Deck 18: Receivables

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

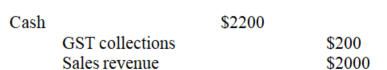

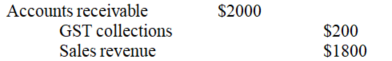

Question

Question

Question

Question

Question

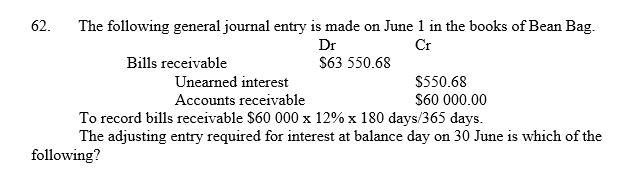

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/65

Play

Full screen (f)

Deck 18: Receivables

1

The main problem that exists in valuing accounts receivables is:

A) keeping track of the amount that is owed by individual debtors.

B) estimating the amount of receivables that will become bad.

C) making adjustments for goods returned.

D) reconciling the debtor's control account with the debtor's subsidiary ledger.

A) keeping track of the amount that is owed by individual debtors.

B) estimating the amount of receivables that will become bad.

C) making adjustments for goods returned.

D) reconciling the debtor's control account with the debtor's subsidiary ledger.

B

2

After writing off bad debts of $1400 the allowance for doubtful debts account balance was $800 credit. What is the correct general journal entry to record an adjustment to bring the allowance for doubtful debts to 10% of accounts receivable of $20 000?

A) Debit bad debts expense $1200; credit allowance for doubtful debts $1200

B) Debit allowance for doubtful debts $1200; credit bad debts expense $1200

C) Debit bad debts expense $1200; credit accounts receivable $1200

D) Debit allowance for doubtful debts $1200; credit accounts receivable $1200

A) Debit bad debts expense $1200; credit allowance for doubtful debts $1200

B) Debit allowance for doubtful debts $1200; credit bad debts expense $1200

C) Debit bad debts expense $1200; credit accounts receivable $1200

D) Debit allowance for doubtful debts $1200; credit accounts receivable $1200

A

3

Allowing customers to buy on credit is only profitable if the costs associated with granting credit are less than the profit on the increased sales generated. Which of the following is not one of the additional costs of selling on credit?

A) Credit checks on customers

B) Additional record keeping

C) Sales commission

D) The cost of collecting outstanding debts

A) Credit checks on customers

B) Additional record keeping

C) Sales commission

D) The cost of collecting outstanding debts

C

4

Which of these is not one of the ways in which the asset 'other receivables' could arise?

A) Loan to director

B) Sale of non-current asset on credit

C) Rent receivable

D) Accrued wages

A) Loan to director

B) Sale of non-current asset on credit

C) Rent receivable

D) Accrued wages

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

5

Which statement regarding the direct write-off method of bad debts is untrue?

A) No estimate is made of future bad debts.

B) Bad debts are written off when they are determined to be uncollectable.

C) Its use is justified on the basis of simplicity.

D) Bad debts are matched against the related sales revenue.

A) No estimate is made of future bad debts.

B) Bad debts are written off when they are determined to be uncollectable.

C) Its use is justified on the basis of simplicity.

D) Bad debts are matched against the related sales revenue.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

6

Under the income statement method of estimating debts likely to be bad:

A) a percentage, based on past experience, is applied to profit.

B) accounts receivable are 'aged' to establish likely bad debts.

C) a percentage, based on past experience, is applied to credit sales.

D) an estimate of bad debts is made by the accountant.

A) a percentage, based on past experience, is applied to profit.

B) accounts receivable are 'aged' to establish likely bad debts.

C) a percentage, based on past experience, is applied to credit sales.

D) an estimate of bad debts is made by the accountant.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

7

When a credit sale involving GST is recorded, the sales account:

A) has the GST deducted.

B) is input taxed.

C) includes the GST.

D) does not include the GST.

A) has the GST deducted.

B) is input taxed.

C) includes the GST.

D) does not include the GST.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

8

Amaad Company calculated that this year's estimated bad debts expense will be $7500. When the necessary adjusting entry is made what effect will it have on the following accounts? Bad debts expense: allowance for doubtful debts: gross accounts receivable.

A) No effect: increase: decrease.

B) No effect: decrease: increase.

C) Increase: increase: no effect.

D) Increase: increase: increase.

A) No effect: increase: decrease.

B) No effect: decrease: increase.

C) Increase: increase: no effect.

D) Increase: increase: increase.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

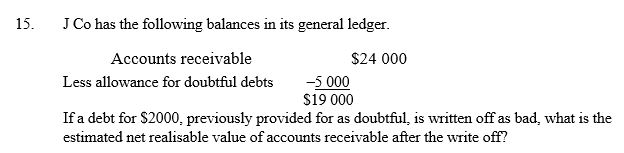

9

A) $21 000

B) $17 000

C) $19 000

D) $22 000

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

10

Which statement is incorrect?

A) If a debtor fails to pay the receivable on its due date this means that the debt is bad.

B) An outstanding debt may be turned over to a collection agency.

C) Bad debts should be deducted as an expense in the same accounting period in which the credit sale is recognised.

D) Bad debts are a cost of selling on credit.

A) If a debtor fails to pay the receivable on its due date this means that the debt is bad.

B) An outstanding debt may be turned over to a collection agency.

C) Bad debts should be deducted as an expense in the same accounting period in which the credit sale is recognised.

D) Bad debts are a cost of selling on credit.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

11

When a credit sale involving GST is recorded the accounts receivable account:

A) includes the GST.

B) does not include the GST.

C) has the GST deducted.

D) is input taxed.

A) includes the GST.

B) does not include the GST.

C) has the GST deducted.

D) is input taxed.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

12

The valuation of accounts receivables at gross receivables less anticipated future bad debts is known as:

A) expected value.

B) fair value.

C) discounted value.

D) estimated value.

A) expected value.

B) fair value.

C) discounted value.

D) estimated value.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

13

How is accounts receivable usually valued in the balance sheet?

A) Historical cost

B) Market value

C) Gross amount less allowance for expected bad debts

D) The lower of cost and net realisable value

A) Historical cost

B) Market value

C) Gross amount less allowance for expected bad debts

D) The lower of cost and net realisable value

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

14

Which of these would not be classified as 'other receivables'?

A) Loans to directors

B) Interest receivable

C) Amounts receivable from the sale of non-current assets

D) Income owing from a credit sale

A) Loans to directors

B) Interest receivable

C) Amounts receivable from the sale of non-current assets

D) Income owing from a credit sale

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

15

If no adjustment is made for doubtful debts, assets are:

A) overstated and profit is understated.

B) understated and profit is overstated.

C) overstated and profit is overstated.

D) understated and profit is understated.

A) overstated and profit is understated.

B) understated and profit is overstated.

C) overstated and profit is overstated.

D) understated and profit is understated.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

16

Nugyen recorded sales of $280 000 during the year. Of these, $180 000 were on credit. Bad debts in the past have averaged 1% of credit sales. Using the income statement method, the amount to provide for estimated bad debt expense for the year is:

A) nil.

B) $180.

C) $2800.

D) $1800.

A) nil.

B) $180.

C) $2800.

D) $1800.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

17

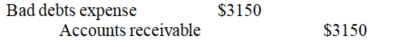

When the direct write off method is used, what is the general journal entry to write off bad debts?

A) Debit allowance for doubtful debts; credit accounts receivable

B) Debit bad debts expense; credit accounts receivable

C) Debit accounts receivable; credit bad debts expense

D) Debit accounts receivable; credit allowance for doubtful debts

A) Debit allowance for doubtful debts; credit accounts receivable

B) Debit bad debts expense; credit accounts receivable

C) Debit accounts receivable; credit bad debts expense

D) Debit accounts receivable; credit allowance for doubtful debts

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

18

The allowance for doubtful debts account had a balance of $2200 before bad debts of $1400 were written off and the allowance was adjusted to 10% of the accounts receivable balance of $20 000. The new amount of allowance for doubtful debts that is deducted from accounts receivable in the balance sheet is:

A) $1400.

B) $2000.

C) $1200.

D) $2200.

A) $1400.

B) $2000.

C) $1200.

D) $2200.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

19

Christo uses the allowance method of accounting for bad and doubtful debts. When he received notice that Debtor 3459, who owed him $10 000, was in liquidation he decided to write off the debt as bad. What is the general journal entry to record the write off?

A) Debit bad debts expense $10 000; credit allowance for doubtful debts $10 000

B) Debit allowance for doubtful debts $10 000; credit accounts receivable $10 000

C) Debit bad debts expense $10 000; credit accounts receivable $10 000

D) Debit allowance for doubtful debts $10 000; credit bad debts expense $10 000

A) Debit bad debts expense $10 000; credit allowance for doubtful debts $10 000

B) Debit allowance for doubtful debts $10 000; credit accounts receivable $10 000

C) Debit bad debts expense $10 000; credit accounts receivable $10 000

D) Debit allowance for doubtful debts $10 000; credit bad debts expense $10 000

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

20

The text classifies accounts receivables into several broad types. What are they?

A) Accounts receivable, bills receivable, other receivables

B) Debtors, accounts receivables, promissory notes

C) Trade debtors, other debtors, sundry debtors

D) Promissory notes, accounts receivable, prepayments

A) Accounts receivable, bills receivable, other receivables

B) Debtors, accounts receivables, promissory notes

C) Trade debtors, other debtors, sundry debtors

D) Promissory notes, accounts receivable, prepayments

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

21

Which of these indicates an improvement in the management of accounts receivable?

A) An extension of the time taken to collect debts to beyond the normal credit period.

B) A increase in the average collection time for accounts receivable.

C) A change in the average collection period from 36 days to 39 days.

D) A change in the number of times debtors are turned over per year from 10.29 times to 11.61 times.

A) An extension of the time taken to collect debts to beyond the normal credit period.

B) A increase in the average collection time for accounts receivable.

C) A change in the average collection period from 36 days to 39 days.

D) A change in the number of times debtors are turned over per year from 10.29 times to 11.61 times.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

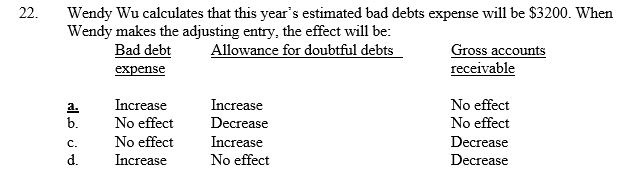

22

The allowance for doubtful debts account has a balance at the start of the year of $1000. At the end of the year debts of $990, including $90 GST, are to be written off and the allowance for doubtful debts is to be adjusted to 10% of the closing accounts receivable balance of $22 000 (including $2000 GST). The amount for bad and doubtful debts appearing in the income statement for the year will be:

A) $2000.

B) $1900.

C) $2100.

D) $2200.

A) $2000.

B) $1900.

C) $2100.

D) $2200.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

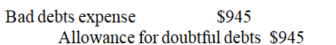

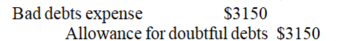

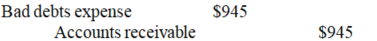

23

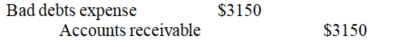

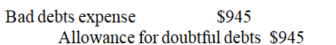

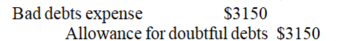

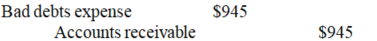

Cartoon Capers recorded sales of $210 000 during the year (net of GST). Of these, 30% were on credit. Bad debts have averaged 1½% of credit sales. The entry to estimate bad debt expense for the year is which of the following?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

24

Girlpower Co has the following balances in its general ledger.

Accounts receivable $57 000

Less allowance for doubtful debts 3000

$54 000

If a debt for $900, previously provided for as doubtful, is written off as bad, what is the estimated net realisable value of accounts receivable after the write off?

A) $54 000

B) $54 900

C) $53 100

D) $56 100

Accounts receivable $57 000

Less allowance for doubtful debts 3000

$54 000

If a debt for $900, previously provided for as doubtful, is written off as bad, what is the estimated net realisable value of accounts receivable after the write off?

A) $54 000

B) $54 900

C) $53 100

D) $56 100

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

25

Which statement concerning the allowance for doubtful debts account is not true?

A) Allowance for doubtful debts is used to adjust receivables for estimated bad debts because individual debtor's balances cannot be removed from the ledger unless there is indisputable evidence they are bad.

B) Allowance for doubtful debts is a contra-asset account designed to reduce receivables to estimated realisable value.

C) Allowance for doubtful debts represents cash set aside to cover losses incurred as a consequence of customers being declared bankrupt.

D) Allowance for doubtful debts normally has a credit balance.

A) Allowance for doubtful debts is used to adjust receivables for estimated bad debts because individual debtor's balances cannot be removed from the ledger unless there is indisputable evidence they are bad.

B) Allowance for doubtful debts is a contra-asset account designed to reduce receivables to estimated realisable value.

C) Allowance for doubtful debts represents cash set aside to cover losses incurred as a consequence of customers being declared bankrupt.

D) Allowance for doubtful debts normally has a credit balance.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

26

How many of these are internal controls relating to accounts receivable?

Sending monthly statements of account to customers.

Reviewing slow paying accounts.

Regular reconciliation of the debtors control account and the subsidiary ledger.

Restricting access to the debtor's records.

Allowing debtors discount for early settlement.

A) 2

B) 3

C) 4

D) 5

Sending monthly statements of account to customers.

Reviewing slow paying accounts.

Regular reconciliation of the debtors control account and the subsidiary ledger.

Restricting access to the debtor's records.

Allowing debtors discount for early settlement.

A) 2

B) 3

C) 4

D) 5

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following is the general journal entry to provide for estimated bad debts under the allowance method?

A) Debit allowance for doubtful debts; credit bad debts expense

B) Debit bad debts expense; credit allowance for doubtful debts

C) Debit accounts receivable; credit bad debts expense

D) Debit bad debts expense; credit accounts receivable

A) Debit allowance for doubtful debts; credit bad debts expense

B) Debit bad debts expense; credit allowance for doubtful debts

C) Debit accounts receivable; credit bad debts expense

D) Debit bad debts expense; credit accounts receivable

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

28

It is not true that:

A) if the firm is too generous in extending credit bad debts will occur.

B) if credit policies are too strict valuable customers may be lost.

C) a credit report from a credit rating agency is an important method of checking on customer's credit history.

D) generally firms offer too much credit to customers.

A) if the firm is too generous in extending credit bad debts will occur.

B) if credit policies are too strict valuable customers may be lost.

C) a credit report from a credit rating agency is an important method of checking on customer's credit history.

D) generally firms offer too much credit to customers.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

29

The major issuers of credit cards in Australia are banks but there are also some credit cards that are issued by non-bank organisations. Which of the following is not a credit card issued by a bank?

A) Visa

B) American Express

C) Bankcard

D) MasterCard

A) Visa

B) American Express

C) Bankcard

D) MasterCard

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

30

Which statement is not true in relation to bad debts recovered?

A) The accounts receivable should be re-established to maintain a complete history of the customer's activity and restore their credit rating.

B) The entry to reinstate the accounts receivable is debit accounts receivable and credit bad debts recovered.

C) The entry made following reinstatement of the account receivable to record the recovery is debit bad debts recovered and credit accounts receivable.

D) The recovery is recorded by effectively reversing the entry originally made to write off the receivable.

A) The accounts receivable should be re-established to maintain a complete history of the customer's activity and restore their credit rating.

B) The entry to reinstate the accounts receivable is debit accounts receivable and credit bad debts recovered.

C) The entry made following reinstatement of the account receivable to record the recovery is debit bad debts recovered and credit accounts receivable.

D) The recovery is recorded by effectively reversing the entry originally made to write off the receivable.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

31

How many of these are an issue in a firm's management of its accounts receivable?

Deciding which customers to offer credit to.

Minimising the costs of carrying accounts receivables.

Following up slow paying customers.

A) 0

B) 1

C) 2

D) 3

Deciding which customers to offer credit to.

Minimising the costs of carrying accounts receivables.

Following up slow paying customers.

A) 0

B) 1

C) 2

D) 3

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

32

While reviewing the books of Edberg Pest Control Service you discover that no adjusting entry was made for estimated bad debts traceable to sales in 2014 (the company's first year of operation). Assuming this error is not corrected, which of the following is true at year-end 2014?

A) Assets are understated, profit is overstated

B) Liabilities are overstated, profit is understated

C) Assets are correct, profit is overstated

D) Assets are overstated, profit is overstated

A) Assets are understated, profit is overstated

B) Liabilities are overstated, profit is understated

C) Assets are correct, profit is overstated

D) Assets are overstated, profit is overstated

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

33

In managing accounts receivable the term 'factoring' relates to:

A) calculating the amount of bad debts expense.

B) ageing the receivables.

C) selling the accounts receivable to a business that will then collect the debts.

D) the proportion of debts expected to become bad.

A) calculating the amount of bad debts expense.

B) ageing the receivables.

C) selling the accounts receivable to a business that will then collect the debts.

D) the proportion of debts expected to become bad.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

34

For M Ltd the general journal entry for a sale of $3300, including GST, paid for by the customer with a bank issued credit card, is which of the following?

A) Debit bank $3300; credit sales $3000; credit GST collected $300

B) Debit bank $3000; debit GST collected $300; credit sales $3300

C) Debit bank $3300; credit sales $3300

D) Debit accounts receivable $3300; credit sales $3000; credit GST collected $300

A) Debit bank $3300; credit sales $3000; credit GST collected $300

B) Debit bank $3000; debit GST collected $300; credit sales $3300

C) Debit bank $3300; credit sales $3300

D) Debit accounts receivable $3300; credit sales $3000; credit GST collected $300

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

35

In relation to the direct write-off method of accounting for bad debts, it is not true that:

A) bad debts are charged as an expense at the time an account is determined to be uncollectable.

B) the entry to write off bad debts is debit bad debts expense, debit GST collected, credit accounts receivable.

C) there is no contra asset account for estimated doubtful debts.

D) bad debts expense is recorded in the same period in which its related sales revenue is included as income.

A) bad debts are charged as an expense at the time an account is determined to be uncollectable.

B) the entry to write off bad debts is debit bad debts expense, debit GST collected, credit accounts receivable.

C) there is no contra asset account for estimated doubtful debts.

D) bad debts expense is recorded in the same period in which its related sales revenue is included as income.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

36

Following are the balances for Grocke Ltd at 12 December.

Accounts receivable $39 420

Allowance for doubtful debts 1301 $38 119

If an account for $600 is written off on 15 April, what is the estimated realisable value of accounts receivable after the write-off? (Ignore any GST adjustment for the purposes of this question.)

A) $38 820

B) $38 119

C) $40 020

D) $37 519

Accounts receivable $39 420

Allowance for doubtful debts 1301 $38 119

If an account for $600 is written off on 15 April, what is the estimated realisable value of accounts receivable after the write-off? (Ignore any GST adjustment for the purposes of this question.)

A) $38 820

B) $38 119

C) $40 020

D) $37 519

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

37

Why should an accounts receivable be re-established if it has previously been written-off but is later collected in full?

A) So that the debits equal the credits.

B) To restore the credit rating of the debtor.

C) So that assets are not understated.

D) So that expenses are not overstated.

A) So that the debits equal the credits.

B) To restore the credit rating of the debtor.

C) So that assets are not understated.

D) So that expenses are not overstated.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

38

On 31 December 2014 Mayo Resources decided that it needed finally to write off as a bad debt a receivable of $4400 (including $400 GST) from Jayne Pty Ltd (in liquidation). If Mayo Resources uses the allowance method, the entry to achieve the write off is which of the following?

A) Debit bad debts expense $4400; credit GST collections $400; credit accounts receivable $4000

B) Debit allowance for doubtful debts $4000; credit bad debts expense $4000

C) Debit bad debts expense $4400; credit accounts receivable $4400

D) Debit allowance for doubtful debts $4000, debit GST collections $400; credit accounts receivable $4400

A) Debit bad debts expense $4400; credit GST collections $400; credit accounts receivable $4000

B) Debit allowance for doubtful debts $4000; credit bad debts expense $4000

C) Debit bad debts expense $4400; credit accounts receivable $4400

D) Debit allowance for doubtful debts $4000, debit GST collections $400; credit accounts receivable $4400

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

39

The measure to reduce bad debts that is undertaken before the debt occurs is:

A) a credit check.

B) a reminder notice.

C) use of a debt collector.

D) issue of a monthly statement to the debtor.

A) a credit check.

B) a reminder notice.

C) use of a debt collector.

D) issue of a monthly statement to the debtor.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

40

A) Increase Increase No effect

B) No effect Decrease No effect

C) No effect Increase Decrease

D) Increase No effect Decrease

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

41

Bills receivable are classified as ________________ in the balance sheet.

A) liabilities

B) assets

C) negative assets

D) equity

A) liabilities

B) assets

C) negative assets

D) equity

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

42

A bill of exchange which represents the right to receive cash in the future is a:

A) bills payable.

B) bills receivable.

C) sundry debtor.

D) credit card.

A) bills payable.

B) bills receivable.

C) sundry debtor.

D) credit card.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

43

Which of these is the most likely way a bills receivable would be settled?

A) Passed on or negotiated to a third party

B) The full value received at maturity

C) The full value received before the due date

D) Cashed at a bank before its due date (discounted)

A) Passed on or negotiated to a third party

B) The full value received at maturity

C) The full value received before the due date

D) Cashed at a bank before its due date (discounted)

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

44

A debit card (EFPTOS) sale is essentially recorded by the seller:

A) as a credit sale.

B) as a cash sale.

C) as a bills receivable.

D) as a bills payable.

A) as a credit sale.

B) as a cash sale.

C) as a bills receivable.

D) as a bills payable.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

45

L was given a bills receivable by K. The bill could have been issued for which one of the following purposes?

A) To pay off L's debt to K.

B) To extend the period of repayment of a debt owing by K to L.

C) To finance the purchase of a fixed asset by L.

D) To borrow money from K.

A) To pay off L's debt to K.

B) To extend the period of repayment of a debt owing by K to L.

C) To finance the purchase of a fixed asset by L.

D) To borrow money from K.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

46

If a 60 days bills receivable was written on 15 February 2013 the maturity date is:

A) 16 April 2013.

B) 15 April 2013.

C) 14 April 2013.

D) 13 April 2013.

A) 16 April 2013.

B) 15 April 2013.

C) 14 April 2013.

D) 13 April 2013.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

47

Which statement concerning bank issued credit card fees (merchant fees) is untrue?

A) They are calculated by the bank once a month.

B) They are calculated as a flat charge regardless of sales.

C) They are recorded by the firm as a debit to the merchant fees expense account and a credit to bank.

D) Credit card fees are subject to GST.

A) They are calculated by the bank once a month.

B) They are calculated as a flat charge regardless of sales.

C) They are recorded by the firm as a debit to the merchant fees expense account and a credit to bank.

D) Credit card fees are subject to GST.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

48

What is the formula for calculating the average collection period for accounts receivable in days?

A) Average receivables/net credit sales

B) Net credit sales/average receivables

C) 365/average receivables

D) Average receivables x 365/net credit sales

A) Average receivables/net credit sales

B) Net credit sales/average receivables

C) 365/average receivables

D) Average receivables x 365/net credit sales

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

49

How many of these are internal controls relating to accounts receivable?

Bad debts write-offs are authorised by a responsible officer.

All cash receipts are stored in a locked safe.

Monthly statements of account are sent to customers.

A) None

B) One

C) Two

D) Three

Bad debts write-offs are authorised by a responsible officer.

All cash receipts are stored in a locked safe.

Monthly statements of account are sent to customers.

A) None

B) One

C) Two

D) Three

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

50

Which statement concerning the receivables turnover ratio is true?

A) It is calculated as total sales divided by average receivables.

B) A change in the ratio from 3.1 times to 2.8 times is a favourable change.

C) If the receivables turnover ratio is divided into 365 this gives the average number of days it takes to sell receivables.

D) It is a measure of how many times the average receivables balance is converted into cash in a year.

A) It is calculated as total sales divided by average receivables.

B) A change in the ratio from 3.1 times to 2.8 times is a favourable change.

C) If the receivables turnover ratio is divided into 365 this gives the average number of days it takes to sell receivables.

D) It is a measure of how many times the average receivables balance is converted into cash in a year.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

51

Which of these is not a reason a business would be prepared to accept a bill of exchange in settlement of a debt?

A) If a legal dispute arises the bill represents a legal, written acknowledgment of the debt and its amount.

B) Because a bill of exchange has government backing.

C) A bill is interest-bearing and thereby produces interest for the business granting credit.

D) A bill is more easily converted into cash than accounts receivable.

A) If a legal dispute arises the bill represents a legal, written acknowledgment of the debt and its amount.

B) Because a bill of exchange has government backing.

C) A bill is interest-bearing and thereby produces interest for the business granting credit.

D) A bill is more easily converted into cash than accounts receivable.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

52

Xi Co has a bills receivable for $3089 given in settlement of a debt. The value of the bill is made up of principal of $3000 and interest of $89. When the note is paid, at the end of its 90 day term, Xi Co's bank is debited with $ _____ and bills receivable is credited with $3089.

A) $3000

B) $3089

C) $2911

D) $3200

A) $3000

B) $3089

C) $2911

D) $3200

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

53

A bill of exchange which represents the right to receive cash in the future is a:

A) bill payable.

B) bill receivable.

C) sundry debtor.

D) credit card.

A) bill payable.

B) bill receivable.

C) sundry debtor.

D) credit card.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

54

The untrue statement concerning the factoring of accounts receivable is which of the following?

A) Businesses rarely factor their accounts receivable.

B) A disadvantage of factoring can be its high cost.

C) Credit cards are a form of factoring (i.e. the credit card firm specialises in the collection of accounts receivable).

D) A typical journal entry to record the sale of accounts receivable is Dr bank; Dr factoring charge expense; Cr accounts receivable control.

A) Businesses rarely factor their accounts receivable.

B) A disadvantage of factoring can be its high cost.

C) Credit cards are a form of factoring (i.e. the credit card firm specialises in the collection of accounts receivable).

D) A typical journal entry to record the sale of accounts receivable is Dr bank; Dr factoring charge expense; Cr accounts receivable control.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

55

The selling of accounts receivable as a means of quickly raising cash, minimising debt collecting expenses and minimising bad debt losses is known as:

A) ageing of debtors.

B) debt factoring.

C) debt diversion.

D) transfer pricing.

A) ageing of debtors.

B) debt factoring.

C) debt diversion.

D) transfer pricing.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

56

In calculating the discount on a bill of exchange, the discount rate is applied to what?

A) The maturity value of the bill for the period it is held by the discounter.

B) The principal for the period it is held by the discounter.

C) The face value.

D) The interest for the period it is held by the discounter.

A) The maturity value of the bill for the period it is held by the discounter.

B) The principal for the period it is held by the discounter.

C) The face value.

D) The interest for the period it is held by the discounter.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

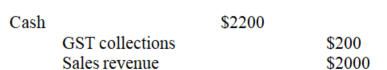

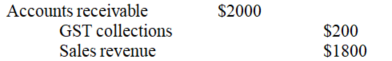

57

Smith’s Pie Shop had bank issued credit card sales of $2200 including GST. Which of the following is the entry to record the sales?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

58

Which statement concerning the accounting treatment of bank issued credit card sales is true?

A) The treatment of bank issued credit card sales is the same as the treatment of non-bank issued credit card sales.

B) A 'merchant fee' for the month's sales is debited to the firm's bank statement at month-end.

C) The business does not retain a copy of the transaction slip.

D) The sale is recorded like a credit sale in the books of the seller.

A) The treatment of bank issued credit card sales is the same as the treatment of non-bank issued credit card sales.

B) A 'merchant fee' for the month's sales is debited to the firm's bank statement at month-end.

C) The business does not retain a copy of the transaction slip.

D) The sale is recorded like a credit sale in the books of the seller.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

59

Milan Tyers has an account receivable for $18 000 from Sunderland Ltd that is overdue. Sunderland requests a 60-day extension of the payment date and Cheung Ltd agrees by accepting a fixed 60-day, 14% promissory note in exchange for the accounts receivable. Which of the following is the entry Milan Tyers makes on receipt of the note?

A) Debit accounts receivable $18 000; debit unearned interest $414.25; credit bills receivable $18 414.25

B) Debit bills receivable $18 414.25; credit accounts receivable $15 000; credit unearned interest $414.25

C) Debit bills receivable $18 000; credit accounts receivable $18 000

D) Debit bills receivable $18 414.25; credit accounts receivable $18 000; credit interest revenue $414.25

A) Debit accounts receivable $18 000; debit unearned interest $414.25; credit bills receivable $18 414.25

B) Debit bills receivable $18 414.25; credit accounts receivable $15 000; credit unearned interest $414.25

C) Debit bills receivable $18 000; credit accounts receivable $18 000

D) Debit bills receivable $18 414.25; credit accounts receivable $18 000; credit interest revenue $414.25

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

60

Milan Tyers has an account receivable for $18 000 from Sunderland Ltd that is overdue. Sunderland requests a 60-day extension of the payment date and Milan Tyers agrees by accepting a fixed 60-day, 14% promissory note in exchange for the accounts receivable. Milan Tyers makes which entry to record the collection of the promissory note from Sunderland including interest?

A) Debit cash $18 414.25; debit unearned interest $414.25; credit bills receivable $18 414.25, credit interest revenue $414.25

B) Debit cash $18 414.25; credit accounts receivable $18 414.25

C) Debit cash $18 414.25; credit bills receivable $18 414.25

D) Debit cash $18 414.25; credit bills receivable $18 000; credit interest revenue $414.25

A) Debit cash $18 414.25; debit unearned interest $414.25; credit bills receivable $18 414.25, credit interest revenue $414.25

B) Debit cash $18 414.25; credit accounts receivable $18 414.25

C) Debit cash $18 414.25; credit bills receivable $18 414.25

D) Debit cash $18 414.25; credit bills receivable $18 000; credit interest revenue $414.25

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

61

A) Debit unearned interest $591.78; credit interest revenue $591.78

B) Debit interest revenue $591.78; credit unearned interest $591.78

C) Debit unearned interest $591.78; credit bills receivable $591.78

D) Debit bank $591.78; credit interest revenue $591.78

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

62

In calculating the discount on a bill of exchange the discount rate is applied to what?

A) The maturity value of the bill for the period it is held by the discounter.

B) The principal for the period it is held by the discounter.

C) The face value.

D) The interest for the period it is held by the discounter.

A) The maturity value of the bill for the period it is held by the discounter.

B) The principal for the period it is held by the discounter.

C) The face value.

D) The interest for the period it is held by the discounter.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

63

If Yorkshire Ltd issued a 90 day promissory note for $60 000 at an agreed interest rate of 8% per annum, the amount of interest payable, to the nearest dollar, is:

A) $1184.

B) $4800.

C) $533.

D) unable to be calculated without more information.

A) $1184.

B) $4800.

C) $533.

D) unable to be calculated without more information.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

64

Which statement concerning discounting a bill receivable is incorrect?

A) To be discounted, before it matures, a bill receivable may be sold to a bank in exchange for cash.

B) In calculating the amount of discount on sale of the bill the discount rate is applied to its maturity value for the period it is held by the discounter.

C) One of the disadvantages of a bill of exchange is the relative difficulty with which it can be converted into cash.

D) The maturity value of the bill less the discount deducted by the bank is paid to the endorser of the bill by the bank.

A) To be discounted, before it matures, a bill receivable may be sold to a bank in exchange for cash.

B) In calculating the amount of discount on sale of the bill the discount rate is applied to its maturity value for the period it is held by the discounter.

C) One of the disadvantages of a bill of exchange is the relative difficulty with which it can be converted into cash.

D) The maturity value of the bill less the discount deducted by the bank is paid to the endorser of the bill by the bank.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

65

The maturity value of a bills receivable includes:

A) interest only.

B) principal only.

C) principal and interest.

D) principal and interest plus a bonus payment.

A) interest only.

B) principal only.

C) principal and interest.

D) principal and interest plus a bonus payment.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck