Deck 21: Option Applications and Corporate Finance

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/102

Play

Full screen (f)

Deck 21: Option Applications and Corporate Finance

1

When the exercise price of an option is equal to the current price of the stock, the option is said to be ________.

A) at-the-money

B) in-the-money

C) out-of-the-money

D) none of the above

A) at-the-money

B) in-the-money

C) out-of-the-money

D) none of the above

at-the-money

2

The ________ side of an options contract has the option to exercise, while the ________ side has an obligation to fulfill the contract.

A) long, long

B) short, long

C) long, short

D) short, short

A) long, long

B) short, long

C) long, short

D) short, short

long, short

3

Which of the following statements is FALSE?

A) A call option gives the owner the right to buy the asset.

B) A put option gives the owner the right to sell the asset.

C) A financial options contract gives the writer the right (but not the obligation) to purchase or sell an asset at a fixed price at some future date.

D) A stock option gives the holder the option to buy or sell a share of stock on or before a given date for a given price.

A) A call option gives the owner the right to buy the asset.

B) A put option gives the owner the right to sell the asset.

C) A financial options contract gives the writer the right (but not the obligation) to purchase or sell an asset at a fixed price at some future date.

D) A stock option gives the holder the option to buy or sell a share of stock on or before a given date for a given price.

A financial options contract gives the writer the right (but not the obligation) to purchase or sell an asset at a fixed price at some future date.

4

________ options allow the holder to exercise the option on any date up to and including the expiration date.

A) Canadian

B) American

C) European

D) None of the above

A) Canadian

B) American

C) European

D) None of the above

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

5

The ________ is the total number of contracts of a particular option that have been written and not yet closed.

A) mark interest

B) open interest

C) turnover

D) local turnover

A) mark interest

B) open interest

C) turnover

D) local turnover

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

6

Using an option to reduce the risk of a portfolio is called ________, while using options to bet on the direction of the market or an asset is called ________.

A) hedging, speculation

B) hedging, verification

C) verification, hedging

D) speculation, hedging

A) hedging, speculation

B) hedging, verification

C) verification, hedging

D) speculation, hedging

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

7

The price at which the holder of an option buys or sells a share of stock when the option is exercised is called the ________ price.

A) strike

B) American

C) dilutive

D) none of the above

A) strike

B) American

C) dilutive

D) none of the above

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

8

A put option gives the owner the right to ________ an asset at a fixed price at some future date.

A) sell

B) buy

C) hold

D) none of the above

A) sell

B) buy

C) hold

D) none of the above

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

9

Standard stock options are traded and bought and sold through dealers only and cannot be bought via an exchange.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

10

Options are also called derivative assets because they derive their value solely from the price of another asset.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

11

________ options allow the holder to exercise the option only on the expiration date.

A) Canadian

B) American

C) European

D) None of the above

A) Canadian

B) American

C) European

D) None of the above

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

12

A call option gives the owner the right to ________ an asset at a fixed price at some future date.

A) sell

B) buy

C) hold

D) none of the above

A) sell

B) buy

C) hold

D) none of the above

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

13

For every owner of a call option there is also an option writer, the person who takes the other side.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

14

An options contract gives the owner the ________ but not the ________ to buy or sell an asset at a fixed price at some future date.

A) obligation, right

B) right, option

C) right, obligation

D) option, right

A) obligation, right

B) right, option

C) right, obligation

D) option, right

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

15

When the exercise price of a call option is lower than the current price of the stock, the option is said to be ________.

A) at-the-money

B) in-the-money

C) out-of-the-money

D) none of the above

A) at-the-money

B) in-the-money

C) out-of-the-money

D) none of the above

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following statements is FALSE?

A) The option buyer, also called the option holder, holds the right to exercise the option and has a long position in the contract.

B) The market price of the option is also called the exercise price.

C) If the payoff from exercising an option immediately is positive, the option is said to be in-the-money.

D) As with other financial assets, options can be bought and sold. Standard stock options are traded on organized exchanges, while more specialized options are sold through dealers.

A) The option buyer, also called the option holder, holds the right to exercise the option and has a long position in the contract.

B) The market price of the option is also called the exercise price.

C) If the payoff from exercising an option immediately is positive, the option is said to be in-the-money.

D) As with other financial assets, options can be bought and sold. Standard stock options are traded on organized exchanges, while more specialized options are sold through dealers.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

17

When the exercise price of a call option is higher than the current price of the stock, the option is said to be ________.

A) at-the-money

B) in-the-money

C) out-of-the-money

D) none of the above

A) at-the-money

B) in-the-money

C) out-of-the-money

D) none of the above

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following statements is FALSE?

A) When a holder of an option enforces the agreement and buys or sells a share of stock at the agreed-upon price, he is exercising the option.

B) There are two kinds of options. European options allow their holders to exercise the option on any date up to and including a final date called the expiration date.

C) Because an option is a contract between two parties, for every owner of a financial option, there is also an option writer, the person who takes the other side of the contract.

D) The price at which the holder buys or sells the share of stock when the option is exercised is called the strike price or exercise price.

A) When a holder of an option enforces the agreement and buys or sells a share of stock at the agreed-upon price, he is exercising the option.

B) There are two kinds of options. European options allow their holders to exercise the option on any date up to and including a final date called the expiration date.

C) Because an option is a contract between two parties, for every owner of a financial option, there is also an option writer, the person who takes the other side of the contract.

D) The price at which the holder buys or sells the share of stock when the option is exercised is called the strike price or exercise price.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

19

When a company writes a call option on new stock in the company, it is called a ________.

A) convertible bond

B) put option

C) stock option

D) warrant

A) convertible bond

B) put option

C) stock option

D) warrant

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following statements is FALSE?

A) A holder would not exercise an in-the-money option.

B) The option seller, also called the option writer, sells (or writes) the option and has a short position in the contract.

C) Because the long side has the option to exercise, the short side has an obligation to fulfill the contract.

D) When the exercise price of an option is equal to the current price of the stock, the option is said to be at-the-money.

A) A holder would not exercise an in-the-money option.

B) The option seller, also called the option writer, sells (or writes) the option and has a short position in the contract.

C) Because the long side has the option to exercise, the short side has an obligation to fulfill the contract.

D) When the exercise price of an option is equal to the current price of the stock, the option is said to be at-the-money.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following statements is FALSE?

A) Options also allow investors to speculate, or place a bet on the direction in which they believe the market is likely to move.

B) Options where the strike price and the stock price are very far apart are referred to as deep in-the-money or deep out-of-the-money.

C) Call options with strike prices above the current stock price are in-the-money, as are put options with strike prices below the current stock price.

D) European options allow their holders to exercise the option only on the expiration date-holders cannot exercise before the expiration date.

A) Options also allow investors to speculate, or place a bet on the direction in which they believe the market is likely to move.

B) Options where the strike price and the stock price are very far apart are referred to as deep in-the-money or deep out-of-the-money.

C) Call options with strike prices above the current stock price are in-the-money, as are put options with strike prices below the current stock price.

D) European options allow their holders to exercise the option only on the expiration date-holders cannot exercise before the expiration date.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

22

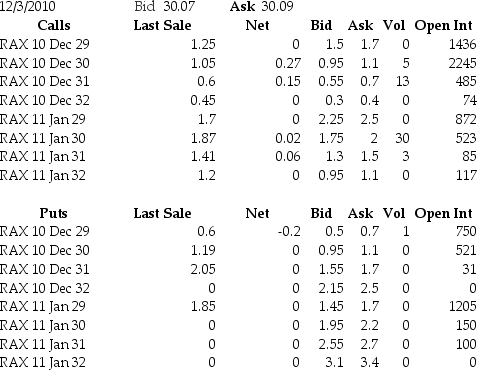

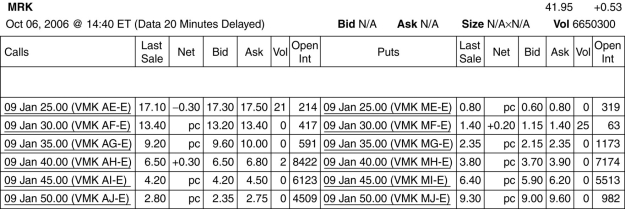

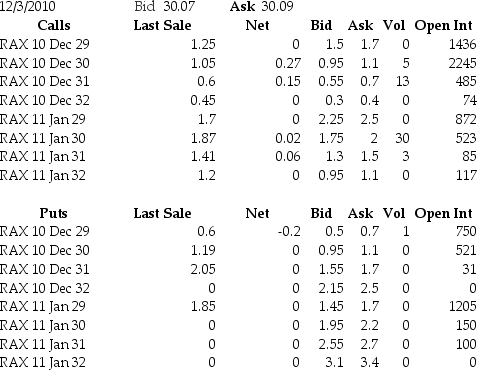

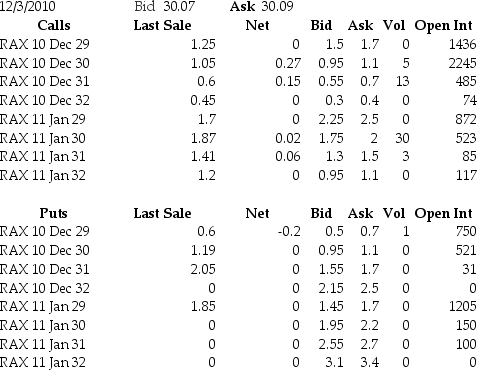

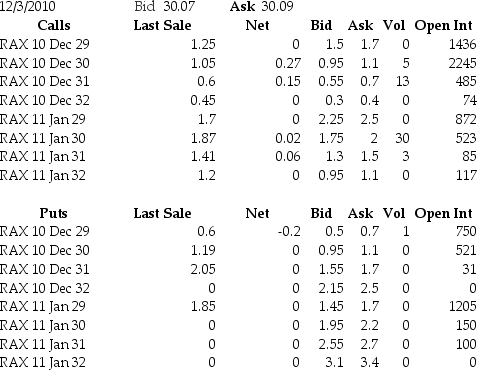

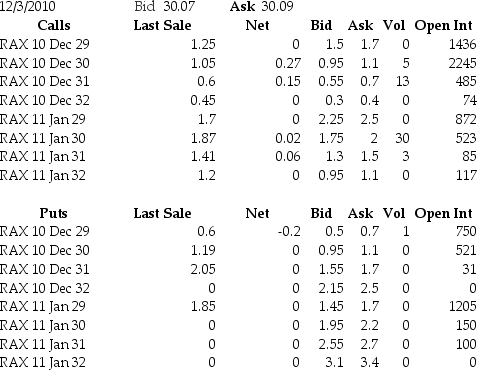

Use the table for the question(s) below.

Consider the following information on options from the CBOE for Rackspace.

RAX 30.09 +0.48

Assume you want to buy five call option contracts that with an exercise price closest to being at-the-money and that expires December 2010. The current price that you would have to pay for such a contract is ________.

A) $550

B) $110

C) $475

D) $300

Consider the following information on options from the CBOE for Rackspace.

RAX 30.09 +0.48

Assume you want to buy five call option contracts that with an exercise price closest to being at-the-money and that expires December 2010. The current price that you would have to pay for such a contract is ________.

A) $550

B) $110

C) $475

D) $300

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

23

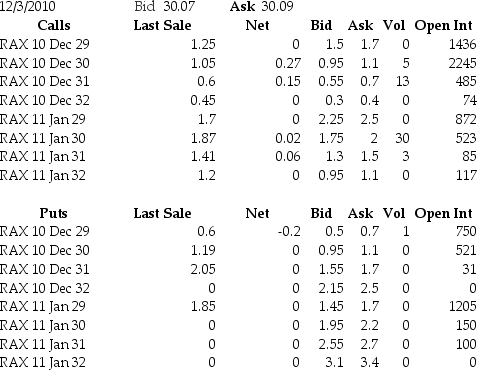

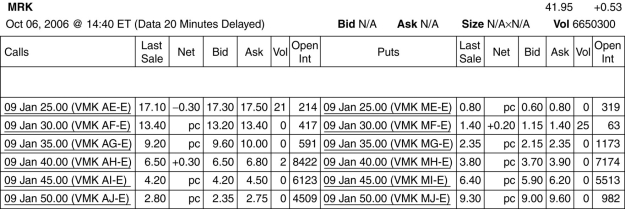

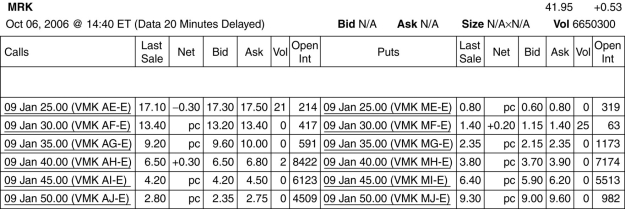

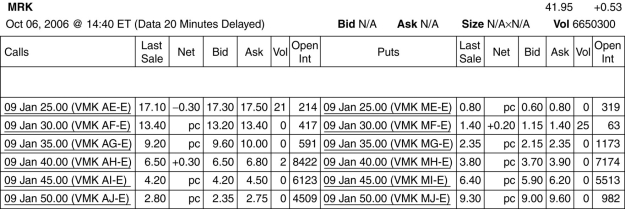

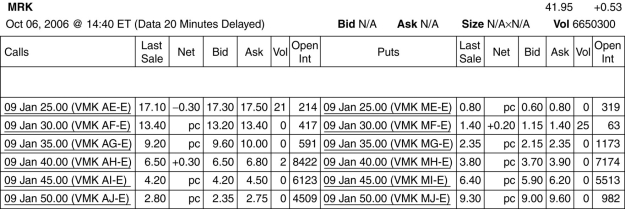

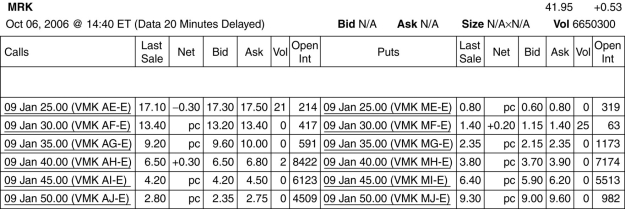

Use the table for the question(s) below.

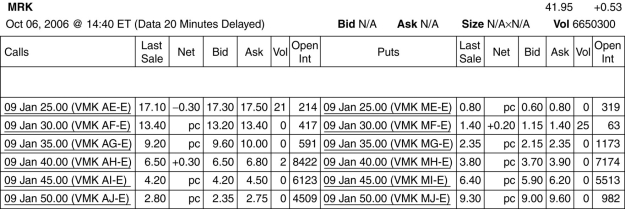

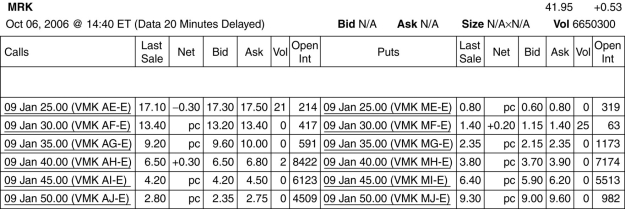

Consider the following information on options from the CBOE for Merck:

Assume you want to buy one options contract that with an exercise price closest to being at-the-money and that expires January 2009. The current price that you would have to pay for such a contract is ________.

A) $680

B) $380

C) $650

D) $420

Consider the following information on options from the CBOE for Merck:

Assume you want to buy one options contract that with an exercise price closest to being at-the-money and that expires January 2009. The current price that you would have to pay for such a contract is ________.

A) $680

B) $380

C) $650

D) $420

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

24

The holder of a put option has ________.

A) the obligation to sell a security for a given price

B) the right to buy a security for a given price

C) the right to sell a security for a given price

D) the obligation to buy a security for a given price

A) the obligation to sell a security for a given price

B) the right to buy a security for a given price

C) the right to sell a security for a given price

D) the obligation to buy a security for a given price

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

25

Using options to place a bet on the direction in which you believe the market is likely to move is called ________.

A) speculation

B) hedging

C) a covered position

D) a naked position

A) speculation

B) hedging

C) a covered position

D) a naked position

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

26

When is an option out-the-money?

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

27

What are American options?

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

28

What are European options?

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

29

Use the table for the question(s) below.

Consider the following information on options from the CBOE for Merck:

The open interest for a January 2009 put option that is closest to being at-the-money is ________.

A) 7,174

B) 982

C) 319

D) 8,422

Consider the following information on options from the CBOE for Merck:

The open interest for a January 2009 put option that is closest to being at-the-money is ________.

A) 7,174

B) 982

C) 319

D) 8,422

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

30

When is an option in-the-money?

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

31

The writer of a call option has ________.

A) the obligation to sell a security for a given price

B) the obligation to buy a security for a given price

C) the right to sell a security for a given price

D) the right to buy a security for a given price

A) the obligation to sell a security for a given price

B) the obligation to buy a security for a given price

C) the right to sell a security for a given price

D) the right to buy a security for a given price

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

32

Using options to reduce risk is called ________.

A) speculation

B) a naked position

C) hedging

D) a covered position

A) speculation

B) a naked position

C) hedging

D) a covered position

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

33

When is an option at-the-money?

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

34

What is a call option?

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

35

Use the table for the question(s) below.

Consider the following information on options from the CBOE for Rackspace.

RAX 30.09 +0.48

How many of the December 2010 put options are in-the-money?

A) 1

B) 2

C) 3

D) 4

Consider the following information on options from the CBOE for Rackspace.

RAX 30.09 +0.48

How many of the December 2010 put options are in-the-money?

A) 1

B) 2

C) 3

D) 4

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

36

What is a put option?

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

37

Use the table for the question(s) below.

Consider the following information on options from the CBOE for Merck:

How many of the January 2009 put options are in-the-money?

A) 1

B) 2

C) 3

D) 4

Consider the following information on options from the CBOE for Merck:

How many of the January 2009 put options are in-the-money?

A) 1

B) 2

C) 3

D) 4

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

38

Use the table for the question(s) below.

Consider the following information on options from the CBOE for Merck:

How many of the January 2009 call options are in-the-money?

A) 1

B) 2

C) 3

D) 4

Consider the following information on options from the CBOE for Merck:

How many of the January 2009 call options are in-the-money?

A) 1

B) 2

C) 3

D) 4

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

39

Although the payouts on a long position in an options contract are never negative, the profit from purchasing and holding it could be negative.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

40

Use the table for the question(s) below.

Consider the following information on options from the CBOE for Rackspace.

RAX 30.09 +0.48

The open interest for a January 2011 call option that is closest to being at-the-money is ________.

A) 1436

B) 2245

C) 872

D) 523

Consider the following information on options from the CBOE for Rackspace.

RAX 30.09 +0.48

The open interest for a January 2011 call option that is closest to being at-the-money is ________.

A) 1436

B) 2245

C) 872

D) 523

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

41

Suppose that a stock sells at a price of $60 on the expiration date. Compute the price of a call option if the option strike price is $20.

A) $20

B) $30

C) $40

D) $50

A) $20

B) $30

C) $40

D) $50

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

42

Suppose that a stock sells at a price of $40 on the expiration date. Compute the price of a put option if the option strike price is $20.

A) $0

B) $10

C) $20

D) $30

A) $0

B) $10

C) $20

D) $30

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

43

The payoff to the holder of a call option is ________.

A) strike price minus stock price if stock price is more than strike price

B) strike price minus stock price if stock price is less than strike price

C) stock price minus strike price if stock price is less than strike price

D) stock price minus strike price if stock price is more than strike price

A) strike price minus stock price if stock price is more than strike price

B) strike price minus stock price if stock price is less than strike price

C) stock price minus strike price if stock price is less than strike price

D) stock price minus strike price if stock price is more than strike price

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

44

Suppose that a stock sells at a price of $40 on the expiration date. Compute the price of a call option if the option strike price is $20.

A) $20

B) $30

C) $40

D) $50

A) $20

B) $30

C) $40

D) $50

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

45

Suppose that a stock sells at a price of $10 on the expiration date. Compute the price of a call option if the option strike price is $20.

A) $20

B) $30

C) $40

D) $0

A) $20

B) $30

C) $40

D) $0

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

46

Suppose that a stock sells at a price of $50 on the expiration date. Compute the price of a put option if the option strike price is $80.

A) $20

B) $30

C) $40

D) $50

A) $20

B) $30

C) $40

D) $50

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

47

When a stock price appreciates by a certain percentage, a call option on the same stock appreciates by a lower percentage amount.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

48

An investor purchases a call option and its underlying stock on the same day. If the stock appreciates by 25%, the call option will appreciate by ________.

A) more than 25%

B) less than 25%

C) exactly 25%

D) none of the above

A) more than 25%

B) less than 25%

C) exactly 25%

D) none of the above

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

49

Suppose that a stock sells at a price of $60 on the expiration date. Compute the payoff to the seller of a put option if the option strike price is $20.

A) -$20

B) -$10

C) 0

D) $40

A) -$20

B) -$10

C) 0

D) $40

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

50

Suppose that a stock sells at a price of $40 on the expiration date. Compute the price of a put option if the option strike price is $60.

A) $20

B) $30

C) $40

D) $50

A) $20

B) $30

C) $40

D) $50

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

51

Suppose that a stock sells at a price of $40 on the expiration date. Compute the payoff to the seller of a call option if the option strike price is $50.

A) -$20

B) -$10

C) 0

D) $20

A) -$20

B) -$10

C) 0

D) $20

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

52

Suppose that a stock sells at a price of $40 on the expiration date. Compute the payoff to the seller of a put option if the option strike price is $50.

A) -$20

B) -$10

C) 0

D) $40

A) -$20

B) -$10

C) 0

D) $40

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

53

Suppose that a stock sells at a price of $60 on the expiration date. Compute the payoff to the seller of a put option if the option strike price is $80.

A) -$20

B) -$10

C) 0

D) $40

A) -$20

B) -$10

C) 0

D) $40

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

54

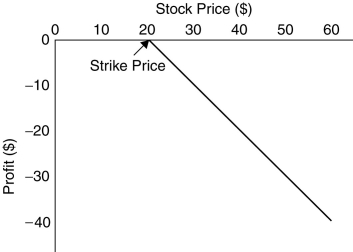

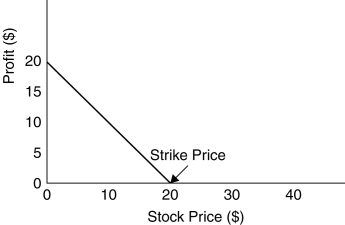

Use the figure for the question below.

This graph depicts the payoffs of a ________.

A) short position in a put option at expiration

B) short position in a call option at expiration

C) long position in a put option at expiration

D) long position in a call option at expiration

This graph depicts the payoffs of a ________.

A) short position in a put option at expiration

B) short position in a call option at expiration

C) long position in a put option at expiration

D) long position in a call option at expiration

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

55

Suppose you purchase a call option for $5 and a strike price of $40. On the expiration day, the price of the stock is $55. What is the return on the call option if you hold your position until maturity?

A) 125%

B) 200%

C) 275%

D) 300%

A) 125%

B) 200%

C) 275%

D) 300%

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

56

The payoff to the holder of a put option is ________.

A) strike price minus stock price if stock price is more than strike price

B) strike price minus stock price if stock price is less than strike price

C) stock price minus strike price if stock price is less than strike price

D) stock price minus strike price if stock price is more than strike price

A) strike price minus stock price if stock price is more than strike price

B) strike price minus stock price if stock price is less than strike price

C) stock price minus strike price if stock price is less than strike price

D) stock price minus strike price if stock price is more than strike price

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

57

Suppose you purchase a call option for $5 and a strike price of $20. On the expiration day, the price of the stock is $30. What is the return on the call option if you hold your position until maturity?

A) 25%

B) 50%

C) 75%

D) 100%

A) 25%

B) 50%

C) 75%

D) 100%

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

58

Suppose that a stock sells at a price of $40 on the expiration date. Compute the payoff to the seller of a call option if the option strike price is $20.

A) -$20

B) -$30

C) -$40

D) -$50

A) -$20

B) -$30

C) -$40

D) -$50

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

59

Suppose you purchase a call option for $4 and a strike price of $30. On the expiration day, the price of the stock is $40. What is the return on the call option if you hold your position until maturity?

A) 125%

B) 130%

C) 150%

D) 170%

A) 125%

B) 130%

C) 150%

D) 170%

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

60

Suppose that a stock sells at a price of $60 on the expiration date. Compute the payoff to the seller of a call option if the option strike price is $20.

A) -$20

B) -$30

C) -$40

D) -$50

A) -$20

B) -$30

C) -$40

D) -$50

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following statements is FALSE?

A) Put-call parity gives the price of a European call option in terms of the price of a European put, the underlying stock, and a zero-coupon bond.

B) For a given strike price, the value of a call option is higher if the current price of the stock is higher, as there is a greater likelihood the option will end up in-the-money.

C) The value of an otherwise identical call option is higher if the strike price the holder must pay to buy the stock is higher.

D) Because a put is the right to sell the stock, puts with a lower strike price are less valuable.

A) Put-call parity gives the price of a European call option in terms of the price of a European put, the underlying stock, and a zero-coupon bond.

B) For a given strike price, the value of a call option is higher if the current price of the stock is higher, as there is a greater likelihood the option will end up in-the-money.

C) The value of an otherwise identical call option is higher if the strike price the holder must pay to buy the stock is higher.

D) Because a put is the right to sell the stock, puts with a lower strike price are less valuable.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

62

The value of a call option ________ with the risk-free rate, and the value of a put option ________ with the risk-free rate.

A) increases, increases

B) decreases, decreases

C) increases, decreases

D) decreases, increases

A) increases, increases

B) decreases, decreases

C) increases, decreases

D) decreases, increases

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

63

KD Industries stock is currently trading at $32 per share. Consider a put option on KD stock with a strike price of $30. The maximum value of this put option is ________.

A) $0

B) $32

C) $30

D) $2

A) $0

B) $32

C) $30

D) $2

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

64

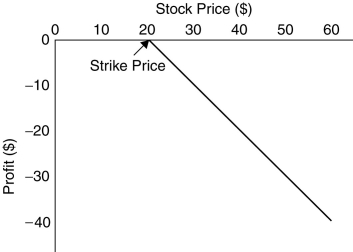

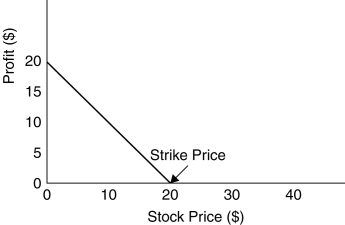

Use the figure for the question below.

This graph depicts the payoffs of a ________.

A) long position in a put option at expiration

B) short position in a call option at expiration

C) short position in a put option at expiration

D) long position in a call option at expiration

This graph depicts the payoffs of a ________.

A) long position in a put option at expiration

B) short position in a call option at expiration

C) short position in a put option at expiration

D) long position in a call option at expiration

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

65

The value of an option ________ with the volatility of the underlying stock.

A) increases

B) decreases

C) unchanged

D) cannot say for sure

A) increases

B) decreases

C) unchanged

D) cannot say for sure

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

66

A European option on a stock is more valuable than an otherwise similar American option on the same stock.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

67

In case of normal swings in the risk-free rate, option prices are not very sensitive to changes in the risk-free rate.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

68

KD Industries stock is currently trading at $32 per share. Consider a put option on KD stock with a strike price of $30. The intrinsic value of this put option is ________.

A) $0

B) -$2

C) $2

D) $30

A) $0

B) -$2

C) $2

D) $30

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

69

You pay $3.25 for a call option on Luther Industries that expires in three months with a strike price of $40.00. Three months later, at expiration, Luther Industries is trading at $41.00 per share. Your profit per share on this transaction is closest to ________.

A) -$1.00

B) $1.00

C) -$2.25

D) $2.25

A) -$1.00

B) $1.00

C) -$2.25

D) $2.25

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

70

Which of the following statements is FALSE?

A) Because an American option cannot be worth less than its intrinsic value, it cannot have a negative time value.

B) An American option with a later exercise date is of more worth than an otherwise identical American option with an earlier exercise date.

C) The value of an option generally decreases with the volatility of the stock.

D) The investor holding a short position in an option has an obligation; he or she takes the opposite side of the contract to the investor who holds the long position.

A) Because an American option cannot be worth less than its intrinsic value, it cannot have a negative time value.

B) An American option with a later exercise date is of more worth than an otherwise identical American option with an earlier exercise date.

C) The value of an option generally decreases with the volatility of the stock.

D) The investor holding a short position in an option has an obligation; he or she takes the opposite side of the contract to the investor who holds the long position.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

71

A European option with a later exercise date may trade potentially for less than an otherwise identical option with an earlier exercise date.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

72

The value of an otherwise identical call option is ________ if the strike price the holder must pay to buy the stock is ________.

A) higher, higher

B) lower, lower

C) higher, lower

D) none of the above

A) higher, higher

B) lower, lower

C) higher, lower

D) none of the above

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

73

What is the short position of an options contract?

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

74

You have shorted a call option on WSJ stock with a strike price of $50. The option will expire in exactly six months. If the stock is trading at $45 in three month, what will you owe for each share in the contract?

A) $0

B) $50

C) $60

D) $10

A) $0

B) $50

C) $60

D) $10

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

75

You have shorted a call option on WSJ stock with a strike price of $50. The option will expire in exactly six months. If the stock is trading at $60 in three months, what will you owe for each share in the contract?

A) $0

B) $60

C) $50

D) $10

A) $0

B) $60

C) $50

D) $10

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

76

The value of an otherwise identical American call option is ________ if the exercise date is ________.

A) higher, longer

B) lower, longer

C) higher, closer

D) none of the above

A) higher, longer

B) lower, longer

C) higher, closer

D) none of the above

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

77

What is the long position of an options contract?

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

78

The value of an otherwise identical call option is ________ if the stock price is ________.

A) higher, higher

B) lower, higher

C) higher, lower

D) none of the above

A) higher, higher

B) lower, higher

C) higher, lower

D) none of the above

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following statements is FALSE?

A) The intrinsic value of an option is the value it would have if it expired immediately.

B) A European option cannot be worth less than an identical American option.

C) Put options increase in value as the stock price falls.

D) A put option cannot be worth more than its strike price.

A) The intrinsic value of an option is the value it would have if it expired immediately.

B) A European option cannot be worth less than an identical American option.

C) Put options increase in value as the stock price falls.

D) A put option cannot be worth more than its strike price.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

80

Which of the following will not increase the value of a put option?

A) an increase in the time to maturity

B) a decrease in the stock price

C) a decrease in the stocks volatility

D) an increase in the exercise price

A) an increase in the time to maturity

B) a decrease in the stock price

C) a decrease in the stocks volatility

D) an increase in the exercise price

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck