Deck 23: Decision Making and Risk

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/32

Play

Full screen (f)

Deck 23: Decision Making and Risk

1

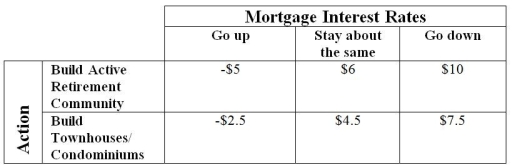

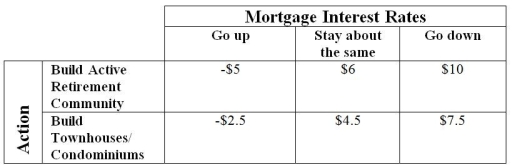

Consider the following to answer the question(s) below:

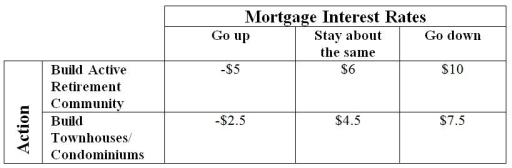

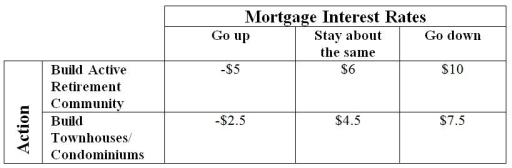

A land owner is considering a community development project. Even though he realizes that the current market for housing is not very favourable, he believes that there will be an influx of retirees into the area within the next five years. He is trying to decide between two alternatives: (1) building detached homes in a planned retirement community or (2) building a smaller townhouse/condominium complex. Mortgage interest rates will affect his outcomes and the applicable payoff (in $ millions) table is shown below.

Suppose housing analysts predict that the probabilities for future mortgage interest rates going up, staying about the same, and going down are 0.35, 0.50 and 0.15, respectively. The expected value for building an active retirement community is

A) $2.5 million

B) $3.625 million

C) $2.75 million

D) $875,000

E) Indeterminate

A land owner is considering a community development project. Even though he realizes that the current market for housing is not very favourable, he believes that there will be an influx of retirees into the area within the next five years. He is trying to decide between two alternatives: (1) building detached homes in a planned retirement community or (2) building a smaller townhouse/condominium complex. Mortgage interest rates will affect his outcomes and the applicable payoff (in $ millions) table is shown below.

Suppose housing analysts predict that the probabilities for future mortgage interest rates going up, staying about the same, and going down are 0.35, 0.50 and 0.15, respectively. The expected value for building an active retirement community is

A) $2.5 million

B) $3.625 million

C) $2.75 million

D) $875,000

E) Indeterminate

C

2

Consider the following to answer the question(s) below:

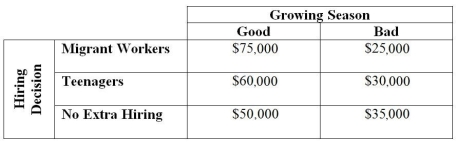

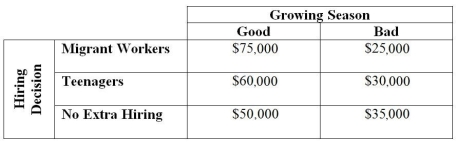

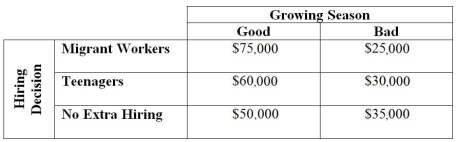

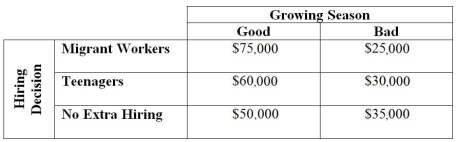

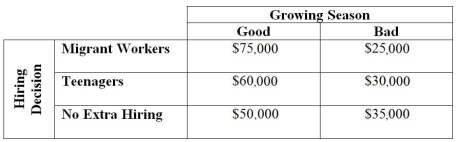

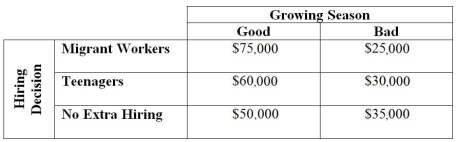

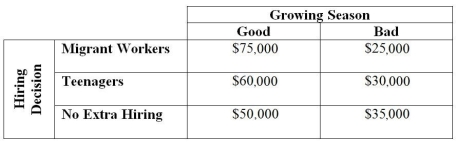

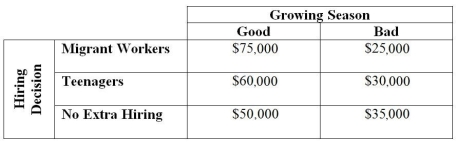

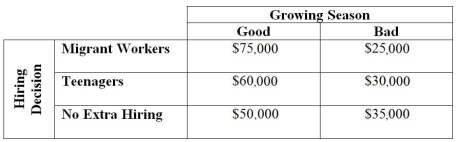

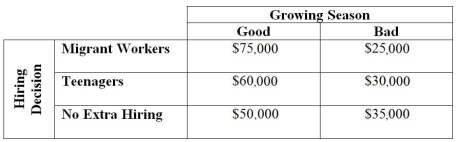

A farm owner who grows summer vegetables (e.g. tomatoes) must decide whether to employ additional pickers this season. If he does, he could hire either migrant workers or local teenagers who need summer employment. The migrant workers are more experienced, faster, but more expensive. Although the teenagers will work for less, they are not as experienced and tend to damage plants and produce. His profits, taking into account losses from unpicked perished or damaged produce, depend on whether there is a good or bad growing season. The payoffs are shown in the table below.

Using the maximin approach, which action should the farm owner choose?

A farm owner who grows summer vegetables (e.g. tomatoes) must decide whether to employ additional pickers this season. If he does, he could hire either migrant workers or local teenagers who need summer employment. The migrant workers are more experienced, faster, but more expensive. Although the teenagers will work for less, they are not as experienced and tend to damage plants and produce. His profits, taking into account losses from unpicked perished or damaged produce, depend on whether there is a good or bad growing season. The payoffs are shown in the table below.

Using the maximin approach, which action should the farm owner choose?

The farm owner would choose to do no additional hiring.

3

The expected value of perfect information is

A) $2.5 million

B) $3.625 million

C) $2.75 million

D) $875,000

E) Indeterminate

A) $2.5 million

B) $3.625 million

C) $2.75 million

D) $875,000

E) Indeterminate

D

4

Consider the following to answer the question(s) below:

A farm owner who grows summer vegetables (e.g. tomatoes) must decide whether to employ additional pickers this season. If he does, he could hire either migrant workers or local teenagers who need summer employment. The migrant workers are more experienced, faster, but more expensive. Although the teenagers will work for less, they are not as experienced and tend to damage plants and produce. His profits, taking into account losses from unpicked perished or damaged produce, depend on whether there is a good or bad growing season. The payoffs are shown in the table below.

Based on the expected value approach, the farmer should

A) hire migrant workers if the growing season is good

B) hire teenagers

C) not do any extra hiring

D) hire migrant workers

E) not do any extra hiring if the growing season is bad

A farm owner who grows summer vegetables (e.g. tomatoes) must decide whether to employ additional pickers this season. If he does, he could hire either migrant workers or local teenagers who need summer employment. The migrant workers are more experienced, faster, but more expensive. Although the teenagers will work for less, they are not as experienced and tend to damage plants and produce. His profits, taking into account losses from unpicked perished or damaged produce, depend on whether there is a good or bad growing season. The payoffs are shown in the table below.

Based on the expected value approach, the farmer should

A) hire migrant workers if the growing season is good

B) hire teenagers

C) not do any extra hiring

D) hire migrant workers

E) not do any extra hiring if the growing season is bad

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

5

Compute the standard deviation for each action.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

6

Consider the following to answer the question(s) below:

A farm owner who grows summer vegetables (e.g. tomatoes) must decide whether to employ additional pickers this season. If he does, he could hire either migrant workers or local teenagers who need summer employment. The migrant workers are more experienced, faster, but more expensive. Although the teenagers will work for less, they are not as experienced and tend to damage plants and produce. His profits, taking into account losses from unpicked perished or damaged produce, depend on whether there is a good or bad growing season. The payoffs are shown in the table below.

Suppose the Farmers' Almanac predicts the probability of a good growing season this year to be 0.75. What is the expected value of hiring teenagers?

A) $62,500

B) $52,500

C) $46,250

D) $12,990

E) Indeterminate.

A farm owner who grows summer vegetables (e.g. tomatoes) must decide whether to employ additional pickers this season. If he does, he could hire either migrant workers or local teenagers who need summer employment. The migrant workers are more experienced, faster, but more expensive. Although the teenagers will work for less, they are not as experienced and tend to damage plants and produce. His profits, taking into account losses from unpicked perished or damaged produce, depend on whether there is a good or bad growing season. The payoffs are shown in the table below.

Suppose the Farmers' Almanac predicts the probability of a good growing season this year to be 0.75. What is the expected value of hiring teenagers?

A) $62,500

B) $52,500

C) $46,250

D) $12,990

E) Indeterminate.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

7

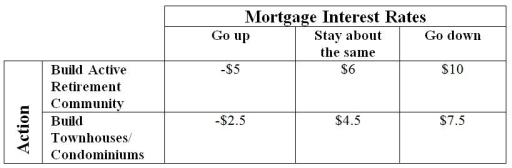

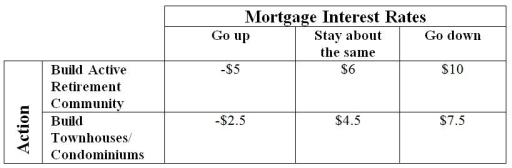

If the land owner is risk averse he would choose the action with the lowest Coefficient of Variation (CV). Which of the following is true?

A) The CV is lower for building townhouses and condominiums.

B) The CV is lower for building an active retirement community.

C) Even if the land owner is risk averse, the CV leads to the same choice as the expected value approach.

D) The CV is higher for building townhouses and condominiums, and even if the land owner is risk averse, the CV leads to the same choice as the expected value approach.

E) The CV is lower for building an active retirement community, and even if the land owner is risk averse, the CV leads to the same choice as the expected value approach.

A) The CV is lower for building townhouses and condominiums.

B) The CV is lower for building an active retirement community.

C) Even if the land owner is risk averse, the CV leads to the same choice as the expected value approach.

D) The CV is higher for building townhouses and condominiums, and even if the land owner is risk averse, the CV leads to the same choice as the expected value approach.

E) The CV is lower for building an active retirement community, and even if the land owner is risk averse, the CV leads to the same choice as the expected value approach.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

8

Suppose housing analysts predict that the probabilities for future mortgage interest rates going up, staying about the same, and going down are 0.35, 0.50 and 0.15, respectively. Compute the expected value for each action. Based on these results, which action should the land owner choose?

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

9

Compute the Coefficient of Variation for each action. If the land owner is risk averse, would the CV for each action lead to the same choice as the expected value? Explain.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

10

Compute the Coefficient of Variation for each action. If the farm owner is risk averse, would the CV for each action lead to the same choice as the expected value? Explain.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

11

Compute the standard deviation for each action.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

12

Suppose the farmer's almanac predicts the probability of a good growing season this year to be 0.75. Compute the expected value for each action. Based on these results, which action should the farm owner choose?

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

13

What is the expected value of perfect information?

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

14

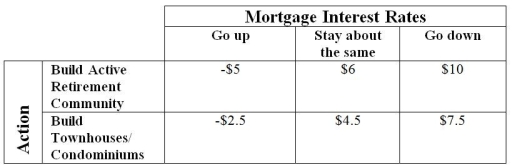

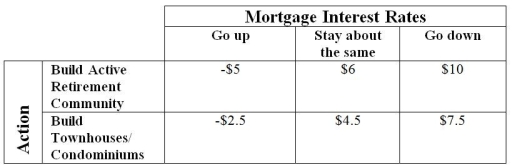

Consider the following to answer the question(s) below:

A land owner is considering a community development project. Even though he realizes that the current market for housing is not very favourable, he believes that there will be an influx of retirees into the area within the next five years. He is trying to decide between two alternatives: (1) building detached homes in a planned retirement community or (2) building a smaller townhouse/condominium complex. Mortgage interest rates will affect his outcomes and the applicable payoff (in $ millions) table is shown below.

Using the maximin approach, which action should the land owner choose?

A land owner is considering a community development project. Even though he realizes that the current market for housing is not very favourable, he believes that there will be an influx of retirees into the area within the next five years. He is trying to decide between two alternatives: (1) building detached homes in a planned retirement community or (2) building a smaller townhouse/condominium complex. Mortgage interest rates will affect his outcomes and the applicable payoff (in $ millions) table is shown below.

Using the maximin approach, which action should the land owner choose?

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

15

Consider the following to answer the question(s) below:

A land owner is considering a community development project. Even though he realizes that the current market for housing is not very favourable, he believes that there will be an influx of retirees into the area within the next five years. He is trying to decide between two alternatives: (1) building detached homes in a planned retirement community or (2) building a smaller townhouse/condominium complex. Mortgage interest rates will affect his outcomes and the applicable payoff (in $ millions) table is shown below.

According to the maximin approach, the land owner should

A) build the active retirement community if interest rates go down

B) build the active retirement community

C) build townhouses/condominiums if interest rates go down

D) build townhouses/condominiums

E) build either the active retirement community or townhouses/condominiums

A land owner is considering a community development project. Even though he realizes that the current market for housing is not very favourable, he believes that there will be an influx of retirees into the area within the next five years. He is trying to decide between two alternatives: (1) building detached homes in a planned retirement community or (2) building a smaller townhouse/condominium complex. Mortgage interest rates will affect his outcomes and the applicable payoff (in $ millions) table is shown below.

According to the maximin approach, the land owner should

A) build the active retirement community if interest rates go down

B) build the active retirement community

C) build townhouses/condominiums if interest rates go down

D) build townhouses/condominiums

E) build either the active retirement community or townhouses/condominiums

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

16

What is the expected value of perfect information?

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

17

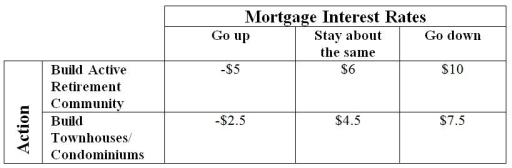

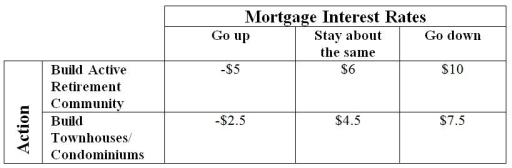

Consider the following to answer the question(s) below:

A land owner is considering a community development project. Even though he realizes that the current market for housing is not very favourable, he believes that there will be an influx of retirees into the area within the next five years. He is trying to decide between two alternatives: (1) building detached homes in a planned retirement community or (2) building a smaller townhouse/condominium complex. Mortgage interest rates will affect his outcomes and the applicable payoff (in $ millions) table is shown below.

Using the maximax approach, which action should the land owner choose?

A land owner is considering a community development project. Even though he realizes that the current market for housing is not very favourable, he believes that there will be an influx of retirees into the area within the next five years. He is trying to decide between two alternatives: (1) building detached homes in a planned retirement community or (2) building a smaller townhouse/condominium complex. Mortgage interest rates will affect his outcomes and the applicable payoff (in $ millions) table is shown below.

Using the maximax approach, which action should the land owner choose?

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

18

Consider the following to answer the question(s) below:

A land owner is considering a community development project. Even though he realizes that the current market for housing is not very favourable, he believes that there will be an influx of retirees into the area within the next five years. He is trying to decide between two alternatives: (1) building detached homes in a planned retirement community or (2) building a smaller townhouse/condominium complex. Mortgage interest rates will affect his outcomes and the applicable payoff (in $ millions) table is shown below.

Based on the expected value approach, the land owner should

A) build the active retirement community if interest rates go down

B) build the active retirement community

C) build townhouses/condominiums if interest rates go down

D) build townhouses/condominiums

E) build either the active retirement community or townhouses/condominiums

A land owner is considering a community development project. Even though he realizes that the current market for housing is not very favourable, he believes that there will be an influx of retirees into the area within the next five years. He is trying to decide between two alternatives: (1) building detached homes in a planned retirement community or (2) building a smaller townhouse/condominium complex. Mortgage interest rates will affect his outcomes and the applicable payoff (in $ millions) table is shown below.

Based on the expected value approach, the land owner should

A) build the active retirement community if interest rates go down

B) build the active retirement community

C) build townhouses/condominiums if interest rates go down

D) build townhouses/condominiums

E) build either the active retirement community or townhouses/condominiums

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

19

Consider the following to answer the question(s) below:

A farm owner who grows summer vegetables (e.g. tomatoes) must decide whether to employ additional pickers this season. If he does, he could hire either migrant workers or local teenagers who need summer employment. The migrant workers are more experienced, faster, but more expensive. Although the teenagers will work for less, they are not as experienced and tend to damage plants and produce. His profits, taking into account losses from unpicked perished or damaged produce, depend on whether there is a good or bad growing season. The payoffs are shown in the table below.

Using the maximax approach, which action should the farm owner choose?

A farm owner who grows summer vegetables (e.g. tomatoes) must decide whether to employ additional pickers this season. If he does, he could hire either migrant workers or local teenagers who need summer employment. The migrant workers are more experienced, faster, but more expensive. Although the teenagers will work for less, they are not as experienced and tend to damage plants and produce. His profits, taking into account losses from unpicked perished or damaged produce, depend on whether there is a good or bad growing season. The payoffs are shown in the table below.

Using the maximax approach, which action should the farm owner choose?

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

20

Consider the following to answer the question(s) below:

A farm owner who grows summer vegetables (e.g. tomatoes) must decide whether to employ additional pickers this season. If he does, he could hire either migrant workers or local teenagers who need summer employment. The migrant workers are more experienced, faster, but more expensive. Although the teenagers will work for less, they are not as experienced and tend to damage plants and produce. His profits, taking into account losses from unpicked perished or damaged produce, depend on whether there is a good or bad growing season. The payoffs are shown in the table below.

According to the maximin approach, the farmer should

A) hire migrant workers if the growing season is good

B) hire teenagers

C) not do any extra hiring

D) hire migrant workers

E) not do any extra hiring if the growing season is good

A farm owner who grows summer vegetables (e.g. tomatoes) must decide whether to employ additional pickers this season. If he does, he could hire either migrant workers or local teenagers who need summer employment. The migrant workers are more experienced, faster, but more expensive. Although the teenagers will work for less, they are not as experienced and tend to damage plants and produce. His profits, taking into account losses from unpicked perished or damaged produce, depend on whether there is a good or bad growing season. The payoffs are shown in the table below.

According to the maximin approach, the farmer should

A) hire migrant workers if the growing season is good

B) hire teenagers

C) not do any extra hiring

D) hire migrant workers

E) not do any extra hiring if the growing season is good

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

21

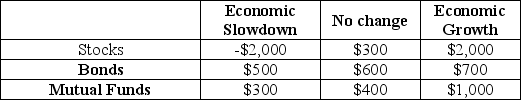

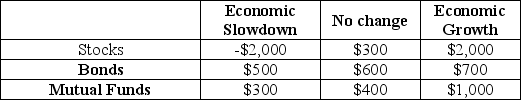

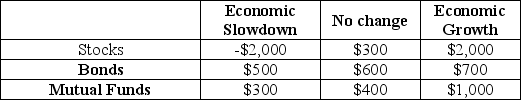

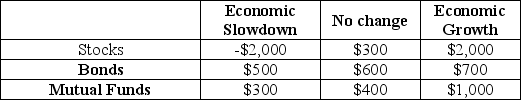

Consider the following to answer the question(s) below:

An investor has $10,000 to invest for one year. The choices for the placement of the funds include stocks, bonds, and mutual funds. The outcome of the investment however, will depend on the economic climate during the year. The table presents the payoffs in dollars for three possible economic scenarios. Forecasts suggest that the probability of a slowdown is 0.25, of no change is 0.50, and of growth is 0.25.

Action Economic Climate

According to the maximax approach, the investor would place his $10,000 in

A) stocks

B) bonds

C) mutual funds

D) stocks if there is economic growth

E) bonds if there is no change in economic climate

An investor has $10,000 to invest for one year. The choices for the placement of the funds include stocks, bonds, and mutual funds. The outcome of the investment however, will depend on the economic climate during the year. The table presents the payoffs in dollars for three possible economic scenarios. Forecasts suggest that the probability of a slowdown is 0.25, of no change is 0.50, and of growth is 0.25.

Action Economic Climate

According to the maximax approach, the investor would place his $10,000 in

A) stocks

B) bonds

C) mutual funds

D) stocks if there is economic growth

E) bonds if there is no change in economic climate

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

22

The Return to Risk Ratio for bonds is

A) 8.4854

B) 70.71

C) 0.1055

D) 1.8935

E) 0.1179

A) 8.4854

B) 70.71

C) 0.1055

D) 1.8935

E) 0.1179

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

23

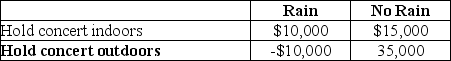

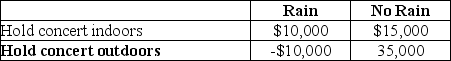

Consider the following to answer the question(s) below:

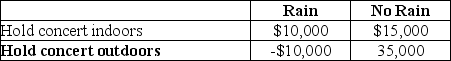

A group is planning a fundraising concert. They must decide whether to hold the event indoors or out. The weather, specifically, whether or not it rains that day, will affect the amount raised by the event. The payoff table is shown below:

Action Weather Conditions

According to the maximin approach, the group should

A) hold the concert indoors

B) hold the concert outdoors

C) hold the concert outdoors if it does not rain

D) hold the concert indoors if it rains

E) hold the concert indoors if it does not rain

A group is planning a fundraising concert. They must decide whether to hold the event indoors or out. The weather, specifically, whether or not it rains that day, will affect the amount raised by the event. The payoff table is shown below:

Action Weather Conditions

According to the maximin approach, the group should

A) hold the concert indoors

B) hold the concert outdoors

C) hold the concert outdoors if it does not rain

D) hold the concert indoors if it rains

E) hold the concert indoors if it does not rain

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

24

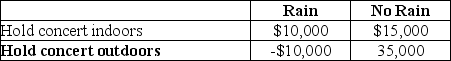

The standard deviation for an outdoor concert is

A) $18,000

B) $14,000

C) $2,000

D) $26,000

E) indeterminate

A) $18,000

B) $14,000

C) $2,000

D) $26,000

E) indeterminate

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

25

Consider the following to answer the question(s) below:

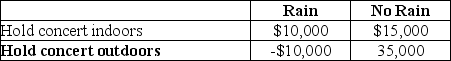

A group is planning a fundraising concert. They must decide whether to hold the event indoors or out. The weather, specifically, whether or not it rains that day, will affect the amount raised by the event. The payoff table is shown below:

Action Weather Conditions

Historically the probability of rain on the day of the planned concert is 0.20. What is the expected value of an indoor concert?

A) $14,000

B) $26,000

C) $4,000

D) $2,000

E) $10,000

A group is planning a fundraising concert. They must decide whether to hold the event indoors or out. The weather, specifically, whether or not it rains that day, will affect the amount raised by the event. The payoff table is shown below:

Action Weather Conditions

Historically the probability of rain on the day of the planned concert is 0.20. What is the expected value of an indoor concert?

A) $14,000

B) $26,000

C) $4,000

D) $2,000

E) $10,000

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

26

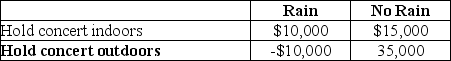

Consider the following to answer the question(s) below:

A group is planning a fundraising concert. They must decide whether to hold the event indoors or out. The weather, specifically, whether or not it rains that day, will affect the amount raised by the event. The payoff table is shown below:

Action Weather Conditions

What is the expected value of perfect information?

A) $4,000

B) $30,000

C) $14,000

D) $26,000

E) $10,000

A group is planning a fundraising concert. They must decide whether to hold the event indoors or out. The weather, specifically, whether or not it rains that day, will affect the amount raised by the event. The payoff table is shown below:

Action Weather Conditions

What is the expected value of perfect information?

A) $4,000

B) $30,000

C) $14,000

D) $26,000

E) $10,000

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

27

If the farmer is risk averse, he would

A) hire migrant workers

B) hire teenagers

C) not do any extra hiring

D) make the same decision as he would using the expected value approach

E) give up farming

A) hire migrant workers

B) hire teenagers

C) not do any extra hiring

D) make the same decision as he would using the expected value approach

E) give up farming

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

28

If the group is risk averse, they should

A) plan to hold the event indoors

B) plan to hold the event outdoors

C) make the same decision as they would using the expected value approach

D) decide not to hold the event at all

E) plan to hold the event outdoors if it does not rain

A) plan to hold the event indoors

B) plan to hold the event outdoors

C) make the same decision as they would using the expected value approach

D) decide not to hold the event at all

E) plan to hold the event outdoors if it does not rain

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

29

The expected value of perfect information is

A) $325

B) $400

C) $775

D) $925

E) $600

A) $325

B) $400

C) $775

D) $925

E) $600

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

30

The expected value with perfect information is

A) $925

B) $600

C) $525

D) $325

E) $150

A) $925

B) $600

C) $525

D) $325

E) $150

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

31

The standard deviation for hiring migrant workers is

A) $21,651

B) $12,990

C) $5,495

D) $2,500

E) $147

A) $21,651

B) $12,990

C) $5,495

D) $2,500

E) $147

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

32

Consider the following to answer the question(s) below:

An investor has $10,000 to invest for one year. The choices for the placement of the funds include stocks, bonds, and mutual funds. The outcome of the investment however, will depend on the economic climate during the year. The table presents the payoffs in dollars for three possible economic scenarios. Forecasts suggest that the probability of a slowdown is 0.25, of no change is 0.50, and of growth is 0.25.

Action Economic Climate

The expected value of mutual funds is

A) $525

B) $150

C) $600

D) $1,150

E) $925

An investor has $10,000 to invest for one year. The choices for the placement of the funds include stocks, bonds, and mutual funds. The outcome of the investment however, will depend on the economic climate during the year. The table presents the payoffs in dollars for three possible economic scenarios. Forecasts suggest that the probability of a slowdown is 0.25, of no change is 0.50, and of growth is 0.25.

Action Economic Climate

The expected value of mutual funds is

A) $525

B) $150

C) $600

D) $1,150

E) $925

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck