Deck 17: Agriculture

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/26

Play

Full screen (f)

Deck 17: Agriculture

1

Which of the following meets the definition of agricultural produce?

A) Dairy cattle

B) Milk

C) Cheese

D) Yoghurt

A) Dairy cattle

B) Milk

C) Cheese

D) Yoghurt

B

2

The entry required when an animal is born on a pig farm is:

A) DR Biological asset xx CR Profit & Loss xx

B) DR Agricultural produce xx CR Profit & Loss xx

C) DR Profit & Loss xx CR Biological asset xx

D) DR Profit & Loss xx CR Agricultural produce xx

A) DR Biological asset xx CR Profit & Loss xx

B) DR Agricultural produce xx CR Profit & Loss xx

C) DR Profit & Loss xx CR Biological asset xx

D) DR Profit & Loss xx CR Agricultural produce xx

A

3

Which of the following would be disclosed in the Statement of Financial Position as a biological asset under IAS 41?

A) Vines

B) Picked fruit

C) Cotton

D) Timber

A) Vines

B) Picked fruit

C) Cotton

D) Timber

A

4

IAS 41 requires disclosure of which of the following?

I aggregate gain or loss on initial recognition of biological assets

II fair value of agricultural produce harvested during the period, at point of harvest

III fair value changes attributable to physical changes

IV fair value changes attributable to price changes

A) I and II only

B) I, II and III only

C) II, III and IV only

D) I, II, III and IV

I aggregate gain or loss on initial recognition of biological assets

II fair value of agricultural produce harvested during the period, at point of harvest

III fair value changes attributable to physical changes

IV fair value changes attributable to price changes

A) I and II only

B) I, II and III only

C) II, III and IV only

D) I, II, III and IV

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following is NOT one of the recognition criteria contained within IAS 41 in relation to recognition of a biological asset or agricultural produce as an asset?

A) the asset has physical form

B) the entity controls the asset as a result of past events

C) it is probable that future economic benefits associated with the asset will flow to the entity

D) the fair value or cost can be reliably measured

A) the asset has physical form

B) the entity controls the asset as a result of past events

C) it is probable that future economic benefits associated with the asset will flow to the entity

D) the fair value or cost can be reliably measured

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

6

IAS 41 applies to the accounting for the following when they relate to agricultural activity:

I agricultural produce

II biological assets

III land related to agricultural activity

IV government grants

A) I, II and III

B) II, III and IV

C) I, II and IV

D) I, III and IV

I agricultural produce

II biological assets

III land related to agricultural activity

IV government grants

A) I, II and III

B) II, III and IV

C) I, II and IV

D) I, III and IV

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

7

According to IFRS 13 Fair Value Measurement, the market used to determine fair value should be:

A) the principal market, or, in the absence of a principal market, the relevant market

B) the most advantageous market

C) the relevant market

D) either the principal market, or, in the absence of a principal market, the most advantageous market

A) the principal market, or, in the absence of a principal market, the relevant market

B) the most advantageous market

C) the relevant market

D) either the principal market, or, in the absence of a principal market, the most advantageous market

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

8

IAS 41 requires that biological assets be measured as follows:

A) on initial recognition and at the end of each reporting period at fair value less costs to sell

B) on initial recognition and at the end of each reporting period at its fair value less costs to sell, except where the fair value cannot be measured reliably

C) at fair value-less estimated costs to sell at the point of harvest

D) at fair value less costs to sell at the point of harvest

A) on initial recognition and at the end of each reporting period at fair value less costs to sell

B) on initial recognition and at the end of each reporting period at its fair value less costs to sell, except where the fair value cannot be measured reliably

C) at fair value-less estimated costs to sell at the point of harvest

D) at fair value less costs to sell at the point of harvest

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

9

Fishy Co operates a fish farm. IAS 41 requires live immature fish to be valued at:

A) cost due to the absence of an active market for such fish

B) the fair value less costs to sell based on prices of slaughtered immature fish

C) either cost or fair value less estimated costs to sell

D) fair value determined by applying a discount factor to the fair value of live mature fish.

A) cost due to the absence of an active market for such fish

B) the fair value less costs to sell based on prices of slaughtered immature fish

C) either cost or fair value less estimated costs to sell

D) fair value determined by applying a discount factor to the fair value of live mature fish.

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

10

Which standard was issued in 2011 that amended IAS 41?

A) IFRS 7

B) IAS 1

C) IAS 18

D) IFRS 13

A) IFRS 7

B) IAS 1

C) IAS 18

D) IFRS 13

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following require disclosures to be made under IAS 17 and IAS 41?

A) operating and financing leases by lessors and lessees

B) finance leases by lessors and lessees only

C) operating and finance leases by lessees only

D) operating and finance leases by lessors only

A) operating and financing leases by lessors and lessees

B) finance leases by lessors and lessees only

C) operating and finance leases by lessees only

D) operating and finance leases by lessors only

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

12

Agricultural produce is defined in IAS 41 as:

A) a living animal or plant

B) a living product capable of biological transformation

C) the harvested product of the entity's biological assets

D) the detachment of produce from a biological asset or cessation of a biological asset's life processes

A) a living animal or plant

B) a living product capable of biological transformation

C) the harvested product of the entity's biological assets

D) the detachment of produce from a biological asset or cessation of a biological asset's life processes

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following is NOT considered an agricultural activity?

A) oyster farming

B) ocean fishing

C) pearl farming

D) fish farming

A) oyster farming

B) ocean fishing

C) pearl farming

D) fish farming

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

14

Milko owns dairy cattle. The market value of the cattle is calculated by reference to the litres of milk able to be produced and the lactation rate of the cows. The cattle are regularly sold at auction. Costs incurred to transport the cattle to auction are $500 per truck. Each truck can transport approximately 100 cattle.

Number of mature cows held at 30 June 2013 5000

Average litres of production per cow 6000 litres

Lactation rate 50%

Price per litre 40 cents

The market value for each cow at 30 June 2013 is:

A) $1000

B) $1195

C) $1200

D) $1205

Number of mature cows held at 30 June 2013 5000

Average litres of production per cow 6000 litres

Lactation rate 50%

Price per litre 40 cents

The market value for each cow at 30 June 2013 is:

A) $1000

B) $1195

C) $1200

D) $1205

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following statements is correct in relation to government grants?

A) Government grants for biological assets measured at fair value are accounted for under IAS 41.

B) Government grants for biological assets measured at cost are accounted for under IAS 41.

C) Government grants for biological assets measured at fair value are accounted for under IAS 20.

D) Government grants for biological assets measured at cost are accounted for under IAS 18.

A) Government grants for biological assets measured at fair value are accounted for under IAS 41.

B) Government grants for biological assets measured at cost are accounted for under IAS 41.

C) Government grants for biological assets measured at fair value are accounted for under IAS 20.

D) Government grants for biological assets measured at cost are accounted for under IAS 18.

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

16

Increases in fair value over cost in relation to land used for agricultural purposes is recognised in equity when the land is:

A) an investment property measured at fair value and accounted for under IAS 40

B) an investment property measured at cost and accounted for under IAS 40

C) not an investment property, is measured at fair value and accounted for under IAS 16

D) not an investment property, is measured at cost and accounted for under IAS 16

A) an investment property measured at fair value and accounted for under IAS 40

B) an investment property measured at cost and accounted for under IAS 40

C) not an investment property, is measured at fair value and accounted for under IAS 16

D) not an investment property, is measured at cost and accounted for under IAS 16

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following is NOT a cost to sell?

A) commissions to brokers

B) transfer taxes and duties

C) levies by regulatory agencies

D) transport costs to get assets to a market

A) commissions to brokers

B) transfer taxes and duties

C) levies by regulatory agencies

D) transport costs to get assets to a market

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

18

When determining the fair value of biological assets and there is no market price for that asset in its present condition IAS 41 requires that:

A) the entity uses the present value of expected net cash flows from the asset discounted at a current market-determined pre-tax rate.

B) the entity measure the asset at cost.

C) the entity uses the contract prices for recent sales of similar assets adjusted for the effects of biological transformation.

D) the entity uses sector benchmarks.

A) the entity uses the present value of expected net cash flows from the asset discounted at a current market-determined pre-tax rate.

B) the entity measure the asset at cost.

C) the entity uses the contract prices for recent sales of similar assets adjusted for the effects of biological transformation.

D) the entity uses sector benchmarks.

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

19

IAS 41 considers that there are three common features to agricultural diversity. Which of the following is NOT one of those features?

A) measurement of change

B) management of change

C) capability to change

D) change transformation

A) measurement of change

B) management of change

C) capability to change

D) change transformation

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following is NOT a reason as to why the IASC felt that agriculture was an industry that needed its own industry specific standard?

A) the specific exclusion of assets related to agricultural activity from other standards

B) agriculture was considered to be an emerging industry at that time

C) accounting guidelines for agricultural activity previously developed by national standard setters had been piecemeal

D) the nature of agricultural activity had created uncertainty or conflicts when applying traditional accounting models

A) the specific exclusion of assets related to agricultural activity from other standards

B) agriculture was considered to be an emerging industry at that time

C) accounting guidelines for agricultural activity previously developed by national standard setters had been piecemeal

D) the nature of agricultural activity had created uncertainty or conflicts when applying traditional accounting models

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following is an agricultural product?

A) tea

B) milk

C) coffee

D) fruit juice

A) tea

B) milk

C) coffee

D) fruit juice

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following is NOT considered to be agricultural produce?

A) timber

B) sugar

C) wool

D) milk

A) timber

B) sugar

C) wool

D) milk

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

23

Use the following information to answer questions 29 and 30.

CowCo is a company that farms dairy cattle. CowCo owns the farmland on which the cattle are located, having purchased it for $1.5 million in 2011. The land is measured at cost under IAS 16.

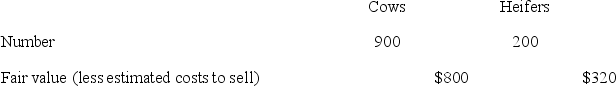

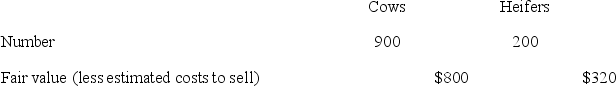

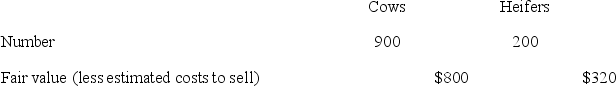

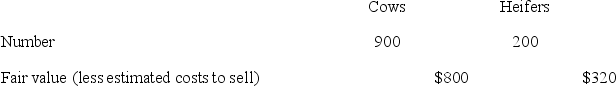

Details of cattle at 30 June 2013 were as follows:

During the year ended 30 June 2014 the following occurred:

During the year ended 30 June 2014 the following occurred:

200 new cows were purchased at $810 each

50 heifers matured into cows

5 heifers died

100 cows were sold for $830 each

The price change between a heifer and a cow at the time of maturity during the year was estimated to be $500

The following is relevant at 30 June 2014:

The land has been valued at $5.6 million

Fair value less estimated costs to sell are as follows (CowCo has determined that these are the appropriate fair values to use for the purposes of transfers and deaths of heifers):

o Cows - $850 /head

o Heifers - $350/head

-The fair value of cows as at 30 June 2014 is:

A) $943 250

B) $892 500

C) $875 000

D) $816 500

CowCo is a company that farms dairy cattle. CowCo owns the farmland on which the cattle are located, having purchased it for $1.5 million in 2011. The land is measured at cost under IAS 16.

Details of cattle at 30 June 2013 were as follows:

During the year ended 30 June 2014 the following occurred:

During the year ended 30 June 2014 the following occurred:200 new cows were purchased at $810 each

50 heifers matured into cows

5 heifers died

100 cows were sold for $830 each

The price change between a heifer and a cow at the time of maturity during the year was estimated to be $500

The following is relevant at 30 June 2014:

The land has been valued at $5.6 million

Fair value less estimated costs to sell are as follows (CowCo has determined that these are the appropriate fair values to use for the purposes of transfers and deaths of heifers):

o Cows - $850 /head

o Heifers - $350/head

-The fair value of cows as at 30 June 2014 is:

A) $943 250

B) $892 500

C) $875 000

D) $816 500

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

24

IAS 41 requires disclosure of which of the following relating to government grants?

A) the nature and extent of grants recognised, unfulfilled conditions attached to the grant and significant increases expected in the level of government grants.

B) the nature and extent of grants recognised, unfulfilled conditions and other contingencies attached to the grant and details of grants applied for but not yet granted

C) unfulfilled conditions and other contingencies attached to the grant and details of grants applied for but not yet granted

D) the nature and extent of grants recognised, unfulfilled conditions and other contingencies attached to the grant and significant decreases expected in the level of government grants.

A) the nature and extent of grants recognised, unfulfilled conditions attached to the grant and significant increases expected in the level of government grants.

B) the nature and extent of grants recognised, unfulfilled conditions and other contingencies attached to the grant and details of grants applied for but not yet granted

C) unfulfilled conditions and other contingencies attached to the grant and details of grants applied for but not yet granted

D) the nature and extent of grants recognised, unfulfilled conditions and other contingencies attached to the grant and significant decreases expected in the level of government grants.

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

25

Use the following information to answer questions 29 and 30.

CowCo is a company that farms dairy cattle. CowCo owns the farmland on which the cattle are located, having purchased it for $1.5 million in 2011. The land is measured at cost under IAS 16.

Details of cattle at 30 June 2013 were as follows:

During the year ended 30 June 2014 the following occurred:

During the year ended 30 June 2014 the following occurred:

200 new cows were purchased at $810 each

50 heifers matured into cows

5 heifers died

100 cows were sold for $830 each

The price change between a heifer and a cow at the time of maturity during the year was estimated to be $500

The following is relevant at 30 June 2014:

The land has been valued at $5.6 million

Fair value less estimated costs to sell are as follows (CowCo has determined that these are the appropriate fair values to use for the purposes of transfers and deaths of heifers):

o Cows - $850 /head

o Heifers - $350/head

-The increase in fair value of livestock attributable to price change is:

A) $76 000

B) $57 000

C) $25 000

D) $6 000

CowCo is a company that farms dairy cattle. CowCo owns the farmland on which the cattle are located, having purchased it for $1.5 million in 2011. The land is measured at cost under IAS 16.

Details of cattle at 30 June 2013 were as follows:

During the year ended 30 June 2014 the following occurred:

During the year ended 30 June 2014 the following occurred:200 new cows were purchased at $810 each

50 heifers matured into cows

5 heifers died

100 cows were sold for $830 each

The price change between a heifer and a cow at the time of maturity during the year was estimated to be $500

The following is relevant at 30 June 2014:

The land has been valued at $5.6 million

Fair value less estimated costs to sell are as follows (CowCo has determined that these are the appropriate fair values to use for the purposes of transfers and deaths of heifers):

o Cows - $850 /head

o Heifers - $350/head

-The increase in fair value of livestock attributable to price change is:

A) $76 000

B) $57 000

C) $25 000

D) $6 000

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

26

RuralCo received a $100 000 grant from the government on 1 July 2013. One of the conditions attached to the grant was the Rural Co had to continue farming in the same location for the next 2 years, otherwise the grant would have to be retuned in full.

The entry to record the receipt of the grant is:

A) DR Cash 100 000 CR Revenue 100 000

B) DR Cash 100 000 CR Revenue 50 000

CR Performance obligation 50 000

C) DR Cash 100 000 CR Performance obligation 100 000

D) No entry required as the grant is conditional and cannot be recognised until the conditions attached to the grant are met.

The entry to record the receipt of the grant is:

A) DR Cash 100 000 CR Revenue 100 000

B) DR Cash 100 000 CR Revenue 50 000

CR Performance obligation 50 000

C) DR Cash 100 000 CR Performance obligation 100 000

D) No entry required as the grant is conditional and cannot be recognised until the conditions attached to the grant are met.

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck