Deck 10: Capital Budgeting: Decision Criteria and Real Option Considerations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/106

Play

Full screen (f)

Deck 10: Capital Budgeting: Decision Criteria and Real Option Considerations

1

The payback method is at best a crude measure of the risk of a project because it fails to consider the ____ of a project's returns.

A) liquidity

B) variability

C) timing

D) magnitude

A) liquidity

B) variability

C) timing

D) magnitude

B

2

Which of the following is not a technique to handle the capital rationing problem?

A) linear programming

B) goal programming

C) ranking projects according to payback

D) ranking projects according to profitability index

A) linear programming

B) goal programming

C) ranking projects according to payback

D) ranking projects according to profitability index

C

3

The ____ measures the present value return for each dollar of initial investment.

A) payback period

B) internal rate of return

C) net present value

D) profitability index

A) payback period

B) internal rate of return

C) net present value

D) profitability index

D

4

One weakness of the internal rate of return approach is that:

A) it does not directly consider the timing of the cash flows from a project

B) it fails to provide a straightforward decision-making criterion

C) it implicitly assumes that the firm is able to reinvest the interim cash flows from a project at the firm's cost of capital.

D) none of the above

A) it does not directly consider the timing of the cash flows from a project

B) it fails to provide a straightforward decision-making criterion

C) it implicitly assumes that the firm is able to reinvest the interim cash flows from a project at the firm's cost of capital.

D) none of the above

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

5

When a project has multiple internal rates of return:

A) the analyst should choose the highest rate to compare with the firm's cost of capital.

B) the analyst should choose the lowest rate to compare with the firm's cost of capital

C) the analyst should choose the rate that seems most "reasonable", given the project's cash flows, to compare with the firm's cost of capital.

D) the analyst should compute the project's net present value and accept the project if its NPV is greater than $0

A) the analyst should choose the highest rate to compare with the firm's cost of capital.

B) the analyst should choose the lowest rate to compare with the firm's cost of capital

C) the analyst should choose the rate that seems most "reasonable", given the project's cash flows, to compare with the firm's cost of capital.

D) the analyst should compute the project's net present value and accept the project if its NPV is greater than $0

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

6

The advantages of the payback approach include all of the following except:

A) it is easy to compute

B) it considers a project's liquidity

C) it considers cash flows, not net income

D) it provides an objective measure of profitability

A) it is easy to compute

B) it considers a project's liquidity

C) it considers cash flows, not net income

D) it provides an objective measure of profitability

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

7

If a net present value analysis for a normal project gives an NPV greater than zero, an internal rate of return calculation on the same project would yield an internal rate of return ____ the required rate of return for the firm.

A) greater than

B) less than

C) equal to

D) cannot be determined from the information given

A) greater than

B) less than

C) equal to

D) cannot be determined from the information given

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

8

The internal rate of return method assumes that the cash flows over the life of the project are reinvested at:

A) the risk-free rate

B) the firm's cost of capital

C) the computed internal rate of return

D) the market capitalization rate

A) the risk-free rate

B) the firm's cost of capital

C) the computed internal rate of return

D) the market capitalization rate

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

9

The objective in solving capital rationing problems is to:

A) accept all projects with a PI greater than 1.1

B) maximize the IRR of the projects that are accepted

C) maximize the NPV of the projects that are accepted

D) minimize the opportunity cost of the firm's funds

A) accept all projects with a PI greater than 1.1

B) maximize the IRR of the projects that are accepted

C) maximize the NPV of the projects that are accepted

D) minimize the opportunity cost of the firm's funds

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

10

Multiple internal rates of return can occur when there is (are):

A) large abandonment costs at the end of a project's life

B) a major shutdown and rebuilding of a facility sometime during its life

C) more than one sign change in the pattern of cash flows over a project's life.

D) all of the above are correct

A) large abandonment costs at the end of a project's life

B) a major shutdown and rebuilding of a facility sometime during its life

C) more than one sign change in the pattern of cash flows over a project's life.

D) all of the above are correct

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

11

In the absence of capital rationing, the ____ method is normally superior to the ____ method when choosing among mutually exclusive investments.

A) net present value, internal rate of return

B) internal rate of return, profitability index

C) net present value, profitability index

D) a and c

A) net present value, internal rate of return

B) internal rate of return, profitability index

C) net present value, profitability index

D) a and c

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

12

In the case of mutually exclusive projects, NPV and PI are likely to yield conflicting decisions when:

A) the projects require the same net investment

B) the projects are significantly different in size

C) multiple rates of return are a possibility

D) none of the above

A) the projects require the same net investment

B) the projects are significantly different in size

C) multiple rates of return are a possibility

D) none of the above

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

13

The relationship between NPV and IRR is such that:

A) both approaches always provide the same ranking of alternative investment projects.

B) the IRR of a project is equal to the firm's cost of capital if the NPV of a project is $0.

C) if the NPV of a project is negative, the IRR must be greater than the cost of capital.

D) none of the above

A) both approaches always provide the same ranking of alternative investment projects.

B) the IRR of a project is equal to the firm's cost of capital if the NPV of a project is $0.

C) if the NPV of a project is negative, the IRR must be greater than the cost of capital.

D) none of the above

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

14

In order to compensate for inflation in capital budgeting procedures, it is necessary to:

A) use constant dollar estimates of costs and revenues

B) use a low discount rate to avoid double counting for inflationary effects

C) rely heavily on the payback procedures

D) none of the above

A) use constant dollar estimates of costs and revenues

B) use a low discount rate to avoid double counting for inflationary effects

C) rely heavily on the payback procedures

D) none of the above

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

15

The net present value method assumes that the cash flows over the life of the project are reinvested at

A) the computed internal rate of return

B) the risk-free rate

C) the market capitalization rate

D) the firm's cost of capital

A) the computed internal rate of return

B) the risk-free rate

C) the market capitalization rate

D) the firm's cost of capital

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

16

The disadvantages of the payback approach include:

A) cash flows after the payback period are ignored in the calculation

B) payback ignores the time value of money

C) payback fails to provide an objective decision-making criterion

D) all of the above

A) cash flows after the payback period are ignored in the calculation

B) payback ignores the time value of money

C) payback fails to provide an objective decision-making criterion

D) all of the above

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

17

According to the profitability index criterion, a project is acceptable if its profitability index is

A) greater than 1 plus the cost of capital

B) greater than 0

C) greater than or equal to 1

D) greater than 1.1

A) greater than 1 plus the cost of capital

B) greater than 0

C) greater than or equal to 1

D) greater than 1.1

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

18

When two or more normal ____ projects are under consideration, the profitability index, the net present value, and the internal rate of return methods will yield identical accept/reject signals.

A) coincident

B) mutually exclusive

C) independent

D) none of the above

A) coincident

B) mutually exclusive

C) independent

D) none of the above

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

19

The payback period of an investment is defined as:

A) the number of years required for cumulative profits from a project to equal the initial outlay.

B) the number of years required for the cumulative cash flows from a project to equal the initial outlay.

C) the number of years required for the cumulative cash flows from a project to equal the average investment in the project, when depreciation is considered.

D) a period of time sufficient to earn a rate of return equal to the firm's cost of capital.

A) the number of years required for cumulative profits from a project to equal the initial outlay.

B) the number of years required for the cumulative cash flows from a project to equal the initial outlay.

C) the number of years required for the cumulative cash flows from a project to equal the average investment in the project, when depreciation is considered.

D) a period of time sufficient to earn a rate of return equal to the firm's cost of capital.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

20

The profitability index (PI) approach:

A) fails to directly consider the timing of a project's cash flows

B) considers only a project's contributions to net income and does not consider cash flow effects

C) always gives the same accept-reject decisions for independent projects as does NPV and IRR

D) always gives the same accept-reject decisions for mutually exclusive projects as does NPV and IRR

A) fails to directly consider the timing of a project's cash flows

B) considers only a project's contributions to net income and does not consider cash flow effects

C) always gives the same accept-reject decisions for independent projects as does NPV and IRR

D) always gives the same accept-reject decisions for mutually exclusive projects as does NPV and IRR

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

21

The "value additivity principle" means that the

A) firm should accept all projects with a positive net present value.

B) firm's value is the sum of the value of all the projects undertaken

C) firm will grow through the addition of new projects

D) positive net present value is added to the firm's net worth

A) firm should accept all projects with a positive net present value.

B) firm's value is the sum of the value of all the projects undertaken

C) firm will grow through the addition of new projects

D) positive net present value is added to the firm's net worth

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

22

All of the following are reasons why a firm may face capital rationing except:

A) reluctant to issue additional debt

B) the discount rate is too high

C) lacks the managerial resources

D) restrictive covenants that limit borrowing

A) reluctant to issue additional debt

B) the discount rate is too high

C) lacks the managerial resources

D) restrictive covenants that limit borrowing

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

23

The ____ of an investment is the period of time for the ____ to equal the initial cash outlay.

A) profitability index; present value of the cash inflows

B) payback period; cumulative cash inflows

C) payback period; present value of the cash inflows

D) none of the above

A) profitability index; present value of the cash inflows

B) payback period; cumulative cash inflows

C) payback period; present value of the cash inflows

D) none of the above

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

24

Real options in capital budgeting can be classified in all of the following ways except:

A) abandonment option

B) investment option

C) purchasing power option

D) shutdown options

A) abandonment option

B) investment option

C) purchasing power option

D) shutdown options

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

25

If the net present value of an investment project is positive then the:

A) project would be unacceptable under the internal rate of return method

B) project would be acceptable under the payback method

C) project's rate of return is greater than the firm's cost of capital

D) all of the above are correct

A) project would be unacceptable under the internal rate of return method

B) project would be acceptable under the payback method

C) project's rate of return is greater than the firm's cost of capital

D) all of the above are correct

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

26

The ____ approach takes into account both the magnitude and timing of cash flows over the entire life of a project in measuring its economic desirability.

A) payback period

B) accounting rate of return

C) average rate of return

D) internal rate of return

A) payback period

B) accounting rate of return

C) average rate of return

D) internal rate of return

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

27

The reason for a postaudit is to

A) help financial managers reduce errors in cash flow estimation

B) reduce the number of accepted risky projects

C) reduce the number of projects submitted

D) determine the correct required rate of return

A) help financial managers reduce errors in cash flow estimation

B) reduce the number of accepted risky projects

C) reduce the number of projects submitted

D) determine the correct required rate of return

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

28

The profitability index would be ____ if the present value of the net cash flows (NCF) over the life of a project were ____.

A) negative; less than zero

B) negative; less than the net investment

C) zero; equal to the net investment

D) none of the above

A) negative; less than zero

B) negative; less than the net investment

C) zero; equal to the net investment

D) none of the above

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following would increase the net present value of a project?

A) increase in the net investment

B) use of straight line depreciation rather than MACRS

C) decrease in the expected accounts payable

D) decrease in the discount rate

A) increase in the net investment

B) use of straight line depreciation rather than MACRS

C) decrease in the expected accounts payable

D) decrease in the discount rate

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

30

The internal rate of return does not take into account the

A) explicit risk of the net cash flows

B) magnitude of cash flows over the project's life

C) net investment

D) timing of cash flows over the entire life of a project

A) explicit risk of the net cash flows

B) magnitude of cash flows over the project's life

C) net investment

D) timing of cash flows over the entire life of a project

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

31

There are many reasons why a firm can earn above-normal profits. These reasons include all of the following except:

A) access to superior labor or managerial talents

B) superior access to financial resources at lower costs

C) patent control of superior product designs

D) ability of new firms to acquire necessary factors of production

A) access to superior labor or managerial talents

B) superior access to financial resources at lower costs

C) patent control of superior product designs

D) ability of new firms to acquire necessary factors of production

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

32

With the net present value approach, all net cash flows are discounted at the

A) required rate of return

B) discount rate

C) cost of capital

D) all of the above

A) required rate of return

B) discount rate

C) cost of capital

D) all of the above

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

33

When dealing with ____ cash flows, the ____ is computed by trial and error.

A) uniform; internal rate of return

B) perpetual; internal rate of return

C) uneven; internal rate of return

D) uneven; net present value

A) uniform; internal rate of return

B) perpetual; internal rate of return

C) uneven; internal rate of return

D) uneven; net present value

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

34

The ____ is interpreted as the ____ for each dollar of initial investment.

A) net present value; present value return

B) profitability index; cash flow return

C) profitability index; present value return

D) none of the above

A) net present value; present value return

B) profitability index; cash flow return

C) profitability index; present value return

D) none of the above

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

35

The net present value method assumes that cash flows are reinvested at the ____, whereas the internal rate of return method assumes that cash flows are reinvested at the ____.

A) discount rate, required rate of return

B) cost of capital, market rate of return

C) firm's cost of capital, computed internal rate of return

D) marginal cost of capital, discount rate

A) discount rate, required rate of return

B) cost of capital, market rate of return

C) firm's cost of capital, computed internal rate of return

D) marginal cost of capital, discount rate

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

36

The profitability index is the ratio of the ____ to the ____.

A) net present value, net investment

B) net investment, net present value

C) present value of future net cash flows, net investment

D) net investment, present value of future net cash flows

A) net present value, net investment

B) net investment, net present value

C) present value of future net cash flows, net investment

D) net investment, present value of future net cash flows

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following investment decision rules (if any) assumes that the cash flows generated are reinvested over the life of the project at the firm's cost of capital?

A) payback period

B) internal rate of return

C) accounting rate of return

D) none of the above

A) payback period

B) internal rate of return

C) accounting rate of return

D) none of the above

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

38

A capital expenditure project has an expected 20 percent internal rate of return and a $10,000 net present value. It has one cash flow sign change.

A) The discount rate used to calculate NPV is greater than 20 percent

B) The project has another internal rate of return in addition to the 20 percent rate mentioned above

C) In the internal rate of return calculation, the project's cash inflows are assumed to be reinvested at the firm's required rate of return

D) None of the above

A) The discount rate used to calculate NPV is greater than 20 percent

B) The project has another internal rate of return in addition to the 20 percent rate mentioned above

C) In the internal rate of return calculation, the project's cash inflows are assumed to be reinvested at the firm's required rate of return

D) None of the above

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

39

Generally, the ____ is considered to be a more realistic reinvestment rate than the ____.

A) risk-free rate, internal rate of return

B) internal rate of return, cost of capital

C) cost of capital, internal rate of return

D) risk-free rate, cost of capital

A) risk-free rate, internal rate of return

B) internal rate of return, cost of capital

C) cost of capital, internal rate of return

D) risk-free rate, cost of capital

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

40

The value additivity principle indicates that, when a firm undertakes an independent project, the value of the firm is increased by the ____ from the project.

A) present value of the cash inflows

B) sum of the cash inflows and outflows

C) net present value

D) none of the above

A) present value of the cash inflows

B) sum of the cash inflows and outflows

C) net present value

D) none of the above

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

41

What is the net present value of a project that requires a net investment of $76,000 and produces net cash flows of $22,000 per year for 7 years? Assume the cost of capital is 15 percent.

A) $ 91,520

B) $ 15,520

C) $ 78,000

D) $167,474

A) $ 91,520

B) $ 15,520

C) $ 78,000

D) $167,474

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

42

Capital expenditures levels tend ____ (in real terms) during periods of relatively high inflation than during low inflation times.

A) to be higher

B) to be lower

C) to be the same

D) to depend on business risk

A) to be higher

B) to be lower

C) to be the same

D) to depend on business risk

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

43

Entrepreneurial firms with a net worth of less than $1 million tend to prefer the ____ method for evaluating capital expenditures.

A) NPV

B) IRR

C) Payback

D) Profitability index

A) NPV

B) IRR

C) Payback

D) Profitability index

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

44

Generally, the existence of a(n) ____ option reduces the downside risk of a project and should be considered in project analysis.

A) designed-in

B) abandonment

C) investment timing

D) output expansion

A) designed-in

B) abandonment

C) investment timing

D) output expansion

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

45

What is the internal rate of return for a project that has a net investment of $150,000 and net cash flows of $40,000 for 5 years?

A) between 10% and 11%

B) between 9% and 10%

C) between 11% and 12%

D) between 12% and 13%

A) between 10% and 11%

B) between 9% and 10%

C) between 11% and 12%

D) between 12% and 13%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

46

An investment project requires a net investment of $100,000. The project is expected to generate annual net cash inflows of $28,000 for the next 5 years. The firm's cost of capital is 12 percent. Determine the net present value for the project.

A) $940

B) $100,940

C) $ 77,884

D) $ 40,000

A) $940

B) $100,940

C) $ 77,884

D) $ 40,000

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

47

Would you invest in a project that has a net investment of $14,600 and a single net cash flow of $24,900 in 5 years, if your required rate of return was 12 percent?

A) Yes - the NPV is $862.90

B) No - the NPV is -$1,975.70

C) No - the NPV is -$481.70

D) Yes - the NPV is $165.70

A) Yes - the NPV is $862.90

B) No - the NPV is -$1,975.70

C) No - the NPV is -$481.70

D) Yes - the NPV is $165.70

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

48

Sigma is thinking about purchasing a new clam digger for $14,000. The expected net cash flows resulting from the digger are $9,000 in year 1, $7,000 in the 2nd year, $5,000 in the 3rd year, and $3,000 in the 4th year. Should Sigma purchase this digger if its cost of capital is 12 percent?

A) Yes, NPV = $3,176

B) Yes, NPV = $5,084

C) Yes, NPV = $16,605

D) Yes, NPV= $19,084

A) Yes, NPV = $3,176

B) Yes, NPV = $5,084

C) Yes, NPV = $16,605

D) Yes, NPV= $19,084

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

49

What is the internal rate of return for a project that has a net investment of $76,000 and net cash flows of $20,507 per year for 7 years?

A) 16%

B) 17%

C) 18.2%

D) 19%

A) 16%

B) 17%

C) 18.2%

D) 19%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

50

When evaluating international capital expenditure projects, the analyst may compute the present value of the net cash flows in the local currency and then ____.

A) discount by one plus the spot rate (1+ S0)

B) multiply by the forward exchange rate

C) discount by the future exchange rate

D) multiply by the spot exchange rate

A) discount by one plus the spot rate (1+ S0)

B) multiply by the forward exchange rate

C) discount by the future exchange rate

D) multiply by the spot exchange rate

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

51

Using the profitability index, which of the following mutually exclusive projects should be accepted? Project A: NPV = $6,000; NINV = $50,000

Project B: NPV = $10,000; NINV = $120,000

Project C: NPV = $8,000; NINV = $80,000

A) A

B) B

C) C

D) all projects should be accepted

Project B: NPV = $10,000; NINV = $120,000

Project C: NPV = $8,000; NINV = $80,000

A) A

B) B

C) C

D) all projects should be accepted

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

52

An investment project requires a net investment of $100,000. The project is expected to generate annual net cash inflows of $28,000 for the next 5 years. The firm's cost of capital is 12 percent. Determine the payback period for the project.

A) 0.28 years

B) 1.4 years

C) 3.57 years

D) 17.86 years

A) 0.28 years

B) 1.4 years

C) 3.57 years

D) 17.86 years

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

53

The reasons that the amount and timing of the net cash flows to the foreign subsidiary and parent may differ include:

A) subsidized loans

B) differential tax rates

C) legal and political constraints on cash remittance

D) all of the above

A) subsidized loans

B) differential tax rates

C) legal and political constraints on cash remittance

D) all of the above

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

54

GoFlo is a small growing firm that is considering the purchase of another truck to serve GoFlo's expanding customer base. The new truck will cost $21,000 and should generate annual net cash flows of $6,000 over the truck's 5-year life. What is the payback period for this project?

A) 3 years

B) 4.2 years

C) 3.5 years

D) 3.3 years

A) 3 years

B) 4.2 years

C) 3.5 years

D) 3.3 years

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

55

The Atlantic Company plans to open a new branch office in a suburban area. The building will cost $200,000 and will be depreciated (on a straight-line basis) over a 20 year life to a $0 estimated salvage value. Equipment for the building will cost an additional $100,000. This equipment has a 20-year life and will be depreciated on a straight-line basis to a $0 estimated salvage value. The branch office is expected to generate additional before tax net income of $30,000 per year. The tax rate is 40 percent and the cost of capital is 12 percent. Compute the net present value for the project.

A) $-63,523

B) $+246,477

C) $+53,523

D) $-53,523

A) $-63,523

B) $+246,477

C) $+53,523

D) $-53,523

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

56

A project requires a net investment of $450,000. It has a profitability index of 1.25 based on the firm's 12 percent cost of capital. Determine the net present value of the project.

A) $ 112,500

B) $ 562,500

C) $1,012,500

D) $ 140,625

A) $ 112,500

B) $ 562,500

C) $1,012,500

D) $ 140,625

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

57

Turntec is considering replacing an automatic shuttle machine that has a book value of $2,000 and a $0 market value with a more efficient machine that will cost $24,000. The annual net cash flows from the new equipment are expected to be $6,000 for the next 6 years. What is the net present value of this project? Assume the firm's cost of capital is 12 percent and it's marginal tax rate is 40 percent.

A) $666

B) $1,466

C) $1,866

D) - $134

A) $666

B) $1,466

C) $1,866

D) - $134

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

58

An investment project requires a net investment of $100,000 and is expected to generate annual net cash inflows of $25,000 for 6 years. The firm's cost of capital is 12 percent. Determine the profitability index for this project.

A) 1.50

B) 1.028

C) .028

D) .972

A) 1.50

B) 1.028

C) .028

D) .972

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

59

An investment project requires a net investment of $100,000. The project is expected to generate annual net cash inflows of $28,000 for the next 5 years. The firm's cost of capital is 12 percent. Determine the internal rate of return for the project (to the nearest tenth of one percent).

A) 12.0%

B) 12.6%

C) 3.6%

D) 12.4%

A) 12.0%

B) 12.6%

C) 3.6%

D) 12.4%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

60

What is the internal rate of return for a project that has a net investment of $14,600 and a single net cash flow of $25,750 in 5 years?

A) 10%

B) 12%

C) 15.3%

D) 13.1%

A) 10%

B) 12%

C) 15.3%

D) 13.1%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

61

G-III Apparel is considering increasing the size of a warehouse. The cost of the expansion is $825,000 and the increase in inventories and accounts payable will be $410,000 and $360,000 respectively. G-III expects that the expansion will increase net cash flows by $150,000 a year for the next 5 years and $200,000 a year for years 6-12. G-III has a 14% cost of capital and a marginal tax rate of 35%. What is the NPV of the warehouse expansion?

A) -$3,450

B) $60,050

C) $10,050

D) -$338,570

A) -$3,450

B) $60,050

C) $10,050

D) -$338,570

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

62

Consider a capital expenditure project that has forecasted revenues equal to $32,000 per year; cash expenses are estimated to be $29,000 per year. The cost of the project equipment is $23,000, and the equipment's estimated salvage value at the end of the project is $9,000. The equipment's $23,000 cost will be depreciated on a straight-line basis to $0 over a 10-year estimated economic life. Assume that the project requires an initial $7,000 working capital investment. The company's marginal tax rate is 30%. Calculate the project's net present value using a 12% discount rate.

A) about -$10,610

B) about -$12,530

C) about -$ 9,954

D) about +$9,462

A) about -$10,610

B) about -$12,530

C) about -$ 9,954

D) about +$9,462

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

63

A project requires a net investment of $100,000. At the firm's cost of capital of 10%, the project's profitability index is 1.15. Determine the net present value of the project.

A) $15,000

B) $215,000

C) $115,000

D) none of the above/cannot be determined

A) $15,000

B) $215,000

C) $115,000

D) none of the above/cannot be determined

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

64

Ecogen is considering the purchase of some new equipment that will cost $340,000 installed. The equipment will produce a product that must be FDA approved and this will require at least a year. Net cash flow in Year 1 will be a negative $110,000 but is expected to be a positive $50,000 in Year 2. Net cash flows will be $150,000, $240,000, and $330,000 in the next 3 years. At the end of 5 years the equipment and the product will be obsolete. If the firm's marginal tax rate is 40% and their costs of capital is 15%, should they invest in the new equipment?

A) Yes, NPV = $2,090

B) Yes, NPV = $12,390

C) No, NPV = -$63,210

D) No, NPV = -$12,210

A) Yes, NPV = $2,090

B) Yes, NPV = $12,390

C) No, NPV = -$63,210

D) No, NPV = -$12,210

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

65

Indexx, a maker of disease-detection systems based on biotechnology is considering purchasing some diagnostic equipment that costs $380,000. Shipping and installation costs will be an additional $30,000. The equipment will be depreciated based on a 3-year MACRS life. Revenues from the new equipment should be $400,000 the first year and increase 15% each year over the expected 5-year economic life. Operating expenses should be $250,000 the first year and these expenses will increase 10% each year. At the end of 5 years the equipment will be obsolete and have no salvage value. Should Indexx invest in this new equipment? Assume Indexx has a cost of capital of 15% and a marginal tax rate of 40%. Use the depreciation schedule listed below:

(3 Year Depreciation Schedule: 33.33%, 44.45%, 14.81%, 7.41%)

A) Yes, NPV = $175,573

B) Yes, NPV = $161,296

C) Yes, NPV = $456,406

D) No, NPV is negative

(3 Year Depreciation Schedule: 33.33%, 44.45%, 14.81%, 7.41%)

A) Yes, NPV = $175,573

B) Yes, NPV = $161,296

C) Yes, NPV = $456,406

D) No, NPV is negative

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

66

What is the internal rate of return for a project that has a net investment of $169,165 and net cash flows of $25,000 in the first year and 40,000 in years 2-7?

A) 12.5%

B) 13%

C) 12%

D) 13.5%

A) 12.5%

B) 13%

C) 12%

D) 13.5%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

67

Axa is replacing an old, fully depreciated extractor with a more efficient machine that will cost $265,000. The new extractor will be depreciated as a 7-year MACRS asset. With the more efficient production, Axa expects annual revenues to increase by $80,000, and annual operating expenses to increase by $25,000. If Axa expects to sell the machine at the beginning of year 6 for $40,000, determine the NPV of this project. Assume the firm's marginal tax rate is 40% and that the firm's cost of capital is 10%. Use the depreciation schedule listed below:

(7-Yr Dep. Schedule: 14.29%, 24.49%, 17.49%, 12.49%, 8.93%, 8.92%, 8.93%, 4.46%)

A) -$46,283

B) -$42,855

C) -$40,773

D) -$38,105

(7-Yr Dep. Schedule: 14.29%, 24.49%, 17.49%, 12.49%, 8.93%, 8.92%, 8.93%, 4.46%)

A) -$46,283

B) -$42,855

C) -$40,773

D) -$38,105

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

68

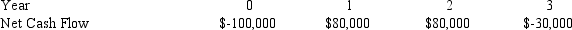

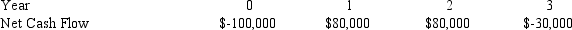

Calculate the net present value for an investment project with the following cash flows using a 12 percent cost of capital:

A) $56,560

B) $30,000

C) $13,840

D) cannot be determined with information given

A) $56,560

B) $30,000

C) $13,840

D) cannot be determined with information given

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

69

ZPS Models is considering a project that has a NINV of $564,000 and generates net cash flows of $105,000 per year for 10 years. What is the NPV of this project if ZPS has a cost of capital of 12.45%?

A) $47,625

B) $18,503

C) $17,490

D) none of the above

A) $47,625

B) $18,503

C) $17,490

D) none of the above

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

70

Red Lake Mines, Inc. is considering adoption of a new project requiring a net investment of $10 million. The project is expected to generate 5 years of net cash inflows of $5 million per year. In the project's sixth, and final year, it is expected to have a net cash outflow of $1 million. What is the project's net present value, using a discount rate of 12 percent?

A) about $8.52 million

B) about $8.00 million

C) about $7.52 million

D) none of the above

A) about $8.52 million

B) about $8.00 million

C) about $7.52 million

D) none of the above

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

71

What is the net present value of a project that has a net investment of $148,000 and net cash flows of $25,000 in the first year, $45,000 in years 2-7 and a negative net cash flow of $27,000 in year 8? Assume the cost of capital is 11 percent.

A) $34,302

B) $74,847

C) $57,738

D) -$2,238

A) $34,302

B) $74,847

C) $57,738

D) -$2,238

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

72

Road Hawk Inc. is adding a new production line that will cost $720,000. The line will be depreciated on a straight-line basis over a 7-year period and will generate net cash flows of $160,000 in each of the 7 years. At the end of the project, it is expected the line can be sold as scrap for $10,000. If the firm's marginal tax rate is 40% and it's required rate of return is 14 percent, what is the net present value of this project?

A) $70,091

B) -$27,920

C) $64,091

D) -$31,520

A) $70,091

B) -$27,920

C) $64,091

D) -$31,520

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

73

Hydroponics is considering adding another greenhouse that would cost $95,000 and generate $20,000 in annual net cash flows over it's 8 year expected life. The greenhouse would be depreciated on a straight-line basis to zero and the salvage value is also expected to be zero. If the firm has a marginal tax rate of 40 percent, what is this project's internal rate of return?

A) between 20 and 24%

B) between 13 and 14%

C) between 28 and 32%

D) between 7 and 8%

A) between 20 and 24%

B) between 13 and 14%

C) between 28 and 32%

D) between 7 and 8%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

74

What is the NPV of a project that required a net investment of $500,00 and produced net cash flows of $150,000 per year for 5 years and $110,000 for the next 5 years? Assume the cost of capital is 14%.

A) $211,080

B) $392,580

C) $588,710

D) $160,920

A) $211,080

B) $392,580

C) $588,710

D) $160,920

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

75

Decode Genetics purchased lab equipment for $600,000 that will generate net cash flows of $130,000 per year for 10 years. What is the IRR for this project?

A) 16.76%

B) 17.26%

C) 18.13%

D) 17.76%

A) 16.76%

B) 17.26%

C) 18.13%

D) 17.76%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

76

Kinetics is considering a project that has a NINV of $874,000 and generates net cash flows of $170,000 per year for 12 years. What is the NPV of this project if Kinetics cost of capital is 14%?

A) $252,760

B) $110,840

C) $88,200

D) $47,570

A) $252,760

B) $110,840

C) $88,200

D) $47,570

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

77

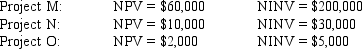

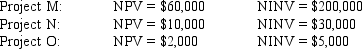

Using the profitability index, which of the following projects should be accepted?

A) Project M

B) Project N

C) Project O

D) All projects should be accepted

A) Project M

B) Project N

C) Project O

D) All projects should be accepted

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

78

Calculate the profitability index for a project that has a net present value equal to -$10,000. The project's net investment is $20,000, and the firm has a 40 percent marginal tax rate.

A) -0.5

B) 0

C) 0.8

D) None of the above

A) -0.5

B) 0

C) 0.8

D) None of the above

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

79

Maplewood Creations is considering the purchase of a new truck to replace an old truck that has a book value of $2,500 and a market value of $800. The annual depreciation expense on the old truck was $500. The new truck, which will cost $29,000, will reduce operating costs $9,000 per year over it's 6 year economic life. The new truck has a 5-year MACRS life and an estimated salvage value at the end of 6 years of $2,000. If Maplewood has a 40 percent marginal tax rate and a cost of capital of 12 percent, what is the NPV of the new truck? Use the Depreciation schedule listed below:

(5-Year depreciation Schedule: 20%, 32%, 19%, 12%, 12%, 5%)

A) $1,517

B) $3,233

C) $29,037

D) $836

(5-Year depreciation Schedule: 20%, 32%, 19%, 12%, 12%, 5%)

A) $1,517

B) $3,233

C) $29,037

D) $836

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

80

What is the internal rate of return for a project that has a net investment of $60,000 and the following net cash flows: Year 1 = $15,000; Year 2 = $20,000; Year 3 = $25,000; Year 4 = $30,000?

A) 17.3%

B) 16.7%

C) 15.7%

D) 16.3%

A) 17.3%

B) 16.7%

C) 15.7%

D) 16.3%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck