Deck 10: Leases

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/24

Play

Full screen (f)

Deck 10: Leases

1

Under AASB 117 Leases, lessors are required to account for lease receipts from operating leases as:

A) revenue, on a reducing balance basis over the lease term.

B) income, on inception date of the lease.

C) income, on a straight-line basis over the lease term.

D) revenue, at the end of the lease term.

A) revenue, on a reducing balance basis over the lease term.

B) income, on inception date of the lease.

C) income, on a straight-line basis over the lease term.

D) revenue, at the end of the lease term.

C

2

Adam Limited and Davies Limited enter into a finance lease agreement with the following terms:

- lease term is 3 years

- estimated economic life of the leased asset is 6 years

- 3 × annual rental payments of $23 000 each payment is one year in arrears

- residual value at the end of the lease term is not guaranteed by the lessee

- interest rate implicit in the lease is 7%.

On inception date, the present value of the minimum lease payments is:

A) $60 359.

B) $64 170.

C) $64 584.

D) $69 000.

- lease term is 3 years

- estimated economic life of the leased asset is 6 years

- 3 × annual rental payments of $23 000 each payment is one year in arrears

- residual value at the end of the lease term is not guaranteed by the lessee

- interest rate implicit in the lease is 7%.

On inception date, the present value of the minimum lease payments is:

A) $60 359.

B) $64 170.

C) $64 584.

D) $69 000.

A

3

Which of the following is NOT one of the situations provided in AASB 117 in relation to the classification of leases as finance leases?

A) Losses from the fluctuation of the fair value of the residual accrue to the lessee.

B) Leased assets are of a specialised nature.

C) The lessee has provided a guarantee that they will acquire the asset at the end of the lease term.

D) The lease is for a major part of the economic life of the asset.

A) Losses from the fluctuation of the fair value of the residual accrue to the lessee.

B) Leased assets are of a specialised nature.

C) The lessee has provided a guarantee that they will acquire the asset at the end of the lease term.

D) The lease is for a major part of the economic life of the asset.

C

4

The user of a leased asset is referred to as the:

A) vendor.

B) purchaser.

C) lessor.

D) lessee.

A) vendor.

B) purchaser.

C) lessor.

D) lessee.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following is NOT an example of a risk of ownership of an asset?

A) Idle capacity.

B) Gains on the eventual sale of the asset.

C) Uninsured damage.

D) Technical obsolescence.

A) Idle capacity.

B) Gains on the eventual sale of the asset.

C) Uninsured damage.

D) Technical obsolescence.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

6

If a sale and leaseback transaction results in a finance lease, AASB 117 Leases, provides the following accounting treatment for any excess of sales proceeds over the carrying amount:

A) recognise directly in retained earnings of the seller-lessee.

B) immediately recognise as income by the seller-lessee.

C) defer and amortise over the lease term.

D) include in the capitalised amount of the leased asset.

A) recognise directly in retained earnings of the seller-lessee.

B) immediately recognise as income by the seller-lessee.

C) defer and amortise over the lease term.

D) include in the capitalised amount of the leased asset.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

7

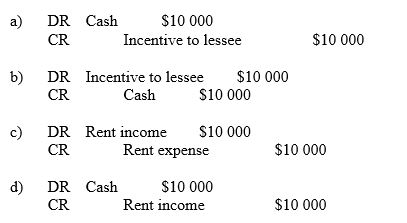

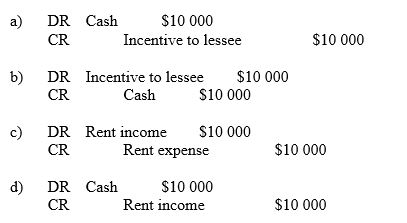

Timely Limited accepts a lease incentive to enter into a 4-year operating lease for equipment. The incentive is cash amounting to $10 000 that will be paid on the date the lease agreement is signed. On inception of the lease, the lessor will record:

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

8

Adam Limited and Davies Limited enter into a finance lease agreement with the following terms:

- lease term is 3 years

- estimated economic life of the leased asset is 6 years

- 3 × annual rental payments of $23 000 each payment is one year in arrears

- residual value at the end of the lease term is not guaranteed by the lessee

- interest rate implicit in the lease is 7%.

The period over which the asset should be depreciated by the lessee is:

A) 3 years.

B) 6 years.

C) the rate as determined by the Commissioner of Taxation.

D) not able to be determined from the information provided.

- lease term is 3 years

- estimated economic life of the leased asset is 6 years

- 3 × annual rental payments of $23 000 each payment is one year in arrears

- residual value at the end of the lease term is not guaranteed by the lessee

- interest rate implicit in the lease is 7%.

The period over which the asset should be depreciated by the lessee is:

A) 3 years.

B) 6 years.

C) the rate as determined by the Commissioner of Taxation.

D) not able to be determined from the information provided.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

9

In relation to finance leases, the following information must be disclosed separately in the financial statements of lessors:

I - Unearned finance income.

II - Contingent rents recognised as income in the period.

III - The unguaranteed residual values accruing to the benefit of the lessee.

IV - The accumulated allowance for uncollectible minimum lease payments receivable.

A) I, II and IV only.

B) I, III and IV only.

C) II, III and IV only.

D) II and IV only.

I - Unearned finance income.

II - Contingent rents recognised as income in the period.

III - The unguaranteed residual values accruing to the benefit of the lessee.

IV - The accumulated allowance for uncollectible minimum lease payments receivable.

A) I, II and IV only.

B) I, III and IV only.

C) II, III and IV only.

D) II and IV only.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

10

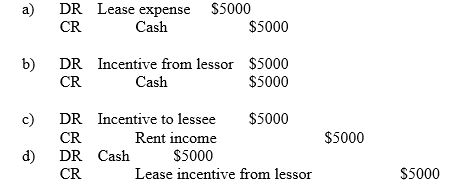

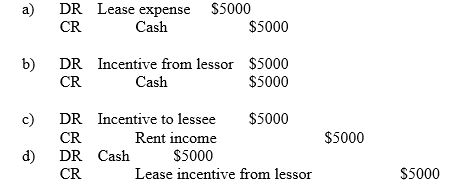

Burgess Limited accepts a lease incentive to enter into a 3-year operating lease for a building. The incentive is a cash amount of $5000 received on signing of the lease agreement. The lessee initially records this transaction as follows:

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

11

On 30 June 2013, Mala Ltd leased a vehicle to Tango Ltd. Mala Ltd had purchased the vehicle on that day for its fair value of $89 721. The lease agreement cost Mala Ltd

$1457 to have drawn up and requires Tango to reimburse Mala for annual insurance costs of $1050. The amount recorded as a lease receivable by Mala Ltd at the inception of the lease is:

A) $88 264.

B) $89 721.

C) $90 771.

D) $91 178.

$1457 to have drawn up and requires Tango to reimburse Mala for annual insurance costs of $1050. The amount recorded as a lease receivable by Mala Ltd at the inception of the lease is:

A) $88 264.

B) $89 721.

C) $90 771.

D) $91 178.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

12

The minimum lease payment is defined as including all of the following components except:

A) bargain purchase option.

B) contingent rentals.

C) a guaranteed residual value.

D) the lease payments occurring over the lease term.

A) bargain purchase option.

B) contingent rentals.

C) a guaranteed residual value.

D) the lease payments occurring over the lease term.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following is included within the scope of AASB 117?

A) Lease agreements for motion picture films.

B) Lease agreements to explore for minerals.

C) Lease agreements for biological assets.

D) Lease agreement for an oil refinery.

A) Lease agreements for motion picture films.

B) Lease agreements to explore for minerals.

C) Lease agreements for biological assets.

D) Lease agreement for an oil refinery.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

14

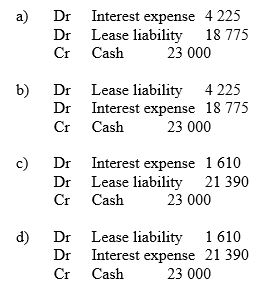

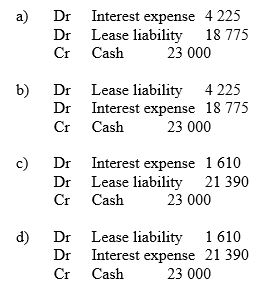

Adam Limited and Davies Limited enter into a finance lease agreement with the following terms:

- lease term is 3 years

- estimated economic life of the leased asset is 6 years

- 3 × annual rental payments of $23 000 each payment is one year in arrears

- residual value at the end of the lease term is not guaranteed by the lessee

- interest rate implicit in the lease is 7%.

The journal entry recorded by the lessee when the payment is made at the end of the first year is:

- lease term is 3 years

- estimated economic life of the leased asset is 6 years

- 3 × annual rental payments of $23 000 each payment is one year in arrears

- residual value at the end of the lease term is not guaranteed by the lessee

- interest rate implicit in the lease is 7%.

The journal entry recorded by the lessee when the payment is made at the end of the first year is:

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

15

A finance lease is an agreement between an owner of an asset and a user of that asset wherein the:

A) legal title to property is transferred to the lessee when the first lease payment is made.

B) ownership passes to the lessor on inception date of the lease.

C) substantially all of the risks and benefits of ownership remain with the lessor.

D) usual risks and benefits of ownership are transferred to the user.

A) legal title to property is transferred to the lessee when the first lease payment is made.

B) ownership passes to the lessor on inception date of the lease.

C) substantially all of the risks and benefits of ownership remain with the lessor.

D) usual risks and benefits of ownership are transferred to the user.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

16

Nelson Ltd manufactures specialised machinery for both sale and lease. On 1 July

2013, Nelson leased a machine to Poggi Ltd. The machine cost Nelson Ltd $195 000 to manufacture, and its fair value at the inception of the lease was $212 515. The interest rate implicit in the lease is 10%, which is in line with current market rates. Under the terms of the lease, Poggi Ltd has guaranteed $25 000 of the asset's expected residual value of $37 000 at the end of the 5-year lease term. The debit to the sales revenue account in Nelson's books is:

A) $187 548.

B) $195 000.

C) $205 063.

D) $212 515.

2013, Nelson leased a machine to Poggi Ltd. The machine cost Nelson Ltd $195 000 to manufacture, and its fair value at the inception of the lease was $212 515. The interest rate implicit in the lease is 10%, which is in line with current market rates. Under the terms of the lease, Poggi Ltd has guaranteed $25 000 of the asset's expected residual value of $37 000 at the end of the 5-year lease term. The debit to the sales revenue account in Nelson's books is:

A) $187 548.

B) $195 000.

C) $205 063.

D) $212 515.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

17

A lessee when accounting for a lease incentive received under an operating lease treats is as a:

A) increase in rental income over the lease term.

B) increase in rental expense over the lease term.

C) reduction in rental expense over the lease term.

D) reduction in rental income over the lease term.

A) increase in rental income over the lease term.

B) increase in rental expense over the lease term.

C) reduction in rental expense over the lease term.

D) reduction in rental income over the lease term.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

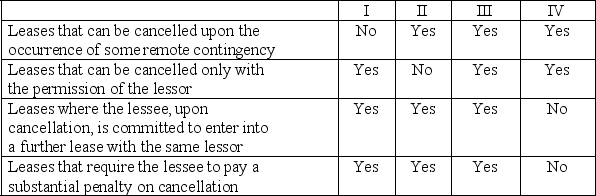

18

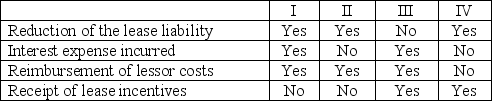

According to AASB 117 Leases, because lease payments are made over the lease term, the payments made under a finance lease must be divided into the following components:

A) I.

B) II.

C) III.

D) IV.

A) I.

B) II.

C) III.

D) IV.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

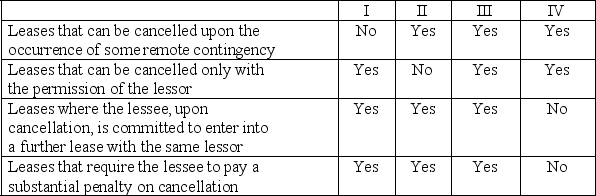

19

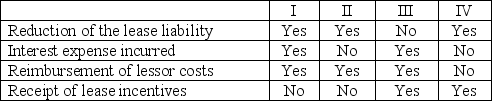

AASB 117 deems cancellable leases with which of the following characteristics to be non-cancellable:

A) I.

B) II.

C) III.

D) IV.

A) I.

B) II.

C) III.

D) IV.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

20

With respect to operating leases, lessors are required under AASB 117 Leases, to make the following disclosures:

I - Total contingent rents recognised as income in the period.

II - Future minimum lease payments under individual, cancellable operating leases, separately.

III - A general description of the lessee's leasing arrangements.

IV - Future minimum lease payments under non-cancellable operating leases in aggregate.

A) I, II and III only.

B) I, III and IV only.

C) II and III only.

D) I, II and IV only.

I - Total contingent rents recognised as income in the period.

II - Future minimum lease payments under individual, cancellable operating leases, separately.

III - A general description of the lessee's leasing arrangements.

IV - Future minimum lease payments under non-cancellable operating leases in aggregate.

A) I, II and III only.

B) I, III and IV only.

C) II and III only.

D) I, II and IV only.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following is an appropriate journal entry for the initial recognition by a lessee of an operating lease arrangement?

A) DR Leased asset: CR Lease liability

B) DR Lease rental expense: CR Cash/accounts payable

C) DR Leased asset: CR Cash/accounts payable

D) DR Lease asset: CR Lease interest expense

A) DR Leased asset: CR Lease liability

B) DR Lease rental expense: CR Cash/accounts payable

C) DR Leased asset: CR Cash/accounts payable

D) DR Lease asset: CR Lease interest expense

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following is an appropriate journal entry for the initial recognition by a lessee of a finance lease arrangement?

A) DR Leased asset: CR Bank loan

B) DR Cash: CR Leased asset

C) DR Lease liability: CR Leased asset

D) DR Leased asset: CR Lease liability

A) DR Leased asset: CR Bank loan

B) DR Cash: CR Leased asset

C) DR Lease liability: CR Leased asset

D) DR Leased asset: CR Lease liability

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

23

AASB 117 requires manufacturer and dealer lessors to recognise selling profit or loss at the:

A) end of the lease.

B) systematically recognised over the lease term.

C) commencement of the lease.

D) 50% at commencement of the lease and 50% at the end of the lease.

A) end of the lease.

B) systematically recognised over the lease term.

C) commencement of the lease.

D) 50% at commencement of the lease and 50% at the end of the lease.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following is an appropriate journal entry for the initial recognition by a lessor of a finance lease arrangement?

A) DR Lease receivable: CR Asset

B) DR Lease receivable: CR Lease liability

C) DR Leased asset: CR Cash/accounts payable

D) DR Leased asset: CR Cash

A) DR Lease receivable: CR Asset

B) DR Lease receivable: CR Lease liability

C) DR Leased asset: CR Cash/accounts payable

D) DR Leased asset: CR Cash

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck