Deck 20: Short-Term Financing

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/55

Play

Full screen (f)

Deck 20: Short-Term Financing

1

Assume that the Swiss franc has an annual interest rate of 8% and is expected to depreciate by 6% against the dollar. From a U.S. perspective, the effective financing rate from borrowing francs is:

A) 8%.

B) 14.48%.

C) 2%.

D) 1.52%.

A) 8%.

B) 14.48%.

C) 2%.

D) 1.52%.

D

2

Euronotes are underwritten by:

A) European central banks.

B) commercial banks.

C) the International Monetary Fund.

D) the Federal Reserve System.

A) European central banks.

B) commercial banks.

C) the International Monetary Fund.

D) the Federal Reserve System.

B

3

The effective financing rate:

A) adjusts the nominal interest rate for inflation over the period of concern.

B) adjusts the nominal interest rate for the change in the spot exchange rate over the period of concern.

C) adjusts the nominal rate for a change in foreign interest rates over the period of concern.

D) adjusts the nominal rate for the forward discount (or premium) over the period of concern.

A) adjusts the nominal interest rate for inflation over the period of concern.

B) adjusts the nominal interest rate for the change in the spot exchange rate over the period of concern.

C) adjusts the nominal rate for a change in foreign interest rates over the period of concern.

D) adjusts the nominal rate for the forward discount (or premium) over the period of concern.

B

4

A U.S. firm plans to borrow Swiss francs today for a one-year period. The Swiss interest rate is 9%. It uses today's spot rate as a forecast for the franc's spot rate in one year. The U.S. one-year interest rate is 10%. The expected effective financing rate on Swiss francs is:

A) equal to the U.S. interest rate.

B) less than the U.S. interest rate, but more than the Swiss interest rate.

C) equal to the Swiss interest rate.

D) less than the Swiss interest rate.

E) more than the U.S. interest rate.

A) equal to the U.S. interest rate.

B) less than the U.S. interest rate, but more than the Swiss interest rate.

C) equal to the Swiss interest rate.

D) less than the Swiss interest rate.

E) more than the U.S. interest rate.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

5

If interest rate parity exists, transactions costs are zero, and the forward rate is an accurate predictor of the future spot rate, then the effective financing rate on a foreign currency:

A) would be equal to the U.S. interest rate.

B) would be less than the U.S. interest rate.

C) would be more than the U.S. financing rate.

D) would be less than the U.S. interest rate if the forward rate exhibited a discount and more than the U.S. interest rate of the forward rate exhibited a premium.

A) would be equal to the U.S. interest rate.

B) would be less than the U.S. interest rate.

C) would be more than the U.S. financing rate.

D) would be less than the U.S. interest rate if the forward rate exhibited a discount and more than the U.S. interest rate of the forward rate exhibited a premium.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

6

Assume the annual British interest rate is above the annual U.S. interest rate. Also assume the pound's forward rate of $1.75 equals the pound's spot rate. Given this information, interest rate parity ____ exist, and the U.S. firm ____ lock in a lower financing cost by borrowing pounds for one year.

A) does; could

B) does; could not

C) does not; could not

D) does not; could

A) does; could

B) does; could not

C) does not; could not

D) does not; could

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

7

If interest rate parity exists and transactions costs are zero, foreign financing with a simultaneous forward purchase of the currency borrowed will result in an effective financing rate that is:

A) less than the domestic interest rate.

B) greater than the domestic interest rate.

C) equal to the domestic interest rate.

D) greater than the domestic interest rate if the forward rate exhibits a premium and less than the domestic interest rate if the forward rate exhibits a discount.

A) less than the domestic interest rate.

B) greater than the domestic interest rate.

C) equal to the domestic interest rate.

D) greater than the domestic interest rate if the forward rate exhibits a premium and less than the domestic interest rate if the forward rate exhibits a discount.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

8

MNCs may be able to lock in a lower cost from financing in a low interest rate foreign currency if they:

A) have future cash inflows in that foreign currency.

B) have future cash outflows in that foreign currency.

C) have offsetting future cash inflows and outflows in that foreign currency.

D) have no other cash flows in that foreign currency.

A) have future cash inflows in that foreign currency.

B) have future cash outflows in that foreign currency.

C) have offsetting future cash inflows and outflows in that foreign currency.

D) have no other cash flows in that foreign currency.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

9

A risk-averse firm would prefer to borrow ____ when the expected financing costs are similar in a foreign country as in the local country.

A) locally

B) in the foreign country

C) either A or B

D) part of the funds locally, and part from the foreign country

A) locally

B) in the foreign country

C) either A or B

D) part of the funds locally, and part from the foreign country

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

10

Assume that the U.S. interest rate is 11% while the interest rate on the euro is 7%. If euros are borrowed by a U.S. firm, they would have to ____ against the dollar by ____ in order to have the same effective financing rate from borrowing dollars.

A) depreciate; about 3.74%

B) appreciate; about 3.74%

C) appreciate; about 4.53%

D) depreciate; about 4.53%

A) depreciate; about 3.74%

B) appreciate; about 3.74%

C) appreciate; about 4.53%

D) depreciate; about 4.53%

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

11

A firm without any exposure to foreign exchange rates would likely increase this exposure the most by:

A) borrowing domestically.

B) borrowing a portfolio of foreign currencies that are not highly correlated.

C) borrowing a portfolio of foreign currencies that are highly correlated.

D) borrowing two foreign currencies that are negatively correlated.

A) borrowing domestically.

B) borrowing a portfolio of foreign currencies that are not highly correlated.

C) borrowing a portfolio of foreign currencies that are highly correlated.

D) borrowing two foreign currencies that are negatively correlated.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

12

The variance in financing costs over time is ____ for foreign financing than domestic financing. The variance when financing with foreign currencies is lower when those currencies exhibit ____ correlations, assuming the firm has no other business in those currencies.

A) lower; low

B) lower; high

C) higher; high

D) higher; low

A) lower; low

B) lower; high

C) higher; high

D) higher; low

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

13

Assume that interest rates of most industrialized countries are similar to the U.S. interest rate. In the last few months, the currencies of all industrialized countries weakened substantially against the U.S. dollar. If non-U.S. firms based in these countries financed with U.S. dollars during this period (even when they had no receivables in dollars), their effective financing rate would have been:

A) negative.

B) zero.

C) positive, but lower than the interest rate of their respective countries.

D) higher than the interest rate of their respective countries.

A) negative.

B) zero.

C) positive, but lower than the interest rate of their respective countries.

D) higher than the interest rate of their respective countries.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

14

Assume the U.S. interest rate is 7.5%, the New Zealand interest rate is 6.5%, the spot rate of the NZ$ is $.52, and the one-year forward rate of the NZ$ is $.50. At the end of the year, the spot rate is $.48. Based on this information, what is the effective financing rate for a U.S. firm that takes out a one-year, uncovered NZ$ loan?

A) about -1.7%.

B) about 0.0%.

C) about 14.7%.

D) about 15.4%.

E) about 8.3%.

A) about -1.7%.

B) about 0.0%.

C) about 14.7%.

D) about 15.4%.

E) about 8.3%.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

15

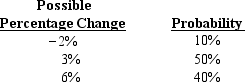

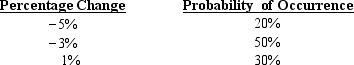

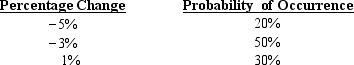

A firm forecasts the euro's value as follows for the next year:  The annual interest rate on the euro is 7%. The expected value of the effective financing rate from a U.S. firm's perspective is about:

The annual interest rate on the euro is 7%. The expected value of the effective financing rate from a U.S. firm's perspective is about:

A) 8.436%.

B) 10.959%.

C) 11.112%.

D) 11.541%.

The annual interest rate on the euro is 7%. The expected value of the effective financing rate from a U.S. firm's perspective is about:

The annual interest rate on the euro is 7%. The expected value of the effective financing rate from a U.S. firm's perspective is about:A) 8.436%.

B) 10.959%.

C) 11.112%.

D) 11.541%.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

16

A negative effective financing rate for a U.S. firm implies that the firm:

A) will incur a loss on the project financed with the funds.

B) paid more interest on the funds than what it would have paid if it had borrowed dollars.

C) will be unable to repay the loan.

D) none of the above

A) will incur a loss on the project financed with the funds.

B) paid more interest on the funds than what it would have paid if it had borrowed dollars.

C) will be unable to repay the loan.

D) none of the above

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

17

Assume that interest rate parity exists, and there are zero transactions costs. If the forward rate consistently underestimates the future spot rate, then:

A) on average, the foreign effective financing rate is greater than the domestic interest rate.

B) on average, the foreign effective financing rate is less than the domestic rate.

C) the foreign effective financing rate exceeds the U.S. interest rate when its forward rate exhibits a discount and is less than the U.S. interest rate when its forward rate exhibits a premium.

D) the foreign effective financing rate is less than the U.S. interest rate when its forward rate exhibits a discount and exceeds the U.S. interest rate when its forward rate exhibits a discount.

A) on average, the foreign effective financing rate is greater than the domestic interest rate.

B) on average, the foreign effective financing rate is less than the domestic rate.

C) the foreign effective financing rate exceeds the U.S. interest rate when its forward rate exhibits a discount and is less than the U.S. interest rate when its forward rate exhibits a premium.

D) the foreign effective financing rate is less than the U.S. interest rate when its forward rate exhibits a discount and exceeds the U.S. interest rate when its forward rate exhibits a discount.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

18

When a U.S. firm borrows a foreign currency and has no offsetting position in this currency, it will incur an effective financing rate that is always above the ____ if the currency ____.

A) foreign currency's interest rate; appreciates

B) foreign currency's interest rate; depreciates

C) domestic interest rate; depreciates

D) domestic interest rate; appreciates

A) foreign currency's interest rate; appreciates

B) foreign currency's interest rate; depreciates

C) domestic interest rate; depreciates

D) domestic interest rate; appreciates

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

19

If a firm repeatedly borrows a foreign currency portfolio, the variability of the portfolio's effective financing rate will be highest if the correlations between currencies in the portfolio are ____ and the individual variability of each currency is ____.

A) high; low

B) high; high

C) low; low

D) low; high

A) high; low

B) high; high

C) low; low

D) low; high

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

20

Assume the U.S. one-year interest rate is 8%, and the British one-year interest rate is 6%. The one-year forward rate of the pound is $1.97. The spot rate of the pound at the beginning of the year is $1.95. By the end of the year, the pound's spot rate is $2.05. Based on the information, what is the effective financing rate for a U.S. firm that takes out a one-year, uncovered British loan?

A) about 12.4%.

B) about 7.1%.

C) about 13.5%.

D) about 10.3%.

E) about 11.3%.

A) about 12.4%.

B) about 7.1%.

C) about 13.5%.

D) about 10.3%.

E) about 11.3%.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

21

The interest rate of euronotes is based on the T-bill rate.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

22

____ typically have maturities of less than one year.

A) Eurobonds

B) Euro-commercial paper

C) Euronotes

D) ADRs

A) Eurobonds

B) Euro-commercial paper

C) Euronotes

D) ADRs

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

23

If interest rate parity exists, financing with a foreign currency may still be feasible, but it would have to be conducted on an uncovered basis (i.e., without use of a forward hedge).

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

24

Firms that believe the forward rate is an unbiased predictor of the future spot rate will prefer borrowing the foreign currency.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

25

Morton Company obtains a one-year loan of 2,000,000 Japanese yen at an interest rate of 6%. At the time the loan is extended, the spot rate of the yen is $.005. If the spot rate of the yen at maturity of the loan is $.0035, what is the effective financing rate of borrowing yen?

A) 37.8%.

B) 51.43%.

C) -25.8%.

D) -6%.

E) none of the above

A) 37.8%.

B) 51.43%.

C) -25.8%.

D) -6%.

E) none of the above

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

26

Assume Jelly Corporation, a U.S.-based MNC, obtains a one-year loan of 1,500,000 Malaysian ringgit (MYR) at a nominal interest rate of 7%. At the time the loan is extended, the spot rate of the ringgit is $.25. If the spot rate of the ringgit in one year is $.28, the dollar amount initially obtained from the loan is $____, and $____ are needed to repay the loan.

A) 375,000; 449,400

B) 449,400; 375,000

C) 6,000,000; 5,357,143

D) 5,357,143; 6,000,000

A) 375,000; 449,400

B) 449,400; 375,000

C) 6,000,000; 5,357,143

D) 5,357,143; 6,000,000

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

27

One reason an MNC may consider foreign financing is that the proceeds could be used to offset a foreign net payables position.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

28

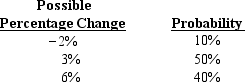

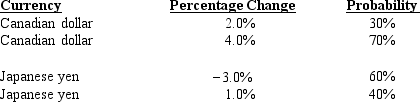

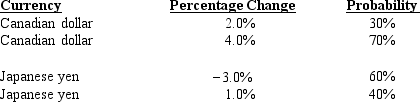

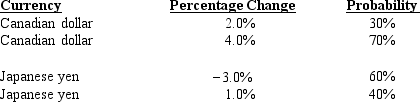

Exhibit 20-2

To benefit from the low correlation between the Canadian dollar (C$) and the Japanese yen (¥), Luzar Corporation decides to borrow 50% of funds needed in Canadian dollars and the remainder in yen. The domestic financing rate for a one-year loan is 7%. The Canadian one-year interest rate is 6% and the Japanese one-year interest rate is 10%. Luzar has determined the following possible percentage changes in the two individual currencies as follows:

Refer to Exhibit 20-2. What is the expected effective financing rate of the portfolio Luzar is contemplating (assume the two currencies move independently from one another)?

A) 9.03%.

B) 7.00%.

C) 10.00%.

D) 7.59%.

E) none of the above

To benefit from the low correlation between the Canadian dollar (C$) and the Japanese yen (¥), Luzar Corporation decides to borrow 50% of funds needed in Canadian dollars and the remainder in yen. The domestic financing rate for a one-year loan is 7%. The Canadian one-year interest rate is 6% and the Japanese one-year interest rate is 10%. Luzar has determined the following possible percentage changes in the two individual currencies as follows:

Refer to Exhibit 20-2. What is the expected effective financing rate of the portfolio Luzar is contemplating (assume the two currencies move independently from one another)?

A) 9.03%.

B) 7.00%.

C) 10.00%.

D) 7.59%.

E) none of the above

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

29

Exhibit 20-1

Assume a U.S.-based MNC is borrowing Romanian leu (ROL) at an interest rate of 8% for one year. Also assume that the spot rate of the leu is $.00012 and the one-year forward rate of the leu is $.00010. The expected spot rate of the leu one-year from now is $.00011.

-Refer to Exhibit 20-1. What is the effective financing rate for the MNC assuming it borrows leu on an uncovered basis?

A) about 10%.

B) about -10%.

C) about -1%.

D) about -2%.

E) none of the above

Assume a U.S.-based MNC is borrowing Romanian leu (ROL) at an interest rate of 8% for one year. Also assume that the spot rate of the leu is $.00012 and the one-year forward rate of the leu is $.00010. The expected spot rate of the leu one-year from now is $.00011.

-Refer to Exhibit 20-1. What is the effective financing rate for the MNC assuming it borrows leu on an uncovered basis?

A) about 10%.

B) about -10%.

C) about -1%.

D) about -2%.

E) none of the above

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

30

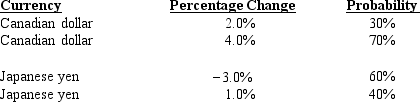

Exhibit 20-3

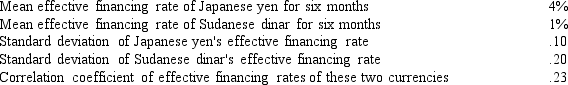

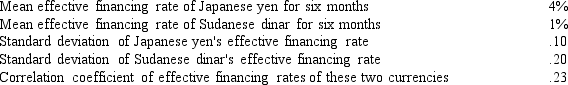

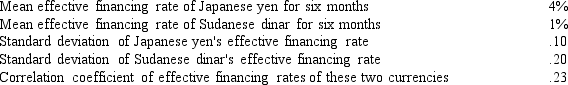

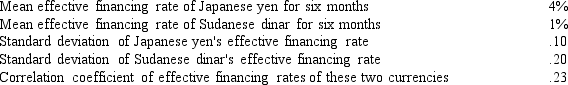

Cameron Corporation would like to simultaneously borrow Japanese yen (¥) and Sudanese dinar (SDD) for a six-month period. Cameron would like to determine the expected financing rate and the variance of a portfolio consisting of 30% yen and 70% dinar. Cameron has gathered the following information:

Refer to Exhibit 20-3. What is the expected financing rate of the portfolio contemplated by Cameron Corporation?

A) 3.10%.

B) 1.90%.

C) 17.00%.

D) 13.00%.

E) none of the above

Cameron Corporation would like to simultaneously borrow Japanese yen (¥) and Sudanese dinar (SDD) for a six-month period. Cameron would like to determine the expected financing rate and the variance of a portfolio consisting of 30% yen and 70% dinar. Cameron has gathered the following information:

Refer to Exhibit 20-3. What is the expected financing rate of the portfolio contemplated by Cameron Corporation?

A) 3.10%.

B) 1.90%.

C) 17.00%.

D) 13.00%.

E) none of the above

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

31

Euronotes are unsecured debt securities whose interest rate is based on the London Interbank Offer Rate (LIBOR) with typical maturities of one, three, and six months.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

32

Exhibit 20-3

Cameron Corporation would like to simultaneously borrow Japanese yen (¥) and Sudanese dinar (SDD) for a six-month period. Cameron would like to determine the expected financing rate and the variance of a portfolio consisting of 30% yen and 70% dinar. Cameron has gathered the following information:

Refer to Exhibit 20-3. What is the expected standard deviation of the portfolio contemplated by Cameron?

A) 2.24%.

B) 14.98%.

C) 2.89%.

D) 17.00%.

E) none of the above

Cameron Corporation would like to simultaneously borrow Japanese yen (¥) and Sudanese dinar (SDD) for a six-month period. Cameron would like to determine the expected financing rate and the variance of a portfolio consisting of 30% yen and 70% dinar. Cameron has gathered the following information:

Refer to Exhibit 20-3. What is the expected standard deviation of the portfolio contemplated by Cameron?

A) 2.24%.

B) 14.98%.

C) 2.89%.

D) 17.00%.

E) none of the above

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

33

A negative effective financing rate implies that the U.S. firm actually paid fewer dollars in total loan repayment than the number of dollars borrowed.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

34

Exhibit 20-1

Assume a U.S.-based MNC is borrowing Romanian leu (ROL) at an interest rate of 8% for one year. Also assume that the spot rate of the leu is $.00012 and the one-year forward rate of the leu is $.00010. The expected spot rate of the leu one-year from now is $.00011.

Maston Corporation has forecasted the value of the Russian ruble as follows for the next year: If the Russian interest rate is 30%, the expected cost of financing a one-year loan in rubles is:

If the Russian interest rate is 30%, the expected cost of financing a one-year loan in rubles is:

A) 27.14%.

B) 32.86%.

C) 26.10%.

D) none of the above

Assume a U.S.-based MNC is borrowing Romanian leu (ROL) at an interest rate of 8% for one year. Also assume that the spot rate of the leu is $.00012 and the one-year forward rate of the leu is $.00010. The expected spot rate of the leu one-year from now is $.00011.

Maston Corporation has forecasted the value of the Russian ruble as follows for the next year:

If the Russian interest rate is 30%, the expected cost of financing a one-year loan in rubles is:

If the Russian interest rate is 30%, the expected cost of financing a one-year loan in rubles is:A) 27.14%.

B) 32.86%.

C) 26.10%.

D) none of the above

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

35

____ are free of default risk.

A) Euronotes

B) Eurobonds

C) Euro-commercial paper

D) None of the above

A) Euronotes

B) Eurobonds

C) Euro-commercial paper

D) None of the above

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

36

Exhibit 20-1

Assume a U.S.-based MNC is borrowing Romanian leu (ROL) at an interest rate of 8% for one year. Also assume that the spot rate of the leu is $.00012 and the one-year forward rate of the leu is $.00010. The expected spot rate of the leu one-year from now is $.00011.

-Refer to Exhibit 20-1. What is the effective financing rate for the MNC assuming it borrows leu on a covered basis?

A) 10%.

B) -10%.

C) -1%.

D) 1%.

E) none of the above

Assume a U.S.-based MNC is borrowing Romanian leu (ROL) at an interest rate of 8% for one year. Also assume that the spot rate of the leu is $.00012 and the one-year forward rate of the leu is $.00010. The expected spot rate of the leu one-year from now is $.00011.

-Refer to Exhibit 20-1. What is the effective financing rate for the MNC assuming it borrows leu on a covered basis?

A) 10%.

B) -10%.

C) -1%.

D) 1%.

E) none of the above

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

37

MNCs can use short-term foreign financing to reduce their exposure to exchange rate fluctuations. For example, if an American-based MNC has ____ in euros, it could borrow ____, resulting in an offsetting effect.

A) payables; euros

B) receivables; euros

C) payables; dollars

D) receivables; dollars

A) payables; euros

B) receivables; euros

C) payables; dollars

D) receivables; dollars

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

38

Exhibit 20-1

Assume a U.S.-based MNC is borrowing Romanian leu (ROL) at an interest rate of 8% for one year. Also assume that the spot rate of the leu is $.00012 and the one-year forward rate of the leu is $.00010. The expected spot rate of the leu one-year from now is $.00011.

Assume that interest rate parity holds between the U.S. and Cyprus. The U.S. one-year interest rate is 7% and the Cyprus one-year interest rate is 6%. What is the approximate effective financing rate of a one-year loan denominated in Cyprus pounds assuming that the MNC covered its exposure by purchasing pounds one year forward?

A) 6%.

B) 7%.

C) 1%.

D) cannot answer without more information

Assume a U.S.-based MNC is borrowing Romanian leu (ROL) at an interest rate of 8% for one year. Also assume that the spot rate of the leu is $.00012 and the one-year forward rate of the leu is $.00010. The expected spot rate of the leu one-year from now is $.00011.

Assume that interest rate parity holds between the U.S. and Cyprus. The U.S. one-year interest rate is 7% and the Cyprus one-year interest rate is 6%. What is the approximate effective financing rate of a one-year loan denominated in Cyprus pounds assuming that the MNC covered its exposure by purchasing pounds one year forward?

A) 6%.

B) 7%.

C) 1%.

D) cannot answer without more information

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

39

If all currencies in a financing portfolio are not correlated with each other, financing with such a portfolio would not be very different from financing with a single foreign currency.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

40

Exhibit 20-2

To benefit from the low correlation between the Canadian dollar (C$) and the Japanese yen (¥), Luzar Corporation decides to borrow 50% of funds needed in Canadian dollars and the remainder in yen. The domestic financing rate for a one-year loan is 7%. The Canadian one-year interest rate is 6% and the Japanese one-year interest rate is 10%. Luzar has determined the following possible percentage changes in the two individual currencies as follows:

Refer to Exhibit 20-2. What is the probability that the financing rate of the two-currency portfolio is less than the domestic financing rate?

A) 12%.

B) 30%.

C) 100%.

D) 0%.

E) none of the above

To benefit from the low correlation between the Canadian dollar (C$) and the Japanese yen (¥), Luzar Corporation decides to borrow 50% of funds needed in Canadian dollars and the remainder in yen. The domestic financing rate for a one-year loan is 7%. The Canadian one-year interest rate is 6% and the Japanese one-year interest rate is 10%. Luzar has determined the following possible percentage changes in the two individual currencies as follows:

Refer to Exhibit 20-2. What is the probability that the financing rate of the two-currency portfolio is less than the domestic financing rate?

A) 12%.

B) 30%.

C) 100%.

D) 0%.

E) none of the above

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

41

If interest rate parity exists, the attempt to finance with a foreign currency while covering the position to avoid exchange rate risk will result in an effective financing rate that is ____ the domestic interest rate.

A) lower than

B) greater than

C) similar to

D) none of the above

A) lower than

B) greater than

C) similar to

D) none of the above

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following statement is false?

A) If interest rate parity holds, foreign financing a simultaneous hedge of that position in the forward market will result in financing costs similar to those in domestic financing.

B) If interest rate parity holds, and the forward rate is an accurate forecast of the future spot rate, uncovered foreign financing will result in financing costs similar to those in domestic financing.

C) If interest rate parity holds, and the forward rate is expected to overestimate the future spot rate, uncovered foreign financing is expected to result in lower financing costs than those in domestic financing.

D) If interest rate parity holds, and the forward rate is expected to underestimate the future spot rate, uncovered foreign financing is expected to result in lower financing costs than those in domestic financing.

A) If interest rate parity holds, foreign financing a simultaneous hedge of that position in the forward market will result in financing costs similar to those in domestic financing.

B) If interest rate parity holds, and the forward rate is an accurate forecast of the future spot rate, uncovered foreign financing will result in financing costs similar to those in domestic financing.

C) If interest rate parity holds, and the forward rate is expected to overestimate the future spot rate, uncovered foreign financing is expected to result in lower financing costs than those in domestic financing.

D) If interest rate parity holds, and the forward rate is expected to underestimate the future spot rate, uncovered foreign financing is expected to result in lower financing costs than those in domestic financing.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

43

If interest rate parity exists, and the forward rate is an accurate estimator of the future spot rate, the foreign financing rate will be ____ the home financing rate.

A) lower than

B) greater than

C) similar to

D) none of the above

A) lower than

B) greater than

C) similar to

D) none of the above

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

44

The degree of volatility of financing with a currency portfolio depends on only the standard deviations of effective financing rates of the individual currencies within the portfolio.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

45

Assume the U.S. one-year interest rate is 9%, while the Chilean one-year interest rate is 13%. If the Chilean peso ____ by ____%, a U.S.-based MNC would incur the same financing cost in dollars versus Chilean pesos over a one year period.

A) depreciates; 3.54

B) appreciates; 3.54

C) depreciates; 3.67

D) appreciates; 3.67

A) depreciates; 3.54

B) appreciates; 3.54

C) depreciates; 3.67

D) appreciates; 3.67

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

46

Foreign financing costs in a single foreign currency ____ financing costs in dollars, and the variance of foreign financing costs over time is ____ than the variance of financing in dollars.

A) are higher than; higher than

B) can be lower or higher than; higher than

C) can be lower or higher than; lower than

D) are lower than; higher than

A) are higher than; higher than

B) can be lower or higher than; higher than

C) can be lower or higher than; lower than

D) are lower than; higher than

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

47

Kushter Inc. would like to finance in euros. European interest rates are currently 4%, and the euro is expected to depreciate by 2% over the next year. What is Kushter's effective financing rate next year?

A) 1.92%

B) 2.00%

C) 6.08%

D) none of the above

A) 1.92%

B) 2.00%

C) 6.08%

D) none of the above

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

48

Assume the U.S. financing rate is 10 percent and that the financing rate in Germany is 9 percent. An MNC would be indifferent between financing in dollars and financing in euros next year if the euro is expected to ____.

A) appreciate by 0.92%.

B) depreciate by 0.92%.

C) appreciate by 1.00%.

D) depreciate by 1.00%.

A) appreciate by 0.92%.

B) depreciate by 0.92%.

C) appreciate by 1.00%.

D) depreciate by 1.00%.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

49

If movements of two currencies with low interest rates are highly negatively correlated, then financing in a portfolio of currencies would not be very beneficial. That is, financing with such a portfolio would not be very different from financing with a single foreign currency.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following is probably not a scenario under which a U.S.-based MNC would consider short-term foreign financing?

A) Canadian dollars offer a lower interest rate than available in the U.S. and are expected to appreciate over the maturity of the loan.

B) Australian dollars offer a lower interest rate than available in the U.S. and are expected to depreciate over the maturity of the loan.

C) A U.S. firms has net receivables in Cyprus pounds.

D) A and C.

E) None of the above

A) Canadian dollars offer a lower interest rate than available in the U.S. and are expected to appreciate over the maturity of the loan.

B) Australian dollars offer a lower interest rate than available in the U.S. and are expected to depreciate over the maturity of the loan.

C) A U.S. firms has net receivables in Cyprus pounds.

D) A and C.

E) None of the above

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

51

A large firm may finance in a foreign currency to offset a net payable position in that foreign country.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

52

A negative effective financing rate indicates that an MNC:

A) paid only a small amount in interested over and above the amount borrowed.

B) has been negatively affected by a large appreciation of the foreign currency.

C) actually paid fewer dollars to repay the loan than it borrowed.

D) would have been better off borrowing in the U.S.

A) paid only a small amount in interested over and above the amount borrowed.

B) has been negatively affected by a large appreciation of the foreign currency.

C) actually paid fewer dollars to repay the loan than it borrowed.

D) would have been better off borrowing in the U.S.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

53

An MNC's parent or subsidiary in need for funds commonly determines whether there are any available internal funds before searching for outside funding.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

54

If interest rate parity does not hold, and the forward ____ is ____ the interest rate differential, then foreign financing with a simultaneous hedge of that position in the forward market results in higher financing costs than those of domestic financing

A) premium; higher than

B) discount; higher than

C) premium; less than

D) A and B

A) premium; higher than

B) discount; higher than

C) premium; less than

D) A and B

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

55

Countries with a ____ rate of inflation tend to have a ____ interest rate.

A) high; low

B) low; high

C) high; high

D) A and B are correct

A) high; low

B) low; high

C) high; high

D) A and B are correct

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck