy response?

A)decrease reserve requirements

B)Increase the interest rate the Fed pays on bank reserves

C)buy government bonds

D)none of the above

A)decrease reserve requirements

B)Increase the interest rate the Fed pays on bank reserves

C)buy government bonds

D)none of the above

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

80

When the economy is initially at full employment:

A)expansionary monetary policy will tend to increase the price level in the short run and the long run.

B)expansionary monetary policy will tend to increase the price level in the short run but not the long run.

C)expansionary monetary policy will tend to increase the price level in the long run but not the short runq

D)expansionary monetary policy will not tend to increase the price level in the short run or the long run.

A)expansionary monetary policy will tend to increase the price level in the short run and the long run.

B)expansionary monetary policy will tend to increase the price level in the short run but not the long run.

C)expansionary monetary policy will tend to increase the price level in the long run but not the short runq

D)expansionary monetary policy will not tend to increase the price level in the short run or the long run.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck