Deck 17: Investment

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/116

Play

Full screen (f)

Deck 17: Investment

1

In the arbitrage equation, a profit-maximizing firm can choose between ________ and ________.

A) investing in capital; investing in human capital

B) investing in new capital; hiring more labor

C) buying new capital; buying a new car

D) putting money in a bank; investing in new capital

E) allocating resources toward production; allocating resources toward inventory

A) investing in capital; investing in human capital

B) investing in new capital; hiring more labor

C) buying new capital; buying a new car

D) putting money in a bank; investing in new capital

E) allocating resources toward production; allocating resources toward inventory

putting money in a bank; investing in new capital

2

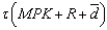

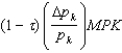

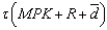

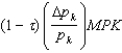

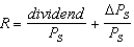

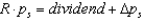

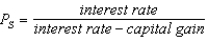

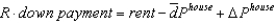

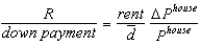

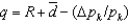

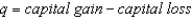

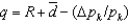

In the equation  is the:

is the:

A) arbitrage equation.

B) real interest rate.

C) rate of return to capital.

D) marginal product of capital.

E) opportunity cost of capital.

is the:

is the:A) arbitrage equation.

B) real interest rate.

C) rate of return to capital.

D) marginal product of capital.

E) opportunity cost of capital.

arbitrage equation.

3

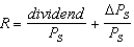

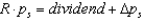

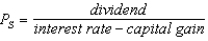

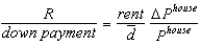

The equation  :

:

A) is the capital arbitrage equation.

B) states that a firm should invest in new capital until the marginal product of capital is equal to the difference between the real interest rate and the growth rate of the price of capital.

C) states that if the real interest rate is zero, arbitrage equation states the marginal product of capital is equal to minus the capital gain.

D) states that if a firm has "too much" capital, it should divest of some of its capital stock.

E) All of these answers are correct.

:

:A) is the capital arbitrage equation.

B) states that a firm should invest in new capital until the marginal product of capital is equal to the difference between the real interest rate and the growth rate of the price of capital.

C) states that if the real interest rate is zero, arbitrage equation states the marginal product of capital is equal to minus the capital gain.

D) states that if a firm has "too much" capital, it should divest of some of its capital stock.

E) All of these answers are correct.

All of these answers are correct.

4

For the profit-maximizing firm, if the real interest rate is greater than the marginal product of capital, the firm should:

A) invest in more capital.

B) get rid of some capital.

C) keep its capital stock the same, as there is a risk premium attached to the real interest rate.

D) hire more workers.

E) buy stocks.

A) invest in more capital.

B) get rid of some capital.

C) keep its capital stock the same, as there is a risk premium attached to the real interest rate.

D) hire more workers.

E) buy stocks.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

5

One reason we are interested in investment is its:

A) contribution to higher interest rates.

B) negative impact on current consumption.

C) relationship to exchange rate markets.

D) impact on financial markets.

E) link to long-term economic growth.

A) contribution to higher interest rates.

B) negative impact on current consumption.

C) relationship to exchange rate markets.

D) impact on financial markets.

E) link to long-term economic growth.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

6

In 2006, investment ________ from about ________ percent of GDP to ________ percent by early 2010.

A) fell; 17.5; less than 11

B) rose; 12; over 15

C) rose; 70; over 71

D) fell; -2.5; less than -5

E) rose; 20; over 21

A) fell; 17.5; less than 11

B) rose; 12; over 15

C) rose; 70; over 71

D) fell; -2.5; less than -5

E) rose; 20; over 21

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

7

If the real interest rate is 4 percent, the marginal product of capital is 2 percent, the depreciation rate is 10 percent, the tax rate is 25 percent, and capital gain is 1 percent, what is the user cost of capital?

A) 40.9 percent

B) 7.5 percent

C) 12.5 percent

D) 10.5 percent

E) 17.3 percent

A) 40.9 percent

B) 7.5 percent

C) 12.5 percent

D) 10.5 percent

E) 17.3 percent

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

8

If the real interest rate is 4 percent, the marginal product of capital is 2 percent, the depreciation rate is 10 percent, the tax rate is 0 percent, and capital gain is 1 percent, what is the user cost of capital?

A) 30 percent

B) -4 percent

C) 13 percent

D) 35 percent

E) 18.2 percent

A) 30 percent

B) -4 percent

C) 13 percent

D) 35 percent

E) 18.2 percent

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

9

If R is the real interest rate, w is the real wage, MPK is the marginal product of capital, and MPL is the marginal product of labor, which of the following conditions informs the profit-maximizing firm how much capital to invest?

A) R = MPK

B) R = w

C) R = 0 and MPK= MPL

D) MPK = MPL

E) MPK MPL if R w

A) R = MPK

B) R = w

C) R = 0 and MPK= MPL

D) MPK = MPL

E) MPK MPL if R w

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

10

During recessions ________ disproportionately to ________.

A) taxes rise; income

B) consumption falls; government expenditures

C) consumption rises; income

D) investment falls; consumption

E) output falls; income

A) taxes rise; income

B) consumption falls; government expenditures

C) consumption rises; income

D) investment falls; consumption

E) output falls; income

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

11

In macroeconomics, investing includes purchases of:

A) roads.

B) services.

C) stocks and bonds.

D) food.

E) transfer payments.

A) roads.

B) services.

C) stocks and bonds.

D) food.

E) transfer payments.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

12

When capital depreciation is included in the arbitrage equation for capital, the user cost of capital is given by:

A) .

.

B) .

.

C) .

.

D) .

.

E) .

.

A)

.

.B)

.

.C)

.

.D)

.

.E)

.

.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

13

We can use the arbitrage equation:

A) to forecast government spending.

B) for understanding fluctuations in precautionary saving.

C) for maximizing profits.

D) to analyze investment in capital, financial assets, and human capital.

E) to improve our understanding of the quantity theory of money.

A) to forecast government spending.

B) for understanding fluctuations in precautionary saving.

C) for maximizing profits.

D) to analyze investment in capital, financial assets, and human capital.

E) to improve our understanding of the quantity theory of money.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

14

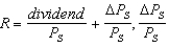

In the equation  is the ________ and

is the ________ and

Is the ________.

A) stock return; bond return

B) return from a bank account; return to owning capital

C) capital gain; initial price of capital

D) real interest rate; rate of return to capital

E) opportunity cost of capital; user cost of capital

is the ________ and

is the ________ and

Is the ________.

A) stock return; bond return

B) return from a bank account; return to owning capital

C) capital gain; initial price of capital

D) real interest rate; rate of return to capital

E) opportunity cost of capital; user cost of capital

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

15

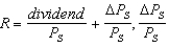

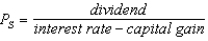

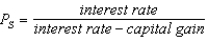

In the equation  is the:

is the:

A) capital gain of capital.

B) return to stock prices.

C) return to capital.

D) user cost of capital if taxes are zero.

E) return to a bank account.

is the:

is the:A) capital gain of capital.

B) return to stock prices.

C) return to capital.

D) user cost of capital if taxes are zero.

E) return to a bank account.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

16

The arbitrage condition for capital demonstrates that under profit-maximizing conditions:

A) returns to a bank account are equal to the return to capital.

B) returns to a bank account are equal to the user cost of capital.

C) if taxes are zero, profits are maximized.

D) profit maximizing will yield the optimal amount of capital a firm should buy.

E) the user cost is less than the marginal product of capital.

A) returns to a bank account are equal to the return to capital.

B) returns to a bank account are equal to the user cost of capital.

C) if taxes are zero, profits are maximized.

D) profit maximizing will yield the optimal amount of capital a firm should buy.

E) the user cost is less than the marginal product of capital.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

17

The important tool introduced in Chapter 17 on investment is the:

A) arbitrage equation.

B) present-value relationship.

C) Fisher equation.

D) quantity theory of money.

E) asset model.

A) arbitrage equation.

B) present-value relationship.

C) Fisher equation.

D) quantity theory of money.

E) asset model.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

18

The user cost of capital equals the:

A) the marginal cost of capital.

B) real interest rate + the depreciation rate -the capital gain.

C) nominal interest rate - the capital gain.

D) rate of inflation + the marginal product of capital.

E) initial capital stock + the stock market value.

A) the marginal cost of capital.

B) real interest rate + the depreciation rate -the capital gain.

C) nominal interest rate - the capital gain.

D) rate of inflation + the marginal product of capital.

E) initial capital stock + the stock market value.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

19

When ________ said, "An investment in knowledge always pays the best interest," he was referring to investing in ________.

A) John Maynard Keynes; government spending

B) Karl Marx; health

C) Benjamin Franklin; new ideas

D) Sir John Templeton; technology

E) Winston Churchill; human capital

A) John Maynard Keynes; government spending

B) Karl Marx; health

C) Benjamin Franklin; new ideas

D) Sir John Templeton; technology

E) Winston Churchill; human capital

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

20

The user cost of capital is:

A) the cost of using one more unit of capital.

B) zero, if taxes are zero.

C) equal to the real interest rate.

D) equal to negative capital gain.

E) higher as corporate taxes fall.

A) the cost of using one more unit of capital.

B) zero, if taxes are zero.

C) equal to the real interest rate.

D) equal to negative capital gain.

E) higher as corporate taxes fall.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

21

According to data in the text, which of these is the country with the lowest corporate tax rate?

A) South Korea

B) Germany

C) the United States

D) Japan

E) Ireland

A) South Korea

B) Germany

C) the United States

D) Japan

E) Ireland

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

22

The investment share of GDP has a ________ relationship to the user cost and a(n) ________ relationship to the capital depreciation rate.

A) negative; negative

B) positive; positive

C) zero; positive

D) negative; positive

E) positive; inverse

A) negative; negative

B) positive; positive

C) zero; positive

D) negative; positive

E) positive; inverse

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

23

According to data in the text, the country with the highest user cost of capital is ________ and ________ has the lowest user cost of capital.

A) the United States; Ireland

B) Sweden; Denmark

C) Greece; Australia

D) France; South Korea

E) Japan; France

A) the United States; Ireland

B) Sweden; Denmark

C) Greece; Australia

D) France; South Korea

E) Japan; France

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

24

If the growth rate of the capital stock is 9 percent, the user cost of capital is 13 percent, the capital depreciation rate is 3 percent, and capital gain is 1 percent, the investment rate is about ________ percent.

A) 6.6

B) 30.8

C) 11.7

D) 1.4

E) 50

A) 6.6

B) 30.8

C) 11.7

D) 1.4

E) 50

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

25

According to data in the text, which is the country with the highest user cost of capital?

A) Mexico

B) Sweden

C) Hungary

D) France

E) the United States

A) Mexico

B) Sweden

C) Hungary

D) France

E) the United States

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

26

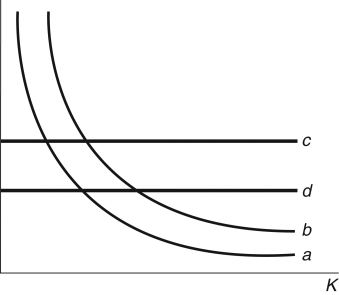

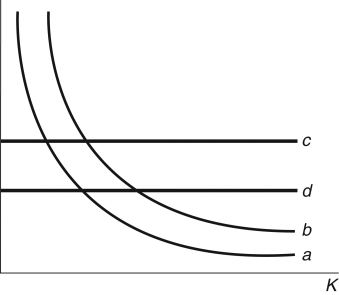

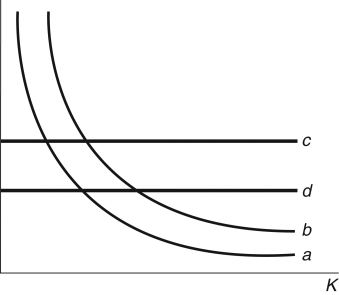

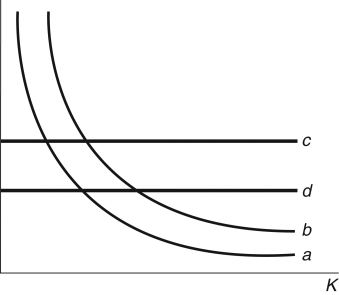

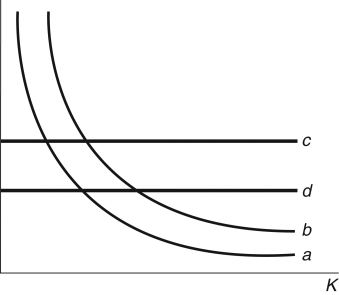

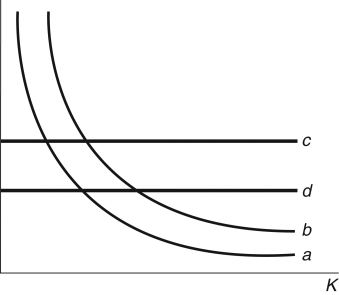

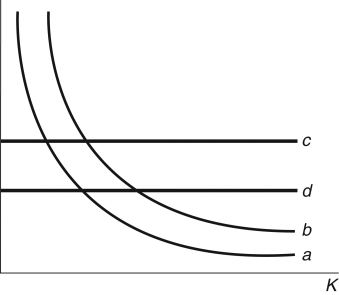

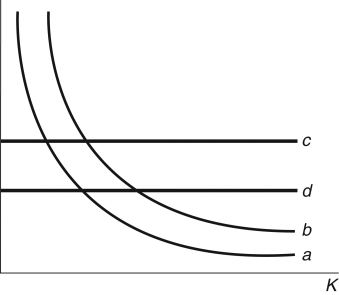

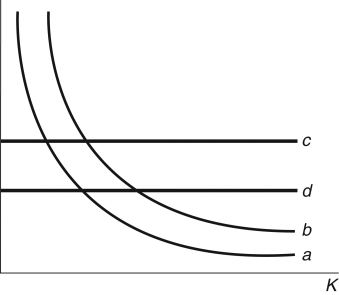

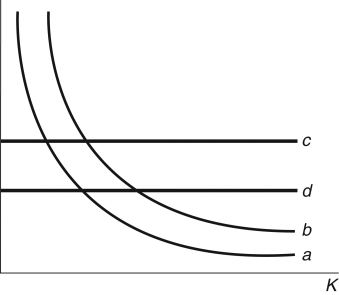

Refer to the following figure when answering the following questions.

Figure 17.1: Capital Arbitrage

Consider Figure 17.1. If there is an increase in the use cost of capital, then curve ________ would shift to curve ________. If the MPK falls, curve ________ would shift to ________.

A) d; c; a; b

B) b; a; c; d

C) d; c; b; a

D) a; b; d; c

E) Not enough information is given.

Figure 17.1: Capital Arbitrage

Consider Figure 17.1. If there is an increase in the use cost of capital, then curve ________ would shift to curve ________. If the MPK falls, curve ________ would shift to ________.

A) d; c; a; b

B) b; a; c; d

C) d; c; b; a

D) a; b; d; c

E) Not enough information is given.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

27

Refer to the following figure when answering the following questions.

Figure 17.1: Capital Arbitrage

Consider Figure 17.1. If there is a decrease in the corporate tax rate, then curve ________ would shift to curve ________.

A) d; c

B) b; a

C) c; d

D) a; b

E) Not enough information is given.

Figure 17.1: Capital Arbitrage

Consider Figure 17.1. If there is a decrease in the corporate tax rate, then curve ________ would shift to curve ________.

A) d; c

B) b; a

C) c; d

D) a; b

E) Not enough information is given.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

28

If capital gain rises, a firm should:

A) consider shutting down.

B) invest in financial assets, like stocks.

C) invest in more capital.

D) lower its output prices.

E) lay off some of its workers.

A) consider shutting down.

B) invest in financial assets, like stocks.

C) invest in more capital.

D) lower its output prices.

E) lay off some of its workers.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

29

When discussing arbitrage in the stock market, a financial investor can choose between:

A) putting money into a savings account or buying a stock.

B) buying a bond or buying a stock.

C) buying a new machine or buying a stock.

D) earning the real interest rate or the marginal product of capital.

E) the price of a bond at maturity or the price of a stock when it is sold.

A) putting money into a savings account or buying a stock.

B) buying a bond or buying a stock.

C) buying a new machine or buying a stock.

D) earning the real interest rate or the marginal product of capital.

E) the price of a bond at maturity or the price of a stock when it is sold.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

30

According to data in the text, the user cost of capital in the United States is ________ percent.

A) 7.0

B) 39.0

C) 12.5

D) 10.0

E) 9.0

A) 7.0

B) 39.0

C) 12.5

D) 10.0

E) 9.0

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

31

Refer to the following figure when answering the following questions.

Figure 17.1: Capital Arbitrage

Consider Figure 17.1. If there is an increase in the marginal product of capital, then curve ________ would shift to curve ________.

A) d; c

B) b; a

C) c; d

D) a; b

E) Not enough information is given.

Figure 17.1: Capital Arbitrage

Consider Figure 17.1. If there is an increase in the marginal product of capital, then curve ________ would shift to curve ________.

A) d; c

B) b; a

C) c; d

D) a; b

E) Not enough information is given.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

32

According to data in the text, which is the country with the highest corporate tax rate?

A) Italy

B) Finland

C) France

D) the United States

E) Ireland

A) Italy

B) Finland

C) France

D) the United States

E) Ireland

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

33

According to data in the text, which of these is the country with the lowest user cost of capital?

A) Ireland

B) the United Kingdom

C) Canada

D) Japan

E) South Korea

A) Ireland

B) the United Kingdom

C) Canada

D) Japan

E) South Korea

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

34

The investment-GDP ratio will rise if:

A) depreciation rises.

B) user cost falls.

C) capital growth is negative.

D) the marginal product of labor is positive.

E) stock prices fall.

A) depreciation rises.

B) user cost falls.

C) capital growth is negative.

D) the marginal product of labor is positive.

E) stock prices fall.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

35

Refer to the following figure when answering the following questions.

Figure 17.1: Capital Arbitrage

Consider Figure 17.1. If there is an increase in capital gains, then curve ________ would shift to curve ________.

A) d; c

B) b; a

C) c; d

D) a; b

E) Not enough information is given.

Figure 17.1: Capital Arbitrage

Consider Figure 17.1. If there is an increase in capital gains, then curve ________ would shift to curve ________.

A) d; c

B) b; a

C) c; d

D) a; b

E) Not enough information is given.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

36

Refer to the following figure when answering the following questions.

Figure 17.1: Capital Arbitrage

Consider Figure 17.1. If there is an increase in the real interest rate, then curve ________ would shift to curve ________.

A) d; c

B) b; a

C) c; d

D) a; b

E) Not enough information is given.

Figure 17.1: Capital Arbitrage

Consider Figure 17.1. If there is an increase in the real interest rate, then curve ________ would shift to curve ________.

A) d; c

B) b; a

C) c; d

D) a; b

E) Not enough information is given.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

37

In the growth model, we assumed the savings rate was given by ________, which is exogenous, but from the chapter on investment, we know it is equal to ________.

A) the saving rate; the growth rate of capital

B)

C)

D) a savings shock;

E) total factor productivity;

A) the saving rate; the growth rate of capital

B)

C)

D) a savings shock;

E) total factor productivity;

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

38

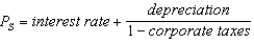

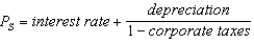

The user cost of capital with a corporate income tax is given by which of the following?

A)

B)

C)

D)

E)

A)

B)

C)

D)

E)

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

39

A decline in the corporate income tax will ________ and the firm will ________.

A) raise the user cost of capital; put more money in the bank

B) increase corporate profits; offset higher capital gains by hiring more labor

C) lower the capital user cost; invest in more capital

D) lower the rate of capital depreciation; hire more capital

E) raise the marginal product of capital; pay more taxes

A) raise the user cost of capital; put more money in the bank

B) increase corporate profits; offset higher capital gains by hiring more labor

C) lower the capital user cost; invest in more capital

D) lower the rate of capital depreciation; hire more capital

E) raise the marginal product of capital; pay more taxes

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

40

An increase in a firm's capital gains will ________and the firm will ________.

A) raise the user cost of capital; put more money in the bank

B) increase corporate profits; offset higher capital gains by hiring more labor

C) raise the marginal product of capital; pay a higher wage

D) lower the rate of capital depreciation; hire more capital

E) lower the capital user cost; invest in more capital

A) raise the user cost of capital; put more money in the bank

B) increase corporate profits; offset higher capital gains by hiring more labor

C) raise the marginal product of capital; pay a higher wage

D) lower the rate of capital depreciation; hire more capital

E) lower the capital user cost; invest in more capital

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

41

If the bank real interest rate is 2 percent, the percent gain in physical capital gain is 2 percent, the marginal product of capital is 3 percent, and the percent dividend return is 5 percent, what is the financial capital gain?

A) 1 percent

B) 0 percent

C) 8 percent

D) -3 percent

E) 3 percent

A) 1 percent

B) 0 percent

C) 8 percent

D) -3 percent

E) 3 percent

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

42

Refer to the following figure when answering the following questions.

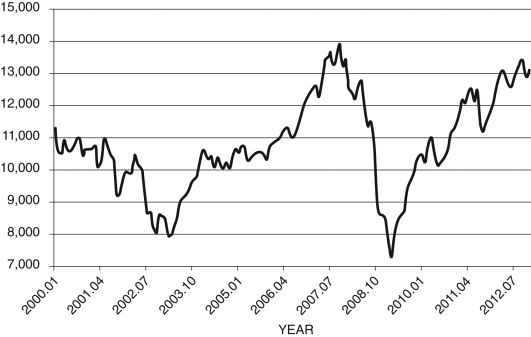

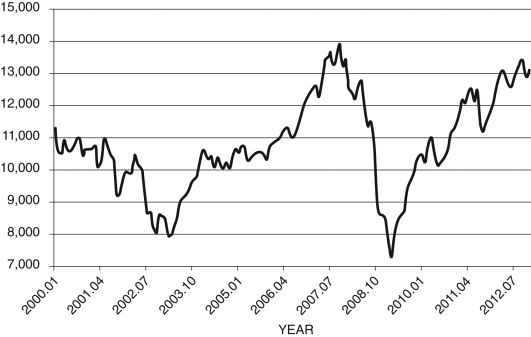

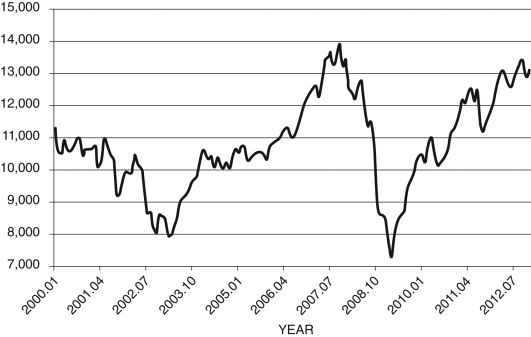

Figure 17.2: Dow Jones Industrial Average: 2000-2012 (Source: Federal Reserve Economic Data, St. Louis Federal Reserve)

(Source: Federal Reserve Economic Data, St. Louis Federal Reserve)

-Your uncle asks you to explain stock prices based on the financial capital arbitrage equation. He shows you the graph shown in Figure 17.2. He asks you to explain the cause in the rise of stock prices for the years 2002-2006. What do you tell him?

A) "As the DJI rises, there are financial capital gains that drive up stock prices."

B) "The rise in the DJI implies that there was an incentive for Congress to increase corporate tax rates, which would have led to falling capital investment. With less capital, stock prices rise."

C) "The rising DJI leads to falling dividend payments, which would lead to a decline in physical capital accumulation. With less capital available, the marginal product of capital rises, leading to higher stock prices."

D) "A rising DJI decreases the MPK."

E) "Rising capital gains, as shown in the figure, have no impact on stock prices."

Figure 17.2: Dow Jones Industrial Average: 2000-2012

(Source: Federal Reserve Economic Data, St. Louis Federal Reserve)

(Source: Federal Reserve Economic Data, St. Louis Federal Reserve)-Your uncle asks you to explain stock prices based on the financial capital arbitrage equation. He shows you the graph shown in Figure 17.2. He asks you to explain the cause in the rise of stock prices for the years 2002-2006. What do you tell him?

A) "As the DJI rises, there are financial capital gains that drive up stock prices."

B) "The rise in the DJI implies that there was an incentive for Congress to increase corporate tax rates, which would have led to falling capital investment. With less capital, stock prices rise."

C) "The rising DJI leads to falling dividend payments, which would lead to a decline in physical capital accumulation. With less capital available, the marginal product of capital rises, leading to higher stock prices."

D) "A rising DJI decreases the MPK."

E) "Rising capital gains, as shown in the figure, have no impact on stock prices."

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

43

If the bank real interest rate is 4 percent, the percent gain in physical capital gain is 3 percent, the marginal product of capital is 2 percent, and the capital gain of financial capital is 1 percent, what is the percent dividend return?

A) 1 percent

B) 6 percent

C) 50 percent

D) 2 percent

E) 5 percent

A) 1 percent

B) 6 percent

C) 50 percent

D) 2 percent

E) 5 percent

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following represents the financial asset arbitrage equation?

A)

B)

C)

D)

E)

A)

B)

C)

D)

E)

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

45

In 2001, the P/E ratio:

A) led to a discussion of "under-exuberance."

B) was inverted.

C) peaked at over 40.

D) equaled the mean P/E ratio.

E) began to rise sharply.

A) led to a discussion of "under-exuberance."

B) was inverted.

C) peaked at over 40.

D) equaled the mean P/E ratio.

E) began to rise sharply.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

46

If the real interest rate is, more or less, constant, and the growth rate of dividends falls sharply:

A) the price-earning ratio would fall.

B) the marginal product of capital would fall.

C) firm profits would rise.

D) stock prices would rise.

E) the MPK would rise.

A) the price-earning ratio would fall.

B) the marginal product of capital would fall.

C) firm profits would rise.

D) stock prices would rise.

E) the MPK would rise.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

47

Refer to the following figure when answering the following questions.

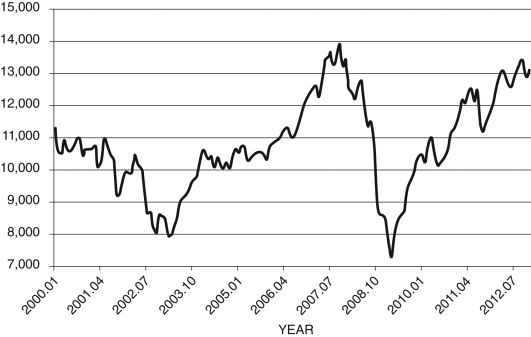

Figure 17.2: Dow Jones Industrial Average: 2000-2012 (Source: Federal Reserve Economic Data, St. Louis Federal Reserve)

(Source: Federal Reserve Economic Data, St. Louis Federal Reserve)

-Your grandmother is a follower of the financial press and decides to quiz you about your knowledge of financial markets. She asks you to explain the price of stock prices based on the financial capital arbitrage equation. She shows you the graph shown in Figure 17.2. She asks you to explain the cause in the rise of stock prices for the years 2008-2012. What do you tell her?

A) "The graph suggests there are capital losses in financial markets, so to cover these losses, stock prices have to rise."

B) "Grandma, I was an art major and didn't have to take finance or economics classes."

C) "Ironically, falling capital gains have no impact on stock prices."

D) "A falling DJI leads to negative capital gains in financial assets. This, in turn, drives stock prices down."

E) "Because, in equilibrium, the real interest rate, capital gains, and dividends move in tandem, the decline in stock prices is due to 'irrational exuberance.'"

Figure 17.2: Dow Jones Industrial Average: 2000-2012

(Source: Federal Reserve Economic Data, St. Louis Federal Reserve)

(Source: Federal Reserve Economic Data, St. Louis Federal Reserve)-Your grandmother is a follower of the financial press and decides to quiz you about your knowledge of financial markets. She asks you to explain the price of stock prices based on the financial capital arbitrage equation. She shows you the graph shown in Figure 17.2. She asks you to explain the cause in the rise of stock prices for the years 2008-2012. What do you tell her?

A) "The graph suggests there are capital losses in financial markets, so to cover these losses, stock prices have to rise."

B) "Grandma, I was an art major and didn't have to take finance or economics classes."

C) "Ironically, falling capital gains have no impact on stock prices."

D) "A falling DJI leads to negative capital gains in financial assets. This, in turn, drives stock prices down."

E) "Because, in equilibrium, the real interest rate, capital gains, and dividends move in tandem, the decline in stock prices is due to 'irrational exuberance.'"

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

48

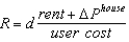

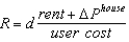

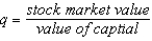

If we divide both sides of the equation  by earnings, we get:

by earnings, we get:

A) the price-earnings ratio.

B) the equilibrium interest rate.

C) firm capital gains/losses.

D) the marginal product of capital.

E) inflation-adjusted prices.

by earnings, we get:

by earnings, we get:A) the price-earnings ratio.

B) the equilibrium interest rate.

C) firm capital gains/losses.

D) the marginal product of capital.

E) inflation-adjusted prices.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

49

Since 1980, interest rates have been trending downward. Given this information, what does this theory suggest happened to stock prices?

A) Stock prices fell.

B) There is no relationship between real interest rates and stock prices.

C) Stock prices remained constant.

D) Stock prices rose.

E) Not enough information is given.

A) Stock prices fell.

B) There is no relationship between real interest rates and stock prices.

C) Stock prices remained constant.

D) Stock prices rose.

E) Not enough information is given.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

50

If the savings interest rate rises, to maintain the financial asset arbitrage equality, either the ________ or the ________, or both.

A) equity falls; price-to-equity ratio falls

B) risk premium falls; dividends rise

C) capital depreciation rises; investment rate rises

D) dividends rise; capital gain rises

E) marginal product of capital falls; user cost falls

A) equity falls; price-to-equity ratio falls

B) risk premium falls; dividends rise

C) capital depreciation rises; investment rate rises

D) dividends rise; capital gain rises

E) marginal product of capital falls; user cost falls

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

51

Between 1880 and 2015, the average P/E ratio was ________ percent.

A) 7.2

B) 25.7

C) 34.5

D) 5.0

E) 16.7

A) 7.2

B) 25.7

C) 34.5

D) 5.0

E) 16.7

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

52

The payment the owner of a stock receives from a firm is called the:

A) return on assets, or ROA.

B) coupon payment.

C) dividend.

D) profit margin.

E) price-to-equity ratio.

A) return on assets, or ROA.

B) coupon payment.

C) dividend.

D) profit margin.

E) price-to-equity ratio.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

53

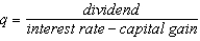

In the equation  is the:

is the:

A) rate of return to dividends.

B) dollar value of the stock market.

C) capital return.

D) marginal product of stocks.

E) discount factor.

is the:

is the:A) rate of return to dividends.

B) dollar value of the stock market.

C) capital return.

D) marginal product of stocks.

E) discount factor.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

54

In the equation  , the left side of the equation is:

, the left side of the equation is:

A) equal to zero, if the real interest rate equals the user cost of capital.

B) the holding cost of the stock.

C) the return from a stock.

D) the return on a bank account.

E) equal to the marginal product of capital.

, the left side of the equation is:

, the left side of the equation is:A) equal to zero, if the real interest rate equals the user cost of capital.

B) the holding cost of the stock.

C) the return from a stock.

D) the return on a bank account.

E) equal to the marginal product of capital.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

55

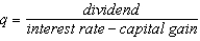

We can write the stock price as:

A) .

.

B) .

.

C) .

.

D) .

.

E) .

.

A)

.

.B)

.

.C)

.

.D)

.

.E)

.

.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

56

According to the financial asset arbitrage equation, all else equal, a rise in the capital gain for a stock implies:

A) a decline in the user cost of capital.

B) a rise in the dividend.

C) a rise in the real interest rate.

D) that the marginal product of capital stays constant.

E) a fall in the price of the stock.

A) a decline in the user cost of capital.

B) a rise in the dividend.

C) a rise in the real interest rate.

D) that the marginal product of capital stays constant.

E) a fall in the price of the stock.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

57

If the marginal product of capital is 3 percent, the real interest rate is 4 percent, and the capital depreciation rate is 10 percent, what is the equilibrium stock price?

A) $1.33

B) $83.33

C) $25.00

D) $0.18

E) Not enough information is given.

A) $1.33

B) $83.33

C) $25.00

D) $0.18

E) Not enough information is given.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

58

The P/E ratio will ________ if ________.

A) rise; earnings fall

B) equal zero; dividend payments equal earnings

C) fall; capital gains rise

D) rise; interest rates rise

E) rise; dividends rise

A) rise; earnings fall

B) equal zero; dividend payments equal earnings

C) fall; capital gains rise

D) rise; interest rates rise

E) rise; dividends rise

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

59

In the simple model of financial asset model arbitrage, we assume that:

A) future markets are perfectly efficient.

B) there is no uncertainty about stock prices.

C) stock prices follow a random walk.

D) the risk premium does not equal zero.

E) capital gains are zero.

A) future markets are perfectly efficient.

B) there is no uncertainty about stock prices.

C) stock prices follow a random walk.

D) the risk premium does not equal zero.

E) capital gains are zero.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

60

If the marginal product of capital is 3 percent, the real interest rate is 4 percent, growth is 2.5 percent, and the capital depreciation rate is 10 percent, what is the equilibrium stock price?

A) $166.67

B) $500.00

C) $0.40

D) $1.88

E) $0.01

A) $166.67

B) $500.00

C) $0.40

D) $1.88

E) $0.01

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

61

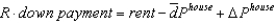

From the residential arbitrage equation, a rise in the down payment will ________ the price of the house, while an increase in the real interest rate will ________ the house price.

A) reduce; raise

B) raise; reduce

C) reduce; reduce

D) raise; have no effect on

E) raise; raise

A) reduce; raise

B) raise; reduce

C) reduce; reduce

D) raise; have no effect on

E) raise; raise

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

62

Between 2006 and 2010, the component of investment that fell the furthest was:

A) software.

B) residential investment.

C) changes in inventory.

D) nonresidential fixed investment.

E) unplanned investment.

A) software.

B) residential investment.

C) changes in inventory.

D) nonresidential fixed investment.

E) unplanned investment.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

63

"Goodwill capital" is essentially:

A) advertising.

B) money set aside for political contributions.

C) the amount of charitable contributions a firm gives.

D) ownership of a brand name.

E) a euphemism for tax payments.

A) advertising.

B) money set aside for political contributions.

C) the amount of charitable contributions a firm gives.

D) ownership of a brand name.

E) a euphemism for tax payments.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

64

You decide to move to Nevada; life in southern California is getting too expensive and you want to know what would be a good offering price on a home, but you know you will only own it a year. Fortunately, you are armed with the simple residential investment equation. You have the following information: the real interest rate is 2 percent; the depreciation rate of homes is 2 percent; average rent is $500; there is no expected capital gain; and you will have a 10 percent down payment. You offer the owner, rounding to the nearest dollar:

A) $41,667.

B) $333,333.

C) $22,727.

D) $4,000.

E) $71,429.

A) $41,667.

B) $333,333.

C) $22,727.

D) $4,000.

E) $71,429.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

65

The arbitrage condition for residential investment is:

A) .

.

B) .

.

C) .

.

D) .

.

E) .

.

A)

.

.B)

.

.C)

.

.D)

.

.E)

.

.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

66

If a stock is just as likely to move up or down, it:

A) is highly correlated.

B) follows a random walk.

C) has a high standard deviation.

D) is stationary.

E) is highly volatile.

A) is highly correlated.

B) follows a random walk.

C) has a high standard deviation.

D) is stationary.

E) is highly volatile.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

67

If markets are efficient, it is ________ when trading on the basis of information.

A) easy to ignore a random walk

B) possible to make sustained profits

C) impossible to make economic profits

D) easy to generate economic rent

E) difficult to understand fundamentals

A) easy to ignore a random walk

B) possible to make sustained profits

C) impossible to make economic profits

D) easy to generate economic rent

E) difficult to understand fundamentals

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

68

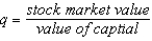

Which of the following equations represents Tobin's q?

A)

B)

C)

D)

E)

A)

B)

C)

D)

E)

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

69

You hear that Ford is likely to announce strong fourth-quarter profits at its next shareholders' meeting. You excitedly decide to buy some Ford stock. When you look up Ford stock prices, you notice that Ford's stock price ________. This is because ________.

A) is unpredictable; of the lack of a random walk

B) is lagging behind other gains in the stock market; of its status as a "moribund" company

C) has fallen; the market believes Ford is lying

D) is flat; pundits believe Ford will not meet its targets

E) has already risen; markets are informationally efficient

A) is unpredictable; of the lack of a random walk

B) is lagging behind other gains in the stock market; of its status as a "moribund" company

C) has fallen; the market believes Ford is lying

D) is flat; pundits believe Ford will not meet its targets

E) has already risen; markets are informationally efficient

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

70

The largest component of physical investment is:

A) nonresidential fixed investment.

B) software.

C) residential investment.

D) changes in inventory.

E) unplanned investment.

A) nonresidential fixed investment.

B) software.

C) residential investment.

D) changes in inventory.

E) unplanned investment.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

71

Calculate Tobin's q for a firm. You have the following information: MPK = 2 percent, R = 3 percent, the stock market value is $1,368, the capital stock is 15 units, and the price of stock is $100. Based on this information, Tobin's q is ________. Given your answer, the market believes the firm should ________.

A) 1.5; invest in capital

B) 0.7; invest in capital

C) 1.1; disinvest in capital

D) 0.9; disinvest in capital

E) 0.8; hold capital constant

A) 1.5; invest in capital

B) 0.7; invest in capital

C) 1.1; disinvest in capital

D) 0.9; disinvest in capital

E) 0.8; hold capital constant

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

72

A financial market is efficient if financial prices:

A) fully and correctly reflect all available information.

B) reflect information only available to traders.

C) adjust to any information.

D) allow for consistent short-term profits to be made.

E) yield returns for owners of capital.

A) fully and correctly reflect all available information.

B) reflect information only available to traders.

C) adjust to any information.

D) allow for consistent short-term profits to be made.

E) yield returns for owners of capital.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

73

Which of the following is a component of physical investment?

i. Nonresidential fixed investment

ii. Residential fixed investment

iii. Inventory

A) i

B) ii

C) i and iii

D) ii and iii

E) i, ii, and iii

i. Nonresidential fixed investment

ii. Residential fixed investment

iii. Inventory

A) i

B) ii

C) i and iii

D) ii and iii

E) i, ii, and iii

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

74

Empirical evidence suggests that ________ mutual funds ________ funds.

A) actively managed; have lower returns than passively managed

B) passively managed; have equal returns to single stock price

C) actively managed; have lower "betas" than single stock

D) passively managed; are more likely to follow a random walk than actively managed

E) indexed; underperform compared to managed

A) actively managed; have lower returns than passively managed

B) passively managed; have equal returns to single stock price

C) actively managed; have lower "betas" than single stock

D) passively managed; are more likely to follow a random walk than actively managed

E) indexed; underperform compared to managed

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

75

Calculate Tobin's q for a firm. You have the following information: MPK = 2 percent, R = 4 percent, the stock market value is $1,728, the capital stock is 12 units, and the price of stock is $120. Based on this information, Tobin's q is ________. Given your answer, the market believes the firm should ________.

A) 1.2; invest in more capital

B) 1.3; disinvest in capital

C) 0.83; disinvest in capital

D) 0.75; invest in more capital

E) 2.07; raise its depreciation rate

A) 1.2; invest in more capital

B) 1.3; disinvest in capital

C) 0.83; disinvest in capital

D) 0.75; invest in more capital

E) 2.07; raise its depreciation rate

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

76

The smallest component of physical investment is:

A) nonresidential fixed investment.

B) software.

C) residential investment.

D) changes in inventory.

E) unplanned investment.

A) nonresidential fixed investment.

B) software.

C) residential investment.

D) changes in inventory.

E) unplanned investment.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

77

When Tobin's q is ________, the market is signaling that a firm should ________.

A) greater than one; invest in more capital

B) equal to zero; shut down

C) infinity; sell its stock holdings

D) less than one; raise dividend payments

E) equal to one; try to take over a firm with a Tobin's q = 0

A) greater than one; invest in more capital

B) equal to zero; shut down

C) infinity; sell its stock holdings

D) less than one; raise dividend payments

E) equal to one; try to take over a firm with a Tobin's q = 0

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

78

From the residential arbitrage equation, a rise in the rent will ________ the price of the house, while an increase in the depreciation rate will ________ the house price.

A) raise; reduce

B) reduce; raise

C) have no effect on; raise

D) raise; raise

E) reduce; have no effect on

A) raise; reduce

B) reduce; raise

C) have no effect on; raise

D) raise; raise

E) reduce; have no effect on

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

79

You decide to move to the mountains of Colorado and want to know what would be a good offering price on a home, but you know you will only own it a year. Fortunately, you are armed with the simple residential investment equation. You have the following information: the real interest rate is 4 percent; the depreciation rate of homes is 5 percent; average rent is $1,000; there is no expected capital gain; and you will have a 20 percent down payment. You offer the owner, rounding to the nearest dollar:

A) $25,000.

B) $125,000.

C) $4,167.

D) $17,241.

E) $50,000.

A) $25,000.

B) $125,000.

C) $4,167.

D) $17,241.

E) $50,000.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

80

Tobin's q is:

A) the ratio of stock market value of a stock to the value of its capital.

B) the ratio of user cost to the corporate tax rate.

C) equal to a stock's capital gains plus any dividends paid.

D) the difference between the marginal product of capital and the real interest rate.

E) an index of the economic environment.

A) the ratio of stock market value of a stock to the value of its capital.

B) the ratio of user cost to the corporate tax rate.

C) equal to a stock's capital gains plus any dividends paid.

D) the difference between the marginal product of capital and the real interest rate.

E) an index of the economic environment.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck