Deck 1: Pricing Products and Services

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/82

Play

Full screen (f)

Deck 1: Pricing Products and Services

1

In target costing, effort is concentrated on effectively marketing the product to maximize its selling price.

False

2

In target costing, the selling price is the starting point and the cost follows from the selling price.

True

3

Holding all other things constant, an increase in fixed production costs will affect:

A)the markup under the absorption costing approach to cost-plus pricing.

B)the markup used to compute the profit-maximizing price.

C)both the markup under the absorption costing approach to cost-plus pricing and the markup used to compute profit-maximizing price.

D)neither the markup under the absorption costing approach to cost-plus pricing nor the markup used to compute profit-maximizing price.

A)the markup under the absorption costing approach to cost-plus pricing.

B)the markup used to compute the profit-maximizing price.

C)both the markup under the absorption costing approach to cost-plus pricing and the markup used to compute profit-maximizing price.

D)neither the markup under the absorption costing approach to cost-plus pricing nor the markup used to compute profit-maximizing price.

A

4

If a product is price inelastic, then only a very large change in selling price will result in a substantial change in the volume of units sold.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

5

The markup over cost under the absorption costing approach would increase if the required rate of return increases, holding everything else constant.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

6

Target costing is the process of determining the maximum allowable cost for a new product and then developing a prototype that can be profitably made for that maximum cost figure.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

7

If the unit sales for one product are more sensitive to price increases than another product, then its markup over variable cost should be less than for the other product if the company wants to maximize profit.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

8

Holding all other things constant, an increase in how sensitive customers are to price would affect:

A)the markup under the absorption costing approach to cost-plus pricing.

B)the markup used to compute the profit-maximizing price.

C)both the markup under the absorption costing approach to cost-plus pricing and the markup used to compute profit-maximizing price.

D)neither the markup under the absorption costing approach to cost-plus pricing nor the markup used to compute profit-maximizing price.

A)the markup under the absorption costing approach to cost-plus pricing.

B)the markup used to compute the profit-maximizing price.

C)both the markup under the absorption costing approach to cost-plus pricing and the markup used to compute profit-maximizing price.

D)neither the markup under the absorption costing approach to cost-plus pricing nor the markup used to compute profit-maximizing price.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

9

The formula for target cost is:

Target cost = Anticipated selling price + Desired profit

Target cost = Anticipated selling price + Desired profit

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

10

Price elasticity measures the degree to which consumers resent an increase in price.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

11

The price elasticity of demand is NOT used to determine the markup over cost when computing the profit-maximizing price.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

12

The price elasticity of demand is NOT used in the absorption costing approach to cost-plus pricing to determine the markup over cost.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

13

Most of the opportunities to reduce the cost of a product come from designing the product so that it is simple to make, uses inexpensive parts, and is robust and reliable.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

14

In the absorption approach to cost-plus pricing, the anticipated markup in dollars is NOT equal to the anticipated profit.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

15

Holding all other things constant, an increase in the company's required return on investment (ROI) will affect:

A)the selling price under the absorption costing approach to cost-plus pricing.

B)the profit-maximizing price.

C)both the selling price under the absorption costing approach to cost-plus pricing and the profit-maximizing price.

D)neither the selling price under the absorption costing approach to cost-plus pricing nor the profit-maximizing price.

A)the selling price under the absorption costing approach to cost-plus pricing.

B)the profit-maximizing price.

C)both the selling price under the absorption costing approach to cost-plus pricing and the profit-maximizing price.

D)neither the selling price under the absorption costing approach to cost-plus pricing nor the profit-maximizing price.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

16

Pricing decisions are most difficult in those situations in which a company makes a product that is in competition with other, identical products for which a market already exists.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

17

Under the absorption approach to costs-plus pricing described in the text, selling and administrative costs are included in the cost base when computing a selling price.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

18

If the formula for the markup percentage on absorption cost is used for setting prices, then the company's desired return on investment (ROI) will not usually be attained unless the assumed number of units sold is actually sold.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

19

Holding all other things constant, if the price elasticity of demand increases (i.e., becomes more negative), then the markup under the economists' approach to pricing will:

A)increase.

B)decrease.

C)remain the same.

D)The effect cannot be determined.

A)increase.

B)decrease.

C)remain the same.

D)The effect cannot be determined.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

20

The markup over cost under the absorption costing approach would increase if selling and administrative expenses increase, holding everything else constant.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

21

The Sloan Corporation must invest $120,000 to produce and market 16,000 units of Product X each year. The company uses the absorption costing approach to cost-plus pricing described in the text to set prices for its products. Other cost information regarding Product X is as follows: If Sloan Corporation requires a 15% return on investment, then the markup percentage on absorption cost for Product X (rounded to the nearest percent) would be:

A)41%

B)16%

C)29%

D)22%

A)41%

B)16%

C)29%

D)22%

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

22

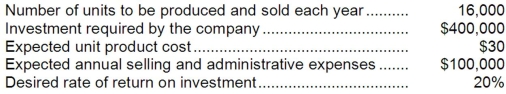

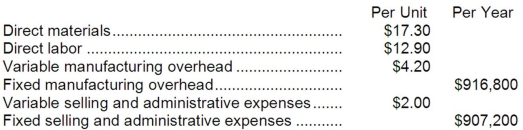

Surent Corporation has the following information available on Product K:

The company uses the absorption costing approach to cost-plus pricing described in the text and a 50% markup. Based on these data, the company's total selling and administrative expenses associated with Product K each year are:

A)$80,000

B)$200,000

C)$920,000

D)$800,000

The company uses the absorption costing approach to cost-plus pricing described in the text and a 50% markup. Based on these data, the company's total selling and administrative expenses associated with Product K each year are:

A)$80,000

B)$200,000

C)$920,000

D)$800,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

23

The formula for target cost is:

A)Target cost = Anticipated selling price - Desired profit.

B)Target cost = Unit cost + (Markup percentage × Unit cost)

C)Target cost = Units sold × Unit cost traceable to product

D)Target cost = (Desired return on assets employed + Selling and administrative expenses) ÷ (Units sold × Unit product cost)

A)Target cost = Anticipated selling price - Desired profit.

B)Target cost = Unit cost + (Markup percentage × Unit cost)

C)Target cost = Units sold × Unit cost traceable to product

D)Target cost = (Desired return on assets employed + Selling and administrative expenses) ÷ (Units sold × Unit product cost)

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

24

Kircher, Inc., manufactures a product with the following costs: The company uses the absorption costing approach to cost-plus pricing described in the text. The pricing calculations are based on budgeted production and sales of 81,000 units per year. The company has invested $220,000 in this product and expects a return on investment of 15%.

The selling price based on the absorption costing approach would be closest to:

A)$71.90

B)$72.31

C)$53.29

D)$93.67

The selling price based on the absorption costing approach would be closest to:

A)$71.90

B)$72.31

C)$53.29

D)$93.67

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

25

Gordy Corporation's management has found that every 3% increase in the selling price of one of the company's products leads to a 6% decrease in the product's total unit sales. The product's absorption costing unit product cost is $22.00. The variable production cost of the product is $6.80 per unit and the variable selling and administrative cost is $2.40 per unit. According to the formula in the text, the product's profit-maximizing price is closest to:

A)$17.77

B)$31.39

C)$17.61

D)$42.12

A)$17.77

B)$31.39

C)$17.61

D)$42.12

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

26

When using the absorption approach to cost-plus pricing described in the text:

A)all costs are included in the cost base.

B)the "plus" or markup figure contains fixed costs and desired profit.

C)the cost base is made up of the unit product cost.

D)only selling and administrative expenses are included in the cost base.

A)all costs are included in the cost base.

B)the "plus" or markup figure contains fixed costs and desired profit.

C)the cost base is made up of the unit product cost.

D)only selling and administrative expenses are included in the cost base.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

27

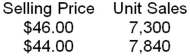

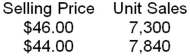

Hanson Corporation recently changed the selling price of one of its products. Data concerning sales for comparable periods before and after the price change are presented below. The product's price elasticity of demand as defined in the text is closest to:

A)-1.71

B)-1.65

C)-1.85

D)-2.45

A)-1.71

B)-1.65

C)-1.85

D)-2.45

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

28

Finn Corporation's management believes that every 5% increase in the selling price of one of the company's products results in a 6% decrease in the product's total unit sales. The variable production cost of this product is $38.30 per unit and the variable selling and administrative cost is $1.00 per unit. The product's profit-maximizing price according to the formula in the text is closest to:

A)$43.62

B)$187.34

C)$41.55

D)$185.84

A)$43.62

B)$187.34

C)$41.55

D)$185.84

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

29

Magner, Inc., uses the absorption costing approach to cost-plus pricing described in the text to set prices for its products. Based on budgeted sales of 34,000 units next year, the unit product cost of a particular product is $61.80. The company's selling and administrative expenses for this product are budgeted to be $809,200 in total for the year. The company has invested $400,000 in this product and expects a return on investment of 9%. The selling price for this product based on the absorption costing approach would be closest to:

A)$86.66

B)$120.03

C)$67.36

D)$85.60

A)$86.66

B)$120.03

C)$67.36

D)$85.60

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

30

Holding all other things constant, an increase in variable selling costs will affect:

A)the selling price under the absorption costing approach to cost-plus pricing.

B)the profit-maximizing price.

C)both the selling price under the absorption costing approach to cost-plus pricing and the profit-maximizing price.

D)neither the selling price under the absorption costing approach to cost-plus pricing nor the profit-maximizing price.

A)the selling price under the absorption costing approach to cost-plus pricing.

B)the profit-maximizing price.

C)both the selling price under the absorption costing approach to cost-plus pricing and the profit-maximizing price.

D)neither the selling price under the absorption costing approach to cost-plus pricing nor the profit-maximizing price.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

31

Perwin Corporation estimates that an investment of $400,000 would be needed to produce and sell 30,000 units of Product B each year. At this level of activity, the unit product cost would be $25. Selling and administrative expenses would total $350,000 each year. The company uses the absorption costing approach to cost-plus pricing described in the text. If a 15% rate of return on investment is desired, then the required markup for Product B would be closest to:

A)15%

B)49%

C)55%

D)58%

A)15%

B)49%

C)55%

D)58%

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

32

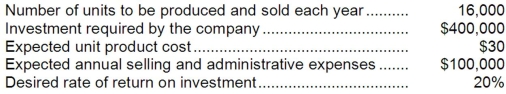

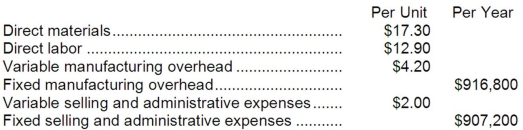

Simmons Corporation estimated that the following costs and activity would be associated with Product T: If the company uses the absorption costing approach to cost-plus pricing described in the text and desires a 20% ROI, the selling price for Product T would be:

A)$37.25

B)$38.75

C)$42.00

D)$44.75

A)$37.25

B)$38.75

C)$42.00

D)$44.75

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

33

Lacy Corporation uses the absorption costing approach to cost-plus pricing described in the text to set prices for its products. Based on budgeted sales of 86,000 units next year, the unit product cost of a particular product is $81.60. The company's selling and administrative expenses for this product are budgeted to be $1,247,000 in total for the year. The company has invested $360,000 in this product and expects a return on investment of 12%. The markup on absorption cost for this product would be closest to:

A)12.0%

B)18.4%

C)29.8%

D)17.8%

A)12.0%

B)18.4%

C)29.8%

D)17.8%

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

34

Joeston Corporation makes a product with the following costs: The company uses the absorption costing approach to cost-plus pricing described in the text. The pricing calculations are based on budgeted production and sales of 14,000 units per year. The company has invested $540,000 in this product and expects a return on investment of 10%. The markup on absorption cost would be closest to:

A)27.1%

B)124.2%

C)34.2%

D)10.0%

A)27.1%

B)124.2%

C)34.2%

D)10.0%

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

35

Ingham Corporation recently changed the selling price of one of its products. Data concerning sales for comparable periods before and after the price change are presented below. The product's variable cost is $16.40 per unit. According to the formula in the text, the product's profit-maximizing price is closest to:

A)$35.82

B)$32.89

C)$35.23

D)$20.74

A)$35.82

B)$32.89

C)$35.23

D)$20.74

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

36

Minden Corporation estimates that the following costs and activity would be associated with the manufacture and sale of product A: If the company uses the absorption costing approach to cost-plus pricing described in the text and desires a 25% rate of return on investment (ROI), the required markup on absorption cost for Product A would be closest to:

A)12%

B)15%

C)17%

D)25%

A)12%

B)15%

C)17%

D)25%

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following items are included in calculating the markup percentage under the absorption approach to cost-plus pricing described in the text?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

38

The following information is available on Browning Inc.'s Product A: The company uses the absorption costing approach to cost-plus pricing described in the text. Based on these data, the total selling and administrative expenses each year are:

A)$720,000

B)$480,000

C)$640,000

D)$400,000

A)$720,000

B)$480,000

C)$640,000

D)$400,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

39

Erdahl Corporation's management believes that every 7% increase in the selling price of one of the company's products leads to a 11% decrease in the product's total unit sales. The product's price elasticity of demand as defined in the text is closest to:

A)-1.72

B)-1.84

C)-1.05

D)-2.05

A)-1.72

B)-1.84

C)-1.05

D)-2.05

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

40

Warvel Corporation's management has found that every 5% increase in the selling price of one of the company's products leads to an 8% decrease in the product's total unit sales. The variable production cost of the product is $18.00 per unit and the variable selling and administrative cost is $12.00 per unit. According to the formula in the text, the product's profit-maximizing price is closest to:

A)$63.08

B)$72.31

C)$96.41

D)$58.67

A)$63.08

B)$72.31

C)$96.41

D)$58.67

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

41

A new product, an automated crepe maker, is being introduced at Miyake Corporation. At a selling price of $73 per unit, management projects sales of 20,000 units. Launching the crepe maker as a new product would require an investment of $400,000. The desired return on investment is 17%. The target cost per crepe maker is closest to:

A)$69.60

B)$85.41

C)$81.43

D)$73.00

A)$69.60

B)$85.41

C)$81.43

D)$73.00

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

42

The markup on absorption cost is closest to:

A)96.5%

B)15.0%

C)31.2%

D)30.0%

A)96.5%

B)15.0%

C)31.2%

D)30.0%

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

43

Aldot Candy Corporation is implementing a target costing approach for its latest new product, the "Big Glob" candy bar. The following information relates to the Big Glob: Based on this information, what is Aldot's target selling price per bar for the Big Glob?

A)$0.48

B)$0.50

C)$0.64

D)$0.70

A)$0.48

B)$0.50

C)$0.64

D)$0.70

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

44

Sawit Corporation, a manufacturer of woodworking tools, wants to introduce a new power screwdriver. To compete effectively, the screwdriver cannot be priced at more than $14. The company requires a 15% rate of return on investment on all new products. In order to produce and sell 80,000 screwdrivers each year, the company will need to make an investment of $800,000. The target cost per screwdriver would be:

A)$15.50

B)$1.50

C)$14.00

D)$12.50

A)$15.50

B)$1.50

C)$14.00

D)$12.50

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

45

The new product would require an investment of $1,200,000 on which the company would like to earn a return of 22 percent. The markup using the absorption costing approach would be:

A)93.8%

B)32.6%

C)71.3%

D)57.5%

A)93.8%

B)32.6%

C)71.3%

D)57.5%

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

46

The product's price elasticity of demand as defined in the text is closest to:

A)-2.13

B)-1.47

C)-1.57

D)-1.81

A)-2.13

B)-1.47

C)-1.57

D)-1.81

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

47

Timax Corporation, a manufacturer of moderate-priced time pieces, would like to introduce a new electronic watch. To compete effectively, the watch could not be priced at more than $50. The company requires a return on investment of 25% on all new products. The plan is to produce and sell 20,000 watches each year. This would require a $500,000 investment. The target cost per watch would be:

A)$64.00

B)$25.00

C)$43.75

D)$39.00

A)$64.00

B)$25.00

C)$43.75

D)$39.00

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

48

The markup percentage on absorption cost is closest to:

A)25%

B)10%

C)15%

D)41%

A)25%

B)10%

C)15%

D)41%

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

49

The product's profit-maximizing price according to the formula in the text is closest to:

A)$10.73

B)$38.89

C)$9.16

D)$19.89

A)$10.73

B)$38.89

C)$9.16

D)$19.89

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

50

The product's profit-maximizing price according to the formula in the text is closest to:

A)$15.31

B)$16.67

C)$20.79

D)$13.86

A)$15.31

B)$16.67

C)$20.79

D)$13.86

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

51

Assume that after introducing the new product, the company finds that it has excess capacity. A foreign dealer has offered to purchase 2,000 units at a special price of $36 per unit. This sale would not disturb regular business. If the special price is accepted on the 2,000 units, the company's overall net income for the year should:

A)decrease by $24,000

B)increase by $20,000

C)increase by $8,000

D)increase by $32,000

A)decrease by $24,000

B)increase by $20,000

C)increase by $8,000

D)increase by $32,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

52

The product's price elasticity of demand as defined in the text is closest to:

A)-3.19

B)-2.02

C)-2.70

D)-4.13

A)-3.19

B)-2.02

C)-2.70

D)-4.13

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

53

The management of Brockington Corporation is considering introducing a new product--a compact barbecue. At a selling price of $80 per unit, management projects sales of 70,000 units. Launching the barbecue as a new product would require an investment of $400,000. The desired return on investment is 15%. The target cost per barbecue is closest to:

A)$79.14

B)$92.00

C)$91.01

D)$80.00

A)$79.14

B)$92.00

C)$91.01

D)$80.00

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

54

The unit target selling price using the absorption costing approach is closest to:

A)$105.75

B)$83.33

C)$121.50

D)$86.00

A)$105.75

B)$83.33

C)$121.50

D)$86.00

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

55

The product's profit-maximizing price according to the formula in the text is closest to:

A)$259.84

B)$33.99

C)$40.89

D)$31.81

A)$259.84

B)$33.99

C)$40.89

D)$31.81

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

56

The absorption costing unit product cost is:

A)$59

B)$86

C)$55

D)$75

A)$59

B)$86

C)$55

D)$75

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

57

If every 10% increase in price leads to a 14% decrease in quantity sold, the profit-maximizing price is closest to:

A)$84.50

B)$124.25

C)$120.90

D)$117.91

A)$84.50

B)$124.25

C)$120.90

D)$117.91

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

58

The selling price based on the absorption costing approach is closest to:

A)$85.28

B)$84.50

C)$110.89

D)$56.95

A)$85.28

B)$84.50

C)$110.89

D)$56.95

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

59

Pedrotti Corporation would like to use target costing for a new product it is considering introducing. At a selling price of $28 per unit, management projects sales of 30,000 units. The new product would require an investment of $300,000. The desired return on investment is 17%. The target cost per unit is closest to:

A)$32.76

B)$26.30

C)$28.00

D)$30.77

A)$32.76

B)$26.30

C)$28.00

D)$30.77

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

60

The product's price elasticity of demand as defined in the text is closest to:

A)-1.75

B)-2.22

C)-2.06

D)-1.07

A)-1.75

B)-2.22

C)-2.06

D)-1.07

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

61

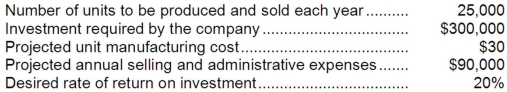

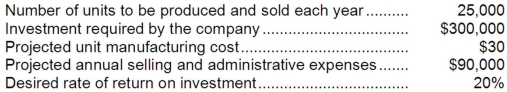

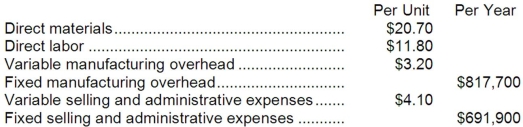

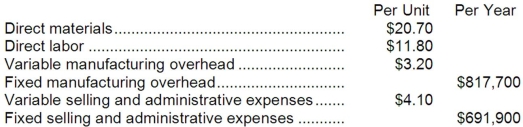

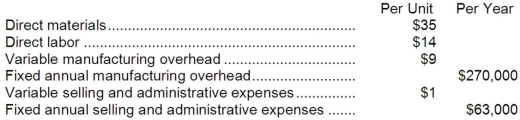

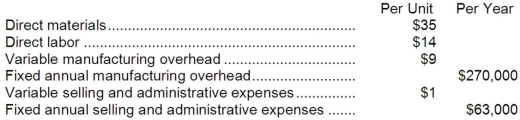

Trepan Corporation is contemplating the introduction of a new product. The company has gathered the following information concerning the product:  The company uses the absorption costing approach to cost-plus pricing as described in the text.

The company uses the absorption costing approach to cost-plus pricing as described in the text.

Required:

a. Compute the markup on absorption cost.

b. Compute the selling price.

c. If the price computed in "b" above is charged, and costs turn out as projected, can the company be assured that no loss will be sustained on the new product? Explain.

The company uses the absorption costing approach to cost-plus pricing as described in the text.

The company uses the absorption costing approach to cost-plus pricing as described in the text.Required:

a. Compute the markup on absorption cost.

b. Compute the selling price.

c. If the price computed in "b" above is charged, and costs turn out as projected, can the company be assured that no loss will be sustained on the new product? Explain.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

62

Ritchie Corporation manufactures a product that has the following costs:  The company uses the absorption costing approach to cost-plus pricing as described in the text. The pricing calculations are based on budgeted production and sales of 37,000 units per year. The company has invested $160,000 in this product and expects a return on investment of 15%.

The company uses the absorption costing approach to cost-plus pricing as described in the text. The pricing calculations are based on budgeted production and sales of 37,000 units per year. The company has invested $160,000 in this product and expects a return on investment of 15%.

Required:

a. Compute the markup on absorption cost.

b. Compute the selling price of the product using the absorption costing approach.

The company uses the absorption costing approach to cost-plus pricing as described in the text. The pricing calculations are based on budgeted production and sales of 37,000 units per year. The company has invested $160,000 in this product and expects a return on investment of 15%.

The company uses the absorption costing approach to cost-plus pricing as described in the text. The pricing calculations are based on budgeted production and sales of 37,000 units per year. The company has invested $160,000 in this product and expects a return on investment of 15%.Required:

a. Compute the markup on absorption cost.

b. Compute the selling price of the product using the absorption costing approach.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

63

The markup on absorption cost for this product would be closest to:

A)45.1%

B)36.7%

C)11.0%

D)34.1%

A)45.1%

B)36.7%

C)11.0%

D)34.1%

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

64

The management of Featherston, Inc., is considering a new product that would have a selling price of $77 per unit and projected sales of 50,000 units. The new product would require an investment of $100,000. The desired return on investment is 20%.

Required:

Determine the target cost per unit for the new product.

Required:

Determine the target cost per unit for the new product.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

65

Gillis Corporation's marketing manager believes that every 10% increase in the selling price of one of the company's products would lead to a 15% decrease in the product's total unit sales. The product's absorption costing unit product cost is $20.00. The variable production cost is $6.00 per unit and the variable selling and administrative cost is $3.00. The fixed selling and administrative expense averages $0.50 per unit.

Required:

a. Compute the product's price elasticity of demand as defined in the text to two decimal places.

b. Compute the product's profit-maximizing price according to the formula in the text.

Required:

a. Compute the product's price elasticity of demand as defined in the text to two decimal places.

b. Compute the product's profit-maximizing price according to the formula in the text.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

66

Pashicke Corporation recently changed the selling price of one of its products. Data concerning sales for comparable periods before and after the price change are presented below.  The product's variable cost is $17.10 per unit.

The product's variable cost is $17.10 per unit.

Required:

a Compute the product's price elasticity of demand as defined in the text to two decimal places.

b. Compute the product's profit-maximizing price according to the formula in the text.

The product's variable cost is $17.10 per unit.

The product's variable cost is $17.10 per unit.Required:

a Compute the product's price elasticity of demand as defined in the text to two decimal places.

b. Compute the product's profit-maximizing price according to the formula in the text.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

67

Loyola International, Inc. is considering adding a portable CD player to its product line. Management believes that in order to be competitive, the CD player cannot be priced above $79. The company requires a minimum return of 20% on its investments. Launching the new product would require an investment of $20,000,000. Sales are expected to be 250,000 units of the CD player per year.

Required:

Compute the target cost of a CD player.

Required:

Compute the target cost of a CD player.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

68

The desired profit according to the target costing calculations is:

A)$380,000

B)$303,000

C)$41,800

D)$77,000

A)$380,000

B)$303,000

C)$41,800

D)$77,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

69

The management of Archut Corporation would like to set the selling price on a new product using the absorption costing approach to cost-plus pricing. The company's accounting department has supplied the following estimates for the new product:  Management plans to produce and sell 9,000 units of the new product annually. The new product would require an investment of $3,002,400 and has a required return on investment of 10%.

Management plans to produce and sell 9,000 units of the new product annually. The new product would require an investment of $3,002,400 and has a required return on investment of 10%.

Required:

a. Determine the unit product cost for the new product.

b. Determine the markup percentage on absorption cost for the new product.

c. Determine the selling price for the new product using the absorption costing approach.

Management plans to produce and sell 9,000 units of the new product annually. The new product would require an investment of $3,002,400 and has a required return on investment of 10%.

Management plans to produce and sell 9,000 units of the new product annually. The new product would require an investment of $3,002,400 and has a required return on investment of 10%.Required:

a. Determine the unit product cost for the new product.

b. Determine the markup percentage on absorption cost for the new product.

c. Determine the selling price for the new product using the absorption costing approach.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

70

Green Hornet Corporation is contemplating the introduction of a new product. The company has gathered the following information concerning the product:  The company uses the absorption costing approach to cost-plus pricing as described in the text.

The company uses the absorption costing approach to cost-plus pricing as described in the text.

Required:

a. Compute the markup on absorption cost.

b. Compute the selling price.

The company uses the absorption costing approach to cost-plus pricing as described in the text.

The company uses the absorption costing approach to cost-plus pricing as described in the text.Required:

a. Compute the markup on absorption cost.

b. Compute the selling price.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

71

The selling price would be closest to:

A)$28.71

B)$26.50

C)$22.00

D)$32.67

A)$28.71

B)$26.50

C)$22.00

D)$32.67

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

72

Nguyen Corporation's marketing manager believes that every 8% increase in the selling price of one of the company's products would lead to a 15% decrease in the product's total unit sales. The product's absorption costing unit product cost is $19.40. The variable production cost is $5.40 per unit and the variable selling and administrative cost is $2.20.

Required:

a. Compute the product's price elasticity of demand as defined in the text to two decimal places.

b. Compute the product's profit-maximizing price according to the formula in the text.

Required:

a. Compute the product's price elasticity of demand as defined in the text to two decimal places.

b. Compute the product's profit-maximizing price according to the formula in the text.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

73

The target cost per unit is closest to:

A)$21.00

B)$18.60

C)$23.52

D)$20.83

A)$21.00

B)$18.60

C)$23.52

D)$20.83

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

74

The selling price based on the absorption costing approach for this product would be closest to:

A)$110.76

B)$81.00

C)$67.04

D)$82.59

A)$110.76

B)$81.00

C)$67.04

D)$82.59

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

75

Okamoto Corporation's management believes that every 7% increase in the selling price of one of the company's products would lead to a 10% decrease in the product's total unit sales. The variable cost per unit of this product is $69.20.

Required:

a. Compute the product's price elasticity of demand as defined in the text to two decimal places.

b. Compute the product's profit-maximizing price according to the formula in the text.

Required:

a. Compute the product's price elasticity of demand as defined in the text to two decimal places.

b. Compute the product's profit-maximizing price according to the formula in the text.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

76

The desired profit according to the target costing calculations is:

A)$420,000

B)$50,400

C)$48,000

D)$372,000

A)$420,000

B)$50,400

C)$48,000

D)$372,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

77

Desalvo Corporation is introducing a new product whose direct materials cost is $41 per unit, direct labor cost is $20 per unit, variable manufacturing overhead is $5 per unit, and variable selling and administrative expense is $4 per unit. The annual fixed manufacturing overhead associated with the product is $120,000 and its annual fixed selling and administrative expense is $8,000. Management plans to produce and sell 8,000 units of the new product annually. The new product would require an investment of $2,192,000 and has a required return on investment of 10%. Management would like to set the selling price on a new product using the absorption costing approach to cost-plus pricing.

Required:

a. Determine the unit product cost for the new product.

b. Determine the markup percentage on absorption cost for the new product.

c. Determine the selling price for the new product using the absorption costing approach.

Required:

a. Determine the unit product cost for the new product.

b. Determine the markup percentage on absorption cost for the new product.

c. Determine the selling price for the new product using the absorption costing approach.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

78

The markup percentage on the new product would be closest to:

A)15.0%

B)46.6%

C)31.6%

D)50.0%

A)15.0%

B)46.6%

C)31.6%

D)50.0%

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

79

Qualls Corporation makes a product that has the following costs:  The company uses the absorption costing approach to cost-plus pricing as described in the text. The pricing calculations are based on budgeted production and sales of 48,000 units per year.

The company uses the absorption costing approach to cost-plus pricing as described in the text. The pricing calculations are based on budgeted production and sales of 48,000 units per year.

The company has invested $360,000 in this product and expects a return on investment of 15%.

Required:

a. Compute the markup on absorption cost.

b. Compute the selling price of the product using the absorption costing approach.

c. Assume that every 10% increase in price leads to a 13% decrease in quantity sold. Assuming no change in cost structure and that direct labor is a variable cost, compute the profit-maximizing price.

The company uses the absorption costing approach to cost-plus pricing as described in the text. The pricing calculations are based on budgeted production and sales of 48,000 units per year.

The company uses the absorption costing approach to cost-plus pricing as described in the text. The pricing calculations are based on budgeted production and sales of 48,000 units per year.The company has invested $360,000 in this product and expects a return on investment of 15%.

Required:

a. Compute the markup on absorption cost.

b. Compute the selling price of the product using the absorption costing approach.

c. Assume that every 10% increase in price leads to a 13% decrease in quantity sold. Assuming no change in cost structure and that direct labor is a variable cost, compute the profit-maximizing price.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

80

The target cost per lawn blower is closest to:

A)$33.63

B)$30.30

C)$38.00

D)$42.18

A)$33.63

B)$30.30

C)$38.00

D)$42.18

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck