Deck 13: Performance Evaluation for Managers

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/65

Play

Full screen (f)

Deck 13: Performance Evaluation for Managers

1

A typical example of a direct cost for the marketing department is:

A) depreciation on the factory building.

B) marketing personnel's salaries.

C) building rent.

D) remuneration for the board of directors.

A) depreciation on the factory building.

B) marketing personnel's salaries.

C) building rent.

D) remuneration for the board of directors.

B

2

A deviation from a financial plan is called a(n):

A) departure.

B) variance.

C) allocation.

D) uncontrollable cost.

A) departure.

B) variance.

C) allocation.

D) uncontrollable cost.

B

3

X Company occupies one site and consists of Departments, T, S and Y. Which of these is an example of an indirect cost if Department T is the cost object?

A) Building rental

B) Salary of Department T manager

C) Commission of the sales persons for Department T

D) Stationery costs of Department T

A) Building rental

B) Salary of Department T manager

C) Commission of the sales persons for Department T

D) Stationery costs of Department T

A

4

Busy Beaver allocates advertising expenses to its two departments, A and B, on the basis of sales. For the current year the sales for department A are $800 000 and for department B $200 000 and total advertising expenses are $16 800. The amount allocated to the two departments is:

A) A $14 400: B $2400.

B) A $13 440: B $3360.

C) A $8400: B $8400.

D) A $12 600: B $4200.

A) A $14 400: B $2400.

B) A $13 440: B $3360.

C) A $8400: B $8400.

D) A $12 600: B $4200.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

5

Which of these factors is the least controllable by the department manager and therefore not his/her main focus of attention?

A) Number of units sold

B) Selling prices

C) Mix of products sold

D) Indirect operating expenses

A) Number of units sold

B) Selling prices

C) Mix of products sold

D) Indirect operating expenses

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

6

Costs that a manager can influence in the short term are called:

A) direct costs.

B) traceable costs.

C) controllable costs.

D) departmental costs.

A) direct costs.

B) traceable costs.

C) controllable costs.

D) departmental costs.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

7

Which of these departments would not be considered a service department in a restaurant business?

A) Human resources department

B) Accounting department

C) Security

D) Food preparation

A) Human resources department

B) Accounting department

C) Security

D) Food preparation

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

8

A projected cost for the future is called a:

A) budgeted cost.

B) fixed cost.

C) random cost.

D) period cost.

A) budgeted cost.

B) fixed cost.

C) random cost.

D) period cost.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

9

Match the following costs with their descriptions.

I) Controllable expenses a. Carefully predetermined costs

II) Standard costs b. Costs which are eliminated if a department is closed

III) Avoidable costs c. Expenses that cannot be directly traced to a cost object

IV) Indirect expenses d. Expenses which can be influenced by a manager

A) I:c, II:a, III:d, IV:b

B) I:d, II:a, III:b, IV:c

C) I:d, II:a, III:b, IV:c

D) I:a, II:d, III:b, IV:c

I) Controllable expenses a. Carefully predetermined costs

II) Standard costs b. Costs which are eliminated if a department is closed

III) Avoidable costs c. Expenses that cannot be directly traced to a cost object

IV) Indirect expenses d. Expenses which can be influenced by a manager

A) I:c, II:a, III:d, IV:b

B) I:d, II:a, III:b, IV:c

C) I:d, II:a, III:b, IV:c

D) I:a, II:d, III:b, IV:c

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

10

A variance is the difference between:

A) a standard cost and a budgeted cost.

B) an actual cost and a budgeted cost.

C) budgeted costs at two different points of time.

D) actual costs at two different points of time.

A) a standard cost and a budgeted cost.

B) an actual cost and a budgeted cost.

C) budgeted costs at two different points of time.

D) actual costs at two different points of time.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

11

A factor that is not involved in the calculation of departmental gross profit is:

A) the number of units sold.

B) selling price.

C) cost of sales.

D) selling and distribution expenses.

A) the number of units sold.

B) selling price.

C) cost of sales.

D) selling and distribution expenses.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

12

Which departmental report is not suitable for use for responsibility accounting purposes?

A) A report where a share of all the businesses expenses have been allocated to departments.

B) A report that the department manager has not participated in preparing.

C) A report that shows no significant variances.

D) A report that only includes costs controllable by the manager.

A) A report where a share of all the businesses expenses have been allocated to departments.

B) A report that the department manager has not participated in preparing.

C) A report that shows no significant variances.

D) A report that only includes costs controllable by the manager.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

13

Which accounting report is most commonly prepared for departmental reporting?

A) Cash flow statement

B) Statement of changes in equity

C) Income statement

D) Balance sheet

A) Cash flow statement

B) Statement of changes in equity

C) Income statement

D) Balance sheet

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

14

The item, department or job for which costs are accumulated is called a:

A) business department.

B) cost object.

C) business.

D) balanced scorecard.

A) business department.

B) cost object.

C) business.

D) balanced scorecard.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

15

Management by exception means:

A) only investigating variances that differ significantly from plan.

B) rewarding exceptional staff.

C) delegating responsibility.

D) understanding that exceptional circumstances may affect expected results.

A) only investigating variances that differ significantly from plan.

B) rewarding exceptional staff.

C) delegating responsibility.

D) understanding that exceptional circumstances may affect expected results.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

16

For a retailer departmental gross profit is calculated as:

A) departmental sales revenue, less cost of sales, less selling expenses allocated to the department.

B) departmental sales revenue, less cost of sales.

C) departmental sales revenue, less all expenses allocated to the department.

D) departmental sales revenue, less gross profit.

A) departmental sales revenue, less cost of sales, less selling expenses allocated to the department.

B) departmental sales revenue, less cost of sales.

C) departmental sales revenue, less all expenses allocated to the department.

D) departmental sales revenue, less gross profit.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

17

Which of these statements is not true? A responsibility accounting system:

A) recognises that expenses are the collective responsibility of the organisation.

B) requires managers to participate in the development of financial plans for their unit.

C) measures separately the performance of each manager's area of responsible.

D) holds managers responsible for costs and income over which they have control.

A) recognises that expenses are the collective responsibility of the organisation.

B) requires managers to participate in the development of financial plans for their unit.

C) measures separately the performance of each manager's area of responsible.

D) holds managers responsible for costs and income over which they have control.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

18

With a management by exception system:

A) significant unfavourable variances are investigated.

B) significant favourable variances are investigated.

C) significant variances are investigated.

D) all variances are investigated.

A) significant unfavourable variances are investigated.

B) significant favourable variances are investigated.

C) significant variances are investigated.

D) all variances are investigated.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following statements concerning departmental (segmental) accounting is true?

A) There is an accounting standard dealing with segment reporting.

B) Segment/departmental information is only produced for use by internal management.

C) Segment/departmental information can only be produced by large organisations.

D) A balance sheet is normally produced for each segment of the business under segmental accounting.

A) There is an accounting standard dealing with segment reporting.

B) Segment/departmental information is only produced for use by internal management.

C) Segment/departmental information can only be produced by large organisations.

D) A balance sheet is normally produced for each segment of the business under segmental accounting.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

20

A responsibility centre that is held accountable for controlling both costs and income is called a(n):

A) cost object.

B) investment centre.

C) profit centre.

D) cost centre.

A) cost object.

B) investment centre.

C) profit centre.

D) cost centre.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

21

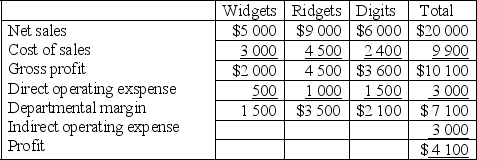

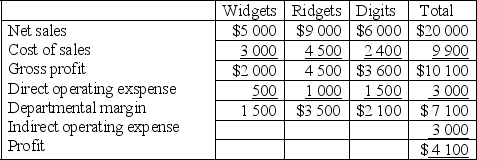

The Corporation has three departments, Widgets, Ridgets and Digits. At the end of the accounting period the following information is available.

The Corporation is considering eliminating the Widgets department. What will be the change in The Corporation's profit if the Widgets department is eliminated? Assume that all indirect expenses are unavoidable and that all other circumstances are held constant.

A) $500 fall

B) $1500 fall

C) $1000 fall

D) $1500 increase

The Corporation is considering eliminating the Widgets department. What will be the change in The Corporation's profit if the Widgets department is eliminated? Assume that all indirect expenses are unavoidable and that all other circumstances are held constant.

A) $500 fall

B) $1500 fall

C) $1000 fall

D) $1500 increase

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

22

A summary of expected costs for a range of activity levels that is geared to changes in the level of productive output, is the definition of a:

A) master budget.

B) continuous budget.

C) flexible budget.

D) departmental budget.

A) master budget.

B) continuous budget.

C) flexible budget.

D) departmental budget.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following statements is not true?

A) Performance reports normally report standard costs and variances.

B) Performance reports should contain space for explanations of variances.

C) Performance reports should be tailored to the responsibilities of the manager or department for which they are prepared.

D) Performance reports do not present the causes of variances.

A) Performance reports normally report standard costs and variances.

B) Performance reports should contain space for explanations of variances.

C) Performance reports should be tailored to the responsibilities of the manager or department for which they are prepared.

D) Performance reports do not present the causes of variances.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

24

A basis for the allocation of delivery expenses to other departments which results in an answer that is not an estimate is:

A) number of deliveries.

B) sales volume.

C) cubic volume of deliveries.

D) the allocation of indirect expenses is always an estimate no matter which method is used.

A) number of deliveries.

B) sales volume.

C) cubic volume of deliveries.

D) the allocation of indirect expenses is always an estimate no matter which method is used.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

25

Department A has a gross profit of $26 000, direct departmental expenses of $9600 and allocated expenses of $17 000 giving a net loss of $600. What would be the effect on the total organisation's profit if Department A was closed?

A) Profits would increase by $600

B) Profits would decrease $16 400

C) Profits would increase by $26 000

D) Profits would decrease by $26 000

A) Profits would increase by $600

B) Profits would decrease $16 400

C) Profits would increase by $26 000

D) Profits would decrease by $26 000

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

26

When direct operating expenses are subtracted from gross profit the result is:

A) departmental contribution.

B) direct costs.

C) departmental profit.

D) a variance.

A) departmental contribution.

B) direct costs.

C) departmental profit.

D) a variance.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

27

The biggest problem with allocating indirect expenses to segments is that:

A) allocations can be somewhat arbitrary and the results can vary widely.

B) some departments consume more indirect expenses.

C) fixed costs are ignored.

D) it is a time-consuming exercise.

A) allocations can be somewhat arbitrary and the results can vary widely.

B) some departments consume more indirect expenses.

C) fixed costs are ignored.

D) it is a time-consuming exercise.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following statements concerning the allocation of indirect expenses to departments is true?

A) A departmental profit calculation should exclude expenses that the departmental manager has no control over.

B) When preparing departmental profit reports it is best to assume that the departments are independent businesses.

C) Different accountants will normally chose similar bases to allocate overhead costs to departments.

D) Accountants have developed methods that have completely removed the subjectivity in allocating indirect costs to departments.

A) A departmental profit calculation should exclude expenses that the departmental manager has no control over.

B) When preparing departmental profit reports it is best to assume that the departments are independent businesses.

C) Different accountants will normally chose similar bases to allocate overhead costs to departments.

D) Accountants have developed methods that have completely removed the subjectivity in allocating indirect costs to departments.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

29

In a decision relating to the possible elimination of a department consideration would need to be given to how many of the following factors?

Alternative uses of the space currently occupied by the department

Adverse effect of the elimination of sales of other departments

Whether all of the direct operating expenses are avoidable

A) 0

B) 1

C) 2

D) 3

Alternative uses of the space currently occupied by the department

Adverse effect of the elimination of sales of other departments

Whether all of the direct operating expenses are avoidable

A) 0

B) 1

C) 2

D) 3

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

30

Performance reports should only contain costs, income or resources that are:

A) different from budgeted amounts.

B) more than budgeted amounts.

C) controllable by the manager.

D) actual rather than budgeted amounts.

A) different from budgeted amounts.

B) more than budgeted amounts.

C) controllable by the manager.

D) actual rather than budgeted amounts.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

31

Which of these is not an example of a service department for a university?

A) Personnel

B) Marketing

C) German department

D) University library

A) Personnel

B) Marketing

C) German department

D) University library

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

32

Which of these departments would not be considered a service department for a tyre retailer?

A) Accounting

B) Workshop

C) Advertising

D) Human resources

A) Accounting

B) Workshop

C) Advertising

D) Human resources

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

33

Bone Dry retailers is considering closing down one of its low-profit departments. Assume that discontinuance of this department will not affect sales of the remaining departments. Which of the cost classifications below should be compared with departmental income to determine whether or not to close the department?

A) Variable costs

B) Avoidable costs

C) Controllable costs

D) Fixed costs

A) Variable costs

B) Avoidable costs

C) Controllable costs

D) Fixed costs

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

34

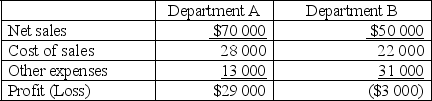

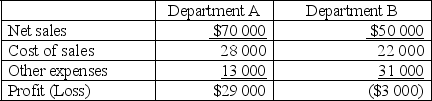

Blurbery Retailers has departments A and B with departmental income statements as follows.

Blurbery is considering eliminating Department B. Of the total 'other expenses' for the two departments of $44 000, $32 000 are fixed general overhead expenses and the rest are variable expenses based on 10% of sales. What is the present departmental contribution of Department B?

A) $28 000

B) ($3000)

C) $11 000

D) $23 000

Blurbery is considering eliminating Department B. Of the total 'other expenses' for the two departments of $44 000, $32 000 are fixed general overhead expenses and the rest are variable expenses based on 10% of sales. What is the present departmental contribution of Department B?

A) $28 000

B) ($3000)

C) $11 000

D) $23 000

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

35

If consideration is being given to closing a department a complete analysis should take into account all of the following except:

A) alternative uses of the space provided.

B) the effect that the closure might have on the sales of other departments.

C) the overhead costs of the entity that have been allocated to the department.

D) the costs of closure.

A) alternative uses of the space provided.

B) the effect that the closure might have on the sales of other departments.

C) the overhead costs of the entity that have been allocated to the department.

D) the costs of closure.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

36

How many of the following could not be cost objects?

A product

A specialised item of equipment

An activity

A department

A) 0

B) 1

C) 2

D) 3

A product

A specialised item of equipment

An activity

A department

A) 0

B) 1

C) 2

D) 3

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

37

A variable costing income statement is the same as a:

A) contribution margin income statement.

B) classified income statement.

C) traditional income statement.

D) departmental income statement.

A) contribution margin income statement.

B) classified income statement.

C) traditional income statement.

D) departmental income statement.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

38

Department Z has a gross profit of $30 000, direct departmental expenses of $12 000 and allocated expenses of $21 000 giving it a net loss of $3000. What would be the effect on the total organisation's profit if Department Z were closed?

A) Profits would increase by $3000

B) Profits would decrease by $18 000

C) Profits would decrease $9000

D) Profits would increase by $30 000

A) Profits would increase by $3000

B) Profits would decrease by $18 000

C) Profits would decrease $9000

D) Profits would increase by $30 000

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

39

In a decision relating to the possible elimination of a department consideration needs to be given to all of the following except:

A) alternative uses of the space currently occupied.

B) adverse effects of the elimination on sales of other departments.

C) whether all of the direct operating expenses are avoidable.

D) unavoidable expenses.

A) alternative uses of the space currently occupied.

B) adverse effects of the elimination on sales of other departments.

C) whether all of the direct operating expenses are avoidable.

D) unavoidable expenses.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

40

The expenses that will continue to exist even if a department is eliminated are called:

A) traceable expenses.

B) indirect expenses.

C) controllable costs.

D) unavoidable costs.

A) traceable expenses.

B) indirect expenses.

C) controllable costs.

D) unavoidable costs.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

41

Anniversary Roses uses a special mix of compost to fortify the soil around their plants. The price standard used is $4.00 per sack of compost. During the year, the purchase price averaged $3.80 per sack. The business purchased and used 1540 sacks of compost during the year. Compute the direct materials price variance indicating whether it is favourable or unfavourable.

A) $324 (F)

B) $308 (F)

C) $298 (F)

D) $302 (U)

A) $324 (F)

B) $308 (F)

C) $298 (F)

D) $302 (U)

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

42

Compute the correct variances: budgeted sales $307 000: actual sales $298 000. actual direct labour $60 000: budgeted direct labour $63 000.

A) Sales variance $9000 F: direct labour variance $3000 F

B) Sales variance $9000 F: direct labour variance $3000 U

C) Sales variance $9000 U: direct labour variance $3000 F

D) Sales variance $9000 U: direct labour variance $3000 U

A) Sales variance $9000 F: direct labour variance $3000 F

B) Sales variance $9000 F: direct labour variance $3000 U

C) Sales variance $9000 U: direct labour variance $3000 F

D) Sales variance $9000 U: direct labour variance $3000 U

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

43

Which department is typically responsible for direct materials price variances?

A) Production

B) Purchasing

C) Engineering

D) Sales

A) Production

B) Purchasing

C) Engineering

D) Sales

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

44

Which of these is not an engineering method that can be used to develop standards?

A) Time and motion studies

B) Work sampling

C) Simulation procedures

D) Balanced scorecard

A) Time and motion studies

B) Work sampling

C) Simulation procedures

D) Balanced scorecard

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

45

The fixed budget performance report of Millar & Associates for the year ended 30 June 2014 shows budgeted manufacturing costs of $390 000 and actual manufacturing costs of $410 000. The unfavourable variance of $20 000 must have been due to:

A) cost factors.

B) poor budgeting.

C) lack of supervision of workers.

D) cannot be determined from the information provided.

A) cost factors.

B) poor budgeting.

C) lack of supervision of workers.

D) cannot be determined from the information provided.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

46

How many of these are considered to be benefits of standard costing?

It makes employees more aware of the impact of costs on operations

It serves as a target against which to evaluate performance

It is a cheap way of valuing inventory

It eliminates the need to compute variances

A) One

B) Two

C) Three

D) Four

It makes employees more aware of the impact of costs on operations

It serves as a target against which to evaluate performance

It is a cheap way of valuing inventory

It eliminates the need to compute variances

A) One

B) Two

C) Three

D) Four

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

47

The performance standard that is usually considered best for use in setting standard costs is:

A) historical.

B) attainable.

C) ideal.

D) average.

A) historical.

B) attainable.

C) ideal.

D) average.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

48

The method not employed in the establishment of standard costs is:

A) analysis of historical performance data.

B) time and motion studies.

C) management judgement concerning future operating conditions.

D) discounted cash flow analysis.

A) analysis of historical performance data.

B) time and motion studies.

C) management judgement concerning future operating conditions.

D) discounted cash flow analysis.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

49

Which of these is a key purpose of standard costing?

A) Determining break-even production level

B) Allocating costs more accurately

C) Controlling costs

D) Profit determination

A) Determining break-even production level

B) Allocating costs more accurately

C) Controlling costs

D) Profit determination

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

50

The performance standard usually considered best in setting standard costs is?

A) Historical

B) Attainable

C) Average

D) Ideal

A) Historical

B) Attainable

C) Average

D) Ideal

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

51

A flexible is a budget where:

A) the budget estimates are prepared for a range of activities.

B) fixed costs are not included.

C) the estimates are amended if they are not attained in the period.

D) preparation may be postponed if the entity is very busy or is short staffed.

A) the budget estimates are prepared for a range of activities.

B) fixed costs are not included.

C) the estimates are amended if they are not attained in the period.

D) preparation may be postponed if the entity is very busy or is short staffed.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

52

If the actual quantity of direct materials used equals the budgeted quantity of direct materials that should have been used, any difference between the budgeted total cost and the actual total cost of direct materials used must be due to a:

A) materials quantity variance.

B) materials efficiency variance.

C) overhead variance.

D) materials price variance.

A) materials quantity variance.

B) materials efficiency variance.

C) overhead variance.

D) materials price variance.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

53

Ten minutes of direct labour is needed to produce one unit of product and direct labour is paid $24 per hour. Budgeted output for the period is estimated to be 8000 units. Actual output for the period turns out to be 8500 units and actual labour costs are $36 200 What budgeted direct labour amount should actual direct labour costs be compared to in order to calculate a valid variance?

A) $32 000

B) $19 200

C) $20 400

D) $34 000

A) $32 000

B) $19 200

C) $20 400

D) $34 000

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

54

Blue Horizon Clothing Company produces men's shirts. During May, the company's records revealed the following information about production of the shirts.

Standards:

Direct materials 5 metres @ $2.50 per metre

Direct labour 1 hour @ $7.50 per hour

Manufacturing overhead:

Variable $9.50 per direct labour hour

Fixed $10.00 per ½ hour of direct labour

Compute the standard unit cost for a shirt.

A) $34.50

B) $44.00

C) $54.50

D) $33.50

Standards:

Direct materials 5 metres @ $2.50 per metre

Direct labour 1 hour @ $7.50 per hour

Manufacturing overhead:

Variable $9.50 per direct labour hour

Fixed $10.00 per ½ hour of direct labour

Compute the standard unit cost for a shirt.

A) $34.50

B) $44.00

C) $54.50

D) $33.50

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

55

Utensil City produces a range of frying pans. During May, the company's records revealed the following information about production of the frying pans.

Standards:

Direct materials 3 units @ $2.50 per unit

Direct labour 1 hour @ $14.00 per hour

Manufacturing overhead

Variable $5.00 per direct labour hour

Fixed $6.00 per direct labour hour

Compute the standard unit cost for a frying pan.

A) $32.50

B) $26.50

C) $27.50

D) $21.50

Standards:

Direct materials 3 units @ $2.50 per unit

Direct labour 1 hour @ $14.00 per hour

Manufacturing overhead

Variable $5.00 per direct labour hour

Fixed $6.00 per direct labour hour

Compute the standard unit cost for a frying pan.

A) $32.50

B) $26.50

C) $27.50

D) $21.50

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

56

A standard cost accounting system can be used for how many of the following costs?

Direct materials

Direct labour

Manufacturing overhead

Indirect materials

A) 1

B) 2

C) 3

D) 4

Direct materials

Direct labour

Manufacturing overhead

Indirect materials

A) 1

B) 2

C) 3

D) 4

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

57

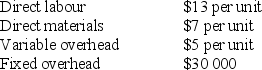

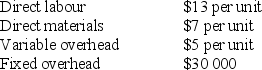

These were Lakeview Company's budgeted production costs for the current year at an expected output of 20 000 units:

Assume Lakeview uses a flexible budgeting system and actually produced 22 000 units at a total cost of $560 000. By how much did actual production cost differ from the flexible budget amount and in which direction?

A) Actual cost was $10 000 over flexible budget

B) Actual cost was $20 000 under flexible budget

C) Actual cost was $20 000 over flexible budget

D) Actual cost was $40 000 under flexible budget

Assume Lakeview uses a flexible budgeting system and actually produced 22 000 units at a total cost of $560 000. By how much did actual production cost differ from the flexible budget amount and in which direction?

A) Actual cost was $10 000 over flexible budget

B) Actual cost was $20 000 under flexible budget

C) Actual cost was $20 000 over flexible budget

D) Actual cost was $40 000 under flexible budget

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

58

Compute the correct variances: budgeted sales $156 000: actual sales $117 000. Actual direct materials $62 000: budgeted direct materials $51 000.

A) Sales variance $39 000 F: direct materials variance $11 000 F

B) Sales variance 39 000 U: direct materials variance $11 000 F

C) Sales variance 39 000 U: direct materials variance $11 000 U

D) Sales variance 55 000 U: direct materials variance $105 000 F

A) Sales variance $39 000 F: direct materials variance $11 000 F

B) Sales variance 39 000 U: direct materials variance $11 000 F

C) Sales variance 39 000 U: direct materials variance $11 000 U

D) Sales variance 55 000 U: direct materials variance $105 000 F

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

59

Which statement relating to standard costs is not true?

A) The approach is not suitable for a service business.

B) An unfavourable variance occurs when actual costs exceed standard costs.

C) They are predetermined costs.

D) They serve as benchmarks against which actual performance can be evaluated.

A) The approach is not suitable for a service business.

B) An unfavourable variance occurs when actual costs exceed standard costs.

C) They are predetermined costs.

D) They serve as benchmarks against which actual performance can be evaluated.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

60

Redoing the budget to actual output is most useful:

A) to calculate profitability accurately.

B) for planning purposes.

C) when actual output equals budgeted output.

D) as a tool to help evaluate performance.

A) to calculate profitability accurately.

B) for planning purposes.

C) when actual output equals budgeted output.

D) as a tool to help evaluate performance.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

61

Which of these is a financial performance measure?

A) Customer complaints

B) Number of orders shipped

C) Working capital ratio

D) Hours of inspections

A) Customer complaints

B) Number of orders shipped

C) Working capital ratio

D) Hours of inspections

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

62

Which statement is true?

A) The limitation of actual costs is that they represent what happened not necessarily what should have happened.

B) Standard costs are the costs necessary to produce an average or standard product.

C) Standard costs can serve as benchmarks against which budgeted performance is measured.

D) Standard costs can only be used for analytical purposes and can never be incorporated into the formal accounting system.

A) The limitation of actual costs is that they represent what happened not necessarily what should have happened.

B) Standard costs are the costs necessary to produce an average or standard product.

C) Standard costs can serve as benchmarks against which budgeted performance is measured.

D) Standard costs can only be used for analytical purposes and can never be incorporated into the formal accounting system.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

63

In current times the focus of managers has tended to shift away from measurement systems that rely on financial data to the design of total management systems. Which of these is not a total management system?

A) Total quality management (TQM)

B) Management by objectives (MBO)

C) The balanced scorecard (BSC)

D) Activity-based costing (ABC)

A) Total quality management (TQM)

B) Management by objectives (MBO)

C) The balanced scorecard (BSC)

D) Activity-based costing (ABC)

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following is a financial performance measure?

A) Profit as a percentage of sales

B) Number of invoices issued

C) Number of set-ups

D) Number of orders received

A) Profit as a percentage of sales

B) Number of invoices issued

C) Number of set-ups

D) Number of orders received

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

65

The balanced scorecard approach requires the organisation to be viewed from four perspectives, which includes how many of the following?

Supplier

Financial performance

Customer

Taxation obligations

A) 1

B) 2

C) 3

D) 4

Supplier

Financial performance

Customer

Taxation obligations

A) 1

B) 2

C) 3

D) 4

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck