Deck 19: Completing the Tests in the Acquisition and Payment Cycle: Verification of Selected Accounts

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/101

Play

Full screen (f)

Deck 19: Completing the Tests in the Acquisition and Payment Cycle: Verification of Selected Accounts

1

Which of the following statements about the audit of fixed assets is the least correct?

A) The primary accounting record for manufacturing equipment and other property, plant and equipment is generally a fixed asset master file.

B) Manufacturing equipment and current assets are normally audited in the same fashion regardless of the activity within a particular account.

C) The emphasis on auditing fixed assets is on verification of current-period acquisitions.

D) Failure to record the acquisition of a fixed asset affects the income statement until the assets are fully depreciated.

A) The primary accounting record for manufacturing equipment and other property, plant and equipment is generally a fixed asset master file.

B) Manufacturing equipment and current assets are normally audited in the same fashion regardless of the activity within a particular account.

C) The emphasis on auditing fixed assets is on verification of current-period acquisitions.

D) Failure to record the acquisition of a fixed asset affects the income statement until the assets are fully depreciated.

B

2

The audit procedure that requires an auditor to "foot the acquisition schedule" relates to which balance-related audit objective?

A) Classification

B) Detail tie-in

C) Existence

D) Cut-off

A) Classification

B) Detail tie-in

C) Existence

D) Cut-off

B

3

Which of the following expenses is not typically evaluated as part of the audit of the acquisition and payment cycle?

A) Depreciation expense

B) Insurance expense

C) Estimated Liability for Warranties

D) Property tax expense

A) Depreciation expense

B) Insurance expense

C) Estimated Liability for Warranties

D) Property tax expense

C

4

Inadequate controls and misstatements discovered through tests of controls and substantive tests of transactions are an indication of the likelihood of misstatements in:

A) the balance sheet.

B) the income statement.

C) the cash flow statement.

D) both the income statement and the balance sheet.

A) the balance sheet.

B) the income statement.

C) the cash flow statement.

D) both the income statement and the balance sheet.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following accounts is not associated with the acquisition and payment cycle?

A) Common stock

B) Property, plant and equipment

C) Accrued property taxes

D) Income tax expense

A) Common stock

B) Property, plant and equipment

C) Accrued property taxes

D) Income tax expense

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following would generally not be a component of the audit of the acquisition and payment cycle?

A) Adequacy of controls over acquisitions of long-lived assets

B) Tracing disposals of long-lived assets to the Fixed Asset Master File

C) Determining the adequacy of the funds available for capital expenditures

D) Reperformance of recorded depreciation expense

A) Adequacy of controls over acquisitions of long-lived assets

B) Tracing disposals of long-lived assets to the Fixed Asset Master File

C) Determining the adequacy of the funds available for capital expenditures

D) Reperformance of recorded depreciation expense

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

7

The primary accounting record for manufacturing equipment and other fixed assets is the:

A) depreciation ledger.

B) fixed asset master file.

C) asset inventory.

D) equipment roster.

A) depreciation ledger.

B) fixed asset master file.

C) asset inventory.

D) equipment roster.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following tests are typically not necessary when auditing a client's schedule of recorded disposals?

A) Footing the schedule.

B) Tracing schedule totals to the general ledger.

C) Tracing cost and accumulated depreciation of the disposals to the property master file.

D) All of the above are necessary.

A) Footing the schedule.

B) Tracing schedule totals to the general ledger.

C) Tracing cost and accumulated depreciation of the disposals to the property master file.

D) All of the above are necessary.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

9

Normally it may be unnecessary to examine supporting documentation for each addition to property, plant, and equipment, but it would be customary to verify:

A) all large transactions.

B) all unusual transactions.

C) a representative sample of typical additions.

D) all three of the above.

A) all large transactions.

B) all unusual transactions.

C) a representative sample of typical additions.

D) all three of the above.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following would indicate a deficiency in internal controls in the acquisition and payment cycle?

A) Repairs and maintenance accounts are reviewed for unusual entries each quarter

B) Acquisitions are made and approved by the department that will use the equipment

C) Acquisitions of equipment greater than $1,000 are to be capitalized

D) Acquisitions of equipment less than $1,000 are to be expensed as incurred

A) Repairs and maintenance accounts are reviewed for unusual entries each quarter

B) Acquisitions are made and approved by the department that will use the equipment

C) Acquisitions of equipment greater than $1,000 are to be capitalized

D) Acquisitions of equipment less than $1,000 are to be expensed as incurred

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

11

A set of records for each piece of equipment that includes descriptive information, date of acquisition, original cost, current year depreciation, and accumulated depreciation is the:

A) acquisitions journal.

B) depreciation schedule.

C) fixed asset master file.

D) file of purchase requisitions.

A) acquisitions journal.

B) depreciation schedule.

C) fixed asset master file.

D) file of purchase requisitions.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

12

To be capitalized as part of property, plant and equipment, assets must:

A) have expected useful lives of more than one year.

B) not be acquired for resale.

C) be useful in multiple productive capacities within the organization.

D) A and B, but not C.

A) have expected useful lives of more than one year.

B) not be acquired for resale.

C) be useful in multiple productive capacities within the organization.

D) A and B, but not C.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

13

You are auditing the acquisition and payment cycle and the presence of excessive recurring losses on retired assets. You may conclude that:

A) insured values are greater than book values.

B) there are a large number of fully depreciated assets.

C) depreciation charges may by insuffient.

D) company has a policy of selling relatively new assets.

A) insured values are greater than book values.

B) there are a large number of fully depreciated assets.

C) depreciation charges may by insuffient.

D) company has a policy of selling relatively new assets.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

14

The auditor should keep in mind that the amount in insurance expense is a residual amount.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

15

You are the in-charge auditor for a long-term client. Which of the following is not a category of tests commonly associated with the audit of manufacturing equipment?

A) Verification of depreciation expense.

B) Analytical procedures.

C) Verification of current-period disposals.

D) Verification of the beginning balance in accumulated depreciation.

A) Verification of depreciation expense.

B) Analytical procedures.

C) Verification of current-period disposals.

D) Verification of the beginning balance in accumulated depreciation.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following audit procedures would be the most correct in determining the audit objective of existence for the equipment account in the fixed asset master file?

A) Examine vendor invoices and receiving reports

B) Review transactions near the balance sheet date

C) Recalculate vendor invoices

D) Examine vendor invoices for correct accounting treatment

A) Examine vendor invoices and receiving reports

B) Review transactions near the balance sheet date

C) Recalculate vendor invoices

D) Examine vendor invoices for correct accounting treatment

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

17

Discuss the key internal controls related to the disposal of property, plant, and equipment.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

18

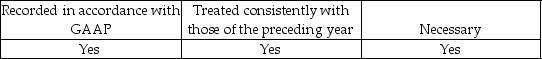

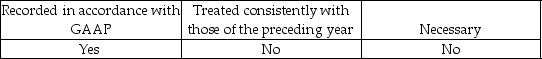

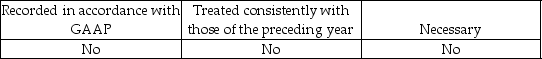

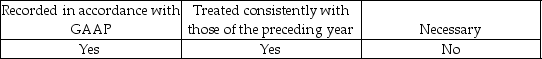

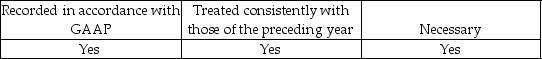

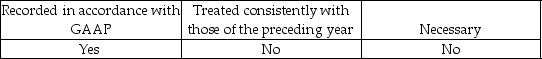

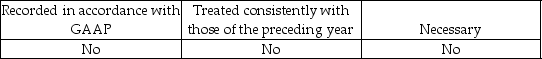

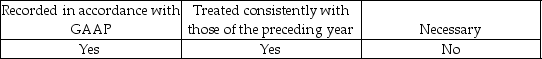

The auditor must know the client's capitalization policies to determine whether acquisitions are:

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

19

Failure to capitalize a fixed asset at the correct amount would impact which financial statements until the company disposes of the asset?

A) The balance sheet only

B) The income statement only

C) The cash flow statement only

D) Both the income statement and the balance sheet

A) The balance sheet only

B) The income statement only

C) The cash flow statement only

D) Both the income statement and the balance sheet

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

20

You are auditing Manufacturing Company and testing the audit related objective of completeness for the equipment accounts. Which of the following audit procedures is most likely to achieve your objective?

A) Examine vendor invoices and receiving reports

B) Physically examine assets

C) Examine vendor invoices of closely related accounts such as repairs and maintenance

D) Trace individual acquisitions to the fixed asset master file

A) Examine vendor invoices and receiving reports

B) Physically examine assets

C) Examine vendor invoices of closely related accounts such as repairs and maintenance

D) Trace individual acquisitions to the fixed asset master file

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

21

A major consideration in verifying the ending balance in fixed assets is the possibility of existing legal encumbrances. Tests to identify possible legal encumbrances would satisfy the audit objective of:

A) existence.

B) presentation and disclosure.

C) detail tie-in.

D) classification.

A) existence.

B) presentation and disclosure.

C) detail tie-in.

D) classification.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

22

The auditor needs to gain reasonable assurance that the equipment accounts in the fixed asset master file are not understated. Which of the following accounts would most likely be reviewed in making that determination?

A) Depreciation expense

B) Repairs and maintenance expense

C) Gains/losses on sales and retirements

D) Cash

A) Depreciation expense

B) Repairs and maintenance expense

C) Gains/losses on sales and retirements

D) Cash

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

23

When auditing depreciation expense, the two major concerns related to the accuracy audit objective are:

A) consistent application of depreciation method and useful lives.

B) consistent application of depreciation method and classification of assets.

C) correctness of calculations and consistent application of depreciation method.

D) cost of the fixed asset and useful lives.

A) consistent application of depreciation method and useful lives.

B) consistent application of depreciation method and classification of assets.

C) correctness of calculations and consistent application of depreciation method.

D) cost of the fixed asset and useful lives.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

24

To achieve effective internal accounting control over fixed asset additions, a company should establish procedures that require:

A) authorization and approval of major fixed asset additions.

B) capitalization of the cost of fixed asset additions in excess of a specific dollar amount.

C) classification, as investments, of those fixed asset additions that are not used in the business.

D) performance of recurring fixed asset maintenance work solely by maintenance department employees.

A) authorization and approval of major fixed asset additions.

B) capitalization of the cost of fixed asset additions in excess of a specific dollar amount.

C) classification, as investments, of those fixed asset additions that are not used in the business.

D) performance of recurring fixed asset maintenance work solely by maintenance department employees.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following audit procedures would be least likely to lead the auditor to find an unrecorded fixed asset disposal?

A) Examination of insurance policies

B) Review of repairs and maintenance expense

C) Review of property tax files

D) Scanning of invoices for fixed asset additions

A) Examination of insurance policies

B) Review of repairs and maintenance expense

C) Review of property tax files

D) Scanning of invoices for fixed asset additions

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

26

The auditor's starting point for verifying disposals of property, plant, and equipment is the:

A) equipment account in the general ledger.

B) file of shipping documents.

C) client's schedule of recorded disposals.

D) equipment subsidiary ledger.

A) equipment account in the general ledger.

B) file of shipping documents.

C) client's schedule of recorded disposals.

D) equipment subsidiary ledger.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

27

Because the failure to record disposals of property, plant, and equipment can significantly affect the financial statements, the search for unrecorded disposals is essential. Which of the following is not a procedure used to verify disposals?

A) Make inquiries of management and production personnel about the possibility of the disposal of assets.

B) Review whether newly acquired assets replace existing assets.

C) Test the valuation of fixed assets recorded in prior periods.

D) Review plant modifications and changes in product line, taxes, or insurance coverage.

A) Make inquiries of management and production personnel about the possibility of the disposal of assets.

B) Review whether newly acquired assets replace existing assets.

C) Test the valuation of fixed assets recorded in prior periods.

D) Review plant modifications and changes in product line, taxes, or insurance coverage.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

28

The auditor is examining the accounting entries made to the accumulated depreciation account during the year and notices a significant amount of debits to the account. Which of the following provides the most logical explanation?

A) Large number of asset retirements

B) Salvage values were revised downward

C) Useful lives were revised downward

D) Allocation of fixed overhead were revised

A) Large number of asset retirements

B) Salvage values were revised downward

C) Useful lives were revised downward

D) Allocation of fixed overhead were revised

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

29

The auditor is testing for unrecorded retirements/disposals of equipment. Which of the following audit procedures would the auditor most likely use?

A) Select items from the fixed asset master file and then physically locate them.

B) Examine the repairs and maintenance amount for large debits.

C) Compare current years depreciation expense with the previous year's depreciation expense.

D) Trace acquisition documents to the fixed asset master file.

A) Select items from the fixed asset master file and then physically locate them.

B) Examine the repairs and maintenance amount for large debits.

C) Compare current years depreciation expense with the previous year's depreciation expense.

D) Trace acquisition documents to the fixed asset master file.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

30

The auditor normally does not need to test the accuracy or classification of fixed assets recorded in prior periods if they are the continuing auditor because:

A) they are rarely material to the audit.

B) they rarely contain misstatements.

C) they are verified in previous audits.

D) they don't affect the balance sheet.

A) they are rarely material to the audit.

B) they rarely contain misstatements.

C) they are verified in previous audits.

D) they don't affect the balance sheet.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

31

Methods used to determine if there are legal encumbrances related to fixed assets include all but which of the following?

A) Reading terms of loan and credit agreements

B) Reviewing loan confirmations received from banks

C) Having discussions with the client or sending letters to legal counsel

D) All of the above may be used to identify legal encumbrances

A) Reading terms of loan and credit agreements

B) Reviewing loan confirmations received from banks

C) Having discussions with the client or sending letters to legal counsel

D) All of the above may be used to identify legal encumbrances

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

32

Changing circumstances may require a change in the useful life of an asset. When this occurs, it involves a change in:

A) accounting estimate rather than a change in accounting principle.

B) accounting principle rather than a change in accounting estimate.

C) both accounting principle and accounting estimate.

D) neither accounting principle nor accounting estimate.

A) accounting estimate rather than a change in accounting principle.

B) accounting principle rather than a change in accounting estimate.

C) both accounting principle and accounting estimate.

D) neither accounting principle nor accounting estimate.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

33

Improperly classifying a fixed asset by recording the amount in the repairs and maintenance expense account will have an effect on which of the following financial statements until the asset would normally have been depreciated?

A) The balance sheet

B) The income statement

C) The cash flow statement

D) Both the income statement and the balance sheet

A) The balance sheet

B) The income statement

C) The cash flow statement

D) Both the income statement and the balance sheet

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

34

In determining the reasonableness of the client's amount for depreciation expense the auditor is primarily concerned that the client has followed a consistent policy and the calculations are correct. Which of the following audit objectives best addresses the above concerns?

A) Existence

B) Accuracy

C) Valuation

D) Allocation

A) Existence

B) Accuracy

C) Valuation

D) Allocation

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

35

The failure to capitalize a permanent asset, or the recording of an asset acquisition at the improper amount, affects the balance sheet:

A) forever.

B) for the current period.

C) for the depreciable life of the asset.

D) until the firm disposes of the asset.

A) forever.

B) for the current period.

C) for the depreciable life of the asset.

D) until the firm disposes of the asset.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

36

The test of details of balances procedure to "examine vendors' invoices of closely related accounts such as repairs to uncover items that should be property, plant, and equipment" satisfies the audit objective of:

A) completeness.

B) detail tie-in.

C) cutoff.

D) existence.

A) completeness.

B) detail tie-in.

C) cutoff.

D) existence.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

37

One of the primary objectives in examining the repairs and maintenance accounts is to obtain evidence that:

A) expenditures of equipment have not been charged to expense.

B) the actual amount recorded is the same as the budgeted amount.

C) expenditures for equipment have been recorded in the proper period.

D) revenue expenditures made on behalf of equipment have been recorded in the proper period.

A) expenditures of equipment have not been charged to expense.

B) the actual amount recorded is the same as the budgeted amount.

C) expenditures for equipment have been recorded in the proper period.

D) revenue expenditures made on behalf of equipment have been recorded in the proper period.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

38

When the auditor is determining appropriate depreciation calculations for the classifications in the client's fixed asset master file she is testing the audit objective of:

A) completeness.

B) existence.

C) classification.

D) valuation and allocation.

A) completeness.

B) existence.

C) classification.

D) valuation and allocation.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

39

The test of details of balances procedure which requires a "recalculation of investment credit" satisfies the audit objective of:

A) classification.

B) detail tie-in.

C) existence.

D) accuracy.

A) classification.

B) detail tie-in.

C) existence.

D) accuracy.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

40

In testing acquisitions the auditor needs to understand the appropriate accounting guidance related to acquisition accounting. Which of the following is NOT an accounting consideration for the auditor as regards to acquisition cost?

A) Inclusion of material transportation and installation costs

B) Recording of trade-in costs

C) Allocating costs when building and equipment are purchased at one price

D) Verifying that purchased equipment amounts correspond to the budgeted amount

A) Inclusion of material transportation and installation costs

B) Recording of trade-in costs

C) Allocating costs when building and equipment are purchased at one price

D) Verifying that purchased equipment amounts correspond to the budgeted amount

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

41

The primary accounting record for property, plant, and equipment accounts is the fixed asset master file. What is included for each fixed asset in the master file?

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

42

The emphasis in auditing manufacturing equipment is on the verification of current-period disposals and acquisitions.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

43

Accrued payroll taxes are normally considered to be associated with the acquisition and payment cycle.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

44

In auditing the current year acquisitions of property, plant, and equipment, all balance-related audit objectives except realizable value and disclosure are used as a framework for subsequent audit testing.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

45

One of the auditor's primary objectives when auditing manufacturing equipment is completeness.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following explanations might satisfy an auditor who discovers significant debits to an accumulated depreciation account?

A) Extraordinary repairs have lengthened the life of an asset.

B) Prior years' depreciation charges were erroneously understated.

C) A reserve for possible loss on retirement has been recorded.

D) An asset has been recorded at its fair value.

A) Extraordinary repairs have lengthened the life of an asset.

B) Prior years' depreciation charges were erroneously understated.

C) A reserve for possible loss on retirement has been recorded.

D) An asset has been recorded at its fair value.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

47

Depreciation expense is normally verified as a part of tests of details of balances rather than as part of tests of controls or substantive tests of transactions.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

48

The auditor receives the client's schedule of recorded disposals and then performs detail tie-in tests of the recorded disposals schedule. What procedures does the auditor perform on the client's schedule of recorded disposals?

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

49

The primary characteristic that distinguishes property, plant, and equipment from inventory, prepaid expenses, and investments is the intention to use property, plant, and equipment as a part of the operations of the client's business over their expected life.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

50

In testing acquisitions, the auditor must understand the relevant accounting standards to insure the client adheres to accepted accounting practices for property, plant, and equipment. Describe below the auditor concerns in this area.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

51

The starting point for the verification of current-year acquisitions of property, plant, and equipment is normally a client-prepared schedule of all acquisitions recorded in the general ledger during the year.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

52

State four of the seven specific balance-related audit objectives for property, plant, and equipment additions and, for each objective, describe one common test of details of balances.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

53

When auditing disposals of property, plant, and equipment, the search for unrecorded disposals is essential. State the four audit procedures frequently used for verifying disposals.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

54

The least helpful common audit test to verify current period acquisitions of property, plant, and equipment is examining vendors' invoices and receiving reports.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

55

Property, plant, and equipment is normally audited in a different manner than current asset accounts. State three reasons why this is so, and discuss the differences in how property, plant, and equipment is audited compared to current assets.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

56

Completeness and existence are the auditor's primary objectives in auditing manufacturing equipment.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

57

If the client fails to record disposals of property, plant, and equipment, both the original cost of the asset account and the net book value will be incorrect. What will the effect be of this misstatement on the original cost and the book value?

A) Both will be overstated indefinitely.

B) The original cost will be overstated indefinitely, and the net book value will be overstated until the asset is fully depreciated.

C) The original cost will be overstated indefinitely, and the net book value will be understated indefinitely.

D) The original cost will be overstated indefinitely, and the net book value will be understated until the asset is fully depreciated.

A) Both will be overstated indefinitely.

B) The original cost will be overstated indefinitely, and the net book value will be overstated until the asset is fully depreciated.

C) The original cost will be overstated indefinitely, and the net book value will be understated indefinitely.

D) The original cost will be overstated indefinitely, and the net book value will be understated until the asset is fully depreciated.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

58

The auditor's review of current year acquisition's cutoff is normally done as part of accounts payable cutoff tests.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

59

In auditing depreciation expense one the auditors concerns is on determining that the client's calculations are correct. In determining that the auditor must weigh which four considerations?

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

60

The most important audit objective for depreciation expense is detail tie-in.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

61

The auditor's tests for proper cutoff of current year acquisitions of property, plant, and equipment are usually done as part of accounts payable cutoff tests.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

62

Confirmations are commonly used to verify additions of property, plant, and equipment.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

63

Describe the audit procedures used to verify the accuracy and detail tie-in objectives for prepaid insurance.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

64

When the auditor recomputes the unexpired portion of prepaid insurance, she is satisfying which audit objective?

A) Completeness

B) Existence

C) Accuracy and detail tie-in

D) Rights

A) Completeness

B) Existence

C) Accuracy and detail tie-in

D) Rights

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

65

In connection with a review of the prepaid insurance account, which of the following audit procedures would you be least likely to use?

A) Recompute the portion of the premium that expired during the year.

B) Prepare excerpts of insurance policies for audit working papers.

C) Confirm premium rates with an independent insurance broker.

D) Examine support for premium payments.

A) Recompute the portion of the premium that expired during the year.

B) Prepare excerpts of insurance policies for audit working papers.

C) Confirm premium rates with an independent insurance broker.

D) Examine support for premium payments.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

66

Which balance-related audit objective is not relevant to an audit of prepaid expenses?

A) Rights

B) Accuracy

C) Detail tie-in

D) Realizable value

A) Rights

B) Accuracy

C) Detail tie-in

D) Realizable value

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

67

One very useful method of auditing depreciation is to use an analytical procedure to test for reasonableness.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

68

Insurance expense for the period is a function of which of the following?

A) The beginning prepaid balance, current premium payments and the ending prepaid balance.

B) The beginning prepaid balance and the current period premium payments.

C) The current period premium payments.

D) The current period premium payments and the ending prepaid balance.

A) The beginning prepaid balance, current premium payments and the ending prepaid balance.

B) The beginning prepaid balance and the current period premium payments.

C) The current period premium payments.

D) The current period premium payments and the ending prepaid balance.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

69

Controls over the acquisition and recording of insurance are a part of which of the following transaction cycles?

A) Inventory and warehousing cycle

B) Capitalization cycle

C) Treasury cycle

D) Acquisition and payment cycle

A) Inventory and warehousing cycle

B) Capitalization cycle

C) Treasury cycle

D) Acquisition and payment cycle

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

70

The audit procedure "foot the schedule of fixed assets acquisitions and trace the total to the general ledger" relates most closely to the completeness objective for fixed assets acquisitions.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

71

Recording an acquisition of a fixed asset at an improper amount affects the balance sheet until the company disposes of the asset, but the income statement is not affected.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

72

Describe two ways the verification of existence and tests for omissions of the client's insurance policies in force can be performed.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

73

A record of insurance policies in force and the due date of each policy is contained in the:

A) voucher register.

B) insurance register.

C) insurance expense account.

D) prepaid insurance account.

A) voucher register.

B) insurance register.

C) insurance expense account.

D) prepaid insurance account.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following accounts would normally not be a part of the acquisition and payment cycle of Prepaid Insurance?

A) Cash

B) Insurance Payable

C) Insurance Expense

D) Prepaid Insurance

A) Cash

B) Insurance Payable

C) Insurance Expense

D) Prepaid Insurance

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

75

Ordinarily, if you are auditing a continuing client, it is unnecessary to test the accuracy objective or the classification objective for fixed assets acquired in prior years.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

76

The approach to auditing patents and copyrights is similar to that used for property, plant, and equipment accounts.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

77

The company's choices for fixed asset on the assets useful life and residual value impact the amount of depreciation recorded.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

78

Which type of audit procedure would normally be sufficient for purposes of auditing prepaid expenses and deferred charges?

A) Tests of controls.

B) Tests of transactions.

C) Tests of details of balances.

D) Analytical procedures.

A) Tests of controls.

B) Tests of transactions.

C) Tests of details of balances.

D) Analytical procedures.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

79

What are several analytical procedures used in the audit of prepaid insurance and insurance expense?

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

80

When auditing acquisitions of property, plant, and equipment, the auditor's review of lease and rental agreements most closely relate to the cutoff objective.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck