Deck 15: Futures Markets and Securities

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/112

Play

Full screen (f)

Deck 15: Futures Markets and Securities

1

Futures trading requires large amounts of capital because the buyer of a contract must deposit the full settlement price of the contract at the time of purchase.

False

2

Although the major commodities exchanges continue to operate separately, ownership has been concentrated under

A)The New York Mercantile Exchange.

B)The Chicago Board of Trade.

C)The Chicago Mercantile Exchange.

D)The New York Stock Exchange.

A)The New York Mercantile Exchange.

B)The Chicago Board of Trade.

C)The Chicago Mercantile Exchange.

D)The New York Stock Exchange.

C

3

All futures contracts trade continuously between 7:30 a.m.and 2:00 p.m., Monday through Friday.

False

4

Commodity prices react to a unique set of economic, political, and international pressures, as well as to the weather.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

5

Futures contracts for various commodities have different trading hours depending on the commodity.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

6

The number of commodities traded in futures markets has been decreasing because of tighter regulations and a narrower definition of commodity.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

7

With futures contracts, the price at which the commodity must be delivered is

A)set when the futures contract is sold.

B)set when the contract expires.

C)is equivalent to the strike price for an options contract.

D)changes frequently during the life of the contract.

A)set when the futures contract is sold.

B)set when the contract expires.

C)is equivalent to the strike price for an options contract.

D)changes frequently during the life of the contract.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

8

The seller of a futures contract

A)has the option of canceling the contract the following day if the price is not acceptable to him/her.

B)is legally bound to make delivery of the specified item on the specified day.

C)receives the entire contract amount at the time the contract is made.

D)must make delivery before receiving any monies on the contract.

A)has the option of canceling the contract the following day if the price is not acceptable to him/her.

B)is legally bound to make delivery of the specified item on the specified day.

C)receives the entire contract amount at the time the contract is made.

D)must make delivery before receiving any monies on the contract.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

9

All trading in the futures market is done on a margin basis.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following are specifically stated in futures contracts?

I.the quantity of the commodity to be delivered

II.the quality of the commodity to be delivered

III.the exact price at which the commodity must be delivered

V.the time and place at which the commodity must be delivered

A)I and II only

B)II and IV only

C)I, II and III only

D)I, II and IV only

I.the quantity of the commodity to be delivered

II.the quality of the commodity to be delivered

III.the exact price at which the commodity must be delivered

V.the time and place at which the commodity must be delivered

A)I and II only

B)II and IV only

C)I, II and III only

D)I, II and IV only

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

11

Unlike stocks and bonds, futures contracts trade only at specific times during normal working hours.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

12

Futures contracts obligates a participant to buy or sell the commodity at the contracted price unless the contract is canceled or liquidated before the expiration date.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

13

With a futures contract, an investor cannot lose more than the price of the contract itself.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

14

The definition of commodity is broad enough to include such things as.foreign currencies and the future value of stock market indexes.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

15

The amount paid at the time a futures contract is sold

A)represents the maximum loss for the buyer of the contract.

B)represents the maximum profit for the buyer of the contract.

C)is simply a refundable security deposit.

D)is the total value of the goods being traded in the future.

A)represents the maximum loss for the buyer of the contract.

B)represents the maximum profit for the buyer of the contract.

C)is simply a refundable security deposit.

D)is the total value of the goods being traded in the future.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following characteristics apply to futures contracts?

I.Futures contracts are an important tool to control risk.

II.Futures contracts are highly risky and involve speculation.

III.Futures contracts specify both the quantity and the quality of the item.

IV.The buyer must hold the contract until maturity.

A)I and II only

B)II and IV only

C)I, II and III only

D)I, II, III and IV

I.Futures contracts are an important tool to control risk.

II.Futures contracts are highly risky and involve speculation.

III.Futures contracts specify both the quantity and the quality of the item.

IV.The buyer must hold the contract until maturity.

A)I and II only

B)II and IV only

C)I, II and III only

D)I, II, III and IV

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following features are shared by futures contracts and options?

I.They have specified expiration dates.

II.Their value is derived from changes in the value of some other asset.

III.Unprofitable futures or options can simply be allowed expire unexercised.

IV.Futures contracts specify the price at which the commodity will be delivered at the expiration date.

A)I and II only

B)I and IV only

C)II and III only

D)I, II and III only

I.They have specified expiration dates.

II.Their value is derived from changes in the value of some other asset.

III.Unprofitable futures or options can simply be allowed expire unexercised.

IV.Futures contracts specify the price at which the commodity will be delivered at the expiration date.

A)I and II only

B)I and IV only

C)II and III only

D)I, II and III only

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

18

A futures contract

I.obligates the buyer of the contract to buy a specified amount of a commodity.

II.grants the buyer the right to either buy or sell a specified amount of a commodity.

III.uses specified settle prices that vary with the type of commodity.

IV.establishes the delivery price based on the selling price of the futures contract.

A)I and III only

B)I and IV only

C)II and III only

D)II and IV only

I.obligates the buyer of the contract to buy a specified amount of a commodity.

II.grants the buyer the right to either buy or sell a specified amount of a commodity.

III.uses specified settle prices that vary with the type of commodity.

IV.establishes the delivery price based on the selling price of the futures contract.

A)I and III only

B)I and IV only

C)II and III only

D)II and IV only

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

19

The Chicago Mercantile Exchange recently merged with

A)the Chicago Board of Trade.

B)the American Exchange.

C)the New York Mercantile Exchange.

D)NASDAQ.

A)the Chicago Board of Trade.

B)the American Exchange.

C)the New York Mercantile Exchange.

D)NASDAQ.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

20

Because a futures contract deals with very large trading units, even a modest price change in the price of the underlying commodity can have a large impact on the market value of the contract.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

21

The normal initial margin requirement for commodities or financial futures ranges from about 2% to 10% of the value of the contract.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

22

Speculators provide liquidity to the futures market.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

23

In the futures markets, gains and losses in a contract's value are calculated every day and added to or subtracted from the trader's account.This procedure is called

A)checking the maintenance margin.

B)checking the maintenance deposit.

C)settling.

D)mark-to-the-market.

A)checking the maintenance margin.

B)checking the maintenance deposit.

C)settling.

D)mark-to-the-market.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

24

BBC Inc.needs to quote a price at which it will sell oatmeal to a large supermarket chain next year.It can limit the risk from an increase in the price of oats next year by

A)taking short positions in oat futures.

B)taking long positions in oat futures.

C)taking long and short positions in oat futures with the same expiration date.

D)taking long and short positions in oat futures with different expiration dates.

A)taking short positions in oat futures.

B)taking long positions in oat futures.

C)taking long and short positions in oat futures with the same expiration date.

D)taking long and short positions in oat futures with different expiration dates.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

25

Eric has just purchased a heating oil contract at $2.05 per gallon.The contract size is 21,000 gallons.Initial margin is $6,075; maintenance margin is $4,500.If the price of heating oil is $2.15 when the contract expires, Eric's percentage profit or loss is

A)4.88% profit.

B)4.88% loss.

C)9.23% loss.

D)34.57% profit.

A)4.88% profit.

B)4.88% loss.

C)9.23% loss.

D)34.57% profit.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

26

Failure to meet a margin call will cause an investor's futures contract to be sold.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

27

The maximum loss on a futures contract is the price paid for the contract.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

28

Hedgers in the futures markets are often either users or producers of the commodity traded.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

29

The seller of a futures contract in euros hopes that the dollar will strengthen against the euro.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

30

Seth McDonald grows corn.In May, he decides to sell 3 contracts, about half of his expected crop, for December delivery.The contract price is $3.65 per bushel and the contract size is 5,000 bushels.Shortly before the delivery date, corn is selling in the spot (immediate delivery)market for $3.85 per bushel.

A)Seth will simply let the contract expire and sell his corn in the spot market.

B)Seth can protect his profit by buying an offsetting contract.

C)Seth has an opportunity loss of $3,000 because he must deliver corn at the lower price.

D)Seth can hold on to his corn for several months and hope that the price to rises enough to offset his loss.

A)Seth will simply let the contract expire and sell his corn in the spot market.

B)Seth can protect his profit by buying an offsetting contract.

C)Seth has an opportunity loss of $3,000 because he must deliver corn at the lower price.

D)Seth can hold on to his corn for several months and hope that the price to rises enough to offset his loss.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

31

A farmer who grows soy beans can hedge against the risk that bad weather will damage her crop by

A)buying soy bean futures for delivery near the time of harvest.

B)selling soy bean futures for delivery near the time of harvest.

C)buying contracts in alternative crops for delivery near the time of harvest.

D)buying contracts in unrelated commodities for delivery near the time of harvest.

A)buying soy bean futures for delivery near the time of harvest.

B)selling soy bean futures for delivery near the time of harvest.

C)buying contracts in alternative crops for delivery near the time of harvest.

D)buying contracts in unrelated commodities for delivery near the time of harvest.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

32

Larry is a corn farmer.To attempt to maximize the value of his crop, Larry is most likely to benefit from

A)selling his crop at the market price when it is harvested.

B)buying a futures contract on corn for delivery at harvest time.

C)selling a futures contract on corn for delivery at harvest time.

D)buying a futures contract on corn and selling a futures contract on wheat.

A)selling his crop at the market price when it is harvested.

B)buying a futures contract on corn for delivery at harvest time.

C)selling a futures contract on corn for delivery at harvest time.

D)buying a futures contract on corn and selling a futures contract on wheat.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

33

Eric has just purchased a heating oil contract at $2.05 per gallon.The contract size is 21,000 gallons.Initial margin is $6,075; maintenance margin is $4,500.If the price of heating oil is $2.15 when the contract expires, Eric's profit or loss is

A)$(2,100)loss.

B)$2,100 profit.

C)$(3,975)loss.

D)$(2,400)loss.

A)$(2,100)loss.

B)$2,100 profit.

C)$(3,975)loss.

D)$(2,400)loss.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following is(are)correct statements about the buyer of a futures contract?

I.The contract buyer is short on the position.

II.The contract buyer wants the price of the item to increase.

III.The buyer can liquidate the position with an offsetting transaction.

IV.The majority of the buyers actually take delivery of the item.

A)II only

B)I and II only

C)I and IV only

D)II and III only

I.The contract buyer is short on the position.

II.The contract buyer wants the price of the item to increase.

III.The buyer can liquidate the position with an offsetting transaction.

IV.The majority of the buyers actually take delivery of the item.

A)II only

B)I and II only

C)I and IV only

D)II and III only

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

35

The loss that can occur with a futures contract.is limited to the initial margin deposit.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

36

Hedgers who buy futures contracts are protecting themselves from future price increases.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

37

The margin deposit associated with the purchase of a futures contract

A)is a partial payment on the contract with the amount of the payment equal to 10% or more of the contract value.

B)represents the purchasers equity in the contract with the balance of the contract financed with borrowed funds at the margin rate of interest.

C)is related to the value of the item underlying the contract.

D)is used to cover any loss in market value of the contract resulting from adverse price fluctuations.

A)is a partial payment on the contract with the amount of the payment equal to 10% or more of the contract value.

B)represents the purchasers equity in the contract with the balance of the contract financed with borrowed funds at the margin rate of interest.

C)is related to the value of the item underlying the contract.

D)is used to cover any loss in market value of the contract resulting from adverse price fluctuations.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

38

Short and long positions in the futures markets refer to the length of time before the contracts' delivery dates.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

39

Speculators in the futures markets have no intention of actually taking possession of the commodity.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

40

An investor's margin in a futures contract is checked each day under a procedure known as mark-to-the-market.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

41

The high rates of returns, either positive or negative, on futures contracts are primarily due to the high initial margin requirement.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

42

Each commodity quote clearly identifies the contract's intrinsic value and time value.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

43

Fred has just sold short 3 contracts of May wheat on the CBT.These are 5,000 bushel contracts.The initial deposit is $1,500 per contract with a maintenance margin of $1,200.

(a)What is Fred's total initial margin?

(b)How much of an increase in the price of wheat is necessary to cause a margin call?

(a)What is Fred's total initial margin?

(b)How much of an increase in the price of wheat is necessary to cause a margin call?

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

44

In commodities trading, open interest at the end of a trading day is equal to

A)the net change in price from the prior day's close.

B)the number of speculative positions sold in the last 60-day period.

C)the number of contracts presently outstanding.

D)the advances minus the declines.

A)the net change in price from the prior day's close.

B)the number of speculative positions sold in the last 60-day period.

C)the number of contracts presently outstanding.

D)the advances minus the declines.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

45

Logan sold a corn futures contract using the initial margin of $2,700.His maintenance margin is $2,000.The price of began to rise in early summer, but Logan wants to keep his contract.When his margin falls below $2,000 (minimum maintenance)

A)his contract will be automatically sold or canceled.

B)he does not need to do anything since the most he can lose is $2,700.

C)he will need to deposit at least $700 with his broker to bring his margin back up to the initial deposit.

D)he will need to deliver the corn immediately.

A)his contract will be automatically sold or canceled.

B)he does not need to do anything since the most he can lose is $2,700.

C)he will need to deposit at least $700 with his broker to bring his margin back up to the initial deposit.

D)he will need to deliver the corn immediately.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following is NOT actively traded in the commodities futures markets?

A)soybeans

B)ethanol

C)weather

D)euros

A)soybeans

B)ethanol

C)weather

D)euros

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

47

All futures contracts are traded on a margin basis.What does "margin" mean, and how does the use of margin affect the inherent risk-return nature of the futures market?

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

48

A wheat futures contract is quoted in cents per bushel with a contract unit of 5,000 bushels.If the contract is quoted at a settle price of 685, then the value of one wheat futures contract is

A)$685.

B)$3,425.

C)$34,250.

D)$68,500

A)$685.

B)$3,425.

C)$34,250.

D)$68,500

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

49

Every commodity contract specifies all the following EXCEPT

A)the settle price.

B)the product.

C)the delivery month.

D)the unit size of the contract.

A)the settle price.

B)the product.

C)the delivery month.

D)the unit size of the contract.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

50

If oat futures are trading at $2.43 and the limit is 20 cents, the range will be $2.23 to $2.63.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

51

The futures market contains two basic types of traders: hedgers and speculators.Define the role played by each of these types of traders.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

52

The rate of return on a futures contract is based on the size of the initial margin deposit.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

53

The purchaser of a futures contract

A)is required to obtain a margin loan equal in amount to the cost of the contract minus the cash down payment.

B)is generally required to make a cash deposit of 10 to 20% of the contract price at the time the contract is entered.

C)does not have to worry about margin calls since margin loans are not required.

D)is affected by the daily procedure known as mark-to-the-market.

A)is required to obtain a margin loan equal in amount to the cost of the contract minus the cash down payment.

B)is generally required to make a cash deposit of 10 to 20% of the contract price at the time the contract is entered.

C)does not have to worry about margin calls since margin loans are not required.

D)is affected by the daily procedure known as mark-to-the-market.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

54

A successful hedge results in a guaranteed sales price to the producers of commodities.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

55

If the purchaser of a futures contract fails to meet a margin call,

A)his/her contract will be sold at the current market price.

B)his/her contract will automatically be executed along with immediate delivery.

C)their local broker can decide to waive the call.

D)they will be given a 30-day grace period before payment is required.

A)his/her contract will be sold at the current market price.

B)his/her contract will automatically be executed along with immediate delivery.

C)their local broker can decide to waive the call.

D)they will be given a 30-day grace period before payment is required.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

56

The open interest at the end of the trading day indicates the number of contracts in existence at that time.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

57

Each commodity contract specifies the product, the exchange on which the contract is traded, the size of the contract, the price at which the commodity must be delivered, and the delivery month.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

58

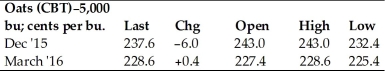

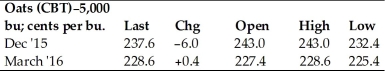

The November 22, 2015 the on-line edition of the Wall Street Journal listed the following information on oat futures.Quotes are in cents per bushel.  Based on this information, which one of the following statements is correct?

Based on this information, which one of the following statements is correct?

A)Oats trade on the New York Mercantile Exchange.

B)The highest price at which the March oats contract traded was $228.60 per contract.

C)The cost of a March 2016 contract was $11,430 at the market close.

D)The price of the March 2016 oats contract at the close was $200 higher than the previous day's closing price.

Based on this information, which one of the following statements is correct?

Based on this information, which one of the following statements is correct?A)Oats trade on the New York Mercantile Exchange.

B)The highest price at which the March oats contract traded was $228.60 per contract.

C)The cost of a March 2016 contract was $11,430 at the market close.

D)The price of the March 2016 oats contract at the close was $200 higher than the previous day's closing price.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

59

The open interest at the end of the trading day indicates the volume of contracts traded during the day.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

60

Investors can trade futures on electricity and natural gas.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

61

The basic reason why investors use spreading strategies when speculating in commodities is to

A)increase leverage.

B)increase profits.

C)reduce risk.

D)decrease transaction costs.

A)increase leverage.

B)increase profits.

C)reduce risk.

D)decrease transaction costs.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

62

For individual investors to adequately hedge their personal portfolios, they should always use the S&P 500 Stock Index futures contract.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

63

What is the return on invested capital to an investor who purchased a futures contract at a price of 297 and sells the contract for 308? The contract is on 5,000 units, requires a 3% margin deposit and is priced in cents per unit.

A)116.5%

B)119.0%

C)123.5%

D)127.4%

A)116.5%

B)119.0%

C)123.5%

D)127.4%

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following statements concerning futures are correct?

I.Investors in financial futures can earn both dividend income from the underlying security as well as the potential capital gain from the futures contract.

II.The return on a futures contract is computed by dividing the net difference between the sale and the purchase price of the contract by the amount of the margin deposit.

III.It is very easy to lose your entire investment in a futures contract in a very short period of time due to the volatility of the futures market and also the use of leverage.

IV.Conservative investors tend to purchase one futures contract as a means of increasing the return on their portfolio while maintaining minimal risk.

A)I and II only

B)II and III only

C)I, II and IV only

D)I, II and III only

I.Investors in financial futures can earn both dividend income from the underlying security as well as the potential capital gain from the futures contract.

II.The return on a futures contract is computed by dividing the net difference between the sale and the purchase price of the contract by the amount of the margin deposit.

III.It is very easy to lose your entire investment in a futures contract in a very short period of time due to the volatility of the futures market and also the use of leverage.

IV.Conservative investors tend to purchase one futures contract as a means of increasing the return on their portfolio while maintaining minimal risk.

A)I and II only

B)II and III only

C)I, II and IV only

D)I, II and III only

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

65

A corn futures contract closed yesterday at a price of $2.40 a bushel.The maximum daily price range is $0.40 and the daily price limit is $0.20.Therefore, the

A)highest closing price for today is $2.80 a bushel.

B)the most the price can fluctuate today is $0.20 a bushel.

C)minimum change in the price today is $0.20 a bushel.

D)lowest closing price for today is $2.20 a bushel.

A)highest closing price for today is $2.80 a bushel.

B)the most the price can fluctuate today is $0.20 a bushel.

C)minimum change in the price today is $0.20 a bushel.

D)lowest closing price for today is $2.20 a bushel.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

66

Some investors combine two or more different futures contracts into one investment position that offers the potential for generating a modest amount of profit while restricting exposure to loss.This practice is called

A)speculating.

B)spreading.

C)gambling.

D)market making.

A)speculating.

B)spreading.

C)gambling.

D)market making.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

67

Which one of the following statements is correct if a speculator short sells a commodity or financial futures contract?

A)The speculator expects to profit from a decline in the price of the contract.

B)The speculator stands to make an unlimited amount of profit since there is no limit to how high the price of the underlying commodity or financial instrument can rise.

C)The speculator is hoping to gain some of the benefit derived from the volatile price while limiting his/her exposure to loss.

D)The speculator may be hedging if the underlying commodity is not in the speculator's possession.

A)The speculator expects to profit from a decline in the price of the contract.

B)The speculator stands to make an unlimited amount of profit since there is no limit to how high the price of the underlying commodity or financial instrument can rise.

C)The speculator is hoping to gain some of the benefit derived from the volatile price while limiting his/her exposure to loss.

D)The speculator may be hedging if the underlying commodity is not in the speculator's possession.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

68

Hedging in the commodities market is a strategy primarily used by

A)individual investors with high risk tolerance levels for commodities.

B)institutional investors on behalf of their conservative investors.

C)by producers and processors of commodities.

D)investors looking for short-term capital gains.

A)individual investors with high risk tolerance levels for commodities.

B)institutional investors on behalf of their conservative investors.

C)by producers and processors of commodities.

D)investors looking for short-term capital gains.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

69

The return on a futures contract

A)is highly related to the low margin requirement.

B)is always equal to or greater than zero.

C)tends to be fairly stable from one trading day to the next.

D)is solely related to the current price of the underlying item.

A)is highly related to the low margin requirement.

B)is always equal to or greater than zero.

C)tends to be fairly stable from one trading day to the next.

D)is solely related to the current price of the underlying item.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

70

The return on a futures contract is calculated as

A)(purchase price - selling price)/purchase price.

B)(selling price - purchase price)/purchase price.

C)(purchase price - selling price)/margin deposit.

D)(selling price - purchase price)/margin deposit.

A)(purchase price - selling price)/purchase price.

B)(selling price - purchase price)/purchase price.

C)(purchase price - selling price)/margin deposit.

D)(selling price - purchase price)/margin deposit.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

71

One reason that commodities appeal to investors is because they

A)act as hedges against inflation during periods of rapidly rising consumer prices.

B)offer high returns for low risks.

C)do not require much specialized knowledge on the part of the investor.

D)are a suitable investment vehicle for one's retirement savings.

A)act as hedges against inflation during periods of rapidly rising consumer prices.

B)offer high returns for low risks.

C)do not require much specialized knowledge on the part of the investor.

D)are a suitable investment vehicle for one's retirement savings.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

72

Which of the following are advantages of using options for futures speculation?

I.increased leverage

II.Potential losses are limited to the cost of the option.

III.Options are available on a broad range of commodity, index, and currency futures.

IV.Investors avoid the possibility of having to take delivery of the commodity.

A)I and II only

B)II and III only

C)I, II and IV only

D)I, II, III and IV

I.increased leverage

II.Potential losses are limited to the cost of the option.

III.Options are available on a broad range of commodity, index, and currency futures.

IV.Investors avoid the possibility of having to take delivery of the commodity.

A)I and II only

B)II and III only

C)I, II and IV only

D)I, II, III and IV

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

73

Lakshmi is confident that the price of gold is going to rise because the rate of inflation is increasing.To profit from her prediction, Lakshmi should

A)buy gold bullion today and then sell an equivalent amount of gold futures.

B)buy a gold futures contract today.

C)sell short a futures contract today.

D)sell short one futures contract and offset it by buying an equivalent long futures contract.

A)buy gold bullion today and then sell an equivalent amount of gold futures.

B)buy a gold futures contract today.

C)sell short a futures contract today.

D)sell short one futures contract and offset it by buying an equivalent long futures contract.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

74

Producers and industrial users of commodities may participate as both hedgers and speculators in the futures markets.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

75

If an investor is going to participate in the commodities market by buying a contract, he/she should do which of the following?

I.Realize that making a profit is relatively easy.

II.Be mentally prepared for an enormous loss.

III.Be financially able to meet repeated margin calls.

IV.Spend all of their available cash on margin deposits.

A)I, II and III only

B)II and III only

C)II and IV only

D)II, III and IV only

I.Realize that making a profit is relatively easy.

II.Be mentally prepared for an enormous loss.

III.Be financially able to meet repeated margin calls.

IV.Spend all of their available cash on margin deposits.

A)I, II and III only

B)II and III only

C)II and IV only

D)II, III and IV only

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

76

The purchasing manager of a jewelry manufacturer is worried that the rising price of gold will have a negative impact on profit margins on items it has promised to merchants in 3 months.She should

A)buy gold bullion today and then sell an equivalent amount of gold futures.

B)buy a gold futures contract today.

C)sell short a futures contract today.

D)sell short one futures contract and offset it by buying an equivalent long futures contract.

A)buy gold bullion today and then sell an equivalent amount of gold futures.

B)buy a gold futures contract today.

C)sell short a futures contract today.

D)sell short one futures contract and offset it by buying an equivalent long futures contract.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

77

An oat futures contract is for 5,000 bushels and the price can change by as much as 20 cents in either direction per trading day.If the margin requirement is $800 per contract, the maximum gain or loss in one day is

A)plus or minus 25%.

B)plus or minus 125%.

C)plus or minus 1.25%.

D)plus or minus 80%.

A)plus or minus 25%.

B)plus or minus 125%.

C)plus or minus 1.25%.

D)plus or minus 80%.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

78

You short sell contract A at 428 and buy contract B at 333.After one month, you close contract A at 435 and contract B at 339.What is you net profit in points?

A)-13

B)-1

C)1

D)13

A)-13

B)-1

C)1

D)13

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

79

George purchased a futures contract at 349.The contract is on 2500 units, requires a 10% margin deposit and is priced in cents per unit.George sold the contract at 278.What is George's return on invested capital?

A)-255.4%

B)-203.4%

C)-155.4%

D)-103.4%

A)-255.4%

B)-203.4%

C)-155.4%

D)-103.4%

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

80

Benjamin bought a contract for future delivery of 5000 bushels of oats at $3.64 per bushel and sold a later contract at $3.92 a bushel.A month later, corn prices were rising and Joseph sold his long contract for $401 per bushel and covered his short by purchasing a contract for $3.99 per bushel.Ignoring trading costs, Joseph

A)broke even.

B)made a profit of $1,850.

C)lost $1,500.

D)made a profit of $1,500.

A)broke even.

B)made a profit of $1,850.

C)lost $1,500.

D)made a profit of $1,500.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck