Deck 4: The Accounting Cycle: Accruals and Deferrals

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/117

Play

Full screen (f)

Deck 4: The Accounting Cycle: Accruals and Deferrals

1

Prepaid expenses are assets that should appear on the balance sheet.

True

2

The adjusting entry to record estimated income taxes in a profitable period consists of a debit to Income Tax Payable and a credit to Income Tax Expense.

False

3

Omission of the adjusting entry needed to accrue an expense at the end of the period would cause liabilities to be understated.

True

4

Every adjusting entry involves the recognition of either revenue or an expense.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

5

Since the Accumulated Depreciation account has a credit balance,it is reported on the liability side of the balance sheet along with other accounts that have a credit balance.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

6

Unpaid expenses may be included as an expense on the income statement.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

7

Depreciation expense on equipment is considered a cash expense since the company must pay cash for the equipment.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

8

Adjusting entries are usually made on a daily basis.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

9

The period of time over which the cost of an asset is allocated to depreciation expense is called its useful life.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

10

When a company receives cash in advance and is obligated to provide a service or a product in the future,the entry would be a debit to a revenue account and a credit to a liability account.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

11

Unearned revenue is a liability and should be reported on the income statement.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

12

Wages are an expense to the employer when earned,rather than when paid.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

13

Adjusting entries are needed whenever transactions affect the revenue or expenses of more than one accounting period.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

14

Adjusting entries are only required when errors are made.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

15

The failure to record an adjusting entry for depreciation would cause assets to be overstated and net income to be understated.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

16

If a depreciable asset's market value increases during the year,no depreciation expense should be recorded.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

17

Recording depreciation expense is an example of an adjusting entry to accrue unpaid expenses resulting from expenses being incurred before cash is paid.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

18

Avalon Company paid $4,400 cash for an insurance policy providing three years protection against fire loss.This transaction could properly be recorded by a $4,400 debit to Unexpired Insurance and a $4,400 credit to Cash.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

19

The Cash account is usually affected by adjusting entries.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

20

One of the purposes of adjusting entries is to convert assets to expenses.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

21

If Hot Bagel Co.estimates depreciation on an automobile to be $578 for the year,the company should make the following adjusting entry:

A)Debit Accumulated Depreciation $578 and credit Depreciation Expense $578.

B)Debit Depreciation Expense $578 and credit Automobile $578.

C)Debit Depreciation Expense $578 and credit Accumulated Depreciation $578.

D)Debit Automobile $578 and credit Depreciation Expense $578.

A)Debit Accumulated Depreciation $578 and credit Depreciation Expense $578.

B)Debit Depreciation Expense $578 and credit Automobile $578.

C)Debit Depreciation Expense $578 and credit Accumulated Depreciation $578.

D)Debit Automobile $578 and credit Depreciation Expense $578.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following is not a purpose of adjusting entries?

A)To prepare the revenue and expense accounts for recording transactions of the following period.

B)To apportion the proper amounts of revenue and expense to the current accounting period.

C)To establish the proper amounts of assets and liabilities in the balance sheet.

D)To accomplish the objective of offsetting the revenue of the period with all the expenses incurred in generating that revenue.

A)To prepare the revenue and expense accounts for recording transactions of the following period.

B)To apportion the proper amounts of revenue and expense to the current accounting period.

C)To establish the proper amounts of assets and liabilities in the balance sheet.

D)To accomplish the objective of offsetting the revenue of the period with all the expenses incurred in generating that revenue.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

23

The realization principle underlies the accounting practices of depreciating plant assets and amortizing the cost of unexpired insurance policies.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

24

Adjusting entries

A)Are generally made daily.

B)Assign revenues to the period in which they are received.

C)Generally fall into one of two categories.

D)Are needed whenever revenue transactions affect more than one period.

A)Are generally made daily.

B)Assign revenues to the period in which they are received.

C)Generally fall into one of two categories.

D)Are needed whenever revenue transactions affect more than one period.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

25

Materiality is determined by the Financial Accounting Standards Board.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

26

Adjusting entries are needed:

A)Whenever revenue is not received in cash.

B)Whenever expenses are not paid in cash.

C)Only to correct errors in the initial recording of business transactions.

D)Whenever transactions affect the revenue or expenses of more than one accounting period.

A)Whenever revenue is not received in cash.

B)Whenever expenses are not paid in cash.

C)Only to correct errors in the initial recording of business transactions.

D)Whenever transactions affect the revenue or expenses of more than one accounting period.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

27

No adjusting entry should consist of:

A)A debit to an expense and a credit to an asset.

B)A debit to an expense and a credit to revenue.

C)A debit to an expense and a credit to a liability.

D)A debit to a liability and a credit to revenue.

A)A debit to an expense and a credit to an asset.

B)A debit to an expense and a credit to revenue.

C)A debit to an expense and a credit to a liability.

D)A debit to a liability and a credit to revenue.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

28

Immaterial items may be accounted for in the most convenient manner,without regard to other theoretical concepts.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

29

The adjusted trial balance may be used in place of the income statement.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

30

An adjusting entry to recognize revenue that has been earned but not yet billed or collected will cause an increase in total liabilities.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

31

The normal balance of the Accumulated Depreciation account is:

A)A debit balance.

B)A credit balance.

C)Either a debit balance or a credit balance.

D)There is no normal balance for this account.

A)A debit balance.

B)A credit balance.

C)Either a debit balance or a credit balance.

D)There is no normal balance for this account.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

32

We can compare income of the current period with income of a previous period to determine whether the operating results are improving or declining:

A)Only if each accounting period covered is a full year.

B)Only if the same accountant prepares the income statement each period.

C)Only if the accounting periods are equal in length.

D)Only if a manual accounting system is used in both periods.

A)Only if each accounting period covered is a full year.

B)Only if the same accountant prepares the income statement each period.

C)Only if the accounting periods are equal in length.

D)Only if a manual accounting system is used in both periods.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following is not an example of an adjusting entry?

A)The entry to record unpaid expenses.

B)The entry to record uncollected revenues.

C)The entry to convert liabilities to revenue.

D)The entry to pay outstanding bills.

A)The entry to record unpaid expenses.

B)The entry to record uncollected revenues.

C)The entry to convert liabilities to revenue.

D)The entry to pay outstanding bills.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following is considered an adjusting entry?

A)The entry to record depreciation.

B)The entry to pay salaries.

C)The entry to pay outstanding bills.

D)The entry to declare a dividend distribution.

A)The entry to record depreciation.

B)The entry to pay salaries.

C)The entry to pay outstanding bills.

D)The entry to declare a dividend distribution.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

35

The purpose of adjusting entries is to:

A)Prepare the revenue and expense accounts for recording the revenue and expenses of the next accounting period.

B)Record certain revenue and expenses that are not properly measured in the course of recording daily routine transactions.

C)Correct errors made during the accounting period.

D)Update the owners' equity account for the changes in owners' equity that had been recorded in revenue and expense accounts throughout the period.

A)Prepare the revenue and expense accounts for recording the revenue and expenses of the next accounting period.

B)Record certain revenue and expenses that are not properly measured in the course of recording daily routine transactions.

C)Correct errors made during the accounting period.

D)Update the owners' equity account for the changes in owners' equity that had been recorded in revenue and expense accounts throughout the period.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

36

An expenditure that benefits year one but is paid for in year two should not be recorded until year two.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

37

Adjusting entries are prepared:

A)Before financial statements and after a trial balance has been prepared.

B)After a trial balance has been prepared and after financial statements are prepared.

C)After posting but before a trial balance is prepared.

D)Anytime an accountant sees fit to prepare the entries.

A)Before financial statements and after a trial balance has been prepared.

B)After a trial balance has been prepared and after financial statements are prepared.

C)After posting but before a trial balance is prepared.

D)Anytime an accountant sees fit to prepare the entries.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

38

The balance in the Retained Earnings account that appears on the adjusted trial balance is the same as the balance of the Retained Earnings account that is reported on the balance sheet.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following is not considered a basic type of adjusting entry?

A)An entry to convert a liability to a revenue.

B)An entry to accrue unpaid expenses.

C)An entry to convert an asset to an expense.

D)An entry to convert an asset to a liability.

A)An entry to convert a liability to a revenue.

B)An entry to accrue unpaid expenses.

C)An entry to convert an asset to an expense.

D)An entry to convert an asset to a liability.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following situations does not require Empire Company to record an adjusting entry at the end of January?

A)On January 1,Empire Company purchased delivery equipment with an estimated useful life of five years.

B)On January 1,Empire Company began delivery service for a large client who will pay at the end of a three-month period.

C)At the end of January,Empire Company pays the custodian for January office cleaning services.

D)On January 1,Empire Company paid rent for six months on its office building.

A)On January 1,Empire Company purchased delivery equipment with an estimated useful life of five years.

B)On January 1,Empire Company began delivery service for a large client who will pay at the end of a three-month period.

C)At the end of January,Empire Company pays the custodian for January office cleaning services.

D)On January 1,Empire Company paid rent for six months on its office building.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

41

The cost of insurance is considered an expense:

A)Only when the entire policy period has passed.

B)Only when the policy is purchased.

C)Only when the premium is paid.

D)Evenly over the term of the policy.

A)Only when the entire policy period has passed.

B)Only when the policy is purchased.

C)Only when the premium is paid.

D)Evenly over the term of the policy.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

42

Gourmet Shop purchased cash registers on April 1 for $12,000.If this asset has an estimated useful life of four years,what is the book value of the cash registers on May 31?

A)$250.

B)$3,000.

C)$9,000.

D)$11,500.

A)$250.

B)$3,000.

C)$9,000.

D)$11,500.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

43

Recently,Bon Appetite Café contracted and paid for a relatively expensive advertisement in Haute Cuisine magazine.Despite the fact that the ad will appear in Haute Cuisine three months after the end of Bon Appetite Café's current fiscal year,the Cafe's accountant recorded the disbursement to advertising expense.If no adjusting entry is made,how will this year's financial statements of Bon Appetite Café be affected?

A)Net income will be overstated and total assets will be understated.

B)Net income will be overstated and total assets will be overstated.

C)Net income will be understated and total assets will be understated.

D)Net income will be understated and total assets will be overstated.

A)Net income will be overstated and total assets will be understated.

B)Net income will be overstated and total assets will be overstated.

C)Net income will be understated and total assets will be understated.

D)Net income will be understated and total assets will be overstated.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following statements regarding depreciation is correct?

A)Depreciation is an exact calculation of the decline in value of an asset.

B)Depreciation is only an estimate of the decline in value of an asset.

C)Depreciation is only recorded at the end of a year and never over a shorter time period.

D)Management must know the exact life of an asset in order to calculate an acceptable depreciation expense.

A)Depreciation is an exact calculation of the decline in value of an asset.

B)Depreciation is only an estimate of the decline in value of an asset.

C)Depreciation is only recorded at the end of a year and never over a shorter time period.

D)Management must know the exact life of an asset in order to calculate an acceptable depreciation expense.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

45

Prepaid expenses are:

A)Assets.

B)Income.

C)Liabilities.

D)Expenses.

A)Assets.

B)Income.

C)Liabilities.

D)Expenses.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

46

Accumulated depreciation is:

A)The depreciation expense recorded on an asset to date.

B)The remaining book value of an asset.

C)The depreciation expense taken on an asset during the current period.

D)An expense on the income statement.

A)The depreciation expense recorded on an asset to date.

B)The remaining book value of an asset.

C)The depreciation expense taken on an asset during the current period.

D)An expense on the income statement.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

47

The entry to record depreciation is an example of an adjusting entry:

A)To apportion a recorded cost.

B)To apportion unearned revenue.

C)To convert a liability to revenue.

D)To record unrecorded revenue.

A)To apportion a recorded cost.

B)To apportion unearned revenue.

C)To convert a liability to revenue.

D)To record unrecorded revenue.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

48

Colonial Systems prepares monthly financial statements.Colonial would record a prepaid expense in each of the following situations except:

A)Colonial Systems purchased a two-year fire insurance policy.

B)Colonial Systems paid for six months' gardening services in advance.

C)A tenant paid Colonial Systems three months' rent in advance.

D)Colonial Systems purchased enough office supplies to last several months.

A)Colonial Systems purchased a two-year fire insurance policy.

B)Colonial Systems paid for six months' gardening services in advance.

C)A tenant paid Colonial Systems three months' rent in advance.

D)Colonial Systems purchased enough office supplies to last several months.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following entries causes an immediate decrease in assets and in net income?

A)The entry to record depreciation expense.

B)The entry to record revenue earned but not yet received.

C)The entry to record the earned portion of rent received in advance.

D)The entry to record accrued wages payable.

A)The entry to record depreciation expense.

B)The entry to record revenue earned but not yet received.

C)The entry to record the earned portion of rent received in advance.

D)The entry to record accrued wages payable.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

50

Which statement is true about land?

A)Land should be depreciated over the same period as the building located on it.

B)Land cannot be depreciated for greater than a 40-year period.

C)Land should not be depreciated.

D)The straight line method should be used to depreciate land.

A)Land should be depreciated over the same period as the building located on it.

B)Land cannot be depreciated for greater than a 40-year period.

C)Land should not be depreciated.

D)The straight line method should be used to depreciate land.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

51

An adjusting entry to convert an asset to expense consists of:

A)A debit to a liability and a credit to cash.

B)A debit to an expense and a credit to cash.

C)A debit to an expense and a credit to an asset account.

D)A debit to an asset account and a credit to an expense account.

A)A debit to a liability and a credit to cash.

B)A debit to an expense and a credit to cash.

C)A debit to an expense and a credit to an asset account.

D)A debit to an asset account and a credit to an expense account.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

52

Shop supplies are expensed when:

A)Consumed.

B)Purchased.

C)Paid for.

D)Ordered.

A)Consumed.

B)Purchased.

C)Paid for.

D)Ordered.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

53

Depreciation expense is:

A)Only an estimate.

B)An exact calculation prepared by an appraiser.

C)Not to be calculated unless the exact life of an asset can be determined.

D)To be determined for all assets owned by a company.

A)Only an estimate.

B)An exact calculation prepared by an appraiser.

C)Not to be calculated unless the exact life of an asset can be determined.

D)To be determined for all assets owned by a company.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

54

Accumulated Depreciation is:

A)An asset account.

B)A revenue account.

C)A contra-asset account.

D)An expense account.

A)An asset account.

B)A revenue account.

C)A contra-asset account.

D)An expense account.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

55

In which of the following situations would the largest amount be recorded as an expense of the current year? (Assume accrual basis accounting.)

A)$4,000 is paid in January for equipment with a useful life of four years.

B)$1,800 is paid in January for a two-year fire insurance policy.

C)$1,200 cash dividends are declared and paid.

D)$900 is paid to an attorney for legal services rendered during the current year.

A)$4,000 is paid in January for equipment with a useful life of four years.

B)$1,800 is paid in January for a two-year fire insurance policy.

C)$1,200 cash dividends are declared and paid.

D)$900 is paid to an attorney for legal services rendered during the current year.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

56

An example of a contra-asset account is:

A)Depreciation Expense.

B)Accumulated Depreciation.

C)Prepaid expenses.

D)Unearned revenue.

A)Depreciation Expense.

B)Accumulated Depreciation.

C)Prepaid expenses.

D)Unearned revenue.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

57

Prepaid expenses appear:

A)As an expense on the income statement.

B)As an asset on the balance sheet.

C)As a liability on the balance sheet.

D)As a reduction to retained earnings.

A)As an expense on the income statement.

B)As an asset on the balance sheet.

C)As a liability on the balance sheet.

D)As a reduction to retained earnings.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

58

An asset purchased on January 1,2012 for $60,000 that has an estimated life of 10 years will have a book value on December 31,2015 of:

A)$60,000.

B)$24,000.

C)$36,000.

D)$42,000.

A)$60,000.

B)$24,000.

C)$36,000.

D)$42,000.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

59

If an asset was purchased on January 1,2012 for $140,000 with an estimated life of 5 years,what is the accumulated depreciation at December 31,2015?

A)$28,000.

B)$112,000.

C)$56,000.

D)$84,000.

A)$28,000.

B)$112,000.

C)$56,000.

D)$84,000.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following statements is not true regarding prepaid expenses?

A)Prepaid expenses represent assets.

B)Prepaid expenses are shown in a special section of the income statement.

C)Prepaid expenses become expenses only as goods or services are used up.

D)Prepaid expenses appear in the balance sheet.

A)Prepaid expenses represent assets.

B)Prepaid expenses are shown in a special section of the income statement.

C)Prepaid expenses become expenses only as goods or services are used up.

D)Prepaid expenses appear in the balance sheet.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following is not considered an end-of-period adjusting entry?

A)The entry to record the portion of unexpired insurance which has become expense during the period.

B)An entry to record revenue which has been earned but has not yet been billed to customers.

C)The entry to record depreciation expense.

D)An entry to record repayment of a bank loan and to recognize related interest expense.

A)The entry to record the portion of unexpired insurance which has become expense during the period.

B)An entry to record revenue which has been earned but has not yet been billed to customers.

C)The entry to record depreciation expense.

D)An entry to record repayment of a bank loan and to recognize related interest expense.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

62

In which of the following situations would Daystar Company record unearned revenue in May?

A)In April,Daystar Company received payment from a customer for services that are performed in May.

B)Daystar Company completes a job for a customer in May; payment will be received in June.

C)Daystar Company is paid on May 25 for work done in the first two weeks of May.

D)Daystar Company receives payment in May for work to be performed in June and July.

A)In April,Daystar Company received payment from a customer for services that are performed in May.

B)Daystar Company completes a job for a customer in May; payment will be received in June.

C)Daystar Company is paid on May 25 for work done in the first two weeks of May.

D)Daystar Company receives payment in May for work to be performed in June and July.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

63

The United Shipping Co.borrowed $25,000 at 12% interest on March 1,2015.The note is to be repaid,with interest,in six months.If United Shipping makes monthly adjusting entries,which of the following is included as part of the March 31 adjusting entry?

A)Debit Interest Receivable $250.

B)Credit Interest Payable $2,500.

C)Debit Interest Expense $250.

D)Debit Interest Payable $250.

A)Debit Interest Receivable $250.

B)Credit Interest Payable $2,500.

C)Debit Interest Expense $250.

D)Debit Interest Payable $250.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

64

On June 1,Norma Company signed a 12-month lease for warehouse space.The lease requires monthly rent of $550,with 4 months paid in advance.Norma Company records the payment by debiting Prepaid Rent $2,200 and crediting Cash $2,200.At the end of June,what should be the balance of Norma's Prepaid Rent account?

A)$0

B)$2,200

C)$1,650

D)$550

A)$0

B)$2,200

C)$1,650

D)$550

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

65

Hahn Corp.has three employees.Each earns $600 per week for a five day work week ending on Friday.This month the last day of the month falls on a Wednesday.The company should make an adjusting entry:

A)Debiting Wage Expense for $1,080 and crediting Wages Payable for $1,080.

B)Debiting Wage Expense for $360 and crediting Wages Payable for $360.

C)Crediting Wage Expense for $1,080 and debiting Wages Payable for $1,080.

D)Crediting Wage Expense for $360 and debiting Wages Payable for $360.

A)Debiting Wage Expense for $1,080 and crediting Wages Payable for $1,080.

B)Debiting Wage Expense for $360 and crediting Wages Payable for $360.

C)Crediting Wage Expense for $1,080 and debiting Wages Payable for $1,080.

D)Crediting Wage Expense for $360 and debiting Wages Payable for $360.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

66

The accrual of interest on a note payable will:

A)Reduce total liabilities.

B)Increase total liabilities.

C)Have no effect upon total liabilities.

D)Will have no effect upon the income statement but will affect the balance sheet.

A)Reduce total liabilities.

B)Increase total liabilities.

C)Have no effect upon total liabilities.

D)Will have no effect upon the income statement but will affect the balance sheet.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

67

The adjusting entry to record interest that has accrued on a note payable to the bank will cause an immediate:

A)Increase in liabilities and reduction in net income.

B)Decrease in liabilities and reduction in net income.

C)Decrease in assets and reduction in net income.

D)Increase in assets and increase in net income.

A)Increase in liabilities and reduction in net income.

B)Decrease in liabilities and reduction in net income.

C)Decrease in assets and reduction in net income.

D)Increase in assets and increase in net income.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

68

Unearned revenue is:

A)An asset.

B)Income.

C)A liability.

D)An expense.

A)An asset.

B)Income.

C)A liability.

D)An expense.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

69

Tuna Co.purchased a building in 2015 for $650,000 and debited an asset called "Buildings" for the entire amount.The company never depreciated the building although it had a useful life of 15 years.At the end of 2015,this action will cause:

A)Net income to be understated.

B)Net income to be overstated.

C)Net income will not be affected.

D)Total assets will be understated.

A)Net income to be understated.

B)Net income to be overstated.

C)Net income will not be affected.

D)Total assets will be understated.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

70

Videobusters,Inc.offered books of video rental coupons to its patrons at $40 per book.Each book contained a certain number of coupons for video rentals.During the current period 500 books were sold for $20,000,and this amount was credited to Unearned Rental Revenue.At the end of the period,it was determined that $15,000 worth of coupons had been used by customers to rent videos.The appropriate adjusting entry at the end of the period would be:

A)Debit Rental Revenue $5,000 and credit Unearned Rental Revenue $5,000.

B)Debit Rental Revenue $15,000 and credit Unearned Rental Revenue $15,000.

C)Debit Unearned Rental Revenue $5,000 and credit Rental Revenue $5,000.

D)Debit Unearned Rental Revenue $15,000 and credit Rental Revenue $15,000.

A)Debit Rental Revenue $5,000 and credit Unearned Rental Revenue $5,000.

B)Debit Rental Revenue $15,000 and credit Unearned Rental Revenue $15,000.

C)Debit Unearned Rental Revenue $5,000 and credit Rental Revenue $5,000.

D)Debit Unearned Rental Revenue $15,000 and credit Rental Revenue $15,000.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

71

As of January 31,Princess Company owes $500 to Butler Co.for equipment rented during January.If no adjustment is made for this item at January 31,how will Princess's financial statements be affected?

A)Cash will be overstated at January 31.

B)Net income for January will be overstated.

C)Owners' equity will be understated.

D)The financial statements will be accurate since the $500 does not have to be paid yet.

A)Cash will be overstated at January 31.

B)Net income for January will be overstated.

C)Owners' equity will be understated.

D)The financial statements will be accurate since the $500 does not have to be paid yet.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

72

The balance of an unearned revenue account:

A)Appears in the balance sheet as a component of owners' equity.

B)Appears in the income statement along with other revenue accounts.

C)Appears in a separate section of the income statement for revenue not yet earned.

D)Appears in the liability section of the balance sheet.

A)Appears in the balance sheet as a component of owners' equity.

B)Appears in the income statement along with other revenue accounts.

C)Appears in a separate section of the income statement for revenue not yet earned.

D)Appears in the liability section of the balance sheet.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

73

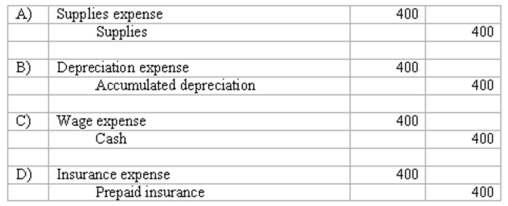

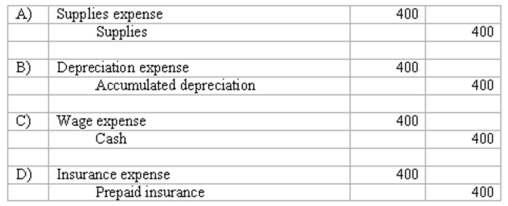

Which of the following would not be considered an adjusting entry?

A)A Above.

B)B Above.

C)C Above.

D)D Above.

A)A Above.

B)B Above.

C)C Above.

D)D Above.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

74

Unearned revenue appears:

A)As income on the income statement.

B)As an asset on the balance sheet.

C)As a liability on the balance sheet.

D)As a part of the retained earnings.

A)As income on the income statement.

B)As an asset on the balance sheet.

C)As a liability on the balance sheet.

D)As a part of the retained earnings.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

75

Under accrual accounting,fees received in advance from customers should be shown as being earned:

A)When cash is collected.

B)When services are performed or goods delivered.

C)When tax rates are low.

D)When tax rates are high.

A)When cash is collected.

B)When services are performed or goods delivered.

C)When tax rates are low.

D)When tax rates are high.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

76

Unearned revenue may also be called:

A)Net income.

B)Deferred revenue.

C)Unexpired revenue.

D)Services rendered.

A)Net income.

B)Deferred revenue.

C)Unexpired revenue.

D)Services rendered.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

77

In which of the following situations would an adjusting entry be made at the end of January to record an accrued expense?

A)Ramona's Nursery purchased playground equipment on January 1 with an estimated useful life of six years.

B)On January 25,Ramona's Nursery hired a college student to drive the minibus; the new employee is to begin work in February.

C)January 31 falls on a Tuesday; salaries are paid on Friday of each week.

D)On January 31,Ramona's Nursery paid the interest owed on a note payable for January.

A)Ramona's Nursery purchased playground equipment on January 1 with an estimated useful life of six years.

B)On January 25,Ramona's Nursery hired a college student to drive the minibus; the new employee is to begin work in February.

C)January 31 falls on a Tuesday; salaries are paid on Friday of each week.

D)On January 31,Ramona's Nursery paid the interest owed on a note payable for January.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

78

Paddle,Inc.purchased equipment for $14,760 on February 1,2015.The equipment has a useful life of 3 years.How much depreciation expense should Paddle recognize on its income statement for 2015?

A)$4,510

B)$410

C)$4,920

D)$14,760

A)$4,510

B)$410

C)$4,920

D)$14,760

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

79

Interest that has accrued during the accounting period on a note payable requires an adjusting entry consisting of:

A)A debit to Interest Expense and a credit to Cash.

B)A debit to Notes Payable and a credit to Interest Payable.

C)A debit to an asset and a credit to a liability.

D)A debit to Interest Expense and a credit to Interest Payable.

A)A debit to Interest Expense and a credit to Cash.

B)A debit to Notes Payable and a credit to Interest Payable.

C)A debit to an asset and a credit to a liability.

D)A debit to Interest Expense and a credit to Interest Payable.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

80

On December 31,Louis Jeweler's made an adjusting entry to record $4,200 accrued interest payable on its mortgage.On January 10,the mortgage payment was made.This payment included interest charges of $6,300,$2,100 of which were applicable to the period from January 1 through January 10.When recording this mortgage payment,the accountant should:

A)Debit Interest Expense $2,100 and debit Accrued Interest Payable $4,200.

B)Debit Interest Expense $6,300.

C)Debit Accrued Interest Payable $6,300.

D)Debit Interest Expense $2,100 and credit Accrued Interest Payable $4,200.

A)Debit Interest Expense $2,100 and debit Accrued Interest Payable $4,200.

B)Debit Interest Expense $6,300.

C)Debit Accrued Interest Payable $6,300.

D)Debit Interest Expense $2,100 and credit Accrued Interest Payable $4,200.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck