Deck 9: Inventory Costing and Capacity Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/210

Play

Full screen (f)

Deck 9: Inventory Costing and Capacity Analysis

1

Which of the following is true of absorption costing?

A) It expenses marketing costs as cost of goods sold.

B) It treats direct manufacturing costs as a period cost.

C) It includes fixed manufacturing overhead as an inventoriable cost.

D) It treats indirect manufacturing costs as a period cost.

A) It expenses marketing costs as cost of goods sold.

B) It treats direct manufacturing costs as a period cost.

C) It includes fixed manufacturing overhead as an inventoriable cost.

D) It treats indirect manufacturing costs as a period cost.

It includes fixed manufacturing overhead as an inventoriable cost.

2

________ is a method of inventory costing in which all variable manufacturing costs and all fixed manufacturing costs are included as inventoriable costs.

A) Variable costing

B) Mixed costing

C) Absorption costing

D) Standard costing

A) Variable costing

B) Mixed costing

C) Absorption costing

D) Standard costing

Absorption costing

3

Which of the following is true of variable costing?

A) It expenses administrative costs as cost of goods sold.

B) It treats direct manufacturing costs as a product cost.

C) It includes fixed manufacturing overhead as an inventoriable cost.

D) It is required for external reporting to shareholders.

A) It expenses administrative costs as cost of goods sold.

B) It treats direct manufacturing costs as a product cost.

C) It includes fixed manufacturing overhead as an inventoriable cost.

D) It is required for external reporting to shareholders.

It treats direct manufacturing costs as a product cost.

4

Under variable costing, lease charges paid on the factory building is an inventoriable cost.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following costs is inventoried when using variable costing?

A) rent on factory building

B) electricity consumed in manufacturing process

C) sales commission paid on each sale

D) advertising costs incurred for the product

A) rent on factory building

B) electricity consumed in manufacturing process

C) sales commission paid on each sale

D) advertising costs incurred for the product

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following costs is inventoried when using absorption costing?

A) variable selling costs

B) fixed administrative costs

C) variable manufacturing costs

D) fixed selling costs

A) variable selling costs

B) fixed administrative costs

C) variable manufacturing costs

D) fixed selling costs

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

7

________ method includes fixed manufacturing overhead costs as inventoriable costs.

A) Variable costing

B) Absorption costing

C) Throughput costing

D) Activity-based costing

A) Variable costing

B) Absorption costing

C) Throughput costing

D) Activity-based costing

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following costs will be treated as period costs under absorption costing?

A) raw materials used in the production

B) sales commission paid on sale of product

C) depreciation on factory equipment

D) rent for factory building

A) raw materials used in the production

B) sales commission paid on sale of product

C) depreciation on factory equipment

D) rent for factory building

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

9

Variable costing regards fixed manufacturing overhead as a(n) ________.

A) administrative cost

B) inventoriable cost

C) period cost

D) product cost

A) administrative cost

B) inventoriable cost

C) period cost

D) product cost

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

10

Variable costing only includes direct manufacturing costs in inventoriable costs.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

11

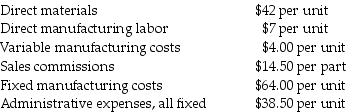

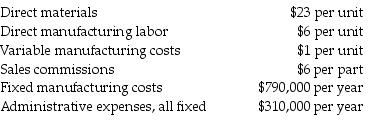

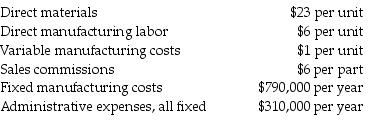

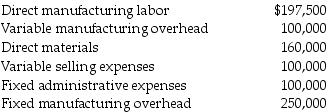

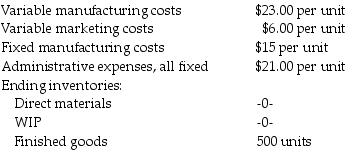

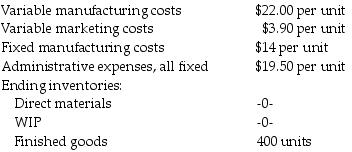

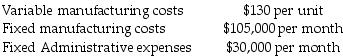

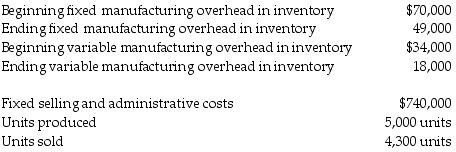

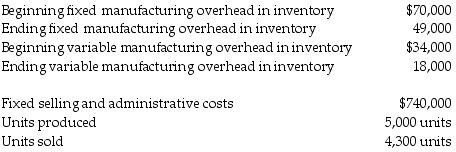

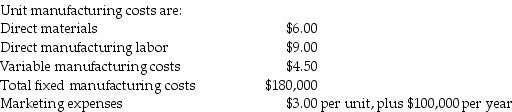

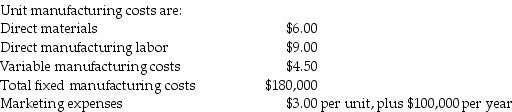

Time Again LLC produces and sells a mantel clock for $100 per unit. In 2017, 41,000 clocks were produced and 37,000 were sold. Other information for the year includes:

What is the inventoriable cost per unit using absorption costing?

A) $49.00

B) $53.00

C) $117.00

D) $106.00

What is the inventoriable cost per unit using absorption costing?

A) $49.00

B) $53.00

C) $117.00

D) $106.00

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

12

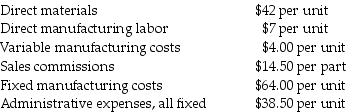

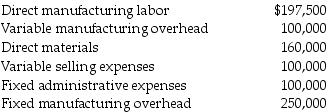

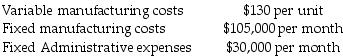

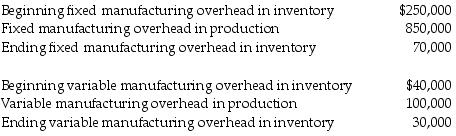

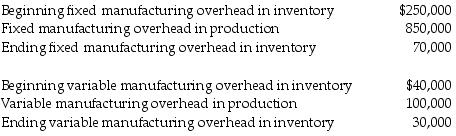

Fast Track Auto produces and sells an auto part for $60 per unit. In 2017, 120,000 parts were produced and 75,000 units were sold. Other information for the year includes:

What is the inventoriable cost per unit using variable costing?

A) $20

B) $25

C) $28

D) $35

What is the inventoriable cost per unit using variable costing?

A) $20

B) $25

C) $28

D) $35

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

13

The unit cost of a product is always higher in variable costing than in absorption costing.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

14

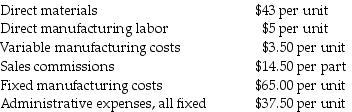

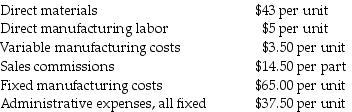

Fast Track Auto produces and sells an auto part for $85 per unit. In 2017, 110,000 parts were produced and 90,000 units were sold. Other information for the year includes:

What is the inventoriable cost per unit using absorption costing?

A) $30.00

B) $36.00

C) $37.18

D) $40.00

What is the inventoriable cost per unit using absorption costing?

A) $30.00

B) $36.00

C) $37.18

D) $40.00

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

15

Under absorption costing, fixed manufacturing costs ________.

A) are period costs

B) are inventoriable costs

C) are treated as an expense

D) are sunk costs

A) are period costs

B) are inventoriable costs

C) are treated as an expense

D) are sunk costs

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

16

In ________, fixed manufacturing costs are included as inventoriable costs.

A) variable costing

B) absorption costing

C) throughput costing

D) activity-based costing

A) variable costing

B) absorption costing

C) throughput costing

D) activity-based costing

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following best describes how fixed cost are treated in a variable cost method?

A) They are part of the product cost

B) They are excluded from inventory cost and are treated as period costs

C) They are allocated to the product cost using a denominator-level capacity choice

D) They are classified as nonmanufacturing costs

A) They are part of the product cost

B) They are excluded from inventory cost and are treated as period costs

C) They are allocated to the product cost using a denominator-level capacity choice

D) They are classified as nonmanufacturing costs

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

18

Time Again, LLC produces and sells a mantel clock for $100 per unit. In 2017, 42,125 clocks were produced and 37,958 were sold. Other information for the year includes:

What is the inventoriable cost per unit using variable costing?

A) $66.00

B) $51.50

C) $48.00

D) $103.50

What is the inventoriable cost per unit using variable costing?

A) $66.00

B) $51.50

C) $48.00

D) $103.50

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

19

AAA Manufacturing Inc, makes a product with the following costs per unit:

Direct materials $180

Direct labor $20

Manufacturing overhead (variable) $30

Manufacturing overhead (fixed) $130

Marketing costs $75

What would be the inventoriable cost per unit under variable costing and what would it be under absorption costing?

A) $180 for variable costing and $305 under absorption costing

B) $230 for variable costing and $305 under absorption costing

C) $230 for variable costing and $360 under absorption costing

D) $200 for variable costing and $305 under absorption costing

Direct materials $180

Direct labor $20

Manufacturing overhead (variable) $30

Manufacturing overhead (fixed) $130

Marketing costs $75

What would be the inventoriable cost per unit under variable costing and what would it be under absorption costing?

A) $180 for variable costing and $305 under absorption costing

B) $230 for variable costing and $305 under absorption costing

C) $230 for variable costing and $360 under absorption costing

D) $200 for variable costing and $305 under absorption costing

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

20

________ is a method of inventory costing in which only variable manufacturing costs are included as inventoriable costs.

A) Fixed costing

B) Variable costing

C) Absorption costing

D) Mixed costing

A) Fixed costing

B) Variable costing

C) Absorption costing

D) Mixed costing

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

21

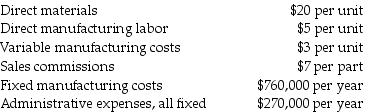

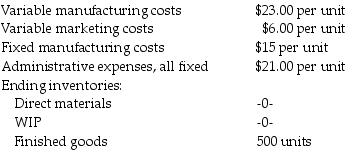

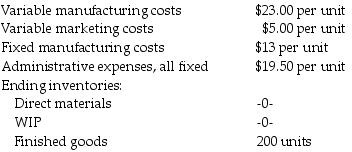

For 2017, Rockford, Inc., had sales of 150,000 units and production of 200,000 units. Other information for the year included:

There was no beginning inventory.

Required:

a.Compute the ending finished goods inventory under both absorption and variable costing.

b.Compute the cost of goods sold under both absorption and variable costing.

There was no beginning inventory.

Required:

a.Compute the ending finished goods inventory under both absorption and variable costing.

b.Compute the cost of goods sold under both absorption and variable costing.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following would be subtracted from sales while calculating contribution margin in a variable costing format of an operating income statement?

A) Direct labor in factory

B) Rent on factory building

C) Rent on the headquarters building

D) Sales commission on incremental sales

A) Direct labor in factory

B) Rent on factory building

C) Rent on the headquarters building

D) Sales commission on incremental sales

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

23

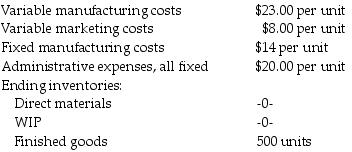

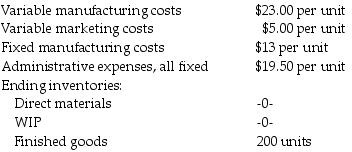

Swansea Finishing produces and sells a decorative pillow for $103.00 per unit. In the first month of operation, 2,300 units were produced and 1,800 units were sold. Actual fixed costs are the same as the amount budgeted for the month. Other information for the month includes:

What is cost of goods sold per unit using variable costing?

A) $23.00

B) $45.00

C) $65.00

D) $31.00

What is cost of goods sold per unit using variable costing?

A) $23.00

B) $45.00

C) $65.00

D) $31.00

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

24

Absorption costing is a method of inventory costing in which only variable manufacturing costs are included as inventoriable costs.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

25

Charlassier Corporation manufactures and sells laptop computers and uses standard costing. For the month of September there was no beginning inventory, there were 3,000 units produced and 2,500 units sold. The manufacturing variable cost per unit is $385 and the variable operating cost per unit was $312.50. The fixed manufacturing cost is $450,000 and the fixed operating cost is $75,000. The selling price per unit is $925.

Required:

Prepare the income statement for Charlassier Corporation for September under variable costing.

Required:

Prepare the income statement for Charlassier Corporation for September under variable costing.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

26

Swan Textiles Inc. produces and sells a decorative pillow for $98.00 per unit. In the first month of operation, 2,300 units were produced and 1,800 units were sold. Actual fixed costs are the same as the amount budgeted for the month. Other information for the month includes:

What is the contribution margin using variable costing?

A) $135,000

B) $124,200

C) $165,600

D) $123,500

What is the contribution margin using variable costing?

A) $135,000

B) $124,200

C) $165,600

D) $123,500

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

27

Speedy Supplies sells a product at a price of $150. It's variable manufactured cost is $30 and the variable marketing cost per unit is $17.50 with fixed cost per period of $60,000. What would be the change in operating income under variable costs if sales increase from 10,000 to 10,500 units?

A) $60,000

B) $51,250

C) $66,250

D) Loss of $8,750

A) $60,000

B) $51,250

C) $66,250

D) Loss of $8,750

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

28

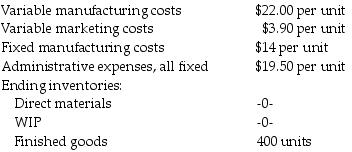

Jean Peck's Furniture manufactures tables for hospitality sector. It takes only bulk orders and each table is sold for $500 after negotiations. In the month of January, it manufactures 3,000 tables and sells 2,600 tables. Actual fixed costs are the same as the amount of fixed costs budgeted for the month.

The following information is provided for the month of January:

At the end of the month Jean Peck's Furniture has an ending inventory of finished goods of 400 units. The company also incurs a sales commission of $13 per unit.

What is the operating income when using absorption costing? (Round any intermediary calculations to the nearest cent and your final answer to the nearest dollar.)

A) $828,000

B) $858,000

C) $794,200

D) $824,200

The following information is provided for the month of January:

At the end of the month Jean Peck's Furniture has an ending inventory of finished goods of 400 units. The company also incurs a sales commission of $13 per unit.

What is the operating income when using absorption costing? (Round any intermediary calculations to the nearest cent and your final answer to the nearest dollar.)

A) $828,000

B) $858,000

C) $794,200

D) $824,200

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

29

Swan Textiles Inc. produces and sells a decorative pillow for $98.00 per unit. In the first month of operation, 2,200 units were produced and 1,800 units were sold. Actual fixed costs are the same as the amount budgeted for the month. Other information for the month includes:

What is the operating income using variable costing?

A) $129,780

B) $69,480

C) $104,580

D) $56,080

What is the operating income using variable costing?

A) $129,780

B) $69,480

C) $104,580

D) $56,080

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

30

Under both variable and absorption costing, research and development costs are period costs.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following statements is true of contribution-margin format of the income statement?

A) It is used for absorption costing.

B) It distinguishes between variable and fixed costs in its format.

C) It distinguishes manufacturing costs from nonmanufacturing costs.

D) It calculates gross margin.

A) It is used for absorption costing.

B) It distinguishes between variable and fixed costs in its format.

C) It distinguishes manufacturing costs from nonmanufacturing costs.

D) It calculates gross margin.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

32

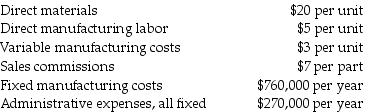

Jean Peck's Furniture manufactures tables for hospitality sector. It takes only bulk orders and each table is sold for $400 after negotiations. In the month of January, it manufactures 3,200 tables and sells 2,400 tables. Actual fixed costs are the same as the amount of fixed costs budgeted for the month.

The following information is provided for the month of January:

At the end of the month Jean Peck's Furniture has an ending inventory of finished goods of 800 units. The company also incurs a sales commission of $11 per unit.

What is the cost of goods sold per unit when using absorption costing?

A) $130.00

B) $101.87

C) $158.13

D) $169.13

The following information is provided for the month of January:

At the end of the month Jean Peck's Furniture has an ending inventory of finished goods of 800 units. The company also incurs a sales commission of $11 per unit.

What is the cost of goods sold per unit when using absorption costing?

A) $130.00

B) $101.87

C) $158.13

D) $169.13

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

33

The gross-margin format is used for ________.

A) variable costing income statement

B) mixed costing income statement

C) absorption costing income statement

D) standard costing income statement

A) variable costing income statement

B) mixed costing income statement

C) absorption costing income statement

D) standard costing income statement

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

34

Jean Peck's Furniture manufactures tables for hospitality sector. It takes only bulk orders and each table is sold for $500 after negotiations. In the month of January, it manufactures 3,100 tables and sells 2,700 tables. Actual fixed costs are the same as the amount of fixed costs budgeted for the month.

The following information is provided for the month of January:

At the end of the month Jean Peck's Furniture has an ending inventory of finished goods of 400 units. The company also incurs a sales commission of $13 per unit.

What is the gross margin when using absorption costing? (Round any intermediary calculations to the nearest cent and your final answer to the nearest dollar.)

A) $958,700

B) $1,179,900

C) $842,003

D) $907,551

The following information is provided for the month of January:

At the end of the month Jean Peck's Furniture has an ending inventory of finished goods of 400 units. The company also incurs a sales commission of $13 per unit.

What is the gross margin when using absorption costing? (Round any intermediary calculations to the nearest cent and your final answer to the nearest dollar.)

A) $958,700

B) $1,179,900

C) $842,003

D) $907,551

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following statements is true of gross-margin format of the income statement?

A) It distinguishes between manufacturing and nonmanufacturing costs.

B) It distinguishes variable costs from fixed costs.

C) It is used for variable costing.

D) It calculates the contribution margin from sales.

A) It distinguishes between manufacturing and nonmanufacturing costs.

B) It distinguishes variable costs from fixed costs.

C) It is used for variable costing.

D) It calculates the contribution margin from sales.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

36

The contribution-margin format is used for ________.

A) variable costing income statement

B) mixed costing income statement

C) absorption costing income statement

D) job order costing income statement

A) variable costing income statement

B) mixed costing income statement

C) absorption costing income statement

D) job order costing income statement

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

37

________ are subtracted from sales to calculate gross margin.

A) Variable and fixed manufacturing costs

B) Fixed administrative costs

C) Variable administrative costs

D) Fixed selling costs

A) Variable and fixed manufacturing costs

B) Fixed administrative costs

C) Variable administrative costs

D) Fixed selling costs

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

38

a.Explain the difference between the variable and absorption costing methods.

b.Which method(s) are required for external reporting? For internal reporting?

b.Which method(s) are required for external reporting? For internal reporting?

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

39

Variable costing is also called direct costing because it considers other nonmanufacturing direct costs, such as direct marketing costs as inventoriable costs.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

40

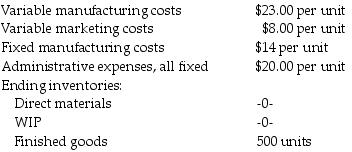

Swansea Finishing produces and sells a decorative pillow for $100.00 per unit. In the first month of operation, 2,000 units were produced and 1,800 units were sold. Actual fixed costs are the same as the amount budgeted for the month. Other information for the month includes:

What is cost of goods sold using variable costing?

A) $41,400

B) $73,800

C) $121,000

D) $56,000

What is cost of goods sold using variable costing?

A) $41,400

B) $73,800

C) $121,000

D) $56,000

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

41

Freetown Corporation incurred fixed manufacturing costs of $34,000 during 2017. Other information for 2017 includes:

The budgeted denominator level is 2,000 units.

Units produced total 1,800 units.

Units sold total 1,300 units.

Beginning inventory was zero.

The company uses absorption costing and the fixed manufacturing cost rate is based on the budgeted denominator level. Manufacturing variances are closed to cost of goods sold.

Operating income using absorption costing will be ________ than operating income if using variable costing. (Round any intermediary calculations to the nearest cent and your final answer to the nearest dollar.)

A) $11,900 higher

B) $9,444 lower

C) $8,500 higher

D) $22,100 lower

The budgeted denominator level is 2,000 units.

Units produced total 1,800 units.

Units sold total 1,300 units.

Beginning inventory was zero.

The company uses absorption costing and the fixed manufacturing cost rate is based on the budgeted denominator level. Manufacturing variances are closed to cost of goods sold.

Operating income using absorption costing will be ________ than operating income if using variable costing. (Round any intermediary calculations to the nearest cent and your final answer to the nearest dollar.)

A) $11,900 higher

B) $9,444 lower

C) $8,500 higher

D) $22,100 lower

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

42

Freetown Corporation incurred fixed manufacturing costs of $26,000 during 2017. Other information for 2017 includes:

The budgeted denominator level is 2,800 units.

Units produced total 1,500 units.

Units sold total 1,300 units.

Beginning inventory was zero.

The company uses absorption costing and the fixed manufacturing cost rate is based on the budgeted denominator level. Manufacturing variances are closed to cost of goods sold.

Fixed manufacturing costs expensed on the income statement (excluding adjustments for variances) total ________. (Round any intermediary calculations to the nearest cent and your final answer to the nearest dollar.)

A) $12,077

B) $22,533

C) $26,000

D) $0

The budgeted denominator level is 2,800 units.

Units produced total 1,500 units.

Units sold total 1,300 units.

Beginning inventory was zero.

The company uses absorption costing and the fixed manufacturing cost rate is based on the budgeted denominator level. Manufacturing variances are closed to cost of goods sold.

Fixed manufacturing costs expensed on the income statement (excluding adjustments for variances) total ________. (Round any intermediary calculations to the nearest cent and your final answer to the nearest dollar.)

A) $12,077

B) $22,533

C) $26,000

D) $0

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

43

Venus Corporation incurred fixed manufacturing costs of $6,300 during 2017. Other information for 2017 includes:

The budgeted denominator level is 1,600 units.

Units produced total 760 units.

Units sold total 640 units.

Beginning inventory was zero.

The company uses variable costing and the fixed manufacturing cost rate is based on the budgeted denominator level. Manufacturing variances are closed to cost of goods sold.

Fixed manufacturing costs included in ending inventory total ________.

A) $995

B) $3,308

C) $473

D) $0

The budgeted denominator level is 1,600 units.

Units produced total 760 units.

Units sold total 640 units.

Beginning inventory was zero.

The company uses variable costing and the fixed manufacturing cost rate is based on the budgeted denominator level. Manufacturing variances are closed to cost of goods sold.

Fixed manufacturing costs included in ending inventory total ________.

A) $995

B) $3,308

C) $473

D) $0

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

44

When comparing the operating incomes between absorption costing and variable costing, and ending finished inventory exceeds beginning finished inventory, it may be assumed that ________.

A) sales decreased during the period

B) variable cost per unit is more than fixed cost per unit

C) there is a favorable production-volume variance

D) absorption costing operating income exceeds variable costing operating income

A) sales decreased during the period

B) variable cost per unit is more than fixed cost per unit

C) there is a favorable production-volume variance

D) absorption costing operating income exceeds variable costing operating income

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

45

Jupiter Corporation incurred fixed manufacturing costs of $18,000 during 2017. Other information for 2017 includes:

The budgeted denominator level is 2,400 units.

Units produced total 2,700 units.

Units sold total 1,600 units.

Variable cost per unit is $4

Beginning inventory is zero.

The fixed manufacturing cost rate is based on the budgeted denominator level.

The operating income using variable costing will be ________ as compared to the operating income under absorption costing. (Round any intermediary calculations to the nearest cent and your final answer to the nearest dollar.)

A) lower by $8,250.00

B) lower by $2,250.00

C) higher by $8,250.00

D) higher by $2,250.00

The budgeted denominator level is 2,400 units.

Units produced total 2,700 units.

Units sold total 1,600 units.

Variable cost per unit is $4

Beginning inventory is zero.

The fixed manufacturing cost rate is based on the budgeted denominator level.

The operating income using variable costing will be ________ as compared to the operating income under absorption costing. (Round any intermediary calculations to the nearest cent and your final answer to the nearest dollar.)

A) lower by $8,250.00

B) lower by $2,250.00

C) higher by $8,250.00

D) higher by $2,250.00

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

46

Jupiter Corporation incurred fixed manufacturing costs of $19,000 during 2017. Other information for 2017 includes:

The budgeted denominator level is 2,300 units.

Units produced total 2,600 units.

Units sold total 1,700 units.

Variable cost per unit is $6

Beginning inventory is zero.

The fixed manufacturing cost rate is based on the budgeted denominator level.

Under absorption costing, the production-volume variance is ________. (Round any intermediary calculations to the nearest cent and your final answer to the nearest dollar.)

A) $4,278

B) $2,300

C) $2,478

D) 0

The budgeted denominator level is 2,300 units.

Units produced total 2,600 units.

Units sold total 1,700 units.

Variable cost per unit is $6

Beginning inventory is zero.

The fixed manufacturing cost rate is based on the budgeted denominator level.

Under absorption costing, the production-volume variance is ________. (Round any intermediary calculations to the nearest cent and your final answer to the nearest dollar.)

A) $4,278

B) $2,300

C) $2,478

D) 0

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following statements is true?

A) When production is equal to sales, operating income will be greater under variable costing than under absorption costing.

B) When production is greater than sales, operating income will be lower under variable costing than absorption costing.

C) When production is less than sales, operating income is higher under absorption costing than variable costing.

D) When production is greater than sales, operating income is greater under absorption cost than under variable costing.

A) When production is equal to sales, operating income will be greater under variable costing than under absorption costing.

B) When production is greater than sales, operating income will be lower under variable costing than absorption costing.

C) When production is less than sales, operating income is higher under absorption costing than variable costing.

D) When production is greater than sales, operating income is greater under absorption cost than under variable costing.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

48

Jupiter Corporation incurred fixed manufacturing costs of $18,000 during 2017. Other information for 2017 includes:

The budgeted denominator level is 2,400 units.

Units produced total 2,700 units.

Units sold total 1,900 units.

Variable cost per unit is $4

Beginning inventory is zero.

The fixed manufacturing cost rate is based on the budgeted denominator level.

Under absorption costing, total manufacturing costs expensed on the income statement (excluding adjustments for variances) total ________. (Round any intermediary calculations to the nearest cent and your final answer to the nearest dollar.)

A) $31,050

B) $21,850

C) $25,050

D) $14,250

The budgeted denominator level is 2,400 units.

Units produced total 2,700 units.

Units sold total 1,900 units.

Variable cost per unit is $4

Beginning inventory is zero.

The fixed manufacturing cost rate is based on the budgeted denominator level.

Under absorption costing, total manufacturing costs expensed on the income statement (excluding adjustments for variances) total ________. (Round any intermediary calculations to the nearest cent and your final answer to the nearest dollar.)

A) $31,050

B) $21,850

C) $25,050

D) $14,250

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

49

The following information pertains to Stone Wall Corporation:

What is the difference between operating incomes under absorption costing and variable costing?

A) $3,000

B) $37,000

C) $21,000

D) $10,500

What is the difference between operating incomes under absorption costing and variable costing?

A) $3,000

B) $37,000

C) $21,000

D) $10,500

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

50

Venus Corporation incurred fixed manufacturing costs of $6,600 during 2017. Other information for 2017 includes:

The budgeted denominator level is 1,600 units.

Units produced total 770 units.

Units sold total 600 units.

Beginning inventory was zero.

The company uses variable costing and the fixed manufacturing cost rate is based on the budgeted denominator level. Manufacturing variances are closed to cost of goods sold.

The production-volume variance totals ________.

A) $1,457

B) $701

C) $3,424

D) 0

The budgeted denominator level is 1,600 units.

Units produced total 770 units.

Units sold total 600 units.

Beginning inventory was zero.

The company uses variable costing and the fixed manufacturing cost rate is based on the budgeted denominator level. Manufacturing variances are closed to cost of goods sold.

The production-volume variance totals ________.

A) $1,457

B) $701

C) $3,424

D) 0

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

51

In general, if inventory increases during an accounting period, ________.

A) variable costing will report less operating income than absorption costing

B) absorption costing will report less operating income than variable costing

C) variable costing and absorption costing will report the same operating income

D) both variable costing and absorption costing will show losses

A) variable costing will report less operating income than absorption costing

B) absorption costing will report less operating income than variable costing

C) variable costing and absorption costing will report the same operating income

D) both variable costing and absorption costing will show losses

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

52

Freetown Corporation incurred fixed manufacturing costs of $30,000 during 2017. Other information for 2017 includes:

The budgeted denominator level is 2,000 units.

Units produced total 1,800 units.

Units sold total 1,300 units.

Beginning inventory was zero.

The company uses absorption costing and the fixed manufacturing cost rate is based on the budgeted denominator level. Manufacturing variances are closed to cost of goods sold.

Fixed manufacturing costs included in ending inventory total ________. (Round any intermediary calculations to the nearest cent and your final answer to the nearest dollar.)

A) $8,333

B) $11,538

C) $7,500

D) $0

The budgeted denominator level is 2,000 units.

Units produced total 1,800 units.

Units sold total 1,300 units.

Beginning inventory was zero.

The company uses absorption costing and the fixed manufacturing cost rate is based on the budgeted denominator level. Manufacturing variances are closed to cost of goods sold.

Fixed manufacturing costs included in ending inventory total ________. (Round any intermediary calculations to the nearest cent and your final answer to the nearest dollar.)

A) $8,333

B) $11,538

C) $7,500

D) $0

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

53

Garfield Company has the following information for the current year:

What is the difference between operating incomes under absorption costing and variable costing?

A) $180,000

B) $100,000

C) $50,000

D) $110,000

What is the difference between operating incomes under absorption costing and variable costing?

A) $180,000

B) $100,000

C) $50,000

D) $110,000

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

54

Venus Corporation incurred fixed manufacturing costs of $6,300 during 2017. Other information for 2017 includes:

The budgeted denominator level is 1,600 units.

Units produced total 770 units.

Units sold total 600 units.

Beginning inventory was zero.

The company uses variable costing and the fixed manufacturing cost rate is based on the budgeted denominator level. Manufacturing variances are closed to cost of goods sold.

Fixed manufacturing costs expensed on the income statement (excluding adjustments for variances) total ________.

A) $2,363

B) $4,909

C) $6,300

D) $0

The budgeted denominator level is 1,600 units.

Units produced total 770 units.

Units sold total 600 units.

Beginning inventory was zero.

The company uses variable costing and the fixed manufacturing cost rate is based on the budgeted denominator level. Manufacturing variances are closed to cost of goods sold.

Fixed manufacturing costs expensed on the income statement (excluding adjustments for variances) total ________.

A) $2,363

B) $4,909

C) $6,300

D) $0

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

55

Venus Corporation incurred fixed manufacturing costs of $4,800 during 2017. Other information for 2017 includes:

The budgeted denominator level is 1,600 units.

Units produced total 770 units.

Units sold total 630 units.

Beginning inventory was zero.

The company uses variable costing and the fixed manufacturing cost rate is based on the budgeted denominator level. Manufacturing variances are closed to cost of goods sold.

Operating income using variable costing will be ________ than operating income if using absorption costing.

A) $2,490 higher

B) $2,490 lower

C) $1,890 higher

D) $420 lower

The budgeted denominator level is 1,600 units.

Units produced total 770 units.

Units sold total 630 units.

Beginning inventory was zero.

The company uses variable costing and the fixed manufacturing cost rate is based on the budgeted denominator level. Manufacturing variances are closed to cost of goods sold.

Operating income using variable costing will be ________ than operating income if using absorption costing.

A) $2,490 higher

B) $2,490 lower

C) $1,890 higher

D) $420 lower

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

56

Jupiter Corporation incurred fixed manufacturing costs of $16,000 during 2017. Other information for 2017 includes:

The budgeted denominator level is 2,300 units.

Units produced total 2,600 units.

Units sold total 1,600 units.

Variable cost per unit is $4

Beginning inventory is zero.

The fixed manufacturing cost rate is based on the budgeted denominator level.

Under variable costing, the fixed manufacturing costs expensed on the income statement (excluding adjustments for variances) total ________.

A) $16,000

B) $11,130

C) $21,530

D) $0

The budgeted denominator level is 2,300 units.

Units produced total 2,600 units.

Units sold total 1,600 units.

Variable cost per unit is $4

Beginning inventory is zero.

The fixed manufacturing cost rate is based on the budgeted denominator level.

Under variable costing, the fixed manufacturing costs expensed on the income statement (excluding adjustments for variances) total ________.

A) $16,000

B) $11,130

C) $21,530

D) $0

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

57

One possible means of determining the difference between operating incomes for absorption costing and variable costing is by ________.

A) subtracting sales of the previous period from sales of this period

B) subtracting fixed manufacturing overhead in beginning inventory from fixed manufacturing overhead in ending inventory

C) multiplying the number of units produced by the budgeted fixed manufacturing cost rate

D) adding fixed manufacturing costs to the production-volume variance

A) subtracting sales of the previous period from sales of this period

B) subtracting fixed manufacturing overhead in beginning inventory from fixed manufacturing overhead in ending inventory

C) multiplying the number of units produced by the budgeted fixed manufacturing cost rate

D) adding fixed manufacturing costs to the production-volume variance

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

58

Freetown Corporation incurred fixed manufacturing costs of $26,000 during 2017. Other information for 2017 includes:

The budgeted denominator level is 2,600 units.

Units produced total 1,800 units.

Units sold total 1,200 units.

Beginning inventory was zero.

The company uses absorption costing and the fixed manufacturing cost rate is based on the budgeted denominator level. Manufacturing variances are closed to cost of goods sold.

The production-volume variance is ________. (Round any intermediary calculations to the nearest cent and your final answer to the nearest dollar.)

A) $6,000

B) $8,000

C) $14,000

D) $0

The budgeted denominator level is 2,600 units.

Units produced total 1,800 units.

Units sold total 1,200 units.

Beginning inventory was zero.

The company uses absorption costing and the fixed manufacturing cost rate is based on the budgeted denominator level. Manufacturing variances are closed to cost of goods sold.

The production-volume variance is ________. (Round any intermediary calculations to the nearest cent and your final answer to the nearest dollar.)

A) $6,000

B) $8,000

C) $14,000

D) $0

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

59

If the unit level of inventory increases during an accounting period, then ________.

A) less operating income will be reported under absorption costing than variable costing

B) more operating income will be reported under absorption costing than variable costing

C) operating income will be the same under absorption costing and variable costing

D) the exact effect on operating income cannot be determined

A) less operating income will be reported under absorption costing than variable costing

B) more operating income will be reported under absorption costing than variable costing

C) operating income will be the same under absorption costing and variable costing

D) the exact effect on operating income cannot be determined

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following statements is true of absorption costing?

A) Absorption costing allocates fixed manufacturing overhead to actual units produced during the period.

B) Absorption costing carries over nonmanufacturing costs to the future periods.

C) Absorption costing shows the same level of profit as variable costing irrespective of the level of inventories.

D) Absorption costing allocates total manufacturing cost using the budgeted level of production for a particular year.

A) Absorption costing allocates fixed manufacturing overhead to actual units produced during the period.

B) Absorption costing carries over nonmanufacturing costs to the future periods.

C) Absorption costing shows the same level of profit as variable costing irrespective of the level of inventories.

D) Absorption costing allocates total manufacturing cost using the budgeted level of production for a particular year.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

61

In absorption costing, fixed manufacturing overhead is treated as a period cost.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

62

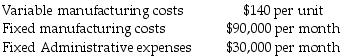

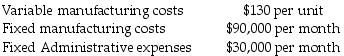

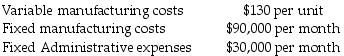

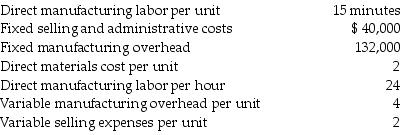

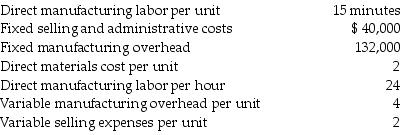

Aspen Manufacturing Company sells its products for $33 each. The current production level is 50,000 units, although only 40,000 units are anticipated to be sold.

Required:

a.Prepare an income statement using absorption costing.

b.Prepare an income statement using variable costing.

Required:

a.Prepare an income statement using absorption costing.

b.Prepare an income statement using variable costing.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

63

At the end of the accounting period, Armstrong Corporation reports operating income of $30,000. Which of the following statements is true, if Armstrong's inventory levels decrease during the accounting period?

A) Variable costing will report less operating income than absorption costing.

B) Absorption costing will report less operating income than variable costing.

C) Variable costing and absorption costing will report the same operating income since the cost of goods sold is the same.

D) Variable costing and absorption costing will report the same operating income since the total costs are the same.

A) Variable costing will report less operating income than absorption costing.

B) Absorption costing will report less operating income than variable costing.

C) Variable costing and absorption costing will report the same operating income since the cost of goods sold is the same.

D) Variable costing and absorption costing will report the same operating income since the total costs are the same.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

64

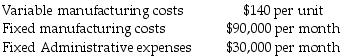

Jarvis Golf Company sells a special putter for $20 each. In March, it sold 28,000 putters while manufacturing 30,000. There was no beginning inventory on March 1. Production information for March was:

Required:

a.Compute the cost per unit under both absorption and variable costing.

b.Compute the ending inventories under both absorption and variable costing.

c.Compute operating income under both absorption and variable costing.

Required:

a.Compute the cost per unit under both absorption and variable costing.

b.Compute the ending inventories under both absorption and variable costing.

c.Compute operating income under both absorption and variable costing.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

65

In variable costing, all nonmanufacturing costs are subtracted from contribution margin.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

66

Beginning inventory + cost of goods manufactured = Cost of goods sold + Ending inventory.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

67

The basis of the difference between variable costing and absorption costing is how fixed manufacturing costs are accounted for.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

68

Johnson Realty bought a 2,000-acre island for $10,000,000 and divided it into 200 equal size lots.

As the lots are sold, they are cleared at an average cost of $5,000.

Storm drains and driveways are installed at an average cost of $8,000 per site.

Sales commissions are 10% of selling price.

Administrative costs are $850,000 per year.

The average selling price was $160,000 per lot during 2017 when 50 lots were sold.

During 2018, the company bought another 2,000-acre island and developed it exactly the same way. Lot sales in 2018 totaled 300 with an average selling price of $160,000. All costs were the same as in 2017.

Required:

Prepare income statements for both years using both absorption and variable costing methods.

As the lots are sold, they are cleared at an average cost of $5,000.

Storm drains and driveways are installed at an average cost of $8,000 per site.

Sales commissions are 10% of selling price.

Administrative costs are $850,000 per year.

The average selling price was $160,000 per lot during 2017 when 50 lots were sold.

During 2018, the company bought another 2,000-acre island and developed it exactly the same way. Lot sales in 2018 totaled 300 with an average selling price of $160,000. All costs were the same as in 2017.

Required:

Prepare income statements for both years using both absorption and variable costing methods.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

69

Ireland Corporation planned to be in operation for three years.

-During the first year, 2017, it had no sales but incurred $240,000 in variable manufacturing expenses and $80,000 in fixed manufacturing expenses.

-In 2018, it sold half of the finished goods inventory from 2017 for $200,000 but it had no manufacturing costs.

-In 2019, it sold the remainder of the inventory for $240,000, had no manufacturing expenses and went out of business.

-Marketing and administrative expenses were fixed and totaled $40,000 each year.

Required:

a.Prepare an income statement for each year using absorption costing.

b.Prepare an income statement for each year using variable costing.

-During the first year, 2017, it had no sales but incurred $240,000 in variable manufacturing expenses and $80,000 in fixed manufacturing expenses.

-In 2018, it sold half of the finished goods inventory from 2017 for $200,000 but it had no manufacturing costs.

-In 2019, it sold the remainder of the inventory for $240,000, had no manufacturing expenses and went out of business.

-Marketing and administrative expenses were fixed and totaled $40,000 each year.

Required:

a.Prepare an income statement for each year using absorption costing.

b.Prepare an income statement for each year using variable costing.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

70

Given a constant contribution margin per unit and constant fixed costs, the period-to-period change in operating income under variable costing is driven solely by ________.

A) changes in the quantity of units actually sold

B) changes in the quantity of units produced

C) changes in ending inventory

D) changes in sales price per unit

A) changes in the quantity of units actually sold

B) changes in the quantity of units produced

C) changes in ending inventory

D) changes in sales price per unit

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

71

The contribution-margin format of the income statement is used with absorption costing.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

72

Absorption costing enables managers to increase operating income by increasing the unit level of sales, as well as by producing more units.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

73

Fixed manufacturing overhead is a period cost both under variable costing and under absorption costing.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

74

When production is less than sales, operating income will be the same regardless of whether variable cost or absorption costing is used.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

75

Absorption-costing income statements usually do not differentiate between variable and fixed costs.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

76

When production is greater than sales, operating income under variable costing will be less than what it would be under absorption costing.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

77

The production-volume variance only exists under variable costing and not under absorption costing.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

78

Given a constant contribution margin per unit and constant fixed costs, the period-to-period change in operating income under variable costing is driven solely by changes in the quantity of units actually manufactured.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

79

The contribution-margin format of the income statement distinguishes manufacturing costs from nonmanufacturing costs.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

80

The production-volume variance, which relates only to fixed manufacturing overhead, exists under absorption costing but not under variable costing.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck