Deck 13: Impairment of Assets

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/49

Play

Full screen (f)

Deck 13: Impairment of Assets

1

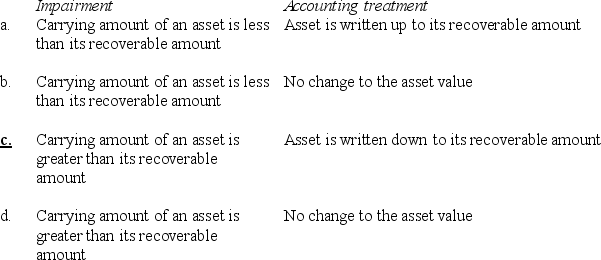

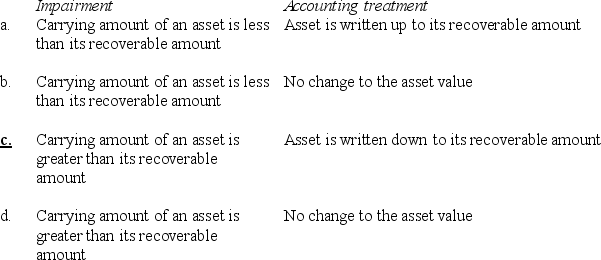

Under AASB 136 Impairment of Assets,impairment of an asset and the accounting treatment using the cost model are which of the following?

C

2

Kerri Limited recognised an impairment loss on an item of plant asset on the 30th June.The recoverable amount of the asset after the loss is $900 and the asset has an estimated useful life of 4 years.Accumulated depreciation was $250 at that date and the straight line depreciation method is used.The original cost of the asset was $2500.The future annual depreciation amount is:

A)$625.

B)$225.

C)$163.

D)$400.

A)$625.

B)$225.

C)$163.

D)$400.

B

3

When an asset is measured at fair value,the appropriate journal entry to record an impairment loss will include which of the following entries?

A)DR Asset

B)DR Loss-downward revaluation of asset

C)DR Revaluation increment

D)DR Depreciation expense

A)DR Asset

B)DR Loss-downward revaluation of asset

C)DR Revaluation increment

D)DR Depreciation expense

B

4

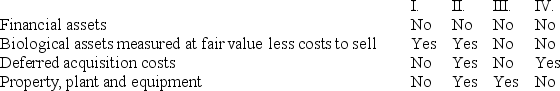

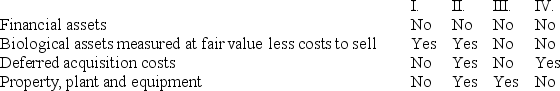

Under AASB 136 Impairment of Assets,which of the following assets are subject to impairment testing?

A)I

B)II

C)III

D)IV

A)I

B)II

C)III

D)IV

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

5

Value in use is:

A)the present value of future cash flows expected to be derived from an asset or cash-generating unit.

B)amount obtainable from disposal of an asset excluding any selling costs.

C)initial cost of an asset less any expected disposal costs.

D)incremental costs directly attributable to disposal of an asset.

A)the present value of future cash flows expected to be derived from an asset or cash-generating unit.

B)amount obtainable from disposal of an asset excluding any selling costs.

C)initial cost of an asset less any expected disposal costs.

D)incremental costs directly attributable to disposal of an asset.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

6

The impairment test involves comparing the asset's:

A)carrying amount with its fair value.

B)carrying amount with its recoverable amount.

C)fair value with its residual value.

D)fair value with its replacement cost.

A)carrying amount with its fair value.

B)carrying amount with its recoverable amount.

C)fair value with its residual value.

D)fair value with its replacement cost.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

7

In allocating an impairment loss,an entity shall not reduce the carrying amount of an asset below the highest of:

A)value in use and zero.

B)present value and zero.

C)cost and market value.

D)initial cost and replacement cost.

A)value in use and zero.

B)present value and zero.

C)cost and market value.

D)initial cost and replacement cost.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

8

An impairment test is conducted only:

A)at each balance date.

B)every three years.

C)when there is evidence that assets have been impaired.

D)at each reporting date including interim reporting dates such as half-year.

A)at each balance date.

B)every three years.

C)when there is evidence that assets have been impaired.

D)at each reporting date including interim reporting dates such as half-year.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following assets need to be tested for impairment every year?

I Intangible assets with indefinite useful lives

II Intangible assets not yet available for use

III Internally generated goodwill

IV Goodwill acquired in a business combination

A)I,II and III only

B)II,III and IV only

C)I,II and IV only

D)I,III and IV only

I Intangible assets with indefinite useful lives

II Intangible assets not yet available for use

III Internally generated goodwill

IV Goodwill acquired in a business combination

A)I,II and III only

B)II,III and IV only

C)I,II and IV only

D)I,III and IV only

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

10

When assessing the value in use of equipment the following estimates of cash flows and risk rates were made.In one year: $1000 at 4%; in 2 years $1000 at 4.5%,and in 3 years $1000 at 5%.The expected present value of the asset is:

A)$3000.

B)$2886.

C)$2591.

D)$2742.

A)$3000.

B)$2886.

C)$2591.

D)$2742.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

11

When an asset is measured using the revaluation model,any impairment loss is treated as:

A)a revaluation decrement.

B)a revaluation increment.

C)a set-off against depreciation expense.

D)an addition to depreciation expense.

A)a revaluation decrement.

B)a revaluation increment.

C)a set-off against depreciation expense.

D)an addition to depreciation expense.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

12

The smallest identifiable group of assets that generates cash inflows that are largely independent of the cash inflows from other assets or groups of assets is referred to as a/an:

A)small-group unit.

B)cash-generating unit.

C)identifiable unit.

D)independent unit.

A)small-group unit.

B)cash-generating unit.

C)identifiable unit.

D)independent unit.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

13

Where an asset is measured using the cost model,any impairment loss is:

A)debited to the retained earnings account.

B)debited to the depreciation expense account.

C)credited to the asset account.

D)credited to the accumulated depreciation and impairment losses account.

A)debited to the retained earnings account.

B)debited to the depreciation expense account.

C)credited to the asset account.

D)credited to the accumulated depreciation and impairment losses account.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

14

The amount by which the carrying amount of an asset or a cash-generating unit exceeds its carrying amount is referred to as a/an:

A)depreciation expense.

B)amortisation cost.

C)impairment loss.

D)loss on disposal.

A)depreciation expense.

B)amortisation cost.

C)impairment loss.

D)loss on disposal.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

15

Holly Limited estimated that it would receive future cash flows from the use of its equipment as follows.

End of year 1 $25 000.

End of year 2 $40 000.

End of year 3 $15 000.

The discount rate was determined as 5%.The 'value in use' of the equipment is:

A)$80 000.

B)$76 190.

C)$73 047.

D)$63 500.

End of year 1 $25 000.

End of year 2 $40 000.

End of year 3 $15 000.

The discount rate was determined as 5%.The 'value in use' of the equipment is:

A)$80 000.

B)$76 190.

C)$73 047.

D)$63 500.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

16

If an impairment loss is recognised against an asset that has previously been revalued up to fair value,the impairment journal entry must include a reduction of the previously recorded:

A)deferred tax asset.

B)deferred tax liability.

C)income tax payable.

D)income tax expense.

A)deferred tax asset.

B)deferred tax liability.

C)income tax payable.

D)income tax expense.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

17

According to AASB 136 Impairment of Assets,the recoverable amount of an asset or cash-generating asset is the:

A)lower of its fair value less costs of disposal and its value in use.

B)higher of its fair value less costs of disposal and its value in exchange.

C)lower of its fair value less costs of disposal and its value in exchange.

D)higher of its fair value less costs of disposal and its value in use.

A)lower of its fair value less costs of disposal and its value in use.

B)higher of its fair value less costs of disposal and its value in exchange.

C)lower of its fair value less costs of disposal and its value in exchange.

D)higher of its fair value less costs of disposal and its value in use.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

18

Gairdner Limited recognised an impairment loss of $50 000 against a cash-generating unit consisting of the following assets: buildings $500 000; roads $300 000; and equipment $600 000.The net carrying amount of the roads after allocation of the impairment loss is:

A)$310 714.

B)$278 571.

C)$289 286.

D)$282 143.

A)$310 714.

B)$278 571.

C)$289 286.

D)$282 143.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following is an internal source of information that may be used to indicate if an asset is impaired?

A)Economic performance of the asset

B)Market capitalisation

C)Interest rates

D)Asset's value

A)Economic performance of the asset

B)Market capitalisation

C)Interest rates

D)Asset's value

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

20

Bella Limited expected future cash flows from the use of equipment as follows: end of year 1 $1500; end of year 2 $4500; end of year 3 $7000.The discount rate was determined as 8%.The value in use of the equipment is:

A)$10 804.

B)$12 037.

C)$13 000.

D)$14 040.

A)$10 804.

B)$12 037.

C)$13 000.

D)$14 040.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

21

The recoverable amount of an asset is defined as the lower of the fair value less costs of disposal and value in use.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

22

Intangible assets that are not yet available for use are not required to be tested for impairment.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

23

Under AASB 136 Impairment of Assets,the impairment testing of goodwill occurs at the:

A)level of the entity itself.

B)lowest level at which goodwill is allocated to cash-generating units.

C)combined segments level.

D)operating division level.

A)level of the entity itself.

B)lowest level at which goodwill is allocated to cash-generating units.

C)combined segments level.

D)operating division level.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

24

A decrease in interest rates is an example of an external source of information that may indicate that an asset is impaired.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

25

The impairment test for goodwill must be conducted:

A)annually or more frequently if there is an indication the cash-generating unit may be impaired.

B)on 1 January each year.

C)once every three years at balance date.

D)only if it is reasonable to expect that goodwill has been impaired.

A)annually or more frequently if there is an indication the cash-generating unit may be impaired.

B)on 1 January each year.

C)once every three years at balance date.

D)only if it is reasonable to expect that goodwill has been impaired.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

26

Any costs arising after the sale of an asset are included in the disposal costs of that asset.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

27

During 2013,Langer Limited estimated that the carrying amount of goodwill was impaired and wrote it down by $100 000.In 2014,the company reassessed goodwill was decided that the old acquired goodwill still existed.The correct accounting treatment in 2014 is:

A)reverse the previous goodwill impairment loss.

B)decrease goodwill by an adjustment to retained earnings.

C)ignore the reversal as it is prohibited by AASB 136 Impairment of Assets.

D)increase goodwill by an adjustment to retained earnings.

A)reverse the previous goodwill impairment loss.

B)decrease goodwill by an adjustment to retained earnings.

C)ignore the reversal as it is prohibited by AASB 136 Impairment of Assets.

D)increase goodwill by an adjustment to retained earnings.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

28

At reporting date,the carrying amount of a cash-generating unit was considered to be have been impaired by $1000.The unit included the following assets: land $5000; plant $4000; and goodwill $1250.The carrying amount of goodwill after the allocation of the impairment loss is:

A)$0.

B)$250.

C)$3000.

D)$4000.

A)$0.

B)$250.

C)$3000.

D)$4000.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following assets is incorrect?

A)Corporate assets should never be allocated to cash-generating units.

B)There are restrictions on how far a particular asset can be written down in the allocation process.

C)Where an impairment loss occurs in a cash-generating unit,and no goodwill exists,the impairment loss is allocated across the carrying amounts of the unit's assets.

D)AASB 136 Impairment of Assets provides guidelines to help determine the cash-generating units in an entity.

A)Corporate assets should never be allocated to cash-generating units.

B)There are restrictions on how far a particular asset can be written down in the allocation process.

C)Where an impairment loss occurs in a cash-generating unit,and no goodwill exists,the impairment loss is allocated across the carrying amounts of the unit's assets.

D)AASB 136 Impairment of Assets provides guidelines to help determine the cash-generating units in an entity.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

30

If the recoverable amount of a cash-generating unit exceeds its carrying amount:

A)the carrying amount must be increased to the recoverable amount.

B)there is no impairment loss.

C)the carrying amount must be decreased to the fair value.

D)there is an impairment loss.

A)the carrying amount must be increased to the recoverable amount.

B)there is no impairment loss.

C)the carrying amount must be decreased to the fair value.

D)there is an impairment loss.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

31

The discount rate used in the determination of the value in use of an asset may be selected from rates used for similar assets in the market.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

32

When calculating value in use,cash flow projections should cover a maximum period of three years.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

33

When calculating value in use,cash inflows relating to financing activities and income tax must be excluded from the calculation.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

34

In relation to the impairment of assets,AASB 136 Impairment of Assets requires which of the following disclosures for each class of assets?

I The line item(s)of the income statement in which impairment losses are included.

II The amount of reversals of impairment losses on revalued assets.

III The amount of impairment losses recognised in profit or loss.

IV The amount of impairment losses on revalued assets.

A)I,II,III and IV

B)I,II and III only

C)II and IV only

D)IV only

I The line item(s)of the income statement in which impairment losses are included.

II The amount of reversals of impairment losses on revalued assets.

III The amount of impairment losses recognised in profit or loss.

IV The amount of impairment losses on revalued assets.

A)I,II,III and IV

B)I,II and III only

C)II and IV only

D)IV only

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following is not one of the guidelines in AASB 136 Impairment of Assets for identifying a cash-generating unit?

A)Consider how management makes decisions about continuing or disposing of the entity's assets and operations.

B)If the output of the group of assets can be sold internally,then these process can be used to measure the value in use of the group of assets.

C)If there is no active market for the output of the group of assets,the group constitutes a cash-generating unit.

D)Consider how management monitors the entity's operations,such as by product lines,business,individual locations,districts or regional areas.

A)Consider how management makes decisions about continuing or disposing of the entity's assets and operations.

B)If the output of the group of assets can be sold internally,then these process can be used to measure the value in use of the group of assets.

C)If there is no active market for the output of the group of assets,the group constitutes a cash-generating unit.

D)Consider how management monitors the entity's operations,such as by product lines,business,individual locations,districts or regional areas.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

36

Where the fair value less costs of disposal exceeds the carrying amount,it is necessary to calculate the value in use of the asset to determine whether it is impaired.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

37

According to AASB 136 Impairment of Assets,which of the following indicators assist in providing external evidence that an impairment loss has reversed?

A)Market interest rates have increased during the period.

B)Significant changes with an adverse effect on the entity have taken place.

C)Market interest rates have decreased during the period.

D)Internal reporting sources indicate that the economic performance of the asset will not be as good as expected.

A)Market interest rates have increased during the period.

B)Significant changes with an adverse effect on the entity have taken place.

C)Market interest rates have decreased during the period.

D)Internal reporting sources indicate that the economic performance of the asset will not be as good as expected.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

38

Higher cash outflows and/or lower cash inflows expected from an asset are examples of internal sources of information that may indicate that an asset is impaired.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

39

Where the carrying amount of an asset exceeds the fair value less costs of disposal,it is necessary to calculate the value in use of the asset to determine whether it is impaired.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

40

Deferred tax assets are subject to annual impairment tests.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

41

If some or all of the output of a group of assets is used internally,the assets may still constitute a cash generating unit.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

42

Where an asset is measured using the cost model,any impairment loss is recognised immediately in profit and loss.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

43

AASB 136 Impairment of Assets prohibits the reversals of impairment losses relating to goodwill.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

44

Cash-generating units should be identified consistently from period to period for the same group of assets.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

45

Where an asset is measured using the revaluation model,any impairment loss is recognised immediately in profit and loss.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

46

A cash generating unit is defined in AASB 136 Impairment of Assets as the smallest identifiable group of assets that generates cash inflows that are largely independent of the cash inflows from other assets or groups of assets.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

47

Corporate assets are tested separately for impairment from other assets within an entity.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

48

When a cash generating unit containing goodwill is impaired,the impairment loss is allocated on a pro-rata basis across all of the assets in the cash generating unit.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

49

AASB 136 Impairment of Assets requires disclosures about estimates and judgements made in the impairment testing process.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck