Deck 16: The Economics of Investment Behavior

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/110

Play

Full screen (f)

Deck 16: The Economics of Investment Behavior

1

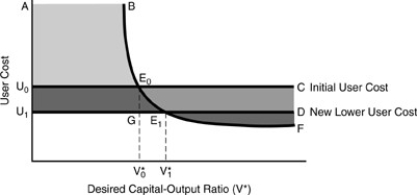

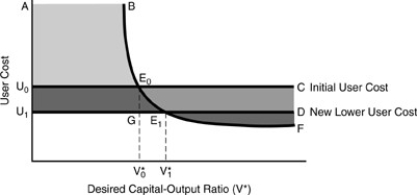

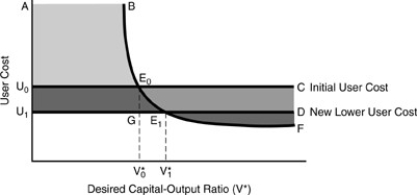

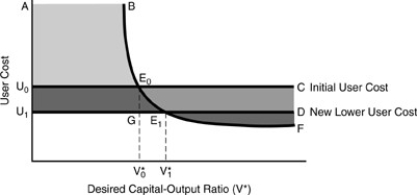

Figure 16-2

In the figure above, if user costs fall, U0 to U1, then area ________ represents the opportunity cost.

A) ABE0U0

B) GE1V0V1

C) U0E0GU1

D) E0E1G

In the figure above, if user costs fall, U0 to U1, then area ________ represents the opportunity cost.

A) ABE0U0

B) GE1V0V1

C) U0E0GU1

D) E0E1G

E0E1G

2

If the government allows businesses to accelerate (increase) depreciation then

A) the user cost of capital declines and V* increases.

B) the user cost of capital declines and V* decreases.

C) the user cost of capital increases and V* decreases.

D) the user cost of capital increases and V* increases.

A) the user cost of capital declines and V* increases.

B) the user cost of capital declines and V* decreases.

C) the user cost of capital increases and V* decreases.

D) the user cost of capital increases and V* increases.

the user cost of capital declines and V* increases.

3

In the simple accelerator theory an

A) increase in actual sales will always lead to an increase in investment.

B) increase in actual output will not lead to an increase in expected sales.

C) increase in actual sales will lead to an increase in replacement investment.

D) increase in the size of the increase in actual sales will lead to an increase in next period's net investment.

A) increase in actual sales will always lead to an increase in investment.

B) increase in actual output will not lead to an increase in expected sales.

C) increase in actual sales will lead to an increase in replacement investment.

D) increase in the size of the increase in actual sales will lead to an increase in next period's net investment.

increase in the size of the increase in actual sales will lead to an increase in next period's net investment.

4

Figure 16-2

In the figure above, the line BF is

A) the MPK less the user cost of capital.

B) the user cost of capital less MPK.

C) the MPK.

D) the demarcation line for profitability.

In the figure above, the line BF is

A) the MPK less the user cost of capital.

B) the user cost of capital less MPK.

C) the MPK.

D) the demarcation line for profitability.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

5

In the simple accelerator theory an increase in expected sales will

A) lead to an increase in net investment.

B) not necessarily lead to an increase in net investment.

C) lead to an immediate increase in replacement investment.

D) lead to an increase in net investment in the following period.

A) lead to an increase in net investment.

B) not necessarily lead to an increase in net investment.

C) lead to an immediate increase in replacement investment.

D) lead to an increase in net investment in the following period.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following is a primary implication of the accelerator theory of investment?

A) net investment occurs when the desired and actual capital stocks are equal

B) in order for gross investment to remain constant, income must remain constant

C) rising rather than high levels of output are necessary to maintain a high level of net investment

D) B and C are both correct.

A) net investment occurs when the desired and actual capital stocks are equal

B) in order for gross investment to remain constant, income must remain constant

C) rising rather than high levels of output are necessary to maintain a high level of net investment

D) B and C are both correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

7

Residential investment did not decline in the recession which began in

A) 1973.

B) 1981.

C) 1990.

D) 2001.

A) 1973.

B) 1981.

C) 1990.

D) 2001.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

8

If the government allows business firms an investment credit to lower taxes then

A) the user cost of capital declines and V* increases.

B) the user cost of capital declines and V* decreases.

C) the user cost of capital increases and V* decreases.

D) the user cost of capital increases and V* increases.

A) the user cost of capital declines and V* increases.

B) the user cost of capital declines and V* decreases.

C) the user cost of capital increases and V* decreases.

D) the user cost of capital increases and V* increases.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following policies would reduce the user cost of capital?

A) a reduction in the money supply

B) a reduction in the personal income tax rate

C) an increase in the corporate profit tax rate

D) an increase in an investment tax credit

A) a reduction in the money supply

B) a reduction in the personal income tax rate

C) an increase in the corporate profit tax rate

D) an increase in an investment tax credit

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

10

The amount of gross investment in the economy depends on the

A) response of expected output to the error in estimating the past period's actual output.

B) amount of the difference between the desired capital stock and last period's capital stock that can be put in place this period.

C) fraction of the capital stock that is replaced each period.

D) All of the above are correct.

A) response of expected output to the error in estimating the past period's actual output.

B) amount of the difference between the desired capital stock and last period's capital stock that can be put in place this period.

C) fraction of the capital stock that is replaced each period.

D) All of the above are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

11

Aggregate private spending is stable according to non-activists PRIMARILY because

A) consumer spending is insulated from changes in income according to the PIH and LCH theories.

B) private residential and non-residential investment is volatile.

C) government spending is volatile.

D) the money supply is unstable.

A) consumer spending is insulated from changes in income according to the PIH and LCH theories.

B) private residential and non-residential investment is volatile.

C) government spending is volatile.

D) the money supply is unstable.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

12

In the simple accelerator model, if expected output declines,

A) gross investment becomes negative.

B) net investment becomes negative.

C) both gross investment and net investment become negative.

D) the desired stock of capital will become negative.

A) gross investment becomes negative.

B) net investment becomes negative.

C) both gross investment and net investment become negative.

D) the desired stock of capital will become negative.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

13

The idea that business firms attempt to maintain a fixed relation between their stock of capital and their expected sales is the basis for the

A) accelerator hypothesis of net investment.

B) permanent-income hypothesis.

C) life cycle hypothesis.

D) adaptive expectations approach.

A) accelerator hypothesis of net investment.

B) permanent-income hypothesis.

C) life cycle hypothesis.

D) adaptive expectations approach.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

14

A fall in the user cost of capital

A) could occur as a result of a higher depreciation rate.

B) would lead to more capital-intensive methods of production.

C) would lead to less capital-intensive methods of production.

D) could occur as a result of a decrease in the marginal product of capital.

A) could occur as a result of a higher depreciation rate.

B) would lead to more capital-intensive methods of production.

C) would lead to less capital-intensive methods of production.

D) could occur as a result of a decrease in the marginal product of capital.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

15

Aggregate private spending is unstable according to policy activists, primarily because

A) consumer non-durable spending is volatile.

B) private residential and non-residential investment is volatile.

C) government spending is volatile.

D) the money supply is unstable.

A) consumer non-durable spending is volatile.

B) private residential and non-residential investment is volatile.

C) government spending is volatile.

D) the money supply is unstable.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following is NOT likely to affect investment?

A) variations in expected output

B) the nominal interest rate

C) the real interest rate

D) the tax treatment of depreciation allowances

A) variations in expected output

B) the nominal interest rate

C) the real interest rate

D) the tax treatment of depreciation allowances

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

17

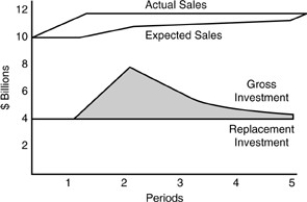

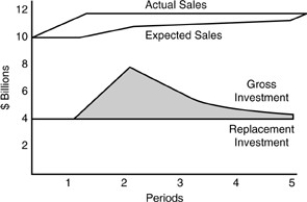

Figure 16-1

In the figure above, the increase in gross investment lags actual sales because

A) replacement investment is not determined by actual sales.

B) expected sales lag actual sales and net investment is determined by expected sales.

C) actual sales lag expected sales and net investment is determined by expected sales.

D) expected sales lead actual sales and net investment is determined by expected sales.

In the figure above, the increase in gross investment lags actual sales because

A) replacement investment is not determined by actual sales.

B) expected sales lag actual sales and net investment is determined by expected sales.

C) actual sales lag expected sales and net investment is determined by expected sales.

D) expected sales lead actual sales and net investment is determined by expected sales.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

18

In the accelerator theory the

A) smaller the desired capital-output ratio the larger will be net investment.

B) smaller the desired capital-output ratio the larger will be replacement investment.

C) larger the desired capital-output ratio the larger will be net investment.

D) larger the desired capital-output ratio the smaller will be replacement investment.

A) smaller the desired capital-output ratio the larger will be net investment.

B) smaller the desired capital-output ratio the larger will be replacement investment.

C) larger the desired capital-output ratio the larger will be net investment.

D) larger the desired capital-output ratio the smaller will be replacement investment.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

19

The simple accelerator theory suggests that investment will be rising when

A) output is rising.

B) the growth of output is rising.

C) output is high.

D) the growth of output is high.

A) output is rising.

B) the growth of output is rising.

C) output is high.

D) the growth of output is high.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

20

The accelerator theory states that

A) the larger this period's desired capital stock the smaller will be this period's net investment.

B) the larger the previous period's desired capital stock the larger will be this period's net investment.

C) the larger the previous period's desired capital stock the smaller will be this period's net investment.

D) this period's net investment is unrelated to this period's desired capital stock.

A) the larger this period's desired capital stock the smaller will be this period's net investment.

B) the larger the previous period's desired capital stock the larger will be this period's net investment.

C) the larger the previous period's desired capital stock the smaller will be this period's net investment.

D) this period's net investment is unrelated to this period's desired capital stock.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

21

The tax-exempt status of municipal bonds implies that, for private firms

A) the user cost of capital will be higher than otherwise.

B) the user cost of capital will be lower than otherwise.

C) the marginal product of capital will be lower than otherwise.

D) the accelerator will be higher than otherwise.

A) the user cost of capital will be higher than otherwise.

B) the user cost of capital will be lower than otherwise.

C) the marginal product of capital will be lower than otherwise.

D) the accelerator will be higher than otherwise.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

22

Under the adaptive method of estimating expected sales in the simple acceleration theory, if a firm's actual sales increase

A) expected sales will increase if j is greater than zero.

B) expected sales will remain the same if j equals zero.

C) expected sales will equal the previous period's actual sales if j equals one.

D) All of the above are correct.

A) expected sales will increase if j is greater than zero.

B) expected sales will remain the same if j equals zero.

C) expected sales will equal the previous period's actual sales if j equals one.

D) All of the above are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

23

The interest income earned on most municipal bonds in the United States is tax exempt. Thus, for such municipalities

A) the level of public investment projects is lower than it would be otherwise.

B) municipal tax revenues are higher than they would be otherwise.

C) the user cost of cost capital is lower than it would be otherwise.

D) All of the above are correct.

A) the level of public investment projects is lower than it would be otherwise.

B) municipal tax revenues are higher than they would be otherwise.

C) the user cost of cost capital is lower than it would be otherwise.

D) All of the above are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

24

If the Fed ________ the money supply, the user cost of capital will ________ and V* will______.

A) increases; increase; increase

B) increases; decrease; increase

C) decreases; decrease; decrease

D) decreases; decrease; increase

A) increases; increase; increase

B) increases; decrease; increase

C) decreases; decrease; decrease

D) decreases; decrease; increase

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

25

"The weather induced failure of the 1999 grain crop leads the Russia to quadruple grain imports from the United States" Assuming that the U.S. grain exports come from government warehouses,

A) net investment in the United States would increase dramatically according to the flexible accelerator theory.

B) net investment in the United States would decrease dramatically according to the flexible accelerator theory.

C) there would be no change in net investment since the Russian demand is temporary.

D) net investment would increase slowly since this is agriculture.

A) net investment in the United States would increase dramatically according to the flexible accelerator theory.

B) net investment in the United States would decrease dramatically according to the flexible accelerator theory.

C) there would be no change in net investment since the Russian demand is temporary.

D) net investment would increase slowly since this is agriculture.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following types of expenditure is most likely NOT determined by an accelerator model?

A) consumer durable spending

B) inventory investment

C) residential housing construction

D) consumer spending on food

A) consumer durable spending

B) inventory investment

C) residential housing construction

D) consumer spending on food

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

27

The desired stock of capital is that stock which

A) firms always obtain.

B) corresponds to the natural level of output.

C) would obtain when net investment is zero.

D) firms are always adjusting toward.

A) firms always obtain.

B) corresponds to the natural level of output.

C) would obtain when net investment is zero.

D) firms are always adjusting toward.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

28

It is often stated that the Japanese firms develop and adapt new technology to manufacturing process twice as fast as U.S. firms. If this is true, ceteris paribus, we would conclude that the

A) depreciation rate of capital does not change, but the user cost of capital increases.

B) depreciation rate of capital increases, but the user cost of capital decreases.

C) depreciation rate of capital increases, and the user cost of capital increases.

D) U.S. interest rate is too high preventing American manufacturers from adopting new technologies.

A) depreciation rate of capital does not change, but the user cost of capital increases.

B) depreciation rate of capital increases, but the user cost of capital decreases.

C) depreciation rate of capital increases, and the user cost of capital increases.

D) U.S. interest rate is too high preventing American manufacturers from adopting new technologies.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

29

The minimum level of net investment necessary to maintain the stock of capital depends on

A) the rate of interest and the size of the capital stock.

B) the rate of depreciation and the size of the capital stock.

C) the corporate profits tax and the interest rate.

D) business confidence and the corporate profits tax.

A) the rate of interest and the size of the capital stock.

B) the rate of depreciation and the size of the capital stock.

C) the corporate profits tax and the interest rate.

D) business confidence and the corporate profits tax.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following will raise the expected marginal product of capital?

A) a reduction in the interest rate

B) increased business optimism

C) an investment tax credit

D) a reduction in the corporate profits tax

A) a reduction in the interest rate

B) increased business optimism

C) an investment tax credit

D) a reduction in the corporate profits tax

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

31

The efficacy of tax incentives as an instrument of activist fiscal policy

A) has been proven to be very substantial in the view of most economists.

B) is not plagued by a substantial lag between the passage of tax legislation and the resulting investment spending.

C) is subject to debate but still is limited by the "legislative lag."

D) has been proven to be so limited that it is no longer considered to be a serious option by most economists.

A) has been proven to be very substantial in the view of most economists.

B) is not plagued by a substantial lag between the passage of tax legislation and the resulting investment spending.

C) is subject to debate but still is limited by the "legislative lag."

D) has been proven to be so limited that it is no longer considered to be a serious option by most economists.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

32

If investment in capital equipment requires two to three years between conceptualization and start-up to production then

A) the gap between the desired capital stock and the existing capital stocks is closed slowly.

B) a change in expected sales will not increase output.

C) V* will be smaller than expected.

D) All of the above are correct.

A) the gap between the desired capital stock and the existing capital stocks is closed slowly.

B) a change in expected sales will not increase output.

C) V* will be smaller than expected.

D) All of the above are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

33

If the government increases the corporate income tax

A) the user cost of capital declines and V* increases.

B) the user cost of capital declines and V* decreases.

C) the user cost of capital increases and V* decreases.

D) the user cost of capital increases and V* increases.

A) the user cost of capital declines and V* increases.

B) the user cost of capital declines and V* decreases.

C) the user cost of capital increases and V* decreases.

D) the user cost of capital increases and V* increases.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

34

Monetarist economists might conclude that the accelerator hypothesis supports their position via fiscal policy since

A) the gap between the desired capital stock and the existing capital stocks is closed slowly.

B) a change in expected sales will not increase output.

C)V* will be smaller than expected.

D) All of the above are correct.

A) the gap between the desired capital stock and the existing capital stocks is closed slowly.

B) a change in expected sales will not increase output.

C)V* will be smaller than expected.

D) All of the above are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

35

Suppose the IRS were to introduce a tax exemption for portion of interest income earned on corporate bonds. This would

A) reduce the user cost of capital.

B) raise the marginal product capital.

C) raise the rate of depreciation.

D) All of the above are correct.

A) reduce the user cost of capital.

B) raise the marginal product capital.

C) raise the rate of depreciation.

D) All of the above are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

36

Following a recession businesses are likely to be ________ and thus ________ the user cost of capital.

A) optimistic; overestimate

B) pessimistic; overestimate

C) optimistic; underestimate

D) pessimistic; underestimate

A) optimistic; overestimate

B) pessimistic; overestimate

C) optimistic; underestimate

D) pessimistic; underestimate

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

37

The 1981 economic recovery act ________ net investment according to ________.

A) greatly increased; Barry Bosworth

B) decreased; Barry Bosworth

C) increased; Martin Feldstein

D) decreased; Martin Feldstein

A) greatly increased; Barry Bosworth

B) decreased; Barry Bosworth

C) increased; Martin Feldstein

D) decreased; Martin Feldstein

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

38

The flexible accelerator theory

A) recognizes that the desired capital-output ratio is not a constant.

B) assumes that firms can make this period's actual capital stock equal to the desired capital stock.

C) sets this period's expected output equal to last period's actual output.

D) recognizes that a constant fraction of the capital stock is replaced each period.

A) recognizes that the desired capital-output ratio is not a constant.

B) assumes that firms can make this period's actual capital stock equal to the desired capital stock.

C) sets this period's expected output equal to last period's actual output.

D) recognizes that a constant fraction of the capital stock is replaced each period.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

39

Employing the error learning model to forecast sales, a firm where sales last period were expected to be $110 million, but actually sold $100 million would forecast that sales this period would be ________ if ________ is the coefficient of adjustment.

A) 103; 0.03

B) 105; 0.5

C) 110; 0.10

D) All of the above are correct.

A) 103; 0.03

B) 105; 0.5

C) 110; 0.10

D) All of the above are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

40

One "problem" with applying the Jorgenson theory of investment to project investment is that

A) the MPK is known with certainty by business executives but the user cost is uncertain.

B) the MPK is known with uncertainty by business executives but the user cost is certain.

C) both user cost and the MPK are uncertain.

D) it does not explain the accelerator.

A) the MPK is known with certainty by business executives but the user cost is uncertain.

B) the MPK is known with uncertainty by business executives but the user cost is certain.

C) both user cost and the MPK are uncertain.

D) it does not explain the accelerator.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

41

By the accelerator hypothesis, if a firm's actual sales jump in one period to a higher maintained level, that firm's capital stock

A) also jumps in one period to a higher maintained level.

B) gradually drifts upward to a higher maintained level.

C) jumps upward and then falls back to zero.

D) jumps upward and then falls back part of the way.

A) also jumps in one period to a higher maintained level.

B) gradually drifts upward to a higher maintained level.

C) jumps upward and then falls back to zero.

D) jumps upward and then falls back part of the way.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

42

Changes in inventory investment are ________ for the Fed to use to time changes in monetary policy.

A) too short-lived

B) short-lived enough

C) gradual enough

D) too gradual

A) too short-lived

B) short-lived enough

C) gradual enough

D) too gradual

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

43

If the economic growth rate INCREASES from 1% to 5%, the simple accelerator hypothesis suggests that

A) investment will continue to rise as output increases.

B) investment will fall as output increases.

C) investment will rise since the rate of change in output increases.

D) None of the above is correct.

A) investment will continue to rise as output increases.

B) investment will fall as output increases.

C) investment will rise since the rate of change in output increases.

D) None of the above is correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

44

"Our knowledge of the factors which govern the yield of an investment some years hence is usually very slight and often negligible." This quote by ________ helps to explain ________.

A) Jorgenson; cycles of overbuilding

B) Keynes; cycles of overbuilding

C) Jorgenson; the accelerator hypothesis

D) Keynes; the accelerator hypothesis

A) Jorgenson; cycles of overbuilding

B) Keynes; cycles of overbuilding

C) Jorgenson; the accelerator hypothesis

D) Keynes; the accelerator hypothesis

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

45

Over the most recent movement from cyclical trough to peak, 1991:Q1 to 2001:Q1, gross private domestic investment ________ approximately ________ percent.

A) rose, 49

B) rose, 73

C) rose, 6

D) fell, 68

E) fell, 20

A) rose, 49

B) rose, 73

C) rose, 6

D) fell, 68

E) fell, 20

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

46

The accelerator theory can explain the paradox that both interest rates and investment rise and fall in concert during the business cycle if

A) the effect of changes in Y effect on In dominate the effect of interest rates on investment.

B) the LM curve is constant.

C) the IS curve is constant.

D) the effect of changes in interest rates on In dominate the effect of changes in Y on In.

A) the effect of changes in Y effect on In dominate the effect of interest rates on investment.

B) the LM curve is constant.

C) the IS curve is constant.

D) the effect of changes in interest rates on In dominate the effect of changes in Y on In.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

47

By the accelerator hypothesis, if a firm's actual sales jump in one period to a higher maintained level, that firm's replacement investment

A) also jumps in one period to a higher maintained level.

B) gradually drifts upward to a higher maintained level.

C) jumps upward and then falls back to zero.

D) jumps upward and then falls back part of the way.

A) also jumps in one period to a higher maintained level.

B) gradually drifts upward to a higher maintained level.

C) jumps upward and then falls back to zero.

D) jumps upward and then falls back part of the way.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

48

Business investment is most similar to what form of consumer expenditures and why?

A) consumer nondurables since they are "used up" in producing consumer welfare

B) consumer durables since they accelerate consume welfare

C) consumer durables since they may be treated as a form of household saving

D) Both A and B are correct.

A) consumer nondurables since they are "used up" in producing consumer welfare

B) consumer durables since they accelerate consume welfare

C) consumer durables since they may be treated as a form of household saving

D) Both A and B are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

49

If the actual capital stock exceeds the desired capital stock due to a cycle of overbuilding then

A) net investment will fall dramatically.

B) net investment will increase dramatically.

C) net investment will not change.

D) the effect on net investment is unknown.

A) net investment will fall dramatically.

B) net investment will increase dramatically.

C) net investment will not change.

D) the effect on net investment is unknown.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

50

By the accelerator hypothesis, if a firm's actual sales jump in one period to a higher maintained level, that firm's net investment

A) also jumps in one period to a higher maintained level.

B) gradually drifts upward to a higher maintained level.

C) jumps upward and then falls back to zero.

D) jumps upward and then falls back part of the way.

A) also jumps in one period to a higher maintained level.

B) gradually drifts upward to a higher maintained level.

C) jumps upward and then falls back to zero.

D) jumps upward and then falls back part of the way.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

51

If capital demand shifts to shorter lived equipment then

A) net investment will fall.

B) net investment will increase.

C) net investment will not change.

D) the effect on net investment is unknown.

A) net investment will fall.

B) net investment will increase.

C) net investment will not change.

D) the effect on net investment is unknown.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

52

By the accelerator hypothesis, if a firm's actual sales jump in one period to a higher maintained level, that firm's gross investment

A) also jumps in one period to a higher maintained level.

B) gradually drifts upward to a higher maintained level.

C) jumps upward and then falls back to zero.

D) jumps upward and then falls back part of the way.

A) also jumps in one period to a higher maintained level.

B) gradually drifts upward to a higher maintained level.

C) jumps upward and then falls back to zero.

D) jumps upward and then falls back part of the way.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

53

If actual output increases are believed to be temporary then

A) net investment will fall.

B) net investment will increase.

C) net investment will not change.

D) the effect on net investment is unknown.

A) net investment will fall.

B) net investment will increase.

C) net investment will not change.

D) the effect on net investment is unknown.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

54

Residential investment plunged quite noticeably ________ the start of the 1973-1975 and 1981-1982 recessions, with the prospect that recent financial deregulation would make it ________ sensitive to future changes in monetary policy.

A) after, more

B) after, less

C) before, more

D) before, less

A) after, more

B) after, less

C) before, more

D) before, less

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

55

The "accelerator hypothesis" of investment states that a firm's net investment is most closely related to the

A) level of its actual sales.

B) change in its actual sales.

C) level of its expected sales.

D) change in its expected sales.

A) level of its actual sales.

B) change in its actual sales.

C) level of its expected sales.

D) change in its expected sales.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

56

What is the largest component of GPDI?

A) residential fixed investment

B) nonresidential fixed investment

C) inventory investment

D) consumer durables

A) residential fixed investment

B) nonresidential fixed investment

C) inventory investment

D) consumer durables

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

57

The effects on the economy of a prolonged decrease in investment are ________ if ________ occurs.

A) more pronounced; consumers adjust permanent income downwards

B) less pronounced; consumers do not adjust permanent income upwards

C) more pronounced; consumers adjust permanent income upwards

D) less pronounced; consumers adjust permanent income downwards

A) more pronounced; consumers adjust permanent income downwards

B) less pronounced; consumers do not adjust permanent income upwards

C) more pronounced; consumers adjust permanent income upwards

D) less pronounced; consumers adjust permanent income downwards

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

58

During the 1987-88 expansion period interest rates in the United States rose as did the rate of investment in the economy. These facts suggest

A) the simple accelerator effect and the effects of higher interest rates complemented each other to raise output growth.

B) the simple accelerator effect and the effects of lower interest rates complemented each other to lower output growth.

C) the effects of the accelerator were greater than those of increased interest rates.

D) the effects of the accelerator were smaller than those of increased interest rates.

A) the simple accelerator effect and the effects of higher interest rates complemented each other to raise output growth.

B) the simple accelerator effect and the effects of lower interest rates complemented each other to lower output growth.

C) the effects of the accelerator were greater than those of increased interest rates.

D) the effects of the accelerator were smaller than those of increased interest rates.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

59

GPDI is ________ volatile than total consumption spending.

A) much more

B) slightly more

C) slightly less

D) much less

A) much more

B) slightly more

C) slightly less

D) much less

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

60

Private investment fluctuates ________, which supports those economists who advocate policy ________.

A) procyclically, rules

B) procyclically, activism

C) countercyclically, rules

D) countercyclically, activism

A) procyclically, rules

B) procyclically, activism

C) countercyclically, rules

D) countercyclically, activism

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

61

What is the value of the firm's capital stock at the end of period 5?

A) 612.5

B) 106.75

C) 175

D) 89.25

A) 612.5

B) 106.75

C) 175

D) 89.25

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

62

The increase in speed and power of personal computers over the past fifteen years has been phenomenal. Such technological change, with the old being ever more quickly replaced by the new, suggests growing ________ in ________ investment.

A) instability, net

B) instability, net and gross

C) instability, gross

D) stability, net and gross

E) stability, net

A) instability, net

B) instability, net and gross

C) instability, gross

D) stability, net and gross

E) stability, net

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

63

In which period does gross investment reach its peak?

A) 1

B) 2

C) 3

D) 4

E) 5

A) 1

B) 2

C) 3

D) 4

E) 5

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

64

By accelerator theory, net investment will remain above zero in the long run only so long as

A) expected sales are greater than v* times the capital stock.

B) replacement investment is above zero.

C) expected sales keep rising.

D) expected sales do not fall.

E) actual sales fall below expected sales.

A) expected sales are greater than v* times the capital stock.

B) replacement investment is above zero.

C) expected sales keep rising.

D) expected sales do not fall.

E) actual sales fall below expected sales.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

65

In going from the simple to the flexible accelerator, j is set at ________, and v* is ________.

A) one, allowed to vary

B) one, set at less than one

C) less than one, set at less than one

D) less than one, set at one

E) less than one, allowed to vary

A) one, allowed to vary

B) one, set at less than one

C) less than one, set at less than one

D) less than one, set at one

E) less than one, allowed to vary

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

66

A reduction in the user cost of capital leads firms to ________ their profit by ________ their capital-output ratio.

A) raise, increasing

B) raise, decreasing

C) lower, increasing

D) lower, decreasing

A) raise, increasing

B) raise, decreasing

C) lower, increasing

D) lower, decreasing

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

67

The "simple" accelerator model, first derived by American economist J.M. Clark in 1917, comes from setting

A) j = 0.

B) j = 1.

C) v* = 0.

D) v* = 1.

A) j = 0.

B) j = 1.

C) v* = 0.

D) v* = 1.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

68

What is the highest value of gross investment over these periods?

A) 140.

B) 106.75.

C) 89.25.

D) 192.5

A) 140.

B) 106.75.

C) 89.25.

D) 192.5

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

69

In a simple macroeconomic model, replacing the assumption of exogenous investment with the accelerator theory of investment ________ the effect on equilibrium GDP of fiscal policy changes, and ________ the effect on equilibrium GDP of changes in autonomous consumption.

A) increases, increases

B) increases, dampens

C) dampens, increases

D) dampens, dampens

A) increases, increases

B) increases, dampens

C) dampens, increases

D) dampens, dampens

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

70

Just after a cyclical trough, given the excess capacity in the economy, there should be an unusually ________ rate of closing the gap between desired and actual capital stocks, making net investment respond relatively ________ to rising sales.

A) high, strongly

B) high, weakly

C) low, strongly

D) low, weakly

A) high, strongly

B) high, weakly

C) low, strongly

D) low, weakly

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

71

Net investment becomes more unstable if j ________ and v*_____.

A) rises, rises

B) rises, falls

C) falls, rises

D) falls, falls

A) rises, rises

B) rises, falls

C) falls, rises

D) falls, falls

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

72

Historical evidence is that net investment usually responds ________ to changes in output growth, which ________ predicted by the simple accelerator model.

A) instantaneously, is

B) instantaneously, is not

C) with a lag, is

D) with a lag, is not

A) instantaneously, is

B) instantaneously, is not

C) with a lag, is

D) with a lag, is not

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

73

In the year that a bakery buys a new $100,000 oven by borrowing at a real interest rate of 5 percent, the oven adds $22,000 to bread sales, depreciates by $8000, and requires $3000 in natural gas and maintenance. Since the MPK is ________ the user cost of capital, the bakery should ________.

A) above, shut down the oven

B) above, consider buying more ovens

C) below, shut down the oven

D) below, consider buying more ovens

A) above, shut down the oven

B) above, consider buying more ovens

C) below, shut down the oven

D) below, consider buying more ovens

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

74

(In/Y) is quite ________ in the U.S. economy, and ________ stay away from its long-run average for several consecutive years.

A) stable, yet it can

B) stable, so it does not

C) volatile, yet it can

D) volatile, so it does not

A) stable, yet it can

B) stable, so it does not

C) volatile, yet it can

D) volatile, so it does not

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

75

In which period does net investment reach its peak?

A) 1

B) 2

C) 3

D) 4

E) 5

A) 1

B) 2

C) 3

D) 4

E) 5

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

76

If a firm's MPK is below its user cost of capital, it is employing too ________ capital and its profit is ________ in the long run.

A) little, above what it will be

B) little, below what it could be

C) much, above what it will be

D) much, below what it could be

A) little, above what it will be

B) little, below what it could be

C) much, above what it will be

D) much, below what it could be

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

77

Compared to the 1960s, during most of the 1990s average annual real GDP growth was ________ while the average ratio of net investment to output was ________.

A) slightly lower, much lower

B) much lower, slightly higher

C) much higher, much lower

D) slightly higher, slightly lower

A) slightly lower, much lower

B) much lower, slightly higher

C) much higher, much lower

D) slightly higher, slightly lower

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

78

Where does the interest rate fit into the accelerator hypothesis of investment?

A) It helps determine the error-learning parameter, j.

B) It helps determine the ratio of desired capital to expected sales, V*

C) It helps determine the depreciation ratio of capital stock to replacement investment.

D) Nowhere: the hypothesis says that investment is independent of the interest rate.

A) It helps determine the error-learning parameter, j.

B) It helps determine the ratio of desired capital to expected sales, V*

C) It helps determine the depreciation ratio of capital stock to replacement investment.

D) Nowhere: the hypothesis says that investment is independent of the interest rate.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

79

In an economy's labor-intensive industries are growing relative to its capital-intensive industries, v* ________, which makes the economy more ________.

A) rises, stable

B) rises, unstable

C) falls, stable

D) falls, unstable

A) rises, stable

B) rises, unstable

C) falls, stable

D) falls, unstable

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

80

What is the value of net investment in period 5?

A) 17.5

B) 89.25

C) 106.75

D) 612.5

A) 17.5

B) 89.25

C) 106.75

D) 612.5

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck