Deck 22: Developing Countries: Growth, Crisis, and Reform

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/116

Play

Full screen (f)

Deck 22: Developing Countries: Growth, Crisis, and Reform

1

What explains the sharply divergent long-run growth patterns?

The answer lies in the economic and political features of developing countries and the way these have changed over time in response to both world events and internal pressures.

2

The world's economies can be divided into four main categories according to their annual per-capita income levels. Which one of the following is NOT one of the categories?

A) low-income

B) upper middle-income

C) high-income

D) lower middle-income

E) middle-income

A) low-income

B) upper middle-income

C) high-income

D) lower middle-income

E) middle-income

E

3

How would you define convergence?

A) tendency for gaps between industrial countries' per-capital incomes to narrow

B) tendency for gaps between all countries' per-capital incomes to narrow

C) the theory that a crisis in a low-income country will spread to all countries, regardless of debt structure

D) the theory that a crisis in a low-income country will spread to only those countries which had lent money to the original country

E) tendency for the world distribution of income to be persistently unequal

A) tendency for gaps between industrial countries' per-capital incomes to narrow

B) tendency for gaps between all countries' per-capital incomes to narrow

C) the theory that a crisis in a low-income country will spread to all countries, regardless of debt structure

D) the theory that a crisis in a low-income country will spread to only those countries which had lent money to the original country

E) tendency for the world distribution of income to be persistently unequal

A

4

How would you describe the world distribution of income?

A) persistently unequal

B) temporarily unequal

C) converging

D) fairly equal

E) completely unpredictable

A) persistently unequal

B) temporarily unequal

C) converging

D) fairly equal

E) completely unpredictable

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

5

Over the period 1960-2000, France grew ________ than the United States economy

A) 2 % slower.

B) 2% faster.

C) more than 2% slower.

D) less than 2% faster.

E) more than 2% faster.

A) 2 % slower.

B) 2% faster.

C) more than 2% slower.

D) less than 2% faster.

E) more than 2% faster.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

6

Compared with industrialized economies, most developing countries are poor in the factors of production essential to modern industry: These factors are

A) capital and skilled labor.

B) capital and unskilled labor.

C) fertile land and unskilled labor.

D) fertile land and skilled labor.

E) water and capital.

A) capital and skilled labor.

B) capital and unskilled labor.

C) fertile land and unskilled labor.

D) fertile land and skilled labor.

E) water and capital.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

7

Average per-capita GDP in the richest, most prosperous economies is ________ times that of the average in the ________ economies.

A) 95, low (poorest) income

B) 95, lower-middle income

C) 73, lower-middle income

D) 44, low (poorest) income

E) 69, low (poorest) income

A) 95, low (poorest) income

B) 95, lower-middle income

C) 73, lower-middle income

D) 44, low (poorest) income

E) 69, low (poorest) income

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following countries had a larger growth rate since 1960?

A) U.S.

B) Senegal

C) South Korea

D) Kamul

E) Colombia

A) U.S.

B) Senegal

C) South Korea

D) Kamul

E) Colombia

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

9

Since 1960, countries in Africa have grown at rates ________ those of the main industrial countries.

A) far below

B) far above

C) about the same

D) slightly below

E) slightly above

A) far below

B) far above

C) about the same

D) slightly below

E) slightly above

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

10

When one compares per-capital output growth rates among countries

A) one needs to correct the data to account for departures from purchasing power parity.

B) such corrections are often not necessary.

C) such corrections are sometimes necessary.

D) the evidence whether such corrections are necessary are vague.

E) such corrections are not necessary.

A) one needs to correct the data to account for departures from purchasing power parity.

B) such corrections are often not necessary.

C) such corrections are sometimes necessary.

D) the evidence whether such corrections are necessary are vague.

E) such corrections are not necessary.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

11

Over the post-war era, the gaps between industrial countries' living standards

A) disappeared.

B) stayed the same.

C) increased.

D) decreased.

E) fluctuated.

A) disappeared.

B) stayed the same.

C) increased.

D) decreased.

E) fluctuated.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

12

Between 1960 and 2010, the annual growth rate in percent per year was the highest in

A) China.

B) United States.

C) Brazil.

D) Singapore.

E) South Korea.

A) China.

B) United States.

C) Brazil.

D) Singapore.

E) South Korea.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

13

Over the post-war era, poorer countries grew

A) faster.

B) slower.

C) stayed the same.

D) grew faster, then grew slower.

E) No general tendency can be found.

A) faster.

B) slower.

C) stayed the same.

D) grew faster, then grew slower.

E) No general tendency can be found.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

14

The main factors that discourage investment in capital and skills in developing countries are

A) political instability, insecure property rights.

B) political instability, insecure property rights, misguided economic policies.

C) political instability, misguided economic policies.

D) political instability.

E) insecure property rights, misguided economic policies.

A) political instability, insecure property rights.

B) political instability, insecure property rights, misguided economic policies.

C) political instability, misguided economic policies.

D) political instability.

E) insecure property rights, misguided economic policies.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

15

Over the period 1960-2010, the United States economy grew at roughly

A) 2.1 percent.

B) 3 percent.

C) 4 percent.

D) one percent.

E) 3.5 percent.

A) 2.1 percent.

B) 3 percent.

C) 4 percent.

D) one percent.

E) 3.5 percent.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

16

The per-capita GNP of the industrial group is about ________ times that of the upper middle-income countries.

A) 6

B) 10

C) 15

D) 19

E) 2

A) 6

B) 10

C) 15

D) 19

E) 2

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

17

Over the post-war era, the gaps between countries' living standards

A) disappeared.

B) stayed the same.

C) increased.

D) decreased.

E) changed inconsistently.

A) disappeared.

B) stayed the same.

C) increased.

D) decreased.

E) changed inconsistently.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

18

Until recently, per-capita income increased in East Asian countries such as Hong Kong, Singapore, South Korea, and Taiwan by ________-fold every generation

A) 2

B) 3

C) 4

D) 5

E) 1

A) 2

B) 3

C) 4

D) 5

E) 1

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

19

Since 1960, South Korea and Singapore enjoyed an average per-capita growth rates ________ the average industrialized world.

A) far below

B) far above

C) about the same

D) slightly below

E) slightly above

A) far below

B) far above

C) about the same

D) slightly below

E) slightly above

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

20

What is the basic problem of developing countries?

A) corruption

B) murder

C) poverty

D) stock market

E) natural resources

A) corruption

B) murder

C) poverty

D) stock market

E) natural resources

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following are characteristic of a developing country?

A) extensive embrace of free trade policies

B) low inflation

C) high national savings

D) a current account deficit and low national savings

E) strong credit institutions

A) extensive embrace of free trade policies

B) low inflation

C) high national savings

D) a current account deficit and low national savings

E) strong credit institutions

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

22

In developing countries, exchange rates tend to be

A) floating with some government intervention.

B) pegged.

C) hard to tell from the data.

D) run by currency boards.

E) flexible.

A) floating with some government intervention.

B) pegged.

C) hard to tell from the data.

D) run by currency boards.

E) flexible.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

23

Most developing countries have tried to

A) liberalize capital movement.

B) control capital movements.

C) Hard to tell from the data.

D) in the 1960s and 1970s control, now to liberalize.

E) in the 1960s and 1970s liberalize, now to control.

A) liberalize capital movement.

B) control capital movements.

C) Hard to tell from the data.

D) in the 1960s and 1970s control, now to liberalize.

E) in the 1960s and 1970s liberalize, now to control.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

24

The relationship between annual real per-capita GDP and corruption across countries has been found to be

A) negative.

B) positive.

C) The relationship was negative in the late 1960s but is now positive.

D) The relationship was in the late 1960s but is now negative.

E) There is no relationship between these two variables.

A) negative.

B) positive.

C) The relationship was negative in the late 1960s but is now positive.

D) The relationship was in the late 1960s but is now negative.

E) There is no relationship between these two variables.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

25

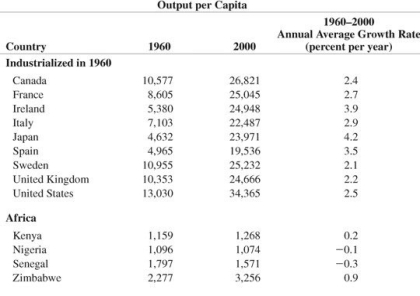

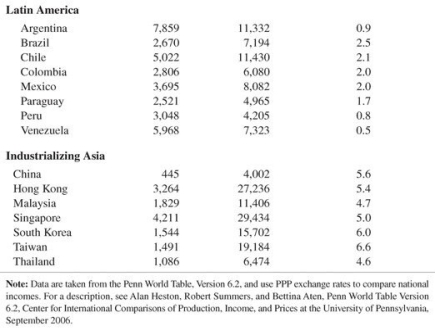

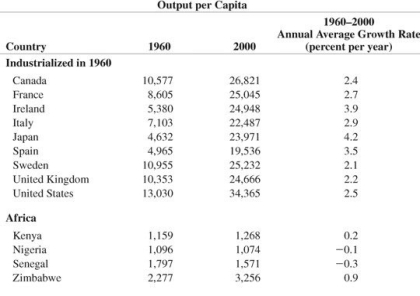

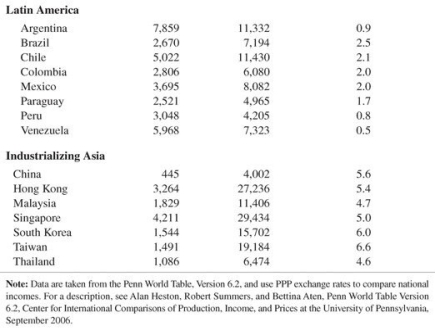

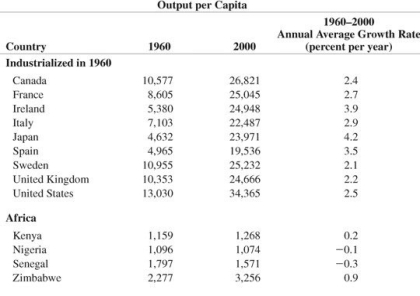

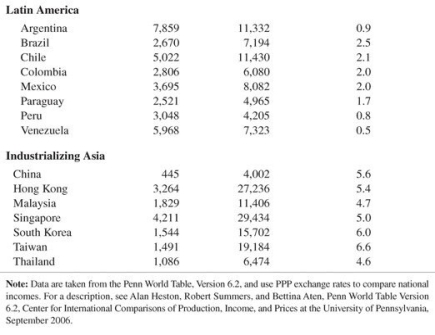

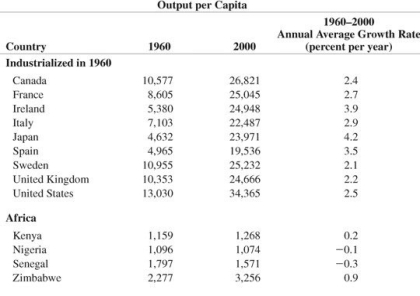

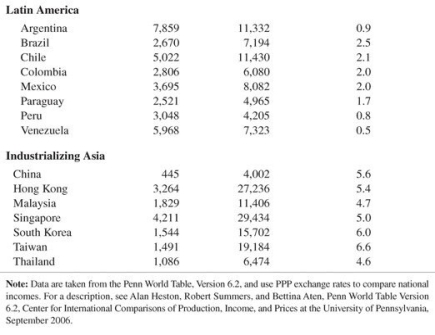

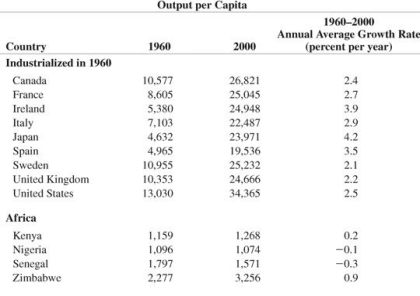

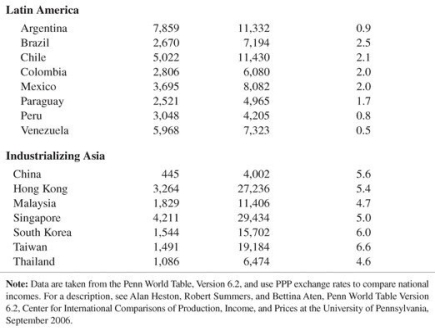

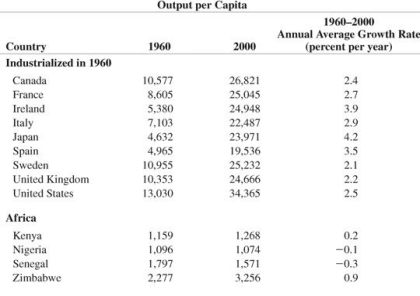

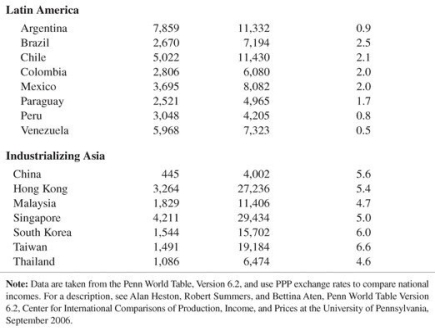

Please consider Table 22-2 below.

Assuming constant Annual Average Growth Rate in the future, calculate the output per capita for the United States and South Korea for the year 2040.

Assuming constant Annual Average Growth Rate in the future, calculate the output per capita for the United States and South Korea for the year 2040.

Assuming constant Annual Average Growth Rate in the future, calculate the output per capita for the United States and South Korea for the year 2040.

Assuming constant Annual Average Growth Rate in the future, calculate the output per capita for the United States and South Korea for the year 2040.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following is NOT a common characteristic of a developing country?

A) extensive direct government control of the economy

B) history of low inflation

C) many weak credit institutions

D) "pegged" exchange rates

E) Agricultural commodities make up a large share of its exports.

A) extensive direct government control of the economy

B) history of low inflation

C) many weak credit institutions

D) "pegged" exchange rates

E) Agricultural commodities make up a large share of its exports.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

27

For many developing countries, natural resources or agricultural commodities make up a ________ share of exports.

A) large

B) moderate

C) nonexistent

D) small

E) insubstantial

A) large

B) moderate

C) nonexistent

D) small

E) insubstantial

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

28

Please consider Table 22-2 below.

At that Annual Average Growth Rate, how many years does it take for the output per capita to double in both the United States and South Korea.

At that Annual Average Growth Rate, how many years does it take for the output per capita to double in both the United States and South Korea.

At that Annual Average Growth Rate, how many years does it take for the output per capita to double in both the United States and South Korea.

At that Annual Average Growth Rate, how many years does it take for the output per capita to double in both the United States and South Korea.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

29

Explain the theory behind convergence and why it is a "deceptively simple" theory.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

30

Please consider Table 22-2 below.

Assuming constant Annual Average Growth Rate in the future, determine the year in which the United States will have the same output per capita as South Korea?

Assuming constant Annual Average Growth Rate in the future, determine the year in which the United States will have the same output per capita as South Korea?

Assuming constant Annual Average Growth Rate in the future, determine the year in which the United States will have the same output per capita as South Korea?

Assuming constant Annual Average Growth Rate in the future, determine the year in which the United States will have the same output per capita as South Korea?

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

31

In general, the development of underground economic activity ________ economic efficiency

A) hinders

B) has no effect

C) aides

D) hard to tell, sometime hinders, sometimes aides

E) spikes

A) hinders

B) has no effect

C) aides

D) hard to tell, sometime hinders, sometimes aides

E) spikes

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

32

Explain what the four main categories of world economies are and give examples?

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

33

One should expect ________ relationship between annual per-capita GDP and an inverse index of corruption

A) a weak and negative

B) a weak and positive

C) a strong and negative

D) a strong and positive

E) an unpredictable

A) a weak and negative

B) a weak and positive

C) a strong and negative

D) a strong and positive

E) an unpredictable

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following countries is the most corrupt?

A) U.S.

B) Iceland

C) Finland

D) New Zealand

E) Greenland

A) U.S.

B) Iceland

C) Finland

D) New Zealand

E) Greenland

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

35

Seigniorage refers to

A) real resources a government earns when it prints money to use for spending on goods and services.

B) nominal resources a government earns when it prints money to use for spending on goods and services.

C) real resources a government earns when it prints money.

D) nominal resources a government earns when it prints money.

E) real resources a government earns when it issues bonds to use for spending on goods and services.

A) real resources a government earns when it prints money to use for spending on goods and services.

B) nominal resources a government earns when it prints money to use for spending on goods and services.

C) real resources a government earns when it prints money.

D) nominal resources a government earns when it prints money.

E) real resources a government earns when it issues bonds to use for spending on goods and services.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

36

For many developing countries, natural resources or agricultural commodities make up ________ share of exports

A) close to no

B) an unimportant

C) an important

D) close a to 5 percent

E) close to a 10 percent

A) close to no

B) an unimportant

C) an important

D) close a to 5 percent

E) close to a 10 percent

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

37

While many developing countries have reformed their economies in order to imitate the success of the successful industrial economies, the process remains incomplete and most developing countries tend to be characterized by all of the following EXCEPT

A) seigniorage.

B) control of capital movements by limiting foreign exchange transactions connected with trade in assets.

C) use of natural resources or agricultural commodities as an important share of exports.

D) a worse job of directing savings toward their most efficient investment uses.

E) reduced corruption and poverty due to limited underground markets.

A) seigniorage.

B) control of capital movements by limiting foreign exchange transactions connected with trade in assets.

C) use of natural resources or agricultural commodities as an important share of exports.

D) a worse job of directing savings toward their most efficient investment uses.

E) reduced corruption and poverty due to limited underground markets.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

38

In general, one would expect that life expectancies reflect international differences in income levels. Do the data support such a claim?

A) Average life span falls as relative poverty falls.

B) Average life span increases as relative poverty falls.

C) There is no statistically significant relationship between the two.

D) The relation is not very strong.

E) The relationship looks more like a U-shape.

A) Average life span falls as relative poverty falls.

B) Average life span increases as relative poverty falls.

C) There is no statistically significant relationship between the two.

D) The relation is not very strong.

E) The relationship looks more like a U-shape.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following does NOT explain why developing countries encouraged new manufacturing industries of their own in the mid 20th century?

A) They were cut off from traditional suppliers of manufactures during WWII.

B) Former colonial areas had something to prove; they wanted to attain the same income levels as their former rulers.

C) Leaders of these countries feared that their efforts to escape poverty would be doomed if they continues to specialize in primary commodity exports.

D) There was political pressure to protect these industries.

E) Developing countries ran out of the natural resources that traditionally made up the majority of their trade.

A) They were cut off from traditional suppliers of manufactures during WWII.

B) Former colonial areas had something to prove; they wanted to attain the same income levels as their former rulers.

C) Leaders of these countries feared that their efforts to escape poverty would be doomed if they continues to specialize in primary commodity exports.

D) There was political pressure to protect these industries.

E) Developing countries ran out of the natural resources that traditionally made up the majority of their trade.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

40

The real resource a government earns when it prints money and spends it on goods and services is called

A) seigniorage.

B) control of capital movements by limiting foreign exchange transactions.

C) pure profits.

D) inflation profits.

E) greenback.

A) seigniorage.

B) control of capital movements by limiting foreign exchange transactions.

C) pure profits.

D) inflation profits.

E) greenback.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

41

How would you define exchange control?

A) The government allocates foreign exchange through decree rather than through the market.

B) a country NOT pegging its exchange rate

C) a country pegging its exchange rate

D) a country buying up excess current account so that CA=0

E) a country restricting all foreign exchange

A) The government allocates foreign exchange through decree rather than through the market.

B) a country NOT pegging its exchange rate

C) a country pegging its exchange rate

D) a country buying up excess current account so that CA=0

E) a country restricting all foreign exchange

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

42

Describe some of the features hindering developing countries from growing faster.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

43

In the instances where a loan has been issued under certain terms and has to be repaid, what happens when the borrower does not uphold these stipulations?

A) call

B) option

C) payment

D) default

E) fraud

A) call

B) option

C) payment

D) default

E) fraud

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

44

Explain the extensive economic role of government within a developing country.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

45

With which country did the Debt Crisis of the early 1980s begin?

A) France

B) Mexico

C) Argentina

D) Japan

E) Germany

A) France

B) Mexico

C) Argentina

D) Japan

E) Germany

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

46

The Convertibility Law of April 1991 in Argentina

A) pegged the Argentinean currency to the US dollar at a ratio of one to one.

B) pegged the Argentinean currency to the US dollar at a ratio of one to two.

C) pegged the Argentinean currency to the US dollar at a ratio of one to 0.5.

D) represents an era of floating exchange rate in Argentina.

E) pegged the Argentinean currency to the British pound at a ratio of one to one.

A) pegged the Argentinean currency to the US dollar at a ratio of one to one.

B) pegged the Argentinean currency to the US dollar at a ratio of one to two.

C) pegged the Argentinean currency to the US dollar at a ratio of one to 0.5.

D) represents an era of floating exchange rate in Argentina.

E) pegged the Argentinean currency to the British pound at a ratio of one to one.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

47

The term Original Sin by two economists Barry Eichengreen and Ricardo Hausmann is used to describe what?

A) low-income economy

B) developing countries' inability to borrow in their own currencies

C) a sin that is part of the Ten Commandments

D) borrows not able to receive loans

E) not diversifying economies portfolios

A) low-income economy

B) developing countries' inability to borrow in their own currencies

C) a sin that is part of the Ten Commandments

D) borrows not able to receive loans

E) not diversifying economies portfolios

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

48

What does it mean for a loan to be in default?

A) when the borrower of the a loan fails to repay on schedule according to a loan contract, without the agreement of the lender

B) when the borrower of a loan fails to repay on schedule according to a loan contract, with the agreement of the lender

C) when the lender of a loan fails to supplies the full amount of a loan to the borrower

D) when the lender of a loan supplies the full amount of a loan to a borrower without any promise of being repaid

E) when the lender of a loan fails to offer the promised sum

A) when the borrower of the a loan fails to repay on schedule according to a loan contract, without the agreement of the lender

B) when the borrower of a loan fails to repay on schedule according to a loan contract, with the agreement of the lender

C) when the lender of a loan fails to supplies the full amount of a loan to the borrower

D) when the lender of a loan supplies the full amount of a loan to a borrower without any promise of being repaid

E) when the lender of a loan fails to offer the promised sum

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

49

Which Latin American country defaulted on loans in 2005 and paid off their creditors at only 1/3 value?

A) Argentina

B) Brazil

C) Chile

D) Colombia

E) Mexico

A) Argentina

B) Brazil

C) Chile

D) Colombia

E) Mexico

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

50

In 1981-1983, the world economy suffered a steep recession. Naturally, the fall in industrial countries' aggregate demand had a direct negative impact on the developing countries. What other mechanism was an even more important contributor to this event?

A) the immediate steep inflation that followed the recession

B) the dollar's sharp depreciation in the foreign exchange market

C) the increase in primary commodity prices, increasing terms of trade in many poor countries

D) the collapse in primary commodity prices and the immediate, large rise in the interest burden that debtors had to pay

E) the influx of defaulting credit

A) the immediate steep inflation that followed the recession

B) the dollar's sharp depreciation in the foreign exchange market

C) the increase in primary commodity prices, increasing terms of trade in many poor countries

D) the collapse in primary commodity prices and the immediate, large rise in the interest burden that debtors had to pay

E) the influx of defaulting credit

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

51

As of 2013, how large is the debt of developing countries to the rest of the world?

A) $350 million

B) $350 billion

C) $7 trillion

D) $35 trillion

E) $3.5 trillion

A) $350 million

B) $350 billion

C) $7 trillion

D) $35 trillion

E) $3.5 trillion

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

52

The $50 billion emergency loan orchestrated by the U.S. Treasury and the IMF to Mexico in 1994

A) was a disastrous policy for Mexico.

B) avoided a disaster to the Mexican economy.

C) did not affect Mexico in the short run.

D) did not affect Mexico in the long run.

E) was ineffective both in the short and long runs.

A) was a disastrous policy for Mexico.

B) avoided a disaster to the Mexican economy.

C) did not affect Mexico in the short run.

D) did not affect Mexico in the long run.

E) was ineffective both in the short and long runs.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

53

Brazil's 1999 crisis was relatively short lived because

A) Brazil's financial institutions had avoided borrowing all together.

B) Brazil's financial institutions had avoided heavy borrowing in local currency.

C) Brazil's financial institutions had avoided heavy borrowing in dollars.

D) Brazil's financial institutions had extended low-interest loans.

E) Brazil's financial institutions had extended high-interest loans.

A) Brazil's financial institutions had avoided borrowing all together.

B) Brazil's financial institutions had avoided heavy borrowing in local currency.

C) Brazil's financial institutions had avoided heavy borrowing in dollars.

D) Brazil's financial institutions had extended low-interest loans.

E) Brazil's financial institutions had extended high-interest loans.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

54

In developing economies, national saving is often ________ relative to developed economies.

A) high

B) the same

C) hard to tell

D) low

E) low for the very poor countries and high for the more developed

A) high

B) the same

C) hard to tell

D) low

E) low for the very poor countries and high for the more developed

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following is a reason that developing countries are running large surpluses?

A) They are required to do so by IMF.

B) They have defaulted on international loans.

C) They have pegged exchange rates and thus the growth of exports must drive surplus up.

D) They have a strong desire to accumulate international reserves to protect against a sudden stop of capital inflows.

E) They don't know how to manage their surpluses.

A) They are required to do so by IMF.

B) They have defaulted on international loans.

C) They have pegged exchange rates and thus the growth of exports must drive surplus up.

D) They have a strong desire to accumulate international reserves to protect against a sudden stop of capital inflows.

E) They don't know how to manage their surpluses.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

56

In 1991, Argentina established a radical institutional reform after experiencing a decade marked by financial instability. This program was called the new Convertibility Law. What did this law do?

A) made Argentina's currency fully convertible into Eurocurrency at a fixed rate

B) required that the monetary base be backed completely by U.S. dollars

C) placed limits on exports of commodities

D) made Argentina's currency fully convertible into U.S. dollars at a fixed rate and required that the monetary base be backed completely by gold or foreign currency

E) restricted risky international trade activity

A) made Argentina's currency fully convertible into Eurocurrency at a fixed rate

B) required that the monetary base be backed completely by U.S. dollars

C) placed limits on exports of commodities

D) made Argentina's currency fully convertible into U.S. dollars at a fixed rate and required that the monetary base be backed completely by gold or foreign currency

E) restricted risky international trade activity

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

57

There are many ways developing countries finance their external deficits EXCEPT

A) bank finance.

B) portfolio investment in ownership of firms.

C) bond finance.

D) official lending.

E) foreign exchange rates.

A) bank finance.

B) portfolio investment in ownership of firms.

C) bond finance.

D) official lending.

E) foreign exchange rates.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

58

A considerable advantage that richer countries have over poorer ones is exemplified by the fact that

A) richer countries do not have to denominate their foreign debts in their own currencies.

B) richer countries have the ability to denominate their foreign debts in foreign currencies.

C) when demand falls for a poorer country's goods, this leads to a significant wealth transfer from foreigners to the poorer country, a kind of international insurance payment.

D) richer countries have the ability to denominate their foreign debts in their own currencies.

E) richer countries can extract trade advantages by using military power.

A) richer countries do not have to denominate their foreign debts in their own currencies.

B) richer countries have the ability to denominate their foreign debts in foreign currencies.

C) when demand falls for a poorer country's goods, this leads to a significant wealth transfer from foreigners to the poorer country, a kind of international insurance payment.

D) richer countries have the ability to denominate their foreign debts in their own currencies.

E) richer countries can extract trade advantages by using military power.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

59

During the time period of 1981-1983 what dramatic world issue happened?

A) political instability, insecure property rights

B) stock market crashed

C) world wide hyperinflation

D) the collapse of the U.S. mortgages market

E) A world economic recession caused developing countries to not be able to make payments on foreign loans, in turn causing a universal default.

A) political instability, insecure property rights

B) stock market crashed

C) world wide hyperinflation

D) the collapse of the U.S. mortgages market

E) A world economic recession caused developing countries to not be able to make payments on foreign loans, in turn causing a universal default.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

60

A trend that has been reinforced by many developing countries is privatization. Privatization refers to

A) purchasing large companies and turning them into state-owned enterprises.

B) investing government money in large, privately-owned companies.

C) exchanging bonds for shares in state-owned enterprises.

D) selling large state-owned enterprises to private owners in the financial sector.

E) selling large state-owned enterprises to private owners in key areas such as electricity, telecommunications, or petroleum.

A) purchasing large companies and turning them into state-owned enterprises.

B) investing government money in large, privately-owned companies.

C) exchanging bonds for shares in state-owned enterprises.

D) selling large state-owned enterprises to private owners in the financial sector.

E) selling large state-owned enterprises to private owners in key areas such as electricity, telecommunications, or petroleum.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

61

Explain why Argentina, one of the world's richest countries at the start of the twentieth century, has become progressively poorer relative to the industrial countries. [An alternative question: What explains Argentina's regress from riches to rags?]

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

62

What factors lie behind capital inflows to the developing world?

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

63

Why may equity finance be preferred to debt finance for developing countries?

A) A fall in domestic income automatically reduces the earnings of foreign shareholders without violating any loan agreement.

B) There are laws insuring against any default with equity finance.

C) The risk is shared between debtor and creditor with debt finance.

D) The tax structure leaves equity finance unconstrained.

E) Repayments are unaffected by falls in real income.

A) A fall in domestic income automatically reduces the earnings of foreign shareholders without violating any loan agreement.

B) There are laws insuring against any default with equity finance.

C) The risk is shared between debtor and creditor with debt finance.

D) The tax structure leaves equity finance unconstrained.

E) Repayments are unaffected by falls in real income.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

64

The 1980s are considered as the "lost decade" of Latin American growth. Explain why?

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

65

When a government defaults on its obligations, the event is called a

A) sovereign default.

B) magisterial default.

C) private default.

D) sudden stop default.

E) national default.

A) sovereign default.

B) magisterial default.

C) private default.

D) sudden stop default.

E) national default.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

66

The main reason for the crisis in Argentina in 2001 and 2002, as to do with exchange rate policy, i.e., the continued peg of the exchange rate to the dollar. Discuss.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

67

Some economists claim that the Chilean experience during the 1990s was much more successful than its Latin American neighbors. Evaluate the Chilean policies during that decade.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

68

Describe alternative forms of capital inflow to finance external deficits and explain why these methods were used in different times?

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

69

Evaluate the Argentinean Convertibility Law of April, 1991.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

70

Write an essay on the importance of a sound banking system in developing countries.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

71

Explain why despite enormous natural resources, much of Latin America's population remains in poverty and the region has been repeatedly experiencing financial crises.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

72

Explain why the distinction between debt and equity finance is useful in analyzing the response of developing countries to unforeseen events such as recession or terms of trade change?

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

73

Explain how Brazil was able to reduce the rate of inflation from 2,669 percent in 1994 to less than 10 percent in 1997?

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

74

"Sharp contractions in a country's output and employment invariably result from a crisis in which the country suddenly loses access to all foreign sources of funds." Explain how the current account identity necessitates these contractions.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

75

List and explain 3 major channels through which developing countries have financed their external deficits.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

76

The following are all the forms of debt finance.

A) bond, bank, and official finance

B) bond and bank finance

C) bond, bank, and portfolio finance

D) foreign direct and portfolio investment

E) direct investment, stock, and dividends

A) bond, bank, and official finance

B) bond and bank finance

C) bond, bank, and portfolio finance

D) foreign direct and portfolio investment

E) direct investment, stock, and dividends

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

77

Explain why a exchange rate-based stabilization plan may result in a real appreciation?

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

78

Since foreign credit dries up in crises when it is most needed, developing countries can protect themselves from default by

A) cutting off imports of goods.

B) allowing the exchange rate to float.

C) using equity finance only.

D) accumulating high levels of international reserves.

E) avoiding the international capital market.

A) cutting off imports of goods.

B) allowing the exchange rate to float.

C) using equity finance only.

D) accumulating high levels of international reserves.

E) avoiding the international capital market.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

79

Should the IMF be abolished? Discuss.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

80

What do you think about international "Chapter 11"?

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck