Deck 10: Derivative Securities Markets

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/61

Play

Full screen (f)

Deck 10: Derivative Securities Markets

1

A credit forward is a forward agreement that hedges against an increase in default risk on a loan after the loan has been created by a lender.

True

2

A negotiated non-standardized agreement between a buyer and seller (with no third-party involvement)to exchange an asset for cash at some future date with the price set today is called a forward agreement.

True

3

A clearinghouse backs the buyer's and seller's position in a forward contract.

False

4

The buyer of a call option on stock benefits if the underlying stock price rises or if the volatility of the stock's price increases.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

5

An in the money American call option increases in value as expiration approaches,but an out of the money American call option decreases in value as expiration approaches.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

6

If you think that interest rates are likely to rise substantially over the next several years,you might sell a T-bond futures contract or buy an interest rate cap to take advantage of your expectations.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

7

By convention,a swap buyer on an interest rate swap agrees to

A)periodically pay a fixed rate of interest and receive a floating rate of interest.

B)periodically pay a floating rate of interest and receive a fixed rate of interest.

C)swap both principal and interest at contract maturity.

D)back both sides of the swap agreement.

E)act as the dealer in the swap agreement.

A)periodically pay a fixed rate of interest and receive a floating rate of interest.

B)periodically pay a floating rate of interest and receive a fixed rate of interest.

C)swap both principal and interest at contract maturity.

D)back both sides of the swap agreement.

E)act as the dealer in the swap agreement.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following is true?

A)Forward contracts have no default risk.

B)Futures contracts require an initial margin requirement be paid.

C)Forward contracts are marked to market daily.

D)Forward contract buyers and sellers do not know who the counterparty is.

E)Futures contracts are only traded over the counter.

A)Forward contracts have no default risk.

B)Futures contracts require an initial margin requirement be paid.

C)Forward contracts are marked to market daily.

D)Forward contract buyers and sellers do not know who the counterparty is.

E)Futures contracts are only traded over the counter.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

9

An increase in which of the following would increase the price of a call option on common stock,ceteris paribus?

I. Stock price

II. Stock price volatility

III. Interest rates

IV. Exercise price

A)II only

B)II and IV only

C)I,II,and III only

D)I,III,and IV only

E)I,II,III,and IV

I. Stock price

II. Stock price volatility

III. Interest rates

IV. Exercise price

A)II only

B)II and IV only

C)I,II,and III only

D)I,III,and IV only

E)I,II,III,and IV

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

10

A professional futures trader who buys and sells futures for his own account throughout the day but typically closes out his positions at the end of the day is called a

A)floor broker.

B)day trader.

C)position trader.

D)specialist.

E)hedger.

A)floor broker.

B)day trader.

C)position trader.

D)specialist.

E)hedger.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

11

Of the following,the most recent derivative security innovations are

A)foreign currency futures.

B)interest rate futures.

C)stock index futures.

D)stock options.

E)credit derivatives.

A)foreign currency futures.

B)interest rate futures.

C)stock index futures.

D)stock options.

E)credit derivatives.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

12

The purchaser of a T-bond futures contract priced at 101-16 at the time of sale agrees to deliver $100,000 face value Treasury bonds in exchange for receiving $101,500 at contract maturity.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

13

Forward contracts are marked to market daily.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

14

Futures or option exchange members who take positions on contracts for only a few moments are called scalpers.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

15

Writing a put option results in a potentially limited gain and a potentially unlimited loss.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

16

Marking to market of futures contracts is the process of realizing gains and losses each day as the futures contract changes in price.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

17

In a futures contract,if funds in the margin account fall below the maintenance margin requirement,a margin call is issued.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

18

You would expect the price quote for a put option to be at least $10 if the put had an exercise price of $40 and the underlying stock was selling for $50.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

19

American options can only be exercised at maturity.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

20

European-style options are options that may only be exercised at maturity.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

21

An investor has unrealized gains in 100 shares of Amazin stock for which he does not wish to pay taxes. However,he is now bearish upon the stock for the short term. The stock is at $76 and he buys a put with a strike of $75 for $300. At expiration the stock is at $68. What is the net gain or loss on the entire stock/option portfolio?

A)$700

B)−$800

C)−$400

D)−$200

E)−$100

A)$700

B)−$800

C)−$400

D)−$200

E)−$100

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

22

An investor is committed to purchasing 100 shares of World Port Management stock in six months. She is worried the stock price will rise significantly over the next six months. The stock is at $45 and she buys a six-month call with a strike of $50 for $250. At expiration the stock is at $54. What is the net economic gain or loss on the entire stock/option portfolio?

A)−$500

B)−$750

C)−$900

D)$400

E)$500

A)−$500

B)−$750

C)−$900

D)$400

E)$500

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

23

A contract that gives the holder the right to sell a security at a preset price only immediately before contract expiration is a(n)

A)American call option.

B)European call option.

C)American put option.

D)European put option.

E)knockout option.

A)American call option.

B)European call option.

C)American put option.

D)European put option.

E)knockout option.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

24

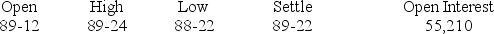

You find the following current quote for the March T-bond contract: $100,000; Pts 32nd,of 100 percent.

You went long in the contract at the open. Which of the following is/are true?

I. At the end of the day,your margin account would be increased.

II. 55,210 contracts were traded that day.

III. You agreed to deliver $100,000 face value T-bonds in March in exchange for $89,120.

IV. You agreed to purchase $100,000 face value T-bonds in March in exchange for $89,375.

A)I,II,and III only

B)I,II,and IV only

C)I and III only

D)I and IV only

E)IV only

You went long in the contract at the open. Which of the following is/are true?

I. At the end of the day,your margin account would be increased.

II. 55,210 contracts were traded that day.

III. You agreed to deliver $100,000 face value T-bonds in March in exchange for $89,120.

IV. You agreed to purchase $100,000 face value T-bonds in March in exchange for $89,375.

A)I,II,and III only

B)I,II,and IV only

C)I and III only

D)I and IV only

E)IV only

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

25

You have taken a stock option position and,if the stock's price increases,you could lose a fixed small amount of money,but if the stock's price decreases,your gain increases. You must have ________.

A)bought a call option

B)bought a put option

C)written a call option

D)written a put option

E)purchased a straddle

A)bought a call option

B)bought a put option

C)written a call option

D)written a put option

E)purchased a straddle

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

26

Measured by the amount outstanding,the largest type of derivative market in the world is the

A)futures market.

B)forward market.

C)swap market.

D)options market.

E)credit forward market.

A)futures market.

B)forward market.

C)swap market.

D)options market.

E)credit forward market.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

27

In a bear market,which option positions make money?

I. Buying a call.

II. Writing a call.

III. Buying a put.

IV. Writing a put.

A)I and II

B)I and III

C)II and IV

D)II and III

E)I and IV

I. Buying a call.

II. Writing a call.

III. Buying a put.

IV. Writing a put.

A)I and II

B)I and III

C)II and IV

D)II and III

E)I and IV

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

28

An interest rate collar is

A)writing a floor and writing a cap.

B)buying a cap and writing a floor.

C)an option on a futures contract.

D)buying a cap and buying a floor.

E)None of these choices are correct.

A)writing a floor and writing a cap.

B)buying a cap and writing a floor.

C)an option on a futures contract.

D)buying a cap and buying a floor.

E)None of these choices are correct.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

29

An interest rate floor is designed to protect an institution from

I. falling interest rates.

II. falling bond prices.

III. increased credit risk on loans.

IV. swap counterparty credit risk.

A)I and IV

B)II and III

C)I and III

D)II and IV

E)I only

I. falling interest rates.

II. falling bond prices.

III. increased credit risk on loans.

IV. swap counterparty credit risk.

A)I and IV

B)II and III

C)I and III

D)II and IV

E)I only

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

30

You have agreed to deliver the underlying commodity on a futures contract in 90 days. Today the underlying commodity price rises and you get a margin call. You must have

A)a long position in a futures contract.

B)a short position in a futures contract.

C)sold a forward contract.

D)purchased a forward contract.

E)purchased a call option on a futures contract.

A)a long position in a futures contract.

B)a short position in a futures contract.

C)sold a forward contract.

D)purchased a forward contract.

E)purchased a call option on a futures contract.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

31

A bank with long-term fixed-rate assets funded with short-term rate-sensitive liabilities could do which of the following to limit their interest rate risk?

I. Buy a cap.

II. Buy an interest rate swap.

III. Buy a floor.

IV. Sell an interest rate swap.

A)I and II only

B)III only

C)I and IV only

D)II and III only

E)III and IV only

I. Buy a cap.

II. Buy an interest rate swap.

III. Buy a floor.

IV. Sell an interest rate swap.

A)I and II only

B)III only

C)I and IV only

D)II and III only

E)III and IV only

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

32

A speculator may write a put option on stock with an exercise price of $15 and earn a $3 premium only if he thought

A)the stock price would stay above $12.

B)the stock volatility would increase.

C)the stock price would fall below $18.

D)the stock price would stay above $15.

E)the stock price would rise above $18 or fall below $12.

A)the stock price would stay above $12.

B)the stock volatility would increase.

C)the stock price would fall below $18.

D)the stock price would stay above $15.

E)the stock price would rise above $18 or fall below $12.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

33

My bank has a larger number of adjustable-rate mortgage loans outstanding. To protect our interest rate income on these loans,the bank could

I. enter into a swap to pay fixed and receive variable.

II. enter into a swap to pay variable and receive fixed.

III. buy an interest rate floor.

IV. buy an interest rate cap.

A)I and III only

B)I and IV only

C)II and III only

D)II and IV only

I. enter into a swap to pay fixed and receive variable.

II. enter into a swap to pay variable and receive fixed.

III. buy an interest rate floor.

IV. buy an interest rate cap.

A)I and III only

B)I and IV only

C)II and III only

D)II and IV only

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

34

New futures contracts must be approved by

A)the CFTC.

B)the SEC.

C)the Warren Commission.

D)the NYSE.

E)the Federal Reserve.

A)the CFTC.

B)the SEC.

C)the Warren Commission.

D)the NYSE.

E)the Federal Reserve.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

35

An agreement between two parties to exchange a series of specified periodic cash flows in the future based on some underlying instrument or price is a(n)

A)forward agreement.

B)futures contract.

C)interest rate collar.

D)option contract.

E)swap contract.

A)forward agreement.

B)futures contract.

C)interest rate collar.

D)option contract.

E)swap contract.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

36

A bank with short-term floating-rate assets funded by long-term fixed-rate liabilities could hedge this risk by

I. buying a T-bond futures contract.

II. buying options on a T-bond futures contract.

III. entering into a swap agreement to pay a fixed rate and receive a variable rate.

IV. entering into a swap agreement to pay a variable rate and receive a fixed rate.

A)I and III only

B)I,II,and IV only

C)II and IV only

D)III only

E)IV only

I. buying a T-bond futures contract.

II. buying options on a T-bond futures contract.

III. entering into a swap agreement to pay a fixed rate and receive a variable rate.

IV. entering into a swap agreement to pay a variable rate and receive a fixed rate.

A)I and III only

B)I,II,and IV only

C)II and IV only

D)III only

E)IV only

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

37

The higher the exercise price,the ________ the value of a put and the ________ the value of a call.

A)higher; higher

B)lower; lower

C)higher; lower

D)lower; higher

A)higher; higher

B)lower; lower

C)higher; lower

D)lower; higher

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

38

A higher level of which of the following variables would make a put option on common stock more valuable,ceteris paribus?

I. Stock price

II. Stock price volatility

III. Interest rates

IV. Exercise price

A)II only

B)II and IV only

C)I,II,and III only

D)I,III,and IV only

E)I,II,III,and IV

I. Stock price

II. Stock price volatility

III. Interest rates

IV. Exercise price

A)II only

B)II and IV only

C)I,II,and III only

D)I,III,and IV only

E)I,II,III,and IV

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

39

You have taken a stock option position and,if the stock's price drops,you will get a level gain no matter how far prices fall,but you could go bankrupt if the stock's price rises. You have________.

A)bought a call option.

B)bought a put option.

C)written a call option.

D)written a put option.

E)written a straddle.

A)bought a call option.

B)bought a put option.

C)written a call option.

D)written a put option.

E)written a straddle.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

40

A stock has a spot price of $55. Its May options are about to expire. One of its puts is worth $5 and one of its calls is worth $10. The exercise price of the put must be ________ and the exercise price of the call must be ________.

A)$50; $45

B)$55; $55

C)$60; $45

D)$60; $50

E)One cannot tell from the information given.

A)$50; $45

B)$55; $55

C)$60; $45

D)$60; $50

E)One cannot tell from the information given.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

41

When would an option hedge be better than a futures or forward hedge?

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

42

How does a futures or option clearinghouse assist traders?

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

43

FNMA has direct holdings of 30-year fixed-rate mortgages financed by three- to five-year agency securities sold to the public.

What kind of interest rate swap could FNMA use to limit their interest rate risk? Explain.

What kind of interest rate swap could FNMA use to limit their interest rate risk? Explain.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

44

A bank has made a risky loan to a midsize consumer goods manufacturer. With the weaker economy,the borrower is expected to have trouble repaying the loan. The bank decides to purchase a digital default option. Which one of the following payout patterns does a digital option provide?

A)The option seller pays a stated amount to the option buyer,usually the par on the loan or bond,in the event of a default on the underlying credit.

B)The option seller pays the buyer if the default risk premium or yield spread on a specified benchmark bond of the borrower increases above some exercise spread.

C)If the option buyer makes fixed periodic payments to the option seller,the seller will pay the option buyer if a credit event occurs.

D)If the option buyer makes periodic payments to the seller and delivers the underlying bond or loan,the seller pays the par value of the security.

E)If interest rates change,the option seller will begin making fixed-rate payments to the option buyer.

A)The option seller pays a stated amount to the option buyer,usually the par on the loan or bond,in the event of a default on the underlying credit.

B)The option seller pays the buyer if the default risk premium or yield spread on a specified benchmark bond of the borrower increases above some exercise spread.

C)If the option buyer makes fixed periodic payments to the option seller,the seller will pay the option buyer if a credit event occurs.

D)If the option buyer makes periodic payments to the seller and delivers the underlying bond or loan,the seller pays the par value of the security.

E)If interest rates change,the option seller will begin making fixed-rate payments to the option buyer.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

45

Two competing fully electronic derivatives markets in the United States are

A)CME Globex and Eurex.

B)Philadelphia Exchange and AMEX.

C)NYSE and ABS.

D)CME and Pacific Exchange.

E)D-Trade and IMM.

A)CME Globex and Eurex.

B)Philadelphia Exchange and AMEX.

C)NYSE and ABS.

D)CME and Pacific Exchange.

E)D-Trade and IMM.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

46

A stock is priced at $27. An American call option on this stock with a $25 strike must be worth at least how much? Numerically show why.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

47

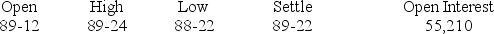

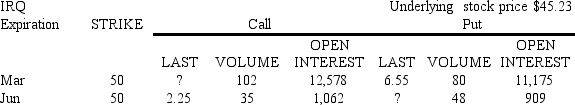

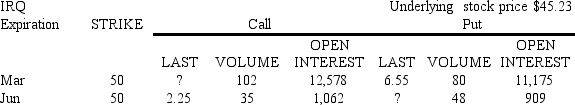

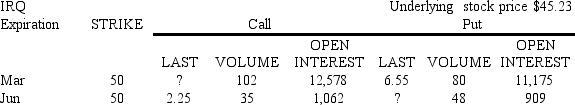

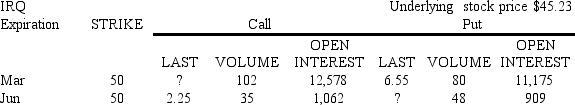

Refer to the Listed Stock Option Price Quote from February and assume it is now January:

Based on the option quote,the June put should cost

I. more than $477.

II. more than $665.

III. more than the March and June 60 calls.

IV. more than the March 60 call but no more than the June 60 call.

A)I only

B)I,II,and IV only

C)I,II,and III only

D)I and III only

E)IV only

Based on the option quote,the June put should cost

I. more than $477.

II. more than $665.

III. more than the March and June 60 calls.

IV. more than the March 60 call but no more than the June 60 call.

A)I only

B)I,II,and IV only

C)I,II,and III only

D)I and III only

E)IV only

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

48

Your firm enters into a swap agreement with a notional principal of $40 million wherein the firm pays a fixed rate of interest of 5.50 percent and receives a variable rate of interest equal to LIBOR plus 150 basis points. If LIBOR is currently 3.75 percent,the NET amount your firm will receive (+)or pay (−)on the next transaction date is

A)− $2,200,000.

B)$2,625,000.

C)$125,000.

D)− $100,000.

E)− $875,000.

A)− $2,200,000.

B)$2,625,000.

C)$125,000.

D)− $100,000.

E)− $875,000.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

49

Refer to the Listed Stock Option Price Quote from February and assume it is now January:

If you buy the March put and don't exercise before contract maturity,you will make a profit if the stock price at maturity ________ from today's price.

A)increases by more than 9.65 percent

B)increases by more than 4.57 percent

C)decreases by more than 3.94 percent

D)decreases by more than 11.99 percent

E)does not decrease by more than 5.64 percent

If you buy the March put and don't exercise before contract maturity,you will make a profit if the stock price at maturity ________ from today's price.

A)increases by more than 9.65 percent

B)increases by more than 4.57 percent

C)decreases by more than 3.94 percent

D)decreases by more than 11.99 percent

E)does not decrease by more than 5.64 percent

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

50

What determines the success or failure of an exchange-traded derivative contract? Why were currency and interest rate futures introduced in the early and late 1970s,respectively?

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

51

A bank lender is concerned about the creditworthiness of one of its major borrowers. The bank is considering using a swap to reduce its credit exposure to this customer. Which type of swap would best meet this need?

A)Interest rate swap

B)Currency swap

C)Equity linked swap

D)Credit default swap

E)DIF swap

A)Interest rate swap

B)Currency swap

C)Equity linked swap

D)Credit default swap

E)DIF swap

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

52

Refer to the Listed Stock Option Price Quote from February and assume it is now January:

Based on the option quote,the March call should cost

A)more than $477.

B)more than $102.

C)less than $665 but more than $477.

D)less than $225.

E)$0.

Based on the option quote,the March call should cost

A)more than $477.

B)more than $102.

C)less than $665 but more than $477.

D)less than $225.

E)$0.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

53

The type of swap most closely linked to the subprime mortgage crisis is the ________.

A)interest rate swap

B)currency swap

C)equity linked swap

D)credit default swap

E)DIF swap

A)interest rate swap

B)currency swap

C)equity linked swap

D)credit default swap

E)DIF swap

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

54

A U.S. firm has a European subsidiary that earns euros. The subsidiary has borrowed dollars at a floating rate of interest. What kind of risk does the subsidiary have? What kind of swap could be used to limit the subsidiary's risk? Be specific.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

55

A contract wherein the buyer agrees to pay a specified interest rate on a loan that will be originated at some future time is called a(n)

A)forward rate agreement.

B)futures loan.

C)option on a futures contract.

D)interest rate swap contract.

E)currency swap contract.

A)forward rate agreement.

B)futures loan.

C)option on a futures contract.

D)interest rate swap contract.

E)currency swap contract.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

56

FNMA has direct holdings of 30-year fixed-rate mortgages financed by three- to five-year agency securities sold to the public.

What kind of interest rate option could FNMA use to limit the interest rate risk? Explain how this would work. Explain how a collar could also be used.

What kind of interest rate option could FNMA use to limit the interest rate risk? Explain how this would work. Explain how a collar could also be used.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

57

When would a forward contract be better for hedging than a futures contract?

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

58

Using the Black-Scholes model,explain what happens to the value of a call as S,T,and σ2 change. Why is the relationship between risk and price different for options than for other securities?

1. As S increases,C (the call premium)increases because the right to buy at the fixed price E has more value as the sale price S rises.

2. As T increases,C increases and as T decreases,C decreases. The less time remaining on the option,the lower its value since there is less time during which the option right is available.

3. As σ increases,C increases.

1. As S increases,C (the call premium)increases because the right to buy at the fixed price E has more value as the sale price S rises.

2. As T increases,C increases and as T decreases,C decreases. The less time remaining on the option,the lower its value since there is less time during which the option right is available.

3. As σ increases,C increases.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

59

Buying an "at-the-money" call option and writing an "at-the-money" put option are two ways to make money when prices rise. When would each be the preferable strategy?

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

60

When might an option on a futures contract be preferable to an option on the underlying instrument?

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

61

A stock is priced at $33.25. The stock has call options with an exercise price of $35 that expire in 60 days. The underlying stock price volatility is 39 percent per year and the annual risk-free rate is 4.5 percent. According to the Black-Scholes option pricing model,what is the most you should be willing to pay for this call option? ![A stock is priced at $33.25. The stock has call options with an exercise price of $35 that expire in 60 days. The underlying stock price volatility is 39 percent per year and the annual risk-free rate is 4.5 percent. According to the Black-Scholes option pricing model,what is the most you should be willing to pay for this call option? Using the Normsdist function in Excel to find N(dx) C0 = ($33.25 × 0.42131)- [$35e−0.045(60/365)× 0.3607]= $1.4781 or $147.81 per contract](https://storage.examlex.com/TB6854/11eaae25_5e9a_399d_87fe_35dbef923df8_TB6854_00.jpg)

![A stock is priced at $33.25. The stock has call options with an exercise price of $35 that expire in 60 days. The underlying stock price volatility is 39 percent per year and the annual risk-free rate is 4.5 percent. According to the Black-Scholes option pricing model,what is the most you should be willing to pay for this call option? Using the Normsdist function in Excel to find N(dx) C0 = ($33.25 × 0.42131)- [$35e−0.045(60/365)× 0.3607]= $1.4781 or $147.81 per contract](https://storage.examlex.com/TB6854/11eaae25_5e9a_399e_87fe_3f68b596a610_TB6854_00.jpg)

Using the Normsdist function in Excel to find N(dx)

C0 = ($33.25 × 0.42131)- [$35e−0.045(60/365)× 0.3607]= $1.4781 or $147.81 per contract

![A stock is priced at $33.25. The stock has call options with an exercise price of $35 that expire in 60 days. The underlying stock price volatility is 39 percent per year and the annual risk-free rate is 4.5 percent. According to the Black-Scholes option pricing model,what is the most you should be willing to pay for this call option? Using the Normsdist function in Excel to find N(dx) C0 = ($33.25 × 0.42131)- [$35e−0.045(60/365)× 0.3607]= $1.4781 or $147.81 per contract](https://storage.examlex.com/TB6854/11eaae25_5e9a_399d_87fe_35dbef923df8_TB6854_00.jpg)

![A stock is priced at $33.25. The stock has call options with an exercise price of $35 that expire in 60 days. The underlying stock price volatility is 39 percent per year and the annual risk-free rate is 4.5 percent. According to the Black-Scholes option pricing model,what is the most you should be willing to pay for this call option? Using the Normsdist function in Excel to find N(dx) C0 = ($33.25 × 0.42131)- [$35e−0.045(60/365)× 0.3607]= $1.4781 or $147.81 per contract](https://storage.examlex.com/TB6854/11eaae25_5e9a_399e_87fe_3f68b596a610_TB6854_00.jpg)

Using the Normsdist function in Excel to find N(dx)

C0 = ($33.25 × 0.42131)- [$35e−0.045(60/365)× 0.3607]= $1.4781 or $147.81 per contract

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck