Deck 9: Cost Accounting Systems

Question

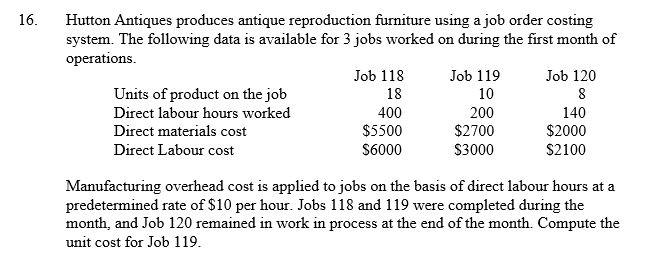

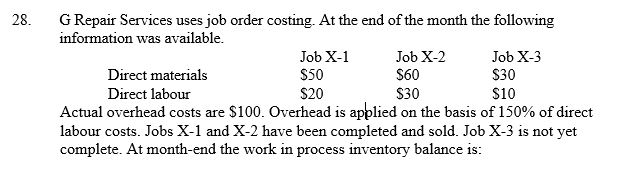

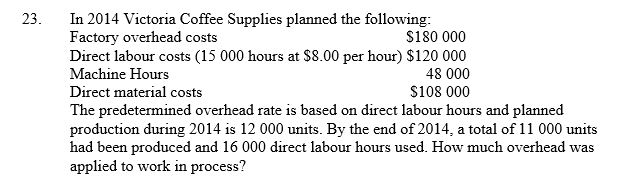

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/66

Play

Full screen (f)

Deck 9: Cost Accounting Systems

1

How many of these control accounts are used in job costing?

I) Factory Overhead

Ii) Work in process Inventory

Iii) Finished Goods Inventory

Iv) Raw Materials Inventory

A) 1

B) 2

C) 3

D) 4

I) Factory Overhead

Ii) Work in process Inventory

Iii) Finished Goods Inventory

Iv) Raw Materials Inventory

A) 1

B) 2

C) 3

D) 4

D

2

Which industry generally uses a job costing system?

A) Oil refining

B) Custom-built furniture manufacturing

C) Motor vehicle manufacturing

D) Soft drink manufacturing

A) Oil refining

B) Custom-built furniture manufacturing

C) Motor vehicle manufacturing

D) Soft drink manufacturing

B

3

The costing system used when entities provide goods or services in response to customer orders and specifications is known as:

A) process costing.

B) conversion costing.

C) just-in-time processing.

D) job costing.

A) process costing.

B) conversion costing.

C) just-in-time processing.

D) job costing.

D

4

Which of these is not a manufacturing overhead cost?

A) Indirect labour

B) Factory manager's salary

C) Direct materials

D) Rent of factory

A) Indirect labour

B) Factory manager's salary

C) Direct materials

D) Rent of factory

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

5

The total of the dollar amounts on the job order cards for jobs that had not been completed would be equal to:

A) costs of goods completed.

B) balance in the work in process inventory account.

C) balance in the finished goods inventory account.

D) cost of sales account.

A) costs of goods completed.

B) balance in the work in process inventory account.

C) balance in the finished goods inventory account.

D) cost of sales account.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

6

A) $700

B) $800

C) $840

D) $770

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

7

Carlo Limited supplied the following information and advised that manufacturing overhead is applied on the basis of direct labour hours.

Estimated manufacturing overhead costs $2 295 000

Estimated direct labour hours 340 000

Actual direct labour hours 348 000

Actual manufacturing overhead costs $2 357 000

What is the predetermined overhead rate?

A) $6.50

B) $6.25

C) $6.75

D) $7.00

Estimated manufacturing overhead costs $2 295 000

Estimated direct labour hours 340 000

Actual direct labour hours 348 000

Actual manufacturing overhead costs $2 357 000

What is the predetermined overhead rate?

A) $6.50

B) $6.25

C) $6.75

D) $7.00

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

8

In a factory with several processes, there may be one or more service departments that do not process the materials directly. Which of the following is not an example of a service department?

A) Factory office

B) Power plant

C) Repair shop

D) Smelting department

A) Factory office

B) Power plant

C) Repair shop

D) Smelting department

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

9

Which best describes the set of costs that are debited directly to work in process inventory?

A) Actual direct materials, actual direct labour, applied overhead

B) Actual indirect materials, actual indirect labour, actual overhead

C) Actual indirect materials, actual direct labour, applied overhead

D) Actual direct materials, actual direct labour, actual overhead

A) Actual direct materials, actual direct labour, applied overhead

B) Actual indirect materials, actual indirect labour, actual overhead

C) Actual indirect materials, actual direct labour, applied overhead

D) Actual direct materials, actual direct labour, actual overhead

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

10

The type of product costing system used by a company is dictated by the:

A) production process.

B) plant supervisor.

C) chief executive officer.

D) project manager.

A) production process.

B) plant supervisor.

C) chief executive officer.

D) project manager.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

11

Match the following.

A) Job order and process costing

B) Job order and variable costing

C) Absorption and process costing

D) Variable costing and indirect costing

A) Job order and process costing

B) Job order and variable costing

C) Absorption and process costing

D) Variable costing and indirect costing

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

12

A job costing system tracks:

A) the use of materials.

B) the conversion of the inputs into work in process.

C) direct labour and the use of materials.

D) direct labour, the use of materials and the conversion of the inputs into work-in-process.

A) the use of materials.

B) the conversion of the inputs into work in process.

C) direct labour and the use of materials.

D) direct labour, the use of materials and the conversion of the inputs into work-in-process.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

13

In the year 2014, Arden Panel Works planned the following.

Factory overhead costs $180 000

Direct labour costs (15 000 hours at $8.00 per hour) $120 000

Machine Hours 48 000

Direct material costs $108 000

The predetermined overhead rate is based on direct labour hours and planned production during 2014 of 12 000 units. The direct material cost in each unit would be:

A) $7.20.

B) $3.50.

C) $15.00.

D) $9.00.

Factory overhead costs $180 000

Direct labour costs (15 000 hours at $8.00 per hour) $120 000

Machine Hours 48 000

Direct material costs $108 000

The predetermined overhead rate is based on direct labour hours and planned production during 2014 of 12 000 units. The direct material cost in each unit would be:

A) $7.20.

B) $3.50.

C) $15.00.

D) $9.00.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

14

Which account is not classified as an asset?

A) Materials

B) Work in process

C) Cost of sales

D) Finished goods

A) Materials

B) Work in process

C) Cost of sales

D) Finished goods

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

15

Match the business with the most likely type of costing system.

1) Oil refinery

2) Automotive brake repairer

3) Bathroom renovator

4) Commercial printer

5) Management consultant

I Job costing

II Process costing

A) 1 and I, 2 and II, 3 and I, 4 and II, 5 and I

B) 1 and II, 2 and I, 3 and I, 4 and I, 5 and I

C) 1 and I, 2 and I, 3 and I, 4 and II, 5 and II

D) 1 and II, 2 and II, 3 and I, 4 and I, 5 and I

1) Oil refinery

2) Automotive brake repairer

3) Bathroom renovator

4) Commercial printer

5) Management consultant

I Job costing

II Process costing

A) 1 and I, 2 and II, 3 and I, 4 and II, 5 and I

B) 1 and II, 2 and I, 3 and I, 4 and I, 5 and I

C) 1 and I, 2 and I, 3 and I, 4 and II, 5 and II

D) 1 and II, 2 and II, 3 and I, 4 and I, 5 and I

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

16

When Job 105 at the Blyth Cabinet Company emerges with its final finishing touches completed, the company's:

A) total assets are increased.

B) total assets are decreased.

C) work in process is decreased.

D) work in process is increased.

A) total assets are increased.

B) total assets are decreased.

C) work in process is decreased.

D) work in process is increased.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

17

The overhead budget, based on a budgeted volume of 100 000 direct labour hours, was $255 000. Actual overhead costs amounted to $270 000 and actual direct labour hours were 105 000. By how much was overhead under or overapplied?

A) $2250 overapplied

B) $15 000 overapplied

C) $2250 underapplied

D) $15 000 underapplied

A) $2250 overapplied

B) $15 000 overapplied

C) $2250 underapplied

D) $15 000 underapplied

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

18

In a job cost system the overhead costs are assigned using:

A) a predetermined overhead rate.

B) variable costs.

C) direct costs.

D) actual overhead rate.

A) a predetermined overhead rate.

B) variable costs.

C) direct costs.

D) actual overhead rate.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

19

The McIntyre Manufacturing Company distributes overhead based on direct labour dollars. The estimated manufacturing overhead for the year was $484 000 and the estimated direct labour dollars for the year were $110 000. Indicate the amount of underapplied or overapplied overhead if actual direct labour was $98 000 and actual manufacturing overhead was $418 800.

A) $12 400 overapplied

B) $12 400 underapplied

C) $12 000 overapplied

D) $12 000 underapplied

A) $12 400 overapplied

B) $12 400 underapplied

C) $12 000 overapplied

D) $12 000 underapplied

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following statements concerning the job cost order is incorrect?

A) It provides an itemised list of all costs charged to a particular job.

B) Orders for incomplete jobs serve as a subsidiary ledger for the work in process account.

C) It traces all costs to jobs.

D) The control number assigned to each job is recorded on the job order.

A) It provides an itemised list of all costs charged to a particular job.

B) Orders for incomplete jobs serve as a subsidiary ledger for the work in process account.

C) It traces all costs to jobs.

D) The control number assigned to each job is recorded on the job order.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

21

Which of these is not a source document for job costing?

A) Materials requisition record

B) The marketing manager's expense sheet

C) Labour hours/time sheets record

D) Invoice for factory expense

A) Materials requisition record

B) The marketing manager's expense sheet

C) Labour hours/time sheets record

D) Invoice for factory expense

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

22

Predetermined overhead rates are necessary for how many of the following reasons?

Actual overheads are not incurred evenly over the period.

Product costs need to be calculated promptly for decision- making.

Overhead cannot be traced directly to products because of its indirect nature.

A) 0

B) 1

C) 2

D) 3

Actual overheads are not incurred evenly over the period.

Product costs need to be calculated promptly for decision- making.

Overhead cannot be traced directly to products because of its indirect nature.

A) 0

B) 1

C) 2

D) 3

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

23

Manufacturing costs assigned to inventory should appear on the income statement in the period in which:

A) the goods are completed.

B) they are incurred.

C) the purchase order to manufacture the goods is received.

D) the sale of goods is recorded.

A) the goods are completed.

B) they are incurred.

C) the purchase order to manufacture the goods is received.

D) the sale of goods is recorded.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

24

Magenta Ltd uses a job order costing system and applies factory overhead, based on direct labour hours, at a rate of $2 per direct labour hour. The data relating to production for last period is:

Direct materials $13 000

Indirect materials 2300

Direct labour (18 000 hours) 54 000

Production supervisor salaries 13 700

Maintenance costs 7000

Factory rent 8100

Factory utilities 1800

Depreciation on machinery 2200

The overhead under or overapplied after overhead has been charged to production is:

A) $900 overapplied.

B) $900 underapplied.

C) $2700 overapplied.

D) $2700 underapplied.

Direct materials $13 000

Indirect materials 2300

Direct labour (18 000 hours) 54 000

Production supervisor salaries 13 700

Maintenance costs 7000

Factory rent 8100

Factory utilities 1800

Depreciation on machinery 2200

The overhead under or overapplied after overhead has been charged to production is:

A) $900 overapplied.

B) $900 underapplied.

C) $2700 overapplied.

D) $2700 underapplied.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

25

In 2014, Brunswick Plumbing Supplies planned the following:

Factory overhead costs $180 000

Direct labour costs (15 000 hours at $8.00 per hour) $120 000

Machine Hours 48 000

Direct material costs $108 000

The predetermined overhead rate is based on direct labour hours and planned production during 2014 is 12 000 units. The estimated cost per unit produced is:

A) $24.00.

B) $44.00.

C) $34.00.

D) $26.00.

Factory overhead costs $180 000

Direct labour costs (15 000 hours at $8.00 per hour) $120 000

Machine Hours 48 000

Direct material costs $108 000

The predetermined overhead rate is based on direct labour hours and planned production during 2014 is 12 000 units. The estimated cost per unit produced is:

A) $24.00.

B) $44.00.

C) $34.00.

D) $26.00.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

26

Mayo Resources supplies the following information. Manufacturing overhead is applied on the basis of direct labour hours.

Estimated manufacturing overhead costs $3 000 000

Estimated direct labour hours 250 000

Actual direct labour hours 240 000

Actual manufacturing overhead costs $3 050 000

Compute the amount of overapplied or underapplied overhead.

A) $50 000 underapplied

B) $50 000 overapplied

C) $70 000 underapplied

D) $70 000 overapplied

Estimated manufacturing overhead costs $3 000 000

Estimated direct labour hours 250 000

Actual direct labour hours 240 000

Actual manufacturing overhead costs $3 050 000

Compute the amount of overapplied or underapplied overhead.

A) $50 000 underapplied

B) $50 000 overapplied

C) $70 000 underapplied

D) $70 000 overapplied

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

27

A) $25.

B) $40.

C) $55.

D) $140.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

28

When direct materials are issued from inventory to production under a job order costing system an increase is recorded in the:

A) materials inventory account.

B) manufacturing overhead account.

C) work in process inventory account.

D) finished goods inventory account.

A) materials inventory account.

B) manufacturing overhead account.

C) work in process inventory account.

D) finished goods inventory account.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

29

A) $180 000

B) $120 000

C) $88 000

D) $192 000

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

30

AFD Production uses a predetermined overhead rate based upon direct labour hours. The firm has the following budgeted and actual data for the current year:

Budgeted factory overhead cost $6000

Actual factory overhead cost $5000

Budgeted direct labour hours 1000

Actual direct labour hours 1100

What was the amount of underapplied or overapplied overhead for the year?

A) $500 overapplied

B) $500 underapplied

C) $1600 underapplied

D) $1600 overapplied

Budgeted factory overhead cost $6000

Actual factory overhead cost $5000

Budgeted direct labour hours 1000

Actual direct labour hours 1100

What was the amount of underapplied or overapplied overhead for the year?

A) $500 overapplied

B) $500 underapplied

C) $1600 underapplied

D) $1600 overapplied

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

31

Surrey Pty Ltd applies overhead to completed jobs using a predetermined rate of 60% of direct labour costs. If Job No. 22 shows $12 000 of factory overhead applied, how much was the direct labour cost of the job?

A) $8000

B) $12 000

C) $19 000

D) $20 000

A) $8000

B) $12 000

C) $19 000

D) $20 000

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

32

Which account would be adjusted for the disposal of an immaterial amount of overapplied manufacturing overhead?

A) Finished goods inventory

B) The overapplied overhead account

C) Cost of sales

D) Work in process inventory

A) Finished goods inventory

B) The overapplied overhead account

C) Cost of sales

D) Work in process inventory

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

33

Albert Manufacturing uses the weighted average method of computing equivalent units of production. In beginning work in process, there were 9000 units 30% complete as to conversion. In ending work in process, there were 5000 units 60% complete. 13 000 units were completed during the year. Determine the equivalent units of production.

A) 16 000

B) 18 000

C) 22 300

D) 16 300

A) 16 000

B) 18 000

C) 22 300

D) 16 300

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

34

For 2014 The Iron Works planned the following.

Factory overhead costs $180 000

Direct labour cost ($8.00 an hour) x (24 000 hrs) $192 000

Machine hours 48 000

Direct material cost $108 000

The predetermined overhead rate is based on direct labour hours and planned production during 2014 is 12 000 units. The estimated cost per unit produced is:

A) $15.

B) $40.

C) $41.

D) $32.

Factory overhead costs $180 000

Direct labour cost ($8.00 an hour) x (24 000 hrs) $192 000

Machine hours 48 000

Direct material cost $108 000

The predetermined overhead rate is based on direct labour hours and planned production during 2014 is 12 000 units. The estimated cost per unit produced is:

A) $15.

B) $40.

C) $41.

D) $32.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

35

Process costs are determined by:

A) dividing the costs of the period by the number of equivalent units produced.

B) adding up all the job costs.

C) allocating the overhead by machine hours.

D) costing each process individually.

A) dividing the costs of the period by the number of equivalent units produced.

B) adding up all the job costs.

C) allocating the overhead by machine hours.

D) costing each process individually.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

36

The work in process account of Green Manufacturing shows a balance of $42 000 at the end of an accounting period. The job cost orders of the two uncompleted jobs show charges of $15 000 and $7000 for materials used and charges of $10 000 and $5000 for direct labour used. From this information it appears that the company is using a predetermined overhead rate as a percentage of direct labour costs, of:

A) 13.5%.

B) 50.0%.

C) 33.3%.

D) 300%.

A) 13.5%.

B) 50.0%.

C) 33.3%.

D) 300%.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

37

Overhead has been underapplied when the:

A) manufacturing overhead account has a debit balance.

B) company has underspent in the manufacturing overhead cost area.

C) manufacturing overhead account has a credit balance.

D) adjusting entry for the underapplied overhead involves a credit to cost of sales.

A) manufacturing overhead account has a debit balance.

B) company has underspent in the manufacturing overhead cost area.

C) manufacturing overhead account has a credit balance.

D) adjusting entry for the underapplied overhead involves a credit to cost of sales.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

38

Which most accurately describes the flow of costs through the accounting system?

A) Factory overhead applied, to work in process, to finished goods

B) Purchases, to factory overhead, to cost of sales

C) Purchases, to finished goods, to work in process

D) Work in process, to cost of sales

A) Factory overhead applied, to work in process, to finished goods

B) Purchases, to factory overhead, to cost of sales

C) Purchases, to finished goods, to work in process

D) Work in process, to cost of sales

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

39

A cost of production report serves as the control document in process costing; which of the information below does it not contain?

A) A physical flow section

B) A costs to be accounted for section

C) A costs accounted for section

D) The number of each job

A) A physical flow section

B) A costs to be accounted for section

C) A costs accounted for section

D) The number of each job

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

40

Berkshire Ltd distributes overhead based on direct labour dollars. The estimated manufacturing overhead for the year was $520 000 and the estimated direct labour dollars for the year were $130 000. Indicate the amount of underapplied or overapplied overhead if actual direct labour was $118 000 and actual manufacturing overhead was $497 400.

A) $25 400 underapplied

B) $25 400 overapplied

C) $22 600 overapplied

D) $22 600 underapplied

A) $25 400 underapplied

B) $25 400 overapplied

C) $22 600 overapplied

D) $22 600 underapplied

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

41

Equivalent units of production measures:

A) the number of partial jobs completed in the period.

B) the production level which could have been achieved under optimum circumstances.

C) the number of full units that could have been completely produced with the effort expended.

D) the number of jobs started but not completed in the period.

A) the number of partial jobs completed in the period.

B) the production level which could have been achieved under optimum circumstances.

C) the number of full units that could have been completely produced with the effort expended.

D) the number of jobs started but not completed in the period.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

42

It is true that Just-in-time (JIT) processing:

A) is only suitable for large businesses.

B) reflects a 'push' approach to manufacturing.

C) runs the risk of interruptions in supply.

D) sounds good in theory but doesn't work in practice.

A) is only suitable for large businesses.

B) reflects a 'push' approach to manufacturing.

C) runs the risk of interruptions in supply.

D) sounds good in theory but doesn't work in practice.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

43

Equivalent units are:

A) the number of whole units represented by the finished units plus the partly completed units.

B) the number of whole units represented by the finished units.

C) the units represented by the total manufacturing costs for the period.

D) the units that would have been produced under optimum circumstances.

A) the number of whole units represented by the finished units plus the partly completed units.

B) the number of whole units represented by the finished units.

C) the units represented by the total manufacturing costs for the period.

D) the units that would have been produced under optimum circumstances.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

44

Something that is not a feature of just-in-time processing is:

A) strict quality control.

B) a steady, reliable supply of raw materials and labour.

C) a variable demand from customers.

D) efficiency in the production process.

A) strict quality control.

B) a steady, reliable supply of raw materials and labour.

C) a variable demand from customers.

D) efficiency in the production process.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following statements concerning cost accounting for service type businesses is correct?

A) Cost information is needed for different reasons in a service business than in a manufacturing business.

B) To determine the rate at which direct labour costs are applied to a particular job a labour cost per hour is developed for each employee.

C) Actual costs rather than budgeted costs are used to determine overhead application rates.

D) Cost accounting is not used in service business.

A) Cost information is needed for different reasons in a service business than in a manufacturing business.

B) To determine the rate at which direct labour costs are applied to a particular job a labour cost per hour is developed for each employee.

C) Actual costs rather than budgeted costs are used to determine overhead application rates.

D) Cost accounting is not used in service business.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

46

Smith Co started 40 000 units into production during the current period and completed 28 000. The other 12 000 units were 30% complete as to conversion costs at the end of the period. Total costs were $60 000 for material and $36 000 for conversion costs.

Material is added at the beginning of the production process. Unit raw material and conversion costs for the period were:

Raw materials cost Conversion cost

A) $5.00 $10.00

B) $1.50 $10.00

C) $5.00 $ .90

D) $1.50 $ 1.14

Material is added at the beginning of the production process. Unit raw material and conversion costs for the period were:

Raw materials cost Conversion cost

A) $5.00 $10.00

B) $1.50 $10.00

C) $5.00 $ .90

D) $1.50 $ 1.14

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

47

In an 'ideal' just-in-time processing plant, the inventories held are:

A) work in process.

B) finished goods.

C) direct materials.

D) supplies of packaging.

A) work in process.

B) finished goods.

C) direct materials.

D) supplies of packaging.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

48

The method of calculating equivalent units where the costs assigned to the beginning inventory of work-in-process are combined with the current periods costs of production and the degree of completion of the beginning units is ignored is the:

A) first-in-first-out method.

B) last-in-last-out method.

C) last-in-first-out method.

D) weighted average method.

A) first-in-first-out method.

B) last-in-last-out method.

C) last-in-first-out method.

D) weighted average method.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

49

The number of full units that could have been completely produced with the effort expended are known as:

A) work-in-process.

B) equivalent units.

C) conversion units.

D) completed units.

A) work-in-process.

B) equivalent units.

C) conversion units.

D) completed units.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

50

Which of these is not a section of a cost of production report?

A) Costs accounted for

B) Costs to be accounted for

C) GST summary

D) Physical flow schedule

A) Costs accounted for

B) Costs to be accounted for

C) GST summary

D) Physical flow schedule

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

51

Service organisations incur little or no cost for:

A) materials.

B) actual overhead.

C) applied overhead.

D) labour.

A) materials.

B) actual overhead.

C) applied overhead.

D) labour.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

52

Which of these differs between job order and process costing?

A) Basic purpose

B) Cost flows

C) Tracing of direct costs and allocation of indirect costs

D) Focal point for cost accumulation

A) Basic purpose

B) Cost flows

C) Tracing of direct costs and allocation of indirect costs

D) Focal point for cost accumulation

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

53

Which of these is not a cost object?

A) A product

B) A service

C) An activity

D) Cash at bank

A) A product

B) A service

C) An activity

D) Cash at bank

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

54

The correct statement concerning process costing is:

A) the type of production is heterogeneous.

B) the flow of products is separated by jobs.

C) the control document is a cost of production report.

D) record keeping is more detailed than for job costing.

A) the type of production is heterogeneous.

B) the flow of products is separated by jobs.

C) the control document is a cost of production report.

D) record keeping is more detailed than for job costing.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

55

Which of these inputs are debited to a work-in-process account with a process costing system?

A) Direct materials and factory overhead applied

B) Direct labour and factory overhead applied

C) Direct materials and direct labour

D) Direct materials, direct labour and factory overhead applied

A) Direct materials and factory overhead applied

B) Direct labour and factory overhead applied

C) Direct materials and direct labour

D) Direct materials, direct labour and factory overhead applied

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

56

Which of these are similar for job order and process costing?

A) Record keeping

B) Measures of output

C) Cost flows, i.e. raw materials to work in process to finished goods to cost of sales

D) Focal point of costs

A) Record keeping

B) Measures of output

C) Cost flows, i.e. raw materials to work in process to finished goods to cost of sales

D) Focal point of costs

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

57

Beginning balance Job No. 58 $20 000

Direct Materials issued to job in the current period $30 600

Direct Labour charged to job in the current period $24 500

Manufacturing overhead applied in the current period $ 40 100

Total number of units produced by Job 58 26 000

What is the unit cost for Job 58?

A) $2.89

B) $3.48

C) $3.66

D) $4.43

Direct Materials issued to job in the current period $30 600

Direct Labour charged to job in the current period $24 500

Manufacturing overhead applied in the current period $ 40 100

Total number of units produced by Job 58 26 000

What is the unit cost for Job 58?

A) $2.89

B) $3.48

C) $3.66

D) $4.43

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

58

The flow of goods in a firm that uses process costing is, work in process at the start 5000 units ½ complete, units started 54 000, units finished 50 000, work in process end of period 9000 units 1/3 complete. Raw materials are issued at the end of the production process. Using the weighted average method, the equivalent units as to conversion cost for the period are:

A) 53 000 units.

B) 50 000 units.

C) 54 000 units.

D) 57 000 units.

A) 53 000 units.

B) 50 000 units.

C) 54 000 units.

D) 57 000 units.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

59

Which of these is not an element of Just-in-time processing (JIT)?

A) Strict quality control

B) Steady demand from customers

C) Efficiency in production process

D) Buffer stocks of finished goods

A) Strict quality control

B) Steady demand from customers

C) Efficiency in production process

D) Buffer stocks of finished goods

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

60

Dreamtime Manufacturing uses the weighted-average method of computing equivalent units of production. For beginning work in process there were 6000 units 30% complete as to materials and conversion costs. For ending work in process there were 4000 units 60% complete as to materials and conversion costs. 16 000 units were completed during the year. Determine the equivalent units of production.

A) 16 000

B) 18 400

C) 20 000

D) 22 600

A) 16 000

B) 18 400

C) 20 000

D) 22 600

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following statements concerning activity-based costing is correct?

A) ABC is a refinement of job costing.

B) Direct labour hours can be a cost driver for ABC.

C) ABC was introduced because of globalisation.

D) ABC is most useful when a smaller number of similar products are produced by a firm.

A) ABC is a refinement of job costing.

B) Direct labour hours can be a cost driver for ABC.

C) ABC was introduced because of globalisation.

D) ABC is most useful when a smaller number of similar products are produced by a firm.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following statements concerning cost drivers is incorrect?

A) As direct labour shrinks as a proportion of manufacturing costs it becomes a more accurate factor by which to apply overhead to products.

B) A cost driver is a measure of the activity that causes overhead costs.

C) In modern day manufacturing there has been a decline in labour costs and an increase in factory overheads as a percentage of product costs.

D) Inaccurate application of overhead to products can lead to wrong conclusions about which products are profitable.

A) As direct labour shrinks as a proportion of manufacturing costs it becomes a more accurate factor by which to apply overhead to products.

B) A cost driver is a measure of the activity that causes overhead costs.

C) In modern day manufacturing there has been a decline in labour costs and an increase in factory overheads as a percentage of product costs.

D) Inaccurate application of overhead to products can lead to wrong conclusions about which products are profitable.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following statements concerning activity-based costing (ABC)is not true?

A) It has been introduced to overcome distortions in costing multiple products which occur when a single base is used to apply overhead to products.

B) ABC is cheaper and less time consuming to implement than traditional costing systems.

C) Overhead costs are accumulated by activities and then assigned to cost objects using a different cost driver for each activity.

D) ABC can be applied in service businesses as well as in manufacturing businesses.

A) It has been introduced to overcome distortions in costing multiple products which occur when a single base is used to apply overhead to products.

B) ABC is cheaper and less time consuming to implement than traditional costing systems.

C) Overhead costs are accumulated by activities and then assigned to cost objects using a different cost driver for each activity.

D) ABC can be applied in service businesses as well as in manufacturing businesses.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

64

A cost allocation base may be any of the following except:

A) a cost pool.

B) a way to link indirect costs to a cost object.

C) a cost driver.

D) a non-financial quantity.

A) a cost pool.

B) a way to link indirect costs to a cost object.

C) a cost driver.

D) a non-financial quantity.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

65

It is incorrect concerning Activity-Based Costing [ABC] that:

A) cost drivers are used to assign costs between activities.

B) it is now used by firms much more commonly than traditional costing.

C) the use of cost drivers allows management to apply overhead more accurately to products with different production requirements.

D) production processes are broken down into activities.

A) cost drivers are used to assign costs between activities.

B) it is now used by firms much more commonly than traditional costing.

C) the use of cost drivers allows management to apply overhead more accurately to products with different production requirements.

D) production processes are broken down into activities.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

66

An activity-based approach to designing a costing system focuses on:

A) direct costs.

B) traceable costs.

C) activities.

D) departments.

A) direct costs.

B) traceable costs.

C) activities.

D) departments.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck