Deck 17: Fiscal Policy

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/93

Play

Full screen (f)

Deck 17: Fiscal Policy

1

The sum of the unemployment rate and the inflation rate is known as:

A)the macroeconomic index.

B)the mortality rate.

C)the market index.

D)the misery index.

E)a coincident indicator.

A)the macroeconomic index.

B)the mortality rate.

C)the market index.

D)the misery index.

E)a coincident indicator.

the misery index.

2

Fiscal policy is most effective in controlling inflation when the economy operates in the _____ region of the aggregate supply curve.

A)horizontal

B)vertical

C)upward rising

D)downward sloping

E)backward bending

A)horizontal

B)vertical

C)upward rising

D)downward sloping

E)backward bending

vertical

3

Suppose the equilibrium level of income exceeds the full employment level of income and there is high inflation.Hence, the government decides to implement a fiscal policy that will act to reducenational output and prices.This can be accomplished by:

A)increasing government spending such that aggregate expenditures are increased.

B)raising taxes and government spending by the same amount such that aggregate supply is decreased and aggregate demand is increased.

C)decreasing government spending such that aggregate demand is reduced.

D)lowering average tax rates such that aggregate supply is increased.

E)increasing transfer payments such that aggregate expenditures decline.

A)increasing government spending such that aggregate expenditures are increased.

B)raising taxes and government spending by the same amount such that aggregate supply is decreased and aggregate demand is increased.

C)decreasing government spending such that aggregate demand is reduced.

D)lowering average tax rates such that aggregate supply is increased.

E)increasing transfer payments such that aggregate expenditures decline.

decreasing government spending such that aggregate demand is reduced.

4

If aggregate demand intersects aggregate supply in the horizontal range of the aggregate supply curve, then, other things equal, an increase in government spending will:

A)raise real GDP by the amount indicated by the government spending multiplier and leave the price level unchanged.

B)lower real GDP by an amount equal to the increased spending and reduce inflation.

C)raise the price level and leave real GDP unchanged.

D)raise both real GDP and the price level by a multiple of the initial spending increase.

E)have no effect on real GDP or the price level, because all private investment will be crowded out.

A)raise real GDP by the amount indicated by the government spending multiplier and leave the price level unchanged.

B)lower real GDP by an amount equal to the increased spending and reduce inflation.

C)raise the price level and leave real GDP unchanged.

D)raise both real GDP and the price level by a multiple of the initial spending increase.

E)have no effect on real GDP or the price level, because all private investment will be crowded out.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

5

Ceteris paribus, if the U.S.federal government reduces fiscal spending which of the following will be observed?

A)The aggregate demand curve will shift to the right.

B)The aggregate expenditure in the economy will decrease.

C)The economy will approach potential GDP.

D)The marginal propensity to consume will increase.

E)The average price level will increase.

A)The aggregate demand curve will shift to the right.

B)The aggregate expenditure in the economy will decrease.

C)The economy will approach potential GDP.

D)The marginal propensity to consume will increase.

E)The average price level will increase.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

6

The effect of an increase in government spending on real GDP will be lesser:

A)the smaller the crowding-out effect.

B)the smaller the percentage of government spending financed by tax increases.

C)the larger the government budget surplus.

D)the more rapidly money is converted into goods.

E)the steeper the aggregate supply curve.

A)the smaller the crowding-out effect.

B)the smaller the percentage of government spending financed by tax increases.

C)the larger the government budget surplus.

D)the more rapidly money is converted into goods.

E)the steeper the aggregate supply curve.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following is not a means of financing government spending?

A)Government subsidies

B)Personal income taxes

C)Printing new money

D)Issuing government bonds

E)Capital gains taxes

A)Government subsidies

B)Personal income taxes

C)Printing new money

D)Issuing government bonds

E)Capital gains taxes

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

8

If the government wants to close a GDP gap, it should:

A)borrow funds from the public by issuing bonds.

B)lower taxes and raise government spending.

C)lower government spending on social security.

D)raise both direct and indirect tax rates.

E)adopt contractionary fiscal policies to control inflation.

A)borrow funds from the public by issuing bonds.

B)lower taxes and raise government spending.

C)lower government spending on social security.

D)raise both direct and indirect tax rates.

E)adopt contractionary fiscal policies to control inflation.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

9

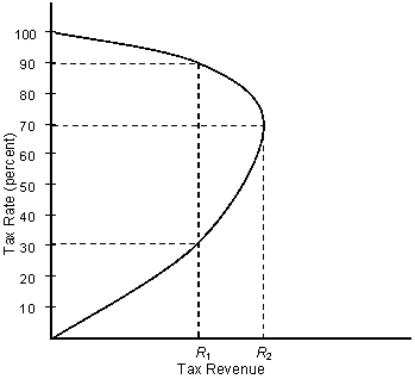

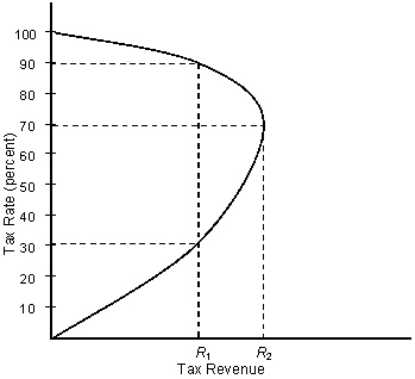

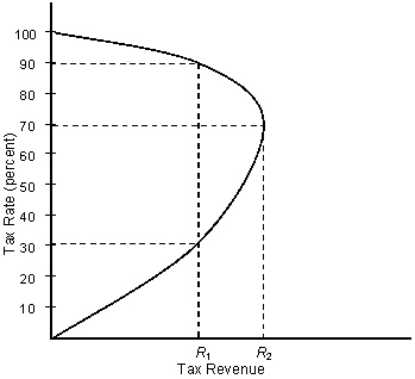

The figure given below depicts the tax revenue for different tax rates applied by the government. Figure 11.2  Refer to Figure 11.2.If the tax rate were 100 percent:

Refer to Figure 11.2.If the tax rate were 100 percent:

A)tax revenue would be maximized.

B)no one would be willing to work.

C)there would be a strong incentive to work.

D)tax revenue would be greater than if the tax rate were zero percent.

E)tax revenue would be less than if the tax rate were zero percent.

Refer to Figure 11.2.If the tax rate were 100 percent:

Refer to Figure 11.2.If the tax rate were 100 percent:A)tax revenue would be maximized.

B)no one would be willing to work.

C)there would be a strong incentive to work.

D)tax revenue would be greater than if the tax rate were zero percent.

E)tax revenue would be less than if the tax rate were zero percent.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

10

If government spending in a country declines by $10 billion and, at the same time, taxes increase by an equal amount, what is the total effect in the economy?

A)Equilibrium real GDP increases

B)Equilibrium real GDP decreases by $20 billion

C)Equilibrium real GDP is unchanged

D)Equilibrium real GDP decreases by more than $10 billion and less than $20 billion

E)Equilibrium real GDP decreases by more than $20 billion

A)Equilibrium real GDP increases

B)Equilibrium real GDP decreases by $20 billion

C)Equilibrium real GDP is unchanged

D)Equilibrium real GDP decreases by more than $10 billion and less than $20 billion

E)Equilibrium real GDP decreases by more than $20 billion

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

11

Government spending equals the sum of _____, _____, and _____.

A)taxes;changes in the reserves of the central bank;changes in net exports

B)taxes;change in government debt;change in government-issued money

C)taxes;public expenditures;private deductible expenditures

D)public expenditures;business investment;change in government debt

E)public debt;welfare expenditures;social security expenditures

A)taxes;changes in the reserves of the central bank;changes in net exports

B)taxes;change in government debt;change in government-issued money

C)taxes;public expenditures;private deductible expenditures

D)public expenditures;business investment;change in government debt

E)public debt;welfare expenditures;social security expenditures

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following statements about taxation is incorrect?

A)A tax cut affects aggregate demand indirectly.

B)A tax cut raises income and expenditures.

C)Cutting taxes by $20 is not the same as increasing government spending by $20.

D)A change in taxes does not affect consumption.

E)An increase in taxes decreases income and expenditures.

A)A tax cut affects aggregate demand indirectly.

B)A tax cut raises income and expenditures.

C)Cutting taxes by $20 is not the same as increasing government spending by $20.

D)A change in taxes does not affect consumption.

E)An increase in taxes decreases income and expenditures.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

13

The _____ is the difference between potential real GDP and the equilibrium level of real GDP.

A)employment gap

B)inflationary gap

C)GDP gap

D)fiscal gap

E)monetary gap

A)employment gap

B)inflationary gap

C)GDP gap

D)fiscal gap

E)monetary gap

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

14

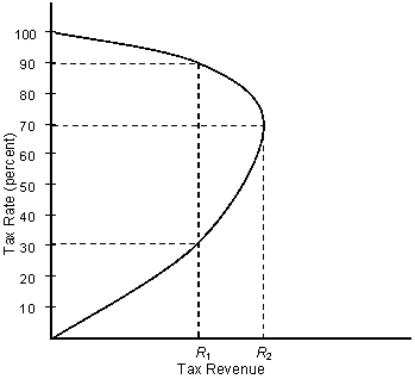

The figure given below depicts the tax revenue for different tax rates applied by the government. Figure 11.2  Refer to Figure 11.2.If you were a member of the Congress that aims to increase tax revenue collections, what would you recommend if the current tax rate were 80 percent?

Refer to Figure 11.2.If you were a member of the Congress that aims to increase tax revenue collections, what would you recommend if the current tax rate were 80 percent?

A)Increasing the tax rate to 100 percent

B)Decreasing the tax rate to 30 percent

C)Decreasing the tax rate to 70 percent

D)Increasing the tax rate to 90 percent

E)Decreasing the tax rate to zero percent

Refer to Figure 11.2.If you were a member of the Congress that aims to increase tax revenue collections, what would you recommend if the current tax rate were 80 percent?

Refer to Figure 11.2.If you were a member of the Congress that aims to increase tax revenue collections, what would you recommend if the current tax rate were 80 percent?A)Increasing the tax rate to 100 percent

B)Decreasing the tax rate to 30 percent

C)Decreasing the tax rate to 70 percent

D)Increasing the tax rate to 90 percent

E)Decreasing the tax rate to zero percent

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

15

Calculate the government spending multiplier if, an increase in government spending by $5 million increases real GDP by $25 million.

A)0.2

B)0.5

C)2

D)5

E)6

A)0.2

B)0.5

C)2

D)5

E)6

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following statements is true of government spending?

A)An increase in government spending raises the equilibrium level of income by a multiple of the original spending increase.

B)Government spending is a part of monetary policy, not fiscal policy.

C)A decline in government spending brings about an expansion in the economy.

D)Increase in government spending increases the recessionary gap in the economy.

E)An increase in government spending shifts the aggregate demand curve downward by a fraction of the rise in government spending.

A)An increase in government spending raises the equilibrium level of income by a multiple of the original spending increase.

B)Government spending is a part of monetary policy, not fiscal policy.

C)A decline in government spending brings about an expansion in the economy.

D)Increase in government spending increases the recessionary gap in the economy.

E)An increase in government spending shifts the aggregate demand curve downward by a fraction of the rise in government spending.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following can be categorized under fiscal policy?

A)Increase in money supply

B)Decrease in money supply

C)Increase in federal funds rate

D)Decrease in reserve requirement

E)Increase in tax rates

A)Increase in money supply

B)Decrease in money supply

C)Increase in federal funds rate

D)Decrease in reserve requirement

E)Increase in tax rates

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

18

When the government uses taxes and spending to affect national economy, it is engaging in:

A)fiscal policy.

B)monetary policy.

C)interest rate policy.

D)trade policy.

E)exchange rate policy.

A)fiscal policy.

B)monetary policy.

C)interest rate policy.

D)trade policy.

E)exchange rate policy.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

19

Suppose the Congress enacts a 5 percent decrease in annual military expenditures.Other things equal, this can be associated with:

A)a change in the slope of the aggregate demand curve.

B)a leftward shift of the aggregate demand curve.

C)a rightward shift of the aggregate demand curve.

D)a movement down along the aggregate demand curve.

E)a movement up along the aggregate demand curve.

A)a change in the slope of the aggregate demand curve.

B)a leftward shift of the aggregate demand curve.

C)a rightward shift of the aggregate demand curve.

D)a movement down along the aggregate demand curve.

E)a movement up along the aggregate demand curve.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

20

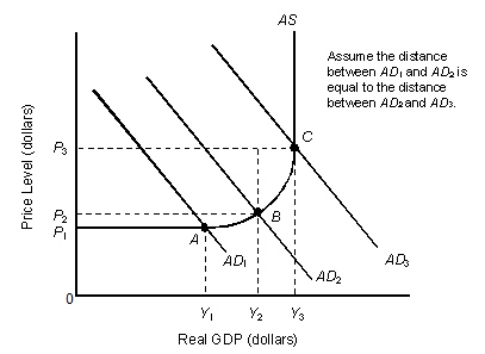

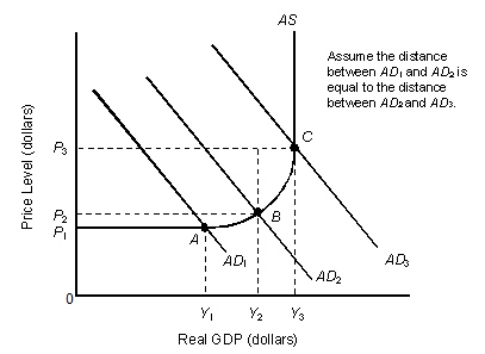

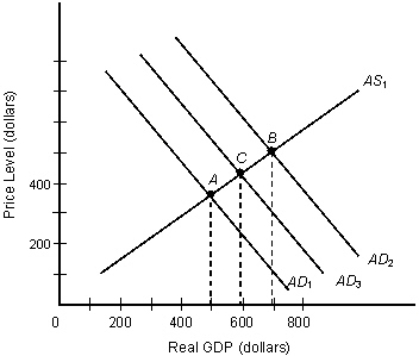

The figure given below shows the macroeconomic equilibria of a country. Figure 11.1  Refer to Figure 11.1.If the economy is in equilibrium at point C, then, other things equal, an increase in government spending will:

Refer to Figure 11.1.If the economy is in equilibrium at point C, then, other things equal, an increase in government spending will:

A)decrease the price level.

B)lower real GDP and leave the price level unchanged.

C)lower real GDP and increase the price level.

D)increase the price level and leave real GDP unchanged.

E)have no effect on real GDP or the price level.

Refer to Figure 11.1.If the economy is in equilibrium at point C, then, other things equal, an increase in government spending will:

Refer to Figure 11.1.If the economy is in equilibrium at point C, then, other things equal, an increase in government spending will:A)decrease the price level.

B)lower real GDP and leave the price level unchanged.

C)lower real GDP and increase the price level.

D)increase the price level and leave real GDP unchanged.

E)have no effect on real GDP or the price level.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

21

In the presence of the crowding out effect, the purchase of Treasury bonds by the government will result in:

A)an increase in the interest rates.

B)a decrease in the price of bonds.

C)a decline in the private sector spending.

D)an increase in the private sector spending.

E)a decrease in the rate of inflation.

A)an increase in the interest rates.

B)a decrease in the price of bonds.

C)a decline in the private sector spending.

D)an increase in the private sector spending.

E)a decrease in the rate of inflation.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

22

_____ refers to the changes in government spending and taxation that are aimed at achieving a policy goal.

A)Discretionary monetary policy

B)Discretionary fiscal policy

C)Discretionary foreign trade policy

D)Discretionary exchange rate policy

E)Discretionary interest rate policy

A)Discretionary monetary policy

B)Discretionary fiscal policy

C)Discretionary foreign trade policy

D)Discretionary exchange rate policy

E)Discretionary interest rate policy

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

23

Critics of the supply-side tax cuts proposed by the Reagan administration argued that lower taxes would:

A)increase the budget deficit.

B)decrease money supply in the economy.

C)reduce the aggregate price level.

D)reduce the disposable income of households.

E)reduce the volume of international trade.

A)increase the budget deficit.

B)decrease money supply in the economy.

C)reduce the aggregate price level.

D)reduce the disposable income of households.

E)reduce the volume of international trade.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

24

Starting with a situation where there is a substantial budget deficit, when tax revenues grow faster than federal expenditures, the government will experience:

A)a balanced budget.

B)an increasing national debt.

C)a declining budget surplus.

D)a declining budget deficit.

E)an increasing budget deficit.

A)a balanced budget.

B)an increasing national debt.

C)a declining budget surplus.

D)a declining budget deficit.

E)an increasing budget deficit.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

25

If fewer businesses offer new bonds to raise investment funds when government borrowing increases interest rates, this would be an example of:

A)Ricardian equivalence.

B)overestimating the tax multiplier.

C)crowding out.

D)increased consumption.

E)the balanced-budget multiplier.

A)Ricardian equivalence.

B)overestimating the tax multiplier.

C)crowding out.

D)increased consumption.

E)the balanced-budget multiplier.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

26

The emphasis on the greater incentives to produce created by lower taxes has come to be known as:

A)trickle-down economics.

B)supply-side economics.

C)the paradox of thrift.

D)the permanent income hypothesis.

E)monetarist economics.

A)trickle-down economics.

B)supply-side economics.

C)the paradox of thrift.

D)the permanent income hypothesis.

E)monetarist economics.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

27

If consumers spend _____ of a change in their disposable income, then a tax increase of $100 would lower consumption by $70.

A)35 percent

B)100 percent

C)80 percent

D)70 percent

E)50 percent

A)35 percent

B)100 percent

C)80 percent

D)70 percent

E)50 percent

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

28

Discretionary fiscal policy is bestdefined as:

A)the deliberate change in tax laws and government spending to change equilibrium income.

B)the deliberate manipulation of the money supply to expand the economy.

C)the arbitrary fluctuation in tax laws and budget requirements.

D)the automatic change in certain fiscal instruments when real GDP changes.

E)the policy action taken by the Congress to reduce the federal budget deficit.

A)the deliberate change in tax laws and government spending to change equilibrium income.

B)the deliberate manipulation of the money supply to expand the economy.

C)the arbitrary fluctuation in tax laws and budget requirements.

D)the automatic change in certain fiscal instruments when real GDP changes.

E)the policy action taken by the Congress to reduce the federal budget deficit.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following correctly explain Ricardian equivalence?

A)Government spending that is financed by borrowing has a smaller effect on the economy than government spending financed by raising taxes.

B)Consumers do not base current spending on future expected tax liabilities.

C)Government borrowing can function like increased current taxes, reducing current household and business expenditures.

D)The government should balance its budget by equating revenue and expenditure in every fiscal year.

E)Government spending does not crowd out private investment.

A)Government spending that is financed by borrowing has a smaller effect on the economy than government spending financed by raising taxes.

B)Consumers do not base current spending on future expected tax liabilities.

C)Government borrowing can function like increased current taxes, reducing current household and business expenditures.

D)The government should balance its budget by equating revenue and expenditure in every fiscal year.

E)Government spending does not crowd out private investment.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

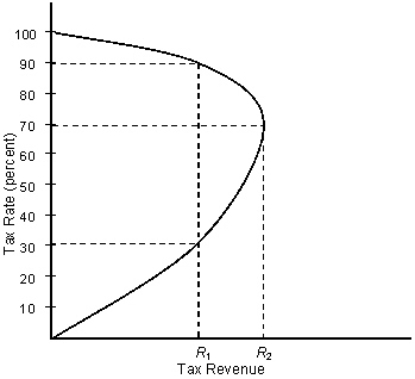

30

The figure given below depicts the tax revenue for different tax rates applied by the government. Figure 11.2  Which of the following is depicted in Figure 11.2?

Which of the following is depicted in Figure 11.2?

A)The Lorenz curve

B)The community indifference curve

C)The aggregate labor supply curve

D)The Laffer curve

E)The Engel curve

Which of the following is depicted in Figure 11.2?

Which of the following is depicted in Figure 11.2?A)The Lorenz curve

B)The community indifference curve

C)The aggregate labor supply curve

D)The Laffer curve

E)The Engel curve

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

31

Ricardian equivalencecan be said to hold if:

A)taxation has greater effect on private spending than government borrowing.

B)taxation has a lesser effect on private spending than government borrowing.

C)government borrowing does not affect private consumption while taxation has a negative impact on private consumption.

D)government spending activities financed by taxation and those financed by borrowing have the same effect on private spending.

E)government spending activities financed by taxation and those financed by borrowing have no effect on private spending.

A)taxation has greater effect on private spending than government borrowing.

B)taxation has a lesser effect on private spending than government borrowing.

C)government borrowing does not affect private consumption while taxation has a negative impact on private consumption.

D)government spending activities financed by taxation and those financed by borrowing have the same effect on private spending.

E)government spending activities financed by taxation and those financed by borrowing have no effect on private spending.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

32

If crowding out exists, the expansionary effect of government spending will be:

A)smaller than intended.

B)negative.

C)infinite.

D)larger than intended.

E)zero.

A)smaller than intended.

B)negative.

C)infinite.

D)larger than intended.

E)zero.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

33

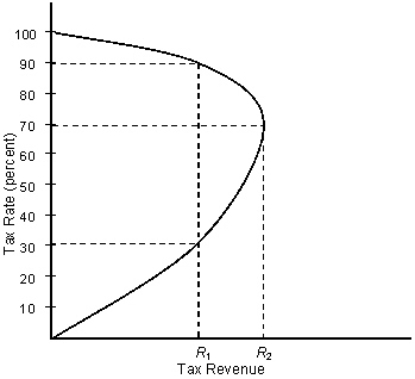

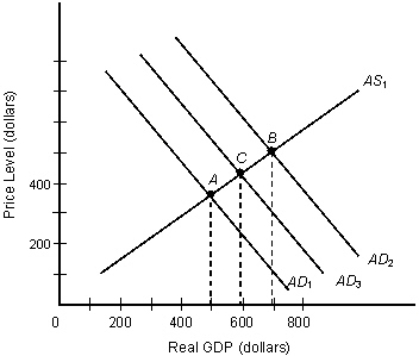

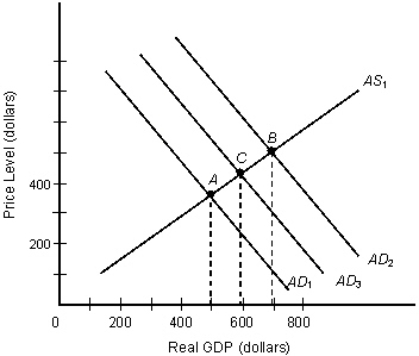

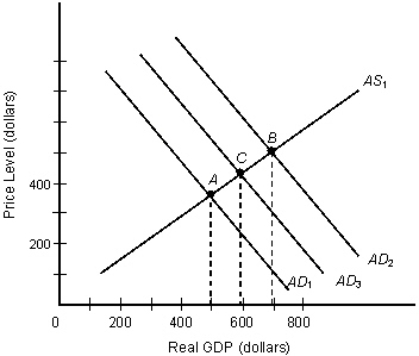

The figure given below depicts the macroeconomic equilibrium in a country. Figure 11.3  Refer to Figure 11.3.Assume that the increase in aggregate demand from AD1 to AD2 was the result of government spending that was financed by borrowing.Assuming that the Ricardian equivalence holds and people expect taxes to rise in future, the equilibrium income will be:

Refer to Figure 11.3.Assume that the increase in aggregate demand from AD1 to AD2 was the result of government spending that was financed by borrowing.Assuming that the Ricardian equivalence holds and people expect taxes to rise in future, the equilibrium income will be:

A)$800.

B)less than $500.

C)more than $800.

D)less than $700.

E)$700.

Refer to Figure 11.3.Assume that the increase in aggregate demand from AD1 to AD2 was the result of government spending that was financed by borrowing.Assuming that the Ricardian equivalence holds and people expect taxes to rise in future, the equilibrium income will be:

Refer to Figure 11.3.Assume that the increase in aggregate demand from AD1 to AD2 was the result of government spending that was financed by borrowing.Assuming that the Ricardian equivalence holds and people expect taxes to rise in future, the equilibrium income will be:A)$800.

B)less than $500.

C)more than $800.

D)less than $700.

E)$700.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

34

In the late 1990s, debt-financed government spending decreased in Mexico.Following this decrease, consumption spending increased.Ricardian equivalence would explain this increase in consumption as the result of:

A)people's expectation of higher future taxes required to pay off government debt.

B)people's expectation of lower future taxes that induce them to save less.

C)automatic stabilization of the economy.

D)the crowding out effect.

E)an increase in current household disposable income.

A)people's expectation of higher future taxes required to pay off government debt.

B)people's expectation of lower future taxes that induce them to save less.

C)automatic stabilization of the economy.

D)the crowding out effect.

E)an increase in current household disposable income.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

35

Identify the correct statement.

A)It is absolutely compulsory for the government to earn a profitable return on the money it earns by selling bonds.

B)When government borrowing rises, interest rates decline, thereby driving up private investment.

C)When interest rates rise, fewer number of corporations offer new bonds to raise investment funds.

D)An increase in interest rate reduces the cost of borrowing by the firms.

E)When interest rates fall, the firm's cost of raising funds through bonds increases.

A)It is absolutely compulsory for the government to earn a profitable return on the money it earns by selling bonds.

B)When government borrowing rises, interest rates decline, thereby driving up private investment.

C)When interest rates rise, fewer number of corporations offer new bonds to raise investment funds.

D)An increase in interest rate reduces the cost of borrowing by the firms.

E)When interest rates fall, the firm's cost of raising funds through bonds increases.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

36

A drop in consumption or investment spending caused by increased government spending is referred to as:

A)the multiplier effect.

B)an expansionary gap.

C)the Ricardian equivalence.

D)the paradox of thrift.

E)the crowding out.

A)the multiplier effect.

B)an expansionary gap.

C)the Ricardian equivalence.

D)the paradox of thrift.

E)the crowding out.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following trends has been observed in federal revenues and expenditures over time?

A)Expenditures were lower than the revenues in the 1998-2001 period.

B)Expenditures were lower than the revenues in the 1930s.

C)Expenditures were higher than the revenues in the 1998-2001 period.

D)Expenditures were more less equal to the revenues in the 1930s.

E)Expenditures were more or less equal to the revenues in the 1998-2001 period.

A)Expenditures were lower than the revenues in the 1998-2001 period.

B)Expenditures were lower than the revenues in the 1930s.

C)Expenditures were higher than the revenues in the 1998-2001 period.

D)Expenditures were more less equal to the revenues in the 1930s.

E)Expenditures were more or less equal to the revenues in the 1998-2001 period.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following is true of fiscal policy before the Great Depression of the 1930s?

A)Fiscal policy was made at the federal level.

B)Policies associated with national defense were made at the state level.

C)Foreign policy was made at the State level.

D)The federal budget was determined mostly by economists and not by politicians.

E)National defense and foreign trade were the focus areas of the federal government while other areas of government policy were dealt by the individual states.

A)Fiscal policy was made at the federal level.

B)Policies associated with national defense were made at the state level.

C)Foreign policy was made at the State level.

D)The federal budget was determined mostly by economists and not by politicians.

E)National defense and foreign trade were the focus areas of the federal government while other areas of government policy were dealt by the individual states.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

39

The ratio of U.S.government spending to GDP reached its peak during:

A)World War I.

B)World War II.

C)the Great Depression.

D)the real estate crisis.

E)the bursting of the stock market bubble.

A)World War I.

B)World War II.

C)the Great Depression.

D)the real estate crisis.

E)the bursting of the stock market bubble.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

40

The figure given below depicts the macroeconomic equilibrium in a country. Figure 11.3  Suppose an economy is in equilibrium.Also suppose that consumer expectations change as the threat of war increases the likelihood of an increase in taxes.This would result in:

Suppose an economy is in equilibrium.Also suppose that consumer expectations change as the threat of war increases the likelihood of an increase in taxes.This would result in:

A)an increase in equilibrium income.

B)no change in equilibrium income.

C)a downward shift of the aggregate supply curve.

D)a decrease in equilibrium income.

E)a change in the slope of the aggregate supply curve.

Suppose an economy is in equilibrium.Also suppose that consumer expectations change as the threat of war increases the likelihood of an increase in taxes.This would result in:

Suppose an economy is in equilibrium.Also suppose that consumer expectations change as the threat of war increases the likelihood of an increase in taxes.This would result in:A)an increase in equilibrium income.

B)no change in equilibrium income.

C)a downward shift of the aggregate supply curve.

D)a decrease in equilibrium income.

E)a change in the slope of the aggregate supply curve.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following can be considered as an automatic stabilizer in the economy?

A)Real exchange rate

B)Real interest rate

C)Unemployment insurance

D)Money supply

E)Disposable income

A)Real exchange rate

B)Real interest rate

C)Unemployment insurance

D)Money supply

E)Disposable income

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

42

Ceteris paribus, the greater the foreign holdings of the U.S.treasury securities:

A)the lower the value of the U.S.dollar in the foreign exchange market.

B)the higher the interest rate in the U.S.

C)the greater the level of U.S.imports.

D)the lower the wealth of the U.S.citizens.

E)the lower the tax rate in the U.S.economy.

A)the lower the value of the U.S.dollar in the foreign exchange market.

B)the higher the interest rate in the U.S.

C)the greater the level of U.S.imports.

D)the lower the wealth of the U.S.citizens.

E)the lower the tax rate in the U.S.economy.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

43

If Joe earns $80, 000 per year and pays $20, 000 in taxes, while Moe earns $100, 000 and pays $22, 000 in taxes, their tax system would best be described as:

A)progressive.

B)proportional.

C)regressive.

D)discretionary.

E)lump-sum.

A)progressive.

B)proportional.

C)regressive.

D)discretionary.

E)lump-sum.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

44

_____ are elements of fiscal policy that automatically change in value as national income changes.

A)Statistical discrepancies

B)Exchange rates

C)Budget deficits

D)Automatic stabilizers

E)Supply-side shocks

A)Statistical discrepancies

B)Exchange rates

C)Budget deficits

D)Automatic stabilizers

E)Supply-side shocks

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

45

If all U.S.government bonds are held by U.S.citizens, then:

A)the bondholders will not earn interest on the bonds.

B)there is no tax liability for funding the U.S.government's debt.

C)there is no net change in national wealth when the national debt changes.

D)the tax liability for funding the debt is not offset by the interest earnings of bondholders.

E)the tax rates are not increased to repay the outstanding debts.

A)the bondholders will not earn interest on the bonds.

B)there is no tax liability for funding the U.S.government's debt.

C)there is no net change in national wealth when the national debt changes.

D)the tax liability for funding the debt is not offset by the interest earnings of bondholders.

E)the tax rates are not increased to repay the outstanding debts.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

46

Assume that European interest rates fall as a result of decreased deficit spending by the governments of the European Union.We would expect all of the following, except:

A)a depreciation of the euro with respect to the U.S.dollar.

B)increased European demand for American government securities.

C)a higher level of U.S.imports from Europe.

D)higher U.S.net exports to Europe.

E)higher French exports to the United States.

A)a depreciation of the euro with respect to the U.S.dollar.

B)increased European demand for American government securities.

C)a higher level of U.S.imports from Europe.

D)higher U.S.net exports to Europe.

E)higher French exports to the United States.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

47

National debt can be defined as:

A)the total money supply in the economy.

B)the total stock of government bonds outstanding.

C)the difference between real GDP and potential GDP.

D)the change in fiscal deficit that results from an increase in government spending.

E)the total volume of private investment in the country.

A)the total money supply in the economy.

B)the total stock of government bonds outstanding.

C)the difference between real GDP and potential GDP.

D)the change in fiscal deficit that results from an increase in government spending.

E)the total volume of private investment in the country.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following is true of U.S.national debt between 1958 and 2010?

A)Total debt in the U.S.crossed $104 trillion in 2009.

B)Debt as a percentage of GDP was the highest in the year 1978.

C)Net interest payable by the U.S.government was the highest in the year 1990.

D)Interest payment as a percentage of total government spending was the highest in 2009.

E)Net interest payable by the U.S.government crossed $250 billion in 2009.

A)Total debt in the U.S.crossed $104 trillion in 2009.

B)Debt as a percentage of GDP was the highest in the year 1978.

C)Net interest payable by the U.S.government was the highest in the year 1990.

D)Interest payment as a percentage of total government spending was the highest in 2009.

E)Net interest payable by the U.S.government crossed $250 billion in 2009.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

49

A major benefit of automatic stabilizers is that they:

A)guarantee a balanced budget over the course of the business cycle.

B)have a tendency to reduce the national debt.

C)help increase recessionary gaps in the economy.

D)moderate the effect of fluctuations in the business cycle.

E)require legislative review by Congress before they can be implemented.

A)guarantee a balanced budget over the course of the business cycle.

B)have a tendency to reduce the national debt.

C)help increase recessionary gaps in the economy.

D)moderate the effect of fluctuations in the business cycle.

E)require legislative review by Congress before they can be implemented.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

50

Under a _____ structure, the marginal income tax rate rises and the average tax rate decreases as personal income falls.

A)value added tax

B)sin tax

C)progressive tax

D)regressive tax

E)lumpsum tax

A)value added tax

B)sin tax

C)progressive tax

D)regressive tax

E)lumpsum tax

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

51

Under a progressive tax system:

A)the average tax rate increases with increases in real GDP.

B)the average tax rate remains constant with changes in real GDP.

C)the average tax rate falls with increases in real GDP.

D)government tax receipts increase when the economy is in a recession.

E)government tax receipts decrease when the economy is expanding.

A)the average tax rate increases with increases in real GDP.

B)the average tax rate remains constant with changes in real GDP.

C)the average tax rate falls with increases in real GDP.

D)government tax receipts increase when the economy is in a recession.

E)government tax receipts decrease when the economy is expanding.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

52

A U.S.federal budget deficit that raises real interest rates is most likely to:

A)lead to a depreciation of the dollar on the foreign exchange market.

B)encourage foreign investment in U.S.securities.

C)lead to an increase in exports.

D)lead to an appreciation of other currencies relative to the U.S.dollar.

E)discourage imports of foreign goods.

A)lead to a depreciation of the dollar on the foreign exchange market.

B)encourage foreign investment in U.S.securities.

C)lead to an increase in exports.

D)lead to an appreciation of other currencies relative to the U.S.dollar.

E)discourage imports of foreign goods.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following does not qualify as an automatic stabilizer in the economy?

A)Lump-sum taxes

B)Food stamps

C)Welfare payments

D)Progressive income taxes

E)Unemployment compensation

A)Lump-sum taxes

B)Food stamps

C)Welfare payments

D)Progressive income taxes

E)Unemployment compensation

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

54

Assume an economy has automatic stabilizers in place that include a progressive tax structure and a transfer payment system.Then in a period of high economic growth and high inflation, we would expect:

A)tax revenues to fall and unemployment compensation to rise.

B)average tax rates and welfare payments to decline.

C)the national debt to become larger.

D)average tax rates and government revenues to rise.

E)government spending on social security benefits to rise.

A)tax revenues to fall and unemployment compensation to rise.

B)average tax rates and welfare payments to decline.

C)the national debt to become larger.

D)average tax rates and government revenues to rise.

E)government spending on social security benefits to rise.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

55

Suppose the real interest rate in the economy is 3% and the nominal interest rate is 6%, what is the current inflation rate?

A)18%

B)9%

C)2%

D)3%

E)2.5%

A)18%

B)9%

C)2%

D)3%

E)2.5%

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following constitutes a transfer payment?

A)Income taxes

B)Corporate salaries

C)Fiscal spending

D)Dividend payments

E)Welfare benefits

A)Income taxes

B)Corporate salaries

C)Fiscal spending

D)Dividend payments

E)Welfare benefits

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following is true about automatic stabilizers?

A)Automatic stabilizers are a part of discretionary fiscal policy.

B)The federal funds rate is an example of an automatic stabilizer.

C)An automatic stabilizer is any program that responds to fluctuations in the business cycle in a way that moderates the effects of those fluctuations.

D)Any kind of trade policy adopted by the government will be considered as an automatic stabilizer.

E)When income rises, automatic stabilizers increase/boost spending.

A)Automatic stabilizers are a part of discretionary fiscal policy.

B)The federal funds rate is an example of an automatic stabilizer.

C)An automatic stabilizer is any program that responds to fluctuations in the business cycle in a way that moderates the effects of those fluctuations.

D)Any kind of trade policy adopted by the government will be considered as an automatic stabilizer.

E)When income rises, automatic stabilizers increase/boost spending.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following is an example of a transfer payment by the government?

A)The government provides unemployment benefits to its citizens

B)The local government invests in building a community center.

C)The government raises funds in order to build bridges and roads.

D)The government provides healthcare to its citizens at a subsidized price.

E)The government provides concessional rates to senior citizens who use public transport.

A)The government provides unemployment benefits to its citizens

B)The local government invests in building a community center.

C)The government raises funds in order to build bridges and roads.

D)The government provides healthcare to its citizens at a subsidized price.

E)The government provides concessional rates to senior citizens who use public transport.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

59

Suppose the marginal tax rate is 37 percent for an income level of $50, 000 and 39 percent for an $80, 000 income.This implies that the underlying tax structure is _____ in nature.

A)fixed

B)progressive

C)regressive

D)lump-sum

E)proportional

A)fixed

B)progressive

C)regressive

D)lump-sum

E)proportional

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

60

If the government sells U.S.Treasury bonds to finance its budget deficit, one would expect:

A)interest rates to rise.

B)domestic investment to rise.

C)tax rates to fall.

D)inflation to rise.

E)interest rates to fall.

A)interest rates to rise.

B)domestic investment to rise.

C)tax rates to fall.

D)inflation to rise.

E)interest rates to fall.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

61

Other things equal, the steeper the slope of the aggregate supply curve, the more effective will be the expansionary fiscal policy.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

62

A decrease in federal income tax rates is an example of fiscal policy that affects GDP through consumption adjustments.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

63

Higher taxes affect real GDP indirectly through both the consumption channel and the output supply channel.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following taxes are more easier to collect in industrial countries than in developing countries?

A)Sales tax

B)Capital gains tax

C)Personal income tax

D)Business tax

E)Export tax

A)Sales tax

B)Capital gains tax

C)Personal income tax

D)Business tax

E)Export tax

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

65

According to Ricardian equivalence, taxation and government borrowing have the same effect on spending in the private sector.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

66

If crowding out exists, contractionary fiscal policy will cause the aggregate demand curve to shift in by more than indicated by the government spending multiplier.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

67

A(n)_____ is an indirect tax imposed on each sale at each stage of production.

A)personal tax

B)value-added tax

C)excise duty

D)sales tax

E)ad-valorem tax

A)personal tax

B)value-added tax

C)excise duty

D)sales tax

E)ad-valorem tax

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

68

Identify the industrial country that spends 43 percent of its budget on social security, health, and education programs.

A)China

B)India

C)Brazil

D)Russia

E)The United States

A)China

B)India

C)Brazil

D)Russia

E)The United States

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

69

Government expenditures on goods and services have an indirect impact on the aggregate demand, while taxes have a direct impact.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

70

An increase in deficit spending tends to raise interest rates, thereby resulting in a multiplier effect that is higher than would be associated with an equivalent increase in consumption spending.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

71

A balanced budget would not affect income because an increase in government spending is exactly matched by an increase in taxes.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

72

For which of the following reasons are VATs considered to be very important revenue generators for the government?

A)They are regressive in nature

B)They target only individuals in the high income class

C)They cannot be avoided by individuals

D)They boost a country's exports

E)They lower a country's imports

A)They are regressive in nature

B)They target only individuals in the high income class

C)They cannot be avoided by individuals

D)They boost a country's exports

E)They lower a country's imports

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

73

When the price level increases, the effect of a change in government spending on real GDP will be understated.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

74

If the price level falls as real GDP decreases, the multiplier effects of any given change in aggregate expenditures are smaller than they would be if the price level remained constant.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

75

Compared to the government in the typical industrial country, the government in the typical developing country:

A)plays the same role in investment spending.

B)plays a larger role in investment spending.

C)plays a smaller role in investment spending.

D)plays no role in investment spending.

E)plays a more negative role in investment spending.

A)plays the same role in investment spending.

B)plays a larger role in investment spending.

C)plays a smaller role in investment spending.

D)plays no role in investment spending.

E)plays a more negative role in investment spending.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

76

The flatter the aggregate supply curve, the less the amount of government spending necessary to close a $1 billion GDP gap.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following would not be considered an indirect tax?

A)A value-added tax

B)A tax on wheat export

C)A tax on imported automobiles

D)A tax on the income of a computer manufacturer

E)A sales tax on cigarettes

A)A value-added tax

B)A tax on wheat export

C)A tax on imported automobiles

D)A tax on the income of a computer manufacturer

E)A sales tax on cigarettes

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

78

If the private sector anticipates higher future taxes as a result of a current budget deficit, current autonomous saving will decline.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following is a form of a direct tax?

A)Personal income taxes

B)Sales taxes

C)Excise taxes

D)Import tariffs

E)Value-added taxes

A)Personal income taxes

B)Sales taxes

C)Excise taxes

D)Import tariffs

E)Value-added taxes

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

80

The higher the level of inflation, the stronger the impact of reductions in the personal income tax on real GDP .

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck